ITV Set for Continued Growth After Another Strong Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Catch up Content

Creating change for good ITV Responsibility Corporate Responsibility Summary Report 2017 Contents About us As an integrated producer broadcaster, we create, own and distribute high quality entertainment on multiple platforms globally. Since our first broadcast in 1955, we’ve grown into an integrated About us 1 producer broadcaster with an increasingly global and diversified How we do business 2 operating footprint. We run the largest commercial family of channels in the UK, as well as deliver programmes on demand through numerous Our Corporate Responsibility Strategy 3 platforms directly and on the ITV Hub. 2017 highlights and achievements 4 Our global production business, ITV Studios, creates and sells Did you programmes and formats from offices in the UK, US, Australia, France, People Germany, the Netherlands, the Nordics and Italy. It’s the largest and most successful commercial production company in the UK, and a know… Our commitments 6 leading unscripted independent producer in the US and Europe. In 2017, 54% of ITV Studios revenue was from outside the UK. ITV Studios Global Our website Case studies 7 Entertainment is a leading international distribution business, offering a Find out more on what we do at catalogue of over 45,000 hours of world-class television and film. In 2017, our itvresponsibility.com, including: Planet We reach 80% of the UK’s TV-watching population each week. group external Our commitments 8 Internationally, we’ve continued to grow with operations in 11 countries Reports and more than 6,300 colleagues based across the globe. revenue was over Policies Case studies 9 Toolkits In 2017, we continued to build significant scale in key creative markets £3.1 billion Latest news around the world, creating and producing programmes and formats Partnerships that return and travel, namely drama, entertainment and factual Our commitments 10 entertainment. -

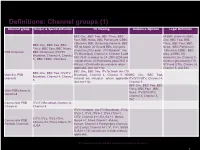

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

ITV Partners with Viewability Company Meetrics

PRESS RELEASE ITV partners with viewability company Meetrics First measurements across all channels show viewability rates above industry-wide benchmarks ITV, the UK’s biggest commercial broadcaster, announces that it has partnered with Meetrics, a leading European software company for advertising measurement and analytics, to provide enhanced advertising campaign delivery validation for VOD advertising across ITV Hub platforms. As part of the partnership, Meetrics provides video viewability data and reporting for ITV Hub on connected TV platforms and In-App (Android and iOS) as well as desktop and mobile web campaigns. This enriches the reporting capabilities for VOD campaigns run on ITV Hub and demonstrates the high quality of ITV’s ad inventory on metrics that are important to agencies and advertisers. With the partnership, ITV underlines its commitment to very high transparency standards and quality controls for the benefit of its advertising customers. Meetrics is an independent vendor accredited for various services by the Media Rating Council and committed to strict privacy rules in full accordance with GDPR. With Meetrics as a partner ITV is breaking new ground by being the first broadcaster in the world to make use of the IAB Open Measurement SDK, which is considered the most rigorous standard for In-App viewability measurement. To date, average measurement for campaigns running across ITV Hub showed a viewability rate (according to the MRC definition) of 98%, which is far beyond average, compared to industry viewability benchmarks. The new viewability measurement and reporting will give advertisers huge confidence that ITV can deliver standards on human and viewability measures that outperform the VOD market. -

INDUSTRY REPORT (AN ARTICLE of ITV ) After My Graduation, My

INDUSTRY REPORT (AN ARTICLE OF ITV ) After my graduation, my ambition is to work in ITV channel, for creating movies for children and applying 3d graphics in news channels is my passion in my life. In this report I would like to study about Itv’s News channel functions and nature of works in ITV’s graphics hub etc. ITV is a 24-hour television news channel in the United Kingdom which Launched in 1955 as Independent Television. It started broadcasting from 1 August 2000 to 23 December 2005. Latterly only between 6:00 am and 6:00 pm when ITV4 cut its hours to half day in 2005 and analogue cable, presenting national and international news plus regular business, sport, entertainment and weather summaries. Priority was usually given to breaking news stories. There was also an added focus on British stories, drawing on the resources of the ITV network's regional newsrooms. As a public service broadcaster, the ITV network is obliged to broadcast programming of public importance, including news, current affairs, children's and religious programming as well as party election broadcasts on behalf of the major political parties and political events. Current ITV Channels: • 1.1ITV • 1.2ITV2 • 1.3ITV3 • 1.4ITV4 • 1.5ITVBe • 1.6ITV Box Office • 1.7ITV Encore • 1.8ITV HD • 1.9CITV Uses of Graphics : 3D Graphics have been used to greatest effect in within news. In what can be a chaotic world where footage isn’t always the best quality news graphics play an important role in striping stories down to the bare essentials. -

Quick Reference Guide To: How to Deliver Content to ITV Your Programme Has Been Commissioned and You Have Been Asked by ITV to Deliver a Piece of Content

July 2020 Quick Reference Guide To: How to Deliver Content to ITV Your programme has been commissioned and you have been asked by ITV to deliver a piece of content. What do you need to do and who are the contacts along the journey?..... Firstly, you will need to know who your Compliance Advisor is. If you’ve not been provided with a contact then email [email protected]. Your Advisor will be able to provide you with legal advice along the journey and will be able to provide you with lots of key information such as your unique Production Number. Another key contact is your Commissioner. They may require some deliverables from you so it’s best to have that discussion directly with them. Within this guide you will find a list of frequently asked questions with links to more detailed documents. 1. My programme will be transmitted live. Does this make a difference? 2. My programme isn’t live; so what exactly am I delivering? 3. Where do I get my Production/Clock Numbers from? 4. Where can I get my tech spec to file deliver? 5. Where do I deliver my DPP AS-11 file to? 6. I need to ensure that my programme has the ITV ‘Look & Feel’. How do I make this happen? 7. Can I make amendments to my programme after I’ve delivered it to Content Delivery? 8. Where do I send my Post Productions Scripts to? 9. What do I do if I have queries around part durations and the total runtime of my programme? 10. -

The Speakers and Chairs 2016

WEDNESDAY 24 FESTIVAL AT A GLANCE 09:30-09:45 10:00-11:00 BREAK BREAK 11:45-12:45 BREAK 13:45-14:45 BREAK 15:30-16:30 BREAK 18:00-19:00 19:00-21:30 20:50-21:45 THE SPEAKERS AND CHAIRS 2016 SA The Rolling BT “Feed The 11:00-11:20 11:00-11:45 P Edinburgh 12:45-13:45 P Meet the 14:45-15:30 P Meet the MK London 2012 16:30-17:00 The MacTaggart ITV Opening Night FH People Hills Chorus Beast” Welcome F Revealed: The T Breakout Does… T Breakout Controller: T Creative Diversity Controller: to Rio 2016: SA Margaritas Lecture: Drinks Reception Just Do Nothing Joanna Abeyie David Brindley Craig Doyle Sara Geater Louise Holmes Alison Kirkham Antony Mayfield Craig Orr Peter Salmon Alan Tyler Breakfast Hottest Trends session: An App Taskmaster session: Charlotte Moore, Network Drinks: Jay Hunt, The Superhumans’ and music Shane Smith The Balmoral screening with Thursday 14.20 - 14.55 Wednesday 15:30-16:30 Thursday 15:00-16:00 Thursday 11:00-11:30 Thursday 09:45-10:45 Wednesday 15:30-16:30 Wednesday 12:50-13:40 Thursday 09:45-10:45 Thursday 10:45-11:30 Wednesday 11:45-12:45 The Tinto The Moorfoot/Kilsyth The Fintry The Tinto The Sidlaw The Fintry The Tinto The Sidlaw The Networking Lounge 10:00-11:30 in TV Formats for Success: Why Branded Content BBC A Little Less Channel 4 Struggle For The Edinburgh Hotel talent Q&A The Pentland Digital is Key in – Big Cash but Conversation, Equality Playhouse F Have I Got F Winning in F Confessions of FH Porridge Adam Abramson Dan Brooke Christiana Ebohon-Green Sam Glynne Alex Horne Thursday 11:30-12:30 Anne Mensah Cathy -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

From Public Service Broadcasting to Public Service Media Gregory Ferrell Lowe & Jo Bardoel (Eds.)

From Public Service Broadcasting to Public Service Media Gregory Ferrell Lowe & Jo Bardoel (eds.) RIPE @ 2007 NORDICOM From Public Service Broadcasting to Public Service Media From Public Service Broadcasting to Public Service Media Gregory Ferrell Lowe & Jo Bardoel (eds.) NORDICOM From Public Service Broadcasting to Public Service Media RIPE@2007 Gregory Ferrell Lowe & Jo Bardoel (eds.) © Editorial matters and selections, the editors; articles, individual con- tributors; Nordicom ISBN 978-91-89471-53-5 Published by: Nordicom Göteborg University Box 713 SE 405 30 GÖTEBORG Sweden Cover by: Roger Palmqvist Cover photo by: Arja Lento Printed by: Livréna AB, Kungälv, Sweden, 2007 Environmental certification according to ISO 14001 Contents Preface 7 Jo Bardoel and Gregory Ferrell Lowe From Public Service Broadcasting to Public Service Media. The Core Challenge 9 PSM platforms: POLICY & strategY Karol Jakubowicz Public Service Broadcasting in the 21st Century. What Chance for a New Beginning? 29 Hallvard Moe Commercial Services, Enclosure and Legitimacy. Comparing Contexts and Strategies for PSM Funding and Development 51 Andra Leurdijk Public Service Media Dilemmas and Regulation in a Converging Media Landscape 71 Steven Barnett Can the Public Service Broadcaster Survive? Renewal and Compromise in the New BBC Charter 87 Richard van der Wurff Focus on Audiences. Public Service Media in the Market Place 105 Teemu Palokangas The Public Service Entertainment Mission. From Historic Periphery to Contemporary Core 119 PSM PROGRAMMES: strategY & tacticS Yngvar Kjus Ideals and Complications in Audience Participation for PSM. Open Up or Hold Back? 135 Brian McNair Current Affairs in British Public Service Broadcasting. Challenges and Opportunities 151 Irene Costera Meijer ‘Checking, Snacking and Bodysnatching’. -

Media: Industry Overview

MEDIA: INDUSTRY OVERVIEW 7 This document is published by Practical Law and can be found at: uk.practicallaw.com/w-022-5168 Get more information on Practical Law and request a free trial at: www.practicallaw.com This note provides an overview of the sub-sectors within the UK media industry. RESOURCE INFORMATION by Lisbeth Savill, Clare Hardwick, Rachael Astin and Emma Pianta, Latham & Watkins, LLP RESOURCE ID w-022-5168 CONTENTS RESOURCE TYPE • Scope of this note • Publishing and the press Sector note • Film • Podcasts and digital audiobooks CREATED ON – Production • Advertising 13 November 2019 – Financing and distribution • Recorded music JURISDICTION • Television • Video games United Kingdom – Production • Radio – Linear and catch-up television • Social media – Video on-demand and video-sharing services • Media sector litigation SCOPE OF THIS NOTE This note provides an overview of the sub-sectors within the UK media industry. Although the note is broken down by sub-sector, in practice, many of these areas overlap in the converged media landscape. For more detailed notes on media industry sub-sectors, see: • Sector note, Recorded music industry overview. • Sector note, TV and fi lm industry overview. • Practice note, Video games industry overview. FILM Production Total UK spend on feature fi lms in 2017 was £2 billion (up 17% on 2016) (see British Film Institute (BFI): Statistical Yearbook 2018). Film production activity in the UK is driven by various factors, including infrastructure, facilities, availability of skills and creative talent and the incentive of fi lm tax relief (for further information, see Practice note, Film tax relief). UK-produced fi lms can broadly be sub-divided into independent fi lms, UK studio-backed fi lms and non-UK fi lms made in the UK. -

Itv Studios Acquires Swedish Production Company Elk Production

ITV STUDIOS ACQUIRES SWEDISH PRODUCTION COMPANY ELK PRODUCTION 21 June 2017 – ITV Studios has acquired the Swedish production company Elk Production, a subsidiary of Elk Entertainment Group. The production label is known for hit entertainment shows including quiz En Ska Bort (Odd One Out) and award-winning series Wahlgrens and Parneviks. Elk Production currently has 15 shows in production or on air across Sweden’s free to air and pay TV channels including Drömpyramiden (Stacked), Ett jobb för Berg (A Job For Berg) and Superskaparna (Supercrafters). It has also produced local versions of international formats including Ninja Warriors, Superstars and Top Chef: Just Desserts. ITV Studios’ majority stake in Elk Production will see the company combine with ITV Studios’ existing Swedish production business, with the amalgamated companies operating under the brand ITV Studios Sweden. ITV Studios Sweden has produced Come Dine With Me for TV4 since 2008 creating 19 seasons so far. It is also producing This Time Next Year for SVT. Elk Production’s current Managing Director, Anna Rydin, will lead the newly combined ITV Studios Sweden reporting to Mike Beale, Managing Director, Nordics and Global Creative Network, ITV Studios. Elk Formats is not included in the acquisition and remains part of Elk Entertainment. However, ITV Studios will be its exclusive formats partner in the Nordics with the right to produce shows, including Stacked and All Inclusive, through ITV Studios’ production companies in Sweden, Denmark, Finland and Norway. ITV Studios now represents a strong library of formats in the region encompassing ITV Studios, Talpa, Twofour and now Elk 1 Entertainment formats. -

Case Study ITV

Case Study ITV Case Study ITV “The main benefit of moving to Fujitsu and their VME services is risk mitigation. In moving to Fujitsu from our incumbent provider we get access to a very rare resource base for VME development and support. This provides us with a path enabling us to keep our critical Artist Payments System application running and allows us to keep our options open when VME as a product is end dated in 2020.” Anthony Chin, Head of Technology - Finance Systems, ITV The customer ITV is an integrated producer broadcaster and the largest commercial television network in the UK. It is the home of popular television from the biggest entertainment events, to original drama, major sport, landmark factual series and independent news. It operates a family of channels including ITV, ITVBe, ITV2, ITV3 and ITV4 and CITV, which are broadcast free-to-air, as well as the pay channel ITV Encore. ITV is also focused on delivering its programming across multiple platforms including itv.com, mobile devices, video on demand and third party platforms. ITV Studios is a global production business, creating and selling programmes and formats from offices in the UK, US, Australia, France, Germany, the Nordics and the Netherlands. It is the largest and most successful commercial production company in the UK, the largest independent non-scripted indie in the US and ITV Studios Global Entertainment is a leading international distribution The customer businesses. The challenge Country: United Kingdom ITV receives revenue from advertising, its online, pay and interactive Industry: Broadcasting business as well as from the production and sales of the programmes Founded: 1955 it creates and holds rights to.