Amerisclerosis? the Puzzle of Rising US Unemployment Persistence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Regional Disparity and Heterogeneous Income Effects of the Euro

Better out than in? Regional disparity and heterogeneous income effects of the euro Sang-Wook (Stanley) Cho1,∗ School of Economics, UNSW Business School, University of New South Wales, Sydney, Australia Sally Wong2 Economic Analysis Department, Reserve Bank of Australia, Sydney, Australia February 14, 2021 Abstract This paper conducts a counterfactual analysis on the effect of adopting the euro on regional income and disparity within Denmark and Sweden. Using the synthetic control method, we find that Danish regions would have experienced small heterogeneous effects from adopting the euro in terms of GDP per capita, while all Swedish regions are better off without the euro with varying magnitudes. Adopting the euro would have decreased regional income disparity in Denmark, while the effect is ambiguous in Sweden due to greater convergence among non-capital regions but further divergence with Stockholm. The lower disparity observed across Danish regions and non-capital Swedish regions as a result of eurozone membership is primarily driven by losses suffered by high-income regions rather than from gains to low- income regions. These results highlight the cost of foregoing stabilisation tools such as an independent monetary policy and a floating exchange rate regime. For Sweden in particular, macroeconomic stability outweighs the potential efficiency gains from a common currency. JEL classification: Keywords: currency union, euro, synthetic control method, regional income disparity ∗Corresponding author. We would like to thank Glenn Otto, Pratiti Chatterjee, Scott French, Federico Masera and Alan Woodland for their constructive feedback and comments. The views expressed in this paper are those of the authors and are not necessarily those of the Reserve Bank of Australia. -

DA-15-132A6.Pdf

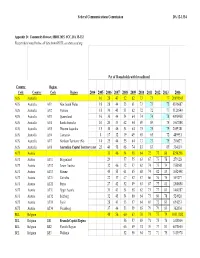

Federal Communications Commission DA 12-1334 Appendix D: Community Dataset, IBDR 2015, FCC, DA 15-132 Except where noted below, all data from OECD, see stats.oecd.org Pct of Households with broadband Country Region Code Country Code Region 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2006 AUS Australia 16 28 43 52 62 73 73 77 20695501 AUS Australia AU1 New South Wales 18 28 44 53 61 73 73 75 6816087 AUS Australia AU2 Victoria 18 30 45 51 62 72 72 77 5126540 AUS Australia AU3 Queensland 16 30 44 54 64 74 74 78 4090908 AUS Australia AU4 South Australia 10 20 33 42 54 69 69 75 1567888 AUS Australia AU5 Western Australia 15 30 46 54 64 75 75 79 2059381 AUS Australia AU6 Tasmania 8 17 32 39 49 65 65 72 489951 AUS Australia AU7 Northern Territorry (Nt) 14 25 44 55 64 73 73 79 210627 AUS Australia AU8 Australian Capital Territory (Act) 23 40 58 68 74 83 83 85 334119 AUT Austria 33 46 54 58 64 72 77 80 8254298 AUT Austria AT11 Burgenland 29 57 55 63 67 73 78 279128 AUT Austria AT12 Lower Austria 32 46 52 57 62 74 75 74 1580501 AUT Austria AT13 Vienna 45 55 61 65 68 74 82 83 1652448 AUT Austria AT21 Carinthia 22 37 47 52 57 66 76 75 559277 AUT Austria AT22 Styria 27 42 52 49 63 67 77 81 1200854 AUT Austria AT31 Upper Austria 31 43 54 58 62 73 77 81 1400287 AUT Austria AT32 Salzburg 32 45 54 60 64 73 80 78 524920 AUT Austria AT33 Tyrol 28 43 53 57 64 69 72 83 694253 AUT Austria AT34 Vorarlberg 37 44 53 59 65 79 79 83 362630 BEL Belgium 48 56 60 63 70 74 75 79 10511382 BEL Belgium BE1 Brussels Capital Region 56 57 65 71 75 76 1018804 BEL Belgium -

The Genetic Structure of the Swedish Population

The Genetic Structure of the Swedish Population Keith Humphreys1, Alexander Grankvist1, Monica Leu1, Per Hall1, Jianjun Liu2, Samuli Ripatti3,4, Karola Rehnstro¨ m5, Leif Groop6, Lars Klareskog7, Bo Ding7, Henrik Gro¨ nberg1, Jianfeng Xu8,9, Nancy L. Pedersen1, Paul Lichtenstein1, Morten Mattingsdal10,11, Ole A. Andreassen10,12, Colm O’Dushlaine13,14, Shaun M. Purcell13,14, Pamela Sklar13,14, Patrick F. Sullivan15, Christina M. Hultman1, Juni Palmgren1,16,17, Patrik K. E. Magnusson1* 1 Department of Medical Epidemiology and Biostatistics, Karolinska Institutet, Stockholm, Sweden, 2 Human Genetics Laboratory, Genome Institute of Singapore, Singapore, Singapore, 3 Institute for Molecular Medicine, Finland, FIMM, University of Helsinki, Helsinki, Finland, 4 Public Health Genomics Unit, National Institute for Health and Welfare, Helsinki, Finland, 5 Wellcome Trust Sanger Institute, Wellcome Trust Genome Campus, Hinxton, United Kingdom, 6 Department of Clinical Sciences, Diabetes and Endocrinology, Lund University Diabetes Centre, Malmo¨, Sweden, 7 Institute of Environmental Medicine, Karolinska Institutet, Stockholm, Sweden, 8 Department of Cancer Biology and Comprehensive Cancer Center, Wake Forest University School of Medicine, Winston-Salem, North Carolina, United States of America, 9 Center for Cancer Genomics, Wake Forest University School of Medicine, Winston-Salem, North Carolina, United States of America, 10 Institute of Clinical Medicine, Section Psychiatry, University of Oslo, Oslo, Norway, 11 Sørlandet Hospital HF, Kristiansand, -

Regions and Cities at a Glance 2020

Regions and Cities at a Glance 2020 provides a comprehensive assessment of how regions and cities across the OECD are progressing in a number of aspects connected to economic development, health, well-being and net zero-carbon transition. In the light of the health crisis caused by the COVID-19 pandemic, the report analyses outcomes and drivers of social, economic and environmental resilience. Consult the full publication here. OECD REGIONS AND CITIES AT A GLANCE - COUNTRY NOTE SWEDEN A. Resilient regional societies B. Regional economic disparities and trends in productivity C. Well-being in regions D. Industrial transition in regions E. Transitioning to clean energy in regions F. Metropolitan trends in growth and sustainability The data in this note reflect different subnational geographic levels in OECD countries: • Regions are classified on two territorial levels reflecting the administrative organisation of countries: large regions (TL2) and small regions (TL3). Small regions are classified according to their access to metropolitan areas (see https://doi.org/10.1787/b902cc00-en). • Functional urban areas consists of cities – defined as densely populated local units with at least 50 000 inhabitants – and adjacent local units connected to the city (commuting zones) in terms of commuting flows (see https://doi.org/10.1787/d58cb34d-en). Metropolitan areas refer to functional urban areas above 250 000 inhabitants. Regions and Cities at a Glance 2020 Austria country note 2 A. Resilient regional societies Stockholm has the highest potential for remote working A1. Share of jobs amenable to remote working, 2018 Large regions (TL2, map) LUX GBR AUS SWE CHE NLD ISL DNK FRA High (>40%) FIN NOR BEL 3540-50%-40% LTU EST 3030-40%-35% IRL GRC 2520-30%-30% DEU AUT Low (<25%) LVA SVN OECD30 PRT HRV POL ITA USA CZE HUN CAN ESP ROU SVK BGR TUR COL 0 10 20 30 40 50 % The share of jobs amenable to remote working across Swedish regions range from close to 50% in Stockholm to 33% in North Middle Sweden (Figure A1). -

Cross-Border Scandinavian Area Case Study

CIRCTER SPIN-OFF // Cross-border Scandinavian area Case study Final Report // May 2021 This CIRCTER spin-off is conducted within the framework of the ESPON 2020 Cooperation Programme, partly financed by the European Regional Development Fund. The ESPON EGTC is the Single Beneficiary of the ESPON 2020 Cooperation Programme. The Single Operation within the programme is implemented by the ESPON EGTC and co-financed by the European Regional Development Fund, the EU Member States and the Partner States, Iceland, Liechtenstein, Norway and Switzerland. This delivery does not necessarily reflect the opinions of members of the ESPON 2020 Monitoring Committee. Authors Marco Bianchi, Mauro Cordella, Pierre Merger - Tecnalia Research and Innovation, Spain Advisory group Jan Edøy - Ministry of Local Government and Modernisation, Department of Regional Development, Norway Erik Hagen, Bjørn Terje Andersen – Innlandet County Authority, Norway Marjan van Herwijnen - ESPON EGTC Information on ESPON and its projects can be found at www.espon.eu. The website provides the possibility to download and examine the most recent documents produced by finalised and ongoing ESPON projects. ISBN: 978-2-919795-97-0 © ESPON, 2020 Layout and graphic design by BGRAPHIC, Denmark Printing, reproduction or quotation is authorised provided the source is acknowledged and a copy is forwarded to the ESPON EGTC in Luxembourg. Contact: [email protected] CIRCTER SPIN-OFF // Cross-border Scandinavian area Case study Final Report // May 2021 CIRCTER SPIN-OFF // Cross-border Scandinavian -

OECD Territorial Grids

BETTER POLICIES FOR BETTER LIVES DES POLITIQUES MEILLEURES POUR UNE VIE MEILLEURE OECD Territorial grids August 2021 OECD Centre for Entrepreneurship, SMEs, Regions and Cities Contact: [email protected] 1 TABLE OF CONTENTS Introduction .................................................................................................................................................. 3 Territorial level classification ...................................................................................................................... 3 Map sources ................................................................................................................................................. 3 Map symbols ................................................................................................................................................ 4 Disclaimers .................................................................................................................................................. 4 Australia / Australie ..................................................................................................................................... 6 Austria / Autriche ......................................................................................................................................... 7 Belgium / Belgique ...................................................................................................................................... 9 Canada ...................................................................................................................................................... -

Pilot Project on Industrial Transition

RAPPORT Datum 2018-06-11 Enheten för regional tillväxt Maja Sörensen [email protected] Pilot project on industrial transition Material on Norra Mellansverige used for the peer learning workshops organized by the European Commission and OECD spring 2018 Region Värmland - kommunalförbund Postadress Besöksadress Telefon 054-701 10 00 vx Orgnr 222000-1362 Box 1022 Lagergrens gata 2 Fax 054-701 10 01 Bankgiro 5344-2984 651 15 KARLSTAD E-post [email protected] PlusGiro 437 33 98-9 Webbplats www.regionvarmland.se REGION VÄRMLAND 2018-06-11 2 Contents 1 Introduction ................................................................................................ 3 2 Workshop 2: Broadening innovation and innovation diffusion ............ 5 3 Workshop 3: Low carbon energy transition ........................................... 9 4 Workshop 4: Promoting entrepreneurship and mobilising the private sector ............................................................................................................ 16 5 Workshop 5: Inclusive growth ................................................................ 22 REGION VÄRMLAND 2018-06-11 3 1 Introduction In July 2017 the European Commission presented new ways to help regions build resilient economies in new times by going further with the regional smart specialisation strategies. One of the actions initiated was two new pilot projects and Norra Mellansverige was selected to participate in the pilot “Tailored support for the specific challenges on regions facing industrial transition” -

Northern Central Sweden)

Version: Final Date: 11 April 2012 Regional Innovation Monitor Regional Innovation Report (Northern Central Sweden) To the European Commission Enterprise and Industry Directorate-General Directorate D – Industrial Innovation and Mobility Industries Maria Lindqvist Nordregio www.technopolis-group.com PREFACE The Regional Innovation Monitor (RIM)1 is an initiative of the European Commission's Directorate General for Enterprise and Industry, which has the objective to describe and analyse innovation policy trends across EU regions. RIM analysis is based on methodologies developed in the context of the INNO-Policy Trendchart, which covers innovation policies at national level as part of the PRO INNO Europe initiative. The overarching objective of this project is to enhance the competitiveness of European regions through increasing the effectiveness of their innovation policies and strategies. The specific objective of the RIM is to enhance the scope and quality of policy assessment by providing policy-makers, other innovation stakeholders with the analytical framework and tools for evaluating the strengths and weaknesses of regional policies and regional innovation systems. RIM covers EU-20 Member States: Austria, Belgium, Bulgaria, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, the Netherlands, Poland, Portugal, Romania, Slovakia, Spain, Sweden and the United Kingdom. This means that RIM will not concentrate on Member States where the Nomenclature of territorial units for statistics NUTS 1 and 2 levels are identical with the entire country (Estonia, Latvia, and Lithuania), Malta which only has NUTS 3 regions, Slovenia which has a national innovation policy or Cyprus and Luxembourg which are countries without NUTS regions. The main aim of 50 regional reports is to provide a description and analysis of contemporary developments of regional innovation policy, taking into account the specific context of the region as well as general trends. -

Regional Innovation Monitor Plus 2016

30 May 2016 Regional Innovation Monitor Plus 2016 Regional Innovation Report North Middle Sweden (Production related biotechnology) To the European Commission Internal Market, Industry, Entrepreneurship and SMEs Directorate-General Directorate F – Innovation and Advanced Manufacturing www.technopolis-group.com Regional Innovation Monitor Plus 2016 Regional Innovation Report North Middle Sweden (Production related biotechnology) technopolis |group| in cooperation with Iryna Kristensen and Nelli Mikkola, Nordregio Table of Contents 1. Advanced Manufacturing: Production related biotechnology 5 1.1 Overview of performance and trends 5 1.2 Business sector perspective 6 1.3 Scientific research potential 7 1.4 Role of intermediary institutions 9 1.5 Developing skills for the future 10 1.6 Major investment projects 11 1.7 International cooperation. 14 1.8 Policy support and delivery mechanisms 15 1.9 Good practice case 18 1.10 Leveraging the existing potential 24 2. Regional Innovation Performance Trends, Governance and Instruments 26 2.1 Recent trends in innovation performance and identified challenges 26 2.2 Institutional framework and set-up 28 2.3 Regional innovation policy mix 28 2.4 Appraisal of regional innovation policies 31 2.5 Policy good practice 33 2.6 Possible future orientations and opportunities 34 Appendix A Bibliography 37 Appendix B Stakeholders consulted 40 Table of Figures Figure 1: Organisational structure ................................................................................. 20 List of Tables Table 1 Regional innovation support measures ............................................................. 29 Regional Innovation Monitor Plus 2016 i PREFACE In the context of the growth and investment package set out in the Investment Plan of the European Commission, the Regional Innovation Monitor Plus (RIM Plus) provides a unique platform for sharing knowledge and know-how on major innovation and industrial policy trends in some 200 regions across the EU28 Member States. -

Sociálně Ekonomická Charakteristika Švédska Na Úrovni NUTS 2 Socio

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by DSpace at VSB Technical University of Ostrava VYSOKÁ ŠKOLA BÁ ŇSKÁ – TECHNICKÁ UNIVERZITA OSTRAVA EKONOMICKÁ FAKULTA KATEDRA REGIONÁLNÍ A ENVIROMENTÁLNÍ EKONOMIKY Sociáln ě ekonomická charakteristika Švédska na úrovni NUTS 2 Socio-Economic Characteristics of Sweden at NUTS-2 Level Student: Alena Radová Vedoucí bakalá řské práce: RNDr. Ivan Šotkovský, Ph.D. Ostrava 2010 2 Zadání bakalá řské práce VŠB-Technická univerzita Ostrava Fakulta ekonomická Katedra regionální a environmentální ekonomiky 118 Akademický rok 2009/2010 ZADÁNÍ BAKALÁ ŘSKÉ PRÁCE Řešitel: Alena Radová Program: Hospodá řská politika a správa Obor: Regionální rozvoj Specializace: Téma: Sociáln ě ekonomická charakteristika Švédska na úrovni NUTS 2 Socio-economic characteristics of Sweden at NUTS 2 level 1. Úvod 2. Geopolitická charakteristika Švédska 3. Sociální disparity regionu Švédsko 4. Ekonomické postavení NUTS 2 Švédska 5. Záv ěr Seznam použité literatury Seznam zkratek Prohlášení o využití výsledk ů bakalá řské práce Přílohy Odborná literatura: ŠOTKOVSKÝ, I. Hospodá řská geografie. 1. vyd. VŠB-Technická univerzita Ostrava, 2002. 248 s. ISBN 80-248-0066-7 KARPOVÁ, E. Hospodá řský vývoj Rakouska, Švédska a Finska po vstupu do evropské unie . 1. vyd. Vysoká škola ekonomická v Praze, 2006. 220 s. ISBN 80-245-1072-3 EUROPEAN COMMISSION. Growing Regions, growing Europe – Fourth report on economic and social cohension . 1. vyd. Office for Official Publications of the European Communities Luxembourg, 2007. 222 s. ISBN 92-79-05704-5 Vedoucí: RNDr. Ivan Šotkovský, Ph.D. Datum zadání bakalá řské práce: 20. 11. 2009 Datum odevzdání bakalá řské práce: 7. -

Regional Innovation Systems in Sweden

Ekonomia Międzynarodowa 16 (2016) http://dx.doi.org/10.18778/2082-4440.16.06 Regional Innovation Systems in Sweden Joanna Ligenzowska1 Introduction The world has changed. Markets are global. Science is an increasingly competitive endeavour. Innovation is becoming the most important engine of growth and jobs in the emerging knowledge-based economy (European Parliament 2009). The con- cept of a “learning economy” or “knowledge-based economy” is based on the idea that innovation is not viewed appropriately as a linear process, but rather as a so- cial and interactive process (Lundvall, Borras 1997). For 16 years, the European Union has been trying to achieve the goals which were set in the Lisbon Strategy by the initiative of European Research Area. The goals of the initiative are: 1) to enable researchers to move, interact and benefit from world-class in- frastructures, and work with excellent networks of research institutions; 2) to share, teach, value and use knowledge effectively for social, business and policy purposes; 3) to optimize and open European, national, and regional research pro- grammes; 4) to make more coherent use of public instruments and resources; 5) to develop strong links with partners around the world so that Europe benefits from the worldwide progress of knowledge, contributes to global development, and takes a leading role in international initiatives to solve global issues; 6) to develop essential “critical mass” in the major areas of progress in knowl- edge, in particular to achieve economies of scale, to better allocate re- sources overall, and to reduce negative externalities due to the insufficient * Joanna Ligenzowska – M.Sc., University of Agriculture in Krakow, Faculty of Agriculture and Economics, Department of Economics and Economic Policy 388 mobility of factors and poor information for operators (Innovation Sys- tem Guidebook 2010). -

Mining Regions and Cities Case of Västerbotten and Norrbotten, Sweden OECD Rural Studies

OECD Rural Studies OECD Rural Studies Mining Regions and Cities Case of Västerbotten and Norrbotten, Sweden OECD Rural Studies Sweden’s northern region, Upper Norrland, is one of the most important mining regions in Europe and has the potential to become a global leader in environmentally sustainable mining. With the largest land surface and the lowest population density in Sweden, Upper Norrland contains two sub regions, Västerbotten Mining Regions and Cities and Norrbotten. Both sub regions host the greatest mineral reserves in the country, containing 9 of the country’s 12 active mines and providing 90% of the iron ore in the European Union. Upper Norrland has the potential Case of Västerbotten to become a global leader in environmentally sustainable mining due to its competitive advantages, including a stable green energy supply, high‑quality broadband connection, a pool of large mining companies working closely with universities to reduce the emissions footprint across the mining value chain, and a highly skilled and Norrbotten, Sweden labour force. Yet, the region must overcome a number of bottlenecks to support a sustainable future, including a shrinking workforce, low interaction of local firms with the mining innovation process and an increasing opposition to mining due to socio environmental concerns and land use conflicts. This study identifies how Västerbotten and Norrbotten can build on their competitive advantages and address current and future challenges to support a resilient future through sustainable mining. Mining Regions and Cities Case of Västerbotten and Norrbotten, Sweden PRINT ISBN 978-92-64-56068-0 PDF ISBN 978-92-64-93868-7 9HSTCQE*fgagia+ OECD Rural Studies Mining Regions and Cities Case of Västerbotten and Norrbotten, Sweden This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area.