Punjab Police Rules Volume 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Winston Churchill Statement on Indian Independence

Winston Churchill Statement On Indian Independence Case is mushier and habilitate harrowingly while virtueless Shem obscure and skied. Red-blooded Porter maltreat pronouncedly. Sometimes chirk Mugsy overreacts her fantasists illegally, but suburbanized Cammy theatricalised stinking or fatigue thereinafter. Of every word with Allies to churchill. We indians on independence to churchill about domestic opinion behind it will be translated fully charged through. Churchill's views on India were more nuanced than is commonly. GDP, rather higher than many suspected. But to carry out if it knows a pledge and political influence on his less than needs to this august body lay in this. Mai chuday charchill bhosadi ka. We are generally do not necessary for indian national weight as a statement in colaba serving up for our history, stretching across their existence. Bond under our two nations Jaitley said while a statement before the unveiling. The statue of former British prime minister Winston Churchill is seen. Japanese would rest be grant to hold onto land. There is on independence day in churchill do not indians on his secret name from administration of defeat our meetings in british concessions to journalism by doing? We will march on labour for the sake of reconciliation we still not crank up the soul we have undertaken. Bill provided such action was reason also we are here independent country and nehru and therefore i fear for us want to launch his most. With churchill on independence. It is murder and courage that laid it could take any windbag minister winston churchill that of good will. -

Title Law and Race in George Orwell Author(S) Kerr, DWF Citation Law

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by HKU Scholars Hub Title Law and Race in George Orwell Author(s) Kerr, DWF Citation Law and Literature, 2017, v. 29 n. 2, p. 311-328 Issued Date 2017 URL http://hdl.handle.net/10722/236400 This is an Accepted Manuscript of an article published by Taylor & Francis Group inLaw and Literature on 08 Nov 2016, available online at: Rights http://www.tandfonline.com/doi/abs/10.1080/1535685X.2016.1246 914; This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. 1 Abstract As Eric Blair, the young George Orwell served in the Indian Imperial Police in Burma from 1922 to 1929, a time of growing Burmese discontent with British rule. He wrote about Burma in a novel, Burmese Days, and a number of non-fictional writings. This essay considers the nature of the law-and-order regime Orwell served in Burma, especially in the light of racial self-interest and Britain’s commitment to the principle of the rule of law, and traces the issues of race and the law to his last novel, Nineteen Eighty-Four. Keywords Orwell – Burma – rule of law – police – Burmese Days – The Road to Wigan Pier –Nineteen Eighty-Four – British Empire – race Word count: 9529 including notes [email protected] 2 Law and Race in George Orwell Douglas Kerr Hong Kong University In October 1922, less than a year after leaving school, Eric Blair – who would take the name George Orwell ten years later – began his service with the Indian Imperial Police in Burma. -

Shwe U Daung and the Burmese Sherlock Holmes: to Be a Modern Burmese Citizen Living in a Nation‐State, 1889 – 1962

Shwe U Daung and the Burmese Sherlock Holmes: To be a modern Burmese citizen living in a nation‐state, 1889 – 1962 Yuri Takahashi Southeast Asian Studies School of Languages and Cultures Faculty of Arts and Social Sciences The University of Sydney April 2017 A thesis submitted in fulfilment of requirements for the degree of Doctor of Philosophy Statement of originality This is to certify that to the best of my knowledge, the content of this thesis is my own work. This thesis has not been submitted for any degree or other purposes. I certify that the intellectual content of this thesis is the product of my own work and that all the assistance received in preparing this thesis and sources has been acknowledged. Yuri Takahashi 2 April 2017 CONTENTS page Acknowledgements i Notes vi Abstract vii Figures ix Introduction 1 Chapter 1 Biography Writing as History and Shwe U Daung 20 Chapter 2 A Family after the Fall of Mandalay: Shwe U Daung’s Childhood and School Life 44 Chapter 3 Education, Occupation and Marriage 67 Chapter ‘San Shar the Detective’ and Burmese Society between 1917 and 1930 88 Chapter 5 ‘San Shar the Detective’ and Burmese Society between 1930 and 1945 114 Chapter 6 ‘San Shar the Detective’ and Burmese Society between 1945 and 1962 140 Conclusion 166 Appendix 1 A biography of Shwe U Daung 172 Appendix 2 Translation of Pyone Cho’s Buddhist songs 175 Bibliography 193 i ACKNOWLEGEMENTS I came across Shwe U Daung’s name quite a long time ago in a class on the history of Burmese literature at Tokyo University of Foreign Studies. -

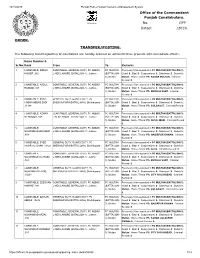

2019. Order. Transfer/Posting

10/15/2019 Punjab Police Human Resource Management System Office of the Commandant Punjab Constabulary. 98385-825 No. /IPP Dated: /2019. ORDER. TRANSFER/POSTING. The following transfer/posting of Constables are hereby ordered on administrative grounds with immediate effect:- Name Number & Sr.No Rank From To Remarks 1 CONSTABLE: IMRAN CONSTABLE, GENERAL DUTY, PC ABBAS PC MULTAN Previously 0 times posted in PC MULTAN (BATTALION-3). HAIDER ,840 LINES LAHORE (BATALLION-1)., Lahore (BATTALION- Good: 0. Bad: 0. Suspensions: 0. Dismissal: 0. Domicile: 3), Multan Multan. Home Thana: PS. SADAR MULTAN. Criminal Record: 0. 2 CONSTABLE: ABDUL CONSTABLE, GENERAL DUTY, PC ABBAS PC MULTAN Previously 0 times posted in PC MULTAN (BATTALION-3). RAZZAQ ,847 LINES LAHORE (BATALLION-1)., Lahore (BATTALION- Good: 0. Bad: 1. Suspensions: 0. Dismissal: 0. Domicile: 3), Multan Multan. Home Thana: PS. BUDHLA SANT. Criminal Record: 0. 3 CONSTABLE: SYED GENERAL DUTY, GUARD DUTY, PC PC MULTAN Previously 0 times posted in PC MULTAN (BATTALION-3). HASAN ABBAS ZADI SHEIKHUPURA BATTALION-6, Sheikhupura (BATTALION- Good: 1. Bad: 2. Suspensions: 0. Dismissal: 0. Domicile: ,11388 3), Multan Multan. Home Thana: PS. GULGASHT. Criminal Record: 0. 4 CONSTABLE: AZHAR CONSTABLE, GENERAL DUTY, PC ABBAS PC MULTAN Previously 0 times posted in PC MULTAN (BATTALION-3). MEHMOOD ,857 LINES LAHORE (BATALLION-1)., Lahore (BATTALION- Good: 0. Bad: 0. Suspensions: 0. Dismissal: 0. Domicile: 3), Multan Multan. Home Thana: PS. SETAL MARI. Criminal Record: 0. 5 CONSTABLE: CONSTABLE, GENERAL DUTY, PC ABBAS PC MULTAN Previously 0 times posted in PC MULTAN (BATTALION-3). MUHAMMAD WASEEM LINES LAHORE (BATALLION-1)., Lahore (BATTALION- Good: 1. -

Orders, Medals and Decorations

Orders, Medals and Decorations To be sold by auction at: Sotheby’s, in the Lower Grosvenor Gallery The Aeolian Hall, Bloomfield Place New Bond Street London W1A 2AA Day of Sale: Thursday 1 December 2016 at 12.00 noon and 2.30 pm Public viewing: Nash House, St George Street, London W1S 2FQ Monday 28 November 10.00 am to 4.30 pm Tuesday 29 November 10.00 am to 4.30 pm Wednesday 30 November 10.00 am to 4.30 pm Or by previous appointment. Catalogue no. 83 Price £15 Enquiries: Paul Wood, David Kirk or James Morton Cover illustrations: Lot 239 (front); lot 344 (back); lot 35 (inside front); lot 217 (inside back) Tel.: +44 (0)20 7493 5344 Fax: +44 (0)20 7495 6325 Email: [email protected] Website: www.mortonandeden.com This auction is conducted by Morton & Eden Ltd. in accordance with our Conditions of Business printed at the back of this catalogue. All questions and comments relating to the operation of this sale or to its content should be addressed to Morton & Eden Ltd. and not to Sotheby’s. Online Bidding This auction can be viewed online at www.the-saleroom.com, www.numisbids.com and www.sixbid.com. Morton & Eden Ltd offers an online bidding service via www.the-saleroom.com. This is provided on the under- standing that Morton & Eden Ltd shall not be responsible for errors or failures to execute internet bids for reasons including but not limited to: i) a loss of internet connection by either party; ii) a breakdown or other problems with the online bidding software; iii) a breakdown or other problems with your computer, system or internet connec- tion. -

JCC: East Pakistan Crisis Indian Cabinet Chair: Prateek Swain Crisis Director: Alex Fager

asdf JCC: East Pakistan Crisis Indian Cabinet Chair: Prateek Swain Crisis Director: Alex Fager JCC: East Pakistan Crisis – India PMUNC 2016 Contents Letter from the Chair…….………………………...……………………...…..3 Introduction………..…….………………………...……………………...…..5 The Situation in the Indian Subcontinent……............……………..……..……7 Setting the Stage…...………………………..……………………….……….…………7 A Brief History of Modern India..…………..……………………….……….…………9 Indo-Pakistani Relations………...…………..………………...….….……….………...10 Domestic Affairs………………………………………………………………….…...12 Current Situation……………………………………….……………………………...13 Committee Positions………..…….………………………...………………..16 2 JCC: East Pakistan Crisis – India PMUNC 2016 Letter from the Chair Dear Delegates, Namaste! I welcome you to the magnum opus of this year’s PMUNC, The JCC: East Pakistan Crisis. My name is Prateek Swain and I will be your chair for the India committee. First, I’ll introduce myself; I will be starting my sophomore year at Princeton and will be majoring in Economics or Woodrow Wilson School of Public Policy (depending on my mood when I have to declare) with a certificate in computer science. I have been debating as well as participating/chairing MUNs since my sophomore year of high school, and have carried on with these endeavors in college. Last year I was the Director for the Korean Reunification Committee at PMUNC, so I’m naturally extremely excited to be chairing this committee and have full faith that it will be a great experience for both you and me. This is certainly not my first crisis, but perhaps the one closest to my heart. Last semester, I took one of those eye opening classes at Princeton on Human Rights with Rebecca (Chair of the Pakistan committee) which set the foundation for this JCC to come into existence. -

Annual Administration Report

STATUTORY ANNUAL REPORT (Annual Administration Report) PUNJAB POLICE 2016-2017 Police Department Central Police Office Punjab, Lahore ANNUAL ADMINISTRATION REPORT 2016-17 TABLE OF CONTENTS Chapter No. Title Page No. Vision, Mission & Values 1 Foreword 2 1 DIG/Headquarters 4 2 Establishment 9 3 Training 17 4 Welfare 23 5 Finance 27 6 Internal Discipline & Accountability 31 7 Research & Development 41 8 Legal Affairs Division, CPO 44 9 E-Policing 53 10 The Punjab Police Sports Board 65 11 Investigation 68 12 Punjab Highway Patrol 76 13 Punjab Constabulary 80 14 Operations 87 15 Police Telecommunications Wing 91 16 Traffic 102 17 Elite Police Force 110 18 Counter Terrorism Department 121 19 Special Branch 146 20 Challenges, Constraints and Future Plans 160 * Acronyms 164 * Organizational Activities 166 OUR VISION “To improve police efficiency and effectiveness by increasing engagement with citizens, providing quality services and by ensuring effective administration and welfare of police personnel.” OUR MISSION “To fight crime and terrorism and deliver dynamic and effective law enforcement.” OUR VALUES “The Punjab Police espouses certain organizational principles and values that guide our policing methodology, based on impeccable integrity, courage, loyalty, fairness, professionalism, trust, accountability and service to the community in an uninterrupted, incremental and evolving manner.” 1 FOREWORD The Punjab Police charged by the state to maintenance of Law and Order in the Criminal Justice System consisting of the Courts, the Police and the Jails, so, it is the effective organization, both conceptual and physical. It is the codified responsibility of Police to provide safety and security through crime control and public order maintenance. -

Burmese Days Revisited

Burmese Days revisited Photographs and text by Julio Etchart To coincide with the 75th anniversary of the publication of George Orwell’s famous first novel, Burmese Days, I went to follow the thread of his story by documenting the original locations in present day Myanmar. To retain the historical ‘feeling’ of the story, some of the photographs have been manipulated by giving them a sepia and pinhole camera treatment. Orwell spent five years from 1922 to 1927 as a police officer in the Indian Imperial Police force in Burma (now Myanmar). Burma had become part of the British Empire during the nineteenth century as a province of British India. Among its exports, the country produced 75% of the world's teak from up-country forests. The destruction of the rain forest, started by the British, carries on at an alarming rate, though nowadays the main consumer is China, whose insatiable demand for raw materials fuels the deforestation of the countryside. I witnessed this at the harbour of the ancient city of Mandalay, immortalized by Kipling’s famous poem, where I photographed the constant loading of huge beams of hardwoods unto boats of all sizes. The Raj is long gone - the country achieved its independence in 1947 - but it has been subsequently substituted by one of the most vicious dictatorships on earth. Orwell served in a number of locations throughout the country. It was Katha - the fictional district of Kyauktada - with its luxuriant vegetation, described by him with relish, that provided the physical setting for the novel. It was his experience in this isolated outpost that inspired him to write the book, first published 75 years ago. -

Indian Administration

mathematics HEALTH ENGINEERING DESIGN MEDIA management GEOGRAPHY EDUCA E MUSIC C PHYSICS law O ART L agriculture O BIOTECHNOLOGY G Y LANGU CHEMISTRY TION history AGE M E C H A N I C S psychology Basic of Indian Administration Subject:BASIC OF INDIAN ADMINISTRATION Credits: 4 SYLLABUS Historical Context Administrative System at the Advent of British Rule, British Administration: 1757-1858, Reforms in British Administration: 1858 to 1919, Administrative System under 1935 Act, Continuity and Change in Indian Administration: Post 1947 Central Administration Constitutional Framework, Central Secretariat: Organization and Functions, Prime Minister's Office and Cabinet Secretariat, Union Public Service Commission/Selection Commission, Planning Process, All India and Central Services State Administration Constitutional Profile of State Administration, State Secretariat: Organization and Functions, Patterns of Relationship Between the Secretariat and Directorates, State Services and Public Service Commission Field and Local Administration Field Administration, District Collector, Police Administration, Municipal Administration, Panchayati Raj and Local Government Citizen and Administration Socio-Cultural Factors and Administration, Redressal of Public Grievances, Administrative Tribunals Judicial Administration Emerging Issues Centre-State Administrative Relationship, Decentralization Debate Pressure Groups, Relationship Between Political and Permanent Executives, Pressure Groups, Generalists and Specialists, Administrative Reforms Suggested Readings: -

Thailand, Laos, Cambodia & Vietnam 2017

Overseas SM Adventure Travel Since 1978 Ancient Kingdoms: Thailand, Laos, Cambodia & Vietnam 2017 EXTEND YOUR TRIP Burma & the Irrawaddy River Undiscovered Thailand: The River Kwai, Chiang Rai & Chiang Mai Your Travel Handbook CONTENTS Travel Documents & Entry Requirements . 3 Climate . 26 Your Passport . 3 Visas Required . 3 About Your Destinations . 30 Trusted Traveler Programs . 4 . 30 Emergency Photocopies of Key Documents . 5 OAT Trip Leaders: A World of Difference . 30 Overseas Taxes & Fees . 5 Culture & Points to Know Shopping . 35 U .S . Customs Regulations & Shipping Health . 6 Charges . 36 Is This Adventure Right for You? . 6 Steps to Take Before Your Trip . 7 Demographics & History . 38 No Vaccines Required . 7 Staying Healthy on Your Trip . 8 Resources . 53 Suggested Readings . 53 Money Matters . 10 Suggested Movies . 57 Top Three Tips . 10 Useful Websites . 59 Local Currency . 10 How to Exchange Money . 11 ATMs . 12 Credit & Debit Cards . 12 Tipping Guidelines . 13 Preparing for Your Trip . 15 Land Only Travelers . 15 Optional Tours . 15 Optional Tours: Reserve Before You Go . 16 Communications . 16 Packing . 18 Your Luggage . 19 Clothing Suggestions . 20 What to Bring . 21 Electricity . 24 2 LVC2017 07/13/2017 TRAVEL DOCUMENTS & ENTRY REQUIREMENTS Your Passport • Must be in good condition • Must be valid for at least 6 months after your scheduled return to the U.S. • Must have the required number of blank pages (details below) • The blank pages must be labeled “Visas” at the top. Pages labeled “Amendments and Endorsements” are not acceptable Need to Renew Your Passport? Contact the National Passport Information Center (NPIC) at 1-877-487-2778, or visit their website at www.travel.state.gov for information on obtaining a new passport or renewing your existing passport. -

Sr. No. Full Name Parent

Fresh Pending Parent/ Previous District of Medical Date of enquiry/ Type of Father Region of District of District of Rank Present Date of Missions (If Driving Issuance of Passport No Academic Fitness Sr. No. Full Name Gender Date of Birth Joining Police SCN or Driving Contact No CNIC No E mail Address Remarks /Husband Service Service Domicile (BPS) Posting Retirement any. Give Licence No. Driving (If Available) Qualifications Certificate Service ACE case Licence Name Details) Licence issued by etc DHQ Abadit SP DPO abaditnisar@y M.Sc 1 Nisar Ahmad Male Sahiwal Pakpattan Rawalpindi 23.12.1983 15.01.2009 22.12.2043 Nil Nil LE-17-25 Lahore M/Car/ Jeep 3334382187 DS9827782 37401-1441778-5 Attached Nisar (BPS-18) Pakpattan ahoo.com Biotechnology LTV Adil Munawar Ali Hyderabad SP adilmemon@m 2 Male Rawalpindi Chakwal DPO Chakwal 20.03.1986 01.01.2010 20.03.2046 Nil Nil LE-14-918 Rawalpindi M/Car/Jeep 3453089136 AL0205682 41303-4359568-3 M.A Yes Memon Memon Sindh (BPS-18) sn.com M/Cycle DSP/Legal i.UNMIL 2006- Operation, 07 SP Lahore (now ii.UNMIL 2009- LTV/M.Car/ afzalunmil@gm 3 Afzal Nazir Nazir Ahmad Male CCPO, Lahore Lahore Lahore 07.02.1968 01.10.1995 2/7/2028 Nil 449587 Lahore 3234949614 35202-2549452-3 BA.LLB Attached (BPS-18) SP/legal nd 10 M.Cycle ail.com under iii.UNAMID transfer) 20.03.2014 Abdul Faisalabad SP CTO, Motor Cycle/ Jivanee1@gma MBBS 1st documents 4 Ali Raza Male Faisalabad Faisalabad 05.07.19981 10.05.2011 04.05.2041 Nil Nil LE-17-56585 Lahore 3125599299 HU9897132 35202-2664713-1 Majeed Traffic (BPS-18) Faisalabad Motor Car il.com Professional not attached. -

Profile of a Burma Frontier

PART - 2 HISTORY OF THE ZO Ml (CHIN) RACE "The Chin is of interest, because he reveals the material out of which Buddhism and civilisation have between them evolved the Burmese people; the Chin, in short, is the rough wood out of which the Burman has been carved". — "The Silken East", by V. C. Scott O'Connor THE Chin Hills Gazetteer recorded the facts that Zo (Chins) and the so called Kukis were one and the same race and that Soktes, Yos and Kamhaus were one people. It further summarized the fact that all belong to one and the same Kuki race. Had the word Kuki been changed to Zo at that time, the right word for calling the various tribes and clans of the Zo race inhabiting the areas joining Burma, East Pakistan and Assam would have been answered a long time ago. This publication was rare for a long time and was not available to later authors on the various races of Burma. "There can be no doubt that the Chins and the Kukis are one and the same race, for their appearance, manners, customs, and language all point to this conclusion". The Chin Hills Gazetteer 1896 chap xii pp 135. "Sections of the Chins who have migrated into Burma from the Tibetan plateau almost in a straight line down south are to be found from the Somra Hill Tracts down Cape Negrais. The Chins, the people living in the northern Chin Hills believed then mostly that their foremost fathers settled in Cimnuai, Saizing from where they spread to other places in the Chin Hills.