The Case of Malev Hungarian Airline

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

The Coordinator´s Activity Report Season : S12 Period : 25th March 2012 - 27th October 2012 Performed by: Slot Coordination Czech Republic Slot Coordination Czech Republic - 1 - Table of contents: 1. Introduction General information and general comments regarding the coordination process 2. Coordination Parameters A) Reference season a) Runway b) Terminal c) Others B) Forthcoming season a) Runway b) Terminal c) Others 3. Additional parameters a) Curfew b) Allotment for PSO c) Allotment for GA/BA d) Local rules 4. Coordination Process A) Initial allocation (IA) a) Requested slots - Historic - New entrant - Re-timed - New incumbent b) Allocated slots - Historic - New entrant - Re-timed - New incumbent i) As requested ii) Offers iii) Reason for not satisfying c) Outstanding requests d) Slot pool - Before initial allocation - After initial allocation B) Slot Return Deadline (SRD) a) Allocated slots b) Slot pool C) End of Season (EoS) a) Allocated slots incl. GA/BA D) Graphics / Histograms - Initial Allocation - SRD - Compare - Main carriers • Capacity • Demand • Allocated Slot Coordination Czech Republic - 2 - 5. Slot mobility a) transfers/exchanges 6. Monitoring Report a) Slot misuse b) Late handback c) Sanctions d) Exemptions 14.1 7. Coordination Committee a) minutes b) constitution 8. Conclusions Slot Coordination Czech Republic - 3 - 1. Introduction This report contains the general total data for S12 season. Time UTC. This report refers to Prague Ruzyne / Václav Havel Airport Prague. It is Level 3 airport, IATA/ICAO: PRG/LKPR The coordination software used: Score, ver. 5.10.10.4. Since November 2011 the online coordination has been performed. The coordination process is conducted in full compliance with EU Reg. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Regulamento (Ue) N

11.2.2012 PT Jornal Oficial da União Europeia L 39/1 II (Atos não legislativos) REGULAMENTOS o REGULAMENTO (UE) N. 100/2012 DA COMISSÃO de 3 de fevereiro de 2012 o que altera o Regulamento (CE) n. 748/2009, relativo à lista de operadores de aeronaves que realizaram uma das atividades de aviação enumeradas no anexo I da Diretiva 2003/87/CE em ou após 1 de janeiro de 2006, inclusive, com indicação do Estado-Membro responsável em relação a cada operador de aeronave, tendo igualmente em conta a expansão do regime de comércio de licenças de emissão da União aos países EEE-EFTA (Texto relevante para efeitos do EEE) A COMISSÃO EUROPEIA, 2003/87/CE e é independente da inclusão na lista de operadores de aeronaves estabelecida pela Comissão por o o força do artigo 18. -A, n. 3, da diretiva. Tendo em conta o Tratado sobre o Funcionamento da União Europeia, (5) A Diretiva 2008/101/CE foi incorporada no Acordo so bre o Espaço Económico Europeu pela Decisão o Tendo em conta a Diretiva 2003/87/CE do Parlamento Europeu n. 6/2011 do Comité Misto do EEE, de 1 de abril de e do Conselho, de 13 de Outubro de 2003, relativa à criação de 2011, que altera o anexo XX (Ambiente) do Acordo um regime de comércio de licenças de emissão de gases com EEE ( 4). efeito de estufa na Comunidade e que altera a Diretiva 96/61/CE o o do Conselho ( 1), nomeadamente o artigo 18. -A, n. 3, alínea a), (6) A extensão das disposições do regime de comércio de licenças de emissão da União, no setor da aviação, aos Considerando o seguinte: países EEE-EFTA implica que os critérios fixados nos o o termos do artigo 18. -

Annual Report 2007

EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 1 Analyses of the European air transport market Annual Report 2007 EUROPEAN COMMISSION EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 2 Air Transport and Airport Research Annual analyses of the European air transport market Annual Report 2007 German Aerospace Center Deutsches Zentrum German Aerospace für Luft- und Raumfahrt e.V. Center in the Helmholtz-Association Air Transport and Airport Research December 2008 Linder Hoehe 51147 Cologne Germany Head: Prof. Dr. Johannes Reichmuth Authors: Erik Grunewald, Amir Ayazkhani, Dr. Peter Berster, Gregor Bischoff, Prof. Dr. Hansjochen Ehmer, Dr. Marc Gelhausen, Wolfgang Grimme, Michael Hepting, Hermann Keimel, Petra Kokus, Dr. Peter Meincke, Holger Pabst, Dr. Janina Scheelhaase web: http://www.dlr.de/fw Annual Report 2007 2008-12-02 Release: 2.2 Page 1 Annual analyses of the European air transport market Annual Report 2007 Document Control Information Responsible project manager: DG Energy and Transport Project task: Annual analyses of the European air transport market 2007 EC contract number: TREN/05/MD/S07.74176 Release: 2.2 Save date: 2008-12-02 Total pages: 222 Change Log Release Date Changed Pages or Chapters Comments 1.2 2008-06-20 Final Report 2.0 2008-10-10 chapters 1,2,3 Final Report - full year 2007 draft 2.1 2008-11-20 chapters 1,2,3,5 Final updated Report 2.2 2008-12-02 all Layout items Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.74176. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Analýza Spádové Oblasti a Projekt Rozvoje Linek Z Letiště Leoše Janáčka V Ostravě

Analýza spádové oblasti a projekt rozvoje linek z letiště Leoše Janáčka v Ostravě Bc. Martina Eliášová Diplomová práce 2012 ABSTRAKT Předkládaná diplomová práce prezentuje čtenáři projekt, jehoţ cílem je návrh na vytvoření nové pravidelné letecké linky z mezinárodního letiště Leoše Janáčka v Ostravě. V teoretic- ké části jsou shrnuty poznatky získané studiem odborné literatury zabývající se leteckou dopravou, cestovním ruchem a analytickými metodami pouţitými v práci. Analytická část charakterizuje současný stav společnosti, podává stručný přehled o ekonomické situaci společnosti a srovnání s konkurenčními letišti. Dále je zde provedena SWOT analýza spo- lečnosti a analýza spádové oblasti letiště z pohledu incomingu a outgoingu. Na základě výsledkŧ analytické části je v projektové části vytvořen projekt na otevření pravidelné le- tecké linky do nové destinace. Klíčová slova: Letiště, incoming, outgoing, spádová oblast, letecký dopravce, nízkonákla- dová letecká společnost, destinace ABSTRACT This disertation presents a reader a project, which aim is to make a proposal of a newly created regular flight from the international Leos Janacek Airport in Ostrava. In the theore- tical section are sumarized knowledges obtained form literature focusing on air transpor- tation, tourism and analytical methods used in the thesis. Analytical part characterize cur- retnt company´s situation, shows general overview about economical company´s situation and draw a comparison with rival airports. After that is made a SWOT analysis and analy- sis of company´s catchment area, based on the wiev of incoming and outgoing. Based on the results of analytical part, there is created the project which deals with opening a regular flight to the new destination. Keywords: Airport, Incoming, Outgoing, Catchment Area, Air Carrier, Low Cost Airline, Destination Děkuji paní Ing. -

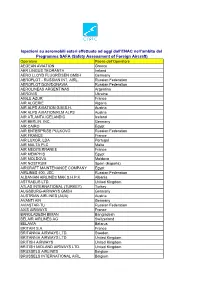

Compagnie Aeree Ispezionate

Ispezioni su aeromobili esteri effettuate ad oggi dall’ENAC nell’ambito del Programma SAFA (Safety Assessment of Foreign Aircraft) Operatore Paese dell'Operatore AEGEAN AVIATION Greece AER LINGUS TEORANTA Ireland AERO LLOYD FLUGREISEN GMBH Germany AEROFLOT - RUSSIAN INT. AIRL. Russian Federation AEROFLOT DON/DONAVIA Russian Federation AEROLINEAS ARGENTINAS Argentina AEROVIS Ukraine AIGLE AZUR France AIR ALGERIE Algeria AIR ALPS AVIATION G.M.B.H. Austria AIR ALPS AVIATION/KLM ALPS Austria AIR ATLANTA ICELANDIC Iceland AIR BERLIN, INC. Germany AIR CAIRO Egypt AIR ENTERPRISE PULKOVO Russian Federation AIR FRANCE France AIR LUXOR, LDA Portugal AIR MALTA PLC Malta AIR MEDITERRANEE France AIR MEMPHIS Egypt AIR MOLDOVA Moldova AIR NOSTRUM Spain (España) AIRCRAFT MAINTENANCE COMPANY Egypt AIRLINES 400, JSC Russian Federation ALBANIAN AIRLINES MAK S.H.P.K. Albania ASTRAEUS LTD. United Kingdom ATLAS INTERNATIONAL (TURKEY) Turkey AUGSBURG-AIRWAYS GMBH Germany AUSTRIAN AIRLINES (AUA) Austria AVANTI AIR Germany AVIASTAR-TU Russian Federation AXIS AIRWAYS France BANGLADESH BIMAN Bangladesh BELAIR AIRLINES AG Switzerland BELAVIA Belarus BRITAIR S.A. France BRITANNIA AIRWAYS LTD. Sweden BRITANNIA AIRWAYS LTD. United Kingdom BRITISH AIRWAYS United Kingdom BRITISH MIDLAND AIRWAYS LTD. United Kingdom BRUSSELS AIRLINES Belgium BRUSSELS INTERNATIONAL AIRL. Belgium CAIRO AIR TRANSPORT COMPANY Egypt CARPATAIR S.A. Romania CATHAY PACIFIC AIRWAYS LTD. Hong Kong CHINA AIRLINES Taiwan (Republic of China) CIMBER AIR A/S Denmark CIRRUS LUFTFAHRTGESELL. MBH Germany CONDOR FLUGDIENST GMBH Germany CORSE AIR INTERNATIONAL France CYPRUS AIRWAYS LTD. Cyprus CZECH AIRLINES J.S.C. Czech Republic DANISH AIR TRANSPORT Denmark DENIM AIR Netherlands EAST LINE AIRLINES Russian Federation EASYJET AIRLINES CO. LTD United Kingdom EDELWEISS AIR AG Switzerland EGYPT AIR Egypt EL AL - ISRAEL AIRLINES LTD. -

Contents « Fly with a Smile

ENGLISCH Umschlag_2006 13.02.2007 11:32 Uhr Seite 1 6jhig^Vc6^ga^cZh<gdje6ccjVaGZedgi'%%+# Contents www.austrian.com « Fly with a smile. Highlights 1 The Group 2 Fly with a smile. Corporate Profile 2 » Departure into the Future 5 A New Direction 5 Strategy 9 Top Quality as Success Factor 15 Product and Service 15 Corporate Management and Control 21 Corporate Governance 21 Corporate Bodies 23 Risk Management 25 Austrian Airlines on the Capital Market 27 Austrian Airlines Shares 27 Investor Relations 31 Management Report 33 Business Development 2006 33 Segments 41 Outlook 51 Resources and Services 55 Human Resources 55 Fleet 59 Corporate Responsibility 63 Consolidated Financial Statements 65 IFRS Consolidated Income Statement 66 IFRS Consolidated Balance Sheet 67 IFRS Consolidated Statement of Changes in Shareholders’ Equity 68 IFRS Consolidated Cash Flow Statement 69 Notes 70 Introduction 70 Notes to the Consolidated Income Statement 77 Notes to the Consolidated Balance Sheet 80 Auditor’s Report 99 Report of the Supervisory Board 100 Equity Interests 101 Group Structure 102 Glossary 103 Contacts Cover Key Figures Cover Austrian Airlines Austrian Annual Report Group 2006 The interactive online version of this report can be found at www.austrian.com/report2006 lll#Vjhig^Vc#Xdb ENGLISCH Umschlag_2006 13.02.2007 11:32 Uhr Seite 1 6jhig^Vc6^ga^cZh<gdje6ccjVaGZedgi'%%+# Contents www.austrian.com « Fly with a smile. Highlights 1 The Group 2 Fly with a smile. Corporate Profile 2 » Departure into the Future 5 A New Direction 5 Strategy 9 Top Quality -

Rozporządzenia

4.9.2013 PL Dziennik Urzędowy Unii Europejskiej L 236/1 II (Akty o charakterze nieustawodawczym) ROZPORZĄDZENIA ROZPORZĄDZENIE KOMISJI (UE) NR 815/2013 z dnia 27 sierpnia 2013 r. zmieniające rozporządzenie (WE) nr 748/2009 w sprawie wykazu operatorów statków powietrznych, którzy wykonywali działalność lotniczą wymienioną w załączniku I do dyrektywy 2003/87/WE poczynając od dnia 1 stycznia 2006 r. ze wskazaniem administrującego państwa członkowskiego dla każdego operatora statków powietrznych, w celu uwzględnienia przystąpienia Chorwacji do Unii Europejskiej (Tekst mający znaczenie dla EOG) KOMISJA EUROPEJSKA, (4) Objęcie operatora statków powietrznych unijnym systemem handlu uprawnieniami do emisji gazów cieplarnianych uzależnione jest od wykonywania działal ności lotniczej wymienionej w załączniku I do dyrektywy uwzględniając Traktat o funkcjonowaniu Unii Europejskiej, 2003/87/WE, nie jest natomiast uzależnione od umiesz czenia danego operatora w wykazie operatorów statków powietrznych ustanowionym przez Komisję na podstawie art. 18a ust. 3 wspomnianej dyrektywy. uwzględniając dyrektywę 2003/87/WE Parlamentu Europej skiego i Rady z dnia 13 października 2003 r. ustanawiającą system handlu przydziałami emisji gazów cieplarnianych we Wspólnocie oraz zmieniającą dyrektywę Rady 96/61/WE ( 1), w szczególności jej art. 18a ust. 3 lit. b), (5) Przystąpienie Chorwacji do Unii Europejskiej w dniu 1 lipca 2013 r. oraz kryteria ustanowione w art. 18a ust. 1 dyrektywy 2003/87/WE w celu określenia admi nistrującego państwa członkowskiego dla poszczególnych a także mając na uwadze, co następuje: operatorów statków powietrznych oznaczają, że niektórzy operatorzy statków powietrznych powinni podlegać regulacjom Chorwacji. (1) Dyrektywą Parlamentu Europejskiego i Rady 2008/101/WE ( 2 ) wprowadzono zmiany w dyrektywie 2003/87/WE w celu uwzględnienia działalności lotniczej w systemie handlu uprawnieniami do emisji gazów (6) Należy zatem odpowiednio zmienić rozporządzenie (WE) cieplarnianych w Unii Europejskiej. -

Q:/S/C/W270A2-03.Pdf

S/C/W/270/Add.2 Page 403 PART H OWNERSHIP S/C/W/270/Add.2 Page 405 H. OWNERSHIP 1. Regulatory aspects 659. This section will discuss: (a) the different concepts associated with the term "ownership", and their interactions; (b) documentary limitations affecting the analysis of the issue; and (c) main regulatory developments. (a) The different concepts associated with the term "ownership" and their interaction 660. As explained in the compilation (paragraphs 7-9, pages 220-221), in the professional and academic aviation literature the term "ownership" is indifferently used to refer to three distinct concepts: (i) The designation policy through which a country attributes the rights to operate, either domestically or under a bilateral Air Services Agreement, to a given airline(s) (e.g. the US Department of Transportation granting traffic rights to American Airlines but not to Continental Airlines on a non-open- skies destination). Designation policies were used in the past both at the national level (e.g. before the 1979 deregulation, the US Civil Aeronautics Board would attribute the right to operate on a given city-pair to a given airline) and at the international level. They seem now to be confined mainly to the international arena with the marginal exception of public services contracts. (ii) The national investment/establishment regime for airlines, whether operating only domestic flights, only international flights, or both. The investment regime may cover also non-scheduled carriers and, in certain instances, general aviation/business aviation carriers. In cases where there is only one, publicly-owned airline, there may be no investment regime since none is needed. -

The Aviation & Space Journal Year XIII No 2 April

ALMA MATER STUDIORUM APRIL/JUNE 2014 YEAR XIII N° 2 The Aviation & Space Journal CONTENTS Aviation Editor Consolidation in Europe’s Airline Industry - Anna Masutti the Role of the EU Competition Watchdog Stephan Simon p.2 Board of Editors Vincent Correia The new European Commission Guidelines for State aid to airports Liu Hao and airlines Stephan Hobe Davide Grespan p.10 Pietro Manzini Pablo Mendes de Leon The Regulation of Personal Injuries in International Carriage by Wolf Müller-Rostin Suborbital Vehicles under Air Law Alessio Quaranta Benjamyn Ian Scott p.20 Benito Pagnanelli Franco Persiani Space Alfredo Roma Isro’s Space Journey Kai-Uwe Schrogl Ajey Lele p.33 Greta Tellarini Leopoldo Tullio Miscellaneous material of interest Stefano Zunarelli Opening the aviation market to the civil use of remotely piloted aircraft sys- tems in a safe and sustainable manner The Issue’s Alfredo Roma p.37 Contributors: Adeliana Carpineta Noise pollution at airports: European Parliament Resolution Isabella Colucci Doriano Ricciutelli p.40 Francesca Grassi Davide Grespan State aid: green light to the financial support granted to Verona and Alessandra Laconi Brescia airports; Long haul flights will not be subjected to the application Ajey Lele of the EU-ETS until 2017; Italy: new application provisions concerning Doriano Ricciutelli taxes, charges and fees whose non-payment prevent the departure of the Alfredo Roma flight; Alitalia and Etihad confirm 49% stake deal Benjamyn Ian Scott Alessandra Laconi p.41 Stephan Simon Forthcoming Events (ALIAS Conference – Florence, October 1-2, 2014) Legal and Social Impact of Automated Systems in Aviation p.45 E-mail: [email protected] Registrazione presso il tribunale di Bologna n. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios