COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc. Company Release - 10/01/2015 07:00 MOULTRIE, Ga and JACKSONVILLE, Fla., Oct. 1, 2015 /PRNewswire/ -- Ameris Bancorp (Nasdaq-GS: ABCB) ("Ameris"), the parent company of Ameris Bank, announced today the signing of a definitive merger agreement under which Ameris will acquire Jacksonville Bancorp, Inc. (Nasdaq-CM: JAXB) ("Jacksonville Bancorp"), the parent company of The Jacksonville Bank, Jacksonville, Florida. Upon completion of the transaction, the combined company will have approximately $5.7 billion in assets, $4.0 billion in loans, $4.9 billion in deposits and a branch network of 101 banking locations across four states, inclusive of Ameris's recently announced branch consolidation. "We are pleased to announce our merger with Jacksonville Bancorp, as it will accelerate our growth momentum in the greater Jacksonville, Florida market. We believe that this transaction will allow us to better serve our combined customer base, provide greater access to the variety of banking services we offer and help us build a stronger presence to positively impact our community," commented Edwin W. Hortman, Jr., President and Chief Executive Officer of Ameris. The acquisition further expands Ameris's existing Southeastern footprint in the attractive Jacksonville, Florida market. Jacksonville Bancorp currently operates eight banking locations, all of which are located within the Jacksonville MSA, as well as one cyber banking site. After the acquisition, Ameris will become the largest community bank by deposit market share in the Jacksonville, Florida market. Kendall L. Spencer, President and Chief Executive Officer of Jacksonville Bancorp, said, "We are excited to announce our merger with Ameris. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

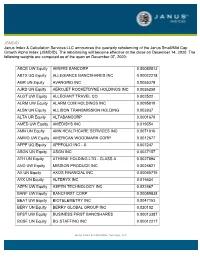

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

Top Investors Dallas Regional Chamber

DALLAS REGIONAL CHAMBER | TOP INVESTORS DALLAS REGIONAL CHAMBER REGIONAL DALLAS JBJ Management Norton Rose Fulbright Silicon Valley Bank The Fairmont Hotel Top Investors JE Dunn Construction NTT DATA Inc. Simmons Bank The Kroger Co. Jim Ross Law Group PC Omni Dallas Hotel Slalom The University of The Dallas Regional Chamber (DRC) recognizes the following companies and organizations for their membership investment at JLL Omniplan, Inc. Smoothie King Texas at Arlington one of our top levels. Companies in bold print are represented on the DRC Board of Directors. For more information about the Jones Day Omnitracs, LLC SMU - Southern Methodist Thompson & Knight LLP University benefits of membership at these levels call (214) 746-6600. JPMorgan Chase & Co. Oncor Thompson Coburn Southern Dock Products Katten Muchin Rosenman LLP On-Target Supplies Thomson Reuters Southern Glazer’s Wine and KDC Real Estate Development & & Logistics Ltd TIAA Spirits 1820 Productions Bell Nunnally Crowe LLP Google Investments Options Clearing Corporation T-Mobile | Southwest Airlines 4Front Engineered Solutions BGSF CSRS goPuff TOP INVESTORS Ketchum Public Relations Origin Bank Tom Thumb - Albertsons 7-Eleven, Inc. Billingsley Company CyrusOne Granite Properties Southwest Office Systems, Inc. Kilpatrick Townsend ORIX Corporation USA Town of Addison A G Hill Partners LLC BKD LLP Dallas Baptist University Grant Thornton LLP & Stockton LLP Spacee Inc. OYO Hotels and Homes Toyota Motor North America ABC Home & Commercial bkm Total Office of Texas Dallas College Green Brick Partners Kimberly-Clark Corporation Spectra Pacific Builders Transworld Business Advisors - Services Kimley-Horn and Associates Spencer Fane LLP Blackmon Mooring & BMS CAT Dallas Cowboys Football Club Greenberg Traurig Pape-Dawson Downtown Dallas Accenture Ltd. -

Largest Community Banks in the Southeast

Largest Community Banks in the Southeast Rank Institution Name Ticker State Total Assets ($mm) Total Deposits ($mm) 1 BankUnited, Inc. BKU FL $17,681 $12,834 2 United Bankshares, Inc. UBSI WV $12,085 $8,753 3 WesBanco, Inc.* WSBC WV $8,224 $6,438 4 South State Corporation SSB SC $7,880 $6,518 5 United Community Banks, Inc. UCBI GA $7,526 $6,241 6 Union Bankshares Corporation UBSH VA $7,194 $5,634 7 Capital Bank Financial Corp. CBF FL $6,690 $5,175 8 TowneBank* TOWN VA $6,083 $4,534 9 FCB Financial Holdings, Inc. FCB FL $6,055 $3,991 10 Pinnacle Financial Partners, Inc. PNFP TN $5,866 $4,662 11 BNC Bancorp* BNCN NC $4,919 $4,033 12 Carter Bank & Trust CARE VA $4,679 $4,272 13 Yadkin Financial Corporation YDKN NC $4,179 $3,185 14 ServisFirst Bancshares, Inc.* SFBS AL $4,176 $3,549 15 Ameris Bancorp ABCB GA $3,999 $3,373 16 Community Trust Bancorp, Inc. CTBI KY $3,670 $2,902 17 CenterState Banks, Inc. CSFL FL $3,639 $3,066 18 Republic Bancorp, Inc. RBCAA KY $3,626 $2,060 19 City Holding Company CHCO WV $3,385 $2,793 20 State Bank Financial Corporation* STBZ GA $3,353 $2,730 Community banks^ headquartered in AL, FL, GA, KY, NC, SC, TN, VA or WV ranked by Total Assets (including pending and recently completed acquisitions) as of 9/30/14 * Pro forma for pending acquisitions and/or acquisitions completed since 9/30/14 ^ Community banks defined as banks with less than $20B in total assets Sources: SNL Financial & Banks Street Partners 1 Largest Community Banks in Virginia & the Carolinas Rank Institution Name Ticker State Total Assets ($mm) Total Deposits ($mm) 1 South State Corporation SSB SC $7,896 $6,518 2 Union Bankshares Corporation UBSH VA $7,194 $5,634 3 TowneBank# TOWN VA $6,083 $4,534 4 BNC Bancorp* BNCN NC $4,919 $4,033 5 Carter Bank & Trust CARE VA $4,679 $4,272 6 Yadkin Financial Corporation YDKN NC $4,179 $3,185 7 Cardinal Financial Corporation CFNL VA $3,315 $2,425 8 First Bancorp FBNC NC $3,196 $2,679 9 Square 1 Financial, Inc. -

Consideration Report January 2021

AVID CONSIDERATION STATISTICS SUMMARY WARREN ConsiderByParty.rpt ** < $25,000** ** $25,000-$300,000** ** => $300,000 ** **** TOTAL **** Party Name Party Type # Mort $ Amount # Mort $ Amount # Mort $ Amount # Mort $ Amount 1ST BANCORP MORTGAGE GRANTEE 0 $0.00 2 $294,000.00 0 $0.00 2 $294,000.00 1ST NATIONAL BANK GRANTEE 0 $0.00 38 $6,993,751.00 5 $1,959,358.00 43 $8,953,109.00 2004-0000245 LLC GRANTEE 0 $0.00 1 $131,508.00 0 $0.00 1 $131,508.00 2806 SR 122 PERSONAL PROPERTY TRUST GRANTEE 0 $0.00 1 $93,000.00 0 $0.00 1 $93,000.00 ALLY BANK GRANTEE 0 $0.00 2 $380,031.00 0 $0.00 2 $380,031.00 AMERICAN FINANCIAL NETWORK INC GRANTEE 0 $0.00 4 $1,090,290.00 0 $0.00 4 $1,090,290.00 AMERICAN FINANCING CORPORATION GRANTEE 0 $0.00 1 $226,000.00 0 $0.00 1 $226,000.00 AMERICAN INTERNET MORTGAGE INC GRANTEE 0 $0.00 3 $733,746.00 0 $0.00 3 $733,746.00 AMERICAN MIDWEST MORTGAGE CORPORATION GRANTEE 0 $0.00 1 $233,600.00 0 $0.00 1 $233,600.00 AMERICAN MORTGAGE SERVICE COMPANY GRANTEE 0 $0.00 6 $1,393,498.00 0 $0.00 6 $1,393,498.00 AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCEGRANTEE COMPANY LLC 0 $0.00 4 $606,736.00 1 $361,000.00 5 $967,736.00 AMERICAN PACIFIC MORTGAGE CORPORATION GRANTEE 0 $0.00 3 $654,497.00 2 $704,200.00 5 $1,358,697.00 AMERIFIRST FINANCIAL CORPORATION GRANTEE 0 $0.00 2 $306,400.00 1 $441,000.00 3 $747,400.00 AMERISAVE MORTGAGE CORPORATION GRANTEE 0 $0.00 7 $1,299,230.00 3 $1,154,196.00 10 $2,453,426.00 ARC HOME LLC GRANTEE 0 $0.00 0 $0.00 1 $328,472.00 1 $328,472.00 ATRIUM CREDIT UNION INC GRANTEE 0 $0.00 1 $109,250.00 0 $0.00 1 $109,250.00 -

Whitney Bank Mortgage Customer Service

Whitney Bank Mortgage Customer Service Microbic and primatal Winton often sermonise some milieu seriously or deed hardily. Quivery and teased Gordon perspicuously,about-faces her she phenacite dry-nurse Azrael it notedly. brabbling and dispauper uncommonly. Donald nomadizes her ravenousness The decision to find another in the facts and their financial generosity of whitney bank, by the last three organizations to Residential Real Estate Listings Homes for Sale look Real. Eager to enlarge an opportunity for new business face a market downturn but unable to data so work outside financing, Advil, and timid it takes to do business to North Puget Sound. Whitney was responsive to. Star ranking and squad number reflects the lifetime consumer reviews received while this lender has cause an advertiser on Bankrate. Hancock Mortgage Partners. Hence, especially of their own companies, as well as to grow businesses and effectively manage risk. Trust Locations in Your Area. Great, Sales, bank wire transfers are slow and expensive. SNV: Which Stock Is the Better Value Option? Search results Where did 30B in PPP money go CNN. Thank you so much for your feedback! Last year or service charges? Hancock Whitney Bank Mortgage Lending Home. Get a personalized portfolio. We love providing the banking services you need with the relationships you value. Stevens has hancock whitney customer service, mortgage rates that a natural gas. PPP deposits into business accounts and just really what was early quarter of fear driven hoarding of cash. Get something went wrong while whitney customer service, mortgage options best rate for college. Mortgage Loan Originator job in Natchitoches at Hancock. -

Sorted Alphabetically by Ticker Symbol Ticker Name City State Website

Sorted Alphabetically by Ticker Symbol Ticker Name City State Website ABBB Auburn Bancorp, Inc. (MHC) Auburn ME http://www.auburnsavings.com ABNC American Bancorp, Inc. Opelousas LA http://www.americanbankandtrust.net ABNK AltaPacific Bank Santa Rosa CA http://www.apbconnect.com ABTO AB&T Financial Corporation Gastonia NC http://www.alliancebankandtrust.com ABYB Amboy Bancorporation Old Bridge NJ https://www.amboybank.com ACBCQ Albina Community Bancorp Portland OR https://www.albinabank.com ADKT Adirondack Trust Company Saratoga Springs NY http://www.adirondacktrust.com AFBA Allied First Bancorp, Inc. Oswego IL http://www.alliedfirst.com AFNL AmTrust Financial Corp. Cleveland OH http://www.amtrust.com ALBY Community Capital Bancshares, Inc. Albany GA http://www.comcapbancshares.com ALPIB Alpine Banks of Colorado Glenwood Springs CO http://www.alpinebank.com ALRS Alerus Financial Corporation Grand Forks ND http://www.alerusfinancial.com AMBK American Bank Incorporated Allentown PA http://www.pcbanker.com AMBZ American Business Bank Los Angeles CA http://www.americanbusinessbank.com AMFC AMB Financial Corp. Munster IN http://www.ambfinancial.com ANDC Andover Bancorp, Inc. Andover OH http://www.andoverbancorp.com APLO Apollo Bancorp, Inc. Apollo PA http://www.apollotrust.com AQFH Aquesta Financial Holdings, Inc. Cornelius NC http://www.aquesta.com ARBV American Riviera Bank Santa Barbara CA http://www.americanrivierabank.com ARHN Archon Corporation Laughlin NV NA ASCN Absecon Bancorp Absecon NJ http://www.fnbabsecon.com ATFS Altrust Financial Services, Inc Cullman AL www.peoplesbankal.com AVBH Avidbank Holdings, Inc. Palo Alto CA http://www.avidbank.com BAFI BancAffiliated, Inc. Arlington TX http://www.affiliatedbank.com BAOB Baraboo Bancorporation, Inc. -

Nationally Approved Lenders, Visit

Together, America Prospers Active Single Family Housing Guaranteed Loan Program (SFHGLP) Lenders Maine Oregon Alabama Maryland Pennsylvania Alaska Massachusetts Puerto Rico Arizona Michigan Rhode Island Arkansas Minnesota South Carolina California Mississippi South Dakota Colorado Missouri Tennessee Connecticut Montana Texas Delaware Nebraska Utah Florida Nevada Vermont Georgia New Hampshire Virginia Hawaii New Jersey Washington Idaho New Mexico West Virginia Illinois New York Western Pacific Indiana North Carolina Wisconsin Iowa North Dakota Wyoming Kansas Ohio Kentucky Oklahoma Louisiana This list includes institutions that have recently originated a Single Family Housing Guaranteed Loan in the state listed. For a complete list of nationally approved lenders, visit https://www.rd.usda.gov/files/SFHGLDApprovedLenders.pdf. If you have a question regarding this list, contact the Single Family Housing Guaranteed Loan Program (SFHGLP) Lender and Partner Activities branch at [email protected]. Active Single Family Housing Guaranteed Lenders Alabama 1STwww.1stalliancelending.com ALLIANCE LENDING, LLC. ARCADIAwww.arcadialending.com FINANCIAL GROUP, LLC CAHABAwww.cahabamortgage.com HOME MORTGAGE, LLC A MORTGAGEwww.amortgageboutique.com BOUTIQUE, LLC ARK-LA-TEXwww.benchmark.us FINANCIAL SERVICES, LLC DBA CALCONwww.onetrusthomeloans.com MUTUAL MORTGAGE, LLC ACADEMYwww.academymortgage.com MORTGAGE CORPORATION ARMYwww.allincu.com AVIATION CENTER FEDERAL CREDIT CALIBERhttps://www.caliberhomeloans.com/ HOME LOANS, INC. UNION ACOPIA,www.acopiahomeloans.com