The Green Grid Representative Agenda SM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interconnection

Interconnection 101 As cloud usage takes off, data production grows exponentially, content pushes closer to the edge, and end users demand data and applications at all hours from all locations, the ability to connect with a wide variety of players becomes ever more important. This report introduces interconnection, its key players and busi- ness models, and trends that could affect interconnection going forward. KEY FINDINGS Network-dense, interconnection-oriented facilities are not easy to replicate and are typically able to charge higher prices for colocation, as well as charging for cross-connects and, in some cases, access to public Internet exchange platforms and cloud platforms. Competition is increasing, however, and competitors are starting the long process of creating network-dense sites. At the same time, these sites are valuable and are being acquired, so the sector is consolidating. Having facili- ties in multiple markets does seem to provide some competitive advantage, particularly if the facilities are similar in look and feel and customers can monitor them all from a single portal and have them on the same contract. Mobility, the Internet of Things, services such as SaaS and IaaS (cloud), and content delivery all depend on net- work performance. In many cases, a key way to improve network performance is to push content, processing and peering closer to the edge of the Internet. This is likely to drive demand for facilities in smaller markets that offer interconnection options. We also see these trends continuing to drive demand for interconnection facilities in the larger markets as well. © 2015 451 RESEARCH, LLC AND/OR ITS AFFILIATES. -

Data Loss Prevention Shines 49

‘Corrective action’ for IT slacker 6 | Xen backers unite 11 | EMC buys e-discovery 12 A case for flash storage 45 | Where data loss prevention shines 49 THE BUSINESS VALUE OF TECHNOLOGY SEPT. 7, 2009 Hybrid Clouds The right formula’s slowly coming together p.15 Also: Hard data on 12 cloud providers p.37 informationweek.com [PLUS] THE INteRNet OF THINGS A special 16-page handbook A United Business Media Publication® CAN $5.95, US $4.95 p. HB1 Copyright 2009 United Business Media LLC. Important Note: This PDF is provided solely as a reader service. It is not intended for reproduction or public distribution. For article reprints, e-prints and permissions please contact: Wright’s Reprints, 1-877-652-5295 / [email protected] THE BUSINESS VALUE OFC TECHNOLOGYONTENTS Sept.7, 2009 Issue 1,240 2 Links COVER STORY Research And Connect InformationWeek’s Analytics Hybrid Clouds Reports, events, and more 15 Getting your data center to work with public cloud 6 Global CIO services isn’t easy By Bob Evans Virginia puts IT supplier on “corrective action plan”—we What’s In The should all be so lucky! 3377 Public Cloud 8 How 12 vendors are CIO Profiles delivering on infrastructure Availability Is Crucial as a service How good a service is doesn’t matter if customers can’t get to it, says VeriSign’s CTO Oracle Puts 11g On The Grid 11 QuickTakes Oracle upgrades database with VMware Wants It All data center grid features Vendor tries to get more cloud providers to use its software by 13 Google’s Down,Not Out challenging Xen When Gmail went offline, -

Annual Report

FINANCIAL AND CORPORATE RESPONSIBILITY PERFORMANCE 2012 ANNUAL REPORT THE WORL D’S BIGGEST CHALLEN GES DESERVE EVEN BIGGER SOLUTIONS. { POWERFUL ANSWERS } FINANCIAL HIGHLIGHTS $115.8 $33.4 $0.90 $2.20 $2.24 $1.975 $2.030 $110.9 $31.5 $0.85 $2.15 $1.925 $106.6 $29.8 $0.31 CONSOLIDATED CASH FLOWS REPORTED ADJUSTED DIVIDENDS REVENUES FROM OPERATING DILUTED EARNINGS DILUTED EARNINGS DECLARED PER (BILLIONS) ACTIVITIES PER SHARE PER SHARE SHARE (BILLIONS) (NON-GAAP) CORPORATE HIGHLIGHTS • $15.3 billion in free cash flow (non-GAAP) • 8.4% growth in wireless retail service revenue • 4.5% growth in operating revenues • 607,000 FiOS Internet subscriber net additions • 13.2% total shareholder return • 553,000 FiOS Video subscriber net additions • 3.0% annual dividend increase • 17.2% growth in FiOS revenue • 5.9 million wireless retail connection net additions • 6.3% growth in Enterprise Strategic Services revenue • 0.91% wireless retail postpaid churn Note: Prior-period amounts have been reclassified to reflect comparable results. See www.verizon.com/investor for reconciliations to U.S. generally accepted accounting principles (GAAP) for the non-GAAP financial measures included in this annual report. In keeping with Verizon’s commitment to protect the environment, this report was printed on paper certified by the Forest Stewardship Council (FSC). By selecting FSC-certified paper, Verizon is making a difference by supporting responsible forest management practices. CHAIRMAN’S LETTER Dear Shareowner, 2012 was a year of accelerating momentum, for Verizon and the communications industry. The revolution in mobile, broadband and cloud networks picked up steam—continuing to disrupt and transform huge sectors of our society, from finance to entertainment to healthcare. -

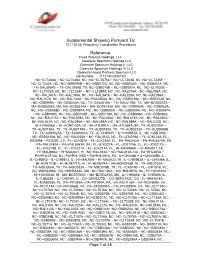

Supplemental Showing Pursuant To: 101.103 (D) Frequency Coordination Procedures

Supplemental Showing Pursuant To: 101.103 (d) Frequency Coordination Procedures Reference: Fixed Wireless Holdings, LLC Clearwire Spectrum Holdings LLC Clearwire Spectrum Holdings II, LLC Clearwire Spectrum Holdings III, LLC Clearwire Hawaii Partners Spectrum LLC Job Number: 111214COMSTI01 NC−CLT288A − NC−CLT048A, NC ; NC−CLT076A − NC−CLT263D, NC ;NC−CLT245F − NC−CLT242A, NC ; NC−GSB090B − NC−GSB072C, NC ;NC−GSB034B − NC−GSB031A, NC ; TX−DAL5954B − TX−DAL0189B, TX; NC−GSB075B − NC−GSB097A, NC ; NC−CLT032B − NC−CLT002A, NC; NC−CLT254F − NC−CLT289A, NC ; NC−RAL018A − NC−RAL006A, NC; NC−RAL241A − NC−RAL198A, NC ; NC−RAL041A − NC−RAL025A, NC; NC−RAL096A − NC−RAL107A, NC ; NC−RAL146A − NC−RAL0256A, NC ; NC−GSB0150A − NC−GSB104B, NC ; NC−GSB998A − NC−GSB040A, NC ; TX−DAL0010A − TX−DAL6175B, TX ; MA−BOS5372A − MA−BOS5808A, MA; MA−BOS5514A − MA−BOS6183A, MA ; NC−GSB060A − NC−GSB062A, NC ; NC−GSB068B − NC−GSB997A, NC ; NC−GSB088A − NC−GSB085A, NC ; NC−GSB097A − NC−GSB099C, NC ; NC−GSB108B − NC−GSB119A, NC ; NC−GSB999A − NC−GSB030A, NC ; NC−RAL015C − NC−RAL008A, NC ; NC−RAL025A − NC−RAL018A, NC ; NC−RAL050A − NC−RAL042A, NC ; NC−RAL096A − NC−RAL095A, NC ; NC−RAL998A − NC−RAL022D, NC ; HI−HON056A − HI−HON0130A, HI ; GA−ATL991A − GA−ATL584A,GA ; TX−AUS0100A − TX−AUS0125A, TX ; TX−AUS0179A − TX−AUS0130A, TX ; TX−AUS0232A − TX−AUS0058B, TX ; TX−AUS0025A − TX−AUS0081A, TX ; IL−CHI0505 − IL−CHI0957A, IL ; NC−GSB105A − NC−GSB0150A, NC ; NC−RAL055A − NC−RAL051A, NC ; FL−JCK079A − FL−JCK125A, FL ; RED998 − RED007, CA ; FL−JCK057A − FL−JCK225A, FL ; PA−PHL062A -

Vendor Contract

d/W^sEKZ'ZDEd ĞƚǁĞĞŶ t'ŽǀĞƌŶŵĞŶƚ͕>>ĂŶĚ d,/EdZ>K>WhZ,^/E'^z^dD;d/W^Ϳ &Žƌ Z&Wϭϴ1102 Internet & Network Security 'ĞŶĞƌĂů/ŶĨŽƌŵĂƚŝŽŶ dŚĞsĞŶĚŽƌŐƌĞĞŵĞŶƚ;͞ŐƌĞĞŵĞŶƚ͟ͿŵĂĚĞĂŶĚĞŶƚĞƌĞĚŝŶƚŽďLJĂŶĚďĞƚǁĞĞŶdŚĞ/ŶƚĞƌůŽĐĂů WƵƌĐŚĂƐŝŶŐ^LJƐƚĞŵ;ŚĞƌĞŝŶĂĨƚĞƌƌĞĨĞƌƌĞĚƚŽĂƐ͞d/W^͟ƌĞƐƉĞĐƚĨƵůůLJͿĂŐŽǀĞƌŶŵĞŶƚĐŽŽƉĞƌĂƚŝǀĞ ƉƵƌĐŚĂƐŝŶŐƉƌŽŐƌĂŵĂƵƚŚŽƌŝnjĞĚďLJƚŚĞZĞŐŝŽŶϴĚƵĐĂƚŝŽŶ^ĞƌǀŝĐĞĞŶƚĞƌ͕ŚĂǀŝŶŐŝƚƐƉƌŝŶĐŝƉĂůƉůĂĐĞ ŽĨďƵƐŝŶĞƐƐĂƚϰϴϰϱh^,ǁLJϮϳϭEŽƌƚŚ͕WŝƚƚƐďƵƌŐ͕dĞdžĂƐϳϱϲϴϲ͘dŚŝƐŐƌĞĞŵĞŶƚĐŽŶƐŝƐƚƐŽĨƚŚĞ ƉƌŽǀŝƐŝŽŶƐƐĞƚĨŽƌƚŚďĞůŽǁ͕ŝŶĐůƵĚŝŶŐƉƌŽǀŝƐŝŽŶƐŽĨĂůůƚƚĂĐŚŵĞŶƚƐƌĞĨĞƌĞŶĐĞĚŚĞƌĞŝŶ͘/ŶƚŚĞĞǀĞŶƚŽĨ ĂĐŽŶĨůŝĐƚďĞƚǁĞĞŶƚŚĞƉƌŽǀŝƐŝŽŶƐƐĞƚĨŽƌƚŚďĞůŽǁĂŶĚƚŚŽƐĞĐŽŶƚĂŝŶĞĚŝŶĂŶLJƚƚĂĐŚŵĞŶƚ͕ƚŚĞ ƉƌŽǀŝƐŝŽŶƐƐĞƚĨŽƌƚŚƐŚĂůůĐŽŶƚƌŽů͘ dŚĞǀĞŶĚŽƌŐƌĞĞŵĞŶƚƐŚĂůůŝŶĐůƵĚĞĂŶĚŝŶĐŽƌƉŽƌĂƚĞďLJƌĞĨĞƌĞŶĐĞƚŚŝƐŐƌĞĞŵĞŶƚ͕ƚŚĞƚĞƌŵƐĂŶĚ ĐŽŶĚŝƚŝŽŶƐ͕ƐƉĞĐŝĂůƚĞƌŵƐĂŶĚĐŽŶĚŝƚŝŽŶƐ͕ĂŶLJĂŐƌĞĞĚƵƉŽŶĂŵĞŶĚŵĞŶƚƐ͕ĂƐǁĞůůĂƐĂůůŽĨƚŚĞƐĞĐƚŝŽŶƐ ŽĨƚŚĞƐŽůŝĐŝƚĂƚŝŽŶĂƐƉŽƐƚĞĚ͕ŝŶĐůƵĚŝŶŐĂŶLJĂĚĚĞŶĚĂĂŶĚƚŚĞĂǁĂƌĚĞĚǀĞŶĚŽƌ͛ƐƉƌŽƉŽƐĂů͘͘KƚŚĞƌ ĚŽĐƵŵĞŶƚƐƚŽďĞŝŶĐůƵĚĞĚĂƌĞƚŚĞĂǁĂƌĚĞĚǀĞŶĚŽƌ͛ƐƉƌŽƉŽƐĂůƐ͕ƚĂƐŬŽƌĚĞƌƐ͕ƉƵƌĐŚĂƐĞŽƌĚĞƌƐĂŶĚĂŶLJ ĂĚũƵƐƚŵĞŶƚƐǁŚŝĐŚŚĂǀĞďĞĞŶŝƐƐƵĞĚ͘/ĨĚĞǀŝĂƚŝŽŶƐĂƌĞƐƵďŵŝƚƚĞĚƚŽd/W^ďLJƚŚĞƉƌŽƉŽƐŝŶŐǀĞŶĚŽƌĂƐ ƉƌŽǀŝĚĞĚďLJĂŶĚǁŝƚŚŝŶƚŚĞƐŽůŝĐŝƚĂƚŝŽŶƉƌŽĐĞƐƐ͕ƚŚŝƐŐƌĞĞŵĞŶƚŵĂLJďĞĂŵĞŶĚĞĚƚŽŝŶĐŽƌƉŽƌĂƚĞĂŶLJ ĂŐƌĞĞĚĚĞǀŝĂƚŝŽŶƐ͘ dŚĞĨŽůůŽǁŝŶŐƉĂŐĞƐǁŝůůĐŽŶƐƚŝƚƵƚĞƚŚĞŐƌĞĞŵĞŶƚďĞƚǁĞĞŶƚŚĞƐƵĐĐĞƐƐĨƵůǀĞŶĚŽƌƐ;ƐͿĂŶĚd/W^͘ ŝĚĚĞƌƐƐŚĂůůƐƚĂƚĞ͕ŝŶĂƐĞƉĂƌĂƚĞǁƌŝƚŝŶŐ͕ĂŶĚŝŶĐůƵĚĞǁŝƚŚƚŚĞŝƌƉƌŽƉŽƐĂůƌĞƐƉŽŶƐĞ͕ĂŶLJƌĞƋƵŝƌĞĚ ĞdžĐĞƉƚŝŽŶƐŽƌĚĞǀŝĂƚŝŽŶƐĨƌŽŵƚŚĞƐĞƚĞƌŵƐ͕ĐŽŶĚŝƚŝŽŶƐ͕ĂŶĚƐƉĞĐŝĨŝĐĂƚŝŽŶƐ͘/ĨĂŐƌĞĞĚƚŽďLJd/W^͕ƚŚĞLJ ǁŝůůďĞŝŶĐŽƌƉŽƌĂƚĞĚŝŶƚŽƚŚĞĨŝŶĂůŐƌĞĞŵĞŶƚ͘ WƵƌĐŚĂƐĞKƌĚĞƌ͕ŐƌĞĞŵĞŶƚŽƌŽŶƚƌĂĐƚŝƐƚŚĞd/W^DĞŵďĞƌ͛ƐĂƉƉƌŽǀĂůƉƌŽǀŝĚŝŶŐƚŚĞ ĂƵƚŚŽƌŝƚLJƚŽƉƌŽĐĞĞĚǁŝƚŚƚŚĞŶĞŐŽƚŝĂƚĞĚĚĞůŝǀĞƌLJŽƌĚĞƌƵŶĚĞƌƚŚĞŐƌĞĞŵĞŶƚ͘^ƉĞĐŝĂůƚĞƌŵƐ -

STATE of NEW YORK PUBLIC SERVICE COMMISSION ANNUAL REPORT of TELEPHONE CORPORATIONS for the Period Ending DECEMBER 31, 2018

STATE OF NEW YORK PUBLIC SERVICE COMMISSION ANNUAL REPORT OF TELEPHONE CORPORATIONS For the period ending DECEMBER 31, 2018 Instructions for this Tab: 1 Fill in your name and address below so that this information will carry to other parts of the spreadsheet. 2 If the respondent's name is long, the "Year ended December 31, 19__" may over pass the print range. This can be corrected by one of two methods: selecting a smaller font size on the specific sheet, or to delete some spaces on the combined string below. Please fill in the following: Respondent's exact legal name : VERIZON NEW YORK INC. Address line 1: 140 WEST STREET Address line 2: NEW YORK, NY 10007 Example For the period starting: JANUARY 1, 2018 January 1, 1995 For the period ending: DECEMBER 31, 2018 December 31,1995 Date due: May 30, 2019 March 31, 1995 For the period starting JANUARY 1, 2018 For the period ending DECEMBER 31, 2018 Year Ended DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Annual Report of VERIZON NEW YORK INC. For the period ending DECEMBER 31, 2018 Please fill in the requested information on Rows 42, 43 and 44. -

Top Cloud Providers

IaaS Performance and Value Analysis A study of performance among 14 top public cloud infrastructure providers By Cloud Spectator and the Cloud Advisory Council October 15, 2013 Table of Contents Executive Summary 2 Overview 2 Findings 2 Experiment Information 3 Price-Performance Value: The CloudSpecs Score 3 CLIENT Configurations and Costs 3 SERVER Configurations and Costs 4 Additional Server Information 4 Notes 4 General System Performance 5 About the Test 5 Results 5 CPU Performance 7 About the Test 7 Results 7 RAM Performance 9 About the Test 9 Results 9 Disk Performance 11 About the Test 11 Results 11 Internal Network Performance 13 About the Test 13 Results 13 Conclusion 15 About Cloud Spectator & Cloud Advisory Council 15 Contact Information 15 Copyright Cloud Spectator, LLC 2013 and Cloud Advisory Council | Non-commercial Use Only 1 Executive Summary Overview Transparency in virtual server performance is a crucial component for vendor selection. As listed on Table 2.3 within the Experiment Information (Additional Server Information) section, hardware varies among providers; thus, performance is not standardized nor guaranteed. This document reports the performance information of 14 of the largest Infrastructure as a Service (IaaS) providers in the United States. While many of the providers serve clients globally with data centers worldwide, Cloud Spectator and the Cloud Advisory Council conducted this study exclusively in each provider’s US data center. Running across a period of 10 consecutive days, the information in this report detail performance results on each provider’s system, including component-level tests measuring CPU, disk, RAM, and internal network. Performance data is related with cost of servers to acquire a price-performance value index, which is used to compare value among providers based on the results. -

Verizon Communications, Inc., Based in New York Were Among the Largest in U.S

Corporate HISTORY HIS TORY OF VERIZON COMMUNICATIONS INC. 2 The History Of Verizon Communications Verizon’s Formation: The Bell Atlantic - GTE Merger The mergers that formed Verizon Verizon Communications, Inc., based in New York were among the largest in U.S. busi- City and incorporated in Delaware, was formed on ness history, culminating in a defini- June 30, 2000, with the merger of Bell Atlantic Corp. tive merger agreement, dated July 27, 1998, between and GTE Corp. Verizon began trading on the New Bell Atlantic, based in New York City, and GTE, which was in the process of moving its headquarters from York Stock Exchange (NYSE) under the VZ symbol on Stamford, Connecticut, to Irving, Texas. Monday, July 3, 2000. It also began trading on the NASDAQ exchange under the same symbol on March GTE and Bell Atlantic had each evolved and grown through years 10, 2010. of mergers, acquisitions and divesti- tures. Each had proven track records in successfully The symbol was selected because it uses the two integrating business operations. letters of the Verizon logo that graphically portray Prior to the merger, GTE was one of the world’s largest speed, while also echoing the genesis of the company telecommunications companies, with 1999 revenues of name: veritas, the Latin word connoting certainty and more than $25 billion. GTE’s National and International Operations served approximately 35 million access reliability, and horizon, signifying forward-looking lines through subsidiaries in the United States, Canada and visionary. and the Dominican -

1 Attachment 1 Notification of Pro Forma Assignment And

ATTACHMENT 1 NOTIFICATION OF PRO FORMA ASSIGNMENT AND TRANSFER OF CONTROL Pursuant to Section 214 of the Communications Act of 1934, as amended, and Section 64.24(f) of the Commission’s rules,1 Verizon Communications Inc. (“Verizon”) notifies the Commission of an internal restructuring that occurred on July 31, 2018, which resulted in the pro forma assignment and transfer of control of certain licensees and authorizations. As further described below, as part of the restructuring the international Section 214 authorization (the “Authorization”) of XO Communications, LLC (“XOC”) was assigned to XO Communications Services, LLC (“XOCS”), and XOCS was relocated within the Verizon ownership chain.2 In addition, certain wholly-owned subsidiaries that were operating under the Authorization were eliminated or relocated in the Verizon ownership chain. Because the restructuring did not result in a change in the ultimate control of any licensees or authorizations, which continue to be controlled by Verizon, the transaction was pro forma. Answer to Question 10 (Section 63.18(c)-(d)) All communications in connection with this notification should be directed to the following: Ian Dillner Jennifer L. Kostyu Federal Regulatory Affairs Wilkinson Barker Knauer, LLP Verizon Communications Inc. 1800 M Street, N.W., Suite 800N 1300 I Street, N.W. Washington, D.C. 20036 Washington, D.C. 20005 Phone: 202.783.4141 Phone: 202.515.2458 Fax: 202.783.5851 [email protected] [email protected] Verizon, a Delaware corporation, does not hold any international Section 214 authorizations but it does directly or indirectly control subsidiaries that hold such authorizations to provide international switched resale services and global or limited global facilities-based and resale services. -

The History of Verizon Communications

The history of Verizon Communications Verizon Communications Inc., based in New York City and incorporated in Delaware, was formed on June 30, 2000, with the merger of Bell Atlantic Corp. and GTE Corp. Verizon began trading on the New York Stock Exchange (NYSE) under the VZ symbol on Monday, July 3, 2000. It also began trading on the NASDAQ exchange under the same symbol on March 10, 2010. The symbol was selected because it uses the two letters of the Verizon logo that graphically portray speed, while also echoing the origin of the company name: veritas, the Latin word connoting certainty and reliability, and horizon, signifying forward-looking and visionary. While Verizon is truly a 21st century company, the mergers that formed Verizon were many years in the making, involving companies with roots that can be traced to the beginnings of the telephone business in the late 19th century. Government regulation largely shaped the evolution of the industry throughout most of the 20th century. Then, with the signing of the Telecommunications Act on February 8, 1996, federal law directed a shift to more market-based policies. This promise of a new competitive marketplace was a driving force behind Verizon’s formation. Verizon’s formation The mergers that formed Verizon were among the largest in U.S. business history, culminating in a definitive merger agreement, dated July 27, 1998, between Bell Atlantic, based in New York City, and GTE, which was in the process of moving its headquarters from Stamford, Conn., to Irving, Texas. GTE and Bell Atlantic had each evolved and grown through years of mergers, acquisitions and divestitures. -

Clicking Clean: How Companies Are Creating the Green Internet April2014

Clicking Clean: How Companies are Creating the Green Internet April2014 greenpeace.org For more information contact: [email protected] Lead Author: Gary Cook, Greenpeace Co-Authors: Tom Dowdall, Greenpeace David Pomerantz, Greenpeace Yifei Wang, Greenpeace Editor: David Pomerantz, Greenpeace Creative Direction & Design by: Arc Communications Published in April 2014 by Greenpeace Inc. 702 H Street, NW Suite 300 Washington, D.C. 20001 United States greenpeace.org 2 Contents Executive Summary 5 Company Scorecard 7 Cloud Source 9 Global Energy Snapshot 13 The Cloud’s Next Stop: China 17 The Road Map to a Green Internet 19 Your Online World: Green IRL, or #dirty? 25 Green Internet Leaders and Best Practices 29 Where the Cloud Touches the Ground 35 -- Map: Global Data Center Hot Spots 36 -- Map: US Data Center Hot Spots 38 -- US Regional Profiles 40 Appendix 1: Methodology 42 Appendix 2: Company Scores Explained 44 Appendix 3: Company Data Center Facilities and Estimates of Power Demand 64 Notes 78 03 4 © Frank van Biemen / EvoSwitch / Greenpeace / EvoSwitch / Biemen van Frank © Greenpeace Clicking Clean: Executive USA How Companies Summary are Creating the Green Internet Executive Summary For the estimated 2.5 billion people around the But there is good news to report: since our last report, world who are connected to the internet, it is How Clean is Your Cloud? (April 2012),3 leading data impossible to imagine life without it. The internet center operators have taken key steps toward building a green internet, particularly those companies that have has rewoven the fabric of our daily lives – how committed to build a 100% renewably powered platform. -

Vendor Landscape: Cloud Infrastructure- As-A-Service

Vendor Landscape: Cloud Infrastructure- as-a-Service Options are proliferating as Cloud Infrastructure-as-a-Service provides a highly agile and low capital cost option for outsourcing IT infrastructure. Info-Tech Research Group 1 Introduction Cloud Infrastructure-as-a-Service (IaaS) is seeing explosive growth, both in the proportion of enterprises looking to IaaS deployment (37% in a recent Info-Tech survey) and in the number and variety of vendor offerings. This Research Is Designed For: This Research Will Help You: Enterprises looking to outsource a portion of Understand what and who is new in the Cloud their IT infrastructure to an external host. Infrastructure-as-a-Service market. Businesses looking to avoid capital expanse in Evaluate Cloud IaaS providers and products expanding their compute and storage for your enterprise needs. infrastructure. Determine which products are most Companies looking to integrate or federate appropriate for particular use cases and internal and external infrastructure to meet and scenarios. manage growing capacity demands. Info-Tech Research Group 2 Executive Summary Info-Tech evaluated fifteen competitors in the IaaS market, Info-Tech Insight including the following notable performers: Champions: 1. Cloud IaaS is set for rapid growth • Amazon played a large part in creating this market and is still leading Of the three forms of cloud service delivery it today. New features and services are consistently being rolled out (Infrastructure-as-a-Service, Software-as-a- as Amazon unrelentingly pursues innovation. Service, Platform-as-a-Service), IaaS is • Rackspace earned the title of Champion for its work with OpenStack, growing fastest – 200% from 2010 to 2012.