STAND. COM. REP. NO. Z.Kc Honolulu, Hawaii

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market

AGENCY/PHOTOGRAPHER ASSOCIATED PRESS ASSOCIATED Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market By Sean Pool and John Dos Passos Coggin June 2013 WWW.AMERICANPROGRESS.ORG Fulfilling the Promise of Concentrating Solar Power Low-Cost Incentives Can Spur Innovation in the Solar Market By Sean Pool and John Dos Passos Coggin May 2013 Contents 1 Introduction and summary 3 6 reasons to support concentrating solar power 5 Concentrating solar power is a proven zero-carbon technology with high growth potential 6 Concentrating solar power can be used for baseload power 7 Concentrating solar power has few impacts on natural resources 8 Concentrating solar power creates jobs Concentrating solar power is low-cost electricity 9 Concentrating solar power is carbon-free electricity on a budget 11 Market and regulatory challenges to innovation and deployment of CSP technology 13 Low-cost policy solutions to reduce risk, promote investment, and drive innovation 14 Existing policy framework 15 Policy reforms to reduce risk and the cost of capital 17 Establish an independent clean energy deployment bank 18 Implement CLEAN contracts or feed-in tariffs Reinstate the Department of Energy’s Loan Guarantee Program 19 Price carbon Policy reforms to streamline regulation and tax treatment 20 Tax reform for capital-intensive clean energy technologies Guarantee transmission-grid connection for solar projects 21 Stabilize and monetize existing tax incentives 22 Further streamline regulatory approval by creating an interagency one-stop shop for solar power 23 Regulatory transparency 24 Conclusion 26 About the authors 27 Endnotes Introduction and summary Concentrating solar power—also known as concentrated solar power, concen- trated solar thermal, and CSP—is a cost-effective way to produce electricity while reducing our dependence on foreign oil, improving domestic energy-price stabil- ity, reducing carbon emissions, cleaning our air, promoting economic growth, and creating jobs. -

Hawaii Clean Energy Initiative Hawaiian Electric Companies’ Energy Agreement One-Year Progress Update

Hawaii Clean Energy Initiative Hawaiian Electric Companies’ Energy Agreement One-Year Progress Update n October 2008, the Hawaiian Electric Companies joined the Governor of Hawaii; the Hawaii Department of Busi ness, Economic Development and Tourism; and Office of Consumer Advocacy in an energy agreement Ias part of the Hawaii Clean Energy Initiative. The agreement – the most aggressive such effort in the nation – aims to move Hawaii decisively away from imported oil for electricity and ground transportation toward diverse, local renewable energy and energy efficiency. Our goal is energy and economic security for Hawaii and reduced greenhouse gas emissions responsible for the climate change to which our islands are especially vulnerable. Making the needed investments now can provide more stable energy costs in the long-run. It will require unprecedented cooperation and commitment among individuals, businesses, institutions and government. We need unity of purpose through good and bad times, success and setbacks, no matter whether oil prices go up and down. This list summarizes some key actions by the Hawaiian Electric Companies in cooperation with others after only one year. Increased Renewable Portfolio Standards (Act 155 - 2009) Hawaiian Electric Companies supported placing into law an increased renewable energy requirement of 40 percent of electric sales by 2030 and a new Energy Efficiency Portfolio Standard. New HCEI proposals submitted to the Hawaii Public Utilities Commission (PUC) • Feed-In Tariff (FIT): Creates standard rates to ease the process for private developers to add renewable energy to Hawaiian Electric Companies’ grids. After detailed hearings to obtain input from a broad range of stakeholders, the PUC issued basic principles for such tariffs. -

The Status of CSP Development

The Status of CSP Development DISH STIRLING POWER TOWER CLFR Tom Mancini CSP Program Manager Sandia National Laboratories PARABOLIC TROUGH 505.844.8643 DISH STIRLING [email protected] [email protected] 1 Presentation Content • Brief Overview of Sandia National Laboratories • Background information • Examples of CSP Technologies − Parabolic Trough Systems − Power Tower Systems − Thermal Energy Storage − Dish Stirling Systems • Status of CSP Technologies • Cost of CSP and Resource Availability • Deployments • R & D Directions [email protected] 2 Four Mission Areas Sandia’s missions meet national needs in four key areas: • Nuclear Weapons • Defense Systems and Assessments • Energy, Climate and Infrastructure Security • International, Homeland, and Nuclear Security [email protected] 3 Research Drives Capabilities High Performance Nanotechnologies Extreme Computing & Microsystems Environments Computer Materials Engineering Micro Bioscience Pulsed Power Science Sciences Electronics Research Disciplines 4 People and Budget . On-site workforce: 11,677 FY10 operating revenue . Regular employees: 8,607 $2.3 billion 13% . Over 1,500 PhDs and 2,500 MS/MA 13% 43% 31% Technical staff (4,277) by discipline: (Operating Budget) Nuclear Weapons Defense Systems & Assessments Energy, Climate, & Infrastructure Security International, Homeland, and Nuclear Security Computing 16% Math 2% Chemistry 6% Physics 6% Other science 6% Other fields 12% Electrical engineering 21% Mechanical engineering 16% Other engineering 15% 5 Sandia’s NSTTF Dish Engine Engine Test Rotating Testing Facility Platform Established in 1976, we provide ………. • CSP R&D NSTTF • Systems analysis and FMEA • System and Tower Testing Solar Furnace component testing and support NATIONAL SOLAR THERMAL TEST FACILITY [email protected] 6 Labs Support the DOE Program The CSP Programs at Sandia and the National Renewable Energy Laboratory (NREL) support the DOE Solar Energy Technology Program. -

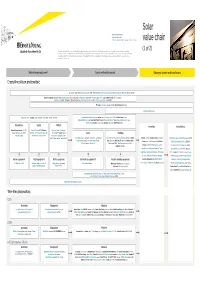

Lsoar Value Chain Value Chain

Solar Private companies in black Public companies in blue Followed by the founding date of companies less than 15 years old value chain (1 of 2) This value chain publication contains information gathered and summarized mainly from Lux Research and a variety of other public sources that we believe to be accurate at the time of ppggyublication. The information is for general guidance only and not intended to be a substitute for detailed research or the exercise of professional judgment. Neither EYGM Limited nor any other member of the global Ernst & Young organization nor Lux Research can accept responsibility for loss to any person relying on this publication. Materials and equipment Components and products Balance of system and installations Crystalline silicon photovoltaic GCL Silicon, China (2006); LDK Solar, China (2005); MEMC, US; Renewable Energy Corporation ASA, Norway; SolarWorld AG, Germany (1998) Bosch Solar Energy, Germany (2000); Canadian Solar, Canada/China (2001); Jinko Solar, China (2006); Kyocera, Japan; Sanyo, Japan; SCHOTT Solar, Germany (2002); Solarfun, China (2004); Tianwei New Energy Holdings Co., China; Trina Solar, China (1997); Yingli Green Energy, China (1998); BP Solar, US; Conergy, Germany (1998); Eging Photovoltaic, China SOLON, Germany (1997) Daqo Group, China; M. Setek, Japan; ReneSola, China (2003); Wacker, Germany Hyundai Heavy Industries,,; Korea; Isofoton,,p Spain ; JA Solar, China (();2005); LG Solar Power,,; Korea; Mitsubishi Electric, Japan; Moser Baer Photo Voltaic, India (2005); Motech, Taiwan; Samsung -

Design, Construction and Operation of CSP Solar Thermal Power Plants in Florida

UNIVERSITY OF SOUTH FLORIDA Design, Construction and Operation of CSP Solar Thermal Power Plants in Florida PI: D. Yogi Goswami Co-PIs: Elias Stefanakos, Muhammad M. Rahman, Sunol Aydin, Robert Reedy Students: Gokmen Demirkaya (Ph.D.); Ricardo Vasquez Padilla (Ph.D.); Huijuan Chen (Ph.D.); Jamie Trahan (Ph.D.) Description: Florida utilities are mandated to achieve 20% renewable energy contribution to their generation mix by 2020. Fig. 1 Direct Normal Radiation for While technologically feasible with solar energy, the capital costs are high – presently, capital costs range from $6,000-$7,000/kW for PV and $3,500-$4,000/kW for concentrating solar thermal power. This project targets the development of solar thermal power technology for bulk power and distributed generation, which will diversify energy resources in Florida and reduce greenhouse emissions by utilizing renewable sources. Also, there will be economic impacts with the establishment of new power industry in Florida, which will help the electrical utilities of the state to meet the renewable portfolio standards. The project has three main tasks; the first one is to develop design methodologies and standards for the proven solar thermal power technologies in combination with bio or fossil fuels based on Florida conditions and resources. Secondly, the project aims to set up demonstration and test facilities for these technologies for optimization for Florida conditions, and the final task is to develop and commercialize innovative technologies based on new thermodynamic cycles. Budget: $882,000 Universities: USF, UF, UCF External Colaborators: Sopogy Corporation Progress Summary Research Objectives for Current Reporting Period: The main research objectives for the current reporting period include the development of a test facility and pilot demonstration systems based on parabolic trough technology. -

US Solar Industry Year in Review 2009

US Solar Industry Year in Review 2009 Thursday, April 15, 2010 575 7th Street NW Suite 400 Washington DC 20004 | www.seia.org Executive Summary U.S. Cumulative Solar Capacity Growth Despite the Great Recession of 2009, the U.S. solar energy 2,500 25,000 23,835 industry grew— both in new installations and 2,000 20,000 employment. Total U.S. solar electric capacity from 15,870 2,108 photovoltaic (PV) and concentrating solar power (CSP) 1,500 15,000 technologies climbed past 2,000 MW, enough to serve -th MW more than 350,000 homes. Total U.S. solar thermal 1,000 10,000 MW 1 capacity approached 24,000 MWth. Solar industry 494 revenues also surged despite the economy, climbing 500 5,000 36 percent in 2009. - - A doubling in size of the residential PV market and three new CSP plants helped lift the U.S. solar electric market 37 percent in annual installations over 2008 from 351 MW in 2008 to 481 MW in 2009. Solar water heating (SWH) Electricity Capacity (MW) Thermal Capacity (MW-Th) installations managed 10 percent year-over-year growth, while the solar pool heating (SPH) market suffered along Annual U.S. Solar Energy Capacity Growth with the broader construction industry, dropping 10 1,200 1,099 percent. 1,036 1,000 918 894 928 Another sign of continued optimism in solar energy: 865 -th 725 758 742 venture capitalists invested more in solar technologies than 800 542 any other clean technology in 2009. In total, $1.4 billion in 600 481 2 351 venture capital flowed to solar companies in 2009. -

The Seeds of Solar Innovation: How a Nation Can Grow a Competitive Advantage by Donny Holaschutz

The Seeds of Solar Innovation: How a Nation can Grow a Competitive Advantage by Donny Holaschutz B.A. Hispanic Studies (2004), University of Texas at Austin B.S. Aerospace Engineering (2004), University of Texas at Austin M.S.E Aerospace Engineering (2007), University of Texas at Austin Submitted to the System Design and Management Program In Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ARCHIVES MASSACHUSETTS INSTITUTE at the OF TECHNOLOGY Massachusetts Institute of Technology February 2012 © 2012 Donny Holaschutz. All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereqfter reated. Signed by Author: Donny Holaschutz Engineering Systems Division and Sloan School of Management January 20, 2012 Certified by: James M. Utterback, Thesis Supervisor David . McGrath jr (1959) Professor of Management and Innovation and Professor of neering SysemsIT oan School of Management Accepted by: Patrick C.Hale Director otS ystem Design and Management Program THIS PAGE INTENTIONALLY LEFT BLANK Table of Contents Fig u re List ...................................................................................................................................................... 5 T ab le List........................................................................................................................................................7 Executive -

Concentrating Solar Power and Water Issues in the U.S. Southwest

Concentrating Solar Power and Water Issues in the U.S. Southwest Nathan Bracken Western States Water Council Jordan Macknick and Angelica Tovar-Hastings National Renewable Energy Laboratory Paul Komor University of Colorado-Boulder Margot Gerritsen and Shweta Mehta Stanford University The Joint Institute for Strategic Energy Analysis is operated by the Alliance for Sustainable Energy, LLC, on behalf of the U.S. Department of Energy’s National Renewable Energy Laboratory, the University of Colorado-Boulder, the Colorado School of Mines, the Colorado State University, the Massachusetts Institute of Technology, and Stanford University. Technical Report NREL/TP-6A50-61376 March 2015 Contract No. DE-AC36-08GO28308 Concentrating Solar Power and Water Issues in the U.S. Southwest Nathan Bracken Western States Water Council Jordan Macknick and Angelica Tovar-Hastings National Renewable Energy Laboratory Paul Komor University of Colorado-Boulder Margot Gerritsen and Shweta Mehta Stanford University Prepared under Task No. 6A50.1010 The Joint Institute for Strategic Energy Analysis is operated by the Alliance for Sustainable Energy, LLC, on behalf of the U.S. Department of Energy’s National Renewable Energy Laboratory, the University of Colorado-Boulder, the Colorado School of Mines, the Colorado State University, the Massachusetts Institute of Technology, and Stanford University. JISEA® and all JISEA-based marks are trademarks or registered trademarks of the Alliance for Sustainable Energy, LLC. The Joint Institute for Technical Report Strategic Energy Analysis NREL/TP-6A50-61376 15013 Denver West Parkway March 2015 Golden, CO 80401 303-275-3000 • www.jisea.org Contract No. DE-AC36-08GO28308 NOTICE This report was prepared as an account of work sponsored by an agency of the United States government. -

Power Generation

MicroCSP Applications Power Generation Holaniku Solar Farm · Keahole, Hawaii · USA · 1,000 MicroCSP Collectors · 2 MW Thermal Energy Generation · 3.8 Acres Overview ADVANTAGES OF Micro-scaled Concentrated Solar Power (MicroCSP) is a member of the MICROCSP TECHNOLOGY Concentrating Solar Power (CSP) technology family that has been FOR POWER redesigned for installation in smaller, modular projects. By reducing the • Projects in the 2-50MW size range traditional CSP trough to one-third of its size, MicroCSP technology can be are easier and faster to permit and cost-effectively deployed to on-site markets for distributed power generation approve, obtain grid connection and or industrial and commercial applications such as air conditioning and financing - reducing some of the process heating. risks associated with large CSP projects. A Key Energy Alternative • With less land requirements, more As a key technology for enhancing energy security, MicroCSP is an economi- project locations and opportunities cally attractive alternative to retail power and distributed fossil fuel markets. for projects to be built close to existing transmission lines are The modular systems can produce power on-site for power customers, possible. including utilities and independent power producers (IPPs), where systems can be connected into the existing grid with minimal interconnection costs. • Systems can be deployed relatively quickly and can contribute substan- MicroCSP’s role in mitigating rising energy costs offers not only a solution to tially to reducing carbon dioxide these challenges, but also an exciting opportunity for investment, innovation, emissions. and job creation. MicroCSP technology MicroCSP for Power Generation MicroCSP is a sustainable method of electric generation fueled by the heat is a smart redesign of the of the sun - an endless source of clean, free energy. -

Sopogy – Microcsp

Sopogy – MicroCSP July 2009 A Scalable Solar Solution for Distributed Generation, Process Heating & Solar Air‐Conditioning Hawaii Solutions Center: 2660 Waiwai Loop, Honolulu, HI 96819 (866) 767‐ 6491 West Coast: 1735 Technology Drive, Suite 400, San Jose, CA 95110 (408) 660‐ 1212 Sopogy White Paper 2 Sopogy Electricity, Heating, Cooling. TM utilizes the same basic Incorporated in 2006, in Honolulu, Hawaii. MicroCSP technological concepts as the large utility- We are a team of enthusiastic engineers out scale CSP systems, however the smaller to change the world for the better. In a very scale MicroCSP™ systems allow for short time we have innovated a NEW solar deployment in areas where only acres or technology, which we call MicroCSPTM. It is a scalable solar solution, which enables cost- effective distributed generation of electricity, process heating, and cooling in a single system. We are now busy bringing affordable electricity, drinking water, heating, and cooling to all regions of the world. Here is how it works and why it matters. TM MicroCSP tens of acres of land are available, rather than the hundreds or even thousands of Sopogy has pioneered a new approach to acres required for its larger scale Concentrating Solar Power (CSP) called counterpart. MicroCSP™, a highly modular and scalable technology that is particularly suitable for MicroCSPTM technology also incorporates distributed generation in the range of 250kW several design and manufacturing – 20 MW. Below this level, photovoltaic innovations that dramatically reduce the cost units have established an expensive, but and increase the flexibility of concentrating flexible solution, while utility-scale CSP solar energy applications. -

Concentrated Solar Power Focusing the Sun’S Energy for Large‐Scale Power Generation

Concentrated Solar Power Focusing the sun’s energy for large‐scale power generation August 2009 Concentrated solar power (CSP) is a method of electric generation fueled by the heat of the sun, an endless source of clean, free energy. Commercially viable and quickly expanding, this type of solar technology requires strong, direct solar radiation and is primarily used as a large, centralized source of power for utilities. In contrast, photovoltaic cells are effective in a wider range of regions and applications. CSP plants generate power best during the late afternoon – during peak demand – and can displace the use of fossil fuel plants that emit the greenhouse gases that cause climate change. As energy storage technology continues to advance, more CSP plants will be able to provide baseload power throughout the night. TECHNOLOGY CSP, also called solar thermal power, uses mirrors to focus sunlight onto a heat‐transfer medium. The steam produced from the heat‐transfer medium powers a turbine or engine that generates electricity. Depending on the type, CSP plants can supply up to 100 megawatts (MW) with a potential to produce up to 300 MW, on par with other utility‐scale power plants. Effective CSP requires solar radiation of at least 5.5 kWh/m2/day – California averages 6.75‐8.25 kWh/m2/day1 – and functions best in arid, flat locations. The U.S. Southwest, Sahara Desert, and Australia have the highest potential capacity for CSP in the world.2 TYPES OF CSP SYSTEMS Parabolic Trough: Long, curved mirrors pivot to concentrate sunlight onto tubes filled with a heat transfer fluid, generally oil or water, whose steam California Parabolic Trough moves a power‐generating turbine. -

Operation Construction Development

Major Solar Projects in the United States Operating, Under Construction, or Under Development Updated March 7, 2016 Overview This list is for informational purposes only, reflecting projects and completed milestones in the public domain. The information in this list was gathered from public announcements of solar projects in the form of company press releases, news releases, and, in some cases, conversations with individual developers. It is not a comprehensive list of all major solar projects under development. This list may be missing smaller projects that are not publicly announced. Particularly, many smaller projects located outside of California that are built on a short time-scale may be underrepresented on this list. Also, SEIA does not guarantee that every identified project will be built. Like any other industry, market conditions may impact project economics and timelines. SEIA will remove a project if it is publicly announced that it has been cancelled. SEIA actively promotes public policy that minimizes regulatory uncertainty and encourages the accelerated deployment of utility-scale solar power. This list includes ground-mounted solar power plants 1 MW and larger. Example Projects Nevada Solar One Sierra SunTower Nellis Air Force Base DeSoto Next Generation Solar Energy Center Developer: Acciona Developer: eSolar Developer: MMA Renewable Ventures Developer: Florida Power & Light Co. Electricity Purchaser: NV Energy Electricity Purchaser: Southern Electricity Purchaser: Nellis AFB Electricity Purchaser: Florida Power & California