ANNUAL REPORT 2018 1 Corporate Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

\203E\203F\203U\203T\203C\203G\203A\203B\203V\203\215\201[\203H\227Pultimate Float Flat Patterned.Xls

FIC リファレンスリスト F フロート 、、、フラット 、、、パターンドガラス (((111///333))) フロートブースト 納入年 納入先 国名 システム プロセス 1992 Ford Motor Co. U.S.A. 4 Zone System : 5250kVA Float- High Iron Plant Shutdown 1993 Pilkington S.I.V. Italy 4 Zone System : 5500kVA Float- High Iron & Incr. Clear 2nd Campaign 1993 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron 1994 Glaverbel Belgium 3 Zone System : 5000kVA Float- High Iron 1996 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron 2nd Campaign 1996 Sisecam Turkey 2 Zone System : 3500kVA Float- High Iron & Incr. Clear 1997 NEG Japan Custom System Special Float Project - PDP * 1997 Kumgang Chemical Korea 3 Zone System : 3500kVA Float- High Iron 2nd Campaign 1998 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron * 1998 Guardian Ind. U.S.A. 2 Zone System : 4500kVA Float- High Iron & Incr. Clear 2nd Campaign 1999 Nippon Sheet Glass Japan Model Study only: 6350kVA Float - Boost Project 3 Zone System 2000 Kumgang Chemical Korea 3 Zone System : 3500kVA Float- High Iron 2001 Jiangsu Farun China 1 Zone System : 1800kVA Float- High Iron * 2001 TGI Kunshan China 1 Zone System : 1800kVA Float- High Iron & Incr. Clear 2001 TGI Kunshan China 2 Zone System : 4500kVA Increased Clear 2002 Jiangsu Farun China 2 Zone System : 3000kVA Float- High Iron & Incr. Clear 2002 Sisecam Turkey 4 Zone System : 4400kVA Float- High Iron & Incr. Clear 2003 Jiangsu Farun China 2 Zone System : 3500kVA Float- High Iron & Incr. Clear 2004 TGI Chengdu China 2 Zone System : 3100kVA Increased Clear 2004 TGI Huanan China 2 Zone System : 3100kVA Increased Clear * 2004 TGI Kunshan China Extra Zone added 2004 Hebei Yingxin China 1 Zone System : 1800kVA Improved Quality & Incr. -

ANNUAL REPORT 2016 Contents

1盲義先自正1空目要有PR公司 XINYI SOLAR HOLDINGS LIMITED (Incorporated unde「 the laws of the Cayman Islands with limited liability) Stock Code: 00968 XINYISOLAR ANNUAL REPORT 2016 Contents 2 Corporate Information 4 Chairman’s Statement 9 Management’s Discussion and Analysis 17 Profile of Directors and Senior Management 21 Corporate Governance Report 28 Report of the Directors 49 Independent Auditor’s Report 55 Consolidated Income Statement 56 Consolidated Statement of Comprehensive Income 57 Consolidated Balance Sheet 59 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Consolidated Financial Statements 144 Financial Summary Corporate Information EXECUTIVE DIRECTORS PRINCIPAL PLACE OF BUSINESS IN HONG KONG Datuk TUNG Ching Sai (Vice Chairman) ø< Mr. LEE Yau Ching (Chief Executive Officer) Unit 2109-2115, 21/F Mr. LI Man Yin Rykadan Capital Tower Mr. CHEN Xi No. 135 Hoi Bun Road Kwun Tong, Kowloon NON-EXECUTIVE DIRECTORS Hong Kong Datuk LEE Yin Yee, B.B.S. (Chairman) ø~ LEGAL ADVISERS AS TO HONG KONG LAW Mr. LEE Shing Put Squire Patton Boggs INDEPENDENT NON-EXECUTIVE DIRECTORS 29th Floor, Edinburgh Tower The Landmark Mr. CHENG Kwok Kin, Paul *ø< 15 Queen’s Road Central Mr. LO Wan Sing, Vincent # +< Central, Hong Kong Mr. KAN E-ting, Martin # ø< * Chairman of audit committee AUDITOR # Members of audit committee + Chairman of remuneration committee PricewaterhouseCoopers, Certified Public Accountants ø Members of remuneration committee 22nd Floor, Prince’s Building ~ Chairman of nomination committee Central, Hong Kong < Members of nomination committee PRINCIPAL BANKERS COMPANY SECRETARY Bank of China (Hong Kong) Mr. CHU Charn Fai, FCCA, CPA The Bank of East Asia Bank of SinoPac REGISTERED OFFICE China Citic Bank Cricket Square Chiyu Banking Corporation Ltd. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

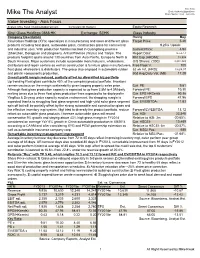

Mike the Analyst

Mike Kwok Email: [email protected] Mike The Analyst Phone Number: (852) - 95035885 Value Investing - Asia Focus Analyst: Mike Kwok / [email protected] Contestant ID: Kwokmi Equity Research Xinyi Glass Holdings 0868:HK Exchange: SEHK Glass Industry Company Description Rating: Buy Xinyi Glass Holdings (XYG) specializes in manufacturing and sales of different glass Target Price: 5.40 products including float glass, automobile glass, construction glass for commercial 9.25% Upside and industrial uses. With production facilities located in Guangdong province Current Price: 4.94 (Shenzhen, Dongguan and jiangmen), Anhui Province (Wuhu) and Tianjin. The Report Date: 5-Jul-14 products footprint spans around 130 countries from Asia-Pacific, Europe to North & Mkt Cap.(HKD'M): 18,932 South America. Major customers include automobile manufacturers, wholesalers, O/S Shares: ('000) 3,832,349 distributors and repair centers as well as construction & furniture glass manufacturers, Free Float %: 100 float glass wholesalers & distributors. The group also engaged in automobile rubber 52 wk H/L (HKD): 8.62/4.57 and plastic components production. 30d Avg Daily Vol: (Mil) 17.28 Overall profit margin reduced, partially offset by diversified biz portfolio Up trending Float glass contribute 45% of the company product portfolio. Investors remain cautious on the margin sustainability given topping property sales price. Cur. PE: 9.81 Although float glass production capacity is expected to up from 3.5M to 4.5M daily Forward PE: 10.30 melting tones due to three float glass production lines expected to be deployed in Cur. EPS:HKCents 50.36 YingKou & Deyang under capacity surplus environment, the dropping margin is Forward EPS 47.96 expected thanks to struggling float glass segment and high-yield solar glass segment Cur. -

![Xinyi Glass [0868.HK] Improving Supply/Demand Situation](https://docslib.b-cdn.net/cover/7250/xinyi-glass-0868-hk-improving-supply-demand-situation-2167250.webp)

Xinyi Glass [0868.HK] Improving Supply/Demand Situation

March 04, 2016 Xinyi Glass [0868.HK] Improving supply/demand situation. Initiate with BUY Xinyi Glass (XYG) is a leading diversified glass manufacturer and the second-largest float China Construction Sector - glass producer in China. XYG has a 20% share worldwide of the automobile (auto) after- market replacement glass market. Despite concerns about the outlook for XYG’s float Building Materials glass division, given industry-wide excess capacity, the Chinese government’s supply-side reform policy might change the supply/demand dynamics of the industry, which would be positive for XYG. With resilient global aftermarket auto glass demand, the wide adoption of BUY Low-E glass, and capacity rationalization in the float glass industry in China, we expect XYG to post a 8.2% top-line CAGR and 18.4% bottom-line CAGR in 2015-17E. We also maintain the view that the negatives for XYG have been priced-in. Details on the govern- Close: HK$4.39 (Mar 03, 2016) ment’s target for capacity reduction in the float glass industry, further cuts in natural gas prices, and the Xinyi Solar (XYS) development plan are share price catalysts. The XYG Target Price: HK$5.5 (+24.7%) share price may come under pressure because of weak market sentiment, which in our view offers a good buying opportunity for investors. XYG is now trading at 8.4x 2016 PER. With its undemanding valuation, we initiate coverage on XYG with a Buy rating for a target price of HK$5.5 (based on 10.5x 2016E PER, lower than historical average and but in line Share Price Performance with the average of its listed peers). -

![Xinyi Glass [0868.HK] Share Price Weakness Offers a Re-Visit Opportunity](https://docslib.b-cdn.net/cover/4387/xinyi-glass-0868-hk-share-price-weakness-offers-a-re-visit-opportunity-2314387.webp)

Xinyi Glass [0868.HK] Share Price Weakness Offers a Re-Visit Opportunity

November 10, 2016 Xinyi Glass [0868.HK] Share price weakness offers a re-visit opportunity. Maintain BUY. Shares of Xinyi Glass (XYG) have been under pressure recently, in our view because of (a) concerns about downstream demand from property developers in response to tightening policies released by the China Construction Sector - Chinese government ; (b) the peak in the float glass price; (c) a potential natural gas price hike; and (d) profit-taking, given the broad-based market correction. Despite concerns about downstream demand, Building Materials the float glass price has held up well, with the average float glass price in key cities in China down only 0.6% from end-Aug to 9 Nov 2016. The YTD average float glass price in key cities has increased 12.5% YoY, up from the 11.1% YoY increase in Jan-Sep 2016. The resilience of the float glass price is due to better downstream demand, which is attributable partly to stable construction activity. According to XYG management, the Company hasn’t experienced a slowdown in float glass shipments. Regard- ing a potential natural gas price hike, at this stage, XYG hasn’t received any formal notice from gas BUY suppliers. Management also highlighted that XYG will enjoy favourable pricing from gas suppliers, so the magnitude of a natural gas price hike will be less than what the news flow suggests. We also be- lieve that the market has missed the news flow on the change in export tax rebates by the Chinese Close: HK$5.93 (Nov 9, 2016) government on auto glass, which is positive for XYG, as it will see a 4% reduction in the cost of sales. -

Catholic United Investment Trust Annual Report

CATHOLIC UNITED INVESTMENT TRUST ANNUAL REPORT (AUDITED) DECEMBER 31, 2016 CATHOLIC UNITED INVESTMENT TRUST TABLE OF CONTENTS Page REPORT OF INDEPENDENT AUDITORS 1-2 Statement of Assets and Liabilities 3-4 Schedule of Investments: Money Market Fund 5-7 Short Bond Fund 8-10 Intermediate Diversified Bond Fund 11-20 Opportunistic Bond Fund 21-26 Balanced Fund 27-37 Value Equity Fund 38-40 Core Equity Index Fund 41-47 Growth Fund 48-51 International Equity Fund 52-55 Small Capitalization Equity Index Fund 56-71 Statements of Operations 72-74 Statements of Changes in Net Assets 75-77 FINANCIAL HIGHLIGHTS 78-80 NOTES TO FINANCIAL STATEMENTS 81-96 Grant Thornton LLP Grant Thornton Tower 171 N. Clark Street, Suite 200 Chicago, IL 60601-3370 REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS T +1 312 856 0200 F +1 312 565 4719 grantthornton.com To the Members of the Board of Trustees And Unitholders of the Catholic United Investment Trust We have audited the accompanying financial statements of the Catholic United Investment Trust, including the Money Market Fund, Short Bond Fund, Intermediate Diversified Bond Fund, Opportunistic Bond Fund, Balanced Fund, Value Equity Fund, Core Equity Index Fund, Growth Fund, International Equity Fund, and Small Capitalization Equity Index Fund, (collectively, the Funds), which comprise the statements of assets and liabilities, including the schedules of investments, as of December 31, 2016, and the related statements of operations, changes in net assets, and financial highlights for the year then ended, and the related notes to the financial statements. The accompanying statements of operations and changes in net assets for the year ended December 31, 2015, and financial highlights for the years ended December 31, 2015, 2014, 2013 and 2012, were audited by other auditors whose report thereon dated March 8, 2016, expressed an unqualified opinion on the financial statements and financial highlights. -

Top 5000 Importers in Fiscal Year 2008

TOP 5000 IMPORTERS IN FISCAL YEAR 2008 NAME ADDR1 ADDR2 CITY STATE ZIP CODE ABERCROMBIE & FITCH TRADING CO 6301 FITCH PATH NEW ALBANY OH 430549269 ADIDAS AMERICA INC 5055 N GREELEY AVE PORTLAND OR 972173524 ADIDAS SALES, INC. ATTN KRISTI BROKAW 5055 N GREELEY AVE PORTLAND OR 972173524 ALDO US INC 2300 EMILE BELANGER MONTREAL CANADA QC H4R3J4 ALPHA GARMENT,INC. 1385 BROADWAY RM 1907 NEW YORK NY 100186001 AMAZON.COM.KYDC, INC. PO BOX 81226 SEATTLE WA 981081300 ANNTAYLOR INC. 7 TIMES SQ RM 1140 NEW YORK NY 100366524 ANVIL KNITWEAR, INC. 146 W COUNTRY CLUB RD HAMER SC 295477289 ARAMARK UNIFORM & CAREER APPAREL 775A TIPTON INDUSTRIAL DRIVE LAWRENCEVILLE GA 300452875 ARIAT INTERNATIONAL INC. 3242 WHIPPLE RD UNION CITY CA 945871217 ASICS AMERICA CORPORATION 29 PARKER STE 100 IRVINE CA 926181667 ASSOCIATED MERCHANDISING CORP. 7000 TARGET PKWY N MAILSTOP NCD-0456 BROOKLYN PARK MN 554454301 ATELIER 4 INC. 3500 47TH AVE LONG ISLAND CITY NY 111012434 BANANA REPUBLIC LLC 2 FOLSOM ST SAN FRANCISCO CA 941051205 BARNEY'S INC. 1201 VALLEY BROOK AVE LYNDHURST NJ 070713509 BCBG MAX AZRIA GROUP INC 2761 FRUITLAND AVE VERNON CA 900583607 BEAUTY AVENUES INC 2 LIMITED PKWY COLUMBUS OH 432301445 BEBE STUDIO, INC. 10345 W OLYMPIC BLVD LOS ANGELES CA 900642524 BED BATH & BEYOND PROCUREMENT CO 110 BI COUNTY BLVD STE 114 FARMINGDALE NY 117353941 BORDERS INC 100 PHOENIX DR ANN ARBOR MI 481082202 BOTTEGA VENETA INC 50 HARTZ WAY SECAUCUS NJ 070942418 BROWN SHOE CO INC 8300 MARYLAND AVE SAINT LOUIS MO 631053693 BURBERRY WHOLESALE LIMITED 3254 N MILL RD STE A VINELAND NJ 083601537 BURLINGTON COAT FACTORY WHSE 1830 ROUTE 130 N BURLINGTON NJ 080163020 BURTON CORPORATION 80 INDUSTRIAL PKY BURLINGTON VT 054015434 BYER CALIFORNIA 66 POTRERO AVE SAN FRANCISCO CA 941034800 C.I. -

![Xinyi Glass [0868.HK] China Construction Sector - 1H 2016 Results Beat Expectations](https://docslib.b-cdn.net/cover/5174/xinyi-glass-0868-hk-china-construction-sector-1h-2016-results-beat-expectations-3755174.webp)

Xinyi Glass [0868.HK] China Construction Sector - 1H 2016 Results Beat Expectations

August 3, 2016 Xinyi Glass [0868.HK] China Construction Sector - 1H 2016 results beat expectations. Improvement continues in 2H. Xinyi Glass (XYG) reported decent 1H 2016 results, beating market expectations. The upside surprise, in Building Materials our view, came mainly from higher-than-expected gross margin improvement, driven mainly by a stronger- than-expected recovery in the float glass segment. XYG’s top-line growth in 1H 2016 was driven mainly by a 22.7% YoY increase in sales of float glass products. The blended gross margin was 34.7% in 1H 2016, up from 26.7% in 1H 2015 and the highest since 2H 2011. Management released positive guidance on the outlook for the Company’s float glass and construction glass divisions. Management believes that the gross BUY margin will be at least stable in 2H 2016 despite concern about China’s economic growth. The price compe- tition in the construction glass segment is expected to come to an end, and XYG aims to raise its average selling price after industry consolidation in 2H 2016. Growth of the construction glass segment is expected Close: HK$6.04 (Aug 1, 2016) to pick up in 2H 2016. With resilient global aftermarket auto glass demand, the wide adoption of Low-E glass, and capacity rationalization in the float glass industry in China, we expect XYG to post solid top- and bottom-line growth in 2016-17E. XYG management also mentioned that the Company is looking for M&A Target Price: HK$7.35 (+21.7%) opportunities as it is difficult to get quota for installation of new production lines. -

Xinyi Glass Initiate at Buy: Vertically Integrated Float Glass Play; Growth with Low Valuation

Xinyi Glass Initiate at Buy: Vertically integrated float glass play; Growth with low valuation Initiating Coverage: BUY | PO: 10.00 HKD | Price: 7.68 HKD Equity | 03 November 2017 Initiate at Buy with HK$10 PO; Attractive Valuation We initiate coverage on Xinyi Glass (XYG) with a Buy rating and PO of HK$10, based on David Ching, CFA >> Research Analyst SOTP with 10x FY18E P/E on its core business and its stake in Xinyi Solar using Merrill Lynch (Hong Kong) +852 3508 3905 BofAML’s valuation. XYG is China’s No.1 float glass producer with 10% market share and [email protected] No.2 in low-emissivity (low-e) construction glass and the world’s largest supplier of Ming Hsun Lee, CFA >> automobile aftermarket glass (ARG) with 25% market share. We have XYG as our top Research Analyst Merrill Lynch (Taiwan) pick in the China glass sector given our positive view on float glass industry, its focus on [email protected] higher value-add products (>30%), healthy b/s (33% net gearing), and 18-20% 2017-20E Matty Zhao >> earnings growth. XYG trades at just 6.7x our 18E P/E with 27% ROE and 7.4% div yield. Research Analyst Merrill Lynch (Hong Kong) [email protected] Key beneficiary of float glass supply-demand improvement We are positive on the supply/demand dynamics of the float glass industry given the upcoming cold-repair cycle in 2018-19E (c.13% of capacity to go offline for 9-12 months), which will likely reduce the effective capacity by c.5%. -

Annual Report

Contents 2 Corporate Information 4 Chairman’s Statement 9 Management’s Discussion and Analysis 17 Profile of Directors and Senior Management 21 Corporate Governance Report 29 Report of the Directors 50 Independent Auditor’s Report 55 Consolidated Income Statement 56 Consolidated Statement of Comprehensive Income 57 Consolidated Balance Sheet 59 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Consolidated Financial Statements 162 Financial Summary Corporate Information EXECUTIVE DIRECTORS PRINCIPAL PLACE OF BUSINESS IN HONG KONG Mr. TUNG Ching Sai (Vice Chairman) ø< Mr. LEE Yau Ching (Chief Executive Officer) Unit 2109-2115, 21/F Mr. LI Man Yin Rykadan Capital Tower Mr. CHEN Xi No. 135 Hoi Bun Road Kwun Tong, Kowloon NON-EXECUTIVE DIRECTORS Hong Kong Dr. LEE Yin, Yee, B.B.S. (Chairman) ø~ Mr. LEE Shing Put LEGAL ADVISERS AS TO HONG KONG LAW Squire Patton Boggs INDEPENDENT NON- EXECUTIVE DIRECTORS 29th Floor, Edinburgh Tower Mr. CHENG Kwok Kin, Paul *ø< The Landmark Mr. LO Wan Sing, Vincent #+< 15 Queen’s Road Central Mr. KAN E-ting, Martin #ø< Central, Hong Kong * Chairman of audit committee AUDITOR # Members of audit committee + Chairman of remuneration committee PricewaterhouseCoopers, Certified Public Accountants ø Members of remuneration committee 22nd Floor, Prince’s Building ~ Chairman of nomination committee Central, Hong Kong < Members of nomination committee PRINCIPAL BANKERS COMPANY SECRETARY Bank of China (Hong Kong) Mr. CHU Charn Fai Bank of East Asia Bank SinoPac REGISTERED