Xinyi Glass [0868.HK]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

\203E\203F\203U\203T\203C\203G\203A\203B\203V\203\215\201[\203H\227Pultimate Float Flat Patterned.Xls

FIC リファレンスリスト F フロート 、、、フラット 、、、パターンドガラス (((111///333))) フロートブースト 納入年 納入先 国名 システム プロセス 1992 Ford Motor Co. U.S.A. 4 Zone System : 5250kVA Float- High Iron Plant Shutdown 1993 Pilkington S.I.V. Italy 4 Zone System : 5500kVA Float- High Iron & Incr. Clear 2nd Campaign 1993 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron 1994 Glaverbel Belgium 3 Zone System : 5000kVA Float- High Iron 1996 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron 2nd Campaign 1996 Sisecam Turkey 2 Zone System : 3500kVA Float- High Iron & Incr. Clear 1997 NEG Japan Custom System Special Float Project - PDP * 1997 Kumgang Chemical Korea 3 Zone System : 3500kVA Float- High Iron 2nd Campaign 1998 Ford Motor Co. U.S.A. 3 Zone System : 3000kVA Float- High Iron * 1998 Guardian Ind. U.S.A. 2 Zone System : 4500kVA Float- High Iron & Incr. Clear 2nd Campaign 1999 Nippon Sheet Glass Japan Model Study only: 6350kVA Float - Boost Project 3 Zone System 2000 Kumgang Chemical Korea 3 Zone System : 3500kVA Float- High Iron 2001 Jiangsu Farun China 1 Zone System : 1800kVA Float- High Iron * 2001 TGI Kunshan China 1 Zone System : 1800kVA Float- High Iron & Incr. Clear 2001 TGI Kunshan China 2 Zone System : 4500kVA Increased Clear 2002 Jiangsu Farun China 2 Zone System : 3000kVA Float- High Iron & Incr. Clear 2002 Sisecam Turkey 4 Zone System : 4400kVA Float- High Iron & Incr. Clear 2003 Jiangsu Farun China 2 Zone System : 3500kVA Float- High Iron & Incr. Clear 2004 TGI Chengdu China 2 Zone System : 3100kVA Increased Clear 2004 TGI Huanan China 2 Zone System : 3100kVA Increased Clear * 2004 TGI Kunshan China Extra Zone added 2004 Hebei Yingxin China 1 Zone System : 1800kVA Improved Quality & Incr. -

GPC15 Final Brochure.Indd

GPC is the largest glass manufacturing event in North America, att racti ng global manufacturers and suppliers to exchange innovati ons and soluti ons. “Ready for a Tri-Mer?” Controls PM, SOx, NOx and more with a single integrated system Visit us in booth #201-203 The New Standard for Glass or contact: Kevin Moss, Business Development Director Furnace Emissions Control 989.321.2991 l [email protected] www.tri-mer.com Since 1960 Factory and Headquarters: 1400 Monroe Street • P.O. Box 730 • Owosso, MI 48867 ©2015 Tri-Mer Corp. 2 “Ready for a Tri-Mer?” Conference on Glass Problems organized by Glass Manufacturing Industry Council & Alfred University Welcome to the 76th Conference on Glass Problems (GPC), a content-rich, technically oriented conference, designed as a SAVE THE DATE high-value resource for the glass manufacturing industry 77th Conference on professional. The Glass Manufacturing Industry Council, in partnership with Alfred University, co-organize the Glass Problems conference, with programming directi on provided by an Robert Weisenburger Lipetz, MBA November 7-10, 2016 Conference Director industry advisory board. As a result, GPC off ers a wealth Columbus, Ohio Glass Manufacturing Industry Council of resources. Technical sessions are designed to cite real The exhibit and technical sessions will take place world data from manufacturers and soluti ons providers. at the Greater Columbus Conventi on Center. Additi onal resources are available, such as our popular short courses, this year in operati ons, combusti on, and The Hospitality Suites will be located fracturing. A symposium on Forming in Glass Manufacturing across the street at the makes use of an enti re day to examine the criti cal processes Hilton Columbus Downton. -

ANNUAL REPORT 2016 Contents

1盲義先自正1空目要有PR公司 XINYI SOLAR HOLDINGS LIMITED (Incorporated unde「 the laws of the Cayman Islands with limited liability) Stock Code: 00968 XINYISOLAR ANNUAL REPORT 2016 Contents 2 Corporate Information 4 Chairman’s Statement 9 Management’s Discussion and Analysis 17 Profile of Directors and Senior Management 21 Corporate Governance Report 28 Report of the Directors 49 Independent Auditor’s Report 55 Consolidated Income Statement 56 Consolidated Statement of Comprehensive Income 57 Consolidated Balance Sheet 59 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Consolidated Financial Statements 144 Financial Summary Corporate Information EXECUTIVE DIRECTORS PRINCIPAL PLACE OF BUSINESS IN HONG KONG Datuk TUNG Ching Sai (Vice Chairman) ø< Mr. LEE Yau Ching (Chief Executive Officer) Unit 2109-2115, 21/F Mr. LI Man Yin Rykadan Capital Tower Mr. CHEN Xi No. 135 Hoi Bun Road Kwun Tong, Kowloon NON-EXECUTIVE DIRECTORS Hong Kong Datuk LEE Yin Yee, B.B.S. (Chairman) ø~ LEGAL ADVISERS AS TO HONG KONG LAW Mr. LEE Shing Put Squire Patton Boggs INDEPENDENT NON-EXECUTIVE DIRECTORS 29th Floor, Edinburgh Tower The Landmark Mr. CHENG Kwok Kin, Paul *ø< 15 Queen’s Road Central Mr. LO Wan Sing, Vincent # +< Central, Hong Kong Mr. KAN E-ting, Martin # ø< * Chairman of audit committee AUDITOR # Members of audit committee + Chairman of remuneration committee PricewaterhouseCoopers, Certified Public Accountants ø Members of remuneration committee 22nd Floor, Prince’s Building ~ Chairman of nomination committee Central, Hong Kong < Members of nomination committee PRINCIPAL BANKERS COMPANY SECRETARY Bank of China (Hong Kong) Mr. CHU Charn Fai, FCCA, CPA The Bank of East Asia Bank of SinoPac REGISTERED OFFICE China Citic Bank Cricket Square Chiyu Banking Corporation Ltd. -

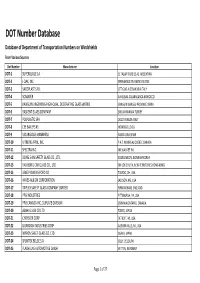

DOT Number Database Database of Department of Transportation Numbers on Windshields from Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A

DOT Number Database Database of Department of Transportation Numbers on Windshields From Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A. EL TALAR TIGRE BS.AS. ARGENTINA DOT‐2 J‐DAK, INC. SPRINGFIELD TN UNITED STATES DOT‐3 SACOPLAST S.R.L. OTTIGLIO ALESSANDRIA ITALY DOT‐4 SOMAVER AIN SEBAA CASABNLANCA MOROCCO DOT‐5 JIANGUIN JINGEHENG HIGH‐QUAL. DECORATING GLASS WORKS JIANGUIN JIANGSU PROVINCE CHINA DOT‐6 BASKENT GLASS COMPANY SINCAN ANKARA TURKEY DOT‐7 POLPLASTIC SPA DOLO VENEZIA ITALY DOT‐8 CEE BAILEYS #1 MONTEBELLO CA DOT‐9 VIDURGLASS MANBRESA BARCELONA SPAIN DOT‐10 VITRERIE APRIL, INC. P.A.T. MONREAL QUEBEC CANADA DOT‐11 SPECTRA INC. MILWAUKEE WI DOT‐12 DONG SHIN SAFETY GLASS CO., LTD. BOOKILMEON, JEONNAM KOREA DOT‐13 YAU BONG CAR GLASS CO., LTD. ON LOK CHUEN, NEW TERRITORIES HONG KONG DOT‐15 LIBBEY‐OWENS‐FORD CO TOLEDO, OH, USA DOT‐16 HAYES‐ALBION CORPORATION JACKSON, MS, USA DOT‐17 TRIPLEX SAFETY GLASS COMPANY LIMITED BIRMINGHAM, ENGLAND DOT‐18 PPG INDUSTRIES PITTSBURGH, PA, USA DOT‐19 PPG CANADA INC.,DUPLATE DIVISION OSHAWA,ONTARIO, CANADA DOT‐20 ASAHI GLASS CO LTD TOKYO, JAPAN DOT‐21 CHRYSLER CORP DETROIT, MI, USA DOT‐22 GUARDIAN INDUSTRIES CORP AUBURN HILLS, MI, USA DOT‐23 NIPPON SHEET GLASS CO. LTD OSAKA, JAPAN DOT‐24 SPLINTEX BELGE S.A. GILLY, BELGIUM DOT‐25 FLACHGLAS AUTOMOTIVE GmbH WITTEN, GERMANY Page 1 of 27 Dot Number Manufacturer Location DOT‐26 CORNING GLASS WORKS CORNING, NY, USA DOT‐27 SEKURIT SAINT‐GOBAIN DEUTSCHLAND GMBH GERMANY DOT‐32 GLACERIES REUNIES S.A. BELGIUM DOT‐33 LAMINATED GLASS CORPORATION DETROIT, MI, USA DOT‐35 PREMIER AUTOGLASS CORPORATION LANCASTER, OH, USA DOT‐36 SOCIETA ITALIANA VETRO S.P.A. -

October 28–31, 2019 Greater Columbus Convention Center Columbus, Ohio USA

CONFERENCE ON GLASS PROBLEMS 80 October 28–31, 2019 Greater Columbus Convention Center Columbus, Ohio USA GPC is the largest glass manufacturing event in North America, attracting global manufacturers and suppliers to exchange innovations and solutions. Organized by: Endorsed by: 1 Tri-Mer World Leader in Glass Emissions Control More installed systems than all other suppliers combined Nearly a decade in glass: container, flat glass, tableware The proven solution for air-fuel and oxy-fuel gas furnace emissions: PM, NOx, SOx, HCl, HF, metals, mercury, hex chrome, dioxins/furans, VOCs, CO Talk with Business Development Director Nick Evans, Booth 305, or call 989-627-1040 www.tri-mer.com 2 80 October 28–31, 2019 Greater Columbus Convention Center Columbus, Ohio USA THANK YOU SPONSORS! Bob Lipetz, MBA S. K. Sundaram, PhD Conference Director Program Director Glass Manufacturing Industry Council Alfred University Welcome to the 80th Conference on Glass Problems (GPC), an es- sential forum for the exchange of ideas and a reliable meeting place for the glass manufacturing industry. We have designed the GPC to provide maximum value in support of your professional goals. The leading trade association bridging glass segments, the Glass Manu- facturing Industry Council (GMIC), in partnership with Alfred University, the leading American glass teaching and research institution, co-orga- nize the conference, with programming direction provided by an active industry advisory board. GPC technical sessions address manufacturing issues, citing real world data from manufacturers and solutions providers. Additional value-rich resources are available, such as our two short courses on Refractories and on Fundamentals of Batch and Furnace Operations. -

LTN201604251262.Pdf

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. * ANNOUNCEMENT ON REPLY TO THE LETTER OF ENQUIRY FROM THE SHANGHAI STOCK EXCHANGE IN RELATION TO POST-VETTING OF THE 2015 ANNUAL REPORT Luoyang Glass Company Limited (the “Company”) and all members of the board (the “Board”) of directors (the “Directors”) of the Company warrant the truthfulness, accuracy and completeness of the contents of this announcement, and accept several and joint responsibilities for any false information, misleading statements or material omissions in this announcement. As required in the Letter of Enquiry in Relation to Post-vetting of the 2015 Annual Report of Luoyang Glass Company Limited (Shang Zheng Gong Han [2016]No. 0379) (hereinafter referred to as “Enquiry Letter”) issued by Shanghai Stock Exchange, the Company hereby replies to the relevant questions in the Enquiry Letter as follows: – 1 – I. INDUSTRY COMPETITION PATTERN AND CORE COMPETITIVENESS OF THE COMPANY 1. Competitive Strengths. Please provide a detailed analysis of the Company’s business model, business status and development prospect in the ultra-thin glass segment, the core competitiveness and major performance drivers, and the competitive advantages and disadvantages of the Company, taking into account the Company’s business scale, industry segments, product competitiveness, market demand and production capacity, technical barriers of products and situations of competitors. -

GLASTON CORPORATION Yliopistonkatu 7 - 00100 Helsinki - Finland Tel.: +358 10 500 500 / Fax: +358 10 500 6515

2015 world directory 2 - Copia omaggio € ââÊ`ÊV«iÀÌ>Ê > Suppliers’ THAT’S WHY THIS WILL BE Profiles YOUR NEXT LAMINATING LINE ZERO DEFECTS ZERO WASTE ZERO DOWNTIME > Suppliers’ ZERO DISPERSION Products & ÊÊ°ÊÓÇÉäÓÉÓää{ÊcÊ{È®Ê>ÀÌ°Ê£]ÊV>Ê£ÊÊ Ê>ÊÊÊUÊÊÊ*Ài Yellow Pages > Glassworks’ Addresses ÌÌ]Ê*ÃÌiÊÌ>>iÊ-«>ÊÊ-«i`°ÊÊ>°Ê«°ÊÊ °°ÊÎxÎÉÓääÎÊVÛ° Powerlam FLAT GLASS LAMINATING LINE WITH EVA & PVB AVAILABLE IN ABSOLUTE PERFORMANCE AND RELIABILITY INTERACTIVE VERSIONS TOO }ÞÊÌiÀ>Ì>]Ê->ÀÌiiÀ}ÞÊ-°À°°]Ê À°Ê,ië°Ê>ÀVÊ*i DESKTOP DISCOVER MORE www.rcnengineering.it IPAD/IPHONE RCN ENGINEERING S.R.L. Via Marcatutto, 7 - 20080 Albairate (MI) Italy Tel +39 02 94602434 - [email protected] www.rcnengineering.it -Õ««iiÌÊÊ>Ê°Ê£{{ÊÊ>ÀV É«ÀÊÊ°ÊÓÉÓä£xÊ`Ê>ÃÃ/iV ANDROID DEVICES www.glassonline.com Multi-roller coating machine for the enamelling and design printing of float glass sheets. ROLLMAC a division of GEMATA - Via Postale Vecchia, 77 - 36070 Trissino (VI) Italy Tel. +39.0445.490618 - Fax +39.0445.490639 - E-mail: [email protected] - www.rollmac.it Because we care Revolutionary. Also our technologies. INSULATING GLASS MANUFACTURING Bystronic glass symbolises innovation with machinery, HANDLING EQUIPMENT systems and services for the processing of architectural AUTOMOTIVE GLASS PREPROCESSING and automotive glass focused on tomorrow’s market. From basic requirements through to entire, customised installations Bystronic glass provides pioneering solutions – naturally, all in the highest quality. www.bystronic-glass.com IR medium wave twin tubes emitters for: iÃÊÌ>µÕ>ÀÌâÊ>ÃÊ«À`ÕViÃÊ } ÞÊ Ê UÊ >>Ì}Êià >««ÀiV>Ìi`Ê iµÕ«iÌÊ vÀÊ Ì iÊ }>ÃÃÊ Ê UÊ ÀÀÀ}Êià industry such as manual and au- Ê UÊ `ÀÞÊÃVÀiiÊ«ÀÌ}Êià tomatic tin side detectors and UV polymerization units. -

Disclosed Manufacturers

The Collegiate Licensing Company 8/5/2013 3:45:44PM Disclosed Manufacturers Disclosed as of 08/05/2013 University of Cincinnati Factory: Dong Yang New Day Huang Garment Co. Disclosed: 06/03/2013 Phone: 86-0379-86880108 180s LLC Contact: Mr. Lu Jun Hua Deyork Vietnam Co., Ltd Factory: Address: West City Industrial Zone Disclosed: 05/03/2013 Phone: 84-663-533970 Dongyang City 322100 China Customer Service Contact: Email: Suoi Cao hamlet, Phuoc Long Village, Go Dau District Address: Product: Apparel Tay Ninh 840000 Vietnam Association: Manufacturer Email: [email protected] Green Vina Co., Ltd. Product: Apparel Factory: 12/18/2011 84-650-6284-177 Association: Manufacturer Disclosed: Phone: Contact: Mr. Joseph Park Long Way Enterprise Co., Ltd. Factory: Address: Bonh Dang Questa, Binh Hoa Ward Disclosed: 02/10/2013 Phone: 86-755-27116775Ext.8202 Thua An 84 Vietnam Mr. Sammi Cheng Contact: Email: [email protected] Lou Village Industrial Estate, Gong Ming Guang Ming New District Address: Product: Apparel Shenzhen China Association: Manufacturer Email: [email protected] Jiang Yin Jiu Dine S & T Co. Product: Apparel Factory: 12/07/2011 86-510-86872719 Association: Manufacturer Disclosed: Phone: Contact: Ms. Jane Kim TuYu Sports Instruments Factory Factory: Address: 218 Chang Jiang Rd. Disclosed: 07/05/2007 Phone: 86-755-29116775 Jiang Yin 21440 China Mr. Fred Tseng Contact: Email: [email protected] Lou Village, 1st Industrial Estate, Gong Ming, Bao An Address: Product: Apparel Shen Zhen 518107 China Association: Manufacturer Email: [email protected] JME Vina Co. Ltd. Product: Ear Wraps Factory: 01/09/2013 84-650-3822991 Association: Manufacturer Disclosed: Phone: Contact: Mr. -

Company News

August 31, 2017 COMPANY NEWS China Glass Holdings Limited [3300.HK; HK$0.70; Not Rated] Key takeaways from 1H 2017 results presentation and detailed discussion with management Market Cap: US$162m; Free Float: 41.1%; 3-months Average Daily Turnover: US$0.13m Analyst: Mark Po [China Glass Holding Limited] The Company. China Glass Holdings Limited (CGH) produces float glass in (HK$) (HK$ million) 1.5 10 China, and markets its glass under the SUBO brand name in China and internationally. 8 CGH held its 1H 2017 results presentation yesterday. Management discussed 1 the Company’s 1H 2017 results, the outlook for industry and the Company, and 6 its near-term expansion plan. We also had a detailed discussion with CGIH’s 4 new management regarding the Company’s relationship with CNBM Group, its 0.5 roadmap and strategy, and its overseas business development. We believe that 2 CGH is likely to be the platform for CNBM Group to develop glass operations in both China and overseas markets. 0 0 1H 2017 results highlights. CGH’s 1H 2017 net profit was RMB22.9m, which is Aug16 Oct16 Dec16 Feb17 Apr17 Jun17 Turnover (RHS) Price (LHS) a turnaround from a net loss of RMB93.9m in 1H 2016. Turnover increased by Key Financials 2013 2014 2015 2016 about 20% YoY, from RMB918m in 1H 2016 to RMB1,101m in 1H 2017. The (in RMB m) increase in turnover was attributable mainly to a 13% YoY increase in the average selling price (ASP), from RMB60.5/DWC in 1H 2016 to RMB68.6/DWC Revenue 2,760.4 2,489.4 1,968.9 2,139.7 Gross Profit 537.2 372.2 78.3 327.3 in 1H 2017. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

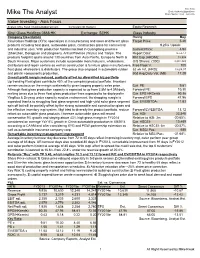

Mike the Analyst

Mike Kwok Email: [email protected] Mike The Analyst Phone Number: (852) - 95035885 Value Investing - Asia Focus Analyst: Mike Kwok / [email protected] Contestant ID: Kwokmi Equity Research Xinyi Glass Holdings 0868:HK Exchange: SEHK Glass Industry Company Description Rating: Buy Xinyi Glass Holdings (XYG) specializes in manufacturing and sales of different glass Target Price: 5.40 products including float glass, automobile glass, construction glass for commercial 9.25% Upside and industrial uses. With production facilities located in Guangdong province Current Price: 4.94 (Shenzhen, Dongguan and jiangmen), Anhui Province (Wuhu) and Tianjin. The Report Date: 5-Jul-14 products footprint spans around 130 countries from Asia-Pacific, Europe to North & Mkt Cap.(HKD'M): 18,932 South America. Major customers include automobile manufacturers, wholesalers, O/S Shares: ('000) 3,832,349 distributors and repair centers as well as construction & furniture glass manufacturers, Free Float %: 100 float glass wholesalers & distributors. The group also engaged in automobile rubber 52 wk H/L (HKD): 8.62/4.57 and plastic components production. 30d Avg Daily Vol: (Mil) 17.28 Overall profit margin reduced, partially offset by diversified biz portfolio Up trending Float glass contribute 45% of the company product portfolio. Investors remain cautious on the margin sustainability given topping property sales price. Cur. PE: 9.81 Although float glass production capacity is expected to up from 3.5M to 4.5M daily Forward PE: 10.30 melting tones due to three float glass production lines expected to be deployed in Cur. EPS:HKCents 50.36 YingKou & Deyang under capacity surplus environment, the dropping margin is Forward EPS 47.96 expected thanks to struggling float glass segment and high-yield solar glass segment Cur.