The Aviation & Space Journal Year XIII No 2 April

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

CORSIA Aeroplane Operator to State Attributions

CORSIA Aeroplane Operator to State Attributions This is a preliminary version of the ICAO document “CORSIA Aeroplane Operator to State Attributions” that has been prepared to support the timely implementation of CORSIA from 1 January 2019. It contains aeroplane operators with international flights, and to which State they are attributed, based on information reported by States by 30 November 2018 in accordance with the Environmental Technical Manual (Doc 9501), Volume IV – Procedures for Demonstrating Compliance with the CORSIA, Chapter 3, Table 3-1. Terms used in the tables on the following pages are: • Aeroplane Operator Name is the full name of the aeroplane operator as reported by the State; • Attribution Method is one of three options as selected by the State: "ICAO Designator", "Air Operator Certificate" or "Place of Juridical Registration" in accordance with Annex 16 – Environmental Protection, Volume IV – Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), Part II, Chapter 1, 1.2.4; and • Identifier is associated with each Attribution Method as reported by the State: o If the Attribution Method is "ICAO Designator", the Identifier is the aeroplane operator's three-letter designator according to ICAO Doc 8585; o If the Attribution Method is "Air Operator Certificate", the Identifier is the number of the AOC (or equivalent) of the aeroplane operator; o If the Attribution Method is "Place of Juridical Registration", the Identifier is the name of the State where the aeroplane operator is registered as juridical person. Disclaimer: The designations employed and the presentation of the material presented herein do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

Regulamento (Ue) N

11.2.2012 PT Jornal Oficial da União Europeia L 39/1 II (Atos não legislativos) REGULAMENTOS o REGULAMENTO (UE) N. 100/2012 DA COMISSÃO de 3 de fevereiro de 2012 o que altera o Regulamento (CE) n. 748/2009, relativo à lista de operadores de aeronaves que realizaram uma das atividades de aviação enumeradas no anexo I da Diretiva 2003/87/CE em ou após 1 de janeiro de 2006, inclusive, com indicação do Estado-Membro responsável em relação a cada operador de aeronave, tendo igualmente em conta a expansão do regime de comércio de licenças de emissão da União aos países EEE-EFTA (Texto relevante para efeitos do EEE) A COMISSÃO EUROPEIA, 2003/87/CE e é independente da inclusão na lista de operadores de aeronaves estabelecida pela Comissão por o o força do artigo 18. -A, n. 3, da diretiva. Tendo em conta o Tratado sobre o Funcionamento da União Europeia, (5) A Diretiva 2008/101/CE foi incorporada no Acordo so bre o Espaço Económico Europeu pela Decisão o Tendo em conta a Diretiva 2003/87/CE do Parlamento Europeu n. 6/2011 do Comité Misto do EEE, de 1 de abril de e do Conselho, de 13 de Outubro de 2003, relativa à criação de 2011, que altera o anexo XX (Ambiente) do Acordo um regime de comércio de licenças de emissão de gases com EEE ( 4). efeito de estufa na Comunidade e que altera a Diretiva 96/61/CE o o do Conselho ( 1), nomeadamente o artigo 18. -A, n. 3, alínea a), (6) A extensão das disposições do regime de comércio de licenças de emissão da União, no setor da aviação, aos Considerando o seguinte: países EEE-EFTA implica que os critérios fixados nos o o termos do artigo 18. -

Zvartnots Airport Expansion Project (Phase 2) (Armenia)

Extended Annual Review Report Project Number: 43922 Investment/Loan Number: 7308/2620 October 2013 Loan Zvartnots Airport Expansion Project (Phase 2) (Armenia) In accordance with ADB’s public communication policy (PCP, 2011), this extended annual review report excludes information referred to in paragraph 67 of the PCP. CURRENCY EQUIVALENTS Currency Unit – dram (AMD) At Appraisal At Project Completion 13 February 2010 30 August 2012 AMD1.00 – $0.00262 $0.00244 $1.00 – AMD381.50 AMD409.36 ABBREVIATIONS ADB – Asian Development Bank AIA – Armenia International Airports AmIA – American International Airports DEG – Deutsche Investitions-und Entwicklungsgesellchaft EAP – environmental action plan EBITDA – earnings before interest, taxes, depreciation, and amortization EBRD – European Bank for Reconstruction and Development ECG – Evaluation Cooperation Group EIA – environmental impact assessment EMP – environmental management plan EROIC – economic return on invested capital ICAO – International Civil Aviation Organization IEE – initial environmental examination OSPF – Office of the Special Project Facilitator RAP – resettlement action plan ROIC – return on invested capital RRP – report and recommendation of the President WACC – weighted average cost of capital ZIA – Zvartnots International Airport NOTES (i) The fiscal year (FY) of the Government of Armenia ends on 31 December. FY before a calendar year denotes the year in which the fiscal year ends, e.g., FY2010 ends on 31 December 2010. (ii) In this report, "$" refers to US dollars. Vice-President L. Venkatachalam, Private Sector and Cofinancing Operations Director General T. Freeland, Private Sector Operations Department (PSOD) Director M. Barrow, Infrastructure Finance Division 1, PSOD Team leader E. Gregori, Unit Head, Project Administration, PSOD Team member s H. Cruda, Senior Safeguards Specialist, PSOD S. -

Annual Report 2007

EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 1 Analyses of the European air transport market Annual Report 2007 EUROPEAN COMMISSION EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 2 Air Transport and Airport Research Annual analyses of the European air transport market Annual Report 2007 German Aerospace Center Deutsches Zentrum German Aerospace für Luft- und Raumfahrt e.V. Center in the Helmholtz-Association Air Transport and Airport Research December 2008 Linder Hoehe 51147 Cologne Germany Head: Prof. Dr. Johannes Reichmuth Authors: Erik Grunewald, Amir Ayazkhani, Dr. Peter Berster, Gregor Bischoff, Prof. Dr. Hansjochen Ehmer, Dr. Marc Gelhausen, Wolfgang Grimme, Michael Hepting, Hermann Keimel, Petra Kokus, Dr. Peter Meincke, Holger Pabst, Dr. Janina Scheelhaase web: http://www.dlr.de/fw Annual Report 2007 2008-12-02 Release: 2.2 Page 1 Annual analyses of the European air transport market Annual Report 2007 Document Control Information Responsible project manager: DG Energy and Transport Project task: Annual analyses of the European air transport market 2007 EC contract number: TREN/05/MD/S07.74176 Release: 2.2 Save date: 2008-12-02 Total pages: 222 Change Log Release Date Changed Pages or Chapters Comments 1.2 2008-06-20 Final Report 2.0 2008-10-10 chapters 1,2,3 Final Report - full year 2007 draft 2.1 2008-11-20 chapters 1,2,3,5 Final updated Report 2.2 2008-12-02 all Layout items Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.74176. -

356 Partners Found. Check If Available in Your Market

367 partners found. Check if available in your market. Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon GA Garuda Indonesia XL LATAM Airlines -

Cyprus Airways Announcement Nicosia 9 January 2015 Dear

Cyprus Airways Announcement Nicosia 9 January 2015 Dear Passengers, Following the adverse decision of the European Commission for Competition, issued today, on the application of the Republic of Cyprus of a Restructuring Plan for Cyprus Airways (Public) Ltd submitted in October 2013, the Board of Directors of Cyprus Airways has decided to initiate the procedure for voluntary liquidation and to that effect all necessary measures will be taken. In the context of the above decision all operations of the company will be suspended as of the close of business today. Cyprus Airways would like to warmly thank the millions of passengers who flew with the airline over the years, for their choice and support. Special thanks are also expressed to the staff of the airline as well as its associates, whose professionalism and dedication were always at the service of the passengers. We are extremely honoured to have made a valuable contribution, over the last 68 years, to the development of the economy of Cyprus and its tourism industry in particular. We have flown the flag of our country worldwide with pride. The government of Cyprus announced that it has decided to offer alternative arrangements to all passengers who have Cyprus Airways tickets. The cost of all alternative arrangements will be undertaken by the Republic. The affected passengers of Cyprus Airways, who have arranged their travel with departure days up to and until 9/2/2015, can immediately contact the travel agency Top Kinisis Travel Public at the national telephone number 77787878, or if they are calling from overseas at the telephone number +357 22869999, in order to arrange for the issuance of a new flight ticket. -

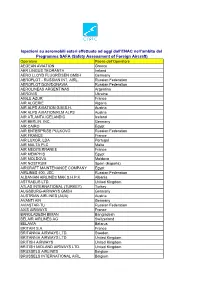

Compagnie Aeree Ispezionate

Ispezioni su aeromobili esteri effettuate ad oggi dall’ENAC nell’ambito del Programma SAFA (Safety Assessment of Foreign Aircraft) Operatore Paese dell'Operatore AEGEAN AVIATION Greece AER LINGUS TEORANTA Ireland AERO LLOYD FLUGREISEN GMBH Germany AEROFLOT - RUSSIAN INT. AIRL. Russian Federation AEROFLOT DON/DONAVIA Russian Federation AEROLINEAS ARGENTINAS Argentina AEROVIS Ukraine AIGLE AZUR France AIR ALGERIE Algeria AIR ALPS AVIATION G.M.B.H. Austria AIR ALPS AVIATION/KLM ALPS Austria AIR ATLANTA ICELANDIC Iceland AIR BERLIN, INC. Germany AIR CAIRO Egypt AIR ENTERPRISE PULKOVO Russian Federation AIR FRANCE France AIR LUXOR, LDA Portugal AIR MALTA PLC Malta AIR MEDITERRANEE France AIR MEMPHIS Egypt AIR MOLDOVA Moldova AIR NOSTRUM Spain (España) AIRCRAFT MAINTENANCE COMPANY Egypt AIRLINES 400, JSC Russian Federation ALBANIAN AIRLINES MAK S.H.P.K. Albania ASTRAEUS LTD. United Kingdom ATLAS INTERNATIONAL (TURKEY) Turkey AUGSBURG-AIRWAYS GMBH Germany AUSTRIAN AIRLINES (AUA) Austria AVANTI AIR Germany AVIASTAR-TU Russian Federation AXIS AIRWAYS France BANGLADESH BIMAN Bangladesh BELAIR AIRLINES AG Switzerland BELAVIA Belarus BRITAIR S.A. France BRITANNIA AIRWAYS LTD. Sweden BRITANNIA AIRWAYS LTD. United Kingdom BRITISH AIRWAYS United Kingdom BRITISH MIDLAND AIRWAYS LTD. United Kingdom BRUSSELS AIRLINES Belgium BRUSSELS INTERNATIONAL AIRL. Belgium CAIRO AIR TRANSPORT COMPANY Egypt CARPATAIR S.A. Romania CATHAY PACIFIC AIRWAYS LTD. Hong Kong CHINA AIRLINES Taiwan (Republic of China) CIMBER AIR A/S Denmark CIRRUS LUFTFAHRTGESELL. MBH Germany CONDOR FLUGDIENST GMBH Germany CORSE AIR INTERNATIONAL France CYPRUS AIRWAYS LTD. Cyprus CZECH AIRLINES J.S.C. Czech Republic DANISH AIR TRANSPORT Denmark DENIM AIR Netherlands EAST LINE AIRLINES Russian Federation EASYJET AIRLINES CO. LTD United Kingdom EDELWEISS AIR AG Switzerland EGYPT AIR Egypt EL AL - ISRAEL AIRLINES LTD. -

Sendung Nr Am

Title: Take off Country: Cyprus Duration: 5’15’’ Insert: Producer: Maria A. Georgiadou Director: Maria A. Georgiadou Camera: Costas Charalambous Kyriacos Moniates Stavros Kyriakides George Rachmatoulin Editing: Elena Ioannou Sound: Menelaos Philippides Christos Hamatsos Panicos Demetriou Kyriacos Kyriacou Music: “Free Bird” by Lynyrd Skynyrd 1 Text: O-Ton: Cyprus Airways spokesman C.A. is the state air carrier of Cyprus, with a fairly long history, a life of 58 years. Our company transports, in conjunction with its subsidiary chartered flights company, EUROCYPRIA, almost ¹/³ of the people traveling between Cyprus and abroad. These numbers… they also reveal the importance of the company to the economy of the island. O-Ton: Acting Director, CIVIL AVIATION Following our accession to the EU, on 1st May 2004, a full liberalization of flights in Cyprus, with EU countries, came about. O-Ton: Cyprus Airways spokesman …Almost 150 airlines fly to Cyprus from Europe, mainly, as well as from other countries. As you know, not only in Cyprus and in Europe, but the world over, just a few short decades ago, air transport was being carried out on a wholly different basis. That is to say, which companies would fly was an issue decided by the states amongst themselves. How much they would charge, what the charges would be, was also an issue decided amongst the states through IATA. O-Ton: Acting Director, CIVIL AVIATION The liberalization of flights gives the right to any air carrier, under certain conditions, to carry out itineraries within the EU. O-Ton: HELIOS Airways, Commercial Manager Our company started to fly in 2001 and entered the chartered flight market in 2002 with flights to London. -

Contents « Fly with a Smile

ENGLISCH Umschlag_2006 13.02.2007 11:32 Uhr Seite 1 6jhig^Vc6^ga^cZh<gdje6ccjVaGZedgi'%%+# Contents www.austrian.com « Fly with a smile. Highlights 1 The Group 2 Fly with a smile. Corporate Profile 2 » Departure into the Future 5 A New Direction 5 Strategy 9 Top Quality as Success Factor 15 Product and Service 15 Corporate Management and Control 21 Corporate Governance 21 Corporate Bodies 23 Risk Management 25 Austrian Airlines on the Capital Market 27 Austrian Airlines Shares 27 Investor Relations 31 Management Report 33 Business Development 2006 33 Segments 41 Outlook 51 Resources and Services 55 Human Resources 55 Fleet 59 Corporate Responsibility 63 Consolidated Financial Statements 65 IFRS Consolidated Income Statement 66 IFRS Consolidated Balance Sheet 67 IFRS Consolidated Statement of Changes in Shareholders’ Equity 68 IFRS Consolidated Cash Flow Statement 69 Notes 70 Introduction 70 Notes to the Consolidated Income Statement 77 Notes to the Consolidated Balance Sheet 80 Auditor’s Report 99 Report of the Supervisory Board 100 Equity Interests 101 Group Structure 102 Glossary 103 Contacts Cover Key Figures Cover Austrian Airlines Austrian Annual Report Group 2006 The interactive online version of this report can be found at www.austrian.com/report2006 lll#Vjhig^Vc#Xdb ENGLISCH Umschlag_2006 13.02.2007 11:32 Uhr Seite 1 6jhig^Vc6^ga^cZh<gdje6ccjVaGZedgi'%%+# Contents www.austrian.com « Fly with a smile. Highlights 1 The Group 2 Fly with a smile. Corporate Profile 2 » Departure into the Future 5 A New Direction 5 Strategy 9 Top Quality -

Airlines and Subsidy: Our Position ¬

Airlines and subsidy: our position ¬ Myth Airline subsidies are a “Gulf” problem FACT Market-distorting subsidies and government support are sadly present in every world region Myth Emirates is subsidised FACT Completely unsubsidised. We campaign against airline subsidies Myth Emirates accesses cheap or free fuel FACT False. We buy fuel from BP, Shell and Chevron in Dubai and worldwide at market rates Myth US and European airlines received support decades ago but are now subsidy-free FACT Bankruptcy protection and government bailouts continue to exist Airlines and subsidy: our position ¬ We understand that despite no evidence, an oft repeated myth can ultimately be accepted as conventional wisdom. In this document you will find our views on subsidy in the airline industry, thorough explanations about Emirates’ business model and our response to misrepresentations that have been levelled against us - from claims about subsidised fuel, financial support and staff conditions to environmental regulation and airport charges. Emirates believes: • A common set of transparent financial reporting metrics to measure and apply against all international carriers should be determined by IATA and ICAO on what defines a subsidy. • Governments should not provide injections, borrowings or financing to airlines, regardless of shareholding status. • All governments should pursue liberalisation and open skies with the objective to end the greatest subsidy of all – aero-political protection. Tim Clark, President, Emirates Airline 1 Contents ¬ Introduction -

Rozporządzenia

4.9.2013 PL Dziennik Urzędowy Unii Europejskiej L 236/1 II (Akty o charakterze nieustawodawczym) ROZPORZĄDZENIA ROZPORZĄDZENIE KOMISJI (UE) NR 815/2013 z dnia 27 sierpnia 2013 r. zmieniające rozporządzenie (WE) nr 748/2009 w sprawie wykazu operatorów statków powietrznych, którzy wykonywali działalność lotniczą wymienioną w załączniku I do dyrektywy 2003/87/WE poczynając od dnia 1 stycznia 2006 r. ze wskazaniem administrującego państwa członkowskiego dla każdego operatora statków powietrznych, w celu uwzględnienia przystąpienia Chorwacji do Unii Europejskiej (Tekst mający znaczenie dla EOG) KOMISJA EUROPEJSKA, (4) Objęcie operatora statków powietrznych unijnym systemem handlu uprawnieniami do emisji gazów cieplarnianych uzależnione jest od wykonywania działal ności lotniczej wymienionej w załączniku I do dyrektywy uwzględniając Traktat o funkcjonowaniu Unii Europejskiej, 2003/87/WE, nie jest natomiast uzależnione od umiesz czenia danego operatora w wykazie operatorów statków powietrznych ustanowionym przez Komisję na podstawie art. 18a ust. 3 wspomnianej dyrektywy. uwzględniając dyrektywę 2003/87/WE Parlamentu Europej skiego i Rady z dnia 13 października 2003 r. ustanawiającą system handlu przydziałami emisji gazów cieplarnianych we Wspólnocie oraz zmieniającą dyrektywę Rady 96/61/WE ( 1), w szczególności jej art. 18a ust. 3 lit. b), (5) Przystąpienie Chorwacji do Unii Europejskiej w dniu 1 lipca 2013 r. oraz kryteria ustanowione w art. 18a ust. 1 dyrektywy 2003/87/WE w celu określenia admi nistrującego państwa członkowskiego dla poszczególnych a także mając na uwadze, co następuje: operatorów statków powietrznych oznaczają, że niektórzy operatorzy statków powietrznych powinni podlegać regulacjom Chorwacji. (1) Dyrektywą Parlamentu Europejskiego i Rady 2008/101/WE ( 2 ) wprowadzono zmiany w dyrektywie 2003/87/WE w celu uwzględnienia działalności lotniczej w systemie handlu uprawnieniami do emisji gazów (6) Należy zatem odpowiednio zmienić rozporządzenie (WE) cieplarnianych w Unii Europejskiej.