2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

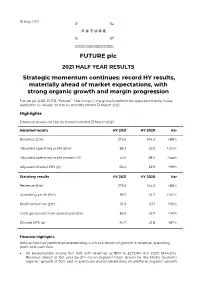

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Page 1 of 29 Applist.Me — There's a List for That! 7/20/2012

applist.me — There's a list for that! Page 1 of 29 469 Apps 101 Science 3D Sun 4th Grade Math: Splash Centered Systems Dr. Tony Phillips, L Math Wo v.1.1 –0.5MB v.3.5 –6MB StudyPad, Inc. v.2.2.1 – 22MB THIS VERSION WILL WORK WITH OS 3.0 OR A major solar flare erupts on the sun. Splash Math is a fun and innovative way ABOVE ONLY. A BACKWARD COMPATIBLE Before long, your phone chirps in your to practice math. With 12 chapters UPDATE WILL BE RELEASED SHOR... pocket to let you know... covering over 140+ math w... View in the App Store. View in the App Store. View in the App Store. 8 Planets A Bee Sees - Learning A Bee Sees Puzzles - BrightSlide LLC Letters, Learn Sha v.2.0 –11MB Headlight Software, Headlight Software, v.1.5 –8.7MB v.1.1 –13.4MB Download the the critically acclaimed The happy, balloon popping bee helps The happy bee helps kids learn letters, educational application 8 Planets. 8 kids learn Letters, Numbers, and Colors. numbers, and shapes with fun puzzles Planets features four gam... With easy to use contr... you can customize yours... View in the App Store. View in the App Store. View in the App Store. A Phonics introduction A Sight Words Read and ABA Flash Cards & app - H Spell a Games - Emot Hetal Shah Hetal Shah Innovative Mobile Ap v.1.0 –18.6MB v.1.0 –9MB v.4.2 –26.3MB If you the parent are familiar with phonics Features: 1) 300 sight words from Dolch ★★★★★ A fun, simple, and easy way to you will immediately appreciate the way list 2) Presented by grade level 3) Two learn to recognize emotions. -

March 2019 LOCAL HERO: WHY LOCAL MEDIA MATTERS

March 2019 LOCAL HERO: WHY LOCAL MEDIA MATTERS After a month of buyouts and announcements, the dial’s interest news. Culture Secretary Jeremy Wright responded been moved on local radio. Global Radio recently announced with a rallying cry to the industry, claiming it can “overcome it would no longer air regional breakfast and drivetime shows the challenges it faces from a changing market”. in favour of national programming, while NewsUK has sold off most of its local radio stations to invest in its national stations Local media isn’t just of benefit to the public interest but can talkSPORT and Virgin Radio. be to advertisers as well. The move from Global, described as “a huge step for the A huge amount of Brits still have a strong sense of local commercial radio sector”, will see 40 of its local breakfast identity, with 90% agreeing they are proud of the area they shows replaced by national programming across the Capital, live in (“Consumer Catalyst”). Local media allows consumers Smooth and Heart networks. Drivetime, evening and to feel a part of their community – even if it’s as simple as weekend programmes will also be reduced, and ten of its 24 hearing local voices and regional accents on the radio, as local stations – including Cambridge, Norwich, Essex and Kent argued by broadcaster Mark Lawson. – will be closed. The announcement comes as part of Global’s longer-term project to bring hundreds of local stations into Brands can tap into this, ensuring they speak to consumers in several national brands – and puts over 100 jobs at risk. -

Leading Music Enthusiast Content Publisher Doubles Video Output

CASE STUDY Leading Music Enthusiast Content Publisher Doubles Video Output with StorNext When a leading creator of specialized music news, enthusiast, and instructional content wanted to increase their output, they hit a major roadblock. Their aging video production SAN, an Xsan inherited through an acquisition, just wasn’t up to a faster tempo. Installing Quantum’s StorNext Pro Foundation turned their workflow from lento to prestissimo and doubled production. StorNext Pro Foundation We do not have a large IT staff, so it was really important to find a solution that would be “turn-key, that could fit in quickly and that would minimize ongoing admin. We needed something that would be easy to install and that would just work once it was in. Anthony Verbanac Director of IT, NewBay Media FEATURED PRODUCTS ” The StorNext Pro Foundation was exactly what we needed...It gives us the capacity we need today, room to grow in the future, and it is compatible with all our applications “and the latest versions of OS X. ” Anthony Verbanac - Director of IT, NewBay Media With over 13 million monthly readers in over previously released material is incorporated into 50 countries around the world, NewBay new offerings, and support has to be provided Media is the industry’s premiere publisher of for YouTube and all the latest Apple, Google, specialized enthusiast content across music, Nook, and Kindle formats. SOLUTION OVERVIEW pro-audio, video, and gaming, which it delivers ∙ StorNext Pro Foundation through a combination of traditional print and AGING SAN LIMITS GROWTH - StorNext® 5 platform new media platforms. -

Preliminary Results FY 2020

Preliminary results FY 2020 25 November 2020 1 2 Agenda ● Overview ● FY 2020 financial review ● Progress against our strategy in FY 2020 ● Recommended offer for GoCo Group plc ● Summary & outlook 3 Exceptional results, Values led 01 ahead of expectations... 02 execution... ● Strong core values facilitated ● Group revenue up 53% to agile response to the rapidly £339.6m, underpinned by changing landscape acquisitions and media organic ● Operating leverage driving revenue growth of 23% adjusted operating margin ● Continued growth in adjusted expansion to 28% operating profit, up 79% to ● Continue to be highly cash £93.4m Continued generative, with adjusted free ● Adjusted free cash flow growth cash flow of 103% of adjusted of 79% strength of operating profit ● Exceptional performance performance despite COVID-19 underpinned ...delivered by ongoing ...enables strong by delivery 03 focus on strategy 04 acquisitions performance ● TI Media integration ● Continued shift in revenue, completed, savings of £20m with Media division now 65% 1 identified, with focus now on of revenues (Sept 2020) building revenue ● Geographical diversification monetisation, with launch of 6 continues with US now 43% of new sites revenue (Sept 2020)1 2 ● Barcroft and SmartBrief both ● Online audience growth of in BAU mode, delivering in 56%, with organic audience line with plans up 48%, driving sales ● Recommended offer for performance in Media GoCo Group plc announced today (25 November) 4 1 Sept month 2020 shown to reflect TI Media acquisition 2 Google Analytics online users. -

Jon Fauer ASC Issue 99 Feb 2020

Jon Fauer ASC www.fdtimes.com Feb 2020 Issue 99 Technique and Technology, Art and Food in Motion Picture Production Worldwide Photo of Claire Mathon AFC by Ariane Damain Vergallo www.fdtimes.com Art, Technique and Technology On Paper, Online, and now on iPad Film and Digital Times is the guide to technique and technology, tools and how-tos for Cinematographers, Photographers, Directors, Producers, Studio Executives, Camera Assistants, Camera Operators, Grips, Gaffers, Crews, Rental Houses, and Manufacturers. Subscribe It’s written, edited, and published by Jon Fauer, ASC, an award-winning Cinematographer and Director. He is the author of 14 bestselling books—over 120,000 in print—famous for their user-friendly way Online: of explaining things. With inside-the-industry “secrets-of the-pros” www.fdtimes.com/subscribe information, Film and Digital Times is delivered to you by subscription or invitation, online or on paper. We don’t take ads and are supported by readers and sponsors. Call, Mail or Fax: © 2020 Film and Digital Times, Inc. by Jon Fauer Direct Phone: 1-570-567-1224 Toll-Free (USA): 1-800-796-7431 subscribe Fax: 1-724-510-0172 Film and Digital Times Subscriptions www.fdtimes.com PO Box 922 Subscribe online, call, mail or fax: Williamsport, PA 17703 Direct Phone: 1-570-567-1224 USA Toll-Free (USA): 1-800-796-7431 1 Year Print and Digital, USA 6 issues $ 49.95 1 Year Print and Digital, Canada 6 issues $ 59.95 Fax: 1-724-510-0172 1 Year Print and Digital, Worldwide 6 issues $ 69.95 1 Year Digital (PDF) $ 29.95 1 year iPad/iPhone App upgrade + $ 9.99 Film and Digital Times (normally 29.99) Get FDTimes on Apple Newsstand with iPad App when you order On Paper, Online, and On iPad a Print or Digital Subscription (above) Total $ __________ Print + Digital Subscriptions Film and Digital Times Print + Digital subscriptions continue to Payment Method (please check one): include digital (PDF) access to current and all back issues online. -

Lofty Valuations and Massive PE and Strategic Buyer Interest Lead M&A

M&A Soundcheck – Q1’18 Lofty Valuations and Massive PE and Strategic Buyer Interest Lead M&A Activity in Q1’18 intrepidib.com | Mergers & Acquisitions | Capital Markets | Strategic Advisory 11755 Wilshire Blvd., 22nd Floor, Los Angeles, CA 90025 T 310.478.9000 F 310.478.9004 Member FINRA/SIPC Lofty Valuations and Massive PE and Strategic Buyer Interest Lead M&A Activity in Q1’18 M&A activity in 2018 is off to a very strong start, reflecting strong demand from private equity and strategic buyers as well as lofty valuations seen in both the public and private markets. It’s been particularly busy for Commercial & Consumer Technology (CCT) M&A in Southern California, where two of the larger deals in the sector occurred with Amazon acquiring Ring for over $1 billion and Foxconn affiliate FIT acquiring Belkin for over $850 million. Both home grown Los Angeles-based companies play squarely in the connected home space. Across the broader CCT markets, A/V integration remains a hot sector, with several deals occurring among mid-tier integrators and Snap AV continuing its acquisition spree following its recapitalization by Hellman & Friedman last year. Intrepid continues to be busy in this active market, closing the sale of Radial Engineering, a well-known manufacturer of accessories for professional musicians and live performance venues just in time for NAMM 2018. We are excited about the robust backlog of opportunities and continued strong interest among acquirers for high-quality assets. If you are considering options for your business or would like to discuss any of these trends, please do not hesitate to reach out. -

Trends in U.S. Oil and Natural Gas Upstream Costs

Trends in U.S. Oil and Natural Gas Upstream Costs March 2016 Independent Statistics & Analysis U.S. Department of Energy www.eia.gov Washington, DC 20585 This report was prepared by the U.S. Energy Information Administration (EIA), the statistical and analytical agency within the U.S. Department of Energy. By law, EIA’s data, analyses, and forecasts are independent of approval by any other officer or employee of the United States Government. The views in this report therefore should not be construed as representing those of the Department of Energy or other federal agencies. U.S. Energy Information Administration | Trends in U.S. Oil and Natural Gas Upstream Costs i March 2016 Contents Summary .................................................................................................................................................. 1 Onshore costs .......................................................................................................................................... 2 Offshore costs .......................................................................................................................................... 5 Approach .................................................................................................................................................. 6 Appendix ‐ IHS Oil and Gas Upstream Cost Study (Commission by EIA) ................................................. 7 I. Introduction……………..………………….……………………….…………………..……………………….. IHS‐3 II. Summary of Results and Conclusions – Onshore Basins/Plays…..………………..…….… -

Science & Technology Trends 2020-2040

Science & Technology Trends 2020-2040 Exploring the S&T Edge NATO Science & Technology Organization DISCLAIMER The research and analysis underlying this report and its conclusions were conducted by the NATO S&T Organization (STO) drawing upon the support of the Alliance’s defence S&T community, NATO Allied Command Transformation (ACT) and the NATO Communications and Information Agency (NCIA). This report does not represent the official opinion or position of NATO or individual governments, but provides considered advice to NATO and Nations’ leadership on significant S&T issues. D.F. Reding J. Eaton NATO Science & Technology Organization Office of the Chief Scientist NATO Headquarters B-1110 Brussels Belgium http:\www.sto.nato.int Distributed free of charge for informational purposes; hard copies may be obtained on request, subject to availability from the NATO Office of the Chief Scientist. The sale and reproduction of this report for commercial purposes is prohibited. Extracts may be used for bona fide educational and informational purposes subject to attribution to the NATO S&T Organization. Unless otherwise credited all non-original graphics are used under Creative Commons licensing (for original sources see https://commons.wikimedia.org and https://www.pxfuel.com/). All icon-based graphics are derived from Microsoft® Office and are used royalty-free. Copyright © NATO Science & Technology Organization, 2020 First published, March 2020 Foreword As the world Science & Tech- changes, so does nology Trends: our Alliance. 2020-2040 pro- NATO adapts. vides an assess- We continue to ment of the im- work together as pact of S&T ad- a community of vances over the like-minded na- next 20 years tions, seeking to on the Alliance. -

The Future of U.S. Commercial Imagery VISION IMPLEMENTATION

» INTERNATIONAL COMPETITION » NEW CONCERNS ABOUT PRIVACY SUMMER 2012 THE OFFICIAL MAGAZINE OF THE UNITED STATES GEOSPATIAL INTELLIGENCE FOUNDATION Crossroads The Future of U.S. Commercial Imagery VISION IMPLEMENTATION At L-3 STRATIS, we help organizations make the technological and cultural changes needed to implement their vision. Our innovative cyber, intel and next generation IT solutions enable your mission, while reducing costs and improving the user experience. Find out more. Contact [email protected] or visit www.L3STRATIS.com STRATIS L-3com.com contents summer 2012 2 | VANTAGE POINT Features 27 | MEMBERSHIP PULSE Introducing the new Accenture upgrades to USGIF strategic partner. trajectory magazine. 9 | AT A CROSSROADS 4 | INTSIDER Proposed cuts to NGA’s EnhancedView 28 | GEN YPG News updates plus high- program revive the commercial Beacon of Hope and YPG lights from got geoint? imagery debate. work together to help By Kristin Quinn rebuild New Orleans. 6 | IN MOTION Small Business Advisory 30 | HORIZONS Working Group hosts Reading List, Peer Intel, 16 | THE $4B GLOBAL PIE luncheon with guest Calendar. speakers from NGA. New competition is forming in the commercial data marketplace. 32 | APERTURE 8 | ELEVATE By Brad Causey Canada has it. Germany Mizzou’s Center for has it. Italy has it. Back in Geospatial Intelligence the U.S., SAR? goes beyond academics. 22 | PIGEONHOLED Privacy policies threaten advances ON THE COVER Cover image of Dallas, Texas, in technology. courtesy of GeoEye. Image has By Jim Hodges been altered with permission for editorial purposes. trAJectorYmAGAZIne.com eXcLusIVes VIDEO PODCAST PANEL “What can you do with Exclusive interview Recap of the Space geography?” National with Kevin Pomfret, Enterprise Council's Geographic video director of the Centre panel on the impor- featuring Keith for Spatial Law and tance of commercial Masback of USGIF.