June 30, 2016 S&P SMALLCAP 600® PURE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Technology Sector Report

FINTECH SECTOR REPORT October 2018 Q3 2018 INSURANCE TECHNOLOGY SECTOR SUMMARY Case Study: Sale of QuoteWizard.com LLC to LendingTree, Inc. (NasdaqGS: TREE) GCA acted as exclusive financial advisor to QuoteWizard, provider of a customer acquisition technology platform, on its sale to LendingTree. Transaction Summary Strategic Rationale ▪ On October 4th, 2018, QuoteWizard.com LLC ▪ QuoteWizard will immediately establish LendingTree as a (“QuoteWizard”) announced it had entered into a leader in the high growth online insurance market definitive agreement to be acquired by LendingTree, Inc. − Since its founding in 2006, QuoteWizard has helped (NasdaqGS:TREE) (“LendingTree”) for up to $370MM over 40 million consumers compare and find TRANSACTION DETAILS − $300MM in up-front consideration at close, payable insurance policies online Closed in cash October 2018 ▪ QuoteWizard’s customer acquisition technology platform − $70MM in potential earn-out consideration based and network of over 30 top tier carriers and 10,000 SECTOR on achievement of certain growth milestones in the insurance agents across the country create a scale and Insurance Technology first three years following transaction close network advantage for high-quality insurance lead distribution Digital Media ▪ The QuoteWizard management team, led by CEO Scott Peyree, will continue as QuoteWizard leadership − Will significantly expand LendingTree’s relationships DEAL TYPE following closing with insurance carriers and agents enable cross M&A ▪ QuoteWizard generated $75.6MM in revenue -

3Rd Quarter Holdings

Calvert VP Russell 2000® Small Cap Index Portfolio September 30, 2020 Schedule of Investments (Unaudited) Common Stocks — 95.2% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,130 $ 226,398 Modine Manufacturing Co.(1) 4,047 25,294 AAR Corp. 2,929 $ 55,065 Motorcar Parts of America, Inc.(1) 1,400 21,784 Aerojet Rocketdyne Holdings, Inc.(1) 6,371 254,139 Standard Motor Products, Inc. 1,855 82,826 AeroVironment, Inc.(1) 1,860 111,619 Stoneridge, Inc.(1) 2,174 39,936 Astronics Corp.(1) 2,153 16,621 Tenneco, Inc., Class A(1)(2) 4,240 29,426 Cubic Corp. 2,731 158,862 Visteon Corp.(1) 2,454 169,866 Ducommun, Inc.(1) 914 30,089 VOXX International Corp.(1) 1,752 13,473 Kaman Corp. 2,432 94,775 Workhorse Group, Inc.(1)(2) 8,033 203,074 Kratos Defense & Security Solutions, Inc.(1) 10,345 199,452 XPEL, Inc.(1) 1,474 38,442 (1) Maxar Technologies, Inc. 5,309 132,406 $2,100,455 Moog, Inc., Class A 2,535 161,049 Automobiles — 0.1% National Presto Industries, Inc. 420 34,381 PAE, Inc.(1) 5,218 44,353 Winnebago Industries, Inc. 2,733 $ 141,214 Park Aerospace Corp. 1,804 19,700 $ 141,214 Parsons Corp.(1) 1,992 66,812 Banks — 6.8% Triumph Group, Inc. 4,259 27,726 (1) Vectrus, Inc. 987 37,506 1st Constitution Bancorp 623 $ 7,414 $ 1,444,555 1st Source Corp. 1,262 38,920 Air Freight & Logistics — 0.4% ACNB Corp. -

COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

COMMUNITY BANK LANDSCAPE North Carolina 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. NORTH CAROLINA BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. NORTH CAROLINA BANK REGULATORY DATA OVERVIEW – NORTH CAROLINA BANK REGULATORY DATA Piedmont Mountains Coastal Plain METHODOLOGY ▪ 3 regions separated by geographic KEY STATE OBSERVATIONS relevance ▪ Median loan growth of 4.69% ▪ Data as of most recent available ▪ Median NIM of 3.77% quarter as of March 31, 2019 ▪ Regulatory call report data shown for all banks NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Does not include Bank of America, NA Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 NORTH CAROLINA BANKS – MOUNTAINS REGION Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) Black Mountain SB SSB Black Mountain $40 $29 3.3 % $34 (6.4) % 85.6 % 12.74 % 31.62 % 0.00 % 0.00 % 0.0 % 0.14 % 0.00 % $41 0.41 % 3.00 % 82.9 % Entegra Bank Franklin 1,668 1,089 2.0 1,251 8.2 87.1 9.67 14.35 0.80 0.43 7.8 1.11 0.02 4,046 0.98 3.17 68.3 HomeTrust Bank Asheville 3,455 2,674 4.7 2,332 10.2 114.7 10.25 12.22 1.09 0.40 10.0 0.91 0.38 3,373 0.39 3.34 69.7 Jackson SB SSB Sylva 32 26 (1.5) 26 (1.3) 101.7 20.97 40.77 1.20 1.03 5.7 0.22 0.00 81 1.00 3.69 69.2 Lifestore Bank (MHC) West Jefferson 293 185 3.2 225 7.7 82.2 10.99 18.61 1.13 1.13 9.6 1.31 0.00 713 0.98 3.46 72.8 Morganton SB S.S.B. -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc

Ameris Bancorp Signs Definitive Merger Agreement to Acquire Jacksonville Bancorp, Inc. Company Release - 10/01/2015 07:00 MOULTRIE, Ga and JACKSONVILLE, Fla., Oct. 1, 2015 /PRNewswire/ -- Ameris Bancorp (Nasdaq-GS: ABCB) ("Ameris"), the parent company of Ameris Bank, announced today the signing of a definitive merger agreement under which Ameris will acquire Jacksonville Bancorp, Inc. (Nasdaq-CM: JAXB) ("Jacksonville Bancorp"), the parent company of The Jacksonville Bank, Jacksonville, Florida. Upon completion of the transaction, the combined company will have approximately $5.7 billion in assets, $4.0 billion in loans, $4.9 billion in deposits and a branch network of 101 banking locations across four states, inclusive of Ameris's recently announced branch consolidation. "We are pleased to announce our merger with Jacksonville Bancorp, as it will accelerate our growth momentum in the greater Jacksonville, Florida market. We believe that this transaction will allow us to better serve our combined customer base, provide greater access to the variety of banking services we offer and help us build a stronger presence to positively impact our community," commented Edwin W. Hortman, Jr., President and Chief Executive Officer of Ameris. The acquisition further expands Ameris's existing Southeastern footprint in the attractive Jacksonville, Florida market. Jacksonville Bancorp currently operates eight banking locations, all of which are located within the Jacksonville MSA, as well as one cyber banking site. After the acquisition, Ameris will become the largest community bank by deposit market share in the Jacksonville, Florida market. Kendall L. Spencer, President and Chief Executive Officer of Jacksonville Bancorp, said, "We are excited to announce our merger with Ameris. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

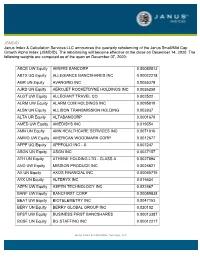

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

Lendingtree, Inc

LENDINGTREE, INC. FORM 10-K (Annual Report) Filed 02/28/17 for the Period Ending 12/31/16 Address 11115 RUSHMORE DRIVE CHARLOTTE, NC 28277 Telephone 704-943-8942 CIK 0001434621 Symbol TREE SIC Code 6163 - Loan Brokers Industry Consumer Lending Sector Financials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2017, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________ FORM 10-K __________________________________________________ (Mark One) ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2016 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-34063 __________________________________________________ LendingTree, Inc. (Exact name of Registrant as specified in its charter) Delaware (State or other jurisdiction of 26-2414818 incorporation or organization) (I.R.S. Employer Identification No.) 11115 Rushmore Drive, Charlotte, North Carolina 28277 (Address of principal executive offices) (704) 541-5351 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of each exchange on which registered Common Stock, $0.01 Par Value The NASDAQ Stock Market Securities registered pursuant to Section 12(g) of the Act: None ________________________________________________________________________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Largest Community Banks in the Southeast

Largest Community Banks in the Southeast Rank Institution Name Ticker State Total Assets ($mm) Total Deposits ($mm) 1 BankUnited, Inc. BKU FL $17,681 $12,834 2 United Bankshares, Inc. UBSI WV $12,085 $8,753 3 WesBanco, Inc.* WSBC WV $8,224 $6,438 4 South State Corporation SSB SC $7,880 $6,518 5 United Community Banks, Inc. UCBI GA $7,526 $6,241 6 Union Bankshares Corporation UBSH VA $7,194 $5,634 7 Capital Bank Financial Corp. CBF FL $6,690 $5,175 8 TowneBank* TOWN VA $6,083 $4,534 9 FCB Financial Holdings, Inc. FCB FL $6,055 $3,991 10 Pinnacle Financial Partners, Inc. PNFP TN $5,866 $4,662 11 BNC Bancorp* BNCN NC $4,919 $4,033 12 Carter Bank & Trust CARE VA $4,679 $4,272 13 Yadkin Financial Corporation YDKN NC $4,179 $3,185 14 ServisFirst Bancshares, Inc.* SFBS AL $4,176 $3,549 15 Ameris Bancorp ABCB GA $3,999 $3,373 16 Community Trust Bancorp, Inc. CTBI KY $3,670 $2,902 17 CenterState Banks, Inc. CSFL FL $3,639 $3,066 18 Republic Bancorp, Inc. RBCAA KY $3,626 $2,060 19 City Holding Company CHCO WV $3,385 $2,793 20 State Bank Financial Corporation* STBZ GA $3,353 $2,730 Community banks^ headquartered in AL, FL, GA, KY, NC, SC, TN, VA or WV ranked by Total Assets (including pending and recently completed acquisitions) as of 9/30/14 * Pro forma for pending acquisitions and/or acquisitions completed since 9/30/14 ^ Community banks defined as banks with less than $20B in total assets Sources: SNL Financial & Banks Street Partners 1 Largest Community Banks in Virginia & the Carolinas Rank Institution Name Ticker State Total Assets ($mm) Total Deposits ($mm) 1 South State Corporation SSB SC $7,896 $6,518 2 Union Bankshares Corporation UBSH VA $7,194 $5,634 3 TowneBank# TOWN VA $6,083 $4,534 4 BNC Bancorp* BNCN NC $4,919 $4,033 5 Carter Bank & Trust CARE VA $4,679 $4,272 6 Yadkin Financial Corporation YDKN NC $4,179 $3,185 7 Cardinal Financial Corporation CFNL VA $3,315 $2,425 8 First Bancorp FBNC NC $3,196 $2,679 9 Square 1 Financial, Inc. -

2021 Quarterly Report (Unaudited)

JANUARY 31, 2021 2021 Quarterly Report (Unaudited) iShares Trust Table of Contents Page iShares Cohen & Steers REIT ETF.......................................................................................................................................... 3 iShares Core Dividend Growth ETF ........................................................................................................................................ 5 iShares Core High Dividend ETF............................................................................................................................................ 11 iShares Core U.S. REIT ETF ............................................................................................................................................... 14 iShares Dow Jones U.S. ETF ............................................................................................................................................... 17 iShares Global REIT ETF................................................................................................................................................... 29 iShares International Developed Real Estate ETF............................................................................................................................ 34 iShares International Select Dividend ETF................................................................................................................................... 38 iShares Morningstar Large-Cap ETF .......................................................................................................................................