Net Profit Increase 6,877% from 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asiasoft Partners with Blizzard Entertainment to Bring Heroes of the Storm™ to 4 Southeast Asian Countries

Asiasoft partners with Blizzard Entertainment to bring Heroes of the Storm™ to 4 Southeast Asian Countries Bangkok, 29 April 2014 - Asiasoft Corporation Public Limited Company ("Asiasoft") today announced a partnership with Blizzard Entertainment, Inc. to bring Heroes of the Storm™ to four Southeast Asian countries: Thailand, Singapore, Malaysia and the Philippines. Since October 2011, Asiasoft has been Blizzard Entertainment's exclusive distribution partner in Thailand, Singapore and Malaysia, providing marketing and channeling for Blizzard's best-selling games such as: Diablo® III, World of Warcraft®: Mists of Pandaria™, StarCraft II®: Heart of the Swarm®, and most recently, Diablo® III: Reaper of Souls™. As of December 2013, in an effort to bring Blizzard games to more players in the region, the partnership has expanded to include the Philippines. Unveiled at BlizzCon® in October 2013, Heroes of the Storm is a free-to-play online team brawler starring iconic characters from Blizzard's franchises: Warcraft, StarCraft and Diablo. Players will be able to customize heroes from across every Blizzard universe, teaming up with friends to engage in fast-paced gameplay across varied battlegrounds that impact team strategy. Heroes of the Storm is currently in the Technical Alpha phase and is being developed for Windows and Mac platforms. "Heroes of the Storm will bring together many of the most popular heroes and villains from more than 20 years of Blizzard games," said Paul Sams, COO of Blizzard Entertainment. "Our focus on team combat and map-based objectives make the game accessible to new players, while offering depth for competitive gamers as well. We believe gamers in Thailand, Singapore, Malaysia and Philippines will love playing Heroes of the Storm." "On behalf of Asiasoft and its subsidiaries, we are honored to be Blizzard's partner in bringing Heroes of the Storm to gamers in Thailand, Singapore, Malaysia and Philippines," said Pramoth Sudjitporn, CEO of Asiasoft Corporation Public Limited Company. -

Xxxxxxxxxxxxx. This Is a Massively Multiplayer Online Game (MMOG) Game Developed by T3 Entertainment, a Company That Is Based in South Korea

xxxxxxxxxxxxx. This is a massively multiplayer online game (MMOG) game developed by T3 Entertainment, a company that is based in South Korea. It is an advanced casual rhythm and dance game. xxxxxxxxx is one of the top games due to its music video format, which allows users to play by using fingers to type and perform dance sequence icons. The game is targeted toward female teenagers, as this game allows gamers to develop their characters as well as interact with other gamers. xxxxxxxxxxxx. This is the first 2D side-scrolling, real-time online fighting game in the world that makes possible for six players to play at one time and fight each other. The game, which is published by xxxxxxxx in Indonesia, has received the x Malaysia The same top 5 game titles played in Malaysia in 2010 continue to dominate the market this year. xxxxxxxxxxx. This is an FPS in which players join either the SAS or Delta Force. Each team attempts to complete their mission/objective and/or eliminate the opposing team. The plot is based on the film TaeGukGi: Brotherhood of War. xx. xxxxx is an online FPS realistic game with modern settings. Similar with Counter Strike, xxx is a shooting game based on multiple team play. Players start by choosing their character. This game has four modes: L Team Death Match, Team Match, Ghost Match, and Annihilation Match. xxxx is an FPS tactical online game which was developed by a South Korean developer, Smile Gate and was published by Neowiz, also from Korea. xxxxxxxxxxxxxx. This is an MMOG game developed by T3 Entertainment, a company that is based in South Korea. -

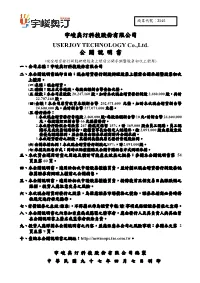

宇峻奧汀科技股份有限公司USERJOY TECHNOLOGY Co.,Ltd. 公開說明書

股票代號:3546 宇峻奧汀科技股份有限公司 USERJOY TECHNOLOGY Co.,Ltd. 公 開 說 明 書 (現金增資發行新股辦理股票上櫃前公開承銷暨股票初次上櫃用) 一、公司名稱:宇峻奧汀科技股份有限公司 二、本公開說明書編印目的:現金增資發行新股辦理股票上櫃前公開承銷暨股票初次 上櫃用。 (一)來源:現金增資。 (二)種類:記名式普通股,每股面額新台幣壹拾元整。 (三)股數:本公司原股數 20,247,160 股,加計本次現金增資發行新股 2,460,000 股,共計 22,707,160 股。 (四)金額:本公司原實收資本額新台幣 202,471,600 元整,加計本次現金增資新台幣 24,600,000 元,共計新台幣 227,071,600 元整。 (五)發行條件: 1.本次現金增資發行普通股 2,460,000 股,每股面額新台幣 10 元,計新台幣 24,600,000 元,每股議訂以新台幣 66 元溢價發行。 2.本次發行除依公司法第 267 條規定保留 15%,計 369,000 股由員工認購,員工認 購不足或放棄認購部份,授權董事長洽特定人認購外,餘 2,091,000 股由原股東放 棄優先認購權利,並全數委由證券承銷商對外公開承銷。 3.本次增資發行之新股,其權利義務與原已發行普通股相同。 (六)公開承銷比例:本次現金增資發行新股之85%,計2,091,000股。 (七)承銷及配售方式:同時以詢價圈購及公開申購配售方式辦理承銷。 三、本次資金運用計畫之用途及預計可能產生效益之概要:參閱本公開說明書第 54 頁至第 60 頁。 四、本公開說明書,適用於初次申請股票櫃檯買賣,並計劃以現金增資發行新股委託 推薦證券商辦理上櫃前之公開銷售。 五、本公開說明書,適用於初次申請股票櫃檯買賣,掛牌後首五個交易日無漲跌幅之 限制,投資人應注意交易之風險。 六、本次現金增資所發行之股票,為因應證券市場價格之變動,證券承銷商必要時得 依規定進行安定操作。 七、有價證券之生效(核准),不得藉以作為證實申報(請)事項或保證證券價值之宣傳。 八、本公開說明書之內容如有虛偽或隱匿之情事者,應由發行人及其負責人與其他曾 在公開說明書上簽名或蓋章者依法負責。 九、投資人應詳閱本公開說明書之內容,並應注意本公司之風險事項:參閱本文第 2 頁至第 9 頁。 十、查詢本公開說明書之網址:http://newmops.tse.com.tw。 宇峻奧汀科技股份有限公司編製 中華民國九十七年四月七日刊印 本公司申請已公開發行普通股 20,247,160 股上櫃乙案,業經財團法人中華民國證券櫃檯買賣 中心依據「財團法人中華民國證券櫃檯買賣中心證券商營業處所買賣有價證券審查準則」審 查後,同意俟股票公開銷售完畢後,列為上櫃股票,並以九十六年十二月二十七日證櫃審字 第 0960038578 號函報奉行政院金融監督管理委員會九十六年十二月二十五日金管證一字第 0960074106 號函准予備查。本次辦理現金增資發行普通股 2,460,000 股,每股面額 10 元, 總額新台幣 24,600,000 元,業經行政院金融監督管理委員會九十七年一月十日金管證一字第 0960075497 號函准予申報生效,現金增資後資本額為新台幣 227,071,600 元。 一、 本次發行前實收資本之來源: 單位:新台幣元 實收資本來源 金 額 佔實收資本比率 創立資本 825,000 0.41% 現金增資 33,772,840 16.68% 合併增資 52,105,160 25.73% 盈餘轉增資 115,768,600 57.18% 合 計 202,471,600 100.00% 二、公開說明書之分送計劃: -

Massively Multiplayer Online Role Playing Games (Mmorpgs) in Malaysia

Massively Multiplayer Online Role Playing Games (MMORPGs) in Malaysia: The Global-Local Nexus A thesis presented to the faculty of the Center for International Studies of Ohio University In partial fulfillment of the requirements for the degree Master of Arts Benjamin Y. Loh August 2013 © 2013 Benjamin Y. Loh. All Rights Reserved. 2 This thesis titled Massively Multiplayer Online Role Playing Games (MMORPGs) in Malaysia: The Global-Local Nexus by BENJAMIN Y. LOH has been approved for the Center for International Studies by Yeong H. Kim Associate Professor of Geography Christine Su Director, Southeast Asian Studies Ming Li Interim Executive Director, Center for International Studies 3 ABSTRACT LOH, BENJAMIN Y., M.A., August 2013, Asian Studies Massively Multiplayer Online Role Playing Games (MMORPGs) in Malaysia: The Global-Local Nexus Director of Thesis: Yeong H. Kim Massively Multiplayer Online Role-Playing Games (MMORPGs) are online entities that are truly global and borderless by nature, but in smaller countries like Malaysia, they are licensed by global developers to local publishers to be localized for local players. From a globalization perspective this appears to be a one-way, top-down relationship from the global to the local. However, this is not the case as the relationship is interchangeable, known as the Global-Local Nexus, as neither of these forces has control over the other, but at the same time they have great influence over one another. This thesis examines the Global-Local Nexus in MMORPGs industry in Malaysia between global developers and local publishers and players. The research was conducted through a series of personal interviews with local publisher representatives and local players. -

G-Star Floor Plan(B2B)

FLOOR PLAN(B2B) 3F (F~L) L01 L02 L03 L04 L05 L06 L07 L08 L09 L11 L12 L13 L14 L15 L17 L18 L19 L20 L21 L22 L24 L25 L26 L27 L28 L29 L30 L31 L32 L33 L34 L35 L36 L37 L38 L39 L40 L41 L42 L44 L45 L46 L47 L48 L49 L50 L51 F13 F45 F73 F83 F99 G25 G58 G64 H41 H45 H96 H99 I17 I68 I64 J48 J50 J44 J81 J87 K29 K30 G19 H91 H92 H93 H94 I61 I62 I63 J41 J42 J43 F12 K25 F11 F72 F82 F97 F10 H21 H86 H87 H89 H90 I01-1 I41 J36 J39 K40 F09 F71 F81 H71 J21 J30 K36 F91 G15 G16 G17 G43 J66 J75 K21 K22 K23 K16 F08 F40 F42 F43 F44 F69 F79 G13 G18 G14 K13 F06 F35 F36 F37 F38 F39 G10 G11 G12 F05 F15 F68 F78 H01 H51 I01 I21 J01 K35 F04 F67 F77 F85 G07 G08 G09 G28 G34 J56 J59 K09 K10 K11 K12 K34 F03 F66 F76 G04 G05 G06 K01 K08 K32 F02 F65 F75 G01 G02 G03 J51 J53 J54 K07 F01 K31 1F (M~Q) Q01 Q02 Q03 Q04 Q05 Q06 Q07 Q08 Q09 Q10 Q11 Q12 Q13 Q15 Q16 Q17 Q18 Q19 Q20 Q21 Q22 Q23 Q25 Q26 Q27 Q28 Q30 Q31 Q32 Q33 Q35 Q37 M58 M66 M72 M78 N33 N36 N39 N42 N83 N89 O41 O55 O98 O107 P43 P45 P52 P56 P57 M65 M71 M76 N31 N35 N38 N41 O50 P53 P54 M11 P88 M64 N34 N37 N40 P41 P49 P50 M36 M37 M39 P67 M10 MC1 MC1 MC1 MC1 M32 M09 M57 M63 M69 M74 N01-1 N63 O21 O78 P21 M08 M28 M56 M62 M68 M07 M24 M25 M26 M55 M61 M67 M73 M06 P86 M05 MC1 MC1 MC1 MC1 M04 M12 M14 M50 M52 M54 N01 N43 O01 O58 P01 P58 P82 M02 M40 M42 M01 Exhibitor Name Booth # Exhibitor Name Booth # Exhibitor Name Booth # Exhibitor Name Booth # Exhibitor Name Booth # 17173.COM I01 CRAZYMEET GAMES F15 IDREAMSKY L14 MOTION TECHNOLOGIES F83 SOFT-WORLD MYCARD G08 1SDK K01 CRETA GAMES Inc. -

Asiasoft Corporation PLC. (AS)

Asiasoft Corporation PLC. (AS) Asiasoft Talk 2014 3rd March 2014 DisclaimerAgenda . The information contained in this presentation is for information purposes only and does not constitute an offer or invitation to sell or the solicitation of an offer or invitation to purchase or subscribe for shares of Asiasoft Corporation Pcl. (“Asiasoft”) in any jurisdiction nor should it or any part of it form the basis of, or be relied upon in any connection with, any contract or commitment whatsoever. This presentation may include information which is forward-looking in nature. Forward-looking information involve known and unknown risks, uncertainties and other factors which may impact on the actual outcomes, including economic conditions in the markets in which Asiasoft operates and general achievement of Asiasoft business forecasts, which will cause the actual results, performance or achievements of Asiasoft to differ, perhaps materially, from the results, performance or achievements expressed or implied in this presentation . This presentation has been prepared by Asiasoft. The information in this presentation has not been independently verified. No representation, warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information and opinions in this presentation. None of Asiasoft or any of its agents or advisers, or any of their respective affiliates, advisers or representatives, shall have any liability (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation . This presentation is made, furnished and distributed for information purposes only. -

Uncharted Business Pte Ltd V Asiasoft Online Pte

Uncharted Business Pte Ltd v Asiasoft Online Pte Ltd [2009] SGHC 188 Case Number : Suit 42/2008 Decision Date : 21 August 2009 Tribunal/Court : High Court Coram : Lee Seiu Kin J Counsel Name(s) : Lionel Tan I Kwok and Lye Yi Xiang (Rajah & Tann LLP) for the plaintiff; Cheong Yuen Hee (Y H Cheong) and Yeh Siang Hui (J S Yeh & Co) for the defendant Parties : Uncharted Business Pte Ltd — Asiasoft Online Pte Ltd Contract 21 August 2009 Lee Seiu Kin J: 1 This suit turned on whether the defendant’s letter of 26 April 2006 (“the Termination Letter”), which gave notice of termination of the appointment of the plaintiff as exclusive e-Pin distributor for three years of all the defendant’s licensed products and services with effect from 1 July 2006, entitled the plaintiff to damages against the defendant under a contract between the parties entitled “Memorandum of Understanding” dated 26 August 2005 (“the MOU”). 2 The plaintiff is a Singapore company in the business of management and consultancy services and the development of e-commerce applications. The people behind the plaintiff are its business advisor, Kang Yong Wah (“Addison”) and one of its directors, Liew Chee Yuan (“Stanley”). The defendant is a Singapore company in the business of internet gaming. It is a wholly owned subsidiary of Asiasoft International Co Ltd (“AI”), a company incorporated in Thailand. The directors of the defendant are Tan Tgow Lim (“Sherman”) and Pramoth Sudjitporn (“Pramoth”). 3 The background to the matter goes back to 2003, when Addison and Stanley were working in a company called SG Web Pte Ltd (“SG Web”). -

Game for Garena

JULY 2015 EDITION Singapore online all-in-one + Cop Turned (gay) Cupid july 2015 • www.forbes.com our Top 200 Smaller CompanieS ViTamin Vim liang yunChao’S By-healTh SweepS ChineSe reTail AustrAliA..............A $10.00 indiA...........................rs 300 KoreA......................w 9,000 pAKistAn...................rs 600 tAiwAn....................nt $250 chinA...................rmb 85.00 indonesiA...........rp 75,000 mAlAysiA...............rm 24.00 philippines.................p 250 thAilAnd.....................b 250 hong Kong................hK $75 jApAn.................¥1238 + tAX new ZeAlAnd.......nZ $12.00 singApore..............s $12.00 united stAtes.......us $10.00 Game For Garena Singapore’s first billion-dollar Web play is now well beyond fantasy play. But from the outset it’s been lifted by angels. BY JESSICA TAN n a balmy Sunday in June 2005 Forrest Li at- learned the recipe, but we’ve made it Peranakan”—Straits- tended his girlfriend’s graduation at Stanford, born cuisine with both Chinese and Malay influences. where he was an M.B.A. student. That morning Since founding Garena in 2009, Li has built it into Singapore’s Steve Jobs delivered his unforgettable com- first billion-dollar Internet company. An investment by the On- mencement speech, urging the class to “stay tario Teachers’ Pension Plan earlier this year, though unspeci- Ohungry, stay foolish.” fied, was reported to value Garena at US$2.5 billion. It publishes Li took Jobs seriously. Today, in a sprawling lounge area of free-to-play cult games like League of Legends and FIFA Online his spanking new 7,500-square-meter Silicon Valley-inspired 3 on its multiplayer platform Garena+, where users also can do office in Singapore, the 37-year-old entrepreneur from Tian- their social networking. -

One Neoliberalism, Many Resistances by Dennis R. Redmond

Copyright 2012 Dennis R. Redmond VIDEOGAME CULTURE AS TRANSNATIONAL MEDIA: ONE NEOLIBERALISM, MANY RESISTANCES BY DENNIS R. REDMOND DISSERTATION Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Communications in the Graduate College of the University of Illinois at Urbana-Champaign, 2012 Urbana, Illinois Doctoral Committee: Professor Angharad Valdivia, Chair Professor Isabel Molina Professor Antoinette Burton Professor Paula Treichler, Emeritus ABSTRACT This dissertation analyzes two best-selling videogames, Hideo Kojima's Metal Gear Solid 4 (2008) and Square Enix' Final Fantasy 12 (2006), as sites of contestation between commercial media corporations on the one hand, and communities of artists, consumers and non-commercial digital users on the other. I argue that Metal Gear Solid 4 rewrites the stealth espionage thriller into a critique of neoliberalism's financial speculations and neocolonial wars, while Final Fantasy 12 rewrites the fantasy role-playing videogame into a critique of the colonial and neocolonial legacies of fantasy and role-playing fiction. Using the tools of critical communications theory, postcolonial media studies, and digital media scholarship, I argue that these videogames narrate the struggle between neoliberalism (i.e. the ideology of late 20 th century market fundamentalism which exerted global hegemony during the thirty years from 1975 to 2005) and a wide range of anti-neoliberal social movements, developmental states (especially those of the BRIC nations, i.e. Brazil, Russia, India and China), and non-commercial networks of digital production, distribution and consumption. I also argue that these videogames frame the politics of transnational media production and transnational audience reception in productive ways. -

Asiasoft Corporation PLC. (AS) Opportunity Day 4Q12

Asiasoft Corporation PLC. (AS) Opportunity Day 4Q12 7th March 2013 DisclaimerAgenda . The information contained in this presentation is for information purposes only and does not constitute an offer or invitation to sell or the solicitation of an offer or invitation to purchase or subscribe for shares of Asiasoft Corporation Pcl. (“Asiasoft”) in any jurisdiction nor should it or any part of it form the basis of, or be relied upon in any connection with, any contract or commitment whatsoever. This presentation may include information which is forward-looking in nature. Forward-looking information involve known and unknown risks, uncertainties and other factors which may impact on the actual outcomes, including economic conditions in the markets in which Asiasoft operates and general achievement of Asiasoft business forecasts, which will cause the actual results, performance or achievements of Asiasoft to differ, perhaps materially, from the results, performance or achievements expressed or implied in this presentation . This presentation has been prepared by Asiasoft. The information in this presentation has not been independently verified. No representation, warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information and opinions in this presentation. None of Asiasoft or any of its agents or advisers, or any of their respective affiliates, advisers or representatives, shall have any liability (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation . This presentation is made, furnished and distributed for information purposes only. -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D. C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 Commission File Number: 000-30540 GIGAMEDIA LIMITED (Exact name of registrant as specified in its charter) REPUBLIC OF SINGAPORE (Jurisdiction of incorporation or organization) 10TH FLOOR, 392 RUIGUANG ROAD, TAIPEI, TAIWAN, R.O.C. (Address of principal executive offices) JOHN R. STRINGER, Chief Executive Officer 10TH FLOOR, 392 RUIGUANG ROAD, TAIPEI, TAIWAN, R.O.C. Tel: 886-2-2656-8000; Fax: 886-2-2656-8003 Securities registered or to be registered pursuant to Section 12(b) of the Exchange Act: Title of Each Class Name of Each Exchange on Which Registered Ordinary Shares The NASDAQ Stock Market LLC Securities registered or to be registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 50,719,976 ordinary shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ⌧ If this annual report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. -

Asiasoft Opportunity Day Group Performance-Q3/2020 CONTENT 2

Asiasoft Opportunity Day Group Performance-Q3/2020 CONTENT 2 01 Company Highlight Q3 02 Market and Industry outlook 03 Financial Information 04 Going Forward 05 Question and Answer 3 • 3 Games launch in Q3 2020 • Revenue reach Baht 1 Billion accumulate 9 months • Revenue increase 65% YoY in Q3 2020 • Gross Profit increase 76% YoY in Q3 2020 • Net Profit increase 183% YoY in Q3 2020 Market and Industry outlook GAME INDUSTRY OUTLOOK AFTER PANDEMIC 5 • The games market will to grow to $217.9 billion by 2023, representing a strong +9.4% CAGR between 2018 and 2023. This is up from previous forecast of $200.8 billion. (CAGR 7.7%) Reference from www.Newzoo.com 2020 GLOBAL GAME MARKET AFTER PANDEMIC 6 Reference from www.Newzoo.com SEA GAME MARKET STATISTICS 2019 7 Statistics Indonesia Malaysia Philippines Singapore Thailand Vietnam (by Million) Population 269.5 100% 32.5 100% 108.1 100% 5.9 100% 69.3 100% 97.4 100% Online Population 91 34% 27.6 85% 70.9 66% 5.1 86% 40.1 58% 55.4 57% Game Enthusiasts 62.6 23% 20.2 62% 46.7 43% 3.6 61% 30.4 44% 39.3 40% Gamers 55.1 20% 19.1 59% 43.4 40% 3.4 58% 27.8 40% 36.5 37% Paying Gamers 33.5 12% 10.3 32% 22.6 21% 1.5 25% 16.3 24% 21.4 22% Games Revenues (Million USD) 1,404 697 586 322 777 531** Annual Spend/Payer (Million USD) 42 68 26 212 48 25 YoY Growth 29.6% 10.2% 27.3% 0.9% 16.6% 12.4% ** Exclude Game Revenue From 3rd Party Reference from www.Newzoo.com SEA GAMERS PER SEGMENT 2019 8 Browser PC Games Downloaded/Boxed PC Games 49.5 Smartphone Games Tablet Games Console Games 38.6 34 24.2 23.4 23 21.7 Gamers