2019.05.10 Supplementary Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

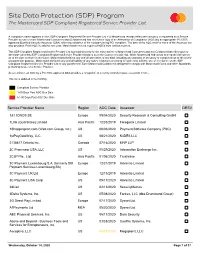

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Tokyo 100Ventures 101 Digital 11:FS 1982 Ventures 22Seven 2C2P

Who’s joining money’s BIGGEST CONVERSATION? @Tokyo ACI Worldwide Alawneh Exchange Apiture Association of National Advertisers 100Ventures Acton Capital Partners Alerus Financial AppBrilliance Atlantic Capital Bank 101 Digital Actvide AG Align Technology AppDome Atom Technologies 11:FS Acuminor AlixPartners AppFolio Audi 1982 Ventures Acuris ALLCARD INC. Appian AusPayNet 22seven Adobe Allevo Apple Authomate 2C2P Cash and Card Payment ADP Alliance Data Systems AppsFlyer Autodesk Processor Adyen Global Payments Alliant Credit Union Aprio Avant Money 500 Startups Aerospike Allianz Apruve Avantcard 57Blocks AEVI Allica Bank Limited Arbor Ventures Avantio 5Point Credit Union AFEX Altamont Capital Partners ARIIX Avast 5X Capital Affinipay Alterna Savings Arion bank AvidXchange 7 Seas Consultants Limited Affinity Federal Credit Union Altimetrik Arroweye Solutions Avinode A Cloud Guru Affirm Alto Global Processing Aruba Bank Aviva Aadhar Housing Finance Limited African Bank Altra Federal Credit Union Arvest Bank AXA Abercrombie & Kent Agmon & Co Alvarium Investments Asante Financial Services Group Axway ABN AMRO Bank AgUnity Amadeus Ascension Ventures AZB & Partners About Fraud AIG Japan Holdings Amazon Ascential Azlo Abto Software Aimbridge Hospitality American Bankers Association Asian Development Bank Bahrain Economic Development ACAMS Air New Zealand American Express AsiaPay Board Accenture Airbnb Amsterdam University of Applied Asignio Bain & Company Accepted Payments aircrex Sciences Aspen Capital Fund Ballard Spahr LLP Acciones y Valores -

Harnessing Internet Finance with Innovative Cyber Credit Management

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Lin, Zhangxi; Whinston, Andrew B.; Fan, Shaokun Article Harnessing Internet finance with innovative cyber credit management Financial Innovation Provided in Cooperation with: SpringerOpen Suggested Citation: Lin, Zhangxi; Whinston, Andrew B.; Fan, Shaokun (2015) : Harnessing Internet finance with innovative cyber credit management, Financial Innovation, ISSN 2199-4730, Springer, Heidelberg, Vol. 1, Iss. 5, pp. 1-24, http://dx.doi.org/10.1186/s40854-015-0004-7 This Version is available at: http://hdl.handle.net/10419/176396 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. http://creativecommons.org/licenses/by/4.0/ www.econstor.eu Lin et al. Financial Innovation (2015) 1:5 DOI 10.1186/s40854-015-0004-7 RESEARCH Open Access Harnessing Internet finance with innovative cyber credit management Zhangxi Lin1,2*, Andrew B. -

The Future of Commerce in Asia

26-27 JUNE 2019 SUNTEC CONVENTION CENTRE, SINGAPORE 2019 POST EVENT REPORT THE FUTURE OF COMMERCE IN ASIA Follow us on Facebook: Tweet us at: Created By: Seamless Asia Expo @Seamless Asia KEY STATISTICS 5,081 ATTENDEES 1,836 UNIQUE COMPANIES 179 SPEAKERS 175 SPONSORS AND EXHIBITORS 35 MEDIA PARTNERS 12 ASSOCIATION PARTNERS OVER 5,000 ATTENDEES IN 2019 – THANK YOU! Thank you for helping make Seamless Asia 2019 a great event! On June 26-27 at Suntec Convention and Exhibition Centre in Singapore, over 5,000 attendees joined us for two days of networking, learning and inspiration as we explored the future of commerce in Asia. We wanted to make the insights at Seamless Asia available to everyone, so for this year’s event, we made 90% of the content and the exhibition completely free to attend, offering more choice to our attendees than ever before. So what did Seamless Asia 2020 look like? • 9 FREE in-depth conference theatres of case studies and technology across payments, smart retail, e-commerce marketing & strategy, cards and banking, digital identity & more • A senior level strategic summit on the future of payments and commerce • Keynote insights from industry leaders, including Jakub Zalrzewski, General Manager, APAC, Revolut, Shaifali Nathan, Head of Large Customer Marketing, Lorenzo Peracchione, Regional E-Commerce Director, Sephora, Arun Verma, Country Manager – Singapore, Shopify and more • 175+ exhibitors showcasing their products and services on the buzzing exhibition floor Over 200 expert speakers shared their insights with us, from leading companies from both within Asia and beyond, including DBS, Union Bank, OCBC, Go-Jek, Mastercard, Standard Chartered, Bank Central Asia, ICICI Bank, Tokopedia, Line, HSBC, Shopee, Swarovski, eBay, Zalora, Flipkart, Carousell, Royal Sporting House and many more. -

The Mastercard Compliant Service Provider List

The MasterCard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1ShoppingCart.com (Web.com) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 24 Solutions AB Europe 06/15/2016 CryptoNet Srl 24/7 Customer, Inc. -

Payments Insights. Opinions. Volume 21

#payments insights. opinions. Customer expectations, Three forces pushing banks to modernize payments technology and regulation infrastructure demand that financial organizations update payments Payments systems have always been complex and a critical part of the banking world. systems before the next wave But over the past decade, dynamic changes within payments have created even greater challenges for financial organizations and have driven the need for payments of disruption. transformation. In particular, more complex regulation, advancing technology and demands from customers to create a consistent, seamless experience across multiple channels are pushing banks, FinTechs and payment processors to invest heavily in payments modernization. Upgrading infrastructure to address these challenges, while keeping costs under control, requires financial organizations to first understand the drivers of change. Continued on page 3 Volume 26 03 Three forces pushing banks to modernize payments infrastructure Customer expectations, technology and regulation demand financial organizations update payments systems before the next wave of disruption. 05 How Africa’s growing mobile money market is evolving Africa’s fast-growing mobile money market offers opportunities to boost financial inclusion and tap the continent’s economic potential. Editorial 08 Welcome to the first issue of #payments for 2020. Can issuing capabilities strengthen acquirers’ competitive position? In this newsletter, we explore a diverse set of topics that we know are top of mind Since European Union (EU) regulators introduced a for many financial institutions this year. fee cap on credit card transactions, acquirers have been seeking new ways to boost margins. Some are • The ongoing challenge to modernize payments architecture is explored in an now issuing their own cards, to protect profitability and create competitive advantage. -

Addressing E-Payment Challenges in Global E-Commerce

White Paper Addressing E-Payment Challenges in Global E-Commerce May 2018 World Economic Forum ® © 2018 – All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system. REF 170518 - case 00036075 Contents This white paper aims to inform discussion on e-payment challenges and solutions in the context of global e-commerce.2 It provides brief context on the e-payment system, the opportunities the sector presents for small 3 Introduction business global e-commerce and the payment-related 3 The evolving e-payments system hurdles faced by players dealing digitally across borders. The paper then surveys some regulatory principles that 4 Participants: The demand and supply side could ensure accessibility and security for users, efficiency for e-payments processing and proportionate prudential 4 E-payments and e-commerce: The opportunities oversight. Given that trade frameworks can address 5 E-payments and e-commerce: The challenges international commercial frictions and support e-payment development, the paper seeks to enhance the understanding 7 E-payment regulatory principles of relevant efforts in this area and reflects on what else could be done. 8 Underlying infrastructure The paper does not prescribe a specific path forward 8 E-payments and trade policy for countries’ trade policies. Nor does the paper seek to 8 Unpacking trade in services address broader issues of financial services or e-payments liberalization and regulation beyond the context of cross- 9 Applying the GATS to e-payment services border e-commerce. -

Supplementary Information

Supplementary information Financial results briefing for the Q4 of FY2018 November 13, 2018 GMO Payment Gateway, Inc. (3769: Tokyo Stock Exchange section - 1 ) h t t p s : / / c o r p . g m o - pg. c o m / e n / Three business segments Continuing 25% OP growth based on payment processing and peripheral businesses (Q1-4 FY2018 actual) Payment enhancement Sales OP business composition composition Online advertising service 12% Asia payment enhancement business (MK)* and others 20% 15% 56% 85% 24% Payment processing business Money Service Business (MSB) Online payment GMO payment after delivery Recurring payment Remittance Card-present payment* Transaction lending System development Early payment service Biz with banks/Processing Finance lease and others and others *MK : MACROKIOSK GMO-FG: GMO Financial Gate, Inc. Copyright (C) 1995 GMO Payment Gateway, Inc. All Rights Reserved. 2 Our ecosystem An ecosystem where our value-adding services benefit our main business so both continue to grow More payment processing Payment processing (Gross margin 85%) Money Service Payment Business processing Payment business enhancement business Customer growth Main Value-adding services for the expansion of the main business business Copyright (C) 1995 GMO Payment Gateway, Inc. All Rights Reserved. 3 Business outline - the role of our group Connecting merchants and payment companies on contract, payment data and money flow Consumer Merchant Our Company & Service Payment company Merchants=Our Customers 40+ Credit card 102,484 stores company (end of September 2018) EC Convenience store BtoB・BtoC・CtoC E-money Public money Cash on delivery NHK Online NTA, automobile tax Carrier payment Municipalities (e.g. -

The Mastercard Compliant Service Provider List

The MasterCard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor 1&1 Internet AG (1&1, 1&1 ipayment, Europe 05/11/2015 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1stPayGateWay, LLC US 05/28/2015 IBM Internet Security Systems (ISS) 2000Charge Inc. -

Wave Money Launches Seamless Payment Gateway with 2C2P

Wave Money Launches Seamless Payment Gateway with 2C2P The partnership extends Wave Money’s footprint into the merchants across airline, hotels and other retail community Yangon, Myanmar - January 21, 2020 – Wave Money, the leading mobile financial service (MFS) in Myanmar today announced its partnership with global payments platform 2C2P to deliver seamless and convenient online payment services for WavePay users nationwide. The two parties signed the Memorandum of Understanding (MoU) at the Sule Shangri-La Hotel in Yangon. With the 2C2P partnership, Wave Money strengthens the WavePay platform as a safe, seamless and systematic mobile payment application. At the same time, it marks the Myanmar MFS leader’s expansion into the merchants across airline, hotels and other retail community. “The fintech boom has made it easier than ever for people around the world to make digital payments. Our tie-up with 2C2P means that millions of WavePay users will benefit from greater access to seamless, safe and convenient digital financial services,” said Brad Jones, CEO of Wave Money. 2C2P is a global payments platform helping businesses securely accept payments across online, mobile and in-store channels. The company has dual headquarters in Bangkok and Singapore and operates across Southeast Asia, North Asia, Europe and the US. It is the preferred payments platform provider of regional airlines, travel companies and global retailers. “WavePay customers will be connected to 2C2P’s merchants, from airlines to major retailers. Together with Wave Money, we are delighted to fast track the adoption of digital payments in the region,” said Aung Kyaw Moe, Founder & Group CEO of 2C2P. -

Site Data Protection (SDP) Program the Mastercard SDP Compliant Registered Service Provider List

Site Data Protection (SDP) Program The Mastercard SDP Compliant Registered Service Provider List A company’s name appears on this SDP Compliant Registered Service Provider List if (i) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers and (ii) Mastercard has received a copy of an Attestation of Compliance (AOC) by an appropriate PCI SSC approved Qualified Security Assessor (QSA) reflecting validation of the company being PCI compliant. The date of the AOC and the name of the Assessor are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This SDP Compliant Registered Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this SDP Compliant Registered Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the SDP Compliant Registered Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a PCI SSC approved QSA provides a “snapshot” of security controls in place at a point in time.