List of Public Interest Entities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Cairn Energy Update

Cairn Energy Update Producer, developer, explorer Oil & gas 24 July 2017 We refresh our view on Cairn Energy, focusing on key areas of interest for investors already familiar with the company. We examine a number of Price 174.7p valuation approaches for SNE in Senegal, the potential for reserve Market cap £1019m upgrades and exploration value. We believe SNE is an outsized asset and £0.8/US$ assume Cairn seeks to farm-down. This will naturally affect long-term Net cash ($m) at 31 December 2016 335 value upside, but would in our view drive a better balance of asset and Shares in issue 583.2m financial risk. We also examine features of Catcher, Cairn’s cost of capital and look at the Indian tax dispute. After a long period of value stagnation Free float 96% (as cash was invested to develop Catcher/Kraken), coming years could be Code CNE a time when investors see a path to this investment steadily bearing fruit. Primary exchange LSE Our core contingent NAV is 225p/share and our RENAV is 255p/share. Secondary exchange N/A (US$m) Operating Cash from Share price performance Year end Revenues PBT cash flow Net cash financing 12/15 0 (498) (16) 603 (6) 12/16 0 (152) (21) 335 (4) 12/17e 59 (792) (21) 18 0 12/18e 402 107 226 98 0 Note: Figures are as reported. SNE reserves upgrades hinge on upper reservoir The recent SNE-6 well test appeared to show strong connectivity between wells in the upper reservoirs, going some way to settle concerns that the pressure declines % 1m 3m 12m seen in past well testing would be major obstacles to recovery. -

Phoenix Group Holdings

PROSPECTUS DATED 25 SEPTEMBER 2020 Phoenix Group Holdings plc (incorporated with limited liability in England and Wales with registered number 11606773) £5,000,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”) Phoenix Group Holdings plc (“Phoenix” or “PGH” or the “Issuer”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue notes (the “Notes”). The Notes may be issued (i) as dated unsubordinated notes (“Senior Notes”), (ii) as dated subordinated notes with terms capable of qualifying as Tier 3 Capital (as defined in “Terms and Conditions of the Tier 3 Notes”) (“Tier 3 Notes”), (iii) as dated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Dated Tier 2 Notes”) or as undated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Undated Tier 2 Notes” and, together with the Dated Tier 2 Notes, the “Tier 2 Notes”). The Tier 2 Notes and the Tier 3 Notes are referred to collectively in this Prospectus as the “Subordinated Notes”. The aggregate nominal amount of Notes outstanding will not at any time exceed £5,000,000,000 (or the equivalent in other currencies). Payments of interest and principal under the Subordinated Notes may be subject to optional or mandatory deferral in accordance with the terms of the relevant Series (as defined herein) of Subordinated Notes. This Prospectus has been approved by the United Kingdom Financial Conduct Authority (the “FCA”), as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) as a base prospectus (the “Prospectus”) for the purposes of the Prospectus Regulation. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The History of Dunedin Income Growth Investment Trust

The History of Dunedin Income Growth Investment Trust PLC The first investment trust launched in Scotland, 1873 – 2018 Dunedin Income Growth Trust Investment Income Dunedin Foreword 1873 – 2018 This booklet, written for us by John Newlands, It is a particular pleasure for me, as Chairman of DIGIT describes the history of Dunedin Income Growth and as former employee of Robert Fleming & Co to be Investment Trust PLC, from its formation in Dundee able to write a foreword to this history. It was Robert in February 1873 through to the present day. Fleming’s vision that established the trust. The history Launched as The Scottish American Investment Trust, of the trust and its role in making professional “DIGIT”, as the Company is often known, was the first investment accessible is as relevant today as it investment trust formed in Scotland and has been was in the 1870s when the original prospectus was operating continuously for the last 145 years. published. I hope you will find this story of Scottish enterprise, endeavour and vision, and of investment Notwithstanding the Company’s long life, and the way over the past 145 years interesting and informative. in which it has evolved over the decades, the same The Board of DIGIT today are delighted that the ethos of investing in a diversified portfolio of high trust’s history has been told as we approach the quality income-producing securities has prevailed 150th anniversary of the trust’s formation. since the first day. Today, while DIGIT invests predominantly in UK listed companies, we, its board and managers, maintain a keen global perspective, given that a significant proportion of the Company’s revenues are generated from outside of the UK and that many of the companies in which we invest have very little exposure to the domestic economy. -

A TRANSFORMED OUTLOOK Paul Mcdonald

AVON RUBBER P.L.C. UNAUDITED PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2019 A TRANSFORMED OUTLOOK Paul McDonald, Chief Executive Officer: “2019 has been a transformational year for Avon Rubber. We have delivered strong results ahead of expectations, secured $340m of long-term contracts, announced the $91m acquisition of 3M’s ballistic protection business, and continued to build our order book to provide excellent visibility for 2020. These results reflect the success of our strategic focus on growing our presence in our core markets and investing further in our product portfolio to meet more of the requirements of our expanding customer base. In the last two years, we have built visibility and breadth within our contract portfolio, enabling us to deliver another record performance, and we enter the new year from a position of strength. The acquisition of 3M’s ballistic protection business will significantly bolster our personal protection offering and accelerate our long-term growth prospects. The transformation during the year leaves us well positioned to deliver further success in 2020 and beyond.” 30 Sept 30 Sept % Increase % Increase 2019 2018 Reported Constant Currency Orders received £181.9m £173.3m 5.0% 1.4% Closing order book £40.4m £37.8m 6.9% (0.7%) Revenue £179.3m £165.5m 8.3% 4.2% Adjusted1 operating profit £31.3m £27.3m 14.7% 10.4% Operating profit £14.4m £22.8m (36.8%) (39.4%) Adjusted1 profit before tax £31.4m £27.2m 15.4% 11.2% Profit before tax £13.7m £21.6m (36.6%) (39.2%) Adjusted1 basic earnings per share2 91.7p 77.1p 18.9% 14.1% Basic earnings per share2 46.9p 64.9p (27.7%) (37.3%) Diluted basic earnings per share2 46.5p 64.4p (27.8%) (37.3%) Dividend per share 20.83p 16.02p 30.0% 30.0% Net cash £48.3m £46.5m Operational highlights • $91m agreement to acquire 3M’s ballistic protection business expected to complete during H120 • First deliveries under the $246m, 5-year M53A1 mask and powered air system contract with the U.S. -

Fund Factsheet Indexed UK Equity 01 Oct 2021

| Retirement | Investments | Insurance | Fund Factsheet Indexed UK Equity 01 Oct 2021 FUND FACTS FUND INTRODUCTION Fund Launch Date Apr 2013 Fund Objective Fund Size €2.4m The objective of this fund is to provide broad exposure to UK Equity markets. It does so by aiming Base Currency EUR to track the performance of underlying indices rather than by active management Number of Holdings 86 Fund Strategy Tax Gross The fund is currently aiming to track the MSCI UK Index through an SSgA managed fund but MoneyMate ID 25003820 may elect to track other appropriate indices. The fund is expected to achieve strong returns in the longer term based on the performance CIV Charge 0.10% of equity markets. AMC 0% This fund is also expected to be more volatile than a mixed asset fund given the higher equity content and is suited to a longer term investment horizon. Source: Performance data quoted on a bid to bid basis i.e. the price investors sell units. FUND PERFORMANCE FUND MANAGER INFORMATION Growth of €10,000 to 01 Oct 2021 €20,000 €15,000 €10,000 Fund Manager(s) State Street Global Advisors €5,000 Fund Manager Profile State Street Global Advisors helps investors €0 around the world ranging from governments and 2014 2015 2016 2017 2018 2019 2020 2021 institutions to financial advisors find better ways to achieve their investment goals. They have a Annualised Return to 01 Oct 2021 – Indexed UK Equity long history of developing innovative investment 1m 3m YTD 1y 3y 5y 10y strategies to help their clients, and those who rely on them, achieve their investment goals. -

Babcock International Group PLC Half Year Results for the Period Ended 30 September 2020

Babcock International Group PLC half year results for the period ended 30 September 2020 25 November 2020 Resilient revenue but operating profit reflects disposals, the impact of civil nuclear insourcing, COVID-19 and weakness in civil aviation Financial results 30 September 30 September 2020 2019 Order book £17.2bn £16.9bn Revenue £2,109.6m £2,194.8m Underlying revenue1 £2,243.7m £2,457.8m Operating profit £76.2m £168.7m Underlying operating profit2 £143.1m £250.6m Basic earnings per share 10.5p 25.6p Underlying basic earnings per share3 15.7p 32.5p Cash generated from operations £149.3m £150.5m Underlying free cash flow (post pension payments)4 £58.4m £6.8m Net debt incl. lease obligations £1,519m £1,754.2m Net debt excl. lease obligations5 £871.3m £1,138.0m Net debt/EBITDA6 2.0x 1.9x See notes on page 2. David Lockwood, Chief Executive Officer, said: “I have been enormously impressed by the way in which our people have adapted to the COVID-19 pandemic and continued to prioritise meeting the needs of our customers. Nevertheless, while demand for our critical services has remained resilient overall, the additional costs incurred and inefficiencies created have impacted our profitability. Our operating profit performance in the first half reflects this COVID-19 impact as well as disposals, the impact of government insourcing of Magnox and Dounreay, and weak trading in civil aviation. “In my first three months at Babcock I have spent time seeing many parts of the business. Our strengths are clear. We have many high-quality businesses, with a deep understanding of our customers, operating in markets where demand for our expertise is strong. -

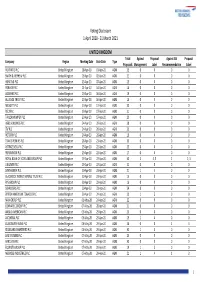

Global Voting Activity Report to March 2021

Voting Disclosure 1 April 2020 ‐ 31 March 2021 UNITED KINGDOM Total Against Proposal Against ISS Proposal Company Region Meeting Date Vote Date Type Proposals Management Label Recommmendation Label RIO TINTO PLC United Kingdom 08‐Apr‐20 01‐Apr‐20 AGM 25 0 0 00 SMITH & NEPHEW PLC United Kingdom 09‐Apr‐20 02‐Apr‐20 AGM 21 0 0 00 HUNTING PLC United Kingdom 15‐Apr‐20 07‐Apr‐20 AGM 15 0 0 00 PORVAIR PLC United Kingdom 21‐Apr‐20 14‐Apr‐20 AGM 14 0 0 00 AGGREKO PLC United Kingdom 23‐Apr‐20 16‐Apr‐20 AGM 19 0 0 00 ALLIANCE TRUST PLC United Kingdom 23‐Apr‐20 16‐Apr‐20 AGM 16 0 0 00 MEGGITT PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 20 0 0 00 RELX PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 21 0 0 00 TAYLOR WIMPEY PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 20 0 0 00 HSBC HOLDINGS PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 28 0 0 00 ITV PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 21 0 0 00 ROTORK PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 19 0 0 00 TRAVIS PERKINS PLC United Kingdom 28‐Apr‐20 21‐Apr‐20 AGM 20 0 0 00 ASTRAZENECA PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 25 0 0 00 PERSIMMON PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 17 0 0 00 ROYAL BANK OF SCOTLAND GROUP PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 30 2 4, 5 22, 3 UNILEVER PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 22 0 0 00 SYNTHOMER PLC United Kingdom 29‐Apr‐20 23‐Apr‐20 AGM 21 1 5 00 BLACKROCK WORLD MINING TRUST PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 15 0 0 00 RPS GROUP PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 16 0 0 00 SCHRODERS PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 24 -

Croda 2020 Results

Press Release 2 March 2021 Results for the year ended 31 December 2020 Strong strategic delivery built on resilient financial performance Croda International Plc (“Croda” or the “Group”), the company that uses smart science to create high performance ingredients and technologies that improve lives, announces its full year results for the year ended 31 December 2020. Highlights Full year ended 31 December % change % change 2 Adjusted1 results 2020 2019 reported rate constant rate Sales – Core Business3 £million 1,293.9 1,265.9 2.2% 2.3% Operating profit £million 319.6 339.7 (5.9)% (4.0)% Profit before tax (PBT) £million 300.6 322.1 (6.7)% (4.8)% Basic earnings per share (EPS) pence 175.5 185.0 (5.1)% n/a Return on sales4 % 23.0 24.7 (1.7)%pts n/a Free cash flow5 £million 176.9 201.7 (12.3)% n/a Reported results (IFRS) 2020 2019 % change Sales £million 1,390.3 1,377.7 0.9% Operating profit £million 290.0 319.9 (9.3)% Profit before tax (PBT) £million 269.5 302.3 (10.9)% Basic EPS pence 155.1 172.8 (10.2)% Ordinary dividend per share pence 91.0 90.0 1.1% Strong strategic delivery in 2020 • Delivering for all stakeholders through our response to COVID-19 o No employees furloughed or use of government liquidity; supported customers, suppliers, employees and communities o Dividends paid in full; 2020 full year dividend increased to 91.0p (52% of adjusted EPS) • Living our Purpose: Smart science to improve livesTM o Prioritising COVID-19 vaccines and drug delivery activities o Launched sustainability Commitment to be Climate, Land and People Positive