Kroger Rival Whole Foods Expands Its Small-Store Concept

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News Release

News Release Kroger Bringing Help and Hope for the Holidays CINCINNATI, Nov. 18, 2013 /PRNewswire/ -- Many families in need will have fresh, wholesome food and clothing, shelter and social services this holiday season thanks to The Kroger Co. (NYSE: KR) customers and associates who shop and work at its family of stores. "Kroger has a proud history of investing in our communities and a rich tradition of bringing help and hope for the holidays," said Lynn Marmer, Kroger'sgroup vice president of corporate affairs. "In keeping with that tradition, we are making it easy for our customers and associates to support their local food banks and The Salvation Army's Red Kettle Campaign in our family of stores this holiday season." Feeding Hungry Neighbors As a founding partner of Feeding America, the nation's largest domestic hunger agency, Kroger has been engaged in the hunger relief effort for more than 30 years. Today, the Kroger family of stores has longstanding relationships with more than 80 local food banks. This holiday season, customers can help, too, thanks to a variety of simple donation opportunities. Making a financial donation to a local food bank is as easy as scanning a pre-marked tag at registers, asking the cashier to 'round up' a grocery order, or place spare change in specially-marked coin boxes at Kroger, City Market, Dillons, Baker's, Gerbes, Food 4 Less, Fred Meyer, Fry's, QFC, Ralphs, and Smith's stores. Major food drives will be held at many Kroger stores in Illinois, Indiana, Kentucky, Louisiana, Michigan, North Carolina, Ohio, Tennessee, Texas, Virginia andWest Virginia; Fred Meyer stores in Alaska, Idaho, Oregon and Washington; and in City Market, Dillons, Baker's, Gerbes, King Soopers and Smith's stores. -

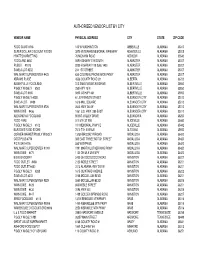

Region 001-004

July 2021 Price Region County Store Name Store Address City Zip 001 BASTROP BROOKSHIRE BROS #55 501 NW LOOP 230 SMITHVILLE 78957 001 BASTROP HEB #475 1080 EAST HIGHWAY 290 ELGIN 78621 001 BASTROP HEB #582 104 HASLER BLVD BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #1042 488 HWY 71 WEST BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #3170 1320 W HIGHWAY 290 ELGIN 78621 001 BELL BROOKSHIRE BROS #69 215 MILL CREEK DRIVE #100 SALADO 76571 001 BELL HEB #039 2509 NORTH MAIN STREET BELTON 76513 001 BELL HEB #071 1314 WEST ADAMS TEMPLE 76504 001 BELL HEB #182 3002 SOUTH 31ST STREET TEMPLE 76502 001 BELL HEB #381 601 INDIAN TRAIL HARKER HEIGHTS 76548 001 BELL HEB #581 2511 TRIMMIER ROAD STE 100 KILLEEN 76542 001 BELL HEB #721 1101 W STAN SCHULUETER LP KILLEEN 76549 001 BELL KILLEEN NUTRITIONAL CENTER 107 SANTA FE PLAZA DRIVE KILLEEN 76541 001 BELL WAL-MART NBH MKT #6459 960 EAST FM 2410 HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #1232 2604 NORTH MAIN STREET BELTON 76513 001 BELL WAL-MART SUPERCENTER #3319 2020 HEIGHTS DRIVE HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #407 1400 LOWES BLVD KILLEEN 76542 001 BELL WAL-MART SUPERCENTER #6286 3404 W STAN SCHLUETER LOOP KILLEEN 76549 001 BELL WAL-MART SUPERCENTER #6929 6801 W ADAMS AVENUE TEMPLE 76502 001 BELL WAL-MART SUPERCENTER #746 3401 SOUTH 31ST STREET TEMPLE 76502 001 BELL WALMART NEIGHBORHOOD MKT #3449 3801 E STAN SCHLUETER LOOP KILLEEN 76542 001 BELL WALMART NEIGHBORHOOD MKT #3450 2900 CLEAR CREEK RD KILLEEN 76549 001 BELL FORT HOOD COMMISSARY II WARRIOR WAY & 10TH BLDG 85020 -

Kroger: Value Trap Or Value Investment - a Deep Due Diligence Dive

Kroger: Value Trap Or Value Investment - A Deep Due Diligence Dive seekingalpha.com /article/4115509-kroger-value-trap-value-investment-deep-due-diligence-dive Chuck 10/23/2017 Walston The acquisition of Whole Foods Market, announced by Amazon ( AMZN) last June sent shockwaves through the grocery industry. 1/20 When the deal was finalized in August, Amazon announced plans to lower the prices of certain products by as much as a third. The company also hinted at additional price reductions in the future. Amazon Prime members will be given special savings and other in-store benefits once the online retail giant integrates its point of sale system into Whole Foods stories. 2/20 Analysts immediately predicted a future of widespread margin cuts across the industry. Well before Amazon's entry into stick and brick groceries, Kroger ( KR) experienced deterioration in comparable store sales. 3/20 (Source: Kroger Investor Presentation slideshow) (Source: SEC Filings via SA contributor Quad 7 Capital) Additionally, Kroger's recent results reflect gross margin compression. 4/20 (Source: SEC Filings via SA contributor Quad 7 Capital) After the takeover, Whole Foods initiated a price war. According to Reuters, prices at a Los Angeles Whole Foods store are lower on some products than comparable goods sold in a nearby Ralph's store owned by Kroger. The Threat From Amazon Research conducted by Foursquare Labs Inc. indicates the publicity surrounding Amazon's recent acquisition of Whole Foods, combined with the announcement of deep price cuts, resulted in a 25% surge in customer traffic. Not content to attack conventional grocers with their panoply of online food services and margin cuts, Amazon registered a trademark application for a meal-kit service. -

A Sustainable Future

KROGER’S 2019 ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG) REPORT A Sustainable Future 2019 We imagine a better future for SUSTAINABILITY people and the planet — a world REPORT with Zero Hunger | Zero Waste. 2019 SUSTAINABILITY Contents REPORT About About This Zero Hunger | Kroger Report Zero Waste Operations Letter from Our Zero Hunger Chairman & CEO Governance Zero Waste 2020 Sustainability Engagement Goals Zero Heroes Report Overview ESG Index Our Customers & Communities Our People Our Planet Our Products Customer Satisfaction Talent Attraction Zero Waste Better-for-You & Digital Innovation & Retention Products Food Waste Health & Nutrition Associate Health Sustainable Product Energy & Emissions & Safety Packaging Food Access Water Responsible Sourcing Community Engagement Supply Chain Accountability Food Safety GRI Index 2018 Awards PAGE 1 \\ THE KROGER FAMILY OF COMPANIES 2019 SUSTAINABILITY REPORT Our Customers Our People Our Planet Our Products & Communities PAGE 2 \\ THE KROGER FAMILY OF COMPANIES 2019 SUSTAINABILITY REPORT About Kroger GRI 102-1, 102-3, 102-5 BECOMING KROGER In 1883, Barney Kroger invested his life savings of $372 to open a grocery store at 66 Pearl Street in downtown Cincinnati. The son of a merchant, he ran his business with a simple motto: “Be particular. Never sell anything you would not want yourself.” This credo served Kroger well over the next 136 years as the supermarket business evolved into a variety of formats aimed at satisfying the ever-changing needs of shoppers. The Kroger Co. is a publicly held corpora- tion (NYSE: KR). Still based in Cincinnati, Kroger operates nearly 2,800 stores under two dozen banners, ranking as one of the world’s largest retailers. -

Alabama Vendor List.Xlsx

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

2020 Fact Book Kroger at a Glance KROGER FACT BOOK 2020 2 Pick up and Delivery Available to 97% of Custom- Ers

2020 Fact Book Kroger At A Glance KROGER FACT BOOK 2020 2 Pick up and Delivery available to 97% of Custom- ers PICK UP AND DELIVERY 2,255 AVAILABLE TO PHARMACIES $132.5B AND ALMOST TOTAL 2020 SALES 271 MILLION 98% PRESCRIPTIONS FILLED HOUSEHOLDS 31 OF NEARLY WE COVER 45 500,000 640 ASSOCIATES MILLION DISTRIBUTION COMPANY-WIDE CENTERS MEALS 34 DONATED THROUGH 100 FEEDING AMERICA FOOD FOOD BANK PARTNERS PRODUCTION PLANTS ARE 35 STATES ACHIEVED 2,223 ZERO WASTE & THE DISTRICT PICK UP 81% 1,596 LOCATIONS WASTE OF COLUMBIA SUPERMARKET DIVERSION FUEL CENTERS FROM LANDFILLS COMPANY WIDE 90 MILLION POUNDS OF FOOD 2,742 RESCUED SUPERMARKETS & 2.3 MULTI-DEPARTMENT STORES BILLION kWh ONE OF AMERICA’S 9MCUSTOMERS $213M AVOIDED SINCE MOST RESPONSIBLE TO END HUNGER 2000 DAILY IN OUR COMMUNITIES COMPANIES OF 2021 AS RECOGNIZED BY NEWSWEEK KROGER FACT BOOK 2020 Table of Contents About 1 Overview 2 Letter to Shareholders 4 Restock Kroger and Our Priorities 10 Redefine Customer Expereince 11 Partner for Customer Value 26 Develop Talent 34 Live Our Purpose 39 Create Shareholder Value 42 Appendix 51 KROGER FACT BOOK 2020 ABOUT THE KROGER FACT BOOK This Fact Book provides certain financial and adjusted free cash flow goals may be affected changes in inflation or deflation in product and operating information about The Kroger Co. by: COVID-19 pandemic related factors, risks operating costs; stock repurchases; Kroger’s (Kroger®) and its consolidated subsidiaries. It is and challenges, including among others, the ability to retain pharmacy sales from third party intended to provide general information about length of time that the pandemic continues, payors; consolidation in the healthcare industry, Kroger and therefore does not include the new variants of the virus, the effect of the including pharmacy benefit managers; Kroger’s Company’s consolidated financial statements easing of restrictions, lack of access to vaccines ability to negotiate modifications to multi- and notes. -

Market Structure Analysis of Florida Metropolitan and Micropolitan

Retail Grocery Market Structure Analysis of Virginia Metropolitan and Micropolitan Areas Prepared for Virginia Community Capital (VCC) by The Reinvestment Fund (TRF) as part of the ReFresh initiative, supported by JPMorgan Chase | February 2015 Retail Grocery Market Structure Analysis of Virginia Metropolitan and Micropolitan Areas Prepared for Virginia Community Capital (VCC) by The Reinvestment Fund (TRF) as part of the ReFresh initiative, supported by JPMorgan Chase | February 2015 TRF’s Market Structure Analysis measures the concentration of market share within a region’s retail grocery industry. In general, as the concentration of market share within the top few grocers increases, the region’s overall level of competition within the industry decreases as it evolves into a tighter oligopoly.1 An oligopoly is a market condition in which the supply of a good or service is largely controlled by a small number of entities, each of which is in a position to influence prices, thus directly affecting its competitors’ ability to sustain profitability. After decades of mergers, acquisitions, and emphasis on economies of scale, the retail grocery industry has naturally evolved into an oligopoly, ranging in intensity from tight (fewer majority owners) to loose (more majority owners), based on the number of owning entities controlling the majority market share.2 TRF’s experience with the Pennsylvania Fresh Food Financing Initiative suggests that a tight oligopoly in at least one Pennsylvania metro area made market penetration especially difficult for local and regional grocers that were not members of the oligopoly. Conversely, loose oligopolies with less concentrated market share exhibited fewer barriers to entry for prospective grocers. -

Target Corporation

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 TARGET CORPORATION (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Notice of 2018 annual meeting of shareholders Wednesday, June 13, 2018 9:00 a.m. -

Kroger’S Growth Strategy Delivering Strong & Sustainable TSR Chairman & Chief Executive Officer 1 Rodney Mcmullen | 4 Gary Millerchip | Chief Financial Officer

Leading with Fresh, Accelerating with Digital 2021 Investor Day Agenda Kroger’s Growth Strategy Delivering Strong & Sustainable TSR Chairman & Chief Executive Officer 1 Rodney McMullen | 4 Gary Millerchip | Chief Financial Officer Accelerating Digital Growth & Profitability Q&A Panel 2 Yael Cosset | Chief Information Officer 5 Network Fulfillment Strategy Supports Growth Gabriel Arreaga | Senior Vice President, Supply Chain Closing Comments Rodney McMullen | Chairman & Chief Executive Officer Media: A Key Driver of Digital Profitability 6 Cara Pratt | Vice President, Kroger Precision Marketing Growing with Food, Leading with Fresh 3 Stuart Aitken | Chief Marketing & Merchandising Officer Fresh for Everyone Amanda Rassi | Vice President, Marketing Elevating the Customer Experience Mary Ellen Adcock | Senior Vice President, Operations 2 Safe Harbor This presentation includes forward-looking non-GAAP financial measures, which management believes to be useful to investors and analysts. Kroger is unable to provide a full reconciliation of the non-GAAP measures used in our guidance, including, but not limited to, adjusted FIFO operating profit to operating profit, and adjusted free cash flow, without unreasonable effort because it is not possible to predict with a reasonable degree of certainty the information necessary to calculate such measures on a GAAP basis. It is not possible to estimate with a reasonable degree of certainty certain of our adjustment items because such information is dependent on future events that may be outside of our -

RETAIL VIEW: Kroger Said to Be Eyeing Albertsons

- Advertisement - RETAIL VIEW: Kroger said to be eyeing Albertsons October 27, 2005 If it happens, the Kroger Co. would become the nation's largest supermarket with sales approaching, if not topping, $100 billion. If it happens, Kroger would receive about $1 of every $5 America spends at the supermarket. What the "it" is, of course, the potential sale of the No. 2 supermarket-specific chain in the United States to the chain occupying the No. 1 slot in that category. Though those rankings can be disputed, depending upon who is counting and what is counted, there is no doubt that the resulting firm would be No. 1 by a large margin. Albertsons operates 2,500 stores in 37 states and has sales in the neighborhood of $37 billion to $40 billion. Kroger's sales are approaching $60 billion with more than 2,500 grocery stores in 32 states. According to industry research, the nation spends about $700 billion at food-retailing outlets annually, with about 60-65 percent spent at supermarkets. (This would include Wal-Mart's grocery sales, which are slightly greater than Kroger's, making it the top retail grocery store in the country. But because of its general merchandise component, it is usually ranked separately.) Neither Albertsons nor the Kroger Co. have confirmed the reports, but the nation's consumer media were abuzz with the rumors of a potential merger through acquisition. The New York Times broke the story, and it soon appeared in The Wall Street Journal, Reuters and in the hometown Idaho and Ohio papers of the two supermarket giants. -

~~Ev:., HONORSFACULTY FELLOW MENTOR DATE

A Comprehensive Financial Analysis of Retail and Wholesale Food Chains THOMAS F. FREEMAN HONORSCOLLEGE SENIORTHESIS BY Aaron Fitzgerald Dallas II FINANCE JESSEH. JONESSCHOOL OF BUSINESS GRADUATION DATE (MAY 2019) APPROVEDBY ~~ev:., HONORSFACULTY FELLOW MENTOR DATE TEXAS SOUTHERN UNIVERSITY Thomas F. Freemon Honors College Aaron Dallas II A Comprehensive Financial Analysis of Retail and Wholesale Food Chains Table of Contents Acknowledgments ........................................................................................ 1 Abstract ..................................................................................................................................... 3 Chapter 1 Company Introductions ............................................................................................ 4 Chapter 2 Financial Analysis .................................................................................................. 14 Chapter 3 Impact of Technology ............................................................................................ 26 Chapter 4 Moving Toward the Future .................................................................................... 34 Chapter 5 Conclusion ................................................................................... 42 Appendix ................................................................................................ 41 Bibliography ............................................................................................. 43 2 Acknowledgments This Thomas F. Freeman Honors -

Supermarkets Price Competition in Dallas ¬Fort Worth Fluid Milk

Supermarkets Price Competition in Dallas Fort Worth Fluid Milk Market Benaissa Chidmi, Texas Tech University Presented at the Southern Agricultural Economics Association Meeting, Mobile Alabama February 4-7, 2007 1 Supermarkets Price Competition in Dallas Fort Worth Fluid Milk Market 1. Introduction Dallas-Fort Worth fluid milk consumers have been benefiting from a price war among supermarket chains that has lowered the prices of milk to levels as low as 99 cents per gallon. One question that comes to the researcher and policy makers minds concerns the level of competition prevailing in the Dallas-Fort Worth supermarket industry. Also of importance is the pricing strategies used by different players to gain market share in a market where Wal-Mart aggressive entry is a daily actuality. This article pursues two objectives: The first is to estimate the effect of the price war on the fluid milk demand in the Dallas-Fort Worth market. This will allow measuring consumers' price sensitivity before and during the price war. The second objective is to assess the supermarket pricing conduct through estimating the price-cost margins of the retailers in selling fluid milk, and how these margins vary with the price war. The issue of measuring the degree of competition in an oligopolistic market has been the focus of many studies in empirical industrial organization. In this literature, there have been two documented approaches: One is the conjectural variation approach, where the focus is on estimating a conduct parameter that informs on the degree of competition of the market or industry analyzed, and that nests the perfect competition, the perfect collusion, and the Cournot/Bertrand models (e.g., Iwata, 1974; Gollop and 2 Roberts, 1979, Appelbaum, 1982; Liang, 1989).1 The second approach is the menu approach, where a number of models based on strategic games played by firms, are estimated and compared to find which game describes the data more consistently.