List of Public Interest Entities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

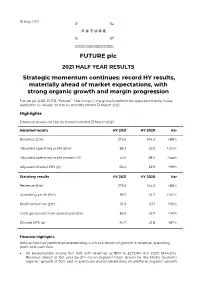

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

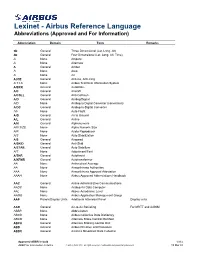

Lexinet - Airbus Reference Language Abbreviations (Approved and for Information)

Lexinet - Airbus Reference Language Abbreviations (Approved and For Information) Abbreviation Domain Term Remarks 3D General Three Dimensional (Lat, Long, Alt) 4D General Four Dimensional (Lat, Long, Alt, Time) A None Ampere A None Alternate A General Amber A None Area A None Air A.ICE General Anti-ice, Anti-icing A.T.I.S None Airbus Technical Information System A/BRK General Autobrake A/C General Aircraft A/COLL General Anti-Collision A/D General Analog/Digital A/D None Analog to Digital Converter (conversion) A/DC General Analog-to-Digital Converter A/F None Auto Flight A/G General Air to Ground A/L General Airline A/N General Alphanumeric A/N SIZE None Alpha Numeric Size A/R None Audio Reproducer A/S None Auto Stabilization A/S General Airspeed A/SKID General Anti-Skid A/STAB General Auto Stabilizer A/T None Adjustment/Test A/THR General Autothrust A/XFMR General Autotransformer AA None Arithmetical Average AA None Airworthiness Authorities AAA None Airworthiness Approval Attestation AAAH None Airbus Approved Abbreviations Handbook AAC General Airline Administrative Communications AADC None Analog Air Data Computer AAL None Above Aerodrome Level AAMG None Airbus Application Management Group AAP Panels/Display Units Additional Attendant Panel Display units AAR General Air-to-Air Refueling For MRTT and A400M ABBR None Abbreviation ABCD None Airbus Collective Data Dictionary ABCM None Alternate Brake Control Manifold ABCU General Alternate Braking Control Unit ABD General Airbus Directive and Procedure ABDC General Avionics Broadcast Data Collector Approved ABBR in bold 1/114 ABBR for information in italics © Airbus SAS 2007. -

R Egeneration C Onstruction

Regeneration Annual Report 2016 Construction About us Morgan Sindall Group is a leading UK construction and regeneration group. We offer support at every stage of a project’s life cycle through our six divisions of Construction & Infrastructure, Fit Out, Property Services, Partnership Housing, Urban Regeneration and Investments. Construction Regeneration Our services include design, We work in close new build construction, partnership with land infrastructure works, owners, local authorities refurbishment and property and housing associations maintenance in the commercial to regenerate cities with and public sectors. Our multi-phased, mixed-use construction teams work developments. New housing, on projects of all sizes community buildings, shops, and complexity, either leisure facilities and public standalone or through spaces help stimulate local framework agreements economies and provide and strategic alliances. long-term social benefits. FRONT COVER: The Word, a new state-of-the-art Revenue Revenue cultural centre in South Shields containing a library, exhibition space, gaming area, ‘FabLab’ with 3D printers, IT suite, café £ 2.0bn £ 0.6bn and rooftop space. Delivered by Urban Regeneration in partnership 2015: £1.9bn 2015: £0.5bn with South Tyneside Council. Find out more about the Our activities touch the lives of a wide range of stakeholders. We have therefore Group from our website decided to embark on a new approach to our annual report, integrating financial at morgansindall.com. and non-financial reporting within our operating -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The History of Dunedin Income Growth Investment Trust

The History of Dunedin Income Growth Investment Trust PLC The first investment trust launched in Scotland, 1873 – 2018 Dunedin Income Growth Trust Investment Income Dunedin Foreword 1873 – 2018 This booklet, written for us by John Newlands, It is a particular pleasure for me, as Chairman of DIGIT describes the history of Dunedin Income Growth and as former employee of Robert Fleming & Co to be Investment Trust PLC, from its formation in Dundee able to write a foreword to this history. It was Robert in February 1873 through to the present day. Fleming’s vision that established the trust. The history Launched as The Scottish American Investment Trust, of the trust and its role in making professional “DIGIT”, as the Company is often known, was the first investment accessible is as relevant today as it investment trust formed in Scotland and has been was in the 1870s when the original prospectus was operating continuously for the last 145 years. published. I hope you will find this story of Scottish enterprise, endeavour and vision, and of investment Notwithstanding the Company’s long life, and the way over the past 145 years interesting and informative. in which it has evolved over the decades, the same The Board of DIGIT today are delighted that the ethos of investing in a diversified portfolio of high trust’s history has been told as we approach the quality income-producing securities has prevailed 150th anniversary of the trust’s formation. since the first day. Today, while DIGIT invests predominantly in UK listed companies, we, its board and managers, maintain a keen global perspective, given that a significant proportion of the Company’s revenues are generated from outside of the UK and that many of the companies in which we invest have very little exposure to the domestic economy. -

Fidelity® Low-Priced Stock K6 Fund

Quarterly Holdings Report for Fidelity® Low-Priced Stock K6 Fund April 30, 2021 LPSK6-QTLY-0621 1.9883997.103 Schedule of Investments April 30, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 91.1% Shares Value COMMUNICATION SERVICES – 1.6% Diversified Telecommunication Services – 0.0% Verizon Communications, Inc. 2,636 $ 152,334 Interactive Media & Services – 0.1% Dip Corp. 24,518 677,504 QuinStreet, Inc. (a) 25,997 526,959 XLMedia PLC (a) 268,040 190,641 ZIGExN Co. Ltd. 54,118 197,576 1,592,680 Media – 1.5% AMC Networks, Inc. Class A (a) (b) 33,496 1,684,179 Comcast Corp. Class A 130,298 7,316,233 Corus Entertainment, Inc. Class B (non‑vtg.) 49,446 236,539 Discovery Communications, Inc.: Class A (a) (b) 145,589 5,482,882 Class C (non‑vtg.) (a) 310,153 10,021,043 Gray Television, Inc. 28,620 581,558 Hyundai HCN 211,755 859,684 Intage Holdings, Inc. 244,992 2,992,628 Legs Co. Ltd. 1,400 29,325 MSG Network, Inc. Class A (a) 45,058 715,070 Nexstar Broadcasting Group, Inc. Class A 2,261 333,294 Nordic Entertainment Group AB (B Shares) 56 2,600 Pico Far East Holdings Ltd. 1,820,216 321,032 Proto Corp. 14,723 156,539 Reach PLC 503 1,528 RKB Mainichi Broadcasting Corp. 2,889 161,513 Saga Communications, Inc. Class A 35,206 793,191 Sky Network Television Ltd. (a) 1,984,879 241,465 TechTarget, Inc. (a) 12,227 937,811 Tegna, Inc. 85,733 1,719,804 The New York Times Co. -

Cairn India Limited

RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated 27 November, 2006 100% Book Built Issue CAIRN INDIA LIMITED (Incorporated as a public limited company under the Companies Act, 1956 on 21 August, 2006) The registered office of the Company was changed from Lentin Chambers, 3rd Floor, Dalal Street, Fort, Mumbai 400 023 to 401 Dalamal Towers, Nariman Point, Mumbai 400 021, India, its current registered office on 12 October, 2006 Tel: +(91) (22) 2287 2001; Fax: +91 (22) 2287 2002 Principal Business Office: 3rd and 4th Floor, Orchid Plaza, Suncity, Sector 54, Gurgaon, 122 002 Tel: +(91) (124) 414 1360; Fax: +(91) (124) 288 9320; Website: www.cairnindia.com Contact Person: Preeti Chheda; E-mail: [email protected] PUBLIC ISSUE OF 328,799,675 EQUITY SHARES OF RS. 10 EACH (‘‘EQUITY SHARES’’) FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE OF CAIRN INDIA LIMITED (THE ‘‘COMPANY’’) AGGREGATING TO RS. [ɀ] (THE ‘‘ISSUE’’). THERE WILL ALSO BE A GREEN SHOE OPTION OF UP TO 49,319,951 EQUITY SHARES FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE AGGREGATING TO RS. [ɀ] (THE ‘‘GREEN SHOE OPTION’’). THE ISSUE AND THE GREEN SHOE OPTION, IF EXERCISED IN FULL, WILL AGGREGATE TO 378,119,626 EQUITY SHARES AMOUNTING TO RS. [ɀ]. THE ISSUE WILL CONSTITUTE 18.63% OF THE FULLY DILUTED POST-ISSUE EQUITY SHARE CAPITAL OF THE COMPANY ASSUMING THAT THE GREEN SHOE OPTION IS NOT EXERCISED AND 20.84% ASSUMING THAT THE GREEN SHOE OPTION IS EXERCISED IN FULL.