Timeline of the Semiconductor Industry in South Portland

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Semiconductor Industry Social Media Review

Revealed SOCIAL SUCCESS White Paper Who’s winning the social media battle in the semiconductor industry? Issue 2, September 3, 2014 The contents of this White Paper are protected by copyright and must not be reproduced without permission © 2014 Publitek Ltd. All rights reserved Who’s winning the social media battle in the semiconductor industry? Issue 2 SOCIAL SUCCESS Who’s winning the social media battle in the semiconductor industry? Report title OVERVIEW This time, in the interest of We’ve combined quantitative balance, we have decided to and qualitative measures to This report is an update to our include these companies - Intel, reach a ranking for each original white paper from channel. Cross-channel ranking Samsung, Sony, Toshiba, Nvidia led us to the overall index. September 2013. - as well as others, to again analyse the following channels: As before, we took a company’s Last time, we took the top individual “number semiconductor companies 1. Blogs score” (quantitative measure) (according to gross turnover - 2. Facebook for a channel, and multiplied main source: Wikipedia), of this by its “good practice score” 3. Google+ which five were ruled out due (qualitative measure). 4. LinkedIn to the diversity of their offering 5. Twitter The companies were ranked by and the difficulty of segmenting performance in each channel. 6. YouTube activity relating to An average was then taken of semiconductors. ! their positions in each to create the final table. !2 Who’s winning the social media battle in the semiconductor industry? Issue 2 Due to the instantaneous nature of social media, this time we decided to analyse a narrower time frame, and picked a single month - August 2014. -

The Evolving Role of Semiconductor Consortia in the United States and Japan

Portland State University PDXScholar Business Faculty Publications and Presentations The School of Business Fall 1998 The Evolving Role of Semiconductor Consortia in the United States and Japan Rose Marie Ham University of California - Berkeley Greg Linden University of California - Berkeley Melissa M. Appleyard Portland State University, [email protected] Follow this and additional works at: https://pdxscholar.library.pdx.edu/busadmin_fac Part of the Business Administration, Management, and Operations Commons Let us know how access to this document benefits ou.y Citation Details Ham, R., Linden, G., & Appleyard, M. M. (1998). The Evolving Role of Semiconductor Consortia in the United States and Japan. California Management Review, 41(1), 137-163. This Article is brought to you for free and open access. It has been accepted for inclusion in Business Faculty Publications and Presentations by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. The Evolving Role of Semiconductor Consortia in the United States and Japan Rose Marie Ham Greg Linden Melissa M. Appleyard ince the late 1970s, governments throughout the industrialized economics have proclaimed the benefits of research consortia. In the United States, tor example, ihe 1984 National Cooperative Research SAct (NCRA) relaxed U.S. antitrust laws to encourage the formation of research consortia hy firms in the same industry; by the end of 1995, over 575 consortia had heen registered under the NCRA in a variety of -

A Report on Semiconductor Foundry Access by US Academics (Discussion Held at a Meeting Virtually Held at the National Science Foundation on Dec 16, 2020)

A Report on Semiconductor Foundry Access by US Academics (Discussion held at a meeting virtually held at the National Science Foundation on Dec 16, 2020) Organizers: Sankar Basu1, Erik Brunvand2, Subhasish Mitra3, H.-S. Philip Wong4 Scribes: Sayeef Salahuddin5, Shimeng Yu6 1 NSF, [email protected] 2 NSF, [email protected] 3 Stanford University, [email protected] 4 Stanford University, [email protected] 5 University of California, Berkeley, [email protected] 6 Georgia Institute of Technology, [email protected] 2 Executive Summary Semiconductor technology and microelectronics7 is a foundational technology that without its continued advancement, the promises of artificial intelligence (AI), 5G/6G communication, and quantum computing will never be realized in practice. Our nation’s economic competitiveness, technology leadership, and national security, depend on our staying at the forefront of microelectronics. We must accelerate the pace of innovation and broaden the pool of researchers who possess research capability in circuit design and device technologies, and provide a pathway to translate these innovations to industry. This meeting has brought to the fore the urgent need for access to semiconductor foundry and design ecosystem to achieve these goals. Microelectronics is a field that requires sustained and rapid innovations, especially as the historical rate of progress following a predictable path, is no longer guaranteed as it had been in the past. Yet, there are many plausible paths to move forward, and the potential for further advances is immense. There is a future in system integration of heterogeneous technologies that requires end-to-end co-design and innovation. Isolated push along silos, such as miniaturization of components, will be inadequate. -

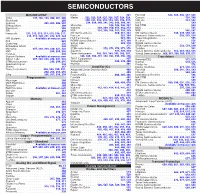

SEMICONDUCTORS MCU/MPU/DSP Kionix

SEMICONDUCTORS MCU/MPU/DSP Kionix . 321 Fairchild . 534 . , 535, 536, 537, 538 Atmel . 197, 198, 199, 200, 201, 202 Maxim . 322 . , 323, 324, 325, 326, 327, 328, 329, Genesic . 539. , 540 Blackhawk . 203 . 330, 331, 332, 333, 334, 335, 336, 337, Infineon . 541, 542 Cypress . 204 . , 205, 206, 207 . 338, 339, 340, 341, 342, 343, 380, 381 IXYS . 543. Energy Micro . 208 Microchip . 344, 345, 346, 347 MA-COM . 544 . Elprotronic . 209 National . 348 . , 349, 350, 351, 352, 353 MCC . 545. FDI . 210 . NXP . 354. , 355, 356, 357, 358, 359 NXP . .546 . , 547 Freescale . 211, 212, 213, 214, 215, 216, 217, ON Semiconductor . .360, 361, 362 ON Semiconductor . 548, 549, 550, 551 . 218, 219, 220, 221, 222, 223, 224 Pericom . 363. , 364 Panasonic Semiconductor . .552 . , 553, 554 IAR Systems . .Available . at mouser.com PLX Technology . .365 . , 366 Power Integrations . 555 Keil . 225 ROHM Semiconductor . 367, 368 Rectron . 556 Code Red . 226. Silicon Labs . 369 . , 370 ROHM Semiconductor . 557 Embedded Artists . 226 . SMSC . 371 . STMicroelectronics . .558, 559, 560 Microchip . 227, 228, 229, 230, 231, 232 STMicroelectronics . 372, 373, 374, 375, 376 Toshiba . 561 NXP . 233 . , 234, 235 Supertex . .377 . , 378, 379 Vishay General Semiconductor .562, 563, 564, 565 Parallax . 236 Texas Instruments . 382, 383, 384, 385, 386, 387, Vishay Semiconductor . 566, 567, 568, 569, 570, 571 Signum Systems . Available at mouser.com . 388, 389, 390, 391, 392, 393, 394, 395, 396 Transistors Silicon Labs . .237 . , 238, 239, 240, 241, 242 THAT Corporation . 397 . Renesas/CEL . 572. , 573 STMicroelectronics . .243, 244, 245 Vishay/Siliconix . .398, 399, 400 Central . .574, 575 Spectrum Digital . -

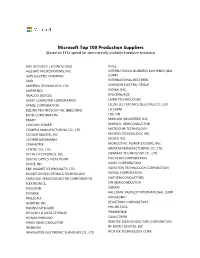

Microsoft Top 100 Production Suppliers (Based on FY14 Spend for Commercially Available Hardware Products)

Microsoft Top 100 Production Suppliers (Based on FY14 spend for commercially available hardware products) AAC ACOUSTIC TECHNOLOGIES INTEL ALLEGRO MICROSYSTEMS, INC. INTERNATIONAL BUSINESS MACHINES (IBM ALPS ELECTRIC COMPANY CORP.) AMD INTERNATIONAL RECTIFIER AMPEREX TECHNOLOGY, LTD. JOHNSON ELECTRIC GROUP AMPHENOL KIONIX, INC. ANALOG DEVICES KYOCERA/AVX ASKEY COMPUTER CORPORATION LAIRD TECHNOLOGIES ATMEL CORPORATION LELON ELECTRONICS (SUZHOU) CO., LTD BIZLINK TECHNOLOGY INC (BIZCONN) LG CHEM BOYD CORPORATION LITE-ON BRADY MARLOW INDUSTRIES, INC. CHICONY POWER MARVELL SEMICONDUCTOR COMPEQ MANUFACTURING CO., LTD. MICROCHIP TECHNOLOGY COOLER MASTER, INC. MICRON TECHNOLOGY, INC. COOPER BUSSMANN MOLEX, INC. CYMMETRIK MONOLITHIC POWER SYSTEMS, INC. CYNTEC CO., LTD. MURATA MANUFACTURING CO., LTD. DELTA ELECTRONICS, INC. NEWMAX TECHNOLOGY CO., LTD. DIGITAL OPTICS VISTA POINT NICHICON CORPORATION DIODE, INC. NIDEC CORPORATION E&E MAGNETICS PRODUCTS, LTD. NUVOTON TECHNOLOGY CORPORATION ELLINGTON ELECTRONICS TECHNOLOGY NVIDIA CORPORATION FAIRCHILD SEMICONDUCTOR CORPORATION NXP SEMICONDUCTORS FLEXTRONICS ON SEMICONDUCTOR FOXCONN OSRAM FOXLINK PALCONN, PALPILOT INTERNATIONAL CORP. FREESCALE PANASONIC GOERTEK, INC. PEGATRON CORPORATION HANNSTAR BOARD PHILIPS PLDS HITACHI-LG DATA STORAGE PRIMESENSE HONDA PRINTING QUALCOMM HYNIX SEMICONDUCTOR REALTEK SEMICONDUCTOR CORPORATION INFINEON RF MICRO DEVICES, INC. INNOVATOR ELECTRONIC SHENZHEN CO., LTD RICHTEK TECHNOLOGY CORP. ROHM CORPORATION SAMSUNG DISPLAY SAMSUNG ELECTRONICS SAMSUNG SDI SAMSUNG SEMICONDUCTOR SEAGATE SHEN ZHEN JIA AI MOTOR CO., LTD. SHENZHEN HORN AUDIO CO., LTD. SHINKO ELECTRIC INDUSTRIES CO., LTD. STARLITE PRINTER, LTD. STMICROELECTRONICS SUNG WEI SUNUNION ENVIRONMENTAL PACKAGING CO., LTD TDK TE CONNECTIVITY TEXAS INSTRUMENTS TOSHIBA TPK TOUCH SOLUTIONS, INC. UNIMICRON TECHNOLOGY CORP. UNIPLAS (SHANGHAI) CO., LTD. UNISTEEL UNIVERSAL ELECTRONICS INCORPORATED VOLEX WACOM CO., LTD. WELL SHIN TECHNOLOGY WINBOND WOLFSON MICROELECTRONICS, LTD. X-CON ELECTRONICS, LTD. YUE WAH CIRCUITS CO., LTD. -

Cad Veteran Richard Smith Joins Micro Magic, Inc. As Senior Technical Advisor

CAD Veteran Richard Smith Joins Micro Magic, Inc. Press Release CAD VETERAN RICHARD SMITH JOINS MICRO MAGIC, INC. AS SENIOR TECHNICAL ADVISOR “Dick brings a tremendous Sunnyvale, California -- June 7, 1999 -- Micro Magic, Inc. wealth of technical and (MMI) today announced the appointment of Dr. Richard business experience in C. Smith as senior technical advisor. Smith comes to MMI EDA to Micro Magic from Cadence Design Systems, Inc., where he was most re- and its customers. Dick cently a senior program manager in consulting services. At will be responsible for Cadence, he also served in software support management assisting with product and as the program manager for the Texas Instruments needs and definitions and account. Smith has held technical and management posi- for launching a design tions with Texas Instruments, National Semiconductor, and center and sales support capability in the Central Hewlett-Packard. region of the U.S.” Mark Santoro, MMI's president and CEO, stated, "Dick Mark Santoro President brings a tremendous wealth of technical and business expe- and CEO Micro Magic, rience in EDA to Micro Magic and its customers. Dick will Inc. be responsible for assisting with product needs and defini- tions and for launching a design center and sales support Contact: Heidi Vantulden capability in the Central region of the U.S." Armstrong Kendall, Inc. 503-672-4685 "MMI has a fresh new approach to EDA. It's a company of highly skilled design engineers who create very high per- heidi@armstrongkendall. formance processors and memories, and the EDA software com environment for managing the entire process," stated Dr. -

Mckinsey on Semiconductors

McKinsey on Semiconductors Creating value, pursuing innovation, and optimizing operations Number 7, October 2019 McKinsey on Semiconductors is Editorial Board: McKinsey Practice Publications written by experts and practitioners Ondrej Burkacky, Peter Kenevan, in McKinsey & Company’s Abhijit Mahindroo Editor in Chief: Semiconductors Practice along with Lucia Rahilly other McKinsey colleagues. Editor: Eileen Hannigan Executive Editors: To send comments or request Art Direction and Design: Michael T. Borruso, copies, email us: Leff Communications Bill Javetski, McKinsey_on_ Semiconductors@ Mark Staples McKinsey.com. Data Visualization: Richard Johnson, Copyright © 2019 McKinsey & Cover image: Jonathon Rivait Company. All rights reserved. © scanrail/Getty Images Managing Editors: This publication is not intended to Heather Byer, Venetia Simcock be used as the basis for trading in the shares of any company or for Editorial Production: undertaking any other complex or Elizabeth Brown, Roger Draper, significant financial transaction Gwyn Herbein, Pamela Norton, without consulting appropriate Katya Petriwsky, Charmaine Rice, professional advisers. John C. Sanchez, Dana Sand, Sneha Vats, Pooja Yadav, Belinda Yu No part of this publication may be copied or redistributed in any form without the prior written consent of McKinsey & Company. Table of contents What’s next for semiconductor How will changes in the 3 profits and value creation? 47 automotive-component Semiconductor profits have been market affect semiconductor strong over the past few years. companies? Could recent changes within the The rise of domain control units industry stall their progress? (DCUs) will open new opportunities for semiconductor companies. Artificial-intelligence hardware: Right product, right time, 16 New opportunities for 50 right location: Quantifying the semiconductor companies semiconductor supply chain Artificial intelligence is opening Problems along the the best opportunities for semiconductor supply chain semiconductor companies in are difficult to diagnose. -

Needham's Semiconductor Expertise What Does The

The Growth Factor - Commentary by John Barr, [email protected] June 23, 2021 - Vol. 32 The Opportunity We See in Semiconductor Manufacturing (6 minute read) 2020 brought an unprecedented economic shutdown. The pandemic accelerated trends that we have been focused on for a long me; we call this the Great Digital and Life Sciences Acceleration. I would like to zero in on the opportunities in semiconductor manufacturing. I’ve long felt the semiconductor industry has moved beyond a cyclical, PC-driven industry to one of strategic importance. The confluence of manufacturing semiconductors for automotive, data center, machine learning, and remote work electronic systems; remaking the supply chain, and securing supplies for geopolitical needs have created a positive scenario for semiconductor manufacturing technology companies. Needham's Semiconductor Expertise Needham Funds have been owners of semiconductor manufacturing companies since our start in 1996. Needham Funds are an affiliate of Needham & Company, which has completed over 580 underwritings and M&A transactions for semiconductor companies since 1985. Addionally, prior to my Wall Street career, I spent 12 years in sales and markeng for Electronic Design Automaon companies, selling to semiconductor and electronic systems companies. I also spent 8 years as a sell-side senior research analyst following semiconductor design and technical soware companies. I served on the board of directors of venture capital-backed Coventor, Inc., which provided simulaon and modeling soluons for semiconductor process technology and was sold to Lam Research, Inc. in 2017. What Does the Opportunity in Semiconductor Manufacturing Mean for Needham Funds? Growth in advanced semiconductor manufacturing has been a dominant investment theme for Needham Funds for over 10 years. -

Discrete Semiconductor Products Fairchild@50

Fairchild Oral History Panel: Discrete Semiconductor Products Fairchild@50 (Panel Session # 3) Participants: Jim Diller Bill Elder Uli Hegel Bill Kirkham Moderated by: George Wells Recorded: October 5, 2007 Mountain View, California CHM Reference number: X4208.2008 © 2007 Computer History Museum Fairchild Semiconductor: Discrete Products George Wells: My name's George Wells. I came to Fairchild in 1969, right in the midst of the Hogan's Heroes, shall we say, subculture, at the time. It was difficult to be in that environment as a bystander, as someone watching a play unfold. It was a difficult time, but we got through that. I came to San Rafael, Wilf asked me to get my ass up to San Rafael and turn it around or shut it down. So I was up in San Rafael for a while, and then I made my way through various different divisions, collecting about 15 of them by the time I was finished. I ended up as executive vice president, working for Wilf, and left the company about a year and a half after the Schlumberger debacle. That's it in a nutshell. Let me just turn over now to Uli Hegel, who was with Fairchild for 38 years, one of the longest serving members, I believe, in the room. Maybe the longest serving member. Uli, why don't you tell us what you did when you came, when you came and what jobs you had when you were there. Uli Hegel: I came to Fairchild in 1959, September 9, and hired into R&D as a forerunner to the preproduction days. -

IC's and Electronic Components

Aero Technical Components 2800 Gandy Blvd. North St. Petersburg, FL 33702 Phone: 1-727-577-6115 Fax: 727-577-563-9134 Email: [email protected] Aero Technical Components A Woman-Owned Small Business www.aerotechcomp.com INTE GRATED CIRCUITS & SEMI-CONDUCTORS Agilent/HP IDT PMC-Sierra Tecor-Littelfuse Actel Infineon /Siemens PMI (Acquired by Analog TelCom Semiconductor Allegro Intel Devices) Teledyne Alliance Integrated Circuit Technology PNY Technologies Pulse Teledyne Technologies Altera International Rectifier Pulse-Engineering Telefunken/Vishay AMD Intersil Corporation QLogic T.I. Analog devices Isocom Quality Semi/IDT Toshiba Atmel ISSI Quick Logic TranSwitch Corporation Broadcom Lattice Ramtron Triquint Semiconductor Brooktre e/ Conexant Level One RCA (Acquired by Intersil) TRW Burr Brow n/ T.I. LG Electronics RF Micro Tyco Electronics California Micro devices (CMD) Linear Technology Samsung Unitrode/TI Catalyst Lite-On Sandisk UMC CEL/NEC Logic devices Sanyo Semiconductor Velio Coomunications C-Cub e/ LSI Logic Lucent/Agere Saronix (Acquired by Pericom) (Acquired by LSI Logic) Vishay Chips & Tec h/Asiliant M Systems SGS Thomson/ST Micro VitelicMosel Corp(MVC) Cirrus Logic Macronix Seiko Epson Vitesse Conexant Maxim Seeq Technology VLS I/ Philips CP Clare Micrel (Acquired by LSI Logic) Waferscal e/ ST Micro Cypress Micro Networks Seiko Instruments Western Digital Dallas Microchip Semtech Winbound Dense-PAC Micron SensitronSemiconductor Xicor/Intersil Elante c/ Intersil Microsemi Sharp Xilinx Epson America Mitel/Vitelic/MVC Siemans/Infineon -

Cadence Design Systems, Inc. 2020 Proxy Statement

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS The 2020 Annual Meeting of Stockholders of CADENCE DESIGN SYSTEMS, INC., a Delaware corporation, will be held as follows: When: Where: April 30, 2020 Cadence San Jose Campus 1:00 p.m. Pacific Time 2655 Seely Avenue, Building 10 San Jose, California 95134 Items of Business: The purpose of the 2020 Annual Meeting of Stockholders is to consider and take action on the following: 1. To elect the nine directors named in the proxy statement to serve until the 2021 Annual Meeting of Stockholders and until their successors are elected and qualified, or until the directors’ earlier death, resignation or removal. 2. To approve the amendment of the Omnibus Equity Incentive Plan. 3. To vote on an advisory resolution to approve named executive officer compensation. 4. To ratify the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Cadence for its fiscal year ending January 2, 2021. 5. To vote on a stockholder proposal regarding special stockholder meetings, if properly presented at the meeting. 6. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. These items of business are more fully described in the proxy statement accompanying this notice. Record Date: Holders of Cadence Design Systems, Inc. common stock at the close of business on March 2, 2020 are entitled to notice of and to vote at the 2020 Annual Meeting of Stockholders and any adjournment or postponement thereof. How to Vote: Your vote is important to us. Please cast your vote promptly via the internet, telephone or mail. -

The LSI Data Acquisition Peripheral of the Future Coorganizers: John A

The LSI Data Acquisition Peripheral of the Future Coorganizers: John A. Schoeff - Advanced Micro Devices, Inc., Sunnyvale, CA James Solomon - National Semiconductor Corp., Santa Clara, CA Moderator: Ray Stata, Analog Devices, Inc., Norwood, MA Designers of A/D and D/A converters are beginning to use the same LSI technologies that are available to microprocessor and memory designers, since they offer the potential for large increases in circuit complexity. In exploring the approaches available for tapping this potential, it is also necessary to consider which tech- nologies are most attractive for data acquisition ICs and what are the analog and digital performance limits of these technologies, and within the expected limits, what types of complex data acquisition ICs would be the most interesting to make. In considering the initial problem panelists are expected to weigh the MDS advantage of high digital density against the bipolar advantage of analog precision. It is felt by some that switched-capacitor techniques will allow MOS to equal the analog accuracy of bipolar. For severalyears, wafer level trim (WLT) techniques havebeen pushed as the answer to the monolithic accuracy problem. Progress to dateon WLTwill be reviewed and compared with competing non-trim approaches. Thus, in addressing the fabrication aspect, the panel will review the variety of data acquisition subsystems presently being built at the PC-board level, such as the traditional A/D, reference, mux, S/H amplifier and bus interface. The feasibility, desirability and economics of including multiple designs in a single LSI circuit will be considered. An attempt will also be made to explore new avenues for data acquisition LSI.