RETAIL VIEW: Kroger Said to Be Eyeing Albertsons

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News Release

News Release Kroger Bringing Help and Hope for the Holidays CINCINNATI, Nov. 18, 2013 /PRNewswire/ -- Many families in need will have fresh, wholesome food and clothing, shelter and social services this holiday season thanks to The Kroger Co. (NYSE: KR) customers and associates who shop and work at its family of stores. "Kroger has a proud history of investing in our communities and a rich tradition of bringing help and hope for the holidays," said Lynn Marmer, Kroger'sgroup vice president of corporate affairs. "In keeping with that tradition, we are making it easy for our customers and associates to support their local food banks and The Salvation Army's Red Kettle Campaign in our family of stores this holiday season." Feeding Hungry Neighbors As a founding partner of Feeding America, the nation's largest domestic hunger agency, Kroger has been engaged in the hunger relief effort for more than 30 years. Today, the Kroger family of stores has longstanding relationships with more than 80 local food banks. This holiday season, customers can help, too, thanks to a variety of simple donation opportunities. Making a financial donation to a local food bank is as easy as scanning a pre-marked tag at registers, asking the cashier to 'round up' a grocery order, or place spare change in specially-marked coin boxes at Kroger, City Market, Dillons, Baker's, Gerbes, Food 4 Less, Fred Meyer, Fry's, QFC, Ralphs, and Smith's stores. Major food drives will be held at many Kroger stores in Illinois, Indiana, Kentucky, Louisiana, Michigan, North Carolina, Ohio, Tennessee, Texas, Virginia andWest Virginia; Fred Meyer stores in Alaska, Idaho, Oregon and Washington; and in City Market, Dillons, Baker's, Gerbes, King Soopers and Smith's stores. -

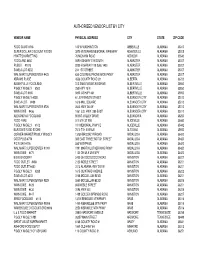

Region 001-004

July 2021 Price Region County Store Name Store Address City Zip 001 BASTROP BROOKSHIRE BROS #55 501 NW LOOP 230 SMITHVILLE 78957 001 BASTROP HEB #475 1080 EAST HIGHWAY 290 ELGIN 78621 001 BASTROP HEB #582 104 HASLER BLVD BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #1042 488 HWY 71 WEST BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #3170 1320 W HIGHWAY 290 ELGIN 78621 001 BELL BROOKSHIRE BROS #69 215 MILL CREEK DRIVE #100 SALADO 76571 001 BELL HEB #039 2509 NORTH MAIN STREET BELTON 76513 001 BELL HEB #071 1314 WEST ADAMS TEMPLE 76504 001 BELL HEB #182 3002 SOUTH 31ST STREET TEMPLE 76502 001 BELL HEB #381 601 INDIAN TRAIL HARKER HEIGHTS 76548 001 BELL HEB #581 2511 TRIMMIER ROAD STE 100 KILLEEN 76542 001 BELL HEB #721 1101 W STAN SCHULUETER LP KILLEEN 76549 001 BELL KILLEEN NUTRITIONAL CENTER 107 SANTA FE PLAZA DRIVE KILLEEN 76541 001 BELL WAL-MART NBH MKT #6459 960 EAST FM 2410 HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #1232 2604 NORTH MAIN STREET BELTON 76513 001 BELL WAL-MART SUPERCENTER #3319 2020 HEIGHTS DRIVE HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #407 1400 LOWES BLVD KILLEEN 76542 001 BELL WAL-MART SUPERCENTER #6286 3404 W STAN SCHLUETER LOOP KILLEEN 76549 001 BELL WAL-MART SUPERCENTER #6929 6801 W ADAMS AVENUE TEMPLE 76502 001 BELL WAL-MART SUPERCENTER #746 3401 SOUTH 31ST STREET TEMPLE 76502 001 BELL WALMART NEIGHBORHOOD MKT #3449 3801 E STAN SCHLUETER LOOP KILLEEN 76542 001 BELL WALMART NEIGHBORHOOD MKT #3450 2900 CLEAR CREEK RD KILLEEN 76549 001 BELL FORT HOOD COMMISSARY II WARRIOR WAY & 10TH BLDG 85020 -

PGY1 Community-Based Pharmacy Residency Program Chicago, Illinois

About Albertsons Companies Application Requirements • Albertsons Companies is one of the largest food and drug • Residency program application retailers in the United States, with both a strong local • Personal statement PGY1 Community-Based presence and national scale. We operate stores across 35 • CV or resume states and the District of Columbia under 20 well-known Pharmacy Residency Program banners including Albertsons, Safeway, Vons, Jewel- • Three electronic references Chicago, Illinois Osco, Shaw’s, Haggen, Acme, Tom Thumb, Randalls, • Official transcripts United Supermarkets, Pavilions, Star Market and Carrs. • Electronic application submission via Our vision is to create patients for life as their most trusted https://portal.phorcas.org/ health and wellness provider, and our mission is to provide a personalized wellness experience with every patient interaction. National Matching Service Code • Living up to our mission and vision, we have continuously 142515 advanced pharmacist-provided patient care and expanded the scope of pharmacy practice. Albertsons Companies has received numerous industry recognitions and awards, Contact Information including the 2018 Innovator of the Year from Drug Store Chandni Clough, PharmD News, Top Large Chain Provider of Medication Therapy Management Services by OutcomesMTM for the past 3 Residency Program Director years, and the 2018 Corporate Immunization Champion [email protected] from APhA. (630) 948-6735 • Albertsons Companies is pleased to offer residency positions by Baltimore, Boise, Chicago, Denver, Houston, Philadelphia, Phoenix, Portland, and San Francisco. To build upon the Doctor of Pharmacy (PharmD) education and outcomes to develop www.albertsonscompanies.com/careers/pharmacy-residency-program.html community‐based pharmacist practitioners with diverse patient care, leadership, and education skills who are eligible to pursue advanced training opportunities including postgraduate year two (PGY2) residencies and professional certifications. -

Kroger: Value Trap Or Value Investment - a Deep Due Diligence Dive

Kroger: Value Trap Or Value Investment - A Deep Due Diligence Dive seekingalpha.com /article/4115509-kroger-value-trap-value-investment-deep-due-diligence-dive Chuck 10/23/2017 Walston The acquisition of Whole Foods Market, announced by Amazon ( AMZN) last June sent shockwaves through the grocery industry. 1/20 When the deal was finalized in August, Amazon announced plans to lower the prices of certain products by as much as a third. The company also hinted at additional price reductions in the future. Amazon Prime members will be given special savings and other in-store benefits once the online retail giant integrates its point of sale system into Whole Foods stories. 2/20 Analysts immediately predicted a future of widespread margin cuts across the industry. Well before Amazon's entry into stick and brick groceries, Kroger ( KR) experienced deterioration in comparable store sales. 3/20 (Source: Kroger Investor Presentation slideshow) (Source: SEC Filings via SA contributor Quad 7 Capital) Additionally, Kroger's recent results reflect gross margin compression. 4/20 (Source: SEC Filings via SA contributor Quad 7 Capital) After the takeover, Whole Foods initiated a price war. According to Reuters, prices at a Los Angeles Whole Foods store are lower on some products than comparable goods sold in a nearby Ralph's store owned by Kroger. The Threat From Amazon Research conducted by Foursquare Labs Inc. indicates the publicity surrounding Amazon's recent acquisition of Whole Foods, combined with the announcement of deep price cuts, resulted in a 25% surge in customer traffic. Not content to attack conventional grocers with their panoply of online food services and margin cuts, Amazon registered a trademark application for a meal-kit service. -

A Sustainable Future

KROGER’S 2019 ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG) REPORT A Sustainable Future 2019 We imagine a better future for SUSTAINABILITY people and the planet — a world REPORT with Zero Hunger | Zero Waste. 2019 SUSTAINABILITY Contents REPORT About About This Zero Hunger | Kroger Report Zero Waste Operations Letter from Our Zero Hunger Chairman & CEO Governance Zero Waste 2020 Sustainability Engagement Goals Zero Heroes Report Overview ESG Index Our Customers & Communities Our People Our Planet Our Products Customer Satisfaction Talent Attraction Zero Waste Better-for-You & Digital Innovation & Retention Products Food Waste Health & Nutrition Associate Health Sustainable Product Energy & Emissions & Safety Packaging Food Access Water Responsible Sourcing Community Engagement Supply Chain Accountability Food Safety GRI Index 2018 Awards PAGE 1 \\ THE KROGER FAMILY OF COMPANIES 2019 SUSTAINABILITY REPORT Our Customers Our People Our Planet Our Products & Communities PAGE 2 \\ THE KROGER FAMILY OF COMPANIES 2019 SUSTAINABILITY REPORT About Kroger GRI 102-1, 102-3, 102-5 BECOMING KROGER In 1883, Barney Kroger invested his life savings of $372 to open a grocery store at 66 Pearl Street in downtown Cincinnati. The son of a merchant, he ran his business with a simple motto: “Be particular. Never sell anything you would not want yourself.” This credo served Kroger well over the next 136 years as the supermarket business evolved into a variety of formats aimed at satisfying the ever-changing needs of shoppers. The Kroger Co. is a publicly held corpora- tion (NYSE: KR). Still based in Cincinnati, Kroger operates nearly 2,800 stores under two dozen banners, ranking as one of the world’s largest retailers. -

Permit Num Retail Name Address City RS-0055-21 Albertsons 0131 1410

Cancell Sales Last Name Sales First ZIP County In Out Tent Stand Wholesaler 1 Wholesaler 2 Wholesaler 3 Wholesaler 4 Wholesaler 5 Sales Location ed Permit Retail Name Address City Num Name Fire Dept RS-0055-21 Albertsons 0131 Shriner Sarah 1410 W Park Plaza Ontario 97914 Malheur TRUE FALSE FALSE FALSE American ONTARIO F&R Promotional Events NW RS-0331-21 Albertsons 0505 Onchi Chad 5415 SW Beaverton-Hillsdale Hwy Portland 97221 Multnomah TRUE FALSE FALSE FALSE American PORTLAND F&R Promotional Events NW RS-0340-21 Albertsons 0513 Walline Jenni 4740 Royal Ave Eugene 97402 Lane TRUE FALSE FALSE FALSE American EUGENE Promotional Events SPRINGFIELD NW FIRE RS-0058-21 Albertsons 0515 Patterson Michelle 3013 NW Stewart Parkway Roseburg 97471 Douglas TRUE FALSE FALSE FALSE American ROSEBURG FD Promotional Events NW RS-0562-21 Albertsons 0536 Maglnigal Danielle 25691 SE Stark St Troutdale 97060 Multnomah TRUE FALSE FALSE FALSE American GRESHAM FIRE Promotional Events & EMERG SRVCS NW RS-0563-21 Albertsons 0564 Dehann Jannine 451 NE 181st St Portland 97230 Multnomah TRUE FALSE FALSE FALSE American GRESHAM FIRE Promotional Events & EMERG SRVCS NW RS-0056-21 Albertsons 0571 Rainsier Mark 19007 S Beavercreek Rd Oregon City 97045 Clackamas TRUE FALSE FALSE FALSE American CLACKAMAS CO Promotional Events FIRE DIST #1 NW RS-0339-21 Albertsons 0572 Souliyalaovong Ruby 311 Coburg Rd Eugene 97401 Lane TRUE FALSE FALSE FALSE American EUGENE Promotional Events SPRINGFIELD NW FIRE RS-0338-21 Albertsons 0574 Vails Tracey 5755 Main St Springfield 97478 Lane TRUE -

MERGER ANTITRUST LAW Albertsons/Safeway Case Study

MERGER ANTITRUST LAW Albertsons/Safeway Case Study Fall 2020 Georgetown University Law Center Professor Dale Collins ALBERTSONS/SAFEWAY CASE STUDY Table of Contents The deal Safeway Inc. and AB Albertsons LLC, Press Release, Safeway and Albertsons Announce Definitive Merger Agreement (Mar. 6, 2014) .............. 4 The FTC settlement Fed. Trade Comm’n, FTC Requires Albertsons and Safeway to Sell 168 Stores as a Condition of Merger (Jan. 27, 2015) .................................... 11 Complaint, In re Cerberus Institutional Partners V, L.P., No. C-4504 (F.T.C. filed Jan. 27, 2015) (challenging Albertsons/Safeway) .................... 13 Agreement Containing Consent Order (Jan. 27, 2015) ................................. 24 Decision and Order (Jan. 27, 2015) (redacted public version) ...................... 32 Order To Maintain Assets (Jan. 27, 2015) (redacted public version) ............ 49 Analysis of Agreement Containing Consent Orders To Aid Public Comment (Nov. 15, 2012) ........................................................... 56 The Washington state settlement Complaint, Washington v. Cerberus Institutional Partners V, L.P., No. 2:15-cv-00147 (W.D. Wash. filed Jan. 30, 2015) ................................... 69 Agreed Motion for Endorsement of Consent Decree (Jan. 30, 2015) ........... 81 [Proposed] Consent Decree (Jan. 30, 2015) ............................................ 84 Exhibit A. FTC Order to Maintain Assets (omitted) ............................. 100 Exhibit B. FTC Order and Decision (omitted) ..................................... -

Kroger Rival Whole Foods Expands Its Small-Store Concept

4/23/2019 Whole Foods adds small stores - Cincinnati Business Courier MENU Account FOR THE EXCLUSIVE USE OF [email protected] From the Cincinnati Business Courier: https://www.bizjournals.com/cincinnati/news/2018/12/12/kroger-rival-whole-foods-expands-its-small- store.html Kroger rival Whole Foods expands its small-store concept Amazon is working on tech that could make it happen, WSJ reports Dec 12, 2018, 2:42pm EST Updated: Dec 12, 2018, 2:51pm EST Whole Foods Market, a significant rival to Cincinnati-based Kroger Co., is adding several of its small-store locations known as 365 around the country, and another could be on the way in Cincinnati. Whole Foods, acquired by Amazon.com last year, opened two 365 stores in the Atlanta area today. Another is in the works in Austin, Texas, where Whole Foods is headquartered. The company planned to open one in San Francisco, too, although that location has run into roadblocks. TODD JOHNSON | SAN FRANCISCO BUSINESS TIMES Whole Foods is expanding its 365 small-store The Atlanta openings make 12 stores for 365. Five are in California. concept. The closest one to Cincinnati is in Akron. Meanwhile, Whole Foods could be moving closer to opening a 365 store in Greater Cincinnati. It recently took out liquor permits for the store location in the Kenwood Collection building, where it’s leasing 30,000 square feet. Whole Foods officials haven’t commented on when that store will open. The company initially leased the space three years ago with plans to open in 2017, but the permits indicate an opening could take place relatively soon. -

PI Setup & Steps for Success

PI Setup & Steps for Success Below is a high-level checklist to assist you with Product Introduction (PI) setup and new item submission. Detailed information is provided in the free Albertsons PI Supplier Training Modules under ‘Education’ on the Albertsons Companies Landing Site at: www.1worldsync.com/albertsons □ Must have a 6-digit Vendor Number and 3-digit Sub Account/Outlet setup in the Albertsons Companies system o Unsure? Contact your Albertsons Companies Sales Merchandising Team o The Sales Merchandising Team must approve supplier setup. More details located at: http://suppliers.safeway.com/pages/BecomeASupplier.htm □ Locate or create your Global Location Number (GLN) (unique identifier) o Suppliers: . Unsure? Contact 1WorldSync at 866-280-4013 or [email protected] . Need to setup a GLN? Contact GS1 at 937-435-3870 or [email protected] . Exclusion applies for Alcohol and Own Brands/Private Label o Brokers: . Ask your supplier to provide the GLN □ PI access o Next step depends on your company’s current engagement . GDSN: 1WorldSync customer (GDSN = Global Data Synchronization Network) . GDSN: Other data pool . Non-GDSN: Existing Account . Non-GDSN: New Account . Broker: Brand owner must give the broker access to PI under their GLN □ If your company already has access to PI o Ask your company administrator to grant you access to PI □ If you don’t have access to PI o GDSN/1WorldSync Customer: contact 1WorldSync at 866-280-4013 or [email protected] o Alcohol entities: Contact 1WorldSync Business Development at 866-280-4013 or [email protected] o Own Brands/Private Label: Contact your Albertsons Companies Own Brands team o Own Brands/Supply-Expense: Contact 1WorldSync Business Development at 866-280-4013 or [email protected] o GDSN/Other Data Pool or Non-GDSN (Fee Based System) . -

Alabama Vendor List.Xlsx

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

Albertsons Ecosystem Y

Albertsons Companies, Inc. 250 Parkcenter Blvd. Albertsons Ecosystem Boise, Idaho, 83706 Phone: (208) 395-6200 www.albertsons.com Outside Relationships Albertsons Companies, Inc. (Delaware Corporation) Outside Relationships Securities Regulation Regulators Capital Suppliers Customers and Stock Exchange Customers Suppliers Capital Regulators Bond Debt Structure Equity Structure Listing Rules Public Debt Financing Debt ($8.7B @ 2/39/20) | Credit Ratings for Long-Term Debt: Moody’s (Ba3) and S&P (B+) Equity Dividends and Common Stock Securities Holders Repurchases Regulators Working Capital $6.9B in Senior $642.1M Safeway $466M New $3.1B Albertsons $18.2 Securied $37.2M Other $666.7M Preferred Stock: Common Stock: Significant Financing Equity Capital US Securities Commercial Unsecured Notes (from Inc. Notes (from Albertsons L.P. Term Loans (from Mortgage Notes, Finance lease Shares Authorized: 30M; Issued: None; Shares Authorized: 1B; Issued: 579.3M; Shareholders and Exchange Banks 3.50% to 6.625%) 3.95% to 7.45%) Notes 4.45% to 5.69%) Notes unsecured obligations Outstanding: None Outstanding: 575.8M Professional Key Producers Massachusetts Commission and Services Financial Distributors Services Operations Human Resources Retail Operations Legal Compliance & Ethics Audit New York Grimmway Governance Corporate Matters (Deloitte) (1.28%) Farms Commercial Contracting Stock Board of Directors Retail Operations Supervision Diversity and Inclusion Strategy (Produce) Steven A. Davis (A,F) Alan H. Schumacher B. Kevin Turner Real Estate & Corporate Development Lobbying Private Exchange Vivek Sankaran Compliance (National Assn of (A,T) (C,T) Supply Chain & Manufacturing Physical Stores McKesson Talent Development Facilities Management Realtors; U.S. Management Sharon L. Allen (C,G) Supervision Governance Selected US and (Branded and James L. -

2020 Fact Book Kroger at a Glance KROGER FACT BOOK 2020 2 Pick up and Delivery Available to 97% of Custom- Ers

2020 Fact Book Kroger At A Glance KROGER FACT BOOK 2020 2 Pick up and Delivery available to 97% of Custom- ers PICK UP AND DELIVERY 2,255 AVAILABLE TO PHARMACIES $132.5B AND ALMOST TOTAL 2020 SALES 271 MILLION 98% PRESCRIPTIONS FILLED HOUSEHOLDS 31 OF NEARLY WE COVER 45 500,000 640 ASSOCIATES MILLION DISTRIBUTION COMPANY-WIDE CENTERS MEALS 34 DONATED THROUGH 100 FEEDING AMERICA FOOD FOOD BANK PARTNERS PRODUCTION PLANTS ARE 35 STATES ACHIEVED 2,223 ZERO WASTE & THE DISTRICT PICK UP 81% 1,596 LOCATIONS WASTE OF COLUMBIA SUPERMARKET DIVERSION FUEL CENTERS FROM LANDFILLS COMPANY WIDE 90 MILLION POUNDS OF FOOD 2,742 RESCUED SUPERMARKETS & 2.3 MULTI-DEPARTMENT STORES BILLION kWh ONE OF AMERICA’S 9MCUSTOMERS $213M AVOIDED SINCE MOST RESPONSIBLE TO END HUNGER 2000 DAILY IN OUR COMMUNITIES COMPANIES OF 2021 AS RECOGNIZED BY NEWSWEEK KROGER FACT BOOK 2020 Table of Contents About 1 Overview 2 Letter to Shareholders 4 Restock Kroger and Our Priorities 10 Redefine Customer Expereince 11 Partner for Customer Value 26 Develop Talent 34 Live Our Purpose 39 Create Shareholder Value 42 Appendix 51 KROGER FACT BOOK 2020 ABOUT THE KROGER FACT BOOK This Fact Book provides certain financial and adjusted free cash flow goals may be affected changes in inflation or deflation in product and operating information about The Kroger Co. by: COVID-19 pandemic related factors, risks operating costs; stock repurchases; Kroger’s (Kroger®) and its consolidated subsidiaries. It is and challenges, including among others, the ability to retain pharmacy sales from third party intended to provide general information about length of time that the pandemic continues, payors; consolidation in the healthcare industry, Kroger and therefore does not include the new variants of the virus, the effect of the including pharmacy benefit managers; Kroger’s Company’s consolidated financial statements easing of restrictions, lack of access to vaccines ability to negotiate modifications to multi- and notes.