Financial Technology Sector Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MARKETAXESS HOLDINGS INC. (Exact Name of Registrant As Specified in Its Charter)

Exhibit I-3 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-34091 MARKETAXESS HOLDINGS INC. (Exact name of registrant as specified in its charter) Delaware 52-2230784 (State of incorporation) (IRS Employer Identification No.) 299 Park Avenue, New York, New York 10171 (Address of principal executive offices) (Zip Code) (212) 813-6000 (Registrant’s telephone number, including area code) SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of each class: Name of each exchange on which registered: Common Stock, par value $0.003 per share NASDAQ Global Select Market SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Northern Trust Asset Management Passive Investment Solutions

Northern Trust Asset Management Passive Investment Solutions March 11, 2020 Mac Nickey Dave Alongi, CFA Jacob C. Weaver, CPA, CFA Bill Kincade Director, Public Funds Head, Fixed Income Index Management Director, Global Equity Director, Transition Management 312-557-3992 312-557-1452 312-444-3172 312-375-8034 [email protected] [email protected] [email protected] [email protected] northerntrust.com northerntrust.com | |© © 2020 2020 Northern Northern Trust Trust 1 PROPOSED AGENDA • Northern Trust Asset Management Overview • Index Management Capabilities • Passive Global Equity • Passive Global Fixed Income • Transition Management • Appendix northerntrust.com | © 2020 Northern Trust 2 Northern Trust Asset Management Overview northerntrust.com | © 2020 Northern Trust 3 PRINCIPLES THAT ENDURE Northern Trust’s core principles of service, expertise, and Service integrity have remained constant for over 125 years, guiding Relentless drive to provide Northern Trust’s evolution to a multi-faceted global financial exceptional service. services provider. Throughout our history and changing market environments, Expertise we have led the financial services industry by aligning our Resolving complex challenges with efforts with these guiding principles. multi-asset class capabilities. Today, we remain committed to these founding principles which continue to unite and drive our partners around the globe Integrity — delivering our clients unparalleled service and Acting with the highest ethics, utmost expertise, with integrity. honesty and unfailing reliability. northerntrust.com -

Navigating a Liquidity-Constrained Fixed Income Environment

Navigating a Liquidity-Constrained Fixed Income Environment February 2015 T. ROWE PRICE Investment Viewpoint EXECUTIVE SUMMARY Credit markets have seen a significant decline approach to managing liquidity risk in client in liquidity in the wake of the 2008 financial portfolios. Portfolio managers, traders, and crisis, as new government regulations have analysts continually collaborate to assess limited Wall Street banks’ proprietary trading liquidity conditions at both the market and activities. This has occurred alongside strong security levels. Quantitative tools provide investor demand for fixed income assets and additional insights into the liquidity profiles heavy corporate debt issuance. of portfolios and prospective performance As the Federal Reserve prepares to unwind under different market scenarios. unprecedented monetary accommodation, A shortage of liquidity could worsen market regulators have expressed concerns that if dislocations if rates rise markedly. But there rates rise and investors aggressively sell their are several factors that should temper the fixed income holdings, dealers’ constrained impact of increasing rates, and demand for capacity to absorb supply has the potential to fixed income seems unlikely to falter for long. fuel financial market volatility. In the current environment, global trading and In the view of T. Rowe Price’s Fixed Income fundamental research capabilities, along with Division, liquidity conditions are unlikely to a long-term investment horizon, are essential improve meaningfully anytime soon. With for meeting clients’ investment objectives. that in mind, this paper discusses our holistic Amid highly accommodative monetary Stimulus efforts from the world’s major policy, record corporate debt issuance, and central banks have dramatically increased the considerable investor demand for yield, money supply and, by extension, lifted asset liquidity in fixed income markets may appear prices. -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

The Annual Meeting Place for Heads of Fixed Income Trading and Portfolio Management from the US's Top Buy Side Firms

The Annual Meeting Place for Heads of Fixed Income Trading and Portfolio Management from the US’s Top Buy Side Firms The Westin Copley Place, Boston MA. Platform Evaluation Day: June 7th l Main Conference: June 8th-9th Buy Side Speakers: Brandon Rasmussen, Fixed Income and Equity Trading, Russell Mayra Rodriguez Valladares, Managing Principal, MRV Associates Sam Priyadarshi, Head of Fixed Income Derivatives, Vanguard Investments Chris White, CEO, ViableMKTS Matt Dabrowski, Wall Street Political Dwayne Middleton, Executive Director, Head of US Fixed Income Edward Boyle, Global Macro Portfolio Manager, American Century Analyst Trading, Morgan Stanley IM (Advisor) Investments Ron Quaranta, Executive Director, Wall Street Blockchain Alliance Brian Kinney, Senior Managing Director & Global Head of Fixed Income Joseph Casteluccio, President, Capital Markets, Head of Trading, Pete Eggleston, CEO, BestEx Beta Solutions, State Street Global Advisors Capital Guardian Jeffrey Young, CEO and Chief Economist, DeepMacro Richard Flynn, Managing Director, Risk and Quantitative Analysis, Todd Finkelstein, Managing Consultant, Formerly Senior Fixed Income Brad Bailey, Research Director, Trading and Markets, Celent Blackrock Portfolio Manager, Conning Asset Management David Weiss, Senior Analyst, Aite Group Rick Harper, Head of Fixed Income and Currency, Wisdomtree Asset Andrew Hofer, Managing Director, Portfolio Manager, Brown Brothers Sell Side, Platform and Technology Provider Speakers: Management Harriman Paul Hamill, Managing Director, Global Head -

Baron Mid Cap Growth Strategy

Baron Mid Cap Growth Strategy June 30, 2021 DEAR INVESTOR: Health Care and Materials investments and lack of exposure to the underperforming Consumer Staples sector added the most value. Favorable PERFORMANCE stock selection in Health Care was driven by IDEXX Laboratories, Inc., the U.S. equities moved higher during the quarter in response to various factors, global leader in veterinary diagnostics, software, and water microbiology including robust macroeconomic data, ongoing fiscal stimulus, strong testing. IDEXX was the largest contributor as veterinary visits continued corporate earnings, and continued reductions in COVID-19 infection rates. their recovery from pandemic lows, leading to double-digit growth in The outlook for inflation remained uncertain, and was an important factor veterinary practice revenues. Weighing instruments provider Mettler- influencing investors’ shifting preferences for growth versus value stocks Toledo International, Inc., pharmaceutical packaging manufacturer West during the quarter. Real Estate, Information Technology (“IT”), Energy, and Pharmaceutical Services, Inc., and DNA sequencing platform Illumina, Communication Services led the market higher in the period, while the Inc. also performed well after reporting strong quarterly financial results Utilities, Consumer Staples, Industrials, Materials, and Consumer and raising full-year guidance. Within Materials, lower exposure to this Discretionary sectors underperformed. lagging sector and outperformance of cleaning and hygiene solutions provider Diversey Holdings, Ltd. lifted relative results. Diversey reported Against this backdrop, Baron Mid Cap Growth Strategy increased 10.06%, solid quarterly results in its first earnings release since becoming a publicly while the Russell Midcap Growth Index (the “Index”) increased 11.07%, and traded company, with upside coming from market share gains in the the S&P 500 Index gained 8.55%. -

Worldwide Discovery Quarterly Update

BAILLIE GIFFORD Worldwide Discovery Quarterly Update 30 June 2021 Contents 02 Executive Summary Baillie Gifford Investment Management (Europe) Limited 03 Commentary is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. 05 Performance Persons resident or domiciled outwith the UK should 11 Portfolio Overview consult with their professional advisers as to whether they require any governmental or other consents in order to enable 12 Governance Summary them to invest, and with their tax advisers for advice relevant to 16 Governance Engagement their own particular circumstances. This document contains information on investments which 17 Voting does not constitute independent research. Accordingly, it is not 19 Transaction Notes subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments 20 Legal Notices concerned. All information is based on a representative portfolio, new client portfolios may not mirror the representative portfolio This document is solely for the use of professional exactly. As at 30 June 2021, in US dollars and sourced from investors and should not be relied upon by any other Baillie Gifford & Co unless otherwise stated. person. It is not intended for use by retail clients. Canada Important Information and Risk Factors Baillie Gifford International LLC is wholly owned by Baillie Baillie Gifford Overseas Limited provides investment Gifford Overseas Limited; it was formed in Delaware in 2005 management and advisory services to non-UK and is registered with the SEC. It is the legal entity through Professional/Institutional clients only. Baillie Gifford Overseas which Baillie Gifford Overseas Limited provides client service Limited is wholly owned by Baillie Gifford & Co. -

JSMDID Janus Index & Calculation Services LLC Announces The

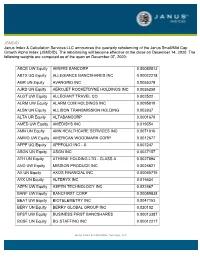

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

Lendingtree, Inc

LENDINGTREE, INC. FORM 10-K (Annual Report) Filed 02/28/17 for the Period Ending 12/31/16 Address 11115 RUSHMORE DRIVE CHARLOTTE, NC 28277 Telephone 704-943-8942 CIK 0001434621 Symbol TREE SIC Code 6163 - Loan Brokers Industry Consumer Lending Sector Financials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2017, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________ FORM 10-K __________________________________________________ (Mark One) ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2016 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-34063 __________________________________________________ LendingTree, Inc. (Exact name of Registrant as specified in its charter) Delaware (State or other jurisdiction of 26-2414818 incorporation or organization) (I.R.S. Employer Identification No.) 11115 Rushmore Drive, Charlotte, North Carolina 28277 (Address of principal executive offices) (704) 541-5351 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of each exchange on which registered Common Stock, $0.01 Par Value The NASDAQ Stock Market Securities registered pursuant to Section 12(g) of the Act: None ________________________________________________________________________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

2021 Quarterly Report (Unaudited)

JANUARY 31, 2021 2021 Quarterly Report (Unaudited) iShares Trust Table of Contents Page iShares Cohen & Steers REIT ETF.......................................................................................................................................... 3 iShares Core Dividend Growth ETF ........................................................................................................................................ 5 iShares Core High Dividend ETF............................................................................................................................................ 11 iShares Core U.S. REIT ETF ............................................................................................................................................... 14 iShares Dow Jones U.S. ETF ............................................................................................................................................... 17 iShares Global REIT ETF................................................................................................................................................... 29 iShares International Developed Real Estate ETF............................................................................................................................ 34 iShares International Select Dividend ETF................................................................................................................................... 38 iShares Morningstar Large-Cap ETF ....................................................................................................................................... -

Marketaxess Holdings Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K Current Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): July 21, 2021 MarketAxess Holdings Inc. (Exact Name of Registrant as Specified in its Charter) Delaware 001-34091 52-2230784 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 55 Hudson Yards New York, New York 10001 (Address of principal executive offices, including zip code) (212) 813-6000 (Registrant’s telephone number, including area code) Not applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Trading Name of each exchange Title of each class Symbol(s) on which registered Common Stock, par value $0.003 per share MKTX NASDAQ Global Select Market Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).