February 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fossil Fuels………………………………………………

Corso di Laurea magistrale in Relazioni Internazionali Comparate Tesi di Laurea Energy and Environment Between development and sustainability Relatore Ch. Prof. Matteo Legrenzi Correlatore Ch. Prof. Duccio Basosi Laureando Alberto Lora Matricola 987611 Anno Accademico 2013 / 2014 TABLE OF CONTENTS Abstract………………………………………………………………………………………………i Introduction...………………………………………………………….........................................1 PART 1 - ENERGY SECURITY Chapter 1. Energy Security……………………………………………………………………...7 1.1 What is energy security?.......................................................................................................7 1.1.1 Definition of energy security…………………………………………………………………………..7 1.1.2 Elements of energy security………………………………………………………………………….8 1.1.3 Different interpretations of energy security………………………………………………………….9 1.1.4 Theories about energy security……………………………………………………………………..11 1.2 Diversification of the energy mix…………………………………………………………………12 1.2.1 Types of energy sources………………………………..............................................................12 1.2.2 Definition of energy mix……………………………………………………………………………..13 1.3 Growing risks………………………………………………………………………………………16 1.3.1 Energy insecurity……………………………………………………………………………………..16 1.3.2 Geological risk………………………………………………………………………………………..17 1.3.3 Geopolitical risk…………………………………………………………………….........................18 1.3.4 Economic risk…………………………………………………………………………………………22 1.3.5 Environmental risk……………………………………………………………………………………22 1.3.6 Solutions………………………………………………………………………………………………23 -

Monthly Report on Petroleum Developments in the World Markets February 2020

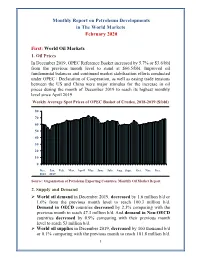

Monthly Report on Petroleum Developments in The World Markets February 2020 First: World Oil Markets 1. Oil Prices In December 2019, OPEC Reference Basket increased by 5.7% or $3.6/bbl from the previous month level to stand at $66.5/bbl. Improved oil fundamental balances and continued market stabilization efforts conducted under OPEC+ Declaration of Cooperation, as well as easing trade tensions between the US and China were major stimulus for the increase in oil prices during the month of December 2019 to reach its highest monthly level since April 2019. Weekly Average Spot Prices of OPEC Basket of Crudes, 2018-2019 ($/bbl) 80 70 60 50 40 30 20 10 0 Dec. Jan. Feb. Mar. April May June July Aug. Sept. Oct. Nov. Dec. 2018 2019 Source: Organization of Petroleum Exporting Countries, Monthly Oil Market Report. 2. Supply and Demand World oil demand in December 2019, decreased by 1.6 million b/d or 1.6% from the previous month level to reach 100.3 million b/d. Demand in OECD countries decreased by 2.3% comparing with the previous month to reach 47.3 million b/d. And demand in Non-OECD countries decreased by 0.9% comparing with their previous month level to reach 53 million b/d. World oil supplies in December 2019, decreased by 100 thousand b/d or 0.1% comparing with the previous month to reach 101.8 million b/d. 1 Non-OPEC supplies remained stable at the same previous month level of 67.2 million b/d. Whereas preliminary estimates show that OPEC crude oil and NGLs/condensates total supplies decreased by 0.6% comparing with the previous month to reach 34.5 million b/d. -

Crude Oil Price Movements

OPEC Monthly Oil Market Report 11 July 2018 Feature article: Oil Market Outlook for 2019 Oil market highlights iii Feature article v Crude oil price movements 1 Commodity markets 8 World economy 11 World oil demand 31 World oil supply 44 Product markets and refinery operations 63 Tanker market 71 Oil trade 76 Stock movements 81 Balance of supply and demand 87 Organization of the Petroleum Exporting Countries Helferstorferstrasse 17, A-1010 Vienna, Austria E-mail: prid(at)opec.org Website: www.opec.org Welcome to the Republic of the Congo Welcome to the Republic of the Congo as the 15th OPEC Member The 174th Meeting of the Conference approved the request from the Republic of the Congo to join the Organization of the Petroleum Exporting Countries (OPEC), with immediate effect from 22nd June 2018. In line with this development, data for the Republic of the Congo is now included within the OPEC grouping. As a result, the figures for OPEC crude production, demand for OPEC crude and non-OPEC supply as well as the OPEC Reference Basket have been adjusted to reflect this change. For comparative purposes, related historical data has also been revised. OPEC Monthly Oil Market Report – July 2018 i Welcome the Republic of Congo ii OPEC Monthly Oil Market Report – July 2018 Oil Market Highlights Oil Market Highlights Crude Oil Price Movements The OPEC Reference Basket (ORB) eased by 1.2% month-on-month (m-o-m) in June to average $73.22/b. The ORB ended 1H18 higher at $68.43/b, up more than 36% since the start of the year. -

Asymmetric Impacts of Oil Price on Inflation: an Empirical Study

energies Article Asymmetric Impacts of Oil Price on Inflation: An Empirical Study of African OPEC Member Countries Umar Bala 1,2 and Lee Chin 2,* 1 Department of Economics, Faculty of Management and Social Sciences, Bauchi State University, P.M.B. 65 Gadau, Nigeria; [email protected] 2 Department of Economics, Faculty of Economics and Management, Universiti Putra Malaysia, 43400 UPM Serdang, Selangor Darul Ehsan, Malaysia * Correspondence: [email protected]; Tel.: +60-603-8946-7769 Received: 14 August 2018; Accepted: 26 October 2018; Published: 2 November 2018 Abstract: This study investigates the asymmetric impacts of oil price changes on inflation in Algeria, Angola, Libya, and Nigeria. Three different kinds of oil price data were applied in this study: the actual spot oil price of individual countries, the OPEC reference basket oil price, and an average of the Brent, WTI, and Dubai oil price. Autoregressive distributed lag (ARDL) dynamic panels were used to estimate the short- and long-term impacts. Also, we partitioned the oil price into positive and negative changes to capture asymmetric impacts and found that both the positive and negative oil price changes positively influenced inflation. However, the impact was found to be more significant when the oil prices dropped. We also found that the money supply, the exchange rate, and the gross domestic product (GDP) are positively related to inflation, while food production is negatively related to inflation. Accordingly, policy-makers should be cautious when formulating policies between the positive and negative changes in oil prices, as it was shown that inflation increased when the oil price dropped. -

Market Indicators As at End*: August-2020

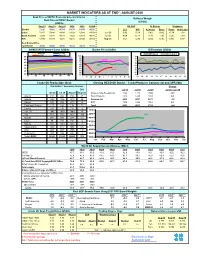

MARKET INDICATORS AS AT END*: AUGUST-2020 Spot Price of OPEC Basket & Selected Crudes Refiners' Margin Real Price of OPEC Basket (US$/b) (US$/b) Aug-18 Aug-19 Aug-20 2018 2019 2020# US Gulf N. Europe Singapore Basket 72.26 59.62 45.19 69.78 64.04 40.50 LLS WTI A. Heavy Brent Oman Arab Light Dubai 72.47 58.88 43.89 69.68 63.48 41.54 Jun-20 3.92 5.19 0.42 0.42 -0.74 1.02 North Sea Dtd 72.64 58.83 44.79 71.22 64.19 40.88 Jul-20 4.64 6.13 -1.86 1.30 1.26 1.99 WTI 67.99 54.84 42.36 65.16 57.02 38.15 Aug-20 3.67 5.30 -2.05 0.16 0.86 0.87 Real Basket Price Jun01=100 46.86 39.02 28.30 35.22 44.73 26.19 NYMEX WTI Forward Curve (US$/b) Basket Price (US$/b) Differentials (US$/b) May-20 Jun-20 WTI-Brent Brent-Dubai Jul-20 Aug-20 50 100 3 90 2 45 2018 80 1 70 40 0 60 35 2019 -1 50 30 40 -2 2020 -3 25 30 20 -4 20 10 -5 1M 3M 5M 7M 9M 11M J F M A M J J A S O N D 03 05 07 11 13 17 19 21 25 27 31 Crude Oil Production (tb/d) Closing OECD Oil Stocks - Crude/Products Commercial and SPR (Mb) Crude Oil Production (Tb/d) Production: Secondary Sources Change Diff. -

Oil and Security Policies

Oil and Security Policies <UN> International Comparative Social Studies Editor-in-Chief Mehdi P. Amineh (Amsterdam Institute for Social Science Research, University of Amsterdam, International Institute for Asian Studies, University of Leiden) Editorial Board Sjoerd Beugelsdijk (Radboud University, Nijmegen, The Netherlands) Simon Bromley (Open University, uk) Harald Fuhr (University of Potsdam, Germany) Gerd Junne (University of Amsterdam, The Netherlands) Kurt W. Radtke (International Institute for Asian Studies, The Netherlands) Ngo Tak-Wing (University of Leiden, The Netherlands) Mario Rutten (University of Amsterdam, The Netherlands) Advisory Board W.A. Arts (University College Utrecht, The Netherlands) G.C.M. Lieten (University of Amsterdam, The Netherlands) H.W. van Schendel (University of Amsterdam/International Institute of Social History, Amsterdam) L.A. Visano (York University, Canada) VOLUME 32 The titles published in this series are listed at brill.com/icss <UN> Oil and Security Policies Saudi Arabia, 1950–2012 By Islam Y. Qasem LEIDEN | BOSTON <UN> Cover illustration: © Ruletkka|Dreamstime.com. Library of Congress Cataloging-in-Publication Data Qasem, Islam Y., author. Oil and security policies : Saudi Arabia, 1950-2012 / by Islam Y. Qasem. pages cm. -- (International comparative social studies, ISSN 1568-4474 ; volume 32) Includes bibliographical references and index. ISBN 978-90-04-27774-8 (hardback : alk. paper) 1. Petroleum industry and trade--Political aspects--Saudi Arabia. 2. Energy consumption--Political aspects--Saudi Arabia. 3. Internal security--Saudi Arabia. 4. National security--Saudi Arabia. 5. Security, International--Saudi Arabia. 6. Saudi Arabia--Foreign relations. I. Title. HD9576.S32Q26 2015 338.2’72820953809045--dc23 2015028649 This publication has been typeset in the multilingual “Brill” typeface. -

Monthly Oil Market Report

Organization of the Petroleum Exporting Countries OMonthlyP Oil MEarket CReport March 2005 Feature Article: Relationship between commercial crude inventories and oil prices Oil Market Highlights 1 Feature Article 3 Outcome of the 135th Meeting of the Conference 5 Highlights of the world economy 7 Crude oil price movements 11 Product markets and refinery operations 15 The oil futures market 19 The tanker market 21 World oil demand 23 World oil supply 28 Rig count 31 Stock movements 32 Balance of supply and demand 34 Obere Donaustrasse 93, A-1020 Vienna, Austria Tel: +43 1 21112 Fax: +43 1 2164320 E-mail: [email protected] Web site: www.opec.org ____________________________________________________________________Monthly Oil Market Report Oil Market Highlights For the first time since the summer of 2004, Japan and Europe appear to have begun to share in the growth of the world economy. The outlook for Japan is particularly encouraging as both domestic and corporate demand look to have made a good start to 2005. The indications for Europe are more modest but early data for Germany, at least, suggest that improving investment demand and consumer spending should produce meaningful GDP growth in the first quarter. Nevertheless the main growth engines of the world economy remain the USA and China. US consumer and investment spending continued to grow strongly in February and the first quarter may see growth of about 4%. Data for China confirms a slight slowdown in the growth rates for retail sales in January and February but industrial production growth accelerated, rising to 16.9% year-on-year. There are risks on the sustainability of world economic growth in 2005. -

Companies Involved in Oilfield Services from Wikipedia, the Free Encyclopedia

Companies Involved in Oilfield Services From Wikipedia, the free encyclopedia Diversified Oilfield Services Companies These companies deal in a wide range of oilfield services, allowing them access to markets ranging from seismic imaging to deep water oil exploration. Schlumberger Halliburton Baker Weatherford International Oilfield Equipment Companies These companies build rigs and supply hardware for rig upgrades and oilfield operations. Yantai Jereh Petroleum Equipment&Technologies Co., Ltd. National-Oilwell Varco FMC Technologies Cameron Corporation Weir SPM Oil & Gas Zhongman Petroleum & Natural Gas Corpration LappinTech LLC Dresser-Rand Group Inc. Oilfield Services Disposal Companies These companies provide saltwater disposal and transportation services for Oil & Gas.. Frontier Oilfield Services Inc. (FOSI) Oil Exploration and Production Services Contractors These companies deal in seismic imaging technology for oil and gas exploration. ION Geophysical Corporation CGG Veritas Brigham Exploration Company OYO Geospace These firms contract drilling rigs to oil and gas companies for both exploration and production. Transocean Diamond Offshore Drilling Noble Hercules Offshore Parker Drilling Company Pride International ENSCO International Atwood Oceanics Union Drilling Nabors Industries Grey Wolf Pioneer Drilling Co Patterson-UTI Energy Helmerich & Payne Rowan Companies Oil and Gas Pipeline Companies These companies build onshore pipelines to transport oil and gas between cities, states, and countries. -

Monthly Oil Market Report

Data Summary Organization of the Petroleum Exporting Countries OMonthlyPOilMEarketCReport December 2008 Feature Article: Present economic situation points to oil market imbalance over the coming months Oil market highlights 1 Feature article 3 Crude oil price movements 5 The oil futures market 9 Commodity markets 11 Highlights of the world economy 18 World oil demand 23 World oil supply 30 Product markets and refinery operations 37 The tanker market 41 Oil trade 44 Stock movements 55 Balance of supply and demand 58 ObereDonaustrasse 93, A-1020 Vienna, Austria Tel +43121112 FaOberx +431eDonaustrasse2164320 E-mail:93, [email protected], Aug striaWeb site: www.opec.org Tel +43121112 Fax +4312164320 E-mail: [email protected] Web site: www.opec.org OPEC Monthly Oil Market Report Publishing Schedule for 2009 Thursday, 15 January Friday, 13 February Friday, 13 March Wednesday, 15 April Wednesday, 13 May Friday, 12 June Tuesday, 14 July Tuesday, 11 August Tuesday, 15 September Tuesday, 13 October Wednesday, 11 November Tuesday, 15 December ____________________________________________________________________Monthly Oil Market Report Oil Market Highlights The downward movement for the OPEC Basket continued for the fifth consecutive month, dominated by the bleak economy. Reports that some nations had moved into recession and the plunge in equity markets to a five-year low triggered fears of further oil demand destruction. In November, the OPEC Reference Basket averaged 28% or $19.40/b lower to stand at $49.76/b. The downward trend continued into December. The worsening economy and weak demand continued to weigh on market direction while lower OPEC exports in November lent stability to the marketplace. -

OPEC Monthly Oil Market Report – February 2021 I Ii OPEC Monthly Oil Market Report – February 2021 Oil Market Highlights

11 February 2021 Feature article: Review of global oil demand trend Oil market highlights i Feature article iii Crude oil price movements 1 Commodity markets 7 World economy 10 World oil demand 25 World oil supply 35 Product markets and refinery operations 49 Tanker market 56 Crude and refined products trade 60 Commercial stock movements 66 Balance of supply and demand 71 Chairman of the Editorial Board HE Mohammad Sanusi Barkindo Secretary General Editor-in-Chief Dr. Ayed S. Al-Qahtani Director, Research Division email: aalqahtani(at)opec.org Editor Behrooz Baikalizadeh Head, Petroleum Studies Department email: bbaikalizadeh(at)opec.org Contributors Crude Oil Price Movements Yacine Sariahmed Senior Oil Price Analyst, PSD email: ysariahmed(at)opec.org Commodity Markets Hector Hurtado Chief Financial Analyst, PSD email: hhurtado(at)opec.org World Economy Imad Al-Khayyat Chief Economic Analyst, PSD email: ial-khayyat(at)opec.org Hector Hurtado Chief Financial Analyst, PSD email: hhurtado(at)opec.org Dr. Asmaa Yaseen Modelling & Forecasting Analyst, PSD email: ayaseen(at)opec.org Dr. Joerg Spitzy Senior Research Analyst, PSD email: jspitzy(at)opec.org World Oil Demand Hassan Balfakeih Chief Oil Demand Analyst, PSD email: hbalfakeih(at)opec.org World Oil Supply Mohammad Ali Danesh Chief Oil Supply Analyst, PSD email: mdanesh(at)opec.org Product Markets and Refinery Operations Tona Ndamba Senior Refinery & Products Analyst, PSD email: tndamba(at)opec.org Tanker Markets Douglas Linton Senior Research Specialist, PSD email: dlinton(at)opec.org Crude and Refined Products Trade Douglas Linton Senior Research Specialist, PSD email: dlinton(at)opec.org Stock Movements Dr. -

OPEC Petroleum

OPEC th International Seminar Petroleum: An Engine for Global Development 3–4 June 2015 Hofburg Palace Vienna, Austria Contact: 50 +44 7818 598178 www.opecseminar.org [email protected] Case for cooperation never stronger When OPEC’s Oil and Energy Ministers gathered in Vienna for the But there are some pertinent facts to consider here. As OPEC 166th Meeting of their Ordinary Conference towards the end of Secretary General, Abdalla Salem El-Badri, pointed out at the press November, they were confronted by the largest assembly of jour- conference — for the past few years, the Organization has more nalists, photographers and analysts the Organization’s relatively- or less been producing what it said it would — 30m b/d. That has new Headquarters in the Austrian capital’s historic First District been the call on the Organization’s oil and that is what its Members Commentary has ever seen. In fact, such was the response to the end-of-year have produced — and will continue to produce in the first half of Ministerial talks that the customary ‘meet and greet’ of the Ministers, 2015. The epitome of stability, one would say. But what of the oil held especially for the media ahead of the plenary session, had to producers outside the Organization? Again the OPEC communiqué: be staggered for safety reasons. “… although world oil demand is forecast to increase during the For the past few years OPEC Ministerial Meetings have, by year 2015, this will, yet again, be offset by the projected increase comparison, been quite muted affairs, as far as the international of 1.36m b/d in non-OPEC supply … giving indications of an ex- press is concerned. -

SECTION 7 Oil Prices

SECTION 7 Oil prices OPEC Annual Statistical Bulletin 2017 Oil prices Oil prices Feature Box: Section 7 Evolution of the Brent-WTI spread in recent years Each year between 1983 and 2006, the American crude oil benchmark, WTI, remained more expensive than its European counterpart, Brent. This indicator, referred to as the Brent-WTI spread, averaged $–1.35/b over that time period, with a standard deviation of $0.61/b, and reached its minimum of $–3.20/b in 2004. In 2007 it moved momentarily into positive territory and averaged $0.26/b, before falling by $2.89/b the next year to its second lowest value since the 1980s. In 2011 it sky-rocketed by $16.19/b, over 666 times the average y-o-y change, and has stayed positive on a yearly basis ever since, marking a fundamental change in the global oil market. The phenomenon of a low WTI price, in comparison with other global benchmarks, is often attributed to the oversupply in the United States (US) crude oil market. For the global market, oil oversupply can be defined as the difference between oil supply and demand, while on a country level trade plays the most crucial part. In the US, the situation is even more complicated with so many factors playing a role. The stocks levels at Cushing, Oklahoma, the delivery point for WTI — often described as the most significant trading hub connecting the Gulf Coast suppliers with northern consumers — is often used as the reference point for assessing over/undersupply in the US.