Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Registration Document

REGISTRATION DOCUMENT 2018 CONTENTS 1 GROUP OVERVIEW 3 4 SUSTAINABLE DEVELOPMENT 157 1.1 Business environment, economic 4.1 Klépierre’s CSR strategy 158 model and strategy 4 4.2 Act for the Planet 162 1.2 Key figures 8 4.3 Act for Territories 179 1.3 Share ownership and stock information 12 4.4 Act for People 184 1.4 Background 12 4.5 Sustainability governance 200 1.5 Property portfolio as of December 31, 2018 14 4.6 Supplemental data, methodology 1.6 Simplified organization chart and concordance tables 203 as of December 31, 2018 25 1.7 Risk management 26 5 CORPORATE GOVERNANCE 219 BUSINESS FOR THE YEAR 35 5.1 Management and oversight of the Company 221 2 5.2 Compensation and benefits of executive 2.1 Business overview 36 corporate officers 244 2.2 Business activity by region 41 2.3 Net current cash flow 45 2.4 Investments, developments, and disposals 46 2.5 Parent company earnings and distribution 49 6 SHARE CAPITAL, SHARE 2.6 Portfolio valuation 49 OWNERSHIP, GENERAL 2.7 Financial policy 54 MEETING OF SHAREHOLDERS 267 2.8 EPRA performance indicators 57 2.9 Outlook 61 6.1 Share capital and share ownership 268 6.2 General Meeting of Shareholders 282 FINANCIAL STATEMENTS 63 3 ADDITIONAL INFORMATION 309 3.1 Consolidated financial statements 7 for the year ended December 31, 2018 64 7.1 General information 310 3.2 Statutory auditors’ report on the 7.2 Documents on display 312 consolidated financial statements 122 7.3 Statement by the person responsible for 3.3 Company financial statements for the year the registration document, which serves -

Mergers & Acquisitions Mexico Annual Issue

Seale & Associates Creative Solutions. Trusted Advice. MERGERS & ACQUISITIONS MEXICO 2019 ANNUAL ISSUE SUMMARY OF MERGERS & ACQUISITIONS IN MEXICO In 2019, the volume and value of announced transactions accumulated to 169 and USD$15.8 billion, respectively, representing a decrease in volume of 25.0% and an increase in reported value 33.7% Year-Over-Year. It is necessary to clarify that two megadeals in the infrastructure sector represent US$7.1 billion of the total value reported 18 18 18 16 17 16 16 13 13 12 11 9 10 Deal Volume in Mexico # of Transactions per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $15.8 226 2016 $8.6 210 2017 $11.4 240 2018 $8.6 $15.8 Deal Volume and 212 Value in Mexico Annual Transactions 2019 $8.7 $7.1* 169 (US$ billion) $7.1 *Megadeals Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. Trusted Advice. SUMMARY OF MERGERS & ACQUISITIONS BY MEXICAN COMPANIES ABROAD In 2019, the volume and value of announced transactions accumulated to 40 deals worth US$3.8 billion, representing a decrease in volume of 14.8% and a decrease in reported value of 26.9% Year-Over-Year 7 6 6 4 4 3 3 3 3 2 2 Deal Volume 1 Abroad # of Transactions 0 per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $13.4 47 2016 $9.6 49 2017 $8.9 39 2018 $5.2 47 Deal Volume and Value Abroad Annual Transactions (US$ billion) 2019 $3.8 40 Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. -

Valuation Multiples by Industry

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (5200-5999) Retail Trade Report Date: 31 March 2021 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Retail-Lumber & Other Building Materials Dealers (5211) 6 1.52 13.48 16.37 3.01 3.38 Retail-Variety Stores (5331) 9 0.91 13.55 18.73 1.83 2.15 Retail-Grocery Stores (5411) 10 0.37 7.19 10.75 0.90 0.95 Retail-Auto Dealers & Gasoline Stations (5500) 21 0.94 12.34 17.63 1.64 1.74 Retail-Auto & Home Supply Stores (5531) 6 1.48 12.72 14.68 2.13 2.67 Retail-Apparel & Accessory Stores (5600) 7 1.17 14.18 39.80 1.34 1.45 Retail-Family Clothing Stores (5651) 10 1.23 15.85 53.84 1.31 1.56 Retail-Shoe Stores (5661) 5 - - - 1.24 1.20 Retail-Home Furniture, Furnishings & Equipment Stores 6 1.17 - - 1.22 2.20 (5700) Retail-Eating & Drinking Places (5810) 6 4.61 54.28 - 1.68 2.55 Retail-Eating Places (5812) 39 2.28 23.89 28.25 1.67 2.20 Retail-Miscellaneous Retail (5900) 7 2.16 - 18.46 1.49 2.69 Retail-Drug Stores And Proprietary Stores (5912) 7 0.59 16.69 39.50 0.78 1.38 Retail-Miscellaneous Shopping Goods Stores (5940) 8 0.79 7.46 10.79 0.95 1.16 Retail-Catalog & Mail-Order Houses (5961) 23 1.17 14.70 22.10 2.88 3.27 Retail-Retail Stores, Nec (5990) 12 0.91 10.77 13.84 1.32 1.28 © 2021 eVal 1 20210427 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

Building a Culture of Diversity, Equity & Inclusion

THE MONTHLY BUSINESS NEWS MAGAZINE OF THE LANSING REGIONAL CHAMBER OF COMMERCE • FEBRUARY 2021 Building a Culture of Diversity, Equity & Inclusion IN THIS ISSUE TECHSMITH ESTABLISHES NEW CORPORATE HEADQUARTERS SHYFT GROUP ANNOUNCES MAJOR JOB ADDITIONS FOCUS ON SMALL BUSINESS: NGAGE MANAGEMENT MESSAGE FROM THE CHAMBER Living Our Commitment to Diversity, Equity & Inclusion was a watershed moment in our nation’s history. It was a year of the unprecedented COVID-19 pandemic, great 2020 turmoil, and divisiveness, and a year that ripped at our souls over the civil unrest that erupted on multiple occasions. The pain of our nation’s failures to come to grips with social justice was felt throughout our communities and within all of our organizations. If there is good news to come out of the past 12 months, it has been in a renewed commitment to elevating the cause of diversity, equity, and inclusion (DE&I). This month’s Focus cover story features several organizations that have TIM DAMAN been among the leaders in DE&I for many years, in some cases, for decades. President and CEO We wanted to highlight the great work that is already being done and Lansing Regional showcase some of the best practices and challenges involved in building a Chamber of Commerce DE&I culture. As leaders, all of us need to be Not surprisingly, organizations that have established DE&I initiatives willing to be vulnerable and have utilized the past year’s civil unrest to strengthen their commitment face our shortcomings in the further. Leaders at the highest levels of these organizations conducted town hall meetings and listening tours where they heard first-hand the DE&I makes our organizations concerns that their team members feel about social injustice and how it impacts their everyday lives. -

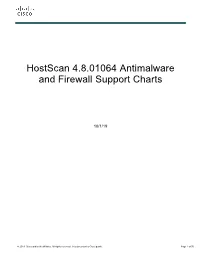

Hostscan 4.8.01064 Antimalware and Firewall Support Charts

HostScan 4.8.01064 Antimalware and Firewall Support Charts 10/1/19 © 2019 Cisco and/or its affiliates. All rights reserved. This document is Cisco public. Page 1 of 76 Contents HostScan Version 4.8.01064 Antimalware and Firewall Support Charts ............................................................................... 3 Antimalware and Firewall Attributes Supported by HostScan .................................................................................................. 3 OPSWAT Version Information ................................................................................................................................................. 5 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.890.0 for Windows .................................................. 5 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.890.0 for Windows ........................................................ 44 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.824.0 for macos .................................................... 65 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.824.0 for macOS ........................................................... 71 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.730.0 for Linux ...................................................... 73 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.730.0 for Linux .............................................................. 76 ©201 9 Cisco and/or its affiliates. All rights reserved. This document is Cisco Public. -

MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020

MINISO InvestorRoom MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020 GUANGZHOU, China, Dec. 18, 2020 /PRNewswire/ -- MINISO Group Holding Limited (NYSE: MNSO) ("MINISO" or the "Company"), a fast-growing global value retailer offering a variety of design-led lifestyle products, today announced its unaudited financial results for the first fiscal quarter ended September 30, 2020. Financial Highlights for the 2021 First Fiscal Quarter Ended September 30, 2020 Revenue for the fiscal quarter ended September 30, 2020, was RMB2,072.1 million (US$305.2 million), representing a decrease of 30.7% from the fiscal quarter endedS eptember 30, 2019, and an increase of 33.4% from the previous fiscal quarter ended June 30, 2020. Gross profit for the fiscal quarter ended September 30, 2020, was RMB522.4 million (US$76.9 million), representing a decrease of 44.3% from the fiscal quarter endedS eptember 30, 2019, and an increase of 37.7% from the previous fiscal quarter ended June 30, 2020. Loss from continuing operations for the fiscal quarter ended September 30, 2020, was RMB1,676.3 million (US$246.9 million) as compared to RMB20.3 million for the fiscal quarter ended September 30, 2019, and RMB74.8 million for the previous fiscal quarter ended June 30, 2020. Adjusted net profit[1] for the fiscal quarter ended September 30, 2020, was RMB102.1 million (US$15.0 million), representing a decrease of 74.6% from the fiscal quarter endedS eptember 30, 2019, and an increase of 140.8% from the previous fiscal quarter endedJ une 30, 2020. -

Shigeru Ban, on Structural Design

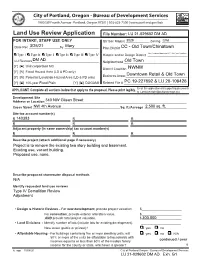

Land Use Review Application File Number: FOR INTAKE, STAFF USE ONLY Qtr Sec Map(s) _____________ Zoning ______________ Date Rec _________________by ___________________ Plan District _____________________________________ Type I Type Ix Type II Type IIx Type III Type IV Historic and/or Design District ______________________ LU Reviews _____________________________________ Neighborhood ___________________________________ [Y] [N] Unincorporated MC District Coalition _________________________________ [Y] [N] Flood Hazard Area (LD & PD only) [Y] [N] Potential Landslide Hazard Area (LD & PD only) Business Assoc __________________________________ [Y] [N] 100-year Flood Plain [Y] [N] DOGAMI Related File # ___________________________________ Email this application and supporting documents APPLICANT: Complete all sections below that apply to the proposal. Please print legibly. to: [email protected] Development Site Address or Location ______________________________________________________________________________ Cross Street ________________________________________________Sq. ft./Acreage _______________________ Site tax account number(s) R R R R R R Adjacent property (in same ownership) tax account number(s) R R R Describe project (attach additional page if necessary) Describe proposed stormwater disposal methods Identify requested land use reviews • Design & Historic Reviews - For new development, provide project valuation. $______________________ For renovation, provide exterior alteration value. $______________________ AND -

Fund Holdings March 31, 2021

Fund Holdings March 31, 2021 Our Funds Daily Income Fund (HDIXX) Short-Term Government Securities Fund (HOSGX) Short-Term Bond Fund (HOSBX) Intermediate Bond Fund (HOIBX) Stock Index Fund (HSTIX) Value Fund (HOVLX) Growth Fund (HNASX) International Equity Fund (HISIX) Small-Company Stock Fund (HSCSX) Table of Contents Daily Income Fund......................................................... 1 Short-Term Government Securities Fund .................... 3 Short-Term Bond Fund.................................................. 7 Intermediate Bond Fund ...............................................15 Stock Index Fund............................................................25 S&P 500 Index Master Portfolio.....................................26 Value Fund ......................................................................35 Growth Fund...................................................................37 International Equity Fund .............................................39 Small-Company Stock Fund..........................................42 Portfolio of Investments Daily Income Fund | March 31, 2021 | (Unaudited) U.S. Government & Agency Obligations | 74.0% of portfolio Interest Rate / Yield Maturity Date Face Amount Value Federal Farm Credit Bank .% // $ ,, $ ,, Federal Farm Credit Bank .(a) // ,, ,, Federal Home Loan Bank . // ,, ,, Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal National Mortgage Assoc. // ,, ,, Tunisia Government AID Bonds .