Powering the Future of Manufacturing with Computers & Electronics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The 2015 PPI Tech/Info Job Ranking

POLICY BRIEF The 2015 PPI Tech/Info Job Ranking BY MICHELLE DI IONNO AND MICHAEL MANDEL NOVEMBER 2015 Introduction This policy brief reports the top 25 tech counties in the country, based on the 2015 PPI Tech/Info Job Index. The top three counties are in the Bay Area—first is San Francisco Country, followed by Santa Clara County (Silicon Valley), and San Mateo County. Travis County, home of Austin, Texas, takes fourth place, with Utah County (Provo, Utah) ranking fifth. The top 25 list also includes well-known tech hubs such as King County (Seattle), New York County (New York City), Middlesex County (Cambridge, Mass.) and Suf- folk County (Boston). However, the PPI Tech/Info Job Index also identifies some unexpectedly strong performers, including East Baton Rouge Parish (Baton Rouge, La.) and St. Charles County (St. Louis, Mo. Metro Area). The PPI Tech/Info This is the third year that we have ranked counties by the PPI Tech/Info Job Index, Index provides an which is based on the number of jobs added in their tech/info industries from 2011 to 2014, relative to the size of the local economy. PPI defines the tech/info sector as objective measure of including telecom, tech, and content industries, including wired and wireless tele- the importance of com, Internet search and publishing, and movie production (see complete list of in- telecom, tech, and cluded industries in the methodology section). content job growth to As in previous years, we find that the local economies with the highest PPI local economies. Tech/Info Job Index tend to have a faster growth rate of non-tech jobs. -

Field Programmable Gate Arrays with Hardwired Networks on Chip

Field Programmable Gate Arrays with Hardwired Networks on Chip PROEFSCHRIFT ter verkrijging van de graad van doctor aan de Technische Universiteit Delft, op gezag van de Rector Magnificus prof. ir. K.C.A.M. Luyben, voorzitter van het College voor Promoties, in het openbaar te verdedigen op dinsdag 6 november 2012 om 15:00 uur door MUHAMMAD AQEEL WAHLAH Master of Science in Information Technology Pakistan Institute of Engineering and Applied Sciences (PIEAS) geboren te Lahore, Pakistan. Dit proefschrift is goedgekeurd door de promotor: Prof. dr. K.G.W. Goossens Copromotor: Dr. ir. J.S.S.M. Wong Samenstelling promotiecommissie: Rector Magnificus voorzitter Prof. dr. K.G.W. Goossens Technische Universiteit Eindhoven, promotor Dr. ir. J.S.S.M. Wong Technische Universiteit Delft, copromotor Prof. dr. S. Pillement Technical University of Nantes, France Prof. dr.-Ing. M. Hubner Ruhr-Universitat-Bochum, Germany Prof. dr. D. Stroobandt University of Gent, Belgium Prof. dr. K.L.M. Bertels Technische Universiteit Delft Prof. dr.ir. A.J. van der Veen Technische Universiteit Delft, reservelid ISBN: 978-94-6186-066-8 Keywords: Field Programmable Gate Arrays, Hardwired, Networks on Chip Copyright ⃝c 2012 Muhammad Aqeel Wahlah All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without permission of the author. Printed in The Netherlands Acknowledgments oday when I look back, I find it a very interesting journey filled with different emotions, i.e., joy and frustration, hope and despair, and T laughter and sadness. -

Policy Playbook for 2009

Part I: Initiative Guide Introduction: Coping with the Downturn, Keeping Focus 1 Jumpstart Oregon Stimulus Proposal 3 Taking Stock of What We Face 6 Oregon Business Plan Framework 8 Summary of Initiative Recommendations 12 Our Progress on Oregon Benchmarks 16 Part II: Cluster Guide Industry Clusters: The Structure of the Oregon Economy 21 Natural Resource Clusters 23 High Technology Clusters 39 Metals, Machinery, and Manufacturing Clusters 52 Sports Apparel and Recreation Product Clusters 58 Clean Technology Industry Clusters 61 2008-2009 Oregon Business Plan Steering Committee Steven D. Pratt (Chair), ESCO Corporation Eric Blackledge, Blackledge Furniture, At-large Member Sam Brooks, S. Brooks & Associates; Chair, Oregon Association of Minority Entrepreneurs David Chen, Equilibrium Capital; Chair, Oregon InC Robert DeKoning, Routeware, Inc.; Vice Chair, Oregon Council, AeA Kirby Dyess, Austin Capital Management; Oregon State Board of Higher Education Dan Harmon, Hoffman Corporation; Chair, Associated Oregon Industries Steve Holwerda, Fergusen Wellman Capital Management, Inc.; Chair, Portland Business Alliance Randolph L. Miller, The Moore Company; At-large Member Michael Morgan, Tonkin Torp, LLP.; Chair, Oregon Business Association Michael R. Nelson, Nelson Real Estate; Member, Oregon Transportation Commission Peggy Fowler, Portland General Electric; Chair, Oregon Business Council Walter Van Valkenburg, Stoel Rives LLP; Chair, Oregon Economic and Community Development Commission Brett Wilcox, Summit Power Alternative Resources; At-large -

Catholic United Investment Trust Annual Report

CATHOLIC UNITED INVESTMENT TRUST ANNUAL REPORT (AUDITED) December 31, 2015 CATHOLIC UNITED INVESTMENT TRUST TABLE OF CONTENTS Page REPORT OF INDEPENDENT AUDITORS 1-2 Statement of Assets and Liabilities 3-4 Schedule of Investments: Money Market Fund 5-7 Short Bond Fund 8-11 Intermediate Diversified Bond Fund 12-21 Opportunistic Bond Fund 22-27 Balanced Fund 28-38 Value Equity Fund 39-41 Core Equity Index Fund 42-48 Growth Fund 49-52 International Equity Fund 53-56 Small Capitalization Equity Index Fund 57-73 Statements of Operations 74-76 Statements of Changes in Net Assets 77-79 NOTES TO FINANCIAL STATEMENTS 80-92 FINANCIAL HIGHLIGHTS 93-95 Crowe Horwath LLP Independent Member Crowe Horwath International INDEPENDENT AUDITOR'S REPORT To the Members of the Board of Trustees and Unit-holders of Catholic United Investment Trust Report on the Financial Statements We have audited the accompanying financial statements of Catholic United Investment Trust – Money Market Fund, Short Bond Fund, Intermediate Diversified Bond Fund, Opportunistic Bond Fund, Balanced Fund, Value Equity Fund, Core Equity Index Fund, Growth Fund, International Equity Fund, and Small Capitalization Equity Index Fund (the “Trust”), which comprise the statement of assets and liabilities as of December 31, 2015, the schedule of investments as of December 31, 2015, the related statements of operations and statements of changes in net assets for the periods ended December 31, 2015 and 2014, and the financial highlights for the periods ended December 31, 2015 and 2014, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. -

A Report on Semiconductor Foundry Access by US Academics (Discussion Held at a Meeting Virtually Held at the National Science Foundation on Dec 16, 2020)

A Report on Semiconductor Foundry Access by US Academics (Discussion held at a meeting virtually held at the National Science Foundation on Dec 16, 2020) Organizers: Sankar Basu1, Erik Brunvand2, Subhasish Mitra3, H.-S. Philip Wong4 Scribes: Sayeef Salahuddin5, Shimeng Yu6 1 NSF, [email protected] 2 NSF, [email protected] 3 Stanford University, [email protected] 4 Stanford University, [email protected] 5 University of California, Berkeley, [email protected] 6 Georgia Institute of Technology, [email protected] 2 Executive Summary Semiconductor technology and microelectronics7 is a foundational technology that without its continued advancement, the promises of artificial intelligence (AI), 5G/6G communication, and quantum computing will never be realized in practice. Our nation’s economic competitiveness, technology leadership, and national security, depend on our staying at the forefront of microelectronics. We must accelerate the pace of innovation and broaden the pool of researchers who possess research capability in circuit design and device technologies, and provide a pathway to translate these innovations to industry. This meeting has brought to the fore the urgent need for access to semiconductor foundry and design ecosystem to achieve these goals. Microelectronics is a field that requires sustained and rapid innovations, especially as the historical rate of progress following a predictable path, is no longer guaranteed as it had been in the past. Yet, there are many plausible paths to move forward, and the potential for further advances is immense. There is a future in system integration of heterogeneous technologies that requires end-to-end co-design and innovation. Isolated push along silos, such as miniaturization of components, will be inadequate. -

2015 Valuation Handbook – Guide to Cost of Capital and Data Published Therein in Connection with Their Internal Business Operations

Market Results Through #DBDLADQ 2014 201 Valuation Handbook Guide to Cost of Capital Industry Risk Premia Company List Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2015 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748- 6008, or online at http://www.wiley.com/go/permissions. The forgoing does not preclude End-users from using the 2015 Valuation Handbook – Guide to Cost of Capital and data published therein in connection with their internal business operations. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Timeline of the Semiconductor Industry in South Portland

Timeline of the Semiconductor Industry in South Portland Note: Thank you to Kathy DiPhilippo, Executive Director/Curator of the South Portland Historical Society and Judith Borelli, Governmental Relations of Texas Inc. for providing some of the information for this timeline below. Fairchild Semiconductor 1962 Fairchild Semiconductor (a subsidiary of Fairchild Camera and Instrument Corp.) opened in the former Boland's auto building (present day Back in Motion) at 185 Ocean Street in June of 1962. They were there only temporarily, as the Western Avenue building was still being constructed. 1963 Fairchild Semiconductor moves to Western Avenue in February 1963. 1979 Fairchild Camera and Instrument Corp. is acquired/merged with Schlumberger, Ltd. (New York) for $363 million. 1987 Schlumberger, Ltd. sells its Fairchild Semiconductor Corp. subsidiary to National Semiconductor Corp. for $122 million. 1997 National Semiconductor sells the majority ownership interest in Fairchild Semiconductor to an investment group (made up of Fairchild managers, including Kirk Pond, and Citcorp Venture Capital Ltd.) for $550 million. Added Corporate Campus on Running Hill Road. 1999 In an initial public offering in August 1999, Fairchild Semiconductor International, Inc. becomes a publicly traded corporation on the New York Stock Exchange. 2016 Fairchild Semiconductor International, Inc. is acquired by ON Semiconductor for $2.4 billion. National Semiconductor 1987 National Semiconductor acquires Fairchild Semiconductor Corp. from Schlumberger, Ltd. for $122 million. 1995 National Semiconductor breaks ground on new 200mm factory in December 1995. 1996 National Semiconductor announces plans for a $600 million expansion of its facilities in South Portland; construction of a new wafer fabrication plant begins. 1997 Plant construction for 200mm factory completed and production starts. -

IBIS Open Forum Minutes

IBIS Open Forum Minutes Meeting Date: March 12, 2010 Meeting Location: Teleconference VOTING MEMBERS AND 2010 PARTICIPANTS Actel (Prabhu Mohan) Agilent Radek Biernacki, Ming Yan, Fangyi Rao AMD Nam Nguyen Ansoft Corporation (Steve Pytel) Apple Computer (Matt Herndon) Applied Simulation Technology (Fred Balistreri) ARM (Nirav Patel) Cadence Design Systems Terry Jernberg*, Wenliang Dai, Ambrish Varma Cisco Systems Syed Huq*, Mike LaBonte*, Tony Penaloza, Huyen Pham, Bill Chen, Ravindra Gali, Zhiping Yang Ericsson Anders Ekholm*, Pete Tomaszewski Freescale Jon Burnett, Om Mandhana Green Streak Programs Lynne Green Hitachi ULSI Systems (Kazuyoshi Shoji) Huawei Technologies (Jinjun Li) IBM Adge Hawes* Infineon Technologies AG (Christian Sporrer) Intel Corporation (Michael Mirmak), Myoung (Joon) Choi, Vishram Pandit, Richard Mellitz IO Methodology Lance Wang* LSI Brian Burdick* Mentor Graphics Arpad Muranyi*, Neil Fernandes, Zhen Mu Micron Technology Randy Wolff* Nokia Siemens Networks GmbH Eckhard Lenski* Samtec (Corey Kimble) Signal Integrity Software Walter Katz*, Mike Steinberger, Todd Westerhoff, Barry Katz Sigrity Brad Brim, Kumar Keshavan Synopsys Ted Mido Teraspeed Consulting Group Bob Ross*, Tom Dagostino Toshiba (Yasumasa Kondo) Xilinx Mike Jenkins ZTE (Huang Min) Zuken Michael Schaeder OTHER PARTICIPANTS IN 2010 AET, Inc. Mikio Kiyono Altera John Oh, Hui Fu Avago Razi Kaw Broadcom Mohammad Ali Curtiss-Wright John Phillips ECL, Inc. Tom Iddings eSilicon Hanza Rahmai Exar Corp. Helen Nguyen Mindspeed Bobby Altaf National Semiconductor Hsinho Wu* NetLogic Microsystems Eric Hsu, Edward Wu Renesas Technology Takuji Komeda Simberian Yuriy Shlepnev Span Systems Corporation Vidya (Viddy) Amirapu Summit Computer Systems Bob Davis Tabula David Banas* TechAmerica (Chris Denham) Texas Instruments Bonnie Baker Independent AbdulRahman (Abbey) Rafiq, Robert Badal In the list above, attendees at the meeting are indicated by *. -

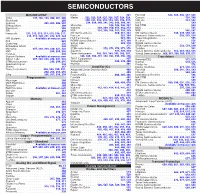

SEMICONDUCTORS MCU/MPU/DSP Kionix

SEMICONDUCTORS MCU/MPU/DSP Kionix . 321 Fairchild . 534 . , 535, 536, 537, 538 Atmel . 197, 198, 199, 200, 201, 202 Maxim . 322 . , 323, 324, 325, 326, 327, 328, 329, Genesic . 539. , 540 Blackhawk . 203 . 330, 331, 332, 333, 334, 335, 336, 337, Infineon . 541, 542 Cypress . 204 . , 205, 206, 207 . 338, 339, 340, 341, 342, 343, 380, 381 IXYS . 543. Energy Micro . 208 Microchip . 344, 345, 346, 347 MA-COM . 544 . Elprotronic . 209 National . 348 . , 349, 350, 351, 352, 353 MCC . 545. FDI . 210 . NXP . 354. , 355, 356, 357, 358, 359 NXP . .546 . , 547 Freescale . 211, 212, 213, 214, 215, 216, 217, ON Semiconductor . .360, 361, 362 ON Semiconductor . 548, 549, 550, 551 . 218, 219, 220, 221, 222, 223, 224 Pericom . 363. , 364 Panasonic Semiconductor . .552 . , 553, 554 IAR Systems . .Available . at mouser.com PLX Technology . .365 . , 366 Power Integrations . 555 Keil . 225 ROHM Semiconductor . 367, 368 Rectron . 556 Code Red . 226. Silicon Labs . 369 . , 370 ROHM Semiconductor . 557 Embedded Artists . 226 . SMSC . 371 . STMicroelectronics . .558, 559, 560 Microchip . 227, 228, 229, 230, 231, 232 STMicroelectronics . 372, 373, 374, 375, 376 Toshiba . 561 NXP . 233 . , 234, 235 Supertex . .377 . , 378, 379 Vishay General Semiconductor .562, 563, 564, 565 Parallax . 236 Texas Instruments . 382, 383, 384, 385, 386, 387, Vishay Semiconductor . 566, 567, 568, 569, 570, 571 Signum Systems . Available at mouser.com . 388, 389, 390, 391, 392, 393, 394, 395, 396 Transistors Silicon Labs . .237 . , 238, 239, 240, 241, 242 THAT Corporation . 397 . Renesas/CEL . 572. , 573 STMicroelectronics . .243, 244, 245 Vishay/Siliconix . .398, 399, 400 Central . .574, 575 Spectrum Digital . -

28521 Folder

5445 NE Dawson Creek Drive Hillsboro, OR 97124 Toll-Free: 1-800-950-0044 Phone: 1-503-615-1100 FAX: 1-503-615-1121 Balance is All Internet E-Mail: [email protected] World Wide Web: http://www.radisys.com/ customer focused market diversity technology partner financial foundation RADISYS 2002 ANNUAL REPORT ANNUAL 2002 RADISYS Financial Overview To our shareholders 2002 (In thousands, except per share data) Years Ended December 31, 2002 was an important year for RadiSys. Our team did an exceptional job diversifying our revenue base, winning new business and driving our financial model to break-even. This was accomplished while making Consolidated Statement of Operations Data 2002 2001 2000 1999 1998 significant investments in research and development and introducing compelling new products for our customers. Our investments in new products enabled the Company to achieve 46 new design wins. These Revenues $200,139 $227,752 $340,676 $251,090 $186,548 design wins are with large customers in a diverse set of end markets. I believe this strong customer position Gross profit $ 59,272 $ 35,172 $116,897 $ 92,297 $ 62,684 will be the foundation for our long-term success. We also strengthened our balance sheet by generating $18 million of operating cash flow and exiting the year with $119 million in cash and investments. I believe (Loss) income from operations $ (7,676) $(60,332) $ 34,005 $ 16,604 $ 8,569 our accomplishments, coupled with our deep customer relationships and increased market diversification, position us well as a leading embedded solutions provider in our industry. Net (loss) income $ (3,305) $(34,486) $ 32,646 $ 18,997 $ 7,818 Net (loss) income per share (diluted)* $ (0.19) $ (2.00) $ 1.80 $ 1.11 $ 0.48 Customer focused Weighted average shares outstanding (diluted)* 17,495 17,249 18,161 17,110 16,129 We have an impressive list of customers in each of our addressable markets. -

High-Tech.Pdf

OREGON KEY INDUSTRIES Clean Technology Wood & Forest Products Advanced Manufacturing High Technology Outdoor Gear & Activewear Firms (2010): 7,997 Employees (2010): 84,285 SNAPSHOT Average Wage (2010): $86,126 Y Export Value (2011): $7.59 billion Sales (2007): $41.5 billion INDUSTR “There is a large pool of technical talent in Portland with Home to the Silicon Forest, the local concentration of high-tech companies the kind of skills we need, it is have made a name for Oregon across the globe. Three companies sparked the evolution of high-tech in Oregon: Tektronix in the 1960s, Mentor close to a wide range of outdoor Graphics in the ‘70s and Intel in the ‘80s. These companies have each activities, it is an incredible place spun-off hundreds of other startups, and evolved into a robust to live and an easy place to supply chain that can provide a competitive advantage to any technology company looking at expansion. recruit workers.” Matt Tucker The largest cluster of Oregon technology companies is located around the CTO & co-founder, Jive Software city of Hillsboro, anchored by Intel’s largest facility in the world and supported by a highly skilled and experienced workforce. This buildup of WWW.OREGON4BIZ.COM talent and infrastructure has spawned other sectors such as bioscience, digital displays and software development. Oregon is home to more than 1,500 software companies, and is particularly strong in the areas of finance, open source, education, mobile and healthcare applications. Healthcare-associated software companies have helped grow a strong bioscience industry that benefits from a renowned research facility in Oregon Health and Sciences University, located in Portland.