The Economist Print Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lucy Sparrow Photo: Dafydd Jones 18 Hot &Coolart

FREE 18 HOT & COOL ART YOU NEVER FELT LUCY SPARROW LIKE THIS BEFORE DAFYDD JONES PHOTO: LUCY SPARROW GALLERIES ONE, TWO & THREE THE FUTURE CAN WAIT OCT LONDON’S NEW WAVE ARTISTS PROGRAMME curated by Zavier Ellis & Simon Rumley 13 – 17 OCT - VIP PREVIEW 12 OCT 6 - 9pm GALLERY ONE PETER DENCH DENCH DOES DALLAS 20 OCT - 7 NOV GALLERY TWO MARGUERITE HORNER CARS AND STREETS 20 - 30 OCT GALLERY ONE RUSSELL BAKER ICE 10 NOV – 22 DEC GALLERY TWO NEIL LIBBERT UNSEEN PORTRAITS 1958-1998 10 NOV – 22 DEC A NEW NOT-FOR-PROFIT LONDON EXHIBITION PLATFORM SUPPORTING THE FUSION OF ART, PHOTOGRAPHY & CULTURE Art Bermondsey Project Space, 183-185 Bermondsey Street London SE1 3UW Telephone 0203 441 5858 Email [email protected] MODERN BRITISH & CONTEMPORARY ART 20—24 January 2016 Business Design Centre Islington, London N1 Book Tickets londonartfair.co.uk F22_Artwork_FINAL.indd 1 09/09/2015 15:11 THE MAYOR GALLERY FORTHCOMING 21 CORK STREET, FIRST FLOOR, LONDON W1S 3LZ TEL: +44 (0) 20 7734 3558 FAX: +44 (0) 20 7494 1377 [email protected] www.mayorgallery.com EXHIBITIONS WIFREDO ARCAY CUBAN STRUCTURES THE MAYOR GALLERY 13 OCT - 20 NOV Wifredo Arcay (b. 1925, Cuba - d. 1997, France) “ETNAIRAV” 1959 Latex paint on plywood relief 90 x 82 x 8 cm 35 1/2 x 32 1/4 x 3 1/8 inches WOJCIECH FANGOR WORKS FROM THE 1960s FRIEZE MASTERS, D12 14 - 18 OCT Wojciech Fangor (b.1922, Poland) No. 15 1963 Oil on canvas 99 x 99 cm 39 x 39 inches STATE_OCT15.indd 1 03/09/2015 15:55 CAPTURED BY DAFYDD JONES i SPY [email protected] EWAN MCGREGOR EVE MAVRAKIS & Friend NICK LAIRD ZADIE SMITH GRAHAM NORTON ELENA SHCHUKINA ALESSANDRO GRASSINI-GRIMALDI SILVIA BRUTTINI VANESSA ARELLE YINKA SHONIBARE NIMROD KAMER HENRY HUDSON PHILIP COLBERT SANTA PASTERA IZABELLA ANDERSSON POPPY DELEVIGNE ALEXA CHUNG EMILIA FOX KARINA BURMAN SOPHIE DAHL LYNETTE YIADOM-BOAKYE CHIWETEL EJIOFOR EVGENY LEBEDEV MARC QUINN KENSINGTON GARDENS Serpentine Gallery summer party co-hosted by Christopher Kane. -

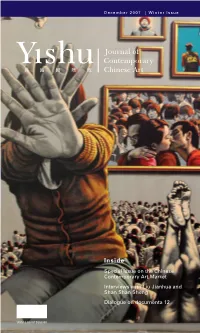

Inside Special Issue on the Chinese Contemporary Art Market Interviews with Liu Jianhua and Shan Shan Sheng Dialogue on Documenta 12

December 2007 | Winter Issue Inside Special Issue on the Chinese Contemporary Art Market Interviews with Liu Jianhua and Shan Shan Sheng Dialogue on documenta 12 US$12.00 NT$350.00 china square 1 2 Contents 4 Editor’s Note 6 Contributors 8 Contemporary Chinese Art: To Get Rich Is Glorious 11 Britta Erickson 17 The Surplus Value of Accumulation: Some Thoughts Martina Köppel-Yang 19 Seeing Through the Macro Perspective: The Chinese Art Market from 2006 to 2007 Zhao Li 23 Exhibition Culture and the Art Market 26 Yü Christina Yü 29 Interview with Zheng Shengtian at the Seven Stars Bar, 798, Beijing Britta Erickson 34 Beyond Selling Art: Galleries and the Construction of Art Market Norms Ling-Yun Tang 44 Taking Stock Joe Martin Hill 41 51 Everyday Miracles: National Pride and Chinese Collectors of Contemporary Art Simon Castets 58 Superfluous Things: The Search for “Real” Art Collectors in China Pauline J. Yao 62 After the Market’s Boom: A Case Study of the Haudenschild Collection 77 Michelle M. McCoy 72 Zhong Biao and the “Grobal” Imagination Paul Manfredi 84 Export—Cargo Transit Mathieu Borysevicz 90 About Export—Cargo Transit: An Interview with Liu Jianhua 87 Chan Ho Yeung David 93 René Block’s Waterloo: Some Impressions of documenta 12, Kassel Yang Jiechang and Martina Köppel-Yang 101 Interview with Shan Shan Sheng Brandi Reddick 109 Chinese Name Index 108 Yishu 22 errata: On page 97, image caption lists director as Liang Yin. Director’s name is Ying Liang. On page 98, image caption lists director as Xialu Guo. -

The Ronald S. Lauder Collection Selections from the 3Rd Century Bc to the 20Th Century Germany, Austria, and France

000-000-NGRLC-JACKET_EINZEL 01.09.11 10:20 Seite 1 THE RONALD S. LAUDER COLLECTION SELECTIONS FROM THE 3RD CENTURY BC TO THE 20TH CENTURY GERMANY, AUSTRIA, AND FRANCE PRESTEL 001-023-NGRLC-FRONTMATTER 01.09.11 08:52 Seite 1 THE RONALD S. LAUDER COLLECTION 001-023-NGRLC-FRONTMATTER 01.09.11 08:52 Seite 2 001-023-NGRLC-FRONTMATTER 01.09.11 08:52 Seite 3 THE RONALD S. LAUDER COLLECTION SELECTIONS FROM THE 3RD CENTURY BC TO THE 20TH CENTURY GERMANY, AUSTRIA, AND FRANCE With preface by Ronald S. Lauder, foreword by Renée Price, and contributions by Alessandra Comini, Stuart Pyhrr, Elizabeth Szancer Kujawski, Ann Temkin, Eugene Thaw, Christian Witt-Dörring, and William D. Wixom PRESTEL MUNICH • LONDON • NEW YORK 001-023-NGRLC-FRONTMATTER 01.09.11 08:52 Seite 4 This catalogue has been published in conjunction with the exhibition The Ronald S. Lauder Collection: Selections from the 3rd Century BC to the 20th Century. Germany, Austria, and France Neue Galerie New York, October 27, 2011 – April 2, 2012 Director of publications: Scott Gutterman Managing editor: Janis Staggs Editorial assistance: Liesbet van Leemput Curator, Ronald S . Lauder Collection: Elizabeth Szancer K ujawski Exhibition designer: Peter de Kimpe Installation: Tom Zoufaly Book design: Richard Pandiscio, William Loccisano / Pandiscio Co. Translation: Steven Lindberg Project coordination: Anja Besserer Production: Andrea Cobré Origination: royalmedia, Munich Printing and Binding: APPL aprinta, W emding for the text © Neue Galerie, New Y ork, 2011 © Prestel Verlag, Munich · London · New Y ork 2011 Prestel, a member of V erlagsgruppe Random House GmbH Prestel Verlag Neumarkter Strasse 28 81673 Munich +49 (0)89 4136-0 Tel. -

Brice Marden Bibliography

G A G O S I A N Brice Marden Bibliography Selected Monographs and Solo Exhibition Catalogues: 2019 Brice Marden: Workbook. New York: Gagosian. 2018 Rales, Emily Wei, Ali Nemerov, and Suzanne Hudson. Brice Marden. Potomac and New York: Glenstone Museum and D.A.P. 2017 Hills, Paul, Noah Dillon, Gary Hume, Tim Marlow and Brice Marden. Brice Marden. London: Gagosian. 2016 Connors, Matt and Brice Marden. Brice Marden. New York: Matthew Marks Gallery. 2015 Brice Marden: Notebook Sept. 1964–Sept.1967. New York: Karma. Brice Marden: Notebook Feb. 1968–. New York: Karma. 2013 Brice Marden: Book of Images, 1970. New York: Karma. Costello, Eileen. Brice Marden. New York: Phaidon. Galvez, Paul. Brice Marden: Graphite Drawings. New York: Matthew Marks Gallery. Weiss, Jeffrey, et al. Brice Marden: Red Yellow Blue. New York: Gagosian Gallery. 2012 Anfam, David. Brice Marden: Ru Ware, Marbles, Polke. New York: Matthew Marks Gallery. Brown, Robert. Brice Marden. Zürich: Thomas Ammann Fine Art. 2010 Weiss, Jeffrey. Brice Marden: Letters. New York: Matthew Marks Gallery. 2008 Dannenberger, Hanne and Jörg Daur. Brice Marden – Jawlensky-Preisträger: Retrospektive der Druckgraphik. Wiesbaden: Museum Wiesbaden. Ehrenworth, Andrew, and Sonalea Shukri. Brice Marden: Prints. New York: Susan Sheehan Gallery. 2007 Müller, Christian. Brice Marden: Werke auf Papier. Basel: Kunstmuseum Basel. 2006 Garrels, Gary, Brenda Richardson, and Richard Shiff. Plane Image: A Brice Marden Retrospective. New York: Museum of Modern Art. Liebmann, Lisa. Brice Marden: Paintings on Marble. New York: Matthew Marks Gallery. 2003 Keller, Eva, and Regula Malin. Brice Marden. Zürich : Daros Services AG and Scalo. 2002 Duncan, Michael. Brice Marden at Gemini. -

Bleckner Biography

ROSS BLECKNER BIOGRAPHY Born in New York City, New York, 1949. Education: New York University, NYC, B.A., 1971. California Institute of the Arts, Valencia, California, M.F.A., 1973. Lives in New York City. Selected Solo Shows: 1983 Mary Boone Gallery, NYC, NY. 1986 Mario Diacono Gallery, Boston, Massachusetts. Mary Boone Gallery, NYC, NY. 1987 Mary Boone Gallery, NYC, NY. 1988 San Francisco Museum of Modern Art, San Francisco, California. Mary Boone Gallery, NYC, NY. 1989 Milwaukee Art Museum, Milwaukee, Wisconsin. Contemporary Arts Museum, Houston, Texas. Carnegie Museum of Art, Pittsburgh, Pennsylvania. 1990 Art Gallery of Ontario, Toronto, Canada. Kunsthalle Zurich, Zurich, Switzerland. 1991 Kolnischer Kunstverein, Koln, Germany. Moderna Museet, Stockholm, Sweden. Mary Boone Gallery, NYC, NY. 1993 Galerie Max Hetzler, Koln, Germany. 1994 Mary Boone Gallery, NYC, NY. 1995 Solomon R. Guggenheim Museum, NYC, NY. Astrup Fearnley Museet for Moderne Kunst, Oslo, Norway. I.V.A.M., Centre Julio Gonzalez, Valencia, Spain. 1996 Mary Boone Gallery, NYC, NY. 1997 Galerie Daniel Templon, Paris, France. Bawag Foundation, Vienna, Austria. 1999 Mary Boone Gallery, NYC, NY. 2000 Mario Diacono Gallery, Boston, Massachusetts. Galerie Ernst Beyeler, Basel, Switzerland. Maureen Paley/Interim Art, London, England. ROSS BLECKNER BIOGRAPHY (continued) : Selected Solo Shows: 2001 Mary Boone Gallery, NYC, NY. 2003 Lehmann Maupin Gallery, NYC, NY. Mary Boone Gallery, NYC, NY. 2004 “Dialogue with Space”, Esbjerg Art Museum, Esbjerg, Denmark. 2005 Ruzicska Gallery, Salzburg, Austria. 2007 Thomas Ammann Fine Art, Zurich, Switzerland. Cais Gallery, Seoul, South Korea. Mary Boone Gallery, NYC, NY. 2008 “New Paintings”, Imago Galleries, Palm Desert, California. 2010 Mary Boone Gallery, NYC, NY. -

Red, Yellow, Blue Lauren Elizabeth Eyler University of South Carolina

University of South Carolina Scholar Commons Theses and Dissertations 1-1-2013 Red, Yellow, Blue Lauren Elizabeth Eyler University of South Carolina Follow this and additional works at: https://scholarcommons.sc.edu/etd Part of the Creative Writing Commons Recommended Citation Eyler, L. E.(2013). Red, Yellow, Blue. (Master's thesis). Retrieved from https://scholarcommons.sc.edu/etd/2315 This Open Access Thesis is brought to you by Scholar Commons. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. RED, YELLOW, BLUE by Lauren Eyler Bachelor of Arts Georgetown University, 2005 Submitted in Partial Fulfillment of the Requirements For the Degree of Master of Fine Arts in Creative Writing College of Arts and Sciences University of South Carolina 2013 Accepted by: Elise Blackwell, Director of Thesis David Bajo, Reader John Muckelbauer, Reader Agnes Mueller, Reader Lacy Ford, Vice Provost and Dean of Graduate Studies © Copyright by Lauren Eyler, 2013 All Rights Reserved. ii ABSTRACT Red, Yellow, Blue is a hybrid, metafictional novel/autobiography. The work explores the life of Ellis, Lotte, Diana John-John and Lauren as they wander through a variety of circumstances, which center on loss and grief. As the novel develops, the author loses control over her intentionality; the character’s she claims to know fuse together, leaving the reader to wonder if Lauren is synonymous with Ellis or if Diana is actually Lotte disguised by a signifier. Red, Yellow, Blue questions the author’s as well as the reader’s ability to understand the transformation that occurs in an individual during long periods of grief and anxiety. -

Basquiat's Brother Sausage, Doig's Reflection

For Immediate Release October 14, 2009 Contact: Matthew Paton Tel. +44 20 7389 2664 [email protected] Milena Sales Tel. +1 212.636.2680 [email protected] CHRISTIE’S TO UNVEIL A MAJOR BASQUIAT, A DOIG MASTERPIECE AND TWO CRUCIAL 1960’s WORKS BY WARHOL FROM ITS NEW YORK EVENING SALE IN LONDON DURING FRIEZE BASQUIAT’S BROTHER SAUSAGE, DOIG’S REFLECTION (WHAT DOES YOUR SOUL LOOK LIKE), AND WARHOL’S MOST WANTED MAN, # 3, ELLIS RUIZ B. and TUNAFISH DISASTER TO BE EXHIBITED IN LONDON OCT 14-17 London – On October 14, for the first time ever in London, a major work by Jean-Michel Basquiat, Brother Sausage (estimate: $9-12 million) and two seminal works from Andy Warhol’s pivotal Death and Disaster series, Most Wanted Men #3, Ellis Ruiz B. (estimate: $5.5-6.5 million) and Tunafish Disaster (estimate: $6-8 million), will be exhibited to the public. One of Peter Doig’s greatest masterpieces will also go on public view in London, for the first time since it dominated the central room of the artist’s Retrospective at Tate Britain in 2008. The works, which will be offered at auction in New York on November 10, are on view as part of a series of exhibitions and auctions dedicated to Post-War and Contemporary Art at Christie’s London from 14 to 17 October to co-incide with Frieze. The leading highlights from the London auctions which will be on public view at Christie’s include significant works by Martin Kippenberger, Lucio Fontana, Damien Hirst, Gerhard Richter, Pino Pascali and a rare, early rediscovered drawing by Lucian Freud (separate release available). -

Annual Report 2003 Annual Report 2003

THE CLEVELAND MUSEUM OF ART ANNUAL REPORT 2003 ANNUAL REPORT 2003 1 ARcover2003.p65 1 6/1/2004, 11:41 PM Annual Report 2003 ARpp01-21.p65 1 6/1/2004, 11:45 PM The Cleveland Cover: School The Annual Report The type is Bembo right in the United 46, 68, 72, 82, 87, 92, Museum of Art children are enthralled was produced by the and TheSans adapted States of America or 100; Becky Bristol: p. 11150 East with the ten litho- External Affairs for this publication. abroad and may not 95; Philip Brutz: pp. Boulevard graphs in Color division of the Composed with be reproduced in any 90 (right), 96; © Cleveland, Ohio Numeral Series (cour- Cleveland Museum of Adobe PC form or medium Disney/Pixar: p. 94; 44106-1797 tesy Margo Leavin Art. PageMaker 6.5. without permission Gregory M. Donley: Copyright © 2004 Gallery, Los Angeles), Narrative: Gregory Photography credits: from the copyright pp. 9 (left), 12, 13, on view in the holders. The follow- 37, 39, 44 (top), 45 The Cleveland M. Donley Works of art in the Museum of Art landmark exhibition ing photographers are (bottom), 47 (bot- Jasper Johns: Numbers. Editing: Barbara J. collection were pho- acknowledged: tom), 49 (top), 67, All rights reserved. Bradley and Kathleen tographed by museum Frontispiece: The Howard Agresti: pp. 71, 77, 79, 80, 89 No portion of this Mills photographers 1, 7, 8 (all), 10 (both), (all); Ann Koslow: p. publication may be museum and lagoon Howard Agriesti and in winter. Design: Thomas H. 36, 38, 40, 43, 44 71 (left); Shannon reproduced in any Barnard Gary Kirchenbauer; (middle and bottom), Masterson: p. -

Michala Božoňová

Michala Božo ňová, 7.ro čník I.stupn ě Výtvarný obor Učitelka Jana Holcová Co mi dala výtvarka? Asi to,že jsem se rok od roku zlepšovala a dostala se do fáze,kdy m ě čeká SUPŠ Sv. Anežky České.Obor jsem si vybrala scénická,interiérová a výstavní tvorba a věř ím,že díky výtvarce to budu dob ře zvládat.Chodím do zušky už od 1.t řídy a po řád mě to baví tak jako na za čátku,i když ob čas jsem m ěla chvíle,kdy jsem to všechno cht ěla vzdát,ale díky babi čce,která m ě v tom strašn ě podporuje pokra čuji a jsem za to ráda.Z výtvarky už znám docela dost technik,které bych asi jinak v ůbec neznala a poznala jsem i spoustu lidí. ANDREW WARHOLA 6. srpna 1928, Pittsburgh– 22. února 1987, New York, znám ější jako Andy Warhol, byl americký malí ř, grafik, filmový tv ůrce a v ůdčí osobnost amerického hnutí pop artu. Představivost, kreativita a fascinace, kterou vzbuzoval u ostatních, prom ěnila Andrewa Warholu, syna prostých slovenských emigrant ů, v Andyho Warhola, superstar amerického pop-artu, v um ělce, který se stal bohatým a slavným.Podstatné ovšem není to, že byl slavný, ale to, že byl skute čně d ůležitým um ělcem, nebo ť p řisp ěl ke zm ěně našeho pohledu na sv ět. Můžeme říci, že spolu s Picassem a Dalím tvo ří trojici nepopiratelných géni ů 20. století. Jeho otec pracoval v uhelných dolech a na stavbách v Pensylvánii. Andy m ěl ješt ě dva starší bratry, Johna a Paula .Všichni spole čně žili na pittsburské 55. -

1 ANDY WARHOL 9 1.1 Biografie

TECHNICKÁ UNIVERZITA V LIBERCI FAKULTA TEXTILNÍ BAKALÁŘSKÁ PRÁCE 2012 MATĚJ BRNICKÝ TECHNICKÁ UNIVERZITA V LIBERCI FAKULTA TEXTILNÍ PÁNSKÁ ODĚVNÍ KOLEKCE “DÍLO ANDY WARHOLA” MEN´S CLOTHING COLLECTION “WORK OF ANDY WARHOL” 2012 MATĚJ BRNICKÝ P r o h l á š e n í Byl jsem seznámen s tím, že na mou bakalářskou práci se plně vztahuje zákon č. 121/2000 Sb., o právu autorském, zejména § 60 – školní dílo. Beru na vědomí, že Technická univerzita v Liberci (TUL) nezasahuje do mých autorských práv užitím mé bakalářské práce pro vnitřní potřebu TUL. Užiji-li bakalářskou práci nebo poskytnu-li licenci k jejímu využití, jsem si vě- dom povinnosti informovat o této skutečnosti TUL; v tomto případě má TUL právo ode mne požadovat úhradu nákladů, které vynaložila na vytvoření díla, až do jejich skutečné výše. Bakalářskou práci jsem vypracoval samostatně s použitím uvedené literatury a na základě konzultací s vedoucím bakalářské práce a konzultantem. Datum Podpis Poděkování V první řadě bych chtěl poděkovat svým rodičům za podporu, bez které bych tuto baka- lářskou práci nemohl dokončit. Jmenovitě pak děkuji vedoucí práce Mgr. art. Zuzaně Veselé, modelovi Dominiku Procházkovi, fotografovi Ondřeji Báčovi a za korekturu manželům Martinkům. 4 Annotation This work is inspired by a famous American artist of the 20th century Andy Warhol. It is especially his paintings and screen printing technology which immediately capture everyone´s attention. From 1962 Warhol gradually found his typical style of painting. Men clothes collection was design from eight types. These types includes t-shirts and simple cut trousers. The t-shirts were made by author himself and so were the printed pictures on them. -

Art Teacher's Book of Lists

JOSSEY-BASS TEACHER Jossey-Bass Teacher provides educators with practical knowledge and tools to create a positive and lifelong impact on student learning. We offer classroom-tested and research-based teaching resources for a variety of grade levels and subject areas. Whether you are an aspiring, new, or veteran teacher, we want to help you make every teaching day your best. From ready-to-use classroom activities to the latest teaching framework, our value-packed books provide insightful, practical, and comprehensive materials on the topics that matter most to K–12 teachers. We hope to become your trusted source for the best ideas from the most experienced and respected experts in the field. TITLES IN THE JOSSEY-BASS EDUCATION BOOK OF LISTS SERIES THE SCHOOL COUNSELOR’S BOOK OF LISTS, SECOND EDITION Dorothy J. Blum and Tamara E. Davis • ISBN 978-0-4704-5065-9 THE READING TEACHER’S BOOK OF LISTS, FIFTH EDITION Edward B. Fry and Jacqueline E. Kress • ISBN 978-0-7879-8257-7 THE ESL/ELL TEACHER’S BOOK OF LISTS, SECOND EDITION Jacqueline E. Kress • ISBN 978-0-4702-2267-6 THE MATH TEACHER’S BOOK OF LISTS, SECOND EDITION Judith A. Muschla and Gary Robert Muschla • ISBN 978-0-7879-7398-8 THE ADHD BOOK OF LISTS Sandra Rief • ISBN 978-0-7879-6591-4 THE ART TEACHER’S BOOK OF LISTS, FIRST EDITION Helen D. Hume • ISBN 978-0-7879-7424-4 THE CHILDREN’S LITERATURE LOVER’S BOOK OF LISTS Joanna Sullivan • ISBN 978-0-7879-6595-2 THE SOCIAL STUDIES TEACHER’S BOOK OF LISTS, SECOND EDITION Ronald L. -

(26.11.2018) Pop

CLAES OLDENBURG’S STORE, 1961 Jim Dine, Five feet of colorful tools, 1962 Roy Lichtenstein, Brushstroke, 1965 James Rosenquist Smoked glass 1962 Andy Warhol, Marylin, 1962 The Stable gallery opening, New York, 1963 In December 1963, Andy Warhol ordered a large number of pine boxes from the Havlicek Woodworking Company. These were destined to be used in the first project in his new studio, dubbed the Factory, which would be presented in his first ever sculpture show. In the early months of 1964, Warhol and his helpers would screen print the labels of famous consumer products on each box, creating facsimiles of the originals: Campbell's tomato juice, Del Monte peach halves, Heinz ketchup, Kellogg's cornflakes, Mott's apple juice, and, of course, Brillo pads. The Brillo boxes (there was both a yellow version and the iconic white) were the most memorable, and, with the earlier Campbell's soup lithos, count among of the most famous images in Warhol's oeuvres. Stacked in piles at New York's Stable Gallery, these boxes would help catapult Warhol into superstardom, and Brillo would become emblematic of that ascent. http://www.artbouillon.com/2013/02/that-brilliant-brillo-box-pops-debt-to.html "New Realists Exhibition," Sidney Janis Gallery, 1962 Andy Warhol, Do it yourself (by-the- numbers), 1962 Jasper Johns, Three Flags, 1958 La luce del Pensiero di Mao Zedong illumina la strada della Grande Rivoluzione Culturale Proletaria, 1966, stampa, 53.5 x 74 cm, collezione Ziyunxuan, pubblicità Campbell ani sessanta Andy Warhol, Cambell soup cans, 1962 Andy Warhol Orange Car Crash Fourteen Times 1963 Green Car Crash.