Professional Investor Fund Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

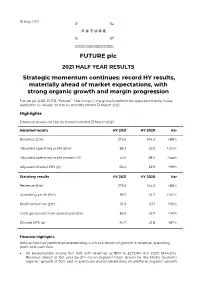

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Preliminary Results FY 2020

Preliminary results FY 2020 25 November 2020 1 2 Agenda ● Overview ● FY 2020 financial review ● Progress against our strategy in FY 2020 ● Recommended offer for GoCo Group plc ● Summary & outlook 3 Exceptional results, Values led 01 ahead of expectations... 02 execution... ● Strong core values facilitated ● Group revenue up 53% to agile response to the rapidly £339.6m, underpinned by changing landscape acquisitions and media organic ● Operating leverage driving revenue growth of 23% adjusted operating margin ● Continued growth in adjusted expansion to 28% operating profit, up 79% to ● Continue to be highly cash £93.4m Continued generative, with adjusted free ● Adjusted free cash flow growth cash flow of 103% of adjusted of 79% strength of operating profit ● Exceptional performance performance despite COVID-19 underpinned ...delivered by ongoing ...enables strong by delivery 03 focus on strategy 04 acquisitions performance ● TI Media integration ● Continued shift in revenue, completed, savings of £20m with Media division now 65% 1 identified, with focus now on of revenues (Sept 2020) building revenue ● Geographical diversification monetisation, with launch of 6 continues with US now 43% of new sites revenue (Sept 2020)1 2 ● Barcroft and SmartBrief both ● Online audience growth of in BAU mode, delivering in 56%, with organic audience line with plans up 48%, driving sales ● Recommended offer for performance in Media GoCo Group plc announced today (25 November) 4 1 Sept month 2020 shown to reflect TI Media acquisition 2 Google Analytics online users. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM -

Schroder UK Mid Cap Fund Plc Unaudited Portfolio Holdings at 31St July 2020

Schroder UK Mid Cap Fund plc Unaudited portfolio holdings at 31st July 2020 The investments listed below have been valued on a fair value basis using closing bid prices. Market Nominal value Investment SEDOL ISIN holding £ 4Imprint Group Ord GBP0.385 664097 GB0006640972 105,000 2,493,750 A G Barr Ord GBP0.04167 B6XZKY7 GB00B6XZKY75 700,000 2,999,500 Anglo Pacific Group Ord GBP0.02 644936 GB0006449366 2,050,000 2,423,100 Bodycote PLC Ord GBP0.173 B3FLWH9 GB00B3FLWH99 800,000 4,504,000 Brewin Dolphin Ord GBP0.01 176581 GB0001765816 1,610,000 4,218,200 Cairn Energy Ord GBP0.0136686 B74CDH8 GB00B74CDH82 2,300,000 2,748,500 Capita Plc B23K0M2 GB00B23K0M20 2,700,000 924,210 CLS Holdings Plc Ord GBP0.025 BF04459 GB00BF044593 1,749,950 3,415,902 Computacenter Plc Ord 0.075555 BV9FP30 GB00BV9FP302 300,000 5,943,000 Cranswick Ord GBP0.10 231888 GB0002318888 114,000 4,078,920 Crest Nicholson Holdings Ltd Ord GBP0.05 B8VZXT9 GB00B8VZXT93 800,000 1,496,000 Dechra Pharmaceuticals Ord GBP0.01 963318 GB0009633180 143,310 4,087,201 Diploma Ord GBP0.05 182663 GB0001826634 320,000 5,801,600 Dunelm Group GBP.01 B1CKQ73 GB00B1CKQ739 790,000 9,709,100 Fisher (James) Ord GBP0.25 339500 GB0003395000 266,000 3,037,720 Future PLC Ord GBP0.15 BYZN904 GB00BYZN9041 212,000 2,925,600 Games Workshop Ord GBP0.05 371847 GB0003718474 80,000 7,024,000 Gamesys Group Plc Ord NPV BZ14BX5 GB00BZ14BX56 132,072 1,226,949 Genus Ord GBP0.10 207458 GB0002074580 80,000 2,716,800 Grafton Group New Units B00MZ44 IE00B00MZ448 530,000 3,407,900 Grainger Ord GBP0.05 B04V127 GB00B04V1276 -

Holdings—Artisan International Small-Mid Fund

Artisan International Small-Mid Fund Holdings As of 31 December 2019 Portfolio Holdings Quantity Security Name/Description Price Book Total Market Value Book Pct Assets (%) 509,413 Abcam PLC 17.91 9,122,869.60 0.54 358,726 ACADIA Pharmaceuticals Inc 42.78 15,346,298.28 0.91 1,176,810 AIXTRON SE 9.58 11,271,009.64 0.67 21,329 ALK-Abello A/S 245.98 5,246,413.67 0.31 1,395,431 Almirall SA 16.42 22,915,332.48 1.36 560,613 Altus Group Ltd 29.23 16,388,178.73 0.97 119,474 Amarin Corp PLC 21.44 2,561,522.56 0.15 714,448 Ambu A/S 16.76 11,972,007.75 0.71 135,950 Applied Therapeutics Inc 27.28 3,708,716.00 0.22 133,410 Aprea Therapeutics Inc 45.89 6,122,184.90 0.36 121,889 Argenx SE 161.08 19,633,407.17 1.16 123,052 Ariake Japan Co Ltd 74.47 9,163,930.04 0.54 133,519 ASOS PLC 44.68 5,965,463.09 0.35 491,103 Aston Martin Lagonda Global Holdings PLC 6.89 3,381,377.19 0.20 1,433,715 Auto Trader Group PLC 7.88 11,292,041.97 0.67 321,773 AVEVA Group PLC 61.67 19,844,827.19 1.18 877,900 Azbil Corp 28.15 24,711,941.19 1.46 3,195,804 B&M European Value Retail SA 5.43 17,339,031.45 1.03 106,854 Baloise Holding AG 180.74 19,312,292.71 1.14 306,500 BASE Inc 16.17 4,956,417.49 0.29 99,317 Basler AG 61.00 6,058,456.06 0.36 295,023 Beijer Ref AB 29.36 8,663,265.59 0.51 3,327 Belimo Holding AG 7,539.73 25,084,670.30 1.49 888,777 Biocartis NV 6.42 5,702,503.42 0.34 1,938,000 BK Brasil Operacao e Assessoria a Restaurantes SA 4.44 8,608,517.79 0.51 1,411,900 BlackBerry Ltd 6.43 9,078,868.72 0.54 4,494,200 boohoo Group PLC 3.95 17,734,038.67 1.05 1,519,036 Britvic -

Future Plc Annual Report and Accounts 2016 01 Future Plc Group Overview Future Plc Is an International Media Group Listed on the London Stock Exchange (Symbol: FUTR)

AR16 Future plc Annual Report and Accounts 2016 01 Future plc Group overview Future plc is an international media group listed on the London Stock Exchange (symbol: FUTR). These highlights refer to the Group’s annual results for the year ended 30 September 2016. Strategic Report Continuing Revenue Net Cash 01 Group overview 02 Chairman’s statement 03 Chief Executive’s review £59.0m £0.5m 05 Strategic overview 2015: £59.8m 2015: Net Debt £(1.8)m 07 What we do 09 Risks and uncertainties 11 Corporate responsibility Continuing EBITDAE Continuing Exceptional items Financial Review £4.7m £(16.5)m 13 Financial review 2015: £3.6m 2015: £(2.5)m Corporate Governance Continuing EBITE Continuing Loss Before Tax 17 Board of Directors 19 Directors’ report 23 Corporate Governance report 29 Directors’ remuneration report £2.3m £(14.9)m 2015: £0.8m 2015: £(2.3)m 41 Independent auditors’ report Financial Statements Continuing Digital Advertising Unique Users 43 Financial statements 79 Notice of Annual General Meeting 84 Investor information 78% 45.2m of total continuing advertising a month (Q4 up 14% on Q3) revenues (2015: 77%) Continuing Recurring Revenues • EBITDAE represents • Recurring revenues earnings before interest, encompass e-commerce tax, depreciation, and subscriptions. amortisation, impairment • Exceptional items for and exceptional items. 2016 above includes • EBITE represents impairment of intangible £15.0m earnings before assets of £13.0m. interest, tax, impairment 2015: £12.9m and exceptional items. Annual Report and Accounts 2016 02 Strategic Report Chairman’s statement A diversified content business with data at its heart This year the Group has gained significant momentum; by moving to a new divisional structure, Future is benefiting from greater operational efficiency. -

Annual Report and Accounts 2019

GoCo Group plc Annual Report & Accounts 2019 We’re on a mission Annual Report & Accounts 2019 Significant growth opportunity £2bnoverspend every year on household bills and insurance in the UK households only occasionally 3 in 5 switch 15mhouseholds are still on default tariffs and likely overpaying for energy 72% likely to sign up to an auto-switching proposition 23mhouseholds didn’t switch energy supplier in the last 12 months: our incremental growth opportunity We are building momentum as we transform the Group £250value of the free car insurance excess cover with GoCompare underlying GoCompare car insurance +4% growth in Q4 £7.0mof AutoSave revenue in 2019 300,000 live AutoSave customers x4year on year increase in number of tech releases 2019: A year of transformation for GoCo Group. We are on a mission to help people everywhere find more of the right products, saving them more time and more money. This year we transformed into a multi-brand Group operating Price Comparison, AutoSave and Rewards businesses. We are investing in our people and are committed to creating a sustainable culture that fosters creativity and innovation. Overview Strategic Report Corporate Governance Financial Statements 2019 Highlights Investing for sustainable growth Revenue AutoSave live customers £152.4m 300,000 2019 £152.4m 2019 300,000 2018 £152.6m 2018 <1,000 APM APM Operating profit Adjusted operating profit • Disciplined financial performance £20.3m £26.5m across the Group • 300,000 live AutoSave customers 2019 £20.3m 2019 £26.5m by 31 December 2019 2018 £37.5m 2018 £44.0m • Acquisition of Look After My Bills in APM Denotes Alternative Performance Measure Use of alternative performance measures is detailed on page 13. -

DIRECTOR's IRREVOCABLE UNDERTAKING To

DIRECTOR’S IRREVOCABLE UNDERTAKING To: Future plc Quay House The Ambury Bath, BA1 1UA GoCo Group plc Imperial House Imperial Way Coedkernew Newport Gwent, NP10 8UH From: Zillah Byng-Thorne c/o Future plc ____25 November 2020 Dear Sirs Proposal by Future plc (the “Offeror”) to acquire GoCo Group plc (the “Company”) 1. Background I am aware that the Offeror intends to acquire the entire issued and to be issued share capital of the Company (i) at the price per Company Share set out in the draft press announcement provided to me, a copy of which is annexed hereto (the “Press Announcement”), comprising the amount in cash and the amount in Shares set out in the Press Announcement; and (ii) substantially on the terms and subject to the conditions set out in the Press Announcement and/or on such other terms and conditions as may be required by the Applicable Requirements and/or as may be agreed between the Offeror and the Company (the “Proposal”) and that the Proposal is expected to be implemented by way of a Scheme. I understand that the Proposal would constitute a class 1 transaction for the Offeror for the purposes of the Listing Rules and accordingly will be conditional, among other things, on the approval of the Offeror Shareholders. I further understand that, in connection with the Proposal, the Offeror is proposing to convene a General Meeting (as defined at paragraph 4.1(A)) to consider, and if thought fit, approve the Offeror Resolutions. 2. Definitions and interpretation 2.1 Terms defined in Schedule 1 to this undertaking have the same meanings when used in this undertaking.