Needham's Semiconductor Expertise What Does The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Report on Semiconductor Foundry Access by US Academics (Discussion Held at a Meeting Virtually Held at the National Science Foundation on Dec 16, 2020)

A Report on Semiconductor Foundry Access by US Academics (Discussion held at a meeting virtually held at the National Science Foundation on Dec 16, 2020) Organizers: Sankar Basu1, Erik Brunvand2, Subhasish Mitra3, H.-S. Philip Wong4 Scribes: Sayeef Salahuddin5, Shimeng Yu6 1 NSF, [email protected] 2 NSF, [email protected] 3 Stanford University, [email protected] 4 Stanford University, [email protected] 5 University of California, Berkeley, [email protected] 6 Georgia Institute of Technology, [email protected] 2 Executive Summary Semiconductor technology and microelectronics7 is a foundational technology that without its continued advancement, the promises of artificial intelligence (AI), 5G/6G communication, and quantum computing will never be realized in practice. Our nation’s economic competitiveness, technology leadership, and national security, depend on our staying at the forefront of microelectronics. We must accelerate the pace of innovation and broaden the pool of researchers who possess research capability in circuit design and device technologies, and provide a pathway to translate these innovations to industry. This meeting has brought to the fore the urgent need for access to semiconductor foundry and design ecosystem to achieve these goals. Microelectronics is a field that requires sustained and rapid innovations, especially as the historical rate of progress following a predictable path, is no longer guaranteed as it had been in the past. Yet, there are many plausible paths to move forward, and the potential for further advances is immense. There is a future in system integration of heterogeneous technologies that requires end-to-end co-design and innovation. Isolated push along silos, such as miniaturization of components, will be inadequate. -

Apple U1 Ultra Wideband (UWB) Analysis

Apple U1 Ultra Wideband (UWB) Analysis Product Brief – October 2019 techinsights.com All content © 2019. TechInsights Inc. All rights reserved. GLOBAL LEADER IN IP & TECHNOLOGY INTELLIGENCE By revealing the innovation others can’t inside advanced technology products, we prove patent value and drive the best Intellectual Property (IP) and technology investment decisions Technology Intelligence Intellectual Property Services We help decision makers in semiconductor, system, financial, We help IP Professionals in global technology companies, and communication service provider companies: licensing entities and legal firms to: • Discover what products are winning in the highest- • Build higher quality, more effective patents growth markets and why • Identify patents of value and gather evidence of use to • Spot or anticipate disruptive events, including the demonstrate this value entrance of new players • Obtain accurate data for planning a potential defensive • Understand state-of-the-art technology strategy or assertion case through independent, objective analysis • Make better portfolio management decisions to invest, • Make better, faster product decisions with greater abandon, acquire or divest confidence • Understand their competition, identify strategic partners, • Understand product costs and bill of materials acquisition targets and business threats 2 All content © 2019. TechInsights Inc. All rights reserved. TechInsights has been publishing technology analysis for 30 years, enabling our customers to advance their intellectual property -

Operational Highlights

078 079 5.1 Business Activities 5.2 Technology Leadership ●Developed integrated fan-out on substrate (InFO-oS) Gen-3, which provides more chip partition integration with larger 5.1.1 Business Scope 5.2.1 R&D Organization and Investment package size and higher bandwidth As the founder and a leader of the dedicated semiconductor foundry segment, TSMC provides a full range of integrated In 2020, TSMC continued to invest in research and ●Expanded 12-inch Bipolar-CMOS-DMOS (BCD) technology semiconductor foundry services, including the most advanced process technologies, leading specialty technologies, the most development, with total R&D expenditures amounting to 8.2% portfolio on 90nm, 55nm and 22nm, targeting a variety of comprehensive design ecosystem support, excellent manufacturing productivity and quality, advanced mask technologies, and of revenue, a level that equals or exceeds the R&D investment fast-growing applications of mobile power management ICs 3DFabricTM advanced packaging and silicon stacking technologies, to meet a growing variety of customer needs. The Company of many other leading high-tech companies. with various levels of integration strives to provide the best overall value to its customers and views customer success as TSMC’s own success. As a result, TSMC has ●Achieved technical qualification of 28nm eFlash for gained customer trust from around the world and has experienced strong growth and success of its own. Faced with the increasingly difficult challenge to continue automobile electronics and micro controller units (MCU) extending Moore’s Law, which calls for the doubling of applications 5.1.2 Customer Applications semiconductor computing power every two years, TSMC has ●Began production of 28nm resistive random access memory focused its R&D efforts on offering customers first-to-market, (RRAM) as a low-cost solution for the price sensitive IoT TSMC manufactured 11,617 different products for 510 customers in 2020. -

Timeline of the Semiconductor Industry in South Portland

Timeline of the Semiconductor Industry in South Portland Note: Thank you to Kathy DiPhilippo, Executive Director/Curator of the South Portland Historical Society and Judith Borelli, Governmental Relations of Texas Inc. for providing some of the information for this timeline below. Fairchild Semiconductor 1962 Fairchild Semiconductor (a subsidiary of Fairchild Camera and Instrument Corp.) opened in the former Boland's auto building (present day Back in Motion) at 185 Ocean Street in June of 1962. They were there only temporarily, as the Western Avenue building was still being constructed. 1963 Fairchild Semiconductor moves to Western Avenue in February 1963. 1979 Fairchild Camera and Instrument Corp. is acquired/merged with Schlumberger, Ltd. (New York) for $363 million. 1987 Schlumberger, Ltd. sells its Fairchild Semiconductor Corp. subsidiary to National Semiconductor Corp. for $122 million. 1997 National Semiconductor sells the majority ownership interest in Fairchild Semiconductor to an investment group (made up of Fairchild managers, including Kirk Pond, and Citcorp Venture Capital Ltd.) for $550 million. Added Corporate Campus on Running Hill Road. 1999 In an initial public offering in August 1999, Fairchild Semiconductor International, Inc. becomes a publicly traded corporation on the New York Stock Exchange. 2016 Fairchild Semiconductor International, Inc. is acquired by ON Semiconductor for $2.4 billion. National Semiconductor 1987 National Semiconductor acquires Fairchild Semiconductor Corp. from Schlumberger, Ltd. for $122 million. 1995 National Semiconductor breaks ground on new 200mm factory in December 1995. 1996 National Semiconductor announces plans for a $600 million expansion of its facilities in South Portland; construction of a new wafer fabrication plant begins. 1997 Plant construction for 200mm factory completed and production starts. -

TSMC Integrated Fan-Out (Info) Package Apple A10

Electronic Costing & Technology Experts 21 rue la Nouë Bras de Fer 44200 Nantes – France Phone : +33 (0) 240 180 916 email : [email protected] www.systemplus.fr September 2016 – Version 1 – Written by Stéphane ELISABETH DISCLAIMER : System Plus Consulting provides cost studies based on its knowledge of the manufacturing and selling prices of electronic components and systems. The given values are realistic estimates which do not bind System Plus Consulting nor the manufacturers quoted in the report. System Plus Consulting is in no case responsible for the consequences related to the use which is made of the contents of this report. The quoted trademarks are property of their owners. © 2016 by SYSTEM PLUS CONSULTING, all rights reserved. 1 Return to TOC Glossary 1. Overview / Introduction 4 – A10 Die Analysis 57 – Executive Summary – A10 Die View, Dimensions & Marking – Reverse Costing Methodology – A10 Die Cross-Section – A10 Die Process Characteristics 2. Company Profile 7 – Comparison with previous generation 65 – Apple Inc. – A9 vs. A10 PoP – Apple Series Application processor – A9 vs. A10 Process – Fan-Out Packaging – TSMC Port-Folio 4. Manufacturing Process Flow 70 – TSMC inFO packaging – Chip Fabrication Unit – Packaging Fabrication Unit 3. Physical Analysis 15 – inFO Reconstitution Flow – Physical Analysis Methodology – iPhone 7 Plus Teardown 17 5. Cost Analysis 81 – A10 Die removal – Synthesis of the cost analysis – A10 Package-on-Package Analysis 23 – Main steps of economic analysis – A10 Package View, Dimensions – Yields Hypotheses – A10 Package XRay View – Die Cost Analysis 86 – A10 Package Opening – Wafer Cost – A10 Package Marking – Die Cost – A10 Package Cross-Section – inFO Packaging Cost Analysis 90 – A10 Package Cross-Section – Adhesive & Passivation – Packaging Wafer Cost – A10 package cross-Section - TIVs – Packaging Cost per process Steps – A10 package cross-Section – Solder Balls – Component Cost – A10 package cross-Section – RDL – Land-Side Decoupling Capacitor Analysis 48 6. -

TSMC Investement in Arizona

Michael R. Splinter Chairman of the Board Senator Robert Menendez Senator Lisa A. Murkowski Honorary Co-Chair Honorary Co-Chair Rupert J. Hammond-Chambers President INTERNAL COMMENTARY: THE STRATEGIC IMPORTANCE OF THE TSMC ARIZONA INVESTMENT MAY 15, 2020 RUPERT J. HAMMOND-CHAMBERS PRESIDENT Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s largest contract chip manufacturer. A key link in the global technology supply chain, it is the most important company most people have never heard of. TSMC, based in Taiwan, is now doubling down on its relationship with the United States in a big way. On Friday, May 15, 2020 TSMC announced the most important technology news of the year; the company committed to building a cutting-edge 5nm fabrication plant (fab) to produce semiconductor chips in Arizona. Its U.S. customers for the chips produced here will not only include U.S. tech companies, but will also include the Pentagon, defense contractors, and the national security community. The visionary founder of TSMC, Morris Chang, imagined a world where fabless semiconductor companies would absorb the financial burden of designing chips, but would outsource their actual production to his TSMC. His vision created a monster that dominates the sector he created - the foundry manufacturing sector – making almost 50% of all chips produced by foundries globally. TSMC’s state-of-the-art process technology and CAPEX investment of approximately US$15 billion/year ensures that it has few, if any, peers. Successive Taiwan governments have continued to nurture TSMC through prioritized access to land, power, and water, thereby allowing it to serve as the beating heart of Taiwan’s technology miracle. -

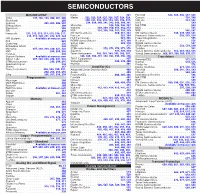

SEMICONDUCTORS MCU/MPU/DSP Kionix

SEMICONDUCTORS MCU/MPU/DSP Kionix . 321 Fairchild . 534 . , 535, 536, 537, 538 Atmel . 197, 198, 199, 200, 201, 202 Maxim . 322 . , 323, 324, 325, 326, 327, 328, 329, Genesic . 539. , 540 Blackhawk . 203 . 330, 331, 332, 333, 334, 335, 336, 337, Infineon . 541, 542 Cypress . 204 . , 205, 206, 207 . 338, 339, 340, 341, 342, 343, 380, 381 IXYS . 543. Energy Micro . 208 Microchip . 344, 345, 346, 347 MA-COM . 544 . Elprotronic . 209 National . 348 . , 349, 350, 351, 352, 353 MCC . 545. FDI . 210 . NXP . 354. , 355, 356, 357, 358, 359 NXP . .546 . , 547 Freescale . 211, 212, 213, 214, 215, 216, 217, ON Semiconductor . .360, 361, 362 ON Semiconductor . 548, 549, 550, 551 . 218, 219, 220, 221, 222, 223, 224 Pericom . 363. , 364 Panasonic Semiconductor . .552 . , 553, 554 IAR Systems . .Available . at mouser.com PLX Technology . .365 . , 366 Power Integrations . 555 Keil . 225 ROHM Semiconductor . 367, 368 Rectron . 556 Code Red . 226. Silicon Labs . 369 . , 370 ROHM Semiconductor . 557 Embedded Artists . 226 . SMSC . 371 . STMicroelectronics . .558, 559, 560 Microchip . 227, 228, 229, 230, 231, 232 STMicroelectronics . 372, 373, 374, 375, 376 Toshiba . 561 NXP . 233 . , 234, 235 Supertex . .377 . , 378, 379 Vishay General Semiconductor .562, 563, 564, 565 Parallax . 236 Texas Instruments . 382, 383, 384, 385, 386, 387, Vishay Semiconductor . 566, 567, 568, 569, 570, 571 Signum Systems . Available at mouser.com . 388, 389, 390, 391, 392, 393, 394, 395, 396 Transistors Silicon Labs . .237 . , 238, 239, 240, 241, 242 THAT Corporation . 397 . Renesas/CEL . 572. , 573 STMicroelectronics . .243, 244, 245 Vishay/Siliconix . .398, 399, 400 Central . .574, 575 Spectrum Digital . -

Semiconductors: a Changing of the Guard

Semiconductors: A Changing of the Guard Richard Spalton MA, CFA Investment Manager Semiconductors: A Changing of the Guard “While an early chip from the 1970s could fit thousands of micrometre-sized transistors, today’s most advanced chips are a complex web of billions of transistors, the smallest of which are just 10nm. To get some idea of how small that is: your fingernails grew 10nm in the time it took to read the previous sentence.”1 Background One of the key enablers of technological progress has been the constantly shrinking size of the transistors on semiconductor chips. Smaller transistors mean that the same number of computations can be completed faster, more efficiently and at lower cost. This concept was famously outlined by Gordon Moore, co-founder of Intel, who in 1965 wrote what became known as Moore’s Law. The manufacturing process for a particular size of transistor is called a process node. Shifting to a new node is highly complex and involves significant capital expenditure. In July 2020 Intel announced that their transition to the 7 nanometre node was running a year behind schedule. This delay will have a significant impact on Intel and its competitors. This announcement marks a changing of the guard in the semiconductor market, with leadership shifting away from Intel towards Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics. Scale Matters Assessing the future prospects of a company requires an assessment of its industry. Manufacturing semiconductors is highly capital intensive – the industry spends USD 100bn per annum on capital expenditure. Companies also need to spend substantial amounts on R&D because each process node is more complex than the last. -

Mckinsey on Semiconductors

McKinsey on Semiconductors Creating value, pursuing innovation, and optimizing operations Number 7, October 2019 McKinsey on Semiconductors is Editorial Board: McKinsey Practice Publications written by experts and practitioners Ondrej Burkacky, Peter Kenevan, in McKinsey & Company’s Abhijit Mahindroo Editor in Chief: Semiconductors Practice along with Lucia Rahilly other McKinsey colleagues. Editor: Eileen Hannigan Executive Editors: To send comments or request Art Direction and Design: Michael T. Borruso, copies, email us: Leff Communications Bill Javetski, McKinsey_on_ Semiconductors@ Mark Staples McKinsey.com. Data Visualization: Richard Johnson, Copyright © 2019 McKinsey & Cover image: Jonathon Rivait Company. All rights reserved. © scanrail/Getty Images Managing Editors: This publication is not intended to Heather Byer, Venetia Simcock be used as the basis for trading in the shares of any company or for Editorial Production: undertaking any other complex or Elizabeth Brown, Roger Draper, significant financial transaction Gwyn Herbein, Pamela Norton, without consulting appropriate Katya Petriwsky, Charmaine Rice, professional advisers. John C. Sanchez, Dana Sand, Sneha Vats, Pooja Yadav, Belinda Yu No part of this publication may be copied or redistributed in any form without the prior written consent of McKinsey & Company. Table of contents What’s next for semiconductor How will changes in the 3 profits and value creation? 47 automotive-component Semiconductor profits have been market affect semiconductor strong over the past few years. companies? Could recent changes within the The rise of domain control units industry stall their progress? (DCUs) will open new opportunities for semiconductor companies. Artificial-intelligence hardware: Right product, right time, 16 New opportunities for 50 right location: Quantifying the semiconductor companies semiconductor supply chain Artificial intelligence is opening Problems along the the best opportunities for semiconductor supply chain semiconductor companies in are difficult to diagnose. -

Texas Instruments Incorporated

A Progressive Digital Media business COMPANY PROFILE Texas Instruments Incorporated REFERENCE CODE: AFDA1C52-BBF2-41FA-A70D-DE34086443A9 PUBLICATION DATE: 20 Oct 2017 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Texas Instruments Incorporated TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 SWOT Analysis ...............................................................................................................4 Texas Instruments Incorporated Page 2 © MarketLine Texas Instruments Incorporated Company Overview Company Overview COMPANY OVERVIEW Texas Instruments Incorporated (Texas Instruments, TI or 'the company') is a designer and producer of semiconductors. The company primarily provides analog integrated circuits (ICs) and embedded processors. TI sells its products to original equipment manufacturers (OEMs), original design manufacturers (ODMs), contract manufacturers and distributors through direct sales force and third-party sales representatives. It has business presence across the Americas, Asia, Europe, the Middle East and Africa. The company is headquartered in Dallas, Texas, the US. The company reported revenues of (US Dollars) US$13,370 million for the fiscal year ended December 2016 (FY2016), an increase of 2.8% -

Annual Report 2002 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LTD

TSE: 2330 NYSE: TSM Taiwan Semiconductor Manufacturing Company, Ltd. Taiwan Semiconductor Manufacturing Company, Ltd. Semiconductor Manufacturing Company, Taiwan Annual Report 2002 121, Park Ave. 3, Science-Based Industrial Park, Hsin-Chu, Taiwan 300-77, R.O.C. Tel: 886-3-578-0221 Fax: 886-3-578-1546 http://www.tsmc.com Taiwan Semiconductor Manufacturing Company, Ltd. Annual Report 2002 • Taiwan Stock Exchange Market Observation Post System: http://mops.tse.com.tw • TSMC annual report is available at http://www.tsmc.com/english/tsmcinfo/c0203.htm Morris Chang, Chairman Printed on March 12, 2003 TABLE OF CONTENTS 3 LETTER TO THE SHAREHOLDERS 7 A BRIEF INTRODUCTION TO TSMC 7 Company Profile 8 Market Overview MAJOR FACILITIES TSMC SPOKESPERSON 9 Organization Corporate Headquarters & FAB 2, FAB 5 Name: Harvey Chang 18 Capital & Shares 121, Park Ave. 3 Title: Senior Vice President & CFO 22 Issuance of Corporate Bonds Science-Based Industrial Park Tel: 886-3-563-6688 Fax: 886-3-563-7000 23 Preferred Shares Hsin-Chu, Taiwan 300-77, R.O.C. Email: [email protected] 24 Issuance of American Depositary Shares Tel: 886-3-578-0221 Fax: 886-3-578-1546 26 Status of Employee Stock Option Plan (ESOP) Acting Spokesperson 26 Status of Mergers and Acquisitions FAB 3 Name: J.H. Tzeng 26 Corporate Governance 9, Creation Rd. 1 Title: Public Relations Department Manager 30 Social Responsibility Information Science-Based Industrial Park Tel: 886-3-563-6688 Fax: 886-3-567-0121 Hsin-Chu, Taiwan 300-77, R.O.C. Email: [email protected] 32 OPERATIONAL HIGHLIGHTS Tel: 886-3-578-1688 Fax: 886-3-578-1548 32 Business Activities AUDITORS 34 Customers FAB 6 Company: T N SOONG & CO 34 Raw Material Supply 1, Nan-Ke North Rd. -

TSMC'schipdominanceis Expectedtocontinueasit Plans$100Bexpansion

JUN 21 Gadjo Sevilla TSMC’s chip dominance is expected to continue as it plans $100B expansion Article The news: As most of the world relies on chip production from TSMC, the global shortage and the lack of a diversified semiconductor supply chain pose risks to the global economy, per The Wall Street Journal. How we got here: TSMC’s microchips are in billions of products ranging from iPhones, PCs, smart home devices, and IoT sensors. TSMC produces high-performance processors Copyright © 2021, Insider Intelligence Inc. All rights reserved. Page 1 designed by companies like Apple and Qualcomm for the latest smartphones and computers, but it also dominates the market for less-sophisticated microcontrollers used for automating smart cars and smart home appliances. Heavy reliance on a single chip producer is exposing risks to the global economy, a reality that’s only become clearer amid the global semiconductor shortage and which is resulting in higher costs being shouldered by consumers. Surging demand for electronics during the pandemic overwhelmed the semiconductor industry and led to a global shortage expected to last another 18 months, per CNBC. China, Europe, and the US have started to invest in various chip foundries to satisfy future demand and better diversify supply chains, but these eorts will have no eect on the current shortage. The bigger picture: Several chip manufacturers are building chip factories in the US, the scale of investment pales beside TSMC’s planned expansion, which will cost $100 billion over the next three years. TSMC’s investment is a quarter of the entire industry’s capital spending per VLSI Research.