Airtran Airways: the Present Is Good, the Future Is Great

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Save a Turbine Engine: Serve It Water

Clare Leavens Award Joe Chase Award Aviall High Achievement Award Transport Canada Approved for R/T Save a turbine engine: serve it water Minimum equipment lists and dispatch deviation guides PAMA and AME news February -March 2015 Volume 13/Issue 5 Publication Mail Agreement No. 0041039024 and Return Undeliverable Canadian Addresses to Alpha Publishing Group (2004) Inc. Unit 7, 11771 Horseshoe Way, Richmond, BC, V7A 4V4 email: [email protected] $7.95 AMU-OFC-IFC.indd 1 1/29/15 7:28 PM AMU-OFC-IFC.indd 2 1/29/15 7:28 PM In perspective: Departments the P&WC PT6 nd here some of you thought Gran- 4 Upcoming Events dad put a lot of miles and years on his good ol’ Harley Flathead 45. Hah! 6 STCs & New Products AThat was nothing. Pratt & Whitney Canada 8 Industry Forum recently tweeted out that its venerable PT6 turbine has now clocked 400 million hours 20 AME Association of flight operation. and PAMA News Four hundred million! What does that 39 Classified even mean? Let’s calculate (roughly): There are 8,760 hours in any 365-day year. Di- 42 AMU Chronicles vide 400 million by 8,760 and you get By Sam Longo 45,662.100456621. Round that number off — without fac- toring in Leap, Aztec or dog years (this is al- Features ready getting too complicated for my lousy math)—and you’re now standing at 46,000 10 subscribe and download at www.amumagazine.com AMU is viewable online: years of service. Did I just do that right? As- Save a Turbine Engine: Serve it Water 10 suming I did (and that’s a big ask, I know) By Mike Broderick then we can break down that history into bite-sized pieces. -

164 - 41 NMB No

NATIONAL MEDIATION BOARD WASHINGTON, DC 20572 (202) 692-5000 In the Matter of the Application of the 41 NMB No. 39 SOUTHWEST AIRLINES PILOTS CASE NO. R-7403 ASSOCIATION (File No. CR-7125) alleging a representation dispute FINDINGS UPON pursuant to Section 2, Ninth, of INVESTIGATION the Railway Labor Act, as amended August 5, 2014 involving employees of SOUTHWEST AIRLINES CO. AND AIRTRAN AIRWAYS This determination addresses the application filed pursuant to the Railway Labor Act (RLA)1 by the Southwest Airlines Pilots Association (SWAPA). SWAPA requests the National Mediation Board (NMB or Board) to investigate whether Southwest Airlines Co. (Southwest) and AirTran Airways (AirTran) (collectively the Carriers) are operating as a single transportation system. The investigation establishes that Southwest and AirTran are operating as a single transportation system for the craft or class of Pilots. PROCEDURAL BACKGROUND On May 2, 2011, Southwest Airlines Co. acquired one hundred percent of the outstanding stock of AirTran Holdings, Inc., the former parent company of AirTran. AirTran operates as a wholly-owned subsidiary of Southwest. The integration process is expected to be finalized by the end of 2014, at which time AirTran will no longer exist. 1 45 U.S.C. § 151, et seq. - 164 - 41 NMB No. 39 On June 3, 2014, SWAPA filed an application alleging a representation dispute involving the craft or class of Pilots. The Pilot craft or class at Southwest is represented by SWAPA pursuant to voluntary recognition. Pilots at AirTran are represented by the Air Line Pilots Association (ALPA) under the Board’s certification in NMB Case Nos. -

Traffic Report

TRAFFIC REPORT PALM BEACH INTERNATIONAL AIRPORT PERIOD ENDED NOVEMBER 2008 2008/Nov 2007/Nov Percent Change 12 Months 12 Months Percent Change Ended Ended November 2008 November 2007 Total Passengers 493,852 561,053 -11.98% 6,521,590 6,955,356 -6.24% Total Cargo Tons * 1,048.7 1,456.6 -28.00% 15,584.7 16,083.5 -3.10% Landed Weight (Thousands of Lbs.) 326,077 357,284 -8.73% 4,106,354 4,370,930 -6.05% Air Carrier Operations** 5,099 5,857 -12.94% 67,831 72,125 -5.95% GA & Other Operations*** 8,313 10,355 -19.72% 107,861 118,145 -8.70% Total Operations 13,412 16,212 -17.27% 175,692 190,270 -7.66% H17 + H18 + H19 + H20 13,412.0000 16,212.0000 -17.27% 175,692.0000 190,270.0000 -7.66% * Freight plus mail reported in US tons. ** Landings plus takeoffs. *** Per FAA Tower. PALM BEACH COUNTY - DEPARTMENT OF AIRPORTS 846 Palm Beach Int'l. Airport, West Palm Beach, FL 33406-1470 or visit our web site at www.pbia.org TRAFFIC REPORT PALM BEACH INTERNATIONAL AIRPORT AIRLINE PERCENTAGE OF MARKET November 2008 2008/Nov 12 Months Ended November 2008 Enplaned Market Share Enplaned Market Share Passengers Passengers Total Enplaned Passengers 246,559 100.00% 3,273,182 100.00% Delta Air Lines, Inc. 54,043 21.92% 676,064 20.65% JetBlue Airways 50,365 20.43% 597,897 18.27% US Airways, Inc. 36,864 14.95% 470,538 14.38% Continental Airlines, Inc. -

1995 Annual Report

Southwest Airlines Co. 1995 Annual Report OUR 6 SECRETS OF SUCCESS Table of Contents Consolidated Highlights ..................................................................2 Introduction .....................................................................................3 Letter to Shareholders.....................................................................4 1. Stick To What You’re Good At ....................................................4 2. Keep It Simple .............................................................................8 3. Keep Fares Low, Costs Lower ..................................................10 4. Treat Customers Like Guests....................................................12 5. Never Stand Still .......................................................................14 6. Hire Great People .....................................................................16 Looking Ahead ..............................................................................18 Destinations ..................................................................................20 Financial Review ...........................................................................21 Management’s Discussion and Analysis .......................................21 Consolidated Financial Statements...............................................27 Report of Independent Auditors ....................................................39 Quarterly Financial Data ...............................................................40 Common Stock Price Ranges -

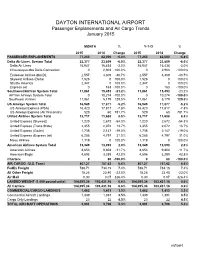

DAYTON INTERNATIONAL AIRPORT Passenger Enplanements and Air Cargo Trends January 2015

DAYTON INTERNATIONAL AIRPORT Passenger Enplanements and Air Cargo Trends January 2015 MONTH % Y-T-D % 2015 2014 Change 2015 2014 Change PASSENGER ENPLANEMENTS 77,253 82,000 -5.8% 77,253 82,000 -5.8% Delta Air Lines, System Total 22,377 23,809 -6.0% 22,377 23,809 -6.0% Delta Air Lines 15,947 16,434 -3.0% 15,947 16,434 -3.0% Chautauqua dba Delta Connection 0 2,903 -100.0% 0 2,903 -100.0% Endeavor Airlines dba DL 2,557 4,309 -40.7% 2,557 4,309 -40.7% Skywest Airlines (Delta) 1,526 0 100.0% 1,526 0 100.0% Shuttle America 2,347 0 100.0% 2,347 0 100.0% Express Jet 0 163 -100.0% 0 163 -100.0% Southwest/AirTran System Total 11,861 15,453 -23.2% 11,861 15,453 -23.2% AirTran Airways System Total 0 10,274 -100.0% 0 10,274 -100.0% Southwest Airlines 11,861 5,179 129.0% 11,861 5,179 129.0% US Airways System Total 16,949 17,877 -5.2% 16,949 17,877 -5.2% US Airways Express (PSA) 16,420 17,817 -7.8% 16,420 17,817 -7.8% US Airways Express (Air Wsconsin) 529 60 781.7% 529 60 781.7% United Airlines System Total 12,717 11,688 8.8% 12,717 11,688 8.8% United Express (Skywest) 1,220 2,672 -54.3% 1,220 2,672 -54.3% United Express (Trans State) 2,355 2,072 13.7% 2,355 2,072 13.7% United Express (GoJet) 1,738 2,147 -19.0% 1,738 2,147 -19.0% United Express (Express Jet) 6,285 4,797 31.0% 6,285 4,797 31.0% Mesa Airlines 1,119 0 100.0% 1,119 0 100.0% American Airlines System Total 13,349 13,093 2.0% 13,349 13,093 2.0% American Airlines 8,653 9,804 -11.7% 8,653 9,804 -11.7% American Eagle 4,696 3,289 42.8% 4,696 3,289 42.8% Charters 0 80 -100.0% 0 80 -100.0% AIR CARGO (U.S. -

Overview and Trends

9310-01 Chapter 1 10/12/99 14:48 Page 15 1 M Overview and Trends The Transportation Research Board (TRB) study committee that pro- duced Winds of Change held its final meeting in the spring of 1991. The committee had reviewed the general experience of the U.S. airline in- dustry during the more than a dozen years since legislation ended gov- ernment economic regulation of entry, pricing, and ticket distribution in the domestic market.1 The committee examined issues ranging from passenger fares and service in small communities to aviation safety and the federal government’s performance in accommodating the escalating demands on air traffic control. At the time, it was still being debated whether airline deregulation was favorable to consumers. Once viewed as contrary to the public interest,2 the vigorous airline competition 1 The Airline Deregulation Act of 1978 was preceded by market-oriented administra- tive reforms adopted by the Civil Aeronautics Board (CAB) beginning in 1975. 2 Congress adopted the public utility form of regulation for the airline industry when it created CAB, partly out of concern that the small scale of the industry and number of willing entrants would lead to excessive competition and capacity, ultimately having neg- ative effects on service and perhaps leading to monopolies and having adverse effects on consumers in the end (Levine 1965; Meyer et al. 1959). 15 9310-01 Chapter 1 10/12/99 14:48 Page 16 16 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY spurred by deregulation now is commonly credited with generating large and lasting public benefits. -

General* Virginia Private Equity Deals*

VIRGINIA M&A ACTIVITY SNAPSHOTS 2002-2006 US M&A Global M&A Year Deal Count Volume (Millions) Year Deal Count Volume (Millions) 2006 11296 $ 1,776,292.75 2006 27912 $ 3,679,516.00 2005 10348 $ 1,297,140.12 2005 24526 $ 2,627,013.25 2004 9716 $ 971,593.81 2004 22102 $ 1,914,663.25 2003 8109 $ 627,724.56 2003 19353 $ 1,221,885.25 2002 7316 $ 528,825.06 2002 18557 $ 1,130,339.12 Virginia M&A - General* Virginia Private Equity Deals* Year Deal Count Volume (Millions) Year Deal Count Volume (Millions) 2006 437 $ 49,844.53 2006 40 $ 2,345.49 2005 381 $ 51,440.98 2005 17 $ 396.05 2004 370 $ 61,057.25 2004 14 $ 598.85 2003 293 $ 16,980.39 2003 13 $ 1,604.73 2002 282 $ 21,126.50 2002 10 $ 536.20 * Any involvement: includes deals with either target, acquirer or seller * Any involvement: includes deals with either target, acquirer or seller headquartered in the state. headquartered in the state. 2006 Active Industries - VA Industry Deal Count Volume (mil) Communications 40 $ 10,190.03 Industrial 22 $ 3,710.94 Consumer, Non-cyclical 41 $ 3,248.73 Financial 57 $ 2,748.02 Technology 41 $ 655.11 * Target Only: Includes deals in which target is headquartered in the state Top 5 Deals 2006 - US * Any Involvement Announced Rank Date Total Value (mil.) Target Name Acquirer Name 1 3/ 5/06 $ 83,105.46 BELLSOUTH CORP AT&T INC 2 11/20/2006 $ 32,500.31 EQUITY OFFICE PROPERTIES TR BLACKSTONE GROUP 3 7/24/06 $ 32,193.46 HCA INC CONSORTIUM 4 5/29/06 $ 27,449.73 KINDER MORGAN INC Knight Holdco LLC 5 10/2/2006 $ 27,159.94 HARRAH'S ENTERTAINMENT INC CONSORTIUM * Bain -

United States Court of Appeals for the Ninth Circuit

Case: 11-16173 05/23/2011 ID: 7761902 DktEntry: 16-1 Page: 1 of 23 (1 of 93) No. 11-16173 IN THE UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT WAYNE TALEFF., et al . Plaintiffs-Appellants, v. SOUTHWEST AIRLINES CO., GUADALUPE HOLDINGS CORP., and AIRTRAN HOLDINGS, INC., Defendants-Appellees. On Appeal of an Interlocutory Order of the United States District Court for the Northern District of California (Case NO. 3:11-CV-2179-JW) PLAINTIFFS-APPELLANTS’ REPLY TO DEFENDANTS’ OPPOSITION TO EMERGENCY MOTION FOR INJUNCTION SEEKING TEMPORARY “HOLD SEPARATE” ORDER PENDING DISPOSITION OF MALANEY, ET AL., V. UAL CORPORATION, ET AL. AND REQUEST FOR RELIEF PENDING THIS APPEAL JOSEPH M. ALIOTO (SBN 42680) THERESA D. MOORE (SBN 99978) THOMAS P. PIER (SBN 235740) JAMIE L . MILLER (SBN 271452) ALIOTO LAW FIRM 225 BUSH STREET 16 TH FLOOR SAN FRANCISCO , CALIFORNIA 94104 TEL : (415) 434-8900 FAX : (415) 434-9200 JMILLER @ALIOTOLAW .COM TMOORE @ALIOTOLAW .COM Attorneys for Plaintiffs-Appellants Case: 11-16173 05/23/2011 ID: 7761902 DktEntry: 16-1 Page: 2 of 23 (2 of 93) TABLE OF CONTENTS SUMMARY OF THE ARGUMENT ..........................................................1 ARGUMENT .............................................................................................1 I. THIS COURT HAS JURISDICTION TO HEAR THIS APPEAL PURSUANT TO 28 U.S.C.A. SECTION 1292 AND THIS COURT’S PRIOR HOLDINGS.........................................2 A. Denial of the Temporary Restraining Order is Appealable because Denial of All Relief was Implied in the Denial by the District Court ...............................................................3 B. Denial of the Temporary Restraining Order is Appealable because Denial of the Temporary Restraining Order was Tantamount to the Denial of the Preliminary Injunction .5 1. -

TAMPA INTERNATIONAL AIRPORT Departing Flight Schedule Departures by Time - April 2014

TAMPA INTERNATIONAL AIRPORT Departing Flight Schedule Departures by Time - April 2014 Departure Arrival Time Time Cities Served Airline Aircraft Flight No. Miles Seats Days 0510 0649 Charlotte US Airways 734 815 508 144 ......7 0510 0649 Charlotte US Airways 320 1813 508 150 12345.. 0510 0649 Charlotte US Airways 319 2061 508 124 .....6. 0530 0655 Atlanta Delta Air Lines 757 2511 406 182 .....6. 0530 0656 Atlanta Delta Air Lines 739 2511 406 180 ......7 0530 0657 Atlanta Delta Air Lines M90 2511 406 160 ...4... 0530 0657 Atlanta Delta Air Lines 757 2511 406 184 123.5.. 0557 0840 Newark United Airlines 738 1612 998 152 ..3.... 0600 0749 Chicago United Airlines 752 588 1012 182 ......7 0600 0752 Chicago United Airlines 739 1142 1012 167 ..3.... 0600 0752 Chicago United Airlines 739 1280 1012 167 .2..... 0600 0752 Chicago United Airlines 739 1485 1012 167 1..45.. 0600 0815 Baltimore Southwest Airlines 73W 387 842 143 .2345.7 0600 0745 Chicago Southwest Airlines 73W 552 997 143 1...... 0600 0850 Providence Southwest Airlines 73W 939 1137 143 .2345.. 0602 0751 Chicago United Airlines 752 588 1012 182 .....6. 0610 0853 Newark United Airlines 738 1612 998 154 1..45.7 0610 0853 Newark United Airlines 739 1612 998 167 .2...6. 0615 0755 Dallas/Fort Worth American Airlines 738 1573 929 150 1234567 0615 0847 Philadelphia US Airways 320 1823 920 150 .....6. 0615 0847 Philadelphia US Airways 321 1823 920 187 ......7 0615 0745 Atlanta Southwest Airlines 73W 2953 406 143 ......7 0615 0835 Baltimore Southwest Airlines 73H 3147 842 175 .....6. -

DENVER INTERNATIONAL AIRPORT Page 1

DENVER INTERNATIONAL AIRPORT TOTAL OPERATIONS AND TRAFFIC October 2014 October YEAR TO DATE % of % of % Grand % Grand Incr./ Incr./ Total Incr./ Incr./ Total 2014 2013 Decr. Decr. 2014 2014 2013 Decr. Decr. 2014 OPERATIONS (1) Air Carrier 36,214 35,562 652 1.8% 73.3% 354,392 351,816 2,576 0.7% 73.2% Air Taxi 12,867 13,816 (949) -6.9% 26.0% 125,656 137,004 (11,348) -8.3% 26.0% General Aviation 325 358 (33) -9.2% 0.7% 3,428 3,331 97 2.9% 0.7% Military 11 5 6 120.0% 0.0% 507 66 441 668.2% 0.1% TOTAL 49,417 49,741 (324) -0.7% 100.0% 483,983 492,217 (8,234) -1.7% 100.0% PASSENGERS (2) International (3) Inbound 38,918 35,703 3,215 9.0% 521,606 448,724 72,882 16.2% Outbound 39,750 36,200 3,550 9.8% 508,623 432,890 75,733 17.5% TOTAL 78,668 71,903 6,765 9.4% 1.7% 1,030,229 881,614 148,615 16.9% 2.3% International/Pre-cleared Inbound 36,381 39,496 (3,115) -7.9% 402,712 374,538 28,174 7.5% Outbound 36,353 37,931 (1,578) -4.2% 432,423 389,785 42,638 10.9% TOTAL 72,734 77,427 (4,693) -6.1% 1.6% 835,135 764,323 70,812 9.3% 1.9% TOTAL INTERNATIONAL 151,402 149,330 2,072 1.4% 3.3% 1,865,364 1,645,937 219,427 13.3% 4.1% Majors (4) Inbound 1,777,326 1,724,242 53,084 3.1% 17,216,500 16,922,459 294,041 1.7% Outbound 1,811,452 1,752,083 59,369 3.4% 17,272,107 16,996,995 275,112 1.6% TOTAL 3,588,778 3,476,325 112,453 3.2% 77.7% 34,488,607 33,919,454 569,153 1.7% 76.7% National (5) Inbound 47,039 49,113 (2,074) -4.2% 527,839 499,868 27,971 5.6% Outbound 47,915 49,486 (1,571) -3.2% 529,501 499,620 29,881 6.0% TOTAL 94,954 98,599 (3,645) -3.7% 2.1% 1,057,340 -

Redalyc.Engineering and Strategy: Returning to the Case of Southwest

Revista Escuela de Administración de Negocios ISSN: 0120-8160 [email protected] Universidad EAN Colombia Berrío Zapata, Cristian Engineering and strategy: returning to the case of southwest airlines, an analysis in production and technology management Revista Escuela de Administración de Negocios, núm. 73, julio-diciembre, 2012, pp. 209-217 Universidad EAN Bogóta, Colombia Available in: http://www.redalyc.org/articulo.oa?id=20625032013 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative Casos empresariales ENGINEERING AND STRATEGY: RETURNING TO THE CASE OF SOUTHWEST AIRLINES, AN ANALYSIS IN PRODUCTION AND TECHNOLOGY MANAGEMENT Cristian Berrío Zapata 1. INTRODUCTION ome company cases let us see what was a network that makes every part of it shake, when any done to produce business model innovation component is touched. This network, immersed into Sthat creates ruptures in the market, changing the environment evolution, is a complete systemic the rules of competition. One of these cases is the unit, where paradigm changes must be supported with story of Southwest Airlines (SWA). This article tries to operational actions so innovation becomes a living demonstrate that engineering operational excellence is force that changes competing profiles. This virtuous fruitless without a compatible moving in other conceptual cycle between thought and action, when successful axes like service, finances, administration and human in producing adaptative and innovative competing resources. The areas of a company are bounded into structures, revolves the markets and generates new rules for competition. -

Reason for Removal of Companies from Sample

Schedule D-6 Part 12 Page 1 of 966 Number of Companies Sheet Name Beginning Ending Reason for Removal of Companies from Sample US Screen 2585 2283 Removed all companies incorporated outside of the US Equity Screen 2283 476 Removed all companies with 2007 common equity of less than $100 million, and all companies with missing or negative common equity in Market Screen 476 458 Removed all companies with less than 60 months of market data Dividend Screen 458 298 Removed all companies with no dividend payment in any quarter of any year Trading Screen 298 297 Removed all companies whose 2007 trading volume to shares outstanding percentage was less than 5% Rating Screen 297 238 Removed all companies with non-investment grade rating from S&P, and removed all companies with a Value Line Safety Rank of 4 or 5 Beta Screen 238 91 Removed all companies with Value Line Betas of 1 or more ROE Screen 91 81 Removed those companies whose average 1996-2007 ROE was outside a range of 1 std. deviation from the average Final Set 81 81 DivQtr04-08 data on quarterly dividend payouts MktHistory data on monthly price closes Trading Volume data on 2007 trading volume and shares outstanding S&P Debt Rating data on S&P debt ratings CEQ% data on 2006 and 2007 common equity ratios ROE data on ROE for 1996-2007 ROE Check calculation for ROE Screen Schedule D-6 Part 12 Page 2 of 966 any year 1991 through 2007 Schedule D-6 Part 12 Page 3 of 966 GICS Country of Economic Incorporati Company Name Ticker SymbSector on 1‐800‐FLOWERS.COM FLWS 25 0 3CI COMPLETE COMPLIANCE CORP TCCC 20 0 3D SYSTEMS CORP TDSC 20 0 3M CO MMM 20 0 4KIDS ENTERTAINMENT INC KDE 25 0 800 TRAVEL SYSTEMS INC IFLYQ 25 0 99 CENTS ONLY STORES NDN 25 0 A.