Payments Powering Platforms Tracker™ Is Powered by Wepay, and PYMNTS Is Grateful for the Company’S Support and Insight

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

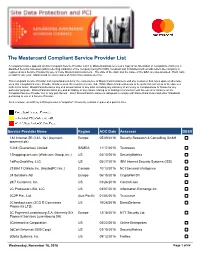

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Moneylab Reader: an Intervention in Digital Economy

READER A N INTERVENTION IN DIGITAL ECONOMY FOREWORD BY SASKIA SASSEN EDITED BY GEERT LOVINK NATHANIEL TKACZ PATRICIA DE VRIES INC READER #10 MoneyLab Reader: An Intervention in Digital Economy Editors: Geert Lovink, Nathaniel Tkacz and Patricia de Vries Copy editing: Annie Goodner, Jess van Zyl, Matt Beros, Miriam Rasch and Morgan Currie Cover design: Content Context Design: Katja van Stiphout EPUB development: André Castro Printer: Drukkerij Tuijtel, Hardinxveld-Giessendam Publisher: Institute of Network Cultures, Amsterdam, 2015 ISBN: 978-90-822345-5-8 Contact Institute of Network Cultures phone: +31205951865 email: [email protected] web: www.networkcultures.org Order a copy or download this publication freely at: www.networkcultures.org/publications Join the MoneyLab mailing list at: http://listcultures.org/mailman/listinfo/moneylab_listcultures.org Supported by: Amsterdam University of Applied Sciences (Hogeschool van Amster- dam), Amsterdam Creative Industries Publishing and the University of Warwick Thanks to everyone at INC, to all of the authors for their contributions, Annie Goodner and Morgan Currie for their copy editing, and to Amsterdam Creative Industries Publishing for their financial support. This publication is licensed under Creative Commons Attribution NonCommercial ShareAlike 4.0 Unported (CC BY-NC-SA 4.0). To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/. EDITED BY GEERT LOVINK, NATHANIEL TKACZ AND PATRICIA DE VRIES INC READER #10 Previously published INC Readers The INC Reader series is derived from conference contributions and produced by the Institute of Network Cultures. They are available in print, EPUB, and PDF form. The MoneyLab Reader is the tenth publication in the series. -

VISA Europe AIS Certified Service Providers

Visa Europe Account Information Security (AIS) List of PCI DSS validated service providers Effective 08 September 2010 __________________________________________________ The companies listed below successfully completed an assessment based on the Payment Card Industry Data Security Standard (PCI DSS). 1 The validation date is when the service provider was last validated. PCI DSS assessments are valid for one year, with the next annual report due one year from the validation date. Reports that are 1 to 60 days late are noted in orange, and reports that are 61 to 90 days late are noted in red. Entities with reports over 90 days past due are removed from the list. It is the member’s responsibility to use compliant service providers and to follow up with service providers if there are any questions about their validation status. 2 Service provider Services covered by Validation date Assessor Website review 1&1 Internet AG Internet payment 31 May 2010 SRC Security www.ipayment.de processing Research & Consulting Payment gateway GmbH Payment processing a1m GmbH Payment gateway 31 October 2009 USD.de AG www.a1m.biz Internet payment processing Payment processing A6IT Limited Payment gateway 30 April 2010 Kyte Consultants Ltd www.A6IT.com Abtran Payment processing 31 July 2010 Rits Information www.abtran.com Security Accelya UK Clearing and Settlement 31 December 2009 Trustwave www.accelya.com ADB-UTVECKLING AB Payment gateway 30 November 2009 Europoint Networking WWW.ADBUTVECKLING.SE AB Adeptra Fraud Prevention 30 November 2009 Protiviti Inc. www.adeptra.com Debt Collection Card Activation Adflex Payment Processing 31 March 2010 Evolution LTD www.adflex.co.uk Payment Gateway/Switch Clearing & settlement 1 A PCI DSS assessment only represents a ‘snapshot’ of the security in place at the time of the review, and does not guarantee that those security controls remain in place after the review is complete. -

Merchants Where Online Debit Card Transactions Can Be Done Using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata

Merchants where online Debit Card Transactions can be done using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata Sky Bookmyshow Flipkart Snapdeal icicipruterm Odisha tax Vodafone Bharat Sanchar Nigam Air India Aircel Akbar online Cleartrip Cox and Kings Ezeego one Flipkart Idea cellular MSEDC Ltd M T N L Reliance Tata Docomo Spicejet Airlines Indigo Airlines Adler Tours And Safaris P twentyfourBySevenBooking Abercrombie n Kent India Adani Gas Ltd Aegon Religare Life Insur Apollo General Insurance Aviva Life Insurance Axis Mutual Fund Bajaj Allianz General Ins Bajaj Allianz Life Insura mobik wik Bangalore electricity sup Bharti axa general insura Bharti axa life insurance Bharti axa mutual fund Big tv realiance Croma Birla sunlife mutual fund BNP paribas mutural fund BSES rajdhani power ltd BSES yamuna power ltd Bharat matrimoni Freecharge Hathway private ltd Relinace Citrus payment services l Sistema shyam teleservice Uninor ltd Virgin mobile Chennai metro GSRTC Club mahindra holidays Jet Airways Reliance Mutual Fund India Transact Canara HSBC OBC Life Insu CIGNA TTK Health Insuranc DLF Pramerica Life Insura Edelweiss Tokio Life Insu HDFC General Insurance IDBI Federal Life Insuran IFFCO Tokio General Insur India first life insuranc ING Vysya Life Insurance Kotak Mahindra Old Mutual L and T General Insurance Max Bupa Health Insurance Max Life Insurance PNB Metlife Life Insuranc Reliance Life Insurance Royal Sundaram General In SBI Life Insurance Star Union Daiichi Life TATA AIG general insuranc Universal Sompo General I -

Payments in Poland 2017

Payments in Poland, 2017 Selected pages from the original report by Inteliace Research October 2017 Version: 17.c Table of contents Executive Summary 3. Retail landscape (merchants) and payment methods Slide 23: Brick&mortar (b&m) vs. online retail landscape, 2015-2017 1. Payments in Poland and in Europe Slide 24: Key payments methods available in B&M and in online retail, 2017 Slide 1: Consumer markets in Europe, 2016 Slide 25: Survey on payment methods in 72 large online stores, Oct. 2017 Slide 2: Total payments in Poland, structure by type, 2012-2016 Slide 26: Online merchants & payment methods– case (1/3): Allegro Slide 3: Total payments: Europe vs. Poland, structure by type, 2016 Slide 27: Online merchants & payment methods– case (2/3): RTVEuroAGD Slide 4: Card payment volumes in Europe & in Poland (1/2), 2014-2016 Slide 28: Online merchants & payment methods– case (3/3): empik.com Slide 5: Card payment volumes in Europe & in Poland (2/2), 2016 Slide 29: Key players in specialized mobile payments (parking, public /municipal transportation, regional railways), 2017 2. Payments and payment infrastructure in Poland Slide 30: Use of payment cards as tickets in public transport Slide 6: Card payments in Poland, 2012-2017F Slide 31: Block chain technology & bitcoin in Poland: Exchanges, bitcoin Slide 7: POS infrastructure evolution in Poland, 2012-2017F acquirers, merchants, 2017 2017 Poland, in Payments Slide 8: Cards/terminals in Poland by functionality, 2Q2015-2Q2017 Slide 9: ATM networks in Poland, 2012-2017H1 Slide 10: ATM cash withdrawals -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

List of Merchants 4

Merchant Name Date Registered Merchant Name Date Registered Merchant Name Date Registered 9001575*ARUBA SPA 05/02/2018 9013807*HBC SRL 05/02/2018 9017439*FRATELLI CARLI SO 05/02/2018 9001605*AGENZIA LAMPO SRL 05/02/2018 9013943*CASA EDITRICE LIB 05/02/2018 9017440*FRATELLI CARLI SO 05/02/2018 9003338*ARUBA SPA 05/02/2018 9014076*MAILUP SPA 05/02/2018 9017441*FRATELLI CARLI SO 05/02/2018 9003369*ARUBA SPA 05/02/2018 9014276*CCS ITALIA ONLUS 05/02/2018 9017442*FRATELLI CARLI SO 05/02/2018 9003946*GIUNTI EDITORE SP 05/02/2018 9014368*EDITORIALE IL FAT 05/02/2018 9017574*PULCRANET SRL 05/02/2018 9004061*FREDDY SPA 05/02/2018 9014569*SAVE THE CHILDREN 05/02/2018 9017575*PULCRANET SRL 05/02/2018 9004904*ARUBA SPA 05/02/2018 9014616*OXFAM ITALIA 05/02/2018 9017576*PULCRANET SRL 05/02/2018 9004949*ELEMEDIA SPA 05/02/2018 9014762*AMNESTY INTERNATI 05/02/2018 9017577*PULCRANET SRL 05/02/2018 9004972*ARUBA SPA 05/02/2018 9014949*LIS FINANZIARIA S 05/02/2018 9017578*PULCRANET SRL 05/02/2018 9005242*INTERSOS ASSOCIAZ 05/02/2018 9015096*FRATELLI CARLI SO 05/02/2018 9017676*PIERONI ROBERTO 05/02/2018 9005281*MESSAGENET SPA 05/02/2018 9015228*MEDIA SHOPPING SP 05/02/2018 9017907*ESITE SOCIETA A R 05/02/2018 9005607*EASY NOLO SPA 05/02/2018 9015229*SILVIO BARELLO 05/02/2018 9017955*LAV LEGA ANTIVIVI 05/02/2018 9006680*PERIODICI SAN PAO 05/02/2018 9015245*ASSURANT SERVICES 05/02/2018 9018029*MEDIA ON SRL 05/02/2018 9007043*INTERNET BOOKSHOP 05/02/2018 9015286*S.O.F.I.A. -

Registros De Entidades 2017

REGISTROS DE ENTIDADES 2017 SITUACION A 31 DE DICIEMBRE DE 2017 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ........................................................................................................ 9 ORDENADO POR CODIGO B.E. ......................................................................................................... 11 BANCOS ORDENADO ALFABETICAMENTE ...................................................................................................... 15 ORDENADO POR CODIGO B.E. ......................................................................................................... 17 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE ...................................................................................................... 27 ORDENADO POR CODIGO B.E. ......................................................................................................... 29 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 33 ORDENADO POR CODIGO B.E. ......................................................................................................... 35 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 47 ORDENADO POR CODIGO B.E. ......................................................................................................... 49 ESTABLECIMIENTOS FINANCIEROS DE CREDITO -

Payment Services)

2018 Business Briefing (Payment Services) December 10, 2018 Representative Director and Senior Executive Vice President Shigeki Yamaguchi © 2018 NTT DATA Corporation Self-introduction ■Business experience Apr 1984 Joined NTT DATA • Engaged in development of middle software for shared scientific computation systems • Project leader of system development for distribution industry, etc. Jul 2010 Head of Enterprise Business Consulting Marketing Sector • Engaged in establishment of NTT Data Business Consulting Corporation, a predecessor of QUNIE CORPORATION, a consulting firm of NTT DATA Group, and concurrently served as Director and Executive Vice President Jan 2013 Representative Director and Senior Managing Director of JSOL Corporation • Engaged in expansion of SAP business Jun 2013 Senior Vice President, Head of Business Consulting & Marketing Sector • In charge of consulting and ERP (Biz∫) business Jun 2014 Senior Vice President, Head of Third Enterprise Sector Shigeki Jun 2016 Executive Vice President, Head of IT Services & Payments Services Sector • In charge of payment business, distribution and service industries Yamaguchi Jun 2017 Director and Executive Vice President, Responsible for Enterprise & Solutions Segment and China & APAC Segment Jun 2018 Representative Director and Senior Executive Vice President ■Area of expertise Digital commerce, payment, and consulting 2 © 2018 NTT DATA Corporation Organizational structure • IT Services & Payments Services Sector of Enterprise & Solutions Segment provides services for Japanese payment -

Credit Card Processing Services RFP

City of York Credit Card Processing Services RFP Questions & Answers 1. What type of equipment do you currently use to process Credit card transactions? (Please provide the Model Number and how many of each Terminal type there is – some model number examples include Vx510, FD55, FD130, Hypercom T7P, etc. The City of York does not own the equipment currently in use. All equipment must be returned to the current service provider upon termination of services. 2. Is there any requirement to interface with an existing legacy system? The City York currently uses Microsoft Dynamics AX; therefore data exports should be one of the following file formats: fixed field, tab delimited or comma delimited so that it interfaces with SK Global. 3. How many merchant IDs does the City of York currently have? And are you looking to keep the same numbers of merchant IDs? There are two merchant IDs, one for The City of York and one for the General Authority which operates the City’s public parking system; there is no desire to add additional IDs. 4. Will each merchant account fall under the same EIN number? Or does the City of York used different EIN numbers for different sectors accepting credit cards? Each merchant Id will have its own EIN. 5. How many current physical locations within York accept Credit, Debit, or E-Check? a. How many Retail locations, internet locations/websites? b. How many mail order/telephone order locations? c. Do you anticipate any new locations that will need to begin Credit Card acceptance? There are 7 locations that accept credit cards; 3 garages, 209 parking meters that accept credit cards. -

MOBILE Payments Market Guide 2013

MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM OVER 350 COMPANIES WORLDWIDE INSIDE Extensive global distribution via worldwide industry events As the mobile payments ecosystem is becoming increasingly more crowded and competitive, the roles of established and new players in the mobile market is shifting, with new opportunities and challenges facing each category of service providers. Efma, the global organization that brings together more than 3,300 retail financial services companies from over 130 countries, welcomes the publication of the Mobile Payments Market Guide 2013 by The Paypers as a valuable source of information and guidance for all actors in the mobile transaction services space. Patrick Desmarès - CEO, Efma MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM Authors Ionela Barbuta Sabina Dobrean Monica Gaza Mihaela Mihaila Adriana Screpnic RELEASE | VERSION 1.0 | APRIL 2013 | COPYRIGHT © THE Paypers BV | ALL RIGHTS reserved 2 MOBILE PAYMENTS MARKET GUIDE 2013 INTRODUCTION Introduction You are reading the Mobile Payments Market Guide 2013, a state- se and the way commerce is done. From a quick and accessible of-the-art overview of the global mobile transaction services channel for banking on the move to a sophisticated tool for shop- ecosystem and the most complete and up-to-date reference ping, price comparison and buying, the saga of the mobile device source for mobile payments, mobile commerce and mobile is an on-going story that unfolds in leaps and bounds within a banking-related information at global level. This guide is published progressively crowded (and potentially fragmented) ecosystem. -

Making Payment to R Wadiwala – Faqs

Making payment to R Wadiwala – FAQs # Description Page No. 01 General 2 02 Cheque Deposit – Directly at HDFC Bank or at our Branch/Associates 3 03 NEFT / RTGS 4 04 Direct Debit Facility / ACH System 5 06 Payment Gateway 6 R Wadiwala Securities/Commodities Pvt Ltd. General 1. What are the different modes of making payment to R Wadiwala? You can make payment to us using any of the following modes: Cheque deposit 1. You can submit cheques to our branches/associates, or 2. You can deposit cheque directly in our bank. NEFT/RTGS You can transfer funds directly from your bank to R. Wadiwala’s bank account using online banking. Payment Gateway / Online You can make payment using our payment gateway platform by login into: Payment 1. Mobile App or Web based trading platform or 2. Our client back office on the web or mobile app. Bank Mandate / Direct debit Simply designate a bank account using ACH system and we automatically deduct your payment from the registered banks. 2. What care should be taken while making payment? Payment should always be made from your registered bank account. Registered bank account is the bank account given by the customer at the time of opening his/her trading account with us. If you want to make payment from any other bank account, you will have to get the new bank account registered with us. You can <Click Here> to get application form to add new bank account with R. Wadiwala. There is no limitation to number of accounts that can be registered with us provided that the name in the bank accounts is same as that of trading account.