Effects of Information, Communication

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste-Exploitants-Aeronefs.Pdf

EN EN EN COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, XXX C(2009) XXX final COMMISSION REGULATION (EC) No xxx/2009 of on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (Text with EEA relevance) EN EN COMMISSION REGULATION (EC) No xxx/2009 of on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (Text with EEA relevance) THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Community, Having regard to Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a system for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC1, and in particular Article 18a(3)(a) thereof, Whereas: (1) Directive 2003/87/EC, as amended by Directive 2008/101/EC2, includes aviation activities within the scheme for greenhouse gas emission allowance trading within the Community (hereinafter the "Community scheme"). (2) In order to reduce the administrative burden on aircraft operators, Directive 2003/87/EC provides for one Member State to be responsible for each aircraft operator. Article 18a(1) and (2) of Directive 2003/87/EC contains the provisions governing the assignment of each aircraft operator to its administering Member State. The list of aircraft operators and their administering Member States (hereinafter "the list") should ensure that each operator knows which Member State it will be regulated by and that Member States are clear on which operators they should regulate. -

Report Afraa 2016

AAFRA_PrintAds_4_210x297mm_4C_marks.pdf 1 11/8/16 5:59 PM www.afraa.org Revenue Optimizer Optimizing Revenue Management Opportunities C M Y CM MY CY CMY K Learn how your airline can be empowered by Sabre Revenue Optimizer to optimize all LINES A ® IR SSO A MPAGNIE S AER CO IEN C N ES N I A D ES A N A T C IO F revenue streams, maximize market share I T R I I O R IA C C A I N F O N S E S A S A ANNUAL and improve analyst productivity. REPORT AFRAA 2016 www.sabreairlinesolutions.com/AFRAA_TRO ©2016 Sabre GLBL Inc. All rights reserved. 11/16 AAFRA_PrintAds_4_210x297mm_4C_marks.pdf 2 11/8/16 5:59 PM How can airlines unify their operations AFRAA Members AFRAA Partners and improve performance? American General Supplies, Inc. Simplify Integrate Go Mobile C Equatorial Congo Airlines LINKHAM M SERVICES PREMIUM SOLUTIONS TO THE TRAVEL, CARD & FINANCIAL SERVICE INDUSTRIES Y CM MY CY CMY K Media Partners www.sabreairlinesolutions.com/AFRAA_ConnectedAirline CABO VERDE AIRLINES A pleasurable way of flying. ©2016 Sabre GLBL Inc. All rights reserved. 11/16 LINES AS AIR SO N C A IA C T I I R O F N A AFRICAN AIRLINES ASSOCIATION ASSOCIATION DES COMPAGNIES AÉRIENNES AFRICAINES AFRAA AFRAA Executive Committee (EXC) Members 2016 AIR ZIMBABWE (UM) KENYA AIRWAYS (KQ) PRESIDENT OF AFRAA CHAIRMAN OF THE EXECUTIVE COMMITTEE Captain Ripton Muzenda Mr. Mbuvi Ngunze Chief Executive Officer Group Managing Director and Chief Executive Officer Air Zimbabwe Kenya Airways AIR BURKINA (2J) EGYPTAIR (MS) ETHIOPIAN AIRLINES (ET) Mr. -

Airlines and Subsidy: Our Position ¬

Airlines and subsidy: our position ¬ Myth Airline subsidies are a “Gulf” problem FACT Market-distorting subsidies and government support are sadly present in every world region Myth Emirates is subsidised FACT Completely unsubsidised. We campaign against airline subsidies Myth Emirates accesses cheap or free fuel FACT False. We buy fuel from BP, Shell and Chevron in Dubai and worldwide at market rates Myth US and European airlines received support decades ago but are now subsidy-free FACT Bankruptcy protection and government bailouts continue to exist Airlines and subsidy: our position ¬ We understand that despite no evidence, an oft repeated myth can ultimately be accepted as conventional wisdom. In this document you will find our views on subsidy in the airline industry, thorough explanations about Emirates’ business model and our response to misrepresentations that have been levelled against us - from claims about subsidised fuel, financial support and staff conditions to environmental regulation and airport charges. Emirates believes: • A common set of transparent financial reporting metrics to measure and apply against all international carriers should be determined by IATA and ICAO on what defines a subsidy. • Governments should not provide injections, borrowings or financing to airlines, regardless of shareholding status. • All governments should pursue liberalisation and open skies with the objective to end the greatest subsidy of all – aero-political protection. Tim Clark, President, Emirates Airline 1 Contents ¬ Introduction -

Insight February 2010

Airline Insurance INSIGHT FEBRUARY 2010 1ST QUARTER 2010 In marked contrast to the fourth With the fourth quarter generating in excess of 70% of quarter of 2009 which saw in excess the annual premium in 2009, many in the market believe of 100 risks renew generating more that the ‘2009 Cycle’ commences on October 1, below we illustrate the percentage premium movements generated than US$1,350 million in premium; since October 2009. The premium generated since the first quarter of 2010 is likely to October 2009 totals US$1,379 million, an increase of 20% see less than 20 risks renew. compared to the previous comparable period. As would be expected, December generates the largest volume of In 2009 the quarter generated US$40 million in premium premium in the past five months. which represents less than 2% of the year’s premium income. HuLL AND LIABILITY With Blue Wings (Germany) ceasing operations and other Q4 2009 AND 2010 NET % PREMIUM MOVEMENTS programmes being incorporated into larger programmes (Bahrain Air & Wataniya Airways), although this is offset by the Air Transat renewal having extended its previous policy AS AT FEBRUARY 2010 and now renewing in March for the first time, however it is 40% 34% likely that this share will decrease slightly in 2010. 35% 30% 28% The lack of renewal activity makes it difficult to draw any 25% 23% realistic conclusions, however it would appear that insurers +20% 20% 20% are still being successful in their attempts to increase 14% premium levels. For 2010 to date, premium is showing an 15% increase of 24%, although the level of premium generated 10% currently totals just US$13 million from six renewals. -

Airbus Presentation

AirbusAirbus andand thethe MiddleMiddle EastEast aa storystory ofof historyhistory andand futurefuture Fouad Attar Head of Commercial, Airbus Middle East Muscat, 21st October 2009 a world of cultural diversity Airbus, a global company … with global outreach 20 languages 3 customer support centres More than 5,500 aircraft delivered 13 manufacturing sites 52,000 employees 315 operators 5 spares centres more than 88 nationalities 312 customers engineering design centres training centres 9 250 resident customer support managers 4 160 offices 24 hour customer support (365 days a year) 50 flight simulators 1 global company © AIRBUS S.A.S. All rights reserved. Confidential and proprietary document. SEPT 2009 2 Airbus, a long history © AIRBUS S.A.S. All rights reserved. Confidential and proprietary document. 3 Airbus, Middle East, example milestones A300 A300 Iranair Iranair ‘80 ‘80 A320 ‘92 A300 A320 ‘92 A300 A310/A300 ’93/’94 Egyptair A310/A300 ’93/’94 Egyptair Kuwait Airways A320 ’09 ‘80 Kuwait Airways A320 ’09 ‘80 Saudi Arabian Saudi Arabian A300 A300 Saudi Arabian A330 ’99 A380 ’08 Saudi Arabian A330 ’99 A321 ’03 A380 ’08 ‘84 Emirates A321 ’03 Emirates ‘84 Emirates MEA Emirates MEA A300 A340-600 ’06 A330 ’09 A300 A340-600 ’06 A330 ’09 PIA A320 ‘91 Qatar Airways Oman Air PIA A320 ‘91 Qatar Airways Oman Air ‘80 Egyptair A340 ‘94 ‘80 Egyptair A340 ‘94 Gulf Air A310 Gulf Air A310 A340-600 ’06 Kuwait Airways A340-600 ’06 Kuwait Airways A320 ‘92 Etihad ‘83 A320 ‘92 Etihad ‘83 Gulf Air Gulf Air A320 ‘90 A320 ‘90 Royal Jordanian Airbus Office Airbus Middle East Royal Jordanian Airbus Office Airbus Middle East Dubai Dubai Dubai Dubai ‘00 ‘06 ‘00 ‘06 8989 90 90 91 91 92 92 93 93 94 94 95 95 96 96 97 97 98 98 99 99 00 00 01 01 02 02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 Source data: AIRBUS © AIRBUS S.A.S. -

Prior Compliance List of Aircraft Operators Specifying the Administering Member State for Each Aircraft Operator – June 2014

Prior compliance list of aircraft operators specifying the administering Member State for each aircraft operator – June 2014 Inclusion in the prior compliance list allows aircraft operators to know which Member State will most likely be attributed to them as their administering Member State so they can get in contact with the competent authority of that Member State to discuss the requirements and the next steps. Due to a number of reasons, and especially because a number of aircraft operators use services of management companies, some of those operators have not been identified in the latest update of the EEA- wide list of aircraft operators adopted on 5 February 2014. The present version of the prior compliance list includes those aircraft operators, which have submitted their fleet lists between December 2013 and January 2014. BELGIUM CRCO Identification no. Operator Name State of the Operator 31102 ACT AIRLINES TURKEY 7649 AIRBORNE EXPRESS UNITED STATES 33612 ALLIED AIR LIMITED NIGERIA 29424 ASTRAL AVIATION LTD KENYA 31416 AVIA TRAFFIC COMPANY TAJIKISTAN 30020 AVIASTAR-TU CO. RUSSIAN FEDERATION 40259 BRAVO CARGO UNITED ARAB EMIRATES 908 BRUSSELS AIRLINES BELGIUM 25996 CAIRO AVIATION EGYPT 4369 CAL CARGO AIRLINES ISRAEL 29517 CAPITAL AVTN SRVCS NETHERLANDS 39758 CHALLENGER AERO PHILIPPINES f11336 CORPORATE WINGS LLC UNITED STATES 32909 CRESAIR INC UNITED STATES 32432 EGYPTAIR CARGO EGYPT f12977 EXCELLENT INVESTMENT UNITED STATES LLC 32486 FAYARD ENTERPRISES UNITED STATES f11102 FedEx Express Corporate UNITED STATES Aviation 13457 Flying -

Uk Air Safety List Effective 1 January 2021

UK AIR SAFETY LIST EFFECTIVE 1 JANUARY 2021 LIST OF AIR CARRIERS WHICH ARE BANNED FROM OPERATING WITHIN THE UNITED KINGDOM. Name of the legal entity of Air Operator Certificate ICAO three State of the air carrier as indicated (‘AOC’) Number or Operating letter the on its AOC (and its Licence Number designator Operator trading name, if different) AVIOR AIRLINES ROI-RNR-011 ROI Venezuela BLUE WING AIRLINES SRBWA-01/2002 BWI Suriname IRAN ASEMAN AIRLINES FS-102 IRC Iran IRAQI AIRWAYS 001 IAW Iraq MED-VIEW AIRLINE MVA/AOC/10-12/05 MEV Nigeria AIR ZIMBABWE (PVT) 177/04 AZW Zimbabwe AFGHANISTAN Afghanistan All air carriers certified by the authorities with responsibility for regulatory oversight of Afghanistan, including ARIANA AFGHAN AIRLINES AOC 009 AFG Afghanistan KAM AIR AOC 001 KMF Afghanistan ANGOLA Angola All air carriers certified by the authorities with responsibility for regulatory oversight of, with the exception of TAAG Angola Airlines and Heli Malongo, including AEROJET AO-008/11-07/17 TEJ TEJ Angola GUICANGO AO-009/11-06/17 YYY Unknown Angola AIR JET AO-006/11-08/18 MBC MBC Angola BESTFLYA AIRCRAFT AO-015/15-06/17YYY Unknown Angola MANAGEMENT HELIANG AO 007/11-08/18 YYY Unknown Angola SJL AO-014/13-08/18YYY Unknown Angola SONAIR AO-002/11-08/17 SOR SOR Angola ARMENIA Armenia All air carriers certified by the authorities with responsibility for regulatory 1 oversight of Armenia, including AIRCOMPANY ARMENIA AM AOC 065 NGT Armenia ARMENIA AIRWAYS AM AOC 063 AMW Armenia ARMENIAN HELICOPTERS AM AOC 067 KAV Armenia ATLANTIS ARMENIAN -

Commission Implementing Regulation (Eu) 2016

L 160/50 EN Official Journal of the European Union 17.6.2016 COMMISSION IMPLEMENTING REGULATION (EU) 2016/963 of 16 June 2016 amending Regulation (EC) No 474/2006 as regards the list of air carriers which are subject to an operating ban within the Union (Text with EEA relevance) THE EUROPEAN COMMISSION, Having regard to the Treaty on the Functioning of the European Union, Having regard to Regulation (EC) No 2111/2005 of the European Parliament and the Council of 14 December 2005 on the establishment of a Community list of air carriers subject to an operating ban within the Community and on informing air passengers of the identity of the operating carrier, and repealing Article 9 of Directive 2004/36/EC (1), and in particular Article 4(2) thereof, Whereas: (1) Commission Regulation (EC) No 474/2006 (2) established the list of air carriers which are subject to an operating ban within the Union, referred to in Chapter II of Regulation (EC) No 2111/2005. (2) In accordance with Article 4(3) of Regulation (EC) No 2111/2005, certain Member States and the European Aviation Safety Agency (‘EASA’) communicated to the Commission information that is relevant in the context of updating that list. Relevant information was also communicated by third countries and international organ isations. On the basis of that information, the list should be updated. (3) The Commission informed all air carriers concerned, either directly or through the authorities responsible for their regulatory oversight, about the essential facts and considerations which would form the basis for a decision to impose an operating ban on them within the Union or to modify the conditions of an operating ban imposed on an air carrier which is included in the list. -

CHAMP Cargosystems Traxon Cargohub Airline Matrix

███ New carrier CHAMP Cargosystems 1 Partner network 2 Carrier that belongs to the Leisure Cargo Group Traxon cargoHUB Airline Matrix 3Additional charges may apply List is subject to change. Terms and conditions may apply according to partners and/or airlines service availability IATA IATA IATA AWB AWB AWB Airline Name 2-letter Airline Name 2-letter Airline Name 2-letter Prefix Prefix Prefix code code code A C N Aer Lingus Ltd. 053 EI China Cargo Airlines 112 CK Nasair Eritrea 2 745 XY Aeroflot Russian Airlines 555 SU China Eastern Airlines 781 MU Neos 2 745 NO AeroUnion (Aerotransporte de Carga Unión) 873 6R China Southern Cargo 784 CZ Niki 2 745 HG AHK Air Hongkong 1 160 LD Condor 2 745 DE Nippon Cargo Airlines 1 933 KZ Air Algerie 3 NEW! 124 AH Czech Airlines 064 OK Air Baltic 1 NEW! 657 BT O - R Air Berlin 2 745 AB D - F Orbest 2 745 6O Air Canada 014 AC Delta Air Lines 006 DL Philippine Airlines 3 NEW! 079 PR Air Canada Rouge 014 AC Dragonair 1 / 3 043 KA Polar Air Cargo 403 PO Air China Int. Cooperation 1 999 CA EL AL Israel Airlines 114 LY Qantas Airways 1 081 QF Air Europa 2 745 UX Emirates Sky Cargo 176 EK Qatar Airways 1 157 QR Air France 057 AF Etihad Crystal Cargo 1 607 EY Royal Air Maroc 147 AT Air India 3 NEW! 098 AI Ethiopian Cargo 071 ET Air Italy 2 745 I9 EVA Airways 1 695 BR S Air Malta 643 KM FedEx Express 3 NEW! 023 FX SAS Scandinavian Airlines 1 117 SK Air Mauritius 239 MK Finnair Cargo 105 AY Saudi Arabian Airlines 065 SV Air New Zealand 1 086 NZ Silkway Airlines 1 NEW! 463 ZP Air Tahiti Nui 244 TN G - J Silkway -

EU) No 659/2013 of 10 July 2013 Amending Regulation (EC

L 190/54 EN Official Journal of the European Union 11.7.2013 COMMISSION IMPLEMENTING REGULATION (EU) No 659/2013 of 10 July 2013 amending Regulation (EC) No 474/2006 establishing the Community list of air carriers which are subject to an operating ban within the Community (Text with EEA relevance) THE EUROPEAN COMMISSION, the framework of Regulation (EC) No 2111/2005 and its implementing Regulation (EC) No 473/2006, with competent authorities and air carriers of the states of Having regard to the Treaty on the Functioning of the European Curaçao & St Maarten, Republic of Guinea, India, Iran, Union, Kazakhstan, Kyrgyzstan, Mozambique and Nepal. The Air Safety Committee also received updates from the Having regard to Regulation (EC) No 2111/2005 of the Commission about technical consultations with the European Parliament and the Council of 14 December 2005 Russian Federation and concerning monitoring of on the establishment of a Community list of air carriers subject Bolivia, Tajikistan and Turkmenistan. to an operating ban within the Community and on informing air passengers of the identity of the operating carrier, and repealing Article 9 of Directive 2004/36/CE ( 1 ), and in particular (6) The Air Safety Committee has heard presentations by Article 4 thereof ( 2), EASA about the results of the analysis of audit reports carried out by the International Civil Aviation Organi sation ('ICAO') in the framework of ICAO’s Universal Whereas: Safety Oversight Audit Programme ('USOAP'). Member States were invited to prioritize ramp inspections on (1) Commission Regulation (EC) No 474/2006 of 22 March air carriers licensed by states in respect of which 2006 ( 3 ) established the Community list of air carriers Significant Safety Concerns ('SSC') have been identified which are subject to an operating ban within the by ICAO or in respect of which EASA concluded that Union referred to in Chapter II of Regulation (EC) No there are significant deficiencies in the safety oversight 2111/2005. -

Travelsky Interline Traffic Agreement

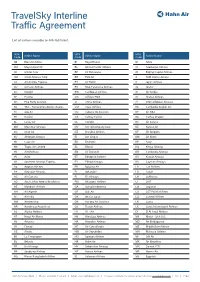

TravelSky Interline Traffic Agreement List of airlines issuable on HR-169 ticket. IATA IATA IATA Code Airline Name Code Airline Name Code Airline Name 0B Blue Air Airline BI Royal Brunei IZ Arkia 2M Maya Island Air BL Jetstar Pacific Airlines J2 Azerbaijan Airlines 3K Jetstar Asia BP Air Botswana JD Beijing Capital Airlines 3M Silver Airways Corp BR EVA Air JJ TAM Linhas Aereas 3S Air Antilles Express BT Air Baltic JL Japan Airlines 3U Sichuan Airlines BV Blue Panorama Airlines JQ Jetstar 4O Interjet BW Caribbean Airlines JU Air Serbia 5F FlyOne CG Airlines PNG JX Starlux Airlines 5H Five Forty Aviation CI China Airlines JY Intercaribbean Airways 5U TAG - Transportes Aereos Guate... CM Copa Airlines K6 Cambodia Angkor Air 7C Jeju Air CU Cubana de Aviacion K7 Air KBZ 7R Rusline CX Cathay Pacific KA Cathay Dragon 8L Lucky Air DE Condor KC Air Astana 8M Myanmar Airways DV JSC Aircompany Scat KE Korean Air 8Q Onur Air DZ Donghai Airlines KF Air Belgium 8U Afriqiyah Airways EI Aer Lingus KM Air Malta 9K Cape Air EK Emirates KP Asky 9N Tropic Air Limited EL Ellinair KQ Kenya Airways 9U Air Moldova EN Air Dolomiti KR Cambodia Airways 9V Avior ET Ethiopian Airlines KU Kuwait Airways 9X Southern Airways Express EY Etihad Airways KX Cayman Airways A3 Aegean Airlines FB Bulgaria Air LA Lan Airlines A9 Georgian Airways FI Icelandair LG Luxair AC Air Canada FJ Fiji Airways LH Lufthansa AD Azul Linhas Aereas Brasileiras FM Shanghai Airlines LI LIAT AE Mandarin Airlines GA Garuda Indonesia LM Loganair AH Air Algerie GF Gulf Air LO LOT Polish Airlines -

Annual Report Annual

LINES A IR SSO A MPAGNIES AER CO IEN C N ES N I A D ES A N A T C IO F I T R I I O R IA C C A F I N O N S E A S S A AFRAA getperformancemore Africaines Aériennes Compagnies Association des AIRLINES ASSOCIATION 2012 ANNUAL REPORT AFRICAN 2012 ANNUAL REPORT The Q400 NextGen gives Ethiopian Airlines the low operating costs and superior performance they need to increase productivity. Ethiopian Airlines has proven that it is possible for an airline to grow their business in today’s economy, by expanding into new markets and increasing frequencies. With their fl eet of Bombardier Q400 NextGen aircraft, Ethiopian Airlines has the superior productivity, increased fl exibility and reduced fl ight times they need to increase their capacity and e ciency. The Q400 NextGen aircraft is one of the most technologically advanced regional aircraft in the world. It has an enhanced cabin, low operating costs, low fuel burn and low emissions – providing an ideal balance of passenger comfort and operating economics, with a reduced environmental scorecard. Welcome to the Q economy. www.q400.com Bombardier, NextGen and Q400 are Trademarks of Bombardier Inc. or its subsidiaries. ©2012 Bombardier Inc. All rights reserved. Q400_Get more Ethiopian_A4_Oct26.indd 1 10/26/12 2:36 PM AFRAA Members> AFRAA Partners> RWANDAIR RESULTS EXPANDS ITS CRJ FLEET WITH THE SPEAK CRJ900 NEXTGEN Bombardier congratulates RwandAir on choosing the industry’s best economics and highest commonality. The CRJ900 NextGen will deliver industry-leading results to RwandAir as they expand their network and develop an e cient hub in the heart of Africa.