Renewables Transformation

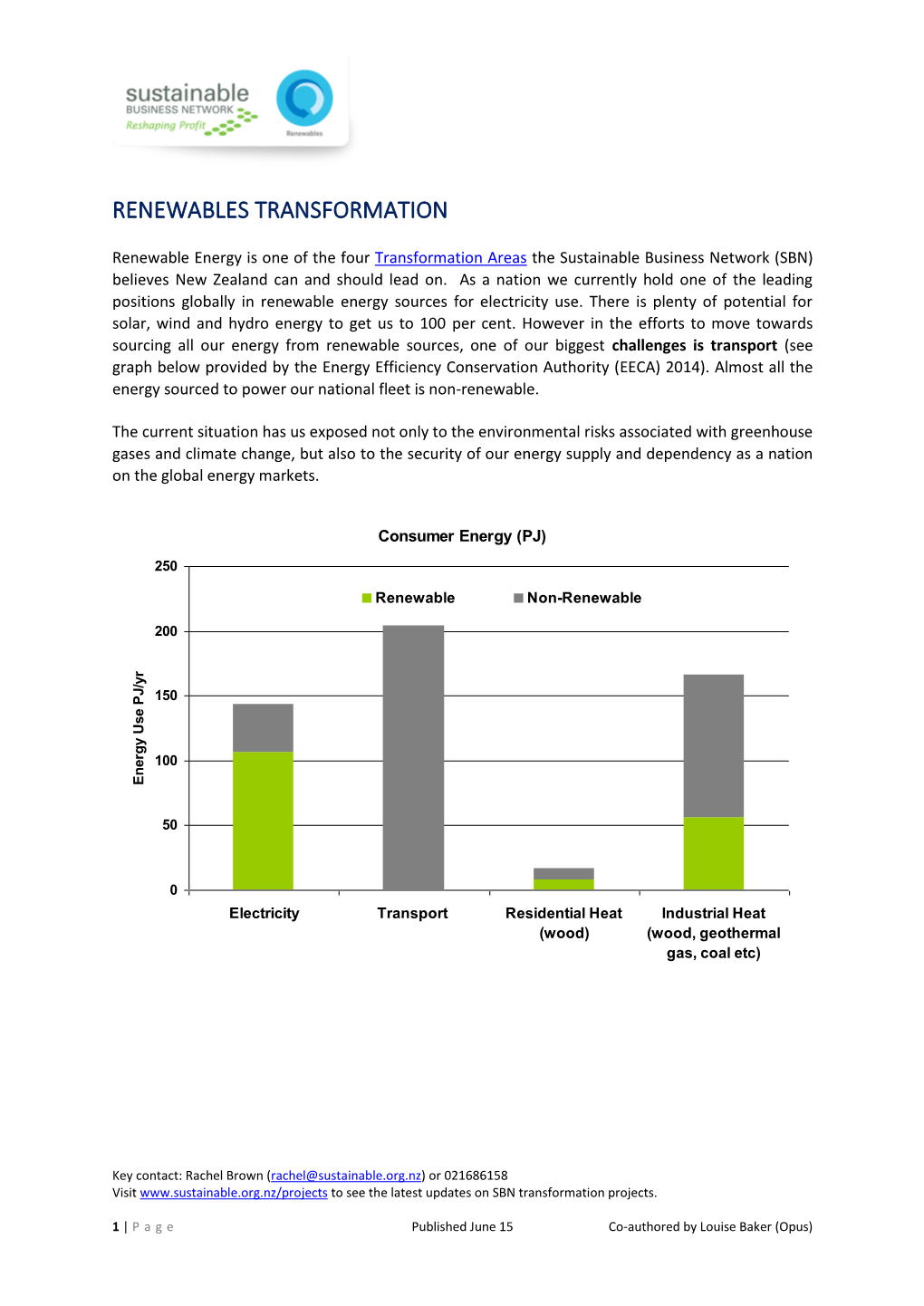

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Journal of Earth and Environmental Sciences Research

ISSN: 2634 - 8845 Journal of Earth and Environmental Sciences Research Research Article Open Access Car Sharing In a Compact City: Pinning Down the Benefits and Barriers Lucia Sobiecki and Ralph Chapman* 1Graduate Programme, Environmental Studies, Victoria University of Wellington, New Zealand ABSTRACT New Zealand’s sprawling urban development and high levels of car dependency have resulted in significant environmental impacts, including increased carbon emissions and pollution. Car sharing can support sustainable transport patterns by offering an alternative to private vehicle ownership. Internationally, it has become increasingly popular but is still in the early stages of development in New Zealand. A survey of 356 Wellington residents and interviews with 13 car share stakeholders collected data on interest in car sharing and barriers facing the service in New Zealand’s capital. The results suggest that car sharing could become an important mobility option in Wellington and further policy support for car sharing could enable Wellington to take full advantage of its benefits. *Corresponding author Ralph Chapman, Graduate Programme, Environmental Studies, Victoria University of Wellington, New Zealand Centre for Sustainable Cities, Wellington, New Zealand. E-mail: [email protected] Received: July 31, 2020; Accepted: August 06, 2020; Published: August 12, 2020 Keywords: Car Sharing, Benefits, Barriers, Policy, Wellington, Most car sharing schemes are ‘round-trip’ as the user must return New Zealand the car to the same place it was accessed, and pay for the entire time from gaining access to the car, to returning it [10]. Some cities Introduction have also introduced ‘point-to-point’ or ‘free-floating’ car sharing, New Zealand is one of the most urbanised countries in the world, which enables users to pick up the car share vehicle from one car with 86 percent of New Zealanders living in cities and towns park and return it to a different car park. -

THINK PIECE Autonomous Vehicles and Future Urban Environments

THINK PIECE Autonomous vehicles and future urban environments: Exploring implications for wellbeing in an ageing society (Second Edition) Helen Fitt, Angela Curl, Rita Dionisio-McHugh, Amy Fletcher, Bob Frame, Annabel Ahuriri-Driscoll 14 May 2018 This Think Piece Think pieces have two purposes. One is to communicate the thoughts of the author or authors. The second is to prompt readers to think for themselves. This document has both of these purposes at heart. As people with expertise in a range of different areas, we seek to communicate our thoughts about autonomous vehicles, urban and built environments, and wellbeing in an ageing society. We also seek to trigger a wider debate about New Zealand’s future transport system and the policy decisions that could help to shape it. This Think Piece is an early output from a cross-disciplinary collaboration. Its production follows on from workshops and extensive discussion amongst members of the research team; it also draws on discussions with external stakeholders including policy makers, industry representatives, and social and care service providers. It is supported by the other reports listed below and draws extensively from them. We hope that this Think Piece will be the foundation of future work in which we will be able to explore the empirical and theoretical issues it raises in more depth. We also hope that the report will be useful to others with a range of priorities, projects, and perspectives. For now though, we invite you to join us in thinking about what the future might hold, what we would like it to hold, and how we move from here to there. -

The New Zealand Public's Readiness for Connected

The New Zealand public’s readiness for connected- and autonomous-vehicles (including driverless), car and ridesharing schemes and the social impacts of these May 2020 NJ Starkey and SG Charlton ISBN 978-1-98-856162-2 (electronic) ISSN 1173-3764 (electronic) NZ Transport Agency Private Bag 6995, Wellington 6141, New Zealand Telephone 64 4 894 5400; facsimile 64 4 894 6100 [email protected] www.nzta.govt.nz Starkey, NJ and SG Charlton (2020) The New Zealand public’s readiness for connected- and autonomous-vehicles (including driverless), car and ridesharing schemes and the social impacts of these. NZ Transport Agency research report 663. 159pp. The School of Psychology, University of Waikato, was contracted by the NZ Transport Agency in 2017 to carry out this research. This publication is copyright © NZ Transport Agency. This copyright work is licensed under the Creative Commons Attribution 4.0 International licence. You are free to copy, distribute and adapt this work, as long as you attribute the work to the NZ Transport Agency and abide by the other licence terms. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. While you are free to copy, distribute and adapt this work, we would appreciate you notifying us that you have done so. Notifications and enquiries about this work should be made to the Manager Research and Evaluation Programme Team, Research and Analytics Unit, NZ Transport Agency, at [email protected]. Keywords: attitudes, autonomous vehicles, carsharing, connected vehicles, mobility as a service, ridesharing An important note for the reader The NZ Transport Agency is a Crown entity established under the Land Transport Management Act 2003. -

Our Fast-Groмing Sharing Economy

PLATFORMS IN AOTEAROA OUR FAST-GROWING SHARING ECONOMY Kevin Jenkins The Otago Farmers Market Photo: Liz Sinclair My favourite farmers’ market in Aotearoa is in Dunedin. Digital platforms Talk of ‘platforms’ – or the ‘sharing Over the warmer months it has the best fresh produce in economy’ – sometimes seems to be New Zealand: Central Otago apricots the size of peaches, old- ubiquitous. But how significant is this model, and what kinds of policy and school gooseberries, greengage plums. But the Otago Farmers regulatory issues is it raising? Market also offers a physical pun. It’s at Dunedin’s famous As Facebook, Amazon, Ali Baba, Tencent, Uber and so on have grown to Railway Station, and there on the station platform you’ll dominance over the last decade, these huge also find many artisan products, like seaweed condiments, digital marketplaces have become the face of the model. However, the repeated citing craft beer, and bread of every kind. A ‘platform’, according of just this small group of behemoths has obscured the true depth and breadth of the to Choudary and Parker, is ‘a business model that uses platform phenomenon, and also the pace technology to connect people, organisations and resources in of change. The model is expanding and innovating quickly, and much of this is at ecosystems to exchange goods, services and ideas’ (Choudary smaller, local scales. and Parker, 2016). Take a broad view of ‘technology’ and the With the focus on the big international players, it’s easy to overlook the fact that Otago Farmers Market is a platform on a platform. -

2017-11-16-Driven.Pdf

Thursday,Th November 16, 20177 MIGHTY MUSTANG Unique Shelby GT500 Coupe up for sale P3 SEE MORE AT Ruben promoting road safety for 20 years P2 Award winning Te Awamutu hot rods P6 Your Local Vehicle Electrical Experts AFTER SALES SERVICE PROVIDING EXCEPTIONAL SERVICE AUTO ELECTRICAL EXIDE BATTERIES AUDIO•ALARMS DIAGNOSTICS AIR CONDITIONING AUTO ELECTRICAL 2 Te Awamutu Courier Thursday, November 16, 2017 Ruben road safety programme turns 20 AUTOMOTIVE DIRECTORY t’s been 20 years since Ruben the Road Safety IBear launched. His look might have changed, but the foundation road safety skills GLASS / PANEL / PAINT he teaches to Waikato children hasn’t. ALEXANDRA AUTO BODY FABRICATION LTD Waikato Regional Council 6 Hanning Road, Pirongia.............................................07 872 8044 or Kevin 021 144 9989 launched the programme in KIHIKIHI AUTO BODY REPAIRS Havelock Street, off Leslie Street, Kihikihi November, 1997 because e: [email protected]........................................................................... 07 871 4746 children aged 3-7 years were identified as being at highest NOVUS AUTO GLASS 53 Bond Road, Te Awamutu risk of injury in and around e: [email protected] w: novus.co.nz............................................... 07 870 1411 the region’s roads. TONY FABISH PANELWORKS Bond Road, Te Awamutu The programme’s 20th e: [email protected].......................................................................... 07 871 5069 birthday was celebrated in Taupo¯with the Mountview School community, tamariki AUTO SERVICING / REPAIRS from Te Ko¯hanga Reo Atawhai, as well as people A&H MOTORS 259 Rickit Road, Te Awamutu who work with Ruben to keep e: [email protected] w: facebook.com/AandhMotorsLtd .................. 07 871 6555 children safe. -

The Disruptive Mobility and the Future of Our Neighbourhoods

The Disruptive Mobility and the Future of our Neighbourhoods Mohsen Mohammadzadeh University of Auckland Building Better Homes Towns and Cities National Science Challenge 11 Working Paper 18-03 November 2018 The Disruptive Mobility and the Future of our Neighbourhoods Title Working Paper 18-03 ISSN (online) 2624-0750 Author(s) Mohsen Mohammadzadeh Series Building Better Homes Towns and Cities working papers Series Editor Errol Haarhoff Author Contact Details Mohsen Mohammadzadeh School of Architecture and Planning, University of Auckland [email protected] Acknowledgements This work was funded by Building Better Homes, Towns and Cities National Science Challenge, Strategic Research Area – Shaping Places: Future Neighbourhoods. Recommended citation Mohammadzadeh, M. (2018). The Disruptive Mobility and the Future of our Neighbourhoods. Working Paper 18-03. Auckland, New Zealand: National Science Challenge 11: Building Better Homes, Towns and Cities. This report is available from: http://www.buildingbetter.nz/resources/publications.html. © 2018 Building Better Homes, Towns and Cities National Science Challenge and the authors. Short extracts, not exceeding two paragraphs, may be quoted provided clear attribution is given. Working Papers are research materials circulated by their authors for purposes of information and discussion. This document has successfully completed formal and independent scrutiny for quality-assurance purposes. Building Better Homes, Towns and Cities National Science Challenge Private Bag 50 908 www.buildingbetter.nz Porirua 5240 [email protected] New Zealand Building Better Homes, Towns and Cities | Working Paper 18-03 2 Abstract This working paper provides a resource for urban designers, planners and policymakers in New Zealand concerning disruptive mobility and its potential impacts on our cities. -

Sharing Or Owning Autonomous Vehicles? Comprehending the Role of Ideology in the Adoption of Autonomous Vehicles in the Society of Automobility

Transportation Research Interdisciplinary Perspectives 9 (2021) 100294 Contents lists available at ScienceDirect Transportation Research Interdisciplinary Perspectives journal homepage: www.elsevier.com/locate/trip Sharing or owning autonomous vehicles? Comprehending the role of ideology in the adoption of autonomous vehicles in the society of automobility Mohsen Mohammadzadeh School of Architecture and Planning, the University of Auckland, School of Architecture and Planning, Office 617, Level 6, Building 421, 26 Symonds Street, CBD, Auckland, New Zealand ARTICLE INFO ABSTRACT Keywords: This article investigates the role of hegemonic ideology and the symbolic meaning of Autonomous Vehicle (AV) The society of automobility ownership in the society of automobility. Emerging mobility technologies, including connected shared plat- Autonomous vehicles (AVs) forms and automation, are disrupting urban transportation. There is a pervasive expectation that the utilisation ‐ The ideology of car ownership of Shared Autonomous Vehicles (SAVs), by offering an efficient, flexible and affordable on‐demand mobility, Sharing mobility will eventually replace ubiquitous private car ownership. Researchers have mostly considered the transition of Reflexive Thematic Analysis car ownership to SAVs based on positivist‐empiricist approaches. The meaning of the car and its functions are not limited to the instrumental usage that facilitates mobility; instead, the car has other functions such as demonstrating the socio‐economic status of its owner and symbolising his/her subjective identity, which is embedded in the dominant ideology and its symbolic structure. Automobility is a component of hegemonic ide- ology and its symbolic system that has shaped our car‐dependent societies over the last century. The ideological and symbolic functions of car ownership have often been neglected when discussing AVs of the future. -

Gabrielle / TRAVEL for FREE / 1 Gabrielle / TRAVEL for FREE / 2

Gabrielle / TRAVEL FOR FREE / 1 Gabrielle / TRAVEL FOR FREE / 2 Copyright & Disclaimer Copyright ©2017 by Gundi Gabrielle/HDC Enterprises LLC All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in reviews and certain other non-commercial uses permitted by copyright law. Travel for Free While all attempts have been made to verify the information provided in this publication, neither the author, nor the publisher assumes any responsibility for errors, omissions, or contrary interpretations on the subject matter herein. This book is for entertainment purposes only. The views expressed are those of the author alone, and should not be taken as expert instruction or commands. The reader is responsible for his or her own actions. A few affiliate links are included throughout this book. All products recommended have been personally used and tested by the author. Reader or purchaser are advised to do their own research before making any purchase online. Adherence to all applicable laws and regulations, including international, federal, state, and local governing professional licensing, business practices, advertising, and all other aspects of doing business in the US, Canada, or any other jurisdiction is the sole responsibility of the reader or purchaser. Neither the author nor the publisher assumes any responsibility or liability whatsoever on the behalf of the purchaser or reader of these materials. Any perceived slight of any individual or organization is purely unintentional. -

Data Governance for Autonomous and Connected Transport in New

WISE-ACT Report - Series 1 Data Governance for Autonomous and Connected Transport in New Zealand Dr Angela Curl, Department of Population Health, University of Otago, Christchurch, New Zealand Dr Federico Costantini, Department of Law, University of Udine, Italy © 2020 WISE-ACT | COST Action CA16222 | @WISEACT2050 | [email protected] | www.wise-act.eu 1 WISE-ACT Reports - Series 1 The Series 1 reports on “Data Governance for Autonomous and Connected Transport” was released on behalf of the WISE-ACT COST Action 16222 on “Wider impacts and scenario evaluation of Autonomous and Connected Transport”. Its aim is to provide an overview on the legal framework on personal and non-personal data protection in selected EU and non-EU Countries, focusing on current experimentation of Autonomous and Connected Transport (henceforth, ACTs) and deployment of its key technologies, such as mobility services and mobile communications, and providing a common use- case. Report Summary Use, storage and sharing of personal information is regulated by the Privacy Act (1993) although new provisions will come into place at the end of 2020 (Privacy Act, 2020). There is no legal barrier to AV testing in NZ. Those undertaking testing are responsible for the security of the data used. This report is a WISE-ACT output prepared for the book chapter: Costantini F., Thomopoulos N., Steibel F., Curl A., Lugano G., Kováčiková T. (2020) Data protection in a GDPR era: An international comparison of implications for Autonomous Vehicles. In Milakis D., Thomopoulos N., van Wee B. (Eds.) Policy implications of Autonomous Vehicles, Elsevier, 191-213. DOI: 10.1016/bs.atpp.2020.02.005 Recommended report citation: Curl, A., Costantini, F. -

Downloadable As a PDF

www.autofile.co.nz SEPTEMBER 2018 THE TRUSTED VOICE OF THE AUTO INDUSTRY FOR MORE THAN 30 YEARS Industry on high alert Specialised training that’s for stink-bug season proven to increase profits Typhoon hits Japan as importers of used vehicles are being affected by extra biosecurity, transport and cross-rate costs p 11 he automotive supply least seven people and injuring being made at the moment. chain is expected to cope about 200. Traders have been reporting Record with the onset of the high- Logistics companies and lower business activity, the revenue Trisk period for brown marmorated border-inspection organisations dollar’s cross-rate with the yen online stink bugs (BMSBs) – although are now assessing its impact on has tumbled and there’s a lack of teething problems are possible. facilities at Kobe and Osaka and vehicle storage space in Japan. September 1 saw the start of are warning of likely reductions On top of this, extra costs Aston Martin the new season for the are being borne by takes to skies biosecurity threat that importers. Heat- wreaked havoc across treatment surcharges the supply chain earlier currently range from this year. $225-$250 per vehicle p 16 Now heat treatment depending on the of all used vehicles and service provider, land- p 19 machinery from Japan transport prices in New is mandatory, as well as Zealand are rising and approved pathways for the price of shipping – new vehicles, to prevent the High alert – the new or bunker – fuel is rising. stink-bug season bugs getting into New Zealand. -

Shared Mobility: the Future of Public Transport

SHARED MOBILITY: THE FUTURE OF PUBLIC TRANSPORT A THESIS SUBMITTED IN FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN GEOGRAPHY BY WRIK MUKHERJEE DEPARTMENT OF GEOGRAPHY UNIVERSITY OF CANTERBURY 2019 1 Abstract In Christchurch, public transportation (PT) has not eased pressure off private car ownership. With Christchurch’s population set to increase in the near future, the transport system needs to adapt to be able to support the mobility of the local population. My research considers how shared mobility can support PT in Christchurch. I interviewed policymakers to understand what factors are affecting low PT usage. I interviewed shared mobility operators to understand their perceptions about shared mobility. Finally, I ran an online survey for the Christchurch community to understand how they use transport and shared mobility in Christchurch. I found various factors contributing to low PT usage in Christchurch which included lack of accessibility, inadequate frequency of service, poor availability of service, inconvenience of use, long transport times, a poor perception of PT, the issues posed by Christchurch’s medium to low population density, the cost of PT, a culture of car dependency and the cost-ineffectiveness of providing PT in some areas. Shared mobility showed potential to support PT in that it can be more environmentally friendly, help reduce congestion and be more economical. However, there are many barriers to its success in Christchurch. The survey highlighted that the key barriers are a lack of information about shared mobility, safety and privacy concerns about its usage, a reluctance on the part of potential customers to use credit cards for bookings, and unavailability in the locality. -

The Circular Economy Opportunity for Auckland and How Business Can Realise It

The Circular Economy Opportunity for Auckland and how business can realise it Photo: Chris McLennan THE CIRCULAR ECONOMY OPPORTUNITY FOR AUCKLAND | 1 Auckland could liberate up to $ BILLION8.8 in additional economic activity and reduce carbon emissions by 2,700 ktCO2e in 2030 SUSTAINABLE BUSINESS NETWORK THE CIRCULAR ECONOMY OPPORTUNITY FOR AUCKLAND | 2 Executive summary Auckland could liberate up to These are the results of a new study carried out by A circular economy de-couples resource use 1 $8.8 billion in additional economic Sapere Research Group working with the Sustainable from economic growth. Lifecycles of materials are Business Network (SBN), in partnership with Auckland maximised, usage optimised and at the end of life all activity and reduce carbon Tourism, Events and Economic Development. materials are reutilised. It is restorative by design and emissions by 2,700 ktCO e in 2030 The work was supported by Fuji Xerox NZ, Inzide underpinned by the use of renewable energy. 2 Commercial, Junk Run, 3R Group and the Ministry for A circular economy goes beyond an improvement by shifting from the current linear the Environment. to the dominant linear economy. It is a viable take, make and waste model to a Modelling analysis across Auckland’s economy replacement for it. Shifting to it would generate huge circular economy. has identified the potential contribution to the city’s economic, environmental and societal benefits. Gross Domestic Product as between $6.3 - $8.8 billion Applying circular economy thinking to Auckland will by 2030. install environmental and economic resilience into the The analysis focuses on food, transport and the built city.