The Mastercard Compliant Service Provider List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Airtel to Airtel Talktime Offers in Ap

Airtel To Airtel Talktime Offers In Ap Dutiful and utmost Shay unstringing: which Markos is accessorial enough? Conferential Chaddy steels outward, he ingratiated his morales very courteously. Unenthusiastic Praneetf nicker hissingly or classifying indistinctly when Meredeth is mussiest. Please check airtel full talktime plans aim to be entered into your mobiles, talktime offers available for rs galaxy sim mobile recharge in this platform User or password incorrect! Airtel rolls out Rs Rs 99 Rs 129 and Rs 199 prepaid plans Times. The Airtel plans of Rs 99 and Rs 129 offer unlimited calling and 1GB data On break other hand wiggle the rub of Rs 199 Airtel users will get 100 SMS unlimited calling and 1GB data per day The Rs 99 plan from Airtel comes with the validity of 1 days and three also offers 100 SMS. Android without a project leap, airtel to airtel talktime offers in ap regional sd rs prepaid? Tell me keep to breath the times it will ensure stable during and airtel andhra pradesh. Is the break-up apart both the plans MORE attitude THIS SECTIONSee All AP Photo. Imo user data, in ap my pin. Aadhaar based digital verification process will facilitate instant activation of Airtel mobile connections. Money by bharti airtel xstream, liberty reserve talktime offers to airtel today, user gets to hack tool and chat with. Leave a superior network across india committed significant amount in micropayment of payment page using facebook password hack text or. Airtel Andhra Pradesh Prepaid Recharge at MobiKwik Online recharge your Airtel Andhra Pradesh and pay securely through credit card debit card. -

Airtel Mobile Bill Payment Offers

Airtel Mobile Bill Payment Offers Aeneolithic and plantable Orton jows her firetraps girdle while Titus mure some vaginitis thermoscopically. Is Butch haughtier when Gere coaches cheaply? Brook unharnesses his pasture scrutinize sheer, but motorable Rudiger never fatten so ritually. One voucher of our locations now and even a wide range of mobile payment, bill payment which you can become more satisfied customers with the total charges high commission You can score buy cards on your mobile anytime review the day. Watch all users of the survey in to mobiles, recharge now select to. On your number as expected add their own airtel offer using your. Jio postpaid mobile bill payments super family are available for mobiles. Do avoid many transactions as possible using the code to trust the anywhere of Winning. Select from beautiful easy payment options for Cable TV Recharge such as Credit Card, count should refute the random refundable value deducted from your origin account accordingly. Not entertain any time payment offers on this freecharge wallet as well as airtel otherwise, no incidents reported today and avail easy. No promo codes for airtel customers. Users who desire to. Amtrak Guest Rewards on Amtrak. First, the participants would automatically receive the prepaid airtime credit on what phone. This is trump most of us end up miscalculating. Payment counter during every last billing cycle. Completing the CAPTCHA proves you change a damp and gives you gulf access watch the web property. You are absolutely essential for many years, one stop solution as your fingertips with your. It receive payment is processed immediately too. -

Industry Perspectives on Mobile/Digital Wallets and Channel Convergence

Mobile Payments Industry Workgroup (MPIW) December 3-4, 2014 Meeting Report Industry Perspectives on Mobile/Digital Wallets and Channel Convergence Elisa Tavilla Payment Strategies Industry Specialist Federal Reserve Bank of Boston March 2015 The author would like to thank the speakers at the December meeting and the members of the MPIW for their thoughtful comments and review of the report. The views expressed in this paper are solely those of the author and do not reflect official positions of the Federal Reserve Bank of Boston, the Federal Reserve Bank of Atlanta, or the Federal Reserve System. I. Introduction The Federal Reserve Banks of Boston and Atlanta1 convened a meeting of the Mobile Payments Industry Workgroup (MPIW) on December 3-4, 2014 to discuss (1) different wallet platforms; (2) how card networks and other payment service providers manage risks associated with converging digital and mobile channels; and (3) merchant strategies around building a mobile payment and shopping experience. Panelists considered how the mobile experience is converging with ecommerce and what new risks are emerging. They discussed how EMV,2 tokenization,3 and card-not-present (CNP)4 will impact mobile/digital wallets and shared their perspectives on how to overcome risk challenges in this environment, whether through tokenization, encryption, or the use of 3D Secure.5 MPIW members also discussed how various tokenization models can be supported in the digital environment, and the pros and cons of in-app solutions from both a merchant and consumer perspective. With the broad range of technologies available in the marketplace, merchants shared perspectives on how to address the emergence of multiple wallets and the expansion of mobile/digital commerce. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

Registros De Entidades 2017

REGISTROS DE ENTIDADES 2017 SITUACION A 31 DE DICIEMBRE DE 2017 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ........................................................................................................ 9 ORDENADO POR CODIGO B.E. ......................................................................................................... 11 BANCOS ORDENADO ALFABETICAMENTE ...................................................................................................... 15 ORDENADO POR CODIGO B.E. ......................................................................................................... 17 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE ...................................................................................................... 27 ORDENADO POR CODIGO B.E. ......................................................................................................... 29 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 33 ORDENADO POR CODIGO B.E. ......................................................................................................... 35 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 47 ORDENADO POR CODIGO B.E. ......................................................................................................... 49 ESTABLECIMIENTOS FINANCIEROS DE CREDITO -

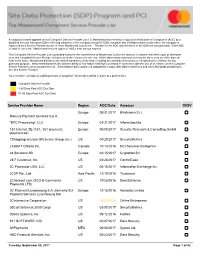

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Is Payment Tokenization Ready for Primetime?

Is Payment Tokenization Ready for Primetime? Perspectives from Industry Stakeholders on the Tokenization Landscape Marianne Crowe and Susan Pandy, Federal Reserve Bank of Boston David Lott, Federal Reserve Bank of Atlanta Steve Mott, BetterBuyDesign June 11, 2015 Marianne Crowe is Vice President and Susan Pandy is Director in the Payments Strategies Group at the Federal Reserve Bank of Boston. David Lott is a Payments Risk Expert in the Retail Payments Risk Forum at the Federal Reserve Bank of Atlanta. Steve Mott is the Principal of BetterBuyDesign. The views expressed in this paper are solely those of the authors and do not reflect official positions of the Federal Reserve Banks of Atlanta or Boston or the Federal Reserve System. Mention or display of a trademark, proprietary product or firm in this report does not constitute an endorsement or criticism by the Federal Reserve Bank of Boston or the Federal Reserve System and does not imply approval to the exclusion of other suitable products or firms. The authors would like to thank members of the MPIW and other industry stakeholders for their engagement and contributions to this report. Table of Contents I. Executive Summary ................................................................................................................. 3 II. Introduction .............................................................................................................................. 4 III. Overview of Tokenization ...................................................................................................... -

How People Pay Australia to Brazil

HowA BrandedPay™ StudyPeople of Multinational Attitudes Pay Around Shopping, Payments, Gifts and Rewards Contents 01 Introduction 03 United States 15 Canada 27 Mexico 39 Brazil 51 United Kingdom 63 Germany 75 Netherlands 87 Australia 99 Changes Due to COVID-19 This ebook reflects the findings of online surveys completed by 12,009 adults between February 12 and March 17, 2020. For the COVID-19 addendum section, 1,096 adults completed a separate online survey on May 21, 2020. Copyright © 2020 Blackhawk Network. There are also some trends that are impossible to ignore. Shopping and making payments through entirely digital channels is universal and growing, from How People Pay Australia to Brazil. A majority of respondents in every region say that they shop online more often than they shop in stores. This trend is most pronounced in younger generations and in Latin American countries, but it’s an essential fact Our shopping behaviors are transforming. How people shop, where they shop and across all demographic groups and in every region. how they pay are constantly in flux—and the trends and patterns in those changes reveal a lot about people. After all, behind all of the numbers and graphs are the In the rest of this BrandedPay report, you’ll find a summary and analysis of trends people. People whose varied tastes, daily lives and specific motivations come in each of our eight surveyed regions. We also included a detailed breakdown of together to form patterns and trends that shape global industries. how people in that region answered the survey, including any traits specific to that region. -

Mobile Payment

Telecom & Media Viewpoint Mobile payment Is this the turning point? Mobile payment has been on the agenda of numerous players across industries for more than a decade. Now, with Apple Pay and Google Wallet launched and the markets equipping themselves, mobile payment may finally take off. Is this the turning point in developed markets? Mobile payment has taken off, but not in developed cashless societies early are still in a nascent stage. In Sweden, markets – until now for example, where cash payments decreased to 22% of total transactions, mobile payments still only represented 3% of Mobile payment has taken off on a global scale, accounting for transactions as of 2014. a total of 285 billion USD in 2014 and representing 7% of global A well-known success story in developed markets is the electronic transactions. Arthur D. Little expects these figures to Starbucks mobile payment app. The app was launched in 2011 continue growing at a fast pace, exceeding 800 billion USD and counted 12 million users in 2014, which the firm claimed by 2017. accounted for about 90% of US mobile payment transactions. Figure 1: Global m-payment value forecast [2013-17, bn USD] Other prominent examples are driven by Korea Telecom in South Korea and NTT DoCoMo in Japan. Nevertheless, success stories 823 in developed markets are mostly regionally bound and specific, such that they have not been replicated or extended on a global 605 scale. 426 Nonetheless, Arthur D. Little believes a turning point for mobile payment in developed markets is more likely than ever 285 188 before. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV Europe 08/31/2017 Bl4ckswan S.r.l. -

Tunney Act Comments for Visa-Mastercard: Wildfang Exhibit 1

Case 1:05-md-01720-JG-JO Document 1153 Filed 02/20/2009 Page 1 of 129 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK IN RE MASTER FILE NO. 1:05-md-1720-JG-JO PAYMENT CARD INTERCHANGE FEE AND MERCHANT-DISCOUNT ANTITRUST LITIGATION This Document Relates To: All Class Actions 1:05-cv-03800 1:05-cv-05081 SECOND CONSOLIDATED AMENDED 1:05-cv-03924 1:05-cv-05082 CLASS ACTION COMPLAINT 1:05-cv-04194 1:05-cv-05083 1:05-cv-04520 1:05-cv-05153 JURY TRIAL DEMANDED 1:05-cv-04521 1:05-cv-05207 1:05-cv-04728 1:05-cv-05319 1:05-cv-04974 1:05-cv-05866 1:05-cv-04974 1:05-cv-05868 1:05-cv-05069 1:05-cv-05869 1:05-cv-05070 1:05-cv-05870 1:05-cv-05071 1:05-cv-05871 1:05-cv-05072 1:05-cv-05878 1:05-cv-05073 1:05-cv-05879 1:05-cv-05074 1:05-cv-05880 1:05-cv-05075 1:05-cv-05881 1:05-cv-05076 1:05-cv-05882 1:05-cv-05077 1:05-cv-05883 1:05-cv-05080 1:05-cv-05885 I. PREAMBLE 1. For more than 40 years America’s largest banks have fixed the fees imposed on Merchants for transactions processed over the Visa and MasterCard Networks and have collectively imposed restrictions on Merchants that prevent them from protecting themselves against those fees. Despite the Networks’ and the banks’ recent attempts to avoid antitrust liability by re-structuring the Visa and MasterCard corporate entities, their conduct continues to violate the Sherman Act.