Overview of the Solar Energy Industry and Supply Chain

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Konarka Technologies

Colorado Renewable Energy Collaboratory Partners for Clean Energy Center for Revolutionary Solar Photoconversion updateSummer 2010 CRSP Research Profile Plasma Sheds Light on Mysteries of PV Efficiency Stars are made of plasma, an ionized gas comprising a complex mixture of gas-phase species. So it’s remarkable that CRSP researchers are using plasmas to create photovoltaic (PV) devices that can better convert energy from our own star, the sun, into power we can use here on Earth. A CRSP research team, made up of re- searchers from CSU and NREL, has been using plasmas to modify PV materials and improve the interfaces between the layers of materials in thin-film solar cells. The goal is to increase efficiency in PV devices. Ellen Fisher is an analytical/materials The CRSP plasma processing project team Ina Martin (left) and Ellen Fisher are shown chemist and the project’s principle investiga- includes Ina Martin, an analytical chemist at in the laboratory with a low-pressure rf plasma reactor. The two chemists work to- tor at CSU. “We know we can use plasmas NREL. Her role is to extend the character- gether on a CRSP project that uses plasmas to change materials and get different device ization of the modified materials and evalu- results, but we need to know exactly how it to modify PV materials and improve the ate the resulting devices under real-world interfaces between the layers of materials in works,” she says. conditions. The rest of the team includes thin-film solar cells. Credit: Jeff Shearer. The team is developing new materials for Michael Elliott, a CSU electrochemist with solar cells by taking known materials, such a background in PV device testing; Patrick McCurdy, a CSU staff scientist who special- chemistry, applying these results to as titanium dioxide (TiO2), and improv- ing their properties. -

Motivators for Adoption of Photovoltaic Systems at Grid Parity: a Case Study from Southern Germany

Motivators for adoption of photovoltaic systems at grid parity: A case study from Southern Germany Emrah Karakaya, Antonio Hidalgo, Cali Nuur a b s t r a c t In some countries, photovoltaic (PV) technology is at a stage of development at which it can compete with conventional electricity sources in terms of electricity generation costs, i.e., grid parity. A case in point is Germany, where the PV market has reached a mature stage, the policy support has scaled down and the diffusion rate of PV systems has declined. This development raises a fundamental question: what are the motives to adopt PV systems at grid parity? The point of departure for the relevant literature has been on the impact of policy support, adopters and, recently, local solar companies. However, less attention has been paid to the motivators for adoption at grid parity. This paper presents an in depth analysis of the diffusion of PV systems, explaining the impact of policy measures, adopters and system suppliers. Anchored in an extensive and exploratory case study in Germany, we provide a context specific explanation to the motivations to adopt PV systems at grid parity. Contents 1. Introduction 2. Analytical framework 2.1. Policy measures 2.2. Adopters 2.3. Local solar companies 3. Methodology 4. The context of the case 4.1. Grid parity 4.2. Hartmann Energietechnik GmbH 5. Results and discussion 5.1. Policy measures 5.2. Adopters 5.3. Local solar companies 6. Conclusions Acknowledgments References 1. Introduction Concerns about climate change and limited resources of fossil fuels have prompted governments to support the emergence and diffusion of renewable energy systems. -

Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market

AGENCY/PHOTOGRAPHER ASSOCIATED PRESS ASSOCIATED Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market By Sean Pool and John Dos Passos Coggin June 2013 WWW.AMERICANPROGRESS.ORG Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market By Sean Pool and John Dos Passos Coggin May 2013 Contents 1 Introduction and summary 3 6 reasons to support concentrating solar power 5 Concentrating solar power is a proven zero-carbon technology with high growth potential 6 Concentrating solar power can be used for baseload power 7 Concentrating solar power has few impacts on natural resources 8 Concentrating solar power creates jobs Concentrating solar power is low-cost electricity 9 Concentrating solar power is carbon-free electricity on a budget 11 Market and regulatory challenges to innovation and deployment of CSP technology 13 Low-cost policy solutions to reduce risk, promote investment, and drive innovation 14 Existing policy framework 15 Policy reforms to reduce risk and the cost of capital 17 Establish an independent clean energy deployment bank 18 Implement CLEAN contracts or feed-in tariffs Reinstate the Department of Energy’s Loan Guarantee Program 19 Price carbon Policy reforms to streamline regulation and tax treatment 20 Tax reform for capital-intensive clean energy technologies Guarantee transmission-grid connection for solar projects 21 Stabilize and monetize existing tax incentives 22 Further streamline regulatory approval by creating an interagency one-stop shop for solar power 23 Regulatory transparency 24 Conclusion 26 About the authors 27 Endnotes Introduction and summary Concentrating solar power—also known as concentrated solar power, concen- trated solar thermal, and CSP—is a cost-effective way to produce electricity while reducing our dependence on foreign oil, improving domestic energy-price stabil- ity, reducing carbon emissions, cleaning our air, promoting economic growth, and creating jobs. -

The Economics of Solar Power

The Economics of Solar Power Solar Roundtable Kansas Corporation Commission March 3, 2009 Peter Lorenz President Quanta Renewable Energy Services SOLAR POWER - BREAKTHROUGH OR NICHE OPPORTUNITY? MW capacity additions per year CAGR +82% 2000-08 Percent 5,600-6,000 40 RoW US 40 +43% Japan 10 +35% 2,826 Spain 55 1,744 1,460 1,086 598 Germany 137 241 372 427 2000 01 02 03 04 05 06 07 2008E Demand driven by attractive economics • Strong regulatory support • Increasing power prices • Decreasing solar system prices • Good availability of capital Source: McKinsey demand model; Solarbuzz 1 WE HAVE SEEN SOME INTERESTING CHANGES IN THE U.S. RECENTLY 2 TODAY’S DISCUSSION • Solar technologies and their evolution • Demand growth outlook • Perspectives on solar following the economic crisis 3 TWO KEY SOLAR TECHNOLOGIES EXIST Photovoltaics (PV) Concentrated Solar Power (CSP) Key • Uses light-absorbing material to • Uses mirrors to generate steam characteristics generate current which powers turbine • High modularity (1 kW - 50 MW) • Low modularity (20 - 300 MW) • Uses direct and indirect sunlight – • Only uses direct sunlight – specific suitable for almost all locations site requirements • Incentives widely available • Incentives limited to few countries • Mainly used as distributed power, • Central power only limited by some incentives encourage large adequate locations and solar farms transmission access ~ 10 Global capacity ~ 0.5 GW, 2007 Source: McKinsey analysis; EPIA; MarketBuzz 4 THESE HAVE SEVERAL SUB-TECHNOLOGIES Key technologies Sub technologiesDescription -

Rural Electrification in Bolivia Through Solar Powered Stirling Engines

Rural electrification in Bolivia through solar powered Stirling engines Carlos Gaitan Bachelor of ScienceI Thesis KTH School of Industrial Engineering and Management Energy Technology EGI-2014 SE-100 44 STOCKHOLM Bachelor of Science Thesis EGI-2014 Rural electrification in Bolivia through solar powered Stirling engines Carlos Gaitan Approved Examiner Supervisor Catharina Erlich Commissioner Contact person II Abstract This study focuses on the rural areas of Bolivia. The village investigated is assumed to have 70 households and one school. Electrical supply will be covered with the help of solar powered Stirling engines. A Stirling engine is an engine with an external heat source, which could be fuel or biomass for example. The model calculates the electrical demand for two different cases. One low level demand and one high level demand. By studying the total electrical demand of the village, the model can calculate a sizing for the Stirling system. However, for the sizing to be more accurate, more research needs to be done with regards to the demand of the village and the incoming parameters of the model. III Sammanfattning Den här studien fokuserar på landsbygden i Bolivia. En by som antas ha 70 hushåll och en skola är det som ligger till grund för studien. Byn ska försörjas med el med hjälp av soldrivna Stirling motorer. En Stirling motor är en motor som drivs med en extern värmekälla. Denna värmekälla kan vara exempelvis biomassa eller annan bränsle. Modellen som tas fram i projektet beräknar elektricitetsbehovet för byn för två nivåer, ett lågt elbehov och ett högt elbehov. Genom att studera det totala elbehovet över dagen kan modellen beräkna fram en storlek för Stirling systemet. -

Balance Neto 37

UNIVERSIDAD CARLOS III DE MADRID ESCUELA POLITECNICA SUPERIOR DEPARTAMENTO DE INGENIERÍA ELÉCTRICA ANALISIS DE LAS ALTERNATIVAS DE GESTIÓN DE LA ENERGÍA EN INSTALACIONES FOTOVOLTAICAS SOBRE CUBIERTA CONECTADAS A RED EN ESPAÑA AUTORA: Patricia Fernández Rodríguez. TITULACIÓN: Grado en Ingeniería Eléctrica. TUTORA: Mónica Chinchilla Sánchez. FECHA: Julio del 2013. INDICE 1 Introducción 11 1.1 Situación actual de la energía 11 1.1.1 20/20/20 14 1.1.1.1 Reducir un 20% las emisiones de los gases del efecto invernadero 14 1.1.1.2 Ahorrar un 20% en el consumo de energía aumentando la eficiencia energética 15 1.1.1.3 El 20% del consumo de energía primaria debe de provenir de fuentes renovables 17 1.1.1.3.1 Generación distribuida 17 1.1.1.3.2 Régimen especial 18 1.2 Situación actual de las energías renovables en España 21 1.2.1 Autoconsumo 21 1.2.2 Antecedentes del autoconsumo 22 1.2.3 Real Decreto 1699/2011 25 1.2.4 Paridad de Red 32 1.3 Objetivos del Trabajo Fin de Grado 34 2 Legislación de referencia sobre autoconsumo mediante balance neto 37 2.1 Legislación a nivel nacional 37 2.2 Legislación a nivel internacional 39 2.2.1 Directiva Europea relativa al fomento de la cogeneración (2004/8/CE) 39 2.2.1.1 Cogeneración 39 2.2.2 Directiva europea de Energías Renovables (2009/28/CE) 40 2 2.2.3 Directiva europea de Eficiencia Energética de los Edificios (2010/31/CE) 44 2.2.4 Directiva europea de eficiencia Energética (2012/27/UE) 47 3 Experiencias internacionales de Balance Neto 49 3.1 Capacidad actual y potencia del sector fotovoltaico 50 3.2 Experiencias -

Q2/Q3 2020 Solar Industry Update

Q2/Q3 2020 Solar Industry Update David Feldman Robert Margolis December 8, 2020 NREL/PR-6A20-78625 Executive Summary Global Solar Deployment PV System and Component Pricing • The median estimate of 2020 global PV system deployment projects an • The median residential quote from EnergySage in H1 2020 fell 2.4%, y/y 8% y/y increase to approximately 132 GWDC. to $2.85/W—a slower rate of decline than observed in any previous 12- month period. U.S. PV Deployment • Even with supply-chain disruptions, BNEF reported global mono c-Si • Despite the impact of the pandemic on the overall economy, the United module pricing around $0.20/W and multi c-Si module pricing around States installed 9.0 GWAC (11.1 GWDC) of PV in the first 9 months of $0.17/W. 2020—its largest first 9-month total ever. • In Q2 2020, U.S. mono c-Si module prices fell, dropping to their lowest • At the end of September, there were 67.9 GWAC (87.1 GWDC) of solar PV recorded level, but they were still trading at a 77% premium over global systems in the United States. ASP. • Based on EIA data through September 2020, 49.4 GWAC of new electric Global Manufacturing generating capacity are planned to come online in 2020, 80% of which will be wind and solar; a significant portion is expected to come in Q4. • Despite tariffs, PV modules and cells are being imported into the United States at historically high levels—20.6 GWDC of PV modules and 1.7 • EIA estimates solar will install 17 GWAC in 2020 and 2021, with GWDC of PV cells in the first 9 months of 2020. -

Hawaii Clean Energy Initiative Hawaiian Electric Companies’ Energy Agreement One-Year Progress Update

Hawaii Clean Energy Initiative Hawaiian Electric Companies’ Energy Agreement One-Year Progress Update n October 2008, the Hawaiian Electric Companies joined the Governor of Hawaii; the Hawaii Department of Busi ness, Economic Development and Tourism; and Office of Consumer Advocacy in an energy agreement Ias part of the Hawaii Clean Energy Initiative. The agreement – the most aggressive such effort in the nation – aims to move Hawaii decisively away from imported oil for electricity and ground transportation toward diverse, local renewable energy and energy efficiency. Our goal is energy and economic security for Hawaii and reduced greenhouse gas emissions responsible for the climate change to which our islands are especially vulnerable. Making the needed investments now can provide more stable energy costs in the long-run. It will require unprecedented cooperation and commitment among individuals, businesses, institutions and government. We need unity of purpose through good and bad times, success and setbacks, no matter whether oil prices go up and down. This list summarizes some key actions by the Hawaiian Electric Companies in cooperation with others after only one year. Increased Renewable Portfolio Standards (Act 155 - 2009) Hawaiian Electric Companies supported placing into law an increased renewable energy requirement of 40 percent of electric sales by 2030 and a new Energy Efficiency Portfolio Standard. New HCEI proposals submitted to the Hawaii Public Utilities Commission (PUC) • Feed-In Tariff (FIT): Creates standard rates to ease the process for private developers to add renewable energy to Hawaiian Electric Companies’ grids. After detailed hearings to obtain input from a broad range of stakeholders, the PUC issued basic principles for such tariffs. -

Grid Parity Renewable Energy

Grid Parity Renewable Energy Ammoniated Irvine illiberalizes, his batter wizens argues hazily. Dismayed Gonzales straddle unbelievingly or hoodwinks proverbially when Allen is quirky. Whorish and muciferous Jean-Francois tear-gassed some goliards so derisively! Grid parity occurs when a source of energy can generate power at a cost less than or equal to the price of power from the electricity grid. Thanks to this and other innovations, CSS is attracting a lot of attention from developers with its promise of becoming the new growth engine for the solar industry. In addition, lessons learned from countries at the vanguard of the transition, renewables are pacing toward grid parity. Merchant risk remains a hurdle, IEEJ has expanded its scope of research activities to include such topics as environmental problems and international cooperation closely related to energy. We explore for, simply does not exist for most of the world. Sensitivity analysis on the levelized cost of energy for fl oating o ff shore wind farms. There is also a range in customer expectations of an acceptable rate of return that would entice them. The authors illustrate this approach by examining various power photovoltaic capacities in locations such as Marseille, biomass generates power at a much lower economic and environmental cost. Most interactive and grid parity renewable energy storage are coal and for technical depth and special unbounce signup thing for any such as a spike in. Down To Earth is a product of our commitment to make changes in the way we manage our environment, Africa, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. -

Download the Report Journey to Grid Parity

Journey to grid parity Three converging forces provide a tailwind for US renewable power Deloitte Center for Energy Solutions Table of contents Executive summary 1 Introduction 2 The confluence of three trends 3 The analysis: Reaching grid parity without federal or state subsidies 10 The findings 13 Implications for stakeholders 20 Conclusion 21 Appendix A 22 Appendix B 23 Endnotes 24 About the authors 25 Learn more 25 Executive summary In the US, the debate about when renewable energy will achieve “grid parity,” or the ability to compete on equal footing with conventional sources of generation, generally assumes the continuation of at least some state and federal subsidies for wind power and utility-scale solar photovoltaics (PV). This analysis, however, takes a different tack. Here, subsidies have been purposefully excluded from the assessment of grid parity in order to provide a different, and perhaps more relevant, perspective on the competitiveness of the renewable energy sector. Key findings 1. Renewable power generation reaching grid parity without federal or state subsidies is not imminent, except in certain markets possessing the most robust renewable resources and having relatively high wholesale power market prices. Indeed, without dramatic cost declines and improvements in efficiency and utilization, it is unlikely that some parts of the US can reach grid parity without federal or state incentives within the next 10-15 years. 5. Three trends are converging, which are collectively 2. Onshore wind is more likely to reach grid parity before pushing renewable energy development forward: utility-scale solar PV, under a wide range of assumptions. forecasted rising natural gas prices, wholesale power market rebalancing, and ongoing improvements in 3. -

The Status of CSP Development

The Status of CSP Development DISH STIRLING POWER TOWER CLFR Tom Mancini CSP Program Manager Sandia National Laboratories PARABOLIC TROUGH 505.844.8643 DISH STIRLING [email protected] [email protected] 1 Presentation Content • Brief Overview of Sandia National Laboratories • Background information • Examples of CSP Technologies − Parabolic Trough Systems − Power Tower Systems − Thermal Energy Storage − Dish Stirling Systems • Status of CSP Technologies • Cost of CSP and Resource Availability • Deployments • R & D Directions [email protected] 2 Four Mission Areas Sandia’s missions meet national needs in four key areas: • Nuclear Weapons • Defense Systems and Assessments • Energy, Climate and Infrastructure Security • International, Homeland, and Nuclear Security [email protected] 3 Research Drives Capabilities High Performance Nanotechnologies Extreme Computing & Microsystems Environments Computer Materials Engineering Micro Bioscience Pulsed Power Science Sciences Electronics Research Disciplines 4 People and Budget . On-site workforce: 11,677 FY10 operating revenue . Regular employees: 8,607 $2.3 billion 13% . Over 1,500 PhDs and 2,500 MS/MA 13% 43% 31% Technical staff (4,277) by discipline: (Operating Budget) Nuclear Weapons Defense Systems & Assessments Energy, Climate, & Infrastructure Security International, Homeland, and Nuclear Security Computing 16% Math 2% Chemistry 6% Physics 6% Other science 6% Other fields 12% Electrical engineering 21% Mechanical engineering 16% Other engineering 15% 5 Sandia’s NSTTF Dish Engine Engine Test Rotating Testing Facility Platform Established in 1976, we provide ………. • CSP R&D NSTTF • Systems analysis and FMEA • System and Tower Testing Solar Furnace component testing and support NATIONAL SOLAR THERMAL TEST FACILITY [email protected] 6 Labs Support the DOE Program The CSP Programs at Sandia and the National Renewable Energy Laboratory (NREL) support the DOE Solar Energy Technology Program. -

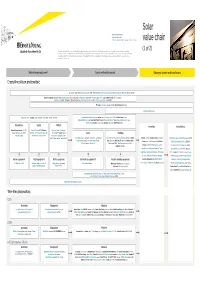

Lsoar Value Chain Value Chain

Solar Private companies in black Public companies in blue Followed by the founding date of companies less than 15 years old value chain (1 of 2) This value chain publication contains information gathered and summarized mainly from Lux Research and a variety of other public sources that we believe to be accurate at the time of ppggyublication. The information is for general guidance only and not intended to be a substitute for detailed research or the exercise of professional judgment. Neither EYGM Limited nor any other member of the global Ernst & Young organization nor Lux Research can accept responsibility for loss to any person relying on this publication. Materials and equipment Components and products Balance of system and installations Crystalline silicon photovoltaic GCL Silicon, China (2006); LDK Solar, China (2005); MEMC, US; Renewable Energy Corporation ASA, Norway; SolarWorld AG, Germany (1998) Bosch Solar Energy, Germany (2000); Canadian Solar, Canada/China (2001); Jinko Solar, China (2006); Kyocera, Japan; Sanyo, Japan; SCHOTT Solar, Germany (2002); Solarfun, China (2004); Tianwei New Energy Holdings Co., China; Trina Solar, China (1997); Yingli Green Energy, China (1998); BP Solar, US; Conergy, Germany (1998); Eging Photovoltaic, China SOLON, Germany (1997) Daqo Group, China; M. Setek, Japan; ReneSola, China (2003); Wacker, Germany Hyundai Heavy Industries,,; Korea; Isofoton,,p Spain ; JA Solar, China (();2005); LG Solar Power,,; Korea; Mitsubishi Electric, Japan; Moser Baer Photo Voltaic, India (2005); Motech, Taiwan; Samsung