C NTENT 2020 L

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Accounts

Worldcall Telecom Limited We at Worldcall are committed to achieving dynamic growth and service excellence by being at the cutting edge of technological innovation. We strive to consistently meet and surpass customers', employees' and stake-holders' expectations by offering state-of-the-art telecom solutions with national & international footprints. We feel pride in making efforts to position Worldcall and Pakistan in the forefront of international arena. In the telecom market of Pakistan, Worldcall to have an over- whelming impact on the basis of following benchmarks: l Create new standards of product offering in basic and value added telephony by being more cost effective, easily accessible and dependable. Thus ensuring real value for money to all segments of market. l Be a leader within indigenous operators in terms of market share, gross revenues and ARPU within five years and maintain the same positioning thereafter. l Achieve utmost customer satisfaction by setting up high standards of technical quality and service delivery. Ensuring the most profitable and sustainable patterns of ROI (Return on Investment) for the stake-holders. Annual Report 2008 01 Worldcall Telecom Limited C O N T E N T S Company Information 05 Notice of Annual General Meeting 07 Message from the Chairman 08 Directors’ Report 11 Key Financial Information 17 Statement of Compliance with the best practices on Transfer Pricing 18 Statement of Compliance with Code of Corporate Governance 19 Auditors’ Review Report on Statement of Compliance with Code of Corporate Governance 21 Auditors’ Report to the Members 22 Balance Sheet 23 Profit and Loss Account 24 Cash Flow Statement 25 Statement of Changes in Equity 26 Notes to the Financial Statements 27 Consolidated Financial Statements 64 Pattern of Shareholding 110 Form of Proxy 115 Annual Report 2008 02 Worldcall Telecom Limited FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2008 Annual Report 2008 03 Worldcall Telecom Limited Annual Report 2008 04 Worldcall Telecom Limited COMPANY INFORMATION Chairman Dr. -

Vimpelcom Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR ⌧ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2012 OR Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 1-34694 VIMPELCOM LTD. (Exact name of registrant as specified in its charter) Bermuda (Jurisdiction of incorporation or organization) Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands (Address of principal executive offices) Jeffrey D. McGhie Group General Counsel & Chief Corporate Affairs Officer Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands Tel: +31 20 797 7200 Fax: +31 20 797 7201 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares, or ADSs, each representing one common share New York Stock Exchange Common shares, US$ 0.001 nominal value New York Stock Exchange* * Listed, not for trading or quotation purposes, but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 1,628,199,135 common shares, US$ 0.001 nominal value. -

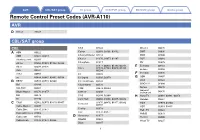

Remote Control Preset Codes (AVR-A110) AVR

AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Remote Control Preset Codes (AVR-A110) AVR D Denon 73347 CBL/SAT group CBL CCS 03322 Director 00476 A ABN 03322 Celrun 02959, 03196, 03442 DMT 03036 ADB 01927, 02254 Channel Master 03118 DSD 03340 Alcatel-Lucent 02901 Charter 01376, 01877, 02187 DST 03389 Amino 01602, 01481, 01822, 02482 Chunghwa 01917 DV 02979 Arion 03034, 03336 01877, 00858, 01982, 02345, E Echostar 03452 Cisco 02378, 02563, 03028, 03265, Arris 02187 03294 Entone 02302 AT&T 00858 CJ 03322 F Freebox 01976 au 03444, 03445, 03485, 03534 CJ Digital 02693, 02979 G GBN 03407 B BBTV 02516, 02518, 02980 CJ HelloVision 03322 GCS 03322 Bell 01998 ClubInternet 02132 GDCATV 02980 BIG.BOX 03465 CMB 02979, 03389 Gehua 00476 General Bright House 01376, 01877 CMBTV 03498 Instrument 00476 BSI 02979 CNS 02350, 02980 H Hana TV 02681, 02881, 02959 BT 02294 Com Hem 00660, 01666, 02015, 02832 Handan 03524 C C&M 02962, 02979, 03319, 03407 01376, 00476, 01877, 01982, HCN 02979, 03340 Comcast 02187 Cable Magico 03035 HDT 02959, 03465 Coship 03318 Cable One 01376, 01877 Hello TV 03322 Cox 01376, 01877 Cable&Wireless 01068 HelloD 02979 Daeryung 01877 Cablecom 01582 D Hi-DTV 03500 DASAN 02683 Cablevision 01376, 01877, 03336 Hikari TV 03237 Digeo 02187 1 AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Homecast 02977, 02979, 03389 02692, 02979, 03196, 03340, 01982, 02703, 02752, 03474, L LG 03389, 03406, 03407, 03500 Panasonic 03475 Huawei 01991 LG U+ 02682, 03196 Philips 01582, 02174, 02294 00660, 01981, 01983, -

MEDIA FACTSHEET (15 Mar 2013) Singapore Unveils 320 Hours of Comedies, Entertainment Programmes and Documentaries at Hong Kong I

MEDIA FACTSHEET (15 Mar 2013) Singapore unveils 320 hours of comedies, entertainment programmes and documentaries at Hong Kong International Film & TV Market (FILMART) The Media Development Authority of Singapore (MDA) will lead 37 Singapore media companies to the 17th edition of the Hong Kong International Film & TV Market (FILMART) where they will meet with producers, distributors and investors to promote their content, negotiate deals and network with key industry players from 18 to 21 March 2013. More than 320 hours of locally-produced content including films and TV programmes will be showcased at the 90-square-metre Singapore Pavilion at the Hong Kong Convention & Exhibition Centre (booth 1A-D01, Hong Kong Convention & Exhibition Centre Level 1, Hall 1A). The content line-up includes recent locally-released film comedies Ah Boys to Men and Ah Boys to Men 2, about recruits in the Singapore military directed by prolific Singapore director Jack Neo; Taxi! Taxi!, inspired by a true story of a retrenched microbiology scientist who turns to taxi driving; Red Numbers by first-time director Dominic Ow about a guy who has three lucky minutes in his miserable life according to a Chinese geomancer; and The Wedding Diary II, the sequel to The Wedding Diary, which depicts life after marriage. Also on show are new entertaining lifestyle TV programmes, from New York Festivals nominee Signature, a TV series featuring world-renowned architect Moshe Safdie and singer Stacey Kent; reality-style lifestyle series Threesome covering topics with Asian TV celebrities Utt, Sonia Couling and Nadya Hutagalung; to light-hearted infotainment décor home makeover show Project Dream Home and Style: Check-in, an interactive 360 content fashion lifestyle programme which uses social media to interact with viewers. -

Table of Contents

TABLE OF CONTENTS Executive Summary 1 Regional Cable TV & Broadband Operators 57 Regional DTH Satellite Pay-TV Operators 77 Regional IPTV & Broadband Operators 90 Regional Broadcasters 99 Regional Digital & Interactive 126 Regional Fixed Service Satellite 161 Regional Broadcasting & Pay-TV Finance 167 Regional Regulation 187 Australia 195 Cambodia 213 China 217 Hong Kong 241 India 266 Indonesia 326 Japan 365 Korea 389 Malaysia 424 Myanmar 443 New Zealand 448 Pakistan 462 Philippines 472 Singapore 500 Sri Lanka 524 Taiwan 543 Thailand 569 Vietnam 590 TABLE OF CONTENTS Executive Summary 1-56 Methodology & Definitions 2 Overview 3-13 Asia Pacific Net New Pay-TV Subscriber Additions (Selected Years) 3 Asia Pacific Pay-TV Subs - Summary Comparison 4 Asia Pacific Pay-TV Industry Revenue Growth 4 China & India - Net New Pay-TV Subscribers (2013) 5 China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 5 Asia Pacific (Ex-China & India), Net New Subscribers (2013) 6 Asia Pacific Ex-China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 8 Economic Growth in Asia (% Real GDP Growth, 2012-2015) 9 Asia Pacific Blended Pay-TV ARPU Dynamics (US$, Monthly) 10 Asia Pacific Pay-TV Advertising (US$ mil.) 10 Asia Pacific Next Generation DTV Deployment 11 Leading Markets for VAS Services (By Revenue, 2023) 12 Asia Pacific Broadband Deployment 12 Asia Pacific Pay-TV Distribution Market Share (2013) 13 Market Projections (2007-2023) 14-41 Population (000) 14 Total Households (000) 14 TV Homes (000) 14 TV Penetration of Total Households (%) -

Comodo Threat Intelligence

Comodo Threat Intelligence Lab SPECIAL REPORT: AUGUST 2017 – IKARUSdilapidated Locky Part II: 2nd Wave of Ransomware Attacks Uses Your Scanner/Printer, Post Office Billing Inquiry THREAT RESEARCH LABS Locky Ransomware August 2017 Special Report Part II A second wave of new but related IKARUSdilapidated Locky ransomware attacks has occurred, building on the attacks discovered by the Comodo Threat Intelligence Lab (part of Comodo Threat Research Labs) earlier in the month of August 2017. This late August campaign also uses a botnet of “zombie computers” to coordinate a phishing attack which sends emails appearing to be from your organization’s scanner/printer (or other legitimate source) and ultimately encrypts the victims’ computers and demands a bitcoin ransom. SPECIAL REPORT 2 THREAT RESEARCH LABS The larger of the two attacks in this wave presents as a scanned image emailed to you from your organization’s scanner/printer. As many employees today scan original documents at the company scanner/printer and email them to themselves and others, this malware-laden email will look very innocent. The sophistication here includes even matching the scanner/printer model number to make it look more common as the Sharp MX2600N is one of the most popular models of business scanner/printers in the market. This second wave August 2017 phishing campaign carrying IKARUSdilapidated Locky ransomware is, in fact, two different campaigns launched 3 days apart. The first (featuring the subject “Scanned image from MX-2600N”) was discovered by the Lab to have commenced primarily over 17 hours on August 18th and the second (a French language email purportedly from the French post office featuring a subject including “FACTURE”) was executed over a 15-hour period on August 21st, 2017. -

Philippines in View Philippines Tv Industry-In-View

PHILIPPINES IN VIEW PHILIPPINES TV INDUSTRY-IN-VIEW Table of Contents PREFACE ................................................................................................................................................................ 5 1. EXECUTIVE SUMMARY ................................................................................................................................... 6 1.1. MARKET OVERVIEW .......................................................................................................................................... 6 1.2. PAY-TV MARKET ESTIMATES ............................................................................................................................... 6 1.3. PAY-TV OPERATORS .......................................................................................................................................... 6 1.4. PAY-TV AVERAGE REVENUE PER USER (ARPU) ...................................................................................................... 7 1.5. PAY-TV CONTENT AND PROGRAMMING ................................................................................................................ 7 1.6. ADOPTION OF DTT, OTT AND VIDEO-ON-DEMAND PLATFORMS ............................................................................... 7 1.7. PIRACY AND UNAUTHORIZED DISTRIBUTION ........................................................................................................... 8 1.8. REGULATORY ENVIRONMENT .............................................................................................................................. -

ASIA PACIFIC PAY-TV DISTRIBUTION the Future of Pay-TV in Asia

ASIA PACIFIC PAY-TV DISTRIBUTION The Future of Pay-TV in Asia September 2017 About the Publisher As a leading independent consulting and research provider, MPA Advisory & Consulting Media Partners Asia (MPA) offers a range of customized MPA customizes our consulting services for a wide range of services and market research to help companies drive business players across the media & telecoms industry. Our expertise development, strategy & planning, M&A, and roll out new helps drive business across the ecosystem. MPA gives companies products & services. Based in Hong Kong, Singapore and India, the data, diligence, insights and strategies to achieve their our teams have local depth and expertise across 18 key markets objectives, including: in Asia Pacific and key international territories. » Benchmarking competition » Entering new markets with local partnerships MPA offers: in-depth research reports across key industry » Initial public offerings (IPOs) sectors; customized consulting services; industry events to » Launching new products and services spread knowledge and unlock partnerships; and publications » M&A transactions that provide insights into driving business. » Restructuring » Recruiting new talent MPA clients include all industry stakeholders, including media & telecoms owners, distributors, policymakers, trade bodies, MPA services include: technology companies and financial institutions. » Benchmarking studies » Due diligence services for M&A MPA Research Reports » Customized market research Our analysts produce 10 reports a year across a variety of sectors » Corporate strategy within the media & telecoms industry, providing data, research » IMC (Independent Market Consultant) research for IPOs and actionable insights that help businesses expand their reach into new markets and benchmark their current performance and MPA Events future growth trajectory. -

Arabic Global 59

ARABIC GLOBAL 59. AL HAYAT CINEMA 120. BAHRAIN SPORT 1 180. AL RASHEED 60. AL NAHAR TV 121. BAHRAIN SPORT 2 181. AL GHADEER 1. AL JAZEERA ARABIC 61. AL HAYAT SPORT 122. BAHRAIN 55 182. AL QETHARA 2. AL JAZEERA ENGLISH 62. AL HAYAT MUSLSALAT 123. BAHRAIN TV 183. OMANN SPORT 3. AL JAZEERA MASR 63. AL HAYAT SERIES 124. ORIENT 184. ALMERGAB 2 4. AL JAZEERA MUBASHER 64. IMAGINE MOVIES 125. AGHAPY 185. TUNISIA TV 5. MBC 1 65. RUSSIA AL YAUM 126. DUBAI TV 186. TUNISIE TELEVISION 6. MBC WANASAH 66. DW TV ARABIC 127. MAEEN 187. MISRATA 7. MBC 4 67. EURO NEWS ARABIC 128. HAMASAT 188. OMAN TV 8. MBC ACTION 68. FUTURE INTERNATIONAL 129. MADANI 189. OMAN TV2 9. MBC MAX 69. FUTURE USA 130. MTV LEBANON 190. SAWSAN TV 10. MBC DRAMA 70. SYRIA SATELLITE 131. NOURSAT AL SHABAB 191. LIBYA AL HURRA 11. MBC MAGHREB 71. CNBC ARABIYAH 132. AL MASRAWIA 192. TOP MOVIES TV 12. MBC 3 72. MBC MASR 133. ABU DHABI DRAMA 2 193. AL HAQEQA 13. MBC PERSIA 73. PANORAMA DRAMA 2 134. AL ANWAR 194. ALL TV 14. MBC 2 74. CRT DRAMA 135. AL MANAR 195. AL LUBNANIA 15. ROTANA CINEMA 75. PANORAMA FILM 136. AL EKHBARIA 196. TAWAZON 16. ROTANA KHALIJIAH 76. PANORAMA DRAMA 137. CORAN TV 197. KIRKUK TV 17. ROTANA MUSIC 77. AL ARABIYAH AL HADATH 138. TELE LIBAN 198. AL FATH 18. ROTANA CLIP 78. AL ALARABIYA 139. AL YAWM PALESTINE 199. FM TV 19. ROTANA MASRIYA 79. FADAK TV 140. BEDAYA 200. -

Download (1MB)

Abrar, Muhammad (2012) Enforcement and regulation in relation to TV broadcasting in Pakistan. PhD thesis. http://theses.gla.ac.uk/3771/ Copyright and moral rights for this thesis are retained by the author A copy can be downloaded for personal non-commercial research or study, without prior permission or charge This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the Author The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the Author When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given. Glasgow Theses Service http://theses.gla.ac.uk/ [email protected] Enforcement and Regulation in Relation to TV Broadcasting in Pakistan Muhammad Abrar Submitted for the Degree of Doctor of Philosophy School of Law College of Social Sciences University of Glasgow November 2012 Abstract Abstract In 2002, private broadcasters started their own TV transmissions after the creation of the Pakistan Electronic Media Authority. This thesis seeks to identify the challenges to the Pakistan public and private electronic media sectors in terms of enforcement. Despite its importance and growth, there is a lack of research on the enforcement and regulatory supervision of the electronic media sector in Pakistan. This study examines the sector and identifies the action required to improve the current situation. To this end, it focuses on five aspects: (i) Institutional arrangements: institutions play a key role in regulating the system properly. (ii) Legislative and regulatory arrangements: legislation enables the electronic media system to run smoothly. -

FLM201 Film Genre: Understanding Types of Film (Study Guide)

Course Development Team Head of Programme : Khoo Sim Eng Course Developer(s) : Khoo Sim Eng Technical Writer : Maybel Heng, ETP © 2021 Singapore University of Social Sciences. All rights reserved. No part of this material may be reproduced in any form or by any means without permission in writing from the Educational Technology & Production, Singapore University of Social Sciences. ISBN 978-981-47-6093-5 Educational Technology & Production Singapore University of Social Sciences 463 Clementi Road Singapore 599494 How to cite this Study Guide (MLA): Khoo, Sim Eng. FLM201 Film Genre: Understanding Types of Film (Study Guide). Singapore University of Social Sciences, 2021. Release V1.8 Build S1.0.5, T1.5.21 Table of Contents Table of Contents Course Guide 1. Welcome.................................................................................................................. CG-2 2. Course Description and Aims............................................................................ CG-3 3. Learning Outcomes.............................................................................................. CG-6 4. Learning Material................................................................................................. CG-7 5. Assessment Overview.......................................................................................... CG-8 6. Course Schedule.................................................................................................. CG-10 7. Learning Mode................................................................................................... -

Asia Pacific to Add 45 Million Pay TV Subscribers

Asia Pacific to add 45 million pay TV subscribers The Asia Pacific pay TV sector is the most vibrant in the world, with subscribers up by 45 million and revenues up by $1.40 billion over the next five years. Pay TV penetration will stay at around 69%. Asia Pacific pay TV subscribers by country (mil) 800.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 2019 2020 2025 Others 70.5 72.3 80.9 Japan 17.4 17.6 17.7 Indonesia 11.2 13.5 18.5 S Korea 20.4 20.3 20.2 India 158.8 161.1 183.1 China 353.4 357.2 356.0 Source: Digital TV Research Ltd China and India together will account for 80% of the region’s 676 million pay TV subscribers by 2025. India will add 24 million pay TV subscribers over the next five years. However, China will peak in 2021 with a slow decline thereafter. OTT penetration and competition will remain much higher in China than in India. Simon Murray, Principal Analyst at Digital TV Research, said: “Much of this subscriber growth is down to the number of TV households increasing by 65 million between 2019 and 2025 to 978 million as populations rise and disposable income climbs. The region’s population is 4 billion – more than half of the world’s total.” For more information on the Asia Pacific OTT TV and Video Forecasts report, please contact: Simon Murray, [email protected], Tel: +44 20 8248 5051 Asia Pacific Pay TV Forecasts Table of Contents Published in March 2020, this 198-page PDF, PowerPoint and excel report comes in three parts: • Outlook: Forecasts for 22 countries in a 52-page PowerPoint document full of charts, graphs and bullet points; • Excel workbook covering each year from 2010 to 2025 for 22 countries by household penetration, by pay TV subscribers, by pay TV revenues and by major operator.