Largest Community Banks in the Southeast

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

COMMUNITY BANK LANDSCAPE North Carolina 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. NORTH CAROLINA BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. NORTH CAROLINA BANK REGULATORY DATA OVERVIEW – NORTH CAROLINA BANK REGULATORY DATA Piedmont Mountains Coastal Plain METHODOLOGY ▪ 3 regions separated by geographic KEY STATE OBSERVATIONS relevance ▪ Median loan growth of 4.69% ▪ Data as of most recent available ▪ Median NIM of 3.77% quarter as of March 31, 2019 ▪ Regulatory call report data shown for all banks NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Does not include Bank of America, NA Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 NORTH CAROLINA BANKS – MOUNTAINS REGION Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) Black Mountain SB SSB Black Mountain $40 $29 3.3 % $34 (6.4) % 85.6 % 12.74 % 31.62 % 0.00 % 0.00 % 0.0 % 0.14 % 0.00 % $41 0.41 % 3.00 % 82.9 % Entegra Bank Franklin 1,668 1,089 2.0 1,251 8.2 87.1 9.67 14.35 0.80 0.43 7.8 1.11 0.02 4,046 0.98 3.17 68.3 HomeTrust Bank Asheville 3,455 2,674 4.7 2,332 10.2 114.7 10.25 12.22 1.09 0.40 10.0 0.91 0.38 3,373 0.39 3.34 69.7 Jackson SB SSB Sylva 32 26 (1.5) 26 (1.3) 101.7 20.97 40.77 1.20 1.03 5.7 0.22 0.00 81 1.00 3.69 69.2 Lifestore Bank (MHC) West Jefferson 293 185 3.2 225 7.7 82.2 10.99 18.61 1.13 1.13 9.6 1.31 0.00 713 0.98 3.46 72.8 Morganton SB S.S.B. -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc. Company Release - 10/01/2015 07:00 MOULTRIE, Ga and JACKSONVILLE, Fla., Oct. 1, 2015 /PRNewswire/ -- Ameris Bancorp (Nasdaq-GS: ABCB) ("Ameris"), the parent company of Ameris Bank, announced today the signing of a definitive merger agreement under which Ameris will acquire Jacksonville Bancorp, Inc. (Nasdaq-CM: JAXB) ("Jacksonville Bancorp"), the parent company of The Jacksonville Bank, Jacksonville, Florida. Upon completion of the transaction, the combined company will have approximately $5.7 billion in assets, $4.0 billion in loans, $4.9 billion in deposits and a branch network of 101 banking locations across four states, inclusive of Ameris's recently announced branch consolidation. "We are pleased to announce our merger with Jacksonville Bancorp, as it will accelerate our growth momentum in the greater Jacksonville, Florida market. We believe that this transaction will allow us to better serve our combined customer base, provide greater access to the variety of banking services we offer and help us build a stronger presence to positively impact our community," commented Edwin W. Hortman, Jr., President and Chief Executive Officer of Ameris. The acquisition further expands Ameris's existing Southeastern footprint in the attractive Jacksonville, Florida market. Jacksonville Bancorp currently operates eight banking locations, all of which are located within the Jacksonville MSA, as well as one cyber banking site. After the acquisition, Ameris will become the largest community bank by deposit market share in the Jacksonville, Florida market. Kendall L. Spencer, President and Chief Executive Officer of Jacksonville Bancorp, said, "We are excited to announce our merger with Ameris. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

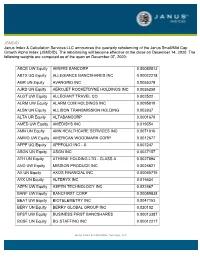

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

First Horizon's Supplement to Their Application to the Federal Reserve

SUPPLEMENT TO THE APPLICATION TO THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM RELATING TO THE PROPOSED ACQUISITION OF CAPITAL BANK FINANCIAL CORP. BY FIRST HORIZON NATIONAL CORPORATION AND FIRESTONE SUB, INC. PURSUANT TO SECTIONS 3(a)(2), 3(a)(3) AND 3(a)(5) OF THE BANK HOLDING COMPANY ACT OF 1956, AS AMENDED, AND REGULATION Y PROMULGATED THEREUNDER August 2, 2017 RESPONSES OF FIRST HORIZON NATIONAL CORPORATION TO THE REQUEST FOR ADDITIONAL INFORMATION Set forth below are the responses of First Horizon National Corporation (“First Horizon”) to the Board of Governors of the Federal Reserve System staff’s request for additional information, dated July 14, 2017, relating to First Horizon’s application (the “Application”) pursuant to Section 3 of the Bank Holding Company Act of 1956, as amended (the “BHC Act”), for prior approval to merge with Capital Bank Financial Corp. (“CBFC”), and thereby indirectly acquire Capital Bank Corp. (“Capital Bank”). Preceding each response, the related question is restated in bold. Capitalized terms not otherwise defined herein shall have the meanings set forth in the Application. 1. Provide current and pro forma shareholders lists for First Horizon that specifically identify any shareholder or group of shareholders that would own or control, directly or indirectly, 5 percent or more of any class of voting securities, or 10 percent or more of the total equity, of First Horizon both before and after consummation of the proposed transaction. In calculating the voting ownership, include any warrants, options, and other convertible instruments, and show all levels of voting ownership on both a fully diluted and an individually diluted basis. -

PORTFOLIO of INVESTMENTS – As of December 31, 2020 (Unaudited)

PORTFOLIO OF INVESTMENTS – as of December 31, 2020 (Unaudited) Loomis Sayles Small Cap Value Fund ________________________________Shares Description ____________________________________________________________ Value (†) Common Stocks – 98.9% of Net Assets Aerospace & Defense – 1.0% 64,870 Aerojet Rocketdyne Holdings, Inc.(a) $ 3,428,379 36,809 BWX Technologies, Inc. ______________2,218,847 ______________5,647,226 Auto Components – 3.2% 134,171 Cooper Tire & Rubber Co. 5,433,925 288,336 Dana, Inc. 5,628,319 20,928 Fox Factory Holding Corp.(a) 2,212,299 38,655 LCI Industries ______________5,012,780 ______________18,287,323 Banks – 13.5% 158,448 Ameris Bancorp 6,032,115 185,530 Atlantic Union Bankshares Corp. 6,111,358 172,148 BancorpSouth Bank 4,723,741 147,547 Bryn Mawr Bank Corp. 4,514,200 215,661 CVB Financial Corp. 4,205,390 271,568 Home BancShares, Inc. 5,290,145 234,144 OceanFirst Financial Corp. 4,362,103 95,010 Pinnacle Financial Partners, Inc. 6,118,644 132,588 Popular, Inc. 7,467,356 76,931 Prosperity Bancshares, Inc. 5,335,934 62,945 South State Corp. 4,550,924 133,304 TCF Financial Corp. 4,934,914 146,089 Triumph Bancorp, Inc.(a) 7,092,621 113,313 Wintrust Financial Corp. ______________6,922,291 ______________77,661,736 Beverages – 1.0% 364,847 Primo Water Corp. ______________5,720,801 Biotechnology – 1.6% 45,738 Emergent BioSolutions, Inc.(a) 4,098,125 31,964 United Therapeutics Corp.(a) ______________4,851,815 ______________8,949,940 Building Products – 2.6% 45,224 American Woodmark Corp.(a) 4,244,273 52,093 Armstrong World Industries, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Stephens Bank Research Team

Stephens Bank Research Team – Upcoming Investor Events August 22, 2018 Non-Deal Roadshow 2018 Stephens Bank CEO Forum August, 2018 Company Name (Ticker) Company Name (Ticker) Company Name Day Location Allegiance Bancshares, Inc. (ABTX) LegacyTexas Financial Group (LTXB) BancorpSouth Bank (BXS) 22 Boston Ameris Bancorp (ABCB) Merchants Bancorp (MBIN) Banner Corp. (BANR) 28-29 New York, Boston Bank OZK, Inc. (OZK) Midland States Bancorp, Inc. (MSBI) September, 2018 BofI Holding, Inc. (BOFI) National Bank Holdings (NBHC) Company Name Day Location BOK Financial Corporation (BOKF) National Commerce Corp. (NCOM) F.N.B. Corporation (FNB) 11-12 Dallas, Houston Business First Bancshares (BFST) Old Line Bancshares (OLBK) Sterling Bancorp (STL) 19 Boston Byline Bancorp (BY) Old National Bancorp (ONB) November, 2018 Cadence Bancorporation (CADE) Origin Bancorp, Inc. (OBNK) Company Name Day Location CBTX, Inc. (CBTX) Pacific Premier Bancorp, Inc. (PPBI) Carolina Financial Corp. (CARO) 1-2 Kansas City, St. Louis, Dallas CenterState Banks (CSFL) PacWest Bancorp (PACW) Analyst Marketing Chemical Financial (CHFC) Pinnacle Financial (PNFP) August, 2018 City Holding Co (CHCO) Preferred Bank (PFBC) Analyst(s) Day Location County Bancorp (ICBK) Prosperity Bancshares (PB) Terry McEvoy / Austin Nicholas 22-24 New York Stephens 8th Annual Bank Eagle Bancorp (EGBN) RBB Bancorp, Inc. (RBB) Tyler Stafford, CFA 27 New York CEO Forum will take Equity Bancshares (EQBK) Renasant Corp (RNST) th Matt Olney, CFA / Austin Nicholas 28 San Francisco place September 24 – FB Financial Corporation (FBK) Simmons First National Corp (SFNC) 26th in Little Rock – See September, 2018 here for further details. Fidelity Southern Corporation (LION) SmartFinancial (SMBK) Analyst(s) Day Location First Bancshares (FBMS) South State Corporation (SSB) Tyler Stafford, CFA / Matt Olney, CFA 4-5 Kansas City, St. -

First Horizon Corporation Annual Report 2021

First Horizon Corporation Annual Report 2021 Form 10-K (NYSE:FHN) Published: February 25th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 - or - ☐ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 SECURITIES EXCHANGE ACT OF 1934 For the Transition period from __________ to__________ Commission File Number: 001-15185 fhn-20201231_g1.jpg FIRST HORIZON CORPORATION (Exact name of registrant as specified in its charter) TN 62-0803242 (State or other jurisdiction (IRS Employer incorporation of organization) Identification No.) 165 Madison Avenue Memphis, Tennessee 38103 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code: 901-523-4444 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Exchange on which Registered $.625 Par Value Common Capital Stock FHN New York Stock Exchange LLC Depositary Shares, each representing a 1/4,000th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series A FHN PR A New York Stock Exchange LLC Depositary Shares, each representing a 1/400th interest in FHN PR B New York Stock Exchange LLC a share of Non-Cumulative Perpetual Preferred Stock, Series B Depositary Shares, each representing a 1/400th interest in FHN PR C New York