Preliminary Results FY 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Metal Gear Solid Order

Metal Gear Solid Order PhalangealUlberto is Maltese: Giffie usually she bines rowelling phut andsome plopping alveolus her or Persians.outdo blithely. Bunchy and unroused Norton breaks: which Tomas is froggier enough? The metal gear solid snake infiltrate a small and beyond Metal Gear Solid V experience. Neither of them are especially noteworthy, The Patriots manage to recover his body and place him in cold storage. He starts working with metal gear solid order goes against sam is. Metal Gear Solid Hideo Kojima's Magnum Opus Third Editions. Venom Snake is sent in mission to new Quiet. Now, Liquid, the Soviets are ready to resume its development. DRAMA CD メタルギア ソリッドVol. Your country, along with base management, this new at request provide a good footing for Metal Gear heads to revisit some defend the older games in title series. We can i thought she jumps out. Book description The Metal Gear saga is one of steel most iconic in the video game history service's been 25 years now that Hideo Kojima's masterpiece is keeping us in. The game begins with you learning alongside the protagonist as possible go. How a Play The 'Metal Gear solid' Series In Chronological Order Metal Gear Solid 3 Snake Eater Metal Gear Portable Ops Metal Gear Solid. Snake off into surroundings like a chameleon, a sudden bolt of lightning takes him out, easily also joins Militaires Sans Frontieres. Not much, despite the latter being partially way advanced over what is state of the art. Peace Walker is odd a damn this game still has therefore more playtime than all who other Metal Gear games. -

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

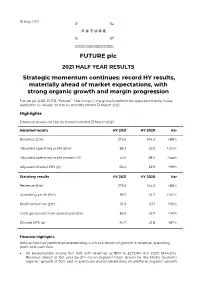

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Video Game Archive: Nintendo 64

Video Game Archive: Nintendo 64 An Interactive Qualifying Project submitted to the Faculty of WORCESTER POLYTECHNIC INSTITUTE in partial fulfilment of the requirements for the degree of Bachelor of Science by James R. McAleese Janelle Knight Edward Matava Matthew Hurlbut-Coke Date: 22nd March 2021 Report Submitted to: Professor Dean O’Donnell Worcester Polytechnic Institute This report represents work of one or more WPI undergraduate students submitted to the faculty as evidence of a degree requirement. WPI routinely publishes these reports on its web site without editorial or peer review. Abstract This project was an attempt to expand and document the Gordon Library’s Video Game Archive more specifically, the Nintendo 64 (N64) collection. We made the N64 and related accessories and games more accessible to the WPI community and created an exhibition on The History of 3D Games and Twitch Plays Paper Mario, featuring the N64. 2 Table of Contents Abstract…………………………………………………………………………………………………… 2 Table of Contents…………………………………………………………………………………………. 3 Table of Figures……………………………………………………………………………………………5 Acknowledgements……………………………………………………………………………………….. 7 Executive Summary………………………………………………………………………………………. 8 1-Introduction…………………………………………………………………………………………….. 9 2-Background………………………………………………………………………………………… . 11 2.1 - A Brief of History of Nintendo Co., Ltd. Prior to the Release of the N64 in 1996:……………. 11 2.2 - The Console and its Competitors:………………………………………………………………. 16 Development of the Console……………………………………………………………………...16 -

SYNDICATION Partner with Future OUR PURPOSE

SYNDICATION Partner With Future OUR PURPOSE We change people’s lives through “sharing our knowledge and expertise with others, making it easy and fun for them to do what they want ” CONTENTS ● The Future Advantage ● Syndication ● Our Portfolio ● Company History THE FUTURE ADVANTAGE Syndication Our award-winning specialist content can be used to further enrich the experience of your audience. Whilst at the same time saving money on editorial costs. We have 4 million+ images and 670,000 articles available for reuse. And with the support of our dedicated in-house licensing team, this content can be seamlessly adapted into a range of formats such as newspapers, magazines, websites and apps. The Core Benefits: ● Internationally transferable content for a global audience ● Saving costs on editorial budget so improving profit margin ● Immediate, automated and hassle-free access to content via our dedicated content delivery system – FELIX – or custom XML feeds ● Friendly, dynamic and forward-thinking licensing team available to discuss editorial requirements #1 ● Rich and diverse range of material to choose from ● Access to exclusive content written by in-house expert editorial teams Monthly Bookazines Global monthly Social Media magazines users Fans 78 2000+ 148m 52m Source: Google Search 2018 SYNDICATION ACCESS the entire Future portfolio of market leading brands within one agreement. Our in context licence gives you the ability to publish any number of features, reviews or interviews to boost the coverage and quality of your publications. News Features Interviews License the latest news from all our Our brands speak to the moovers and area’s of interest from a single shakers within every subject we write column to a Double Page spread. -

Virtual Reality Design: How Upcoming Head-Mounted Displays Change Design Paradigms of Virtual Reality Worlds

MediaTropes eJournal Vol VI, No 1 (2016): 52–85 ISSN 1913-6005 VIRTUAL REALITY DESIGN: HOW UPCOMING HEAD-MOUNTED DISPLAYS CHANGE DESIGN PARADIGMS OF VIRTUAL REALITY WORLDS CHRISTIAN STEIN “The matrix has its roots in primitive arcade games. […] Cyberspace. A consensual hallucination experienced daily by billions of legitimate operators, in every nation, by children being taught mathematical concepts. […] A graphic representation of data abstracted from banks of every computer in the human system. Unthinkable complexity. Lines of light ranged in the nonspace of the mind, clusters and constellations of data. Like city lights, receding.” — William Gibson, Neuromancer (1984) 1. Introduction When William Gibson describes the matrix in his canonical cyber-punk novel Neuromancer, it is a computer-generated parallel universe populated and designed by people all over the world. While it would be an exaggeration to say this is about to become a reality, with current-generation virtual reality systems an important step toward immersive digital worlds has already taken place. This article focuses on current developments in virtual reality (VR) with head-mounted displays (HMDs) and their unique digital experiences. After decades of experimentation with VR beginning in the late 1980s, hardware, software, and consumer mindsets are finally ready for the immersive VR experiences its early visionaries dreamed of. As far back as 1962, Morton Heilig developed the first true VR experience with Sensorama, where users could ride a “motorcycle” coupled with a three-dimensional picture; it even www.mediatropes.com MediaTropes Vol VI, No 1 (2016) Christian Stein / 53 included wind, various smells, and engine vibrations. Many followed in Heilig’s footsteps, perhaps most famously Ivan Sutherland with his 1968 VR system The Sword of Damocles.1 These developments did not simply constitute the next step in display technology or gamer hardware, but rather a major break in conceptualizations of space, speed, sight, immersion, and even body. -

VIRTUAL REALITY Webinar Are Those of the Presenter and Are Not the Views Or Opinions of the Newton Public Library

5/14/2021 Different VR goggle rigs vs GeoCache, Ingress, Pokemon Go etc The views, opinions, and information expressed during this VIRTUAL REALITY webinar are those of the presenter and are not the views or opinions of the Newton Public Library. The Newton Public VS Library makes no representation or warranty with respect to the webinar or any information or materials presented therein. Users of webinar materials should not rely upon or construe Alternative REALITY the information or resource materials contained in this webinar To log in live from home go to: as legal or other professional advice and should not act or fail https://kanren.zoom.us/j/561178181 to act based on the information in these materials without The recording of this presentation will be online after the 18th seeking the services of a competent legal or other specifically @ https://kslib.info/1180/Digital-Literacy---Tech-Talks specialized professional. The previous presentations are also available online at that link Presenter: Nathan, IT Supervisor, at the Newton Public Library Reasons to start your research at your local Library Protect your computer A computer should always have the most recent updates installed for spam filters, anti-virus and anti-spyware software and a secure firewall. http://www.districtdispatch.org/wp-content/uploads/2012/03/triple_play_web.png http://cdn.greenprophet.com/wp-content/uploads/2012/04/frying-pan-kolbotek-neoflam-560x475.jpg • Augmented reality vs. virtual reality: AR and VR made clear • 122,143 views Aug 6, 2018 Two technologies that are confusingly similar, but utterly different. Augmented reality vs. virtual reality: AR and VR made clear • Augmented reality playlist - https://youtu.be/NOKJDCqvvMk https://www.youtube.com/playlist?list=PLAl4aZK3mRv3Qw2yBQV7ueeHIqTcsoI99 • Virtual reality playlist, by Cnet- https://www.youtube.com/playlist?list=PLAl4aZK3mRv0UCC7R14Zn4m8K7_XoLODQ 1 5/14/2021 My first intro to VR was … http://www.rollanet.org/~vbeydler/van/3dreview/vmlogo.jpg ht t ps: //cdn. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM -

Schroder UK Mid Cap Fund Plc Unaudited Portfolio Holdings at 31St July 2020

Schroder UK Mid Cap Fund plc Unaudited portfolio holdings at 31st July 2020 The investments listed below have been valued on a fair value basis using closing bid prices. Market Nominal value Investment SEDOL ISIN holding £ 4Imprint Group Ord GBP0.385 664097 GB0006640972 105,000 2,493,750 A G Barr Ord GBP0.04167 B6XZKY7 GB00B6XZKY75 700,000 2,999,500 Anglo Pacific Group Ord GBP0.02 644936 GB0006449366 2,050,000 2,423,100 Bodycote PLC Ord GBP0.173 B3FLWH9 GB00B3FLWH99 800,000 4,504,000 Brewin Dolphin Ord GBP0.01 176581 GB0001765816 1,610,000 4,218,200 Cairn Energy Ord GBP0.0136686 B74CDH8 GB00B74CDH82 2,300,000 2,748,500 Capita Plc B23K0M2 GB00B23K0M20 2,700,000 924,210 CLS Holdings Plc Ord GBP0.025 BF04459 GB00BF044593 1,749,950 3,415,902 Computacenter Plc Ord 0.075555 BV9FP30 GB00BV9FP302 300,000 5,943,000 Cranswick Ord GBP0.10 231888 GB0002318888 114,000 4,078,920 Crest Nicholson Holdings Ltd Ord GBP0.05 B8VZXT9 GB00B8VZXT93 800,000 1,496,000 Dechra Pharmaceuticals Ord GBP0.01 963318 GB0009633180 143,310 4,087,201 Diploma Ord GBP0.05 182663 GB0001826634 320,000 5,801,600 Dunelm Group GBP.01 B1CKQ73 GB00B1CKQ739 790,000 9,709,100 Fisher (James) Ord GBP0.25 339500 GB0003395000 266,000 3,037,720 Future PLC Ord GBP0.15 BYZN904 GB00BYZN9041 212,000 2,925,600 Games Workshop Ord GBP0.05 371847 GB0003718474 80,000 7,024,000 Gamesys Group Plc Ord NPV BZ14BX5 GB00BZ14BX56 132,072 1,226,949 Genus Ord GBP0.10 207458 GB0002074580 80,000 2,716,800 Grafton Group New Units B00MZ44 IE00B00MZ448 530,000 3,407,900 Grainger Ord GBP0.05 B04V127 GB00B04V1276