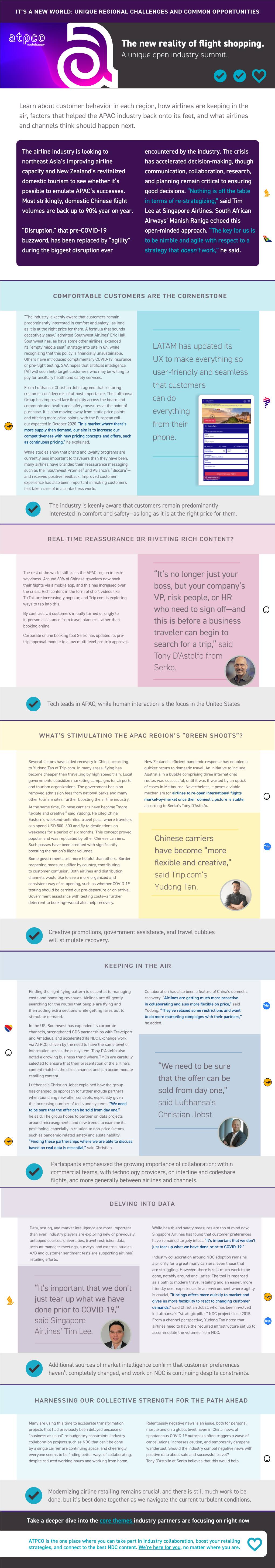

The New Reality of Flight Shopping. a Unique Open Industry Summit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cabin Air Quality on Non-Smoking Commercial Flights: a Review of Published Data on Airborne Pollutants

CABIN AIR QUALITY ON NON-SMOKING COMMERCIAL FLIGHTS: A REVIEW OF PUBLISHED DATA ON AIRBORNE POLLUTANTS Ruiqing Chen1, Lei Fang2, Junjie Liu1, Britta Herbig3, Victor Norrefeldt4, Florian Mayer4, Richard Fox5 and Pawel Wargocki2* 1 Tianjin Key Laboratory of Indoor Air Environmental Quality Control, School of Environmental Science and Engineering, Tianjin University, China 2 International Centre for Indoor Environment and Energy, Department of Civil Engineering, Technical University of Denmark 3 LMU University Hospital Munich, Institute and Clinic for Occupational, Social and Environmental Medicine, Germany 4 Fraunhofer Institute for Building Physics IBP, Holzkirchen Branch, Germany 5 Aircraft Environment Solutions Inc., USA * Corresponding author: email [email protected] Abstract We reviewed 47 documents published 1967-2019 that reported measurements of volatile organic compounds (VOCs) on commercial aircraft. We compared the measurements with the air quality standards and guidelines for aircraft cabins and in some cases buildings. Average levels of VOCs for which limits exist were lower than the permissible levels except for benzene with average concentration at 5.9±5.5 μg/m3. Toluene, benzene, ethylbenzene, formaldehyde, acetaldehyde, limonene, nonanal, hexanal, decanal, octanal, acetic acid, acetone, ethanol, butanal, acrolein, isoprene and menthol were the most frequently appearing compounds. The concentrations of SVOCs (Semi-Volatile Organic Compounds) and other contaminants did not exceed standards and guidelines in buildings except for the average NO2 concentration at 12 ppb. Although the focus was on VOCs, we also retrieved the data on other parameters characterizing cabin environment. Ozone concentration averaged 38±30 ppb below the upper limit recommended for aircraft. The outdoor air supply rate ranged from 1.7 to 39.5 L/s per person and averaged 6.0±0.8 L/s/p (median 5.8 L/s/p), higher than the minimum level recommended for commercial aircraft. -

MEDICAL GUIDELINES for AIRLINE TRAVEL 2Nd Edition

MEDICAL GUIDELINES FOR AIRLINE TRAVEL 2nd Edition Aerospace Medical Association Medical Guidelines Task Force Alexandria, VA VOLUME 74 NUMBER 5 Section II, Supplement MAY 2003 Medical Guidelines for Airline Travel, 2nd Edition A1 Introduction A1 Stresses of Flight A2 Medical Evaluation and Airline Special Services A2 Medical Evaluation A2 Airline Special Services A3 Inflight Medical Care A4 Reported Inflight Illness and Death A4 Immunization and Malaria Prophylaxis A5 Basic Immunizations A5 Supplemental Immunizations A5 Malaria Prophylaxis A6 Cardiovascular Disease A7 Deep Venous Thrombosis A8 Pulmonary Disease A10 Pregnancy and Air Travel A10 Maternal and Fetal Considerations A11 Travel and Children A11 Ear, Nose, and Throat A11 Ear A11 Nose and sinuses A12 Throat A12 Surgical Conditions A13 Neuropsychiatry A13 Neurological A13 Psychiatric A14 Miscellaneous Conditions B14 Air Sickness B14 Anemia A14 Decompression Illness A15 Diabetes A16 Jet Lag A17 Diarrhea A17 Fractures A18 Ophthalmological Conditions A18 Radiation A18 References Copyright 2003 by the Aerospace Medical Association, 320 S. Henry St., Alexandria, VA 22314-3579 The paper used in this publication meets the minimum requirements of American National Standard for Information Sciences—Permanence of Paper for Printed Library Materials. ANSI Z39.48-1984. Medical Guidelines for Airline Travel, 2nd ed. Aerospace Medical Association, Medical Guidelines Task Force, Alexandria, VA Introduction smoke, uncomfortable temperatures and low humidity, jet lag, and cramped seating (64). Nevertheless, healthy Each year approximately 1 billion people travel by air passengers endure these stresses which, for the most on the many domestic and international airlines. It has part, are quickly forgotten once the destination is been predicted that in the coming two decades, the reached. -

Boeing Environment Report 2017

THE BOEING COMPANY 2017 ENVIRONMENT REPORT BUILD SOMETHING CLEANER 1 ABOUT US Boeing begins its second century of business with a firm commitment to lead the aerospace industry into an environmentally progressive and sustainable future. Our centennial in 2016 marked 100 years of Meeting climate change and other challenges innovation in products and services that helped head-on requires a global approach. Boeing transform aviation and the world. The same works closely with government agencies, dedication is bringing ongoing innovation in more customers, stakeholders and research facilities efficient, cleaner products and operations for worldwide to develop solutions that help protect our employees, customers and communities the environment. around the globe. Our commitment to a cleaner, more sustainable Our strategy and actions reflect goals and future drives action at every level of the company. priorities that address the most critical environ- Every day, thousands of Boeing employees lead mental challenges facing our company, activities and projects that advance progress in customers and industry. Innovations that reducing emissions and conserving water and improve efficiency across our product lines resources. and throughout our operations drive reductions This report outlines the progress Boeing made in emissions and mitigate impacts on climate and challenges we encountered in 2016 toward change. our environmental goals and strategy. We’re reducing waste and water use in our In the face of rapidly changing business and facilities, even as we see our business growing. environmental landscapes, Boeing will pursue In addition, we’re finding alternatives to the innovation and leadership that will build a chemicals and hazardous materials in our brighter, more sustainable future for our products and operations, and we’re leading the employees, customers, communities and global development of sustainable aviation fuels. -

Medical Guidelines for Airline Passengers

MEDICAL GUIDELINES FOR AIRLINE PASSENGERS AEROSPACE MEDICAL ASSOCIATION ALEXANDRIA, VA (MAY, 2002) CONTRIBUTORS: Michael Bagshaw, M.D. James R. DeVoll, M.D. Richard T. Jennings, M.D. Brian F. McCrary, D.O. Susan E. Northrup, M.D. Russell B. Rayman, M.D. (Chair) Arleen Saenger, M.D. Claude Thibeault, M.D. 1 Introduction Approximately 1 billion people travel each year by air on the many domestic and international airlines. On U.S. air carriers alone, it has been predicted that in the coming two decades, the number of passengers will double. A global increase in air travel, as well as a growing aged population in many countries, makes it reasonable to assume that there will be a significant increase in older passengers and passengers with illness. Because of a growing interest by the public of health issues associated with commercial flying, the Aerospace Medical Association prepared this monograph for interested air travelers. It is informational only and should not be interpreted by the reader as prescriptive. If the traveler has any questions about fitness to fly, it is recommended that he or she consult a physician. The authors sincerely hope that this publication will educate the traveler and contribute to safe and comfortable flight for passengers. Stresses of Flight Modern commercial aircraft are very safe and, in most cases, reasonably comfortable. However, all flights, short and long haul, impose stresses on all passengers. Preflight, these include airport tumult (e.g., carrying baggage, walking long distances, and flight delays). Inflight stresses include lowered barometric and oxygen pressure, noise and vibration (including turbulence), cigarette smoking (banned on most airlines today), erratic temperatures, low humidity, jet lag, and cramped seating. -

Tobacco, E-Cigarettes, and Cannabis: What Oral Health Providers Should Know

3:45 – 4:45 PM - ET Tobacco, E-cigarettes, and Cannabis: What Oral Health Providers Should Know Abrey Daniel, DDS Lin Chan, DDS • OPEN POLLING QUESTION 1 2 • OPEN POLLING QUESTION 2 3 Disclosure We have no actual or potential conflict of interest in relation to this program/presentation. 4 Tobacco, E-Cigarettes, and Cannabis: What Oral Health Providers Need to Know By: Abrey Daniel, DDS Lin Chan, DDS Funded by the CDPH under Contract # 17-10698 Objectives: • Learn about the evolution of tobacco and the new trends of e-cigarettes and cannabis products. • Learn the negative effects including oral health risks of tobacco, e-cigarettes, and cannabis products. • Acquire information on brief interventions and available resources for dental offices. 6 Tobacco • A plant grown for it’s leaves that is smoked, chewed or sniffed • Contains an addictive chemical, Nicotine • Nicotine acts as a pesticide for the plant • Smoked tobacco: cigarettes, cigars, bidis, kreteks • Loose tobacco: in a pipe or hookah • Chewed tobacco: chewing tobacco, snuf, dip, snus, 7 Types of Tobacco Products www.cdph.ca.gov 8 History of Tobacco • 6000 BC – Native Americans first start cultivating the tobacco plant • Circa 1 BC – Indigenous American tribes start smoking tobacco in religious ceremonies and medicinal purposes • 1612 – First successful commercial crop was cultivated by John Rolfe; tobacco used as cash-crop Source: Tobacco Free Life 9 History of Tobacco (Continued) • 1730 – First American tobacco companies in Virginia • 1847 - Philip Morris (UK) start selling hand-rolled -

FY 2014 R&D Annual Review

FY 2014 R&D Annual Review August 2015 Report of the Federal Aviation Administration to the United States Congress pursuant to Section 44501(c) of Title 49 of the United States Code FY 2014 R&D Annual Review August 2015 The R&D Annual Review is a companion document to the National Aviation Research Plan (NARP), a report of the Federal Aviation Administration to the United States Congress pursuant to Section 44501(c)(3) of Title 49 of the United States Code. The R&D Annual Review is available on the Internet at http://www.faa.gov/go/narp. FY 2014 R&D Annual Review Table of Contents Table of Contents Introduction ..............................................................................................................1 R&D Principle 1 – Improve Aviation Safety ......................................................... 2 R&D Principle 2 – Improve Efficiency ................................................................79 R&D Principle 3 – Reduce Environmental Impacts ..........................................93 Acronym List ........................................................................................................106 i FY 2014 R&D Annual Review List of Figures List of Figures Figure 1: Simulation Validation of GSE Impact Loading on 5-Frame .......................................... 2 Figure 2: Shear Tie Crushing Model Validation............................................................................ 3 Figure 3: Skin Cracking Model Validation ................................................................................... -

Boeing Environment Report 2017

THE BOEING COMPANY 2018 ENVIRONMENT REPORT BUILD SOMETHING CLEANER 1 TABLE OF CONTENTS Cover photo: The 737 MAX 7—12 percent more energy efficient than the airplanes it replaces—is the newest member of the 737 MAX family. It began flight testing in 2018. Photo above: Flowers and wind turbines sprout from the Wild Horse Wind and Solar Facility in central Washington State. The Puget Sound Energy facility generates a portion of the electricity that powers Boeing’s 737 factory in Renton, Washington. Renewable energy sources generate 100 percent of the electricity used at the 737 factory and the 787 Dreamliner factory in North Charleston, South Carolina. ABOUT US The commitment is seen in products This report also shares the stories Boeing is the world’s largest and services that deliver market of employees and partners whose leading energy efficiency. In 2017, leadership, creativity and dedication aerospace company. Every Boeing delivered 933 commercial are making a difference in Boeing’s day, through innovation and and military aircraft to customers aspiration to be the best in aerospace across the globe, products that set and an enduring global industrial commitment, the work of more the standard for reductions in fuel champion. use, emissions and community noise. With pride in our accomplishments to than 140,000 employees across The operations of our factories, date and commitment to accelerate the United States and in offices and other facilities in 2017 the progress, Boeing’s goals and surpassed targets for resource strategy will help strengthen the 65 countries is helping build conservation, further improving company’s global environmental our environmental performance leadership and enhance lives and a more sustainable future for and footprint. -

Tobacco Industry Accountability and Liability in the Time of COVID-19

Issue Brief Tobacco Industry Global Accountability and Liability in the Time of COVID-19 The tobacco industry Frequently Asked Questions must be held to account Summary for health care costs, The tobacco industry must be held to account for health care costs, compensation to victims, compensation to victims, corruption, illicit trade, environmental corruption, illicit trade, damage, food insecurity, child labor, and more. Under the global tobacco control treaty, the World Health Organization Framework environmental damage, Convention on Tobacco Control (WHO FCTC), governments are food insecurity, human called on to adopt stronger tobacco control laws, create robust rights violations, and more. legal frameworks, and take action to make the tobacco industry pay compensation for the harms it has caused. The tobacco industry must not be granted incentives to run its business. To enable corporate accountability, governments must demand transparency from the tobacco industry and adopt policies to resist its influence. Due to limitations of legal systems in many jurisdictions and the escalated impact of tobacco harms during COVID-19, the most rational way to make the tobacco industry pay in a manner that responds to the crisis is to increase and dedicate taxes to a wide range of areas where the industry has caused harm, including creating compensation mechanisms to ensure fair distribution to beneficiaries. This would support countries’ COVID-19 responses as well as help achieve UN Sustainable Development Goals (UN SDGs). Tobacco Industry Accountability and Liability: Frequently Asked Questions I. What is accountability and liability in the II. Why are accountability and liability context of the tobacco industry? important during the COVID-19 pandemic? Corporate accountability is generally defined by the ability to hold a corporation to account for its operations by those Box 1. -

Read the Brief

ISSUE BRIEF May 26, 2021 How can people living with NCDs make tobacco companies pay? Issue Brief: How can people living with NCDs make tobacco companies pay? Tobacco use has been Recognize the fact that established as the cause of tobacco companies are liable various noncommunicable for harms. diseases (NCDs), including respiratory and • Tobacco companies are responsible cardiovascular diseases, for numerous harms to people, the environment and development, including diabetes and cancer. 8 million deaths per year3 and 36.1 Tobacco use is the result million years lived with disability (YLD), of tobacco companies’ contributing an overall disease burden of 230 million measured in disability- aggressive strategies adjusted life years (DALYs).4 Costs of the to sell deadly products, harms caused by the tobacco industry is marketing them in the found here. most deceptive manners. • By continuing to manufacture products Tobacco companies employ that are known to cause disease and fraudulent practices to death, tobacco companies violate people’s right to life and health as enshrined in ensure that they hook human rights laws.5, 6, 7, 8 consumers at an age where they are unable to resist the • Many countries have used existing laws to make tobacco companies liable for 1 addiction, resulting these harms, such as tort law, consumer in long-term effects protection laws, product liability laws and including cognitive damage fraud/corruption laws. Some have created special laws (the Health Care Costs 2 and chronic disease. Recovery law, Canada) or used State-led court proceedings (Brazil, Korea, U.S.) to hold the tobacco industry liable for costs. -

Part 2 – Ticketing

DATA APPLICATION - OPTIONAL SERVICES RESERVATIONS, TICKETING, REPORTING, ACCOUNTING and SETTLEMENT The information contained in this document is the property of ATPCO. No part of this document may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means; mechanical, photocopying, recording, or otherwise, without the prior written permission of ATPCO. Under the law, copying includes translating into another language or format. Legal action will be taken against any infringement Copyright ©2007 by Airline Tariff Publishing Company All rights reserved. DATA APPLICATION - OPTIONAL SERVICES RESERVATIONS, TICKETING, REPORTING, ACCOUNTING & SETTLEMENT Table of Contents 1.0 RESERVATIONS........................................................................................................................................................................... 4 1.1 Availability ................................................................................................................................................................................. 5 1.2 Booking Optional Services ......................................................................................................................................................... 6 1.2.1 Booking Flight Related Services with Existing SSR .......................................................................................................... 7 1.2.2 Booking Flight Related Services with no Existing SSR .................................................................................................... -

김해영어과외교실 교육 상담 곽일신 All That English 011-9394-1856

김해영어과외교실ALL THAT ENGLISH 교육 상담☎ 011-9394-1856 ( 곽일신 ) 1.?다음 글의 빈칸에 들어갈 말로 가장 적절한 것은 If you're writing an article on, say, belly dancing, then you want people who are looking for this type of information on a search engine to be able to find your article. So you would to determine the most likely phrases your readers would use─ for example, how to belly dance, belly dancing fitness, belly dancing─ and then include one or two of those terms in your article title. If you determined that the term belly dancing is searched more frequently than how to belly dance, you might write a title like this: "Belly Dancing for Beginners." Or you might even incorporate two popular search terms into one heading: "Belly Dancing: Fitness Fun for the Healthy-Minded." ① ask your readers about them ② collect evidences on the Internet ③ decorate your article colorfully ④ make your keyword shortly ⑤ do keyword research first 2.?다음 글의 주제로 가장 적절한 것은 Silence is more than staying quiet while someone is speaking. Allowing several seconds to pass before you begin to talk gives the speaker time to catch her breath and gather her thoughts. She might want to continue. Someone who talks nonstop might fear she will lose the floor if she pauses. If the message being sent is complete, this short break gives you time to form your responses and helps you avoid the biggest barrier to listening─ listening with your answer running. If you make up a response before the person is finished, you might miss the end of the message, which is often the main point. -

Lions Honor Seven for Services Ill Squad for Four Jr

(^UHO JOUTH AKBOT FUPLIC i STEVfcMS AVB 3> 'y f* , AKBOT n J oem y ~>. CITIZI \ r VOL W, South VIIIIMIV A n..»fH(la>, June 2. >, Advertising less than 75% 15 centt John Z Award Presented Squad Meets Tice Campaigns For School; Kurtz Appointed junior year in a career total Requirements Olexa Reviews Plans Mayor J. Thomas Croat of 1,485 points Utied as a has appointed Frederick H the C:tv Council, in Superintendent of Schools Board members asked in Kurtz, the director of the forward because of her determining :he City is JOHN Olexa Monday night one resolution for the city's height. Jamie excelled as Department of Engjaaartng, responsible for its provision promised that, barring financial officer to prepare a Washington Road, Ptrlin, as huih a .shooter and of emergency lirst aid another carpenter's strike, supplemental debt n-hounrier while playing a representative on the TOM services to its residents has the five new classrooms statement to support the Rt 9/35 Steering Committee. exceptional defense certified thirty three under construction will be issuance of a bond for The Transportation Basketball coach Keg members of the South ready for the fall semester, construction of the proposed ( ;irney said "her biggest Ambwy Kirs! Aid and Safety and children attending Systems Managment project school. The bond is not to is important in improving asset was her ability to Squad as having met all the Kindergarten will be housed exceed $5,340,000 disrupt an opponent s point training requirements set at the John Street facility conditions on the Rt.