3Rd Quarter Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

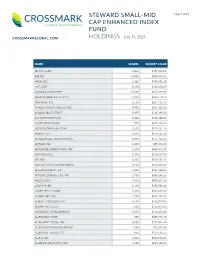

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

Fidelity® Extended Market Index Fund

Quarterly Holdings Report for Fidelity® Extended Market Index Fund May 31, 2021 SEI-QTLY-0721 1.816014.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.8% Shares Value Shares Value COMMUNICATION SERVICES – 6.0% CarGurus, Inc. Class A (a) 481,276 $ 13,581,609 Diversified Telecommunication Services – 0.5% Cars.com, Inc. (a) 356,794 5,212,760 Alaska Communication Systems Group, Inc. 306,734 $ 1,018,357 Creatd, Inc. (a) (b) 42,672 156,606 Anterix, Inc. (a) (b) 65,063 3,218,016 DHI Group, Inc. (a) 262,377 839,606 ATN International, Inc. 49,421 2,336,131 Eventbrite, Inc. (a) (b) 368,036 7,471,131 Bandwidth, Inc. (a) (b) 118,706 14,041,733 EverQuote, Inc. Class A (a) (b) 54,748 1,726,204 Cincinnati Bell, Inc. (a) 265,617 4,090,502 IAC (a) 439,438 70,077,178 Cogent Communications Group, Inc. (b) 226,643 17,134,211 Izea Worldwide, Inc. (a) 258,392 718,330 Consolidated Communications Holdings, Inc. (a) 325,131 3,043,226 Kubient, Inc. (b) 44,094 228,848 Cuentas, Inc. (a) (b) 48,265 108,596 Liberty TripAdvisor Holdings, Inc. (a) 380,876 1,812,970 Globalstar, Inc. (a) (b) 3,272,215 5,235,544 Match Group, Inc. (a) 1,417,570 203,251,187 IDT Corp. Class B (a) 96,642 2,789,088 MediaAlpha, Inc. Class A (b) 91,323 3,864,789 Iridium Communications, Inc. (a) 621,382 23,743,006 Pinterest, Inc. Class A (a) 2,805,904 183,225,531 Liberty Global PLC: Professional Diversity Network, Inc. -

COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

COMMUNITY BANK LANDSCAPE North Carolina 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. NORTH CAROLINA BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. NORTH CAROLINA BANK REGULATORY DATA OVERVIEW – NORTH CAROLINA BANK REGULATORY DATA Piedmont Mountains Coastal Plain METHODOLOGY ▪ 3 regions separated by geographic KEY STATE OBSERVATIONS relevance ▪ Median loan growth of 4.69% ▪ Data as of most recent available ▪ Median NIM of 3.77% quarter as of March 31, 2019 ▪ Regulatory call report data shown for all banks NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Does not include Bank of America, NA Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 NORTH CAROLINA BANKS – MOUNTAINS REGION Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) Black Mountain SB SSB Black Mountain $40 $29 3.3 % $34 (6.4) % 85.6 % 12.74 % 31.62 % 0.00 % 0.00 % 0.0 % 0.14 % 0.00 % $41 0.41 % 3.00 % 82.9 % Entegra Bank Franklin 1,668 1,089 2.0 1,251 8.2 87.1 9.67 14.35 0.80 0.43 7.8 1.11 0.02 4,046 0.98 3.17 68.3 HomeTrust Bank Asheville 3,455 2,674 4.7 2,332 10.2 114.7 10.25 12.22 1.09 0.40 10.0 0.91 0.38 3,373 0.39 3.34 69.7 Jackson SB SSB Sylva 32 26 (1.5) 26 (1.3) 101.7 20.97 40.77 1.20 1.03 5.7 0.22 0.00 81 1.00 3.69 69.2 Lifestore Bank (MHC) West Jefferson 293 185 3.2 225 7.7 82.2 10.99 18.61 1.13 1.13 9.6 1.31 0.00 713 0.98 3.46 72.8 Morganton SB S.S.B. -

1St Quarter Report

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Mid Cap Portfolio March 31, 2021 VIPMID-QTLY-0521 1.799869.117 Schedule of Investments March 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 3.5% Tapestry, Inc. 673,600 $ 27,759,056 Entertainment – 2.3% thredUP, Inc. (b) 26,600 620,578 Activision Blizzard, Inc. 1,187,600 $ 110,446,800 236,705,162 Cinemark Holdings, Inc. (a) 612,400 12,499,084 TOTAL CONSUMER DISCRETIONARY 1,215,512,530 Electronic Arts, Inc. 287,790 38,958,132 Live Nation Entertainment, Inc. (b) 245,500 20,781,575 182,685,591 CONSUMER STAPLES – 5.3% Interactive Media & Services – 0.5% Beverages – 0.6% Bumble, Inc. 39,400 2,457,772 C&C Group PLC (United Kingdom) (b) 7,982,445 30,922,922 IAC (b) 179,700 38,870,907 Monster Beverage Corp. (b) 183,000 16,669,470 41,328,679 47,592,392 Media – 0.7% Food & Staples Retailing – 2.6% Interpublic Group of Companies, Inc. 1,986,185 57,996,602 BJ’s Wholesale Club Holdings, Inc. (b) 1,891,100 84,834,746 Performance Food Group Co. (b) 1,118,796 64,453,838 TOTAL COMMUNICATION SERVICES 282,010,872 U.S. Foods Holding Corp. (b) 1,638,300 62,451,996 211,740,580 CONSUMER DISCRETIONARY – 15.0% Food Products – 1.1% Automobiles – 0.2% Nomad Foods Ltd. (b) 3,382,400 92,880,704 Harley‑Davidson, Inc. 474,400 19,023,440 Household Products – 1.0% Diversified Consumer Services – 0.6% Spectrum Brands Holdings, Inc. -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

2020 Annual Report

HOME SATELLITE 2020 Annual Report OFFICE COMMUNITY SPACES HUB © 2021 Knoll, Inc. All rights reserved. Printed in the United States. The Thriving Workplace Ecosystem Corporate Information Officers Board of Directors Locations Andrew B. Cogan Andrew B. Cogan Knoll, Inc. Muuto Chairman of the Board Director Knoll Office KnollStudio Østergade 36-38 and Chief Executive Officer Chairman of the Board KnollExtra KnollTextiles DK-1100 Copenhagen and Chief Executive Officer 1235 Water Street Denmark Charles W. Rayfield East Greenville, PA 18041 Senior Vice President and Roberto Ardagna 215 679-7991 For showrooms and sales offices: Chief Financial Officer Director muuto.com For showrooms and sales offices: Christopher M. Baldwin Daniel W. Dienst knoll.com HOLLY HUNT President and Chief Operating Director 801 West Adams Street # 700, Officer, Knoll Office Edelman Leather Chicago, IL 60607 Stephen F. Fisher 80 Pickett District Road 312 329-5999 Benjamin A. Pardo Director New Milford, CT 06776 Executive Vice President and 860 350-9600 For showrooms and sales offices: Director of Design Jeffrey A. Harris hollyhunt.com Director For showrooms and sales offices: Michael A. Pollner edelmanleather.com Senior Vice President, Jeffrey Alan Henderson Spinneybeck | FilzFelt Chief Administrative Officer, Director 425 CrossPoint Parkway General Counsel and Secretary Fully Getzville, NY 14068 Ronald R. Kass 117 SE Taylor St 716 446-2380 Roxanne B. Klein Director Suite 301 Senior Vice President, Portland, OR 97214 For showrooms and sales offices: Human Resources Christopher G. Kennedy 888 508-3725 spinneybeck.com Director Esohe M. Omoruyi For showrooms and sales offices: Executive Vice President, John F. Maypole fully.com Consumer and Digital Commerce Director Sarah E. -

Casper Sleep Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 10-Q (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___________________ to ___________________ Commission File Number: 001-39214 Casper Sleep Inc. (Exact Name of Registrant as Specified in its Charter) Delaware 46-3987647 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Three World Trade Center 175 Greenwich Street, Floor 39 New York, NY 10007 (Address of principal executive offices) (Zip Code) (347) 941-1871 (Registrant’s telephone number, including area code) N/A (Former name, former address, and former fiscal year, if changed since last report) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $0.000001 par value per share CSPR The New York Stock Exchange Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

Healthcare Market Monitor

Mergers & Acquisitions Capital Raise Strategic Advisory Healthcare Market Monitor Q1 2021 CTIVITY Q1 2021 M&A A Mergers & Acquisitions Capital Raise Strategic Advisory Highlights Total M&A Volume: Q1 2020 vs. Q1 2021 ▪ In Q1 2021, total Healthcare M&A volume was up 65.1% compared to Q1 2020. 600 515 M&A Volume ▪ The eHealth segment continues to be an attractive space with total deal 500 volume increasing by 44 transactions in Q1 2021 over Q1 2020. Physician Medical Groups also experienced a large increase in volume largely due to 400 private equity buyers or their sponsored companies targeting small 312 Notable physician groups. 300 Transactions ▪ Much of the increase in total Q1 2021 volume could be attributed to the roll- 200 out of COVID-19 vaccines and the uncertainty around presidential election subsiding. 100 Public Indexes ▪ Additionally, aggregate deal value among the segments was up 340.5% over - Q1 2020, reaching $56.8B in Q1 2021. Q1 2020 Q1 2021 M&A Volume by Segment: Q1 2020 vs. Q1 2021 HCA Overview 120 Q1 2020 110 102 95 100 Q1 2021 94 Services 77 80 58 60 49 40 35 Experience 25 28 26 18 20 17 16 17 20 20 10 4 6 0 Behavioral eHealth Home Health / Hospitals Labs / Managed Care Other Services Physician Post-acute Senior / Assisted Contact Us Health Care Hospice Diagnostics Medical Groups Care/Rehab Living Source: CapitalIQ, Healthcare M&A News 2 ELECT OTABLE CTIVITY S , N M&A A Mergers & Acquisitions Capital Raise Strategic Advisory $ in millions Announce Transaction Date Category Target Acquirer/Investor Short Description Value Mar-21 Senior / Assisted Living All Assets of Henry Ford Village, Inc. -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Winning Against a Dominant Brand

Winning against a dominant brand Received (in revised form): 11th February, 2020 DAVID AAKER Vice Chair of Prophet and Professor Emeritus, Berkeley-Haas School of Business David Aaker is Vice Chair of Prophet and Professor Emeritus, Berkeley-Haas School of Business. He is the author if 18 books including Owning Game-Changing Subcategories, Creating Signature Stories and Aaker on Branding and is a member of the American Marketing Association and the New York Marketing Hall of Fame. Abstract David Aaker The successful e-commerce-first brands competing against Amazon provide a road map for any firm going against a dominant player in any category. These brands engage in strategic jujitsu by exploiting Amazon’s vulnerabilities — an impersonal/functional image, being the everything store without in- depth credibility in anything, and often having the personality of a-powerful giant lacking humour or warmth. Strategies that work include developing credibility for their subcategory, a simpler choice set, a brand community, a higher purpose, a personal touch, being the feisty underdog, positioning to highlight advantages and expanding the distribution footprint by adding storefront synergies. Keywords underdog brands, e-commerce strategies, dominant brands FACING A GIANT challengers create a growth platform in Many, if not most, categories have one, that shadow? How do they neutralise the two or occasionally three dominant play- enormous assets of the market giant, or ers that that seem close to invincible. even turn those assets into a liability using Against this reality, it is challenging even some form of strategic jujitsu? A formida- for innovative firms to gain a foothold and ble task. -

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc. Company Release - 10/01/2015 07:00 MOULTRIE, Ga and JACKSONVILLE, Fla., Oct. 1, 2015 /PRNewswire/ -- Ameris Bancorp (Nasdaq-GS: ABCB) ("Ameris"), the parent company of Ameris Bank, announced today the signing of a definitive merger agreement under which Ameris will acquire Jacksonville Bancorp, Inc. (Nasdaq-CM: JAXB) ("Jacksonville Bancorp"), the parent company of The Jacksonville Bank, Jacksonville, Florida. Upon completion of the transaction, the combined company will have approximately $5.7 billion in assets, $4.0 billion in loans, $4.9 billion in deposits and a branch network of 101 banking locations across four states, inclusive of Ameris's recently announced branch consolidation. "We are pleased to announce our merger with Jacksonville Bancorp, as it will accelerate our growth momentum in the greater Jacksonville, Florida market. We believe that this transaction will allow us to better serve our combined customer base, provide greater access to the variety of banking services we offer and help us build a stronger presence to positively impact our community," commented Edwin W. Hortman, Jr., President and Chief Executive Officer of Ameris. The acquisition further expands Ameris's existing Southeastern footprint in the attractive Jacksonville, Florida market. Jacksonville Bancorp currently operates eight banking locations, all of which are located within the Jacksonville MSA, as well as one cyber banking site. After the acquisition, Ameris will become the largest community bank by deposit market share in the Jacksonville, Florida market. Kendall L. Spencer, President and Chief Executive Officer of Jacksonville Bancorp, said, "We are excited to announce our merger with Ameris. -

Shigeru Ban, on Structural Design

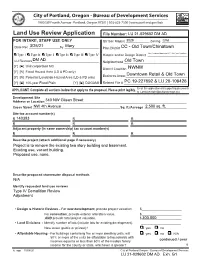

Land Use Review Application File Number: FOR INTAKE, STAFF USE ONLY Qtr Sec Map(s) _____________ Zoning ______________ Date Rec _________________by ___________________ Plan District _____________________________________ Type I Type Ix Type II Type IIx Type III Type IV Historic and/or Design District ______________________ LU Reviews _____________________________________ Neighborhood ___________________________________ [Y] [N] Unincorporated MC District Coalition _________________________________ [Y] [N] Flood Hazard Area (LD & PD only) [Y] [N] Potential Landslide Hazard Area (LD & PD only) Business Assoc __________________________________ [Y] [N] 100-year Flood Plain [Y] [N] DOGAMI Related File # ___________________________________ Email this application and supporting documents APPLICANT: Complete all sections below that apply to the proposal. Please print legibly. to: [email protected] Development Site Address or Location ______________________________________________________________________________ Cross Street ________________________________________________Sq. ft./Acreage _______________________ Site tax account number(s) R R R R R R Adjacent property (in same ownership) tax account number(s) R R R Describe project (attach additional page if necessary) Describe proposed stormwater disposal methods Identify requested land use reviews • Design & Historic Reviews - For new development, provide project valuation. $______________________ For renovation, provide exterior alteration value. $______________________ AND