Trends in U.S. Oil and Natural Gas Upstream Costs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Petroleum Extension-The University of Texas at Austin ROTARY DRILLING SERIES

Petroleum Extension-The University of Texas at Austin ROTARY DRILLING SERIES Unit I: The Rig and Its Maintenance Lesson 1: The Rotary Rig and Its Components Lesson 2: The Bit Lesson 3: Drill String and Drill Collars Lesson 4: Rotary, Kelly, Swivel, Tongs, and Top Drive Lesson 5: The Blocks and Drilling Line Lesson 6: The Drawworks and the Compound Lesson 7: Drilling Fluids, Mud Pumps, and Conditioning Equipment Lesson 8: Diesel Engines and Electric Power Lesson 9: The Auxiliaries Lesson 10: Safety on the Rig Unit II: Normal Drilling Operations Lesson 1: Making Hole Lesson 2: Drilling Fluids Lesson 3: Drilling a Straight Hole Lesson 4: Casing and Cementing Lesson 5: Testing and Completing Unit III: Nonroutine Operations Lesson 1: Controlled Directional Drilling Lesson 2: Open-Hole Fishing Lesson 3: Blowout Prevention Unit IV: Man Management and Rig Management Unit V: Offshore Technology Lesson 1: Wind, Waves, and Weather Lesson 2: Spread Mooring Systems Lesson 3: Buoyancy, Stability, and Trim Lesson 4: Jacking Systems and Rig Moving Procedures Lesson 5: Diving and Equipment Lesson 6: Vessel Inspection and Maintenance Lesson 7: Helicopter Safety Lesson 8: Orientation for Offshore Crane Operations Lesson 9: Life Offshore Lesson 10: Marine Riser Systems and Subsea Blowout Preventers Petroleum Extension-The University of Texas at Austin Library of Congress Cataloging-in-Publication Data Vieira, João Luiz, 1958– Controlled directional drilling / by João Luiz Vieira. — 4th ed. p. cm. — (Rotary drilling series ; unit 3, lesson 1) Rev. ed. of: Controlled directional drilling. 1984 Includes index. ISBN-10 0-88698-254-5 (alk. paper) ISBN-13 978-0-88698-254-6 (alk. -

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

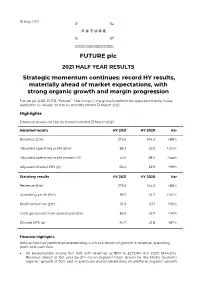

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Algeria Upstream OG Report.Pub

ALGERIA UPSTREAM OIL & GAS REPORT Completed by: M. Smith, Sr. Commercial Officer, K. Achab, Sr. Commercial Specialist, and B. Olinger, Research Assistant Introduction Regulatory Environment Current Market Trends Technical Barriers to Trade and More Competitive Landscape Upcoming Events Best Prospects for U.S. Exporters Industry Resources Introduction Oil and gas have long been the backbone of the Algerian economy thanks to its vast oil and gas reserves, favorable geology, and new opportunities for both conventional and unconventional discovery/production. Unfortunately, the collapse in oil prices beginning in 2014 and the transition to spot market pricing for natural gas over the last three years revealed the weaknesses of this economic model. Because Algeria has not meaningfully diversified its economy since 2014, oil and gas production is even more essential than ever before to the government’s revenue base and political stability. Today’s conjoined global health and economic crises, coupled with persistent declining production levels, have therefore placed Algeria’s oil and gas industry, and the country, at a critical juncture where it requires ample foreign investment and effective technology transfer. One path to the future includes undertaking new oil and gas projects in partnership with international companies (large and small) to revitalize production. The other path, marked by inertia and institutional resistance to change, leads to oil and gas production levels in ten years that will be half of today's production levels. After two decades of autocracy, Algeria’s recent passage of a New Hydrocarbons Law seems to indicate that the country may choose the path of partnership by profoundly changing its tax and investment laws in the hydrocarbons sector to re-attract international oil companies. -

Unconventional Gas and Oil in North America Page 1 of 24

Unconventional gas and oil in North America This publication aims to provide insight into the impacts of the North American 'shale revolution' on US energy markets and global energy flows. The main economic, environmental and climate impacts are highlighted. Although the North American experience can serve as a model for shale gas and tight oil development elsewhere, the document does not explicitly address the potential of other regions. Manuscript completed in June 2014. Disclaimer and copyright This publication does not necessarily represent the views of the author or the European Parliament. Reproduction and translation of this document for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2014. Photo credits: © Trueffelpix / Fotolia (cover page), © bilderzwerg / Fotolia (figure 2) [email protected] http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog) Unconventional gas and oil in North America Page 1 of 24 EXECUTIVE SUMMARY The 'shale revolution' Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking). Economic impacts This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals. The production of tight oil is costly, so that a high oil price is required to make it economically viable. -

Billing Code: 4310-MR

This document is scheduled to be published in the Federal Register on 02/21/2013 and available online at http://federalregister.gov/a/2013-03994, and on FDsys.gov Billing Code: 4310-MR DEPARTMENT OF THE INTERIOR Bureau of Ocean Energy Management Environmental Documents Prepared for Oil, Gas, and Mineral Operations by the Gulf of Mexico Outer Continental Shelf (OCS) Region AGENCY: Bureau of Ocean Energy Management (BOEM), Interior. ACTION: Notice of the Availability of Environmental Documents Prepared for OCS Mineral Proposals by the Gulf of Mexico OCS Region. SUMMARY: BOEM, in accordance with Federal regulations that implement the National Environmental Policy Act (NEPA), announces the availability of NEPA-related Site-Specific Environmental Assessments (SEAs) and Findings of No Significant Impact (FONSIs). These documents were prepared during the period October 1, 2012, through December 31, 2012, for oil, gas, and mineral-related activities that were proposed in the Gulf of Mexico, and are more specifically described in the Supplementary Information Section of this notice. FOR FURTHER INFORMATION CONTACT: Bureau of Ocean Energy Management, Gulf of Mexico OCS Region, Attention: Public Information Office (GM 250E), 1201 Elmwood Park Boulevard, Room 250, New Orleans, Louisiana 70123-2394, or by calling 1- 800-200-GULF. SUPPLEMENTARY INFORMATION: BOEM prepares SEAs and FONSIs for certain proposals that relate to exploration, development, production, and transport of oil, gas, and mineral resources on the Federal OCS. These SEAs examine the potential environmental effects of proposed activities and present BOEM conclusions regarding the significance of those effects. The SEAs are used as a basis for determining whether or not approval of the proposals constitutes a major Federal action that significantly affects the quality of the human environment in accordance with NEPA Section 102(2)(C). -

1981-04-15 EA Plan of Development Production

United States Department of the Interior Office of the Secretary Minerals Management Service 1340 West Sixth Street Los Angeles, California 90017 OCS ENVIRONMENTAL ASSESSMENT July 8, 1982 Operator Chevron U.S.A. Inc. Plan Type Development/Production Lease OCS-P 0296 Block 34 N., 37 W. Pl atfonn Edith Date Submitted April 15, 1981 Prepared by the Office of the Deputy Minerals Manager, Field Operations, Pacific OCS Region Related Environmental Documents U. S. DEPARTMENT OF THE INTERIOR GEOLOGICAL SURVEY Environmental Impact Report - Environmental Assessment, Shell OCS Beta Unit Development (prepared jointly with agencies of the State of California, 1978) 3 Volumes Environmental Assessment, Exploration, for Lease OCS-P 0296 BUREAU OF LAND MANAGEMENT Proposed 1975 OCS Oil and Gas General Lease Sale Offshore Southern California (OCS Sale No. 35), 5 Volumes Proposed 1979 OCS Oil and Gas Lease Sale Offshore Southern California (OCS Sale No. 48), 5 Volumes Proposed 1982 OCS Oil and Gas General Lease Sale Offshore Southern California (OCS Sale No. 68), 2 Volumes u.c. Santa Cruz - BLM, Study of Marine Mammals and Seabirds of the Southern California Bight ENVIRONMENTAL ASSESSMENT CHEVRON U.S.A. INC. OPERATOR PLAN OF DEVELOPMENT/PRODUCTION, PROPOSED PLATFORM EDITH, LEASE OCS-P 0296, BETA AREA, SAN PEDRO BAY, OFFSHORE SOUTHERN CALIFORNIA Table of Contents Page I. DESCRIPTION OF THE PROPOSED ACTION ••••••••••••••••••••• 1 II. DESCRIPTION OF AFFECTED ENVIRONMENT •••••••••••••••••••• 12 III. ENVIRONMENTAL CONSEQUENCES ••••••••••••••••••••••••••••• 29 IV. ALTERNATIVES TO THE PROPOSED ACTION •••••••••••••••••••• 46 v. UNAVOIDABLE ADVERSE ENVIRONMENTAL EFFECTS •••••••••••••• 48 VI. CONTROVERSIAL ISSUES ••••••••••••••••••••••••••••••••••• 48 VII. FINDING OF NO SIGNIFICANT IMPACT (FONS!) ••••••••••••••• 51 VIII. ENVIRONMENTAL ASSESSMENT DETERMINATION ••••••••••••••••• 55 IX. -

View Annual Report

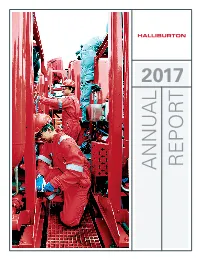

ANNUAL 2017 REPORT Financial Highlights (Millions of dollars and shares, except per share data) 20171 20161 20151 Revenue Dividends to in billions Shareholders Revenue $ 20,620 $ 15,887 $ 23,633 in millions Operating Income (Loss) $ 1,362 $ (6,778) $ (165) Amounts Attributable to Company Shareholders: Loss from Continuing Operations $ (444) $ (5,761) $ (666) $614 $626 $620 $15.9 Net Loss $ (463) $ (5,763) $ (671) $20.6 $23.6 Diluted Income per Share Attributable to Company Shareholders: Loss from Continuing Operations $ (0.51) $ (6.69) $ (0.78) Net Loss $ (0.53) $ (6.69) $ (0.79) Cash Dividends per Share $ 0.72 $ 0.72 $ 0.72 Diluted Common Shares Outstanding 870 861 853 Working Capital2 $ 5,915 $ 7,654 $ 14,733 Capital Expenditures $ 1,373 $ 798 $ 2,184 Total Debt $ 10,942 $ 12,384 $ 15,355 17 16 15 17 16 15 Debt to Total Capitalization3 57% 57% 50% Depreciation, Depletion and Amortization $ 1,556 $ 1,503 $ 1,835 4 Total Capitalization $ 19,291 $ 21,832 $ 30,850 Capital Expenditures in billions 1 Reported results during these periods include impairments and other charges of $647 million for the year ended December 31, 2017, merger-related costs and termination fee of $4.1 billion and impairments and other charges of $3.4 billion for the year ended December 31, 2016, and impairments and other charges of $2.2 billion for the year ended December 31, 2015. 2 Working Capital is defined as total current assets less total current liabilities. $1.4 $0.8 $2.2 3 Debt to Total Capitalization is defined as total debt divided by the sum of total debt plus total shareholders’ equity. -

Hydraulic Fracturing

www.anadarko.com | NYSE: APC The Equipment: From Rig to Producing Well Hydraulic Fracturing Producing Well: 20+ Years Drilling Rig Anadarko Petroleum Corporation 13 www.anadarko.com | NYSE: APC Horizontal Drilling . Commences with Common Rotary Vertical Drilling . Wellbore then Reaches a “Kickoff Kickoff Point Point” ~6,300 feet Entry Point . Drill Bit Angles Diaggyonally Until ~7,000 feet the “Entry Point” . Wellbore Becomes Fully Horizontal to Maximize Contact Lateral Length with Productive Zones Anadarko Petroleum Corporation 14 www.anadarko.com | NYSE: APC Horizontal Drilling – Significant Surface‐Space Reduction Traditional Vertical Wells Horizontal Drilling Anadarko Petroleum Corporation www.anadarko.com | NYSE: APC Hydraulic Fracturing . Essential Technology in Oil and Natural Gas Production from Tight Sands and Shales . Involves Injecting a Mixture of Water, Sand and a Relatively Small Multiple Layers of 1+ Mile Separates Aquifer Amount of Additives Protective from Fractured Formation Under Pressure into Steel and Cement Targeted Formations . Pressure Creates Pathways, Propped Open by Sand, for Oil or Natural Gas to Flow to the Wellbore Anadarko Petroleum Corporation 16 www.anadarko.com | NYSE: APC Hydraulic Fracturing Equipment Water tanks Blender Blender Frac Van ellheadW ellheadW SdtkSand tanks Pump trucks 17 Anadarko Petroleum Corporation 17 www.anadarko.com | NYSE: APC Hydraulic Fracturing Technology Equipment Water Tanks Pump Trucks Sand Movers Blenders Frac Design Primarily Water and Sand Additives Include: . Gel (ice cream) . Biocide (bleach) . Friction reducer (polymer used in make‐up, nail and skin products) Anadarko Publicly Shares the Ingredients of All Hydraulic Fracturing Operations at www.FracFocus.org Anadarko Petroleum Corporation 18 www.anadarko.com | NYSE: APC Hydraulic Fracturing is Transparent . -

JX Report for a Sustainable Future 2010 JX Report for a Sustainable Future 2010 the JX Group Was Formed in April 2010 in Quest of a Sustainable Future

2010 Report for a Sustainable Future JX JX Holdings, Inc. JX Report for a Sustainable Future 2010 The JX Group was formed in April 2010 in quest of a sustainable future. Under our new mission statement, the JX Group aims to make major advances in the fields of energy, resources and materials. Guided by the slogan of “The Future of Energy, Resources and Materials,” the JX Group is determined to shape the future. JX Group Mission Statement JX Group Slogan JX Group Mission Statement JX Group will contribute to the development of a sustainable economy and society through innovation in the areas of energy, resources and materials. JX Group Values Our actions will respect the EARTH. Ethics Advanced ideas Relationship with society Trustworthy products/services Harmony with the environment About JX The name “JX” symbolizes the JX Group’s mission statement. The letter “J” represents our position as one of the world’s largest integrated energy, resources and materials business groups from Japan, while the letter “X” represents our willingness to pioneer new frontiers, our future growth and development potential and innovation. About the JX Corporate Brand Mark The JX corporate brand mark symbolizes the continuity of the global environment and the JX Group based on the JX Group’s mission statement. The design, in which the “JX” logo overlaps with a sphere, represents the JX Group’s commitment to a green earth—i.e., our contribution to the development of a sustainable economy and society, through innovation in the areas of energy, resources and materials. * The JX corporate brand mark is common to JX Holdings, Inc., JX Nippon Oil & Energy Corporation, JX Nippon Oil & Gas Exploration Corporation and JX Nippon Mining & Metals Corporation. -

Information on Hydraulic Fracturing

an open pathway to the well. This allows the oil migration of fluids associated with oil and gas and gas to seep from the rock into the pathway, development. After it is determined that the well up the well and to the surface for collection. In is capable of producing oil or natural gas, a Colorado, the targeted formations for hydraulic production casing is set to provide an added fracturing are often more than 7,000 feet layer of separation between the oil or natural underground, and some 5,000 feet below any gas stream and freshwater aquifer. A well drinking water aquifers. survey called a cement bond log is performed to ensure the cement is properly sealed around the The process of hydraulic fracturing has been casing. Additionally, the COGCC requires that used for decades in Colorado, dating to the prior to hydraulic fracturing, the casing be 1970s. Hydraulic fracturing continues to be pressure tested with fluid to the maximum Colorado Department of Natural Resources refined and improved and is now standard for pressure that will ever be applied to the casing. virtually all oil and gas wells in our state, and The well’s construction design is reviewed by across much of the country. Hydraulic fracturing the professional engineering staff at the has made it possible to get the oil and gas out of COGCC. Any flaw in the design will be Information on rocks that were not previously considered as corrected prior to issuing the required drilling likely sources for fossil fuels. permit. Hydraulic Fracturing Common questions and answers about Q: What kinds of fluids do operators use to What is hydraulic fracturing? hydraulic fracturing. -

Manual Borehole Drilling As a Cost-Effective Solution for Drinking

water Review Manual Borehole Drilling as a Cost-Effective Solution for Drinking Water Access in Low-Income Contexts Pedro Martínez-Santos 1,* , Miguel Martín-Loeches 2, Silvia Díaz-Alcaide 1 and Kerstin Danert 3 1 Departamento de Geodinámica, Estratigrafía y Paleontología, Universidad Complutense de Madrid, Ciudad Universitaria, 28040 Madrid, Spain; [email protected] 2 Departamento de Geología, Geografía y Medio Ambiente, Facultad de Ciencias Ambientales, Universidad de Alcalá, Campus Universitario, Alcalá de Henares, 28801 Madrid, Spain; [email protected] 3 Ask for Water GmbH, Zürcherstr 204F, 9014 St Gallen, Switzerland; [email protected] * Correspondence: [email protected]; Tel.: +34-659-969-338 Received: 7 June 2020; Accepted: 7 July 2020; Published: 13 July 2020 Abstract: Water access remains a challenge in rural areas of low-income countries. Manual drilling technologies have the potential to enhance water access by providing a low cost drinking water alternative for communities in low and middle income countries. This paper provides an overview of the main successes and challenges experienced by manual boreholes in the last two decades. A review of the existing methods is provided, discussing their advantages and disadvantages and comparing their potential against alternatives such as excavated wells and mechanized boreholes. Manual boreholes are found to be a competitive solution in relatively soft rocks, such as unconsolidated sediments and weathered materials, as well as and in hydrogeological settings characterized by moderately shallow water tables. Ensuring professional workmanship, the development of regulatory frameworks, protection against groundwater pollution and standards for quality assurance rank among the main challenges for the future. -

Statoil-2015-Statutory-Report.Pdf

2015 Statutory report in accordance with Norwegian authority requirements © Statoil 2016 STATOIL ASA BOX 8500 NO-4035 STAVANGER NORWAY TELEPHONE: +47 51 99 00 00 www.statoil.com Cover photo: Øyvind Hagen Statutory report 2015 Board of directors report ................................................................................................................................................................................................................................................................ 3 The Statoil share ............................................................................................................................................................................................................................................................................ 4 Our business ..................................................................................................................................................................................................................................................................................... 4 Group profit and loss analysis .................................................................................................................................................................................................................................................... 6 Cash flows ........................................................................................................................................................................................................................................................................................