AFRAA Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

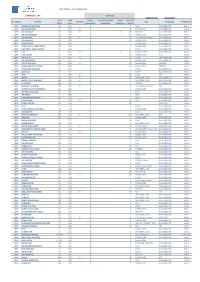

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Liste-Exploitants-Aeronefs.Pdf

EN EN EN COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, XXX C(2009) XXX final COMMISSION REGULATION (EC) No xxx/2009 of on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (Text with EEA relevance) EN EN COMMISSION REGULATION (EC) No xxx/2009 of on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (Text with EEA relevance) THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Community, Having regard to Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a system for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC1, and in particular Article 18a(3)(a) thereof, Whereas: (1) Directive 2003/87/EC, as amended by Directive 2008/101/EC2, includes aviation activities within the scheme for greenhouse gas emission allowance trading within the Community (hereinafter the "Community scheme"). (2) In order to reduce the administrative burden on aircraft operators, Directive 2003/87/EC provides for one Member State to be responsible for each aircraft operator. Article 18a(1) and (2) of Directive 2003/87/EC contains the provisions governing the assignment of each aircraft operator to its administering Member State. The list of aircraft operators and their administering Member States (hereinafter "the list") should ensure that each operator knows which Member State it will be regulated by and that Member States are clear on which operators they should regulate. -

Lufthansa Micro Focus® Quality Center on Saas Delivers a Fresh Impetus for Application Testing at Lufthansa

Customer Success Story Application Delivery Management Lufthansa Micro Focus® Quality Center on SaaS delivers a fresh impetus for application testing at Lufthansa. Overview system. Each step of the process must work in Lufthansa ranks among the top ten airlines in the perfect harmony. First, the passenger’s iden- world in terms of size and is the second largest tity is verified; this data is then compared to European airline. From its Frankfurt and Munich that on the reservation system. This is followed At a Glance hubs, Lufthansa flies to 202 destinations in 78 by the seat reservation process, calculating air countries. Besides its passenger business, the miles in the Miles & More system, and mak- ■ Industry aviation group comprises divisions for cargo, ing adjustments in the catering system for any Aerospace & Defense aircraft maintenance, IT and catering. special requests. If a suitcase is checked in, it is weighed, assigned to the passenger, and then ■ Location Cologne, Germany Challenge sent on its way to the airplane via the airport’s conveyor system. Finally, the passenger re- Today, an airline passenger can check in for ■ Challenge their flight with just a couple of taps on a ceives their boarding card with all the relevant flight information. To provide departments with tools for software mobile phone, by pressing a few buttons at testing and test management without accruing the automatic check-in machine, or having a high internal costs for IT. short conversation with the staff at the check- Lufthansa’s check-in system has more than in desk. The airlines’ goal is for this to be a 160 interfaces to other IT systems; both to in- ■ Products and Services simple, pain-free experience for passengers; ternal systems and to the systems of external Secured Quality Center licenses in a such simplicity depends on a highly complex partners such as airports. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

HOW ETHIOPIAN IS MANAGING the MAX CRISIS COMMENT ETHIOPIAN GÈRE LA CRISE DU B737MAX PAGE 15 Setting a New Benchmark in Passenger « » Comfort and Wellbeing

full page_Layout 1 25/06/2018 10:26 Page 1 africa27_cover_Layout 1 22/06/2019 11:20 Page 2 africa27_cover_Layout 1 22/06/2019 11:20 Page 1 ISSUE 3, VOLUME 7: JULY – SEPTEMBER 2019 AFRICAN AEROSPACE ISSUE 3 VOLUME 7: JULY – JULY 7: VOLUME 3 ISSUE 2019 SEPTEMBER THE MAGAZINE FOR AEROSPACE PROFESSIONALS IN AFRICA THE A330neo. www.africanaerospace.aero F LY The A330neo shares many of the same innovations as the groundbreaking A350 XWB, delivering a 25% saving in fuel consumption compared to others in the category. Both aircraft also bene t from a common type rating, which means pilot training costs are signi cantly lower too. And on top of that, they can be tted with our PUBLISHED BY TIMES GROUP AFTERMATAFTERMATH beautifully designed Airspace cabins, HOW ETHIOPIAN IS MANAGING THE MAX CRISIS COMMENT ETHIOPIAN GÈRE LA CRISE DU B737MAX PAGE 15 setting a new benchmark in passenger « » comfort and wellbeing. DEFENCE BUSINESS AVIATION HUMANITARIAN Innovation. We make it y. The battle The green Air for tactical light for response airlift industry to cyclone supremacy change devastation airbus.com PAGE 37 PAGE 50 PAGE 68 africa27_SECT_Layout 1 22/06/2019 13:45 Page 82 MAINTENANCE African aviation has a quandary: operators can’t afford to keep spending their maintenance budgets abroad, while establishing their own maintenance, repair and overhaul (MRO) facilities is prohibitively expensive. But there is movement in the right direction, as Chuck Grieve reports. Can Africa keep the wheels turning on its MRO potential? frica embodies “great unrealised importance of MRO” that the region does not The anticipated growth in African demand potential” in aircraft MRO, and a have its own facilities. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Annual Report 2015

Consistently safeguarding the future Annual Report 2015 Lufthansa Group The Lufthansa Group is the world’s leading aviation group. Its portfolio of companies consists of hub airlines, point-to-point airlines and aviation service companies. Its combination of business segments makes the Lufthansa Group a globally unique aviation group whose integrated value chain not only offers financial synergies but also puts it in a superior position over its competitors in terms of know-how. Key figures Lufthansa Group 2015 2014 Change in % Revenue and result Total revenue €m 32,056 30,011 6.8 of which traffic revenue €m 25,322 24,388 3.8 EBIT1) €m 1,676 1,000 67.6 Adjusted EBIT €m 1,817 1,171 55.2 EBITDA1) €m 3,395 2,530 34.2 Net profit / loss €m 1,698 55 2,987.3 Key balance sheet and cash flow statement figures Total assets €m 32,462 30,474 6.5 Equity ratio % 18.0 13.2 4.8 pts Net indebtedness €m 3,347 3,418 – 2.1 Cash flow from operating activities €m 3,393 1,977 71.6 Capital expenditure (gross) €m 2,569 2,777 – 7.5 Key profitability and value creation figures EBIT margin % 5.2 3.3 1.9 pts Adjusted EBIT margin % 5.7 3.9 1.8 pts EBITDA margin 1) % 10.6 8.4 2.2 pts EACC €m 323 – 223 ROCE % 7.7 4.6 3.1 pts Lufthansa share Share price at year-end € 14.57 13.83 5.3 Earnings per share € 3.67 0.12 2,958.3 Proposed dividend per share € 0.50 – Traffic figures 2) Passengers thousands 107,679 105,991 1.6 Freight and mail thousand tonnes 1,864 1,924 – 3.1 Passenger load factor % 80.4 80.1 0.3 pts Cargo load factor % 66.3 69.9 – 3.6 pts Flights number 1,003,660 1,001,961 0.2 Employees Average number of employees number 119,559 118,973 0.5 Employees as of 31.12. -

2.2 Togo Aviation

2.2 Togo Aviation Key airport information may also be found at: http://worldaerodata.com/ In Togo, the National Agency of Civil Aviation of Togo (ANAC-TOGO) created by the law n° 2007-007 of January 22nd, 2007 bearing the code of the civil aviation, is the authority in charge of the implementation of international standards and recommendations and the implementation of the Togolese State's civil aviation policy. In this capacity, ANAC-TOGO is responsible for: the execution of the State's civil aviation policy the negotiation of international agreements in the context of special powers and warrants conferred by the State the development of a technical regulation of civil aviation in accordance with the standards of the International Civil Aviation Organization (ICAO) the development and implementation of the Civil Aviation and Air Transport Strategy in accordance with the National Priority Guidelines the monitoring of the application of the national regulations in force and of the international conventions signed and ratified by Togo about safety, security and facilitation the management of all traffic rights resulting from air agreements signed by the State the coordination and supervision of all aeronautical and airport activities and the monitoring of the activities of international and regional organizations working in the field of civil aviation monitoring the management of the land assets of the State assigned to civil aviation monitoring of the State's commitments in the field of civil aviation The Agency represents the State in the commissions, committees, assemblies and councils whose object relates to its missions. ASKY Airlines serves 19 scheduled destinations throughout West and Central Africa from its hub at Lomé airport. -

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies. -

Amended Master AFI RVSM Height Monitoring 26 Aug 2020.Xlsx

AFI RVSM DATABASE CURRENT AT 26 Aug 2020 ICAO Acft Type Reg. No. Operator Acft Op ICAO RVSM Yes/No RVSM Approval Date Operator Country B772 D2TED TAAG DTA Yes 23/09/2008 Angola B772 D2TEE TAAG DTA Yes 23/09/2008 Angola B772 D2TEF TAAG DTA Yes 23/09/2008 Angola B773 D2TEG TAAG DTA Yes 01/11/2011 Angola B773 D2TEH TAAG DTA Yes 01/11/2011 Angola B773 D2TEI TAAG DTA Yes 25/06/2014 Angola B773 D2TEJ TAAG DTA Yes 10/05/2016 Angola B773 D2TEK TAAG DTA Yes 15/02/2017 Angola B737 D2TBF TAAG DTA Yes 23/09/2008 Angola B737 D2TBG TAAG DTA Yes 23/09/2008 Angola B737 D2TBH TAAG DTA Yes 23/09/2008 Angola B737 D2TBJ TAAG DTA Yes 23/09/2008 Angola B737 D2TBK TAAG DTA Yes 19/12/2011 Angola C750 D2EZR Angolan Air Operator DCD Yes 18/02/2009 Angola E145 D2FDF AeroJet IGA Yes 23/07/2018 Angola C560 D2EBA AeroJet IGA Yes 29/07/2009 Angola E145 D2EBP AeroJet IGA Yes 29/08/2013 Angola C550 D2EPI EMCICA IGA Yes 30/11/2016 Angola F900 D2ANT Government of Angola IGA Yes 05/11/2014 Angola GLEX D2ANG Government of Angola IGA Yes 23/04/2008 Angola GLEX D2ANH Government of Angola IGA Yes 04/12/2017 Angola C550 D2GES Humbertico IGA Yes 19/12/2017 Angola E135 D2FIA SJL Aeronautica IGA Yes 08/02/2019 Angola C680 D2EPL Socolil-Aeronautica SOR Yes 28/03/2018 Angola B737 D2EWS Sonair SOR Yes 07/12/2010 Angola B737 D2EVW Sonair SOR Yes 07/12/2010 Angola B721 D2ESU Sonair SOR Yes 13/09/2006 Angola BE40 A2WIN NAC Botswana NAC Yes 29/04/2011 Botswana BE40 A2DBK FT Meat Packaging Processing IGA Yes 13/05/2011 Botswana GLEX OK1 Botswana Defence Force BDF Yes 21/10/2009 Botswana C550 A2BCL BCL BCL Yes 06/10/2011 Botswana H25B A2MCB Kalahari Air Services IGA Yes 23/01/2013 Botswana B722 XTBFA Government of Burkina Faso IGA Yes 12/04/2007 Burkina Faso E170 XTABS Air Burkina VBW Yes 29/12/2017 Burkina Faso E170 XTABT Air Burkina VBW Yes 29/12/2017 Burkina Faso E190 XTABV Air Burkina VBW Yes 27/06/2019 Burkina Faso E190 XTABY Air Burkina VBW Yes 27/06/2019 Burkina Faso E190 XTABZ Air Burkina VBW Yes 27/06/2019 Burkina Faso B752 D4CBP TACV.