An Inside Look at Residential Property in Germany Sven Henkes (Managing Director) and Nikolaus Ziegert (Owner & Founder) EDITORIAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Champion Brands to My Wife, Mercy the ‘Made in Germany’ Champion Brands Nation Branding, Innovation and World Export Leadership

The ‘Made in Germany’ Champion Brands To my wife, Mercy The ‘Made in Germany’ Champion Brands Nation Branding, Innovation and World Export Leadership UGESH A. JOSEPH First published 2013 by Gower Publishing Published 2016 by Routledge 2 Park Square, Milton Park, Abingdon, Oxon OX14 4RN 711 Third Avenue, New York, NY 10017, USA Routledge is an imprint of the Taylor & Francis Group, an informa business Copyright © Ugesh A. Joseph 2013 Ugesh A. Joseph has asserted his right under the Copyright, Designs and Patents Act, 1988, to be identified as the author of this work. Gower Applied Business Research Our programme provides leaders, practitioners, scholars and researchers with thought provoking, cutting edge books that combine conceptual insights, interdisciplinary rigour and practical relevance in key areas of business and management. All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. Notice: Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation without intent to infringe. British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library. The Library of Congress has cataloged the printed edition as follows: Joseph, Ugesh A. The ‘Made in Germany’ champion brands: nation branding, innovation and world export leadership / by Ugesh A. Joseph. pages cm Includes bibliographical references and index. ISBN 978-1-4094-6646-8 (hardback: alk. -

Long-Term Monitoring of SARS-Cov-2 in Wastewater of the Frankfurt

medRxiv preprint doi: https://doi.org/10.1101/2020.10.26.20215020; this version posted October 27, 2020. The copyright holder for this preprint (which was not certified by peer review) is the author/funder, who has granted medRxiv a license to display the preprint in perpetuity. It is made available under a CC-BY-NC-ND 4.0 International license . 1 Long-term monitoring of SARS-CoV-2 in wastewater of the Frankfurt 2 metropolitan area in Southern Germany 3 4 5 Shelesh Agrawal1, Laura Orschler1, Susanne Lackner1, * 6 7 1 Technische Universität Darmstadt, Institute IWAR, Chair of Wastewater Engineering, 8 Franziska-Braun-Straße 7,64287 Darmstadt, Germany 9 * E-mail: [email protected], Phone: +49 615 116 20309, Fax: +49 615 10 116 20305. 11 12 13 Abstract 14 15 Wastewater-based epidemiology (WBE) is a great approach that enables us to 16 comprehensively monitor the community to determine the scale and dynamics of 17 infections in a city, particularly in metropolitan cities with a high population density. 18 Therefore, we monitored the time course of the SARS-CoV-2 RNA concentration in 19 raw sewage in the Frankfurt metropolitan area, the European financial center. To 20 determine the SARS-CoV-2 concentration in sewage, we continuously collected 21 samples from two wastewater treatment plant (WWTP) influents (Niederrad and 22 Sindlingen) serving the Frankfurt metropolitan area and performed RT-qPCR analysis 23 targeting three genes (N gene, S gene, and ORF1ab gene). In August, a resurgence 24 in the SARS-CoV-2 RNA load was observed, reaching 3 x 1013 copies/day, which 25 represents similar levels compared to April with approx. -

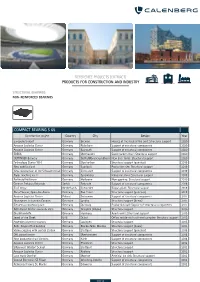

Reference List Construction and Industry

REFERENCE PROJECTS (EXTRACT) PRODUCTS FOR CONSTRUCTION AND INDUSTRY STRUCTURAL BEARINGS NON-REINFORCED BEARINGS COMPACT BEARING S 65 Construction project Country City Design Year Europahafenkopf Germany Bremen Houses at the head of the port: Structural support 2020 Amazon Logistics Center Germany Paderborn Support of structural components 2020 Amazon Logistics Center Germany Bayreuth Support of structural components 2020 EDEKA Germany Oberhausen Supermarket chain: Structural support 2020 OETTINGER Brewery Germany Gotha/Mönchengladbach New beer tanks: Structural support 2020 Technology Center YG-1 Germany Oberkochen Structural support (punctual) 2019 New nobilia plant Germany Saarlouis Production site: Structural support 2019 New construction of the Schwaketenbad Germany Constance Support of structural components 2019 Paper machine no. 2 Germany Spremberg Industrial plant: Structural support 2019 Parkhotel Heilbronn Germany Heilbronn New opening: Structural support 2019 German Embassy Belgrade Serbia Belgrade Support of structural components 2018 Bio Energy Netherlands Coevorden Biogas plant: Structural support 2018 NaturTheater, Open-Air-Arena Germany Bad Elster Structural support (punctual) 2018 Amazon Logistics Center Poland Sosnowiec Support of structural components 2017 Novozymes Innovation Campus Denmark Lyngby Structural support (linear) 2017 Siemens compressor plant Germany Duisburg Production hall: Support of structural components 2017 DAV Alpine Centre swoboda alpin Germany Kempten (Allgäu) Structural support 2016 Glasbläserhöfe -

Stadt Frankfurt Am Main Stadtplanungsamt, Abteilung Gesamtstadt

ZEITLICHE VERFÜGBARKEIT VON WOHNBAULAND WOHNBAUPOTENZIALE WEP 2015 UND RESTPOTENZIALE ÄLTERER WEP Wohnungsbaugebiete (Potenziale) mit zeitlich geschätzter Flächenverfügbarkeit (Baureife) 31 Nr. Potenziale Baureife 20 1 Adickesallee bis in 5 Jahren 38 2 Am Eschbachtal, Harheimer Weg (Bonames Ost) bis in 5 Jahren 3 Am Riedberg * bis in 5 Jahren 21 4 Am Stockborn bis in 5 Jahren 6 5 An der Sandelmühle bis in 5 Jahren 2 6 Ben-Gurion-Ring bis in 5 Jahren 7 Berkersheim Ost bis in 10 Jahren 3 33 8 Breite Gasse bis in 5 Jahren 9 Bürostadt Niederrad/Hahnstraße bis in 5 Jahren 7 39 10 Bürostadt Niederrad/Lyoner Straße bis in 5 Jahren 11 Fischerfeldstraße / Lange Straße bis in 5 Jahren 5 35 15 12 Grünzug Unterliederbach bis in 10 Jahren 26 13 Güterplatz / Heinrichstraße bis in 5 Jahren 14 Hanauer Landstraße - Westlich Osthafenplatz / Launhardtstraße bis in 5 Jahren 4 15 Heddernheim (Kleintierzucht) * bis in 5 Jahren 16 Honsell-Dreieck bis in 5 Jahren 17 Kleyerstraße / Ackermannstraße bis in 5 Jahren 43 19 30 18 Klinikum Höchst (Nördlich Hospitalstraße) bis in 5 Jahren 24 36 19 Leuchte bis in 5 Jahren 20 Nieder-Eschbach Nord langfristig verfügbar 1 21 Nieder-Eschbach Süd langfristig verfügbar 22 Nieder Tor bis in 5 Jahren 23 Nördlich Dieburger Straße bis in 5 Jahren 32 24 Nördlich Kollwitzstraße bis in 10 Jahren 34 25 Nördlich Straßburger Straße bis in 5 Jahren 40 23 41 8 26 Nordöstlich der Anne-Frank-Siedlung (Eschersheim Nord) bis in 10 Jahren 42 45 14 27 Silogebiet I * bis in 5 Jahren 12 18 46 50 11 13 16 28 Silogebiet II langfristig verfügbar -

Bauhaus 1 Bauhaus

Bauhaus 1 Bauhaus Staatliches Bauhaus, commonly known simply as Bauhaus, was a school in Germany that combined crafts and the fine arts, and was famous for the approach to design that it publicized and taught. It operated from 1919 to 1933. At that time the German term Bauhaus, literally "house of construction" stood for "School of Building". The Bauhaus school was founded by Walter Gropius in Weimar. In spite of its name, and the fact that its founder was an architect, the Bauhaus did not have an architecture department during the first years of its existence. Nonetheless it was founded with the idea of creating a The Bauhaus Dessau 'total' work of art in which all arts, including architecture would eventually be brought together. The Bauhaus style became one of the most influential currents in Modernist architecture and modern design.[1] The Bauhaus had a profound influence upon subsequent developments in art, architecture, graphic design, interior design, industrial design, and typography. The school existed in three German cities (Weimar from 1919 to 1925, Dessau from 1925 to 1932 and Berlin from 1932 to 1933), under three different architect-directors: Walter Gropius from 1919 to 1928, 1921/2, Walter Gropius's Expressionist Hannes Meyer from 1928 to 1930 and Ludwig Mies van der Rohe Monument to the March Dead from 1930 until 1933, when the school was closed by its own leadership under pressure from the Nazi regime. The changes of venue and leadership resulted in a constant shifting of focus, technique, instructors, and politics. For instance: the pottery shop was discontinued when the school moved from Weimar to Dessau, even though it had been an important revenue source; when Mies van der Rohe took over the school in 1930, he transformed it into a private school, and would not allow any supporters of Hannes Meyer to attend it. -

F+U Academy of Languages

English version F+U Academy of Languages 2020 Berlin Language courses Corporate training University preparation Special courses Winner 2017 Test centre Accommodation German Language School www.fuu-languages.eu www.fuu-berlin-languages.eu 1 Albrechtstraße Reinhardtstraße Contents F+U in the heart of the capital city Friedrichstraß ß e nstra George F+U in the heart of the capital city .......................................... 3 Accommodation prices Berlin – centre of German politics and culture ..................5-7 F+U shared apartments, private apartments .......................... 31 Paul-Löbe-Allee The F+U international language school in Berlin ............ 9-11 F+U Campus hall of residence ............................................... 32 Spree General information, regulations ..................................... 13-15 F+U Academy Hostel Berlin ...................................................34 e Cultural and leisure activities ............................................... 15 F+U host families, external accommodation .......................... 35 e Dorotheenstraß 5 Course levels ........................................................................... 16 2 e Common European Framework of Reference for Languages Facts and figures ....................................................................36 Dorotheenstraß Mittelstraße Scheidemannstraße 6 (CEFR) ........................................................................................ F+U – international test centre .............................................. 17 State -

The Elbphilharmonie. More Than Just a Concert Hall

ARCHITECTURE Since its official opening on 11 January 2017, the Elbphilharmonie has come to be an absolute crowd-puller. Every year, some 4 million people visit the Plaza, the public viewing area between the building’s brick base and the glass superstructure. The Plaza offers a superb panoramic view of the harbour and the city, and entry is free of charge. It is also home to the Elbphilharmonie Shop and to the Smart Table, where visitors can explore the Elbphilharmonie interactively. A good 675 concerts per season – most of them sold A SPECTACULAR GESAMTKUNSTWERK out – lure some 900,000 enthusiastic music lovers to the Elbphilharmonie. More than THE ELBPHILHARMONIE. MORE THAN JUST A CONCERT HALL 80,000 visitors a year take part in the official guided tours, which include the foyer areas and the two concert halls. The Elbphilharmonie Hamburg is positioned between the industrial harbour and the city centre and is regarded worldwide as Hamburg’s landmark. The spectacular, 110-metre- high glass facade rises up like a wave of glass, and literally seems to hover above the rugged brick base of the historic quayside warehouse. The concert hall was designed by Swiss architects Herzog & de Meuron and is located in the flow of the River Elbe at the western point of the HafenCity Hamburg, opposite the Landungsbrücken piers and in close proximity to the Speicherstadt, Kontorhausviertel and Chilehaus UNESCO World Heritage Site. With 2,100 seats, the Grand Hall is the true centrepiece of the Elbphilharmonie. The seats rise in a steep incline to encircle the stage for an entirely new music experience, rooted in acoustic perfection and an unprecedented closeness between artists and concertgoers. -

Jahrgang 2008 Eberswalde, 05.09.2008 Nr. 7/2008

Jahrgang 2008 Eberswalde, 05.09.2008 Nr. 7/2008 Inhaltsverzeichnis: Amtlicher Teil: Öffentliche Bekanntmachungen: Bekanntmachungen des Landkreises Barnim Seite 2 Wahlbekanntmachung der zugelassenen Wahlvorschläge gemäß § 38 des Brandenburgischen Kommunalwahlgesetzes und § 40 Abs. 1 der Brandenburgischen Kommunalwahlverordnung für die Wahl des Kreistages Barnim am 28. September 2008 Seite 2 Wahlkreis I Seite 5 Wahlkreis II Seite 8 Wahlkreis III Seite 11 Wahlkreis IV Seite 13 Wahlkreis V Seite 16 Wahlkreis VI Seite 18 Wahlkreis VII Seite 21 Wahlkreis VIII Seite 25 Wahlkreis IX Seite 27 Öffentliche Bekanntmachung gemäß § 35 Abs. 4 der Brandenburgischen Kommunalwahlverordnung (BbgKWahlV) Seite 28 Öffentliche Bekanntmachung gemäß § 66 Abs. 3 der Brandenburgischen Kommunalwahlverordnung (BbgKWahlV) Impressum Bezugsmöglichkeiten: Amtsblatt für den Landkreis Barnim Das Amtsblatt für den Landkreis Barnim ist Herausgeber: unter der Internetadresse Landkreis Barnim Der Landrat www.barnim.de Anschrift: Am Markt 1 16225 Eberswalde in den Seiten der Kreisverwaltung nachlesbar. Das Amtsblatt für den Landkreis Barnim Telefon: 03334/214 1 701 erscheint mindestens 6mal pro Jahr und kann Fax: 03334/214 2 703 unter der neben stehenden Anschrift bezogen Mail: [email protected] werden. Bei Postbezug wird ein Unkostenbeitrag in Höhe der geltenden Druck: Druckerei R. Blankenburg Posttarife in Rechnung gestellt. Börnicker Straße 13 Das Amtsblatt wird in der Kreisverwaltung 16321 Bernau bei Berlin sowie in den Verwaltungen der Ämter und Gemeinden ausgelegt. Seite 2 Amtsblatt für den Landkreis Barnim Nr. 7/2008 Amtlicher Teil Öffentliche Bekanntmachungen Wahlbekanntmachung der zugelassenen Wahlvorschläge gemäß § 38 des Brandenburgischen Kommunalwahlgesetzes und § 40 Abs. 1 der Brandenburgischen Kommunalwahlverordnung für die Wahl des Kreistages Barnim am 28. September 2008 Für die Wahl des Kreistages Barnim am 28. -

Festival Village

77 Festival Location Conference Location Eatery Location to Sternschanze 1 Abaton 2 Angie's Nightclub 64 Grilly Idol 1 2 Angie's Nightclub 49 Arcotel Onyx 65 Kopiba 3 Astra Bühne "Zur geilen Knolle" ▶ Board Room 66 Playground Coffee 4 Bucerius Kunstforum ▶ Networking Area (Wiener Bistro) 67 Überquell 5 Centro Sociale ▶ Reeperbahn Festival Lounge 69 6 Docks ▶ Speakers Lounge Service Festival Village Schanzenstraße 7 Elbphilharmonie ▶ Suite 616 68 Artist Catering 68 8 Erotic Art Museum ▶ Suite 716 69 Artist Check-In & Shuttle Area Artist Catering 9 Festival Village 50 Chikago 70 Info & Merch Desk Spiegelzelt Info & Merch Desk 70 ▶ Spiegelzelt 51 Dips'n Stix ▶ Festival Village Info & Merch Desk B e c k s t r . 24 Klaus presented by SEAT 6 Docks Spielbudenplatz Info & Merch Desk ▶ Field Of Arts ▶ 65 5 16 M a r k t s t r . Voormann Fritz Bühne Bazookas Bus 52 East Hotel 71 Taschengarderobe / Bag Drop Ausstellung ▶ Shared Studio Fritz Bühne Aqua 72 Ticket Desk ▶ ▶ Bernstorfstraße Field Of Arts ▶ Shared Studio ▶ C1 ▶ Conference Registration Wohlers Allee 45 presented by SEAT 71 ▶ Klaus Voormann Ausstellung ▶ C2 ▶ Festival Ticketing N e u e r K a m p FELDSTR. T h a d e n s t r . 14 Feldstr. 47 72 10 Flatstock Europe Poster Convention ▶ Cinema ▶ Guestlist 36 11 Galerien in der Neustadt ▶ Foyer (1st floor) Bazzookas Ticket Desk Bus Glacischaussee 12 Grosse Freiheit 36 ▶ Foyer (ground floor) Hotel Otzenstr. 13 Gruenspan ▶ Ginger 49 Arcotel Onyx Hamburg St. Pauli 14 Grüner Jäger ▶ Mandarin 73 Cityhotel Monopol Entrance Otzenstr. 15 Hamburger Schulmuseum 53 Egon Hotel 52 East Hotel Gilbertstr. -

New York Stories« Elbphilharmonie Brings the Music of the Big Apple to Hamburg – from 30 March to 4 April

PRESS RELEASE »NEW YORK STORIES« ELBPHILHARMONIE BRINGS THE MUSIC OF THE BIG APPLE TO HAMBURG – FROM 30 MARCH TO 4 APRIL Hamburg, 27 March 2017: On six evenings featuring a whole variety of big names, audiences at the Elbphilharmonie can hear different facets of the wealth of musical styles that New York City is home to. The programme ranges from John Zorn’s »Bagatelle Marathon«, contemporary pieces for string quartet with the JACK Quartet and from an evening with Michael Feinstein and the hr- Bigband, playing gems from the »Great American Songbook«, to rap with Zebra Katz, great art pop with Anohni and the ensemble yMusic, and electronic music with Tyondai Braxton. The climax of the festival will be two concerts given by the New York Philharmonic under its principal conductor Alan Gilbert with cellist Yo-Yo Ma and the soprano Christina Landshamer. In addition, one of America’s leading contemporary composers, John Adams, will be making a guest appearance. It's an unchallenged claim that New York never sleeps. And if a city never sleeps, its inhabitants obviously have more time for everything, including playing music and listening to it. And it’s true that New Yorkers set great store by music – not least because so many aspiring musicians gravitate to the city from far afield in the belief that this is the only place where they can make their fortune. How did Frank Sinatra put it in the song he made immortal, »New York, New York«? – »If I can make it there, I’ll make it anywhere«. For decades, the East Coast metropolis, consisting of the five boroughs Manhattan, the Bronx, Brooklyn, Queens and Staten Island, was the focus of longing for countless immigrants from all over Europe. -

Gemarkungen Der Amtsgerichte Strausberg, Bad Freienwalde (Oder), Bernau Bei Berlin Und Eberswalde

Amtsgericht Strausberg: Altlandsberg Grunow Rehfelde Bollersdorf Hennickendorf Rüdersdorf Bruchmühle Hermersdorf-Obersdorf Strausberg Buchholz Herzfelde Trebnitz Buckow/Märkische Schweiz Hohenstein Vogelsdorf Dahlwitz-Hoppegarten Hönow Waldsieversdorf Eggersdorf bei Müncheberg Hoppegarten bei Müncheberg Wegendorf Eggersdorf bei Strausberg Ihlow Werder Fredersdorf Jahnsfelde Wesendahl Garzau Klosterdorf Zinndorf Garzin Lichtenow Gielsdorf Müncheberg Münchehofe Neuenhagen bei Berlin Petershagen Amtsgericht Bad Freienwalde (Oder): Altbarnim Groß Neuendorf Neureetz Altfriedland Gusow Neurüdnitz Altglietzen Güstebieser Loose Neutrebbin Altranft Haselberg Ortwig Altreetz Hathenow Platkow Alttrebbin Heckelberg Prötzel Alt Tucheband Hohensaaten Quappendorf Altwriezen/Beauregard Hohenwutzen Rathsdorf-Neugaul Bad Freienwalde Kienitz Rathstock Batzlow Kiehnwerder Reichenberg Beiersdorf Klein Neuendorf Reichenow Bleyen Kruge/ Gersdorf Ringenwalde Bliesdorf Kunersdorf/Metzdorf Schiffmühle Bralitz Küstrin- Kietz Schulzendorf Brunow Letschin Sietzing Buschdorf Leuenberg Sophienthal Dannenberg Lüdersdorf/Biesdorf Steinbeck Eichwerder Mädewitz Steintoch Falkenberg Manschnow Sternebeck/Harnekop Frankenfelde Möglin Wölsickendorf/Wollenberg Freudenberg Neubarnim Wriezen Friedrichsaue Neuenhagen Wulkow b. Trebnitz Genschmar Neuhardenberg Wuschewier Gieshof Zelliner Loose Neuküstrinchen Wustrow Golzow Neulewin Zäckericker Loose Gorgast Neulietzegöricke Zechin Amtsgericht Bernau bei Berlin : Ahrensfelde Lanke Schwanebeck Basdorf Lindenberg Seefeld Bernau Lobetal -

English-Speaking Doctors in Frankfurt on the Main

Last update: 08.06.2018 English-speaking Doctors in Frankfurt on the Main List of Contents (Alphabetized): i) Children’s Emergency Services ii) Dentistry iii) Ear, Nose & Throat – Otolaryngology iv) General Practice v) Hospitals and Clinics in Frankfurt vi) Internists vii) Obstetrics/ Gynecology viii) Ophthalmology ix) Pediatricians and Youth Medicine x) Further Lists and Search Engines 1. Children’s Emergency Cervises Children’s Emergency Telephone Address/ Location Open Hours Services Child and Youth 116117 Theodor-Stern-Kai 7 Wed. 16:00 till 20:00 Emergency Service 60596 Frankfurt am Main Fr. 16:00 till 20:00 Frankfurt/ University Niederrad Sat. 16:00 till 20:00 Clinic Frankfurt Sun. 16:00 till 20:00 Other (holidays and bridge days) 09:00 till 20:00 Child and Youth Gotenstraße 6-8 Wed. 16:00 till 20:00 116117 Emergency Service 65929 Frankfurt am Main, Fr. 16:00 till 20:00 Frankfurt –West/Main- Höchst Sat. 16:00 till 20:00 Taunus Sun. 16:00 till 20:00 Other (holidays and bridge (Frankfurt Höchst Clinic) days) 09:00 till 20:00 Goethe University Frankfurt am Main — Goethe Welcome Centre — [email protected] Emergency Service Frankfurt Mo. 19:00 till 00:00 Nibelungenallee 37-41 (ÄBD-Zentrale Tue. 19:00 till 00:00 60316 Frankfurt am Main, Bürgerhospital) 116117 Wed. 14:00 till 00:00 Nordend Thu. 19:00 till 00:00 Fr. 14:00 till 00:00 Sat. 08:00 till 00:00 Sun. 08:00 till 00:00 Other (holidays and bridge days) 08:00 till 00:00 Child and Youth Starkenburgring 66 Wed.