Media Nations 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

As Filed with the Securities and Exchange Commission on July 2, 1998

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 2, 1998 REGISTRATION NO. 333-57283 - ------------------------------------------------------------------------------- - ------------------------------------------------------------------------------- SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 --------------- AMENDMENT NO. 1 TO FORM S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 --------------- CROWN CASTLE INTERNATIONAL CORP. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) DELAWARE 4899 76-0470458 (STATE OR OTHER JURISDICTION (PRIMARY STANDARD (I.R.S. EMPLOYER OF INCORPORATION OR INDUSTRIAL IDENTIFICATION NUMBER) ORGANIZATION) CLASSIFICATION NUMBER) 510 BERING DRIVE SUITE 500 HOUSTON, TEXAS 77057 (713) 570-3000 (ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER, INCLUDING AREA CODE, OF REGISTRANT'S PRINCIPAL EXECUTIVE OFFICES) --------------- MR. CHARLES C. GREEN, III EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER CROWN CASTLE INTERNATIONAL CORP. 510 BERING DRIVE SUITE 500 HOUSTON, TEXAS 77057 (713) 570-3000 (NAME, ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER, INCLUDING AREA CODE, OF AGENT FOR SERVICE) --------------- COPIES TO: STEPHEN L. BURNS, ESQ. KIRK A. DAVENPORT, ESQ. CRAVATH, SWAINE & MOORE LATHAM & WATKINS 825 EIGHTH AVENUE 885 THIRD AVENUE NEW YORK, NEW YORK 10019 NEW YORK, NEW YORK 10022 --------------- APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [_] If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

PSB Report Definitions

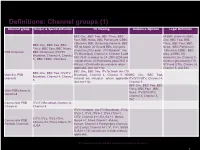

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 Th 2020

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 COMPARATIVE CHARTS 1. National Stations 2. Scottish Stations 3. London Stations 4. Breakfast Shows – National and London stations "Please note that the information contained within this quarterly data release has yet to be announced or otherwise made public and as such could constitute relevant information for the purposes of section 118 of FSMA and non-public price sensitive information for the purposes of the Criminal Justice Act 1993. Failure to comply with this embargo could result in prosecution’’. Source RAJAR / Ipsos MORI / RSMB RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 NATIONAL STATIONS STATIONS SURVEY REACH REACH REACH % CHANGE % CHANGE SHARE SHARE SHARE PERIOD '000 '000 '000 REACH Y/Y REACH Q/Q % % % Q1 19 Q4 19 Q1 20 Q1 20 vs. Q1 19 Q1 20 vs. Q4 19 Q1 19 Q4 19 Q1 20 ALL RADIO Q 48945 48136 48894 -0.1% 1.6% 100.0 100.0 100.0 ALL BBC Q 34436 33584 33535 -2.6% -0.1% 51.4 51.0 49.7 15-44 Q 13295 13048 13180 -0.9% 1.0% 35.2 35.5 34.4 45+ Q 21142 20535 20355 -3.7% -0.9% 60.2 59.4 57.9 ALL BBC NETWORK RADIO Q 31846 31081 30835 -3.2% -0.8% 44.8 45.0 43.4 BBC RADIO 1 Q 9303 8790 8915 -4.2% 1.4% 5.7 5.6 5.6 BBC RADIO 2 Q 15356 14438 14362 -6.5% -0.5% 17.4 17.0 16.3 BBC RADIO 3 Q 2040 2126 1980 -2.9% -6.9% 1.2 1.4 1.3 BBC RADIO 4 (INCLUDING 4 EXTRA) Q 11459 11416 11105 -3.1% -2.7% 13.1 13.4 12.9 BBC RADIO 4 Q 11010 10977 10754 -2.3% -2.0% 11.9 12.0 11.7 BBC RADIO 4 EXTRA Q 2238 2271 1983 -11.4% -12.7% 1.3 1.4 1.2 BBC RADIO 5 LIVE (INC. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

HD Digital Box GFSAT200HD/A Instruction Manual Welcome to Your

HD Digital Box GFSAT200HD/A Instruction Manual Welcome to your new freesat+ HD digital TV recorder Now you can pause, rewind and record both HD and SD television, and so much more Goodmans GFSAT200HD-A_IB_Rev2_120710.indd 1 12/07/2010 14:11:18 Welcome Thank you for choosing this Goodmans freesat HD Digital Box. Not only can it receive over 140 subscription free channels, but if you have a broadband service with a minimum speed of 1Mb you can access IP TV services, which you can watch back at a time to suit you. It’s really simple to use; it’s all done using the clear, easy to understand on screen menus which are operated from the remote control. It even has a reminder function so that you won’t miss your favourite programmes. For a one off payment, you can buy a digital A digital box lets you access digital channels box, satellite dish and installation giving you that are broadcast in the UK. It uses a digital over 140 channels covering the best of TV signal, received through your satellite dish and more. and lets you watch it through your existing television. This product is capable of receiving and This product has a HDMI connector so that decoding Dolby Digital Plus. you can watch high definition TV via a HDMI lead when connected to a HD Ready TV. Manufactured under license from Dolby HDMI, the HDMI logo and High-Definition Laboratories. Dolby and the double-D symbol Multimedia Interface are trademarks or are trademarks of Dolby Laboratories. -

Tv Uk Freesat

Tv uk freesat loading Skip to content Freesat Logo TV Guide Menu. What is Freesat · Channels · Get Freesat · THE APP · WHAT'S ON · Help. Login / Register. My Freesat ID. With over channels - and 13 in high definition - it's not hard to find unbelievably good TV. With Freesat's smart TV Recorders you can watch BBC iPlayer, ITV Hub*, All 4, Demand 5 and YouTube on your TV. Tune into our stellar line-up of digital radio channels and get up to date Get Freesat · What's on · Sport. If you're getting a new TV, choose one with Freesat built in and you can connect directly to your satellite dish with no need for a separate box. You can now even. With a Freesat Smart TV Recorder you can enjoy the UK's favourite Catch Up services: BBC iPlayer, ITV Hub*, All 4 & Demand 5, plus videos on YouTube. Freesat TV Listings. What's on TV now and next. Full grid view can be viewed at Freesat is a free-to-air digital satellite television joint venture between the BBC and ITV plc, . 4oD launched on Freesat's Freetime receivers on 27 June , making Freesat the first UK TV platform to host the HTML5 version of 4oD. Demand Owner: BBC and ITV plc. Freesat, the satellite TV service from the BBC and ITV, offers hundreds of TV and radio channels to watch Lifestyle: Food Network UK, Showcase TV, FilmOn. FREESAT CHANNEL LIST - TV. The UK IPTV receiver now works on both wired internet and WiFi which , BET Black Entertainment TV, Entertainment. -

Select Committee of Tynwald on the Television Licence Fee Report 2010/11

PP108/11 SELECT COMMITTEE OF TYNWALD ON THE TELEVISION LICENCE FEE REPORT 2010/11 REPORT OF THE SELECT COMMITTEE OF TYNWALD ON THE TELEVISION LICENCE FEE At the sitting of Tynwald Court on 18th November 2009 it was resolved - "That Tynwald appoints a Committee of three Members with powers to take written and oral evidence pursuant to sections 3 and 4 of the Tynwald Proceedings Act 1876, as amended, to investigate the feasibility and impact of withdrawal from or amendment of the agreement under which residents of the Isle of Man pay a television licence fee; and to report." The powers, privileges and immunities relating to the work of a committee of Tynwald are those conferred by sections 3 and 4 of the Tynwald Proceedings Act 1876, sections 1 to 4 of the Privileges of Tynwald (Publications) Act 1973 and sections 2 to 4 of the Tynwald Proceedings Act 1984. Mr G D Cregeen MHK (Malew & Santon) (Chairman) Mr D A Callister MLC Hon P A Gawne MHK (Rushen) Copies of this Report may be obtained from the Tynwald Library, Legislative Buildings, Finch Road, Douglas IM7 3PW (Tel 07624 685520, Fax 01624 685522) or may be consulted at www, ,tynwald.orgim All correspondence with regard to this Report should be addressed to the Clerk of Tynwald, Legislative Buildings, Finch Road, Douglas IMI 3PW TABLE OF CONTENTS 1. Introduction 1 2. The broadcasting landscape in the Isle of Man 4 Historical background 4 Legal framework 5 The requirement to pay the licence fee 5 Whether the licence fee is a UK tax 6 Licence fee collection and enforcement 7 Infrastructure for terrestrial broadcasting 10 Television 10 Radio: limitations of analogue transmission capability and extent of DAB coverage 13 3. -

FREEVIEW DTT Multiplexes (UK Inc NI) Incorporating Planned Local TV and Temporary HD Muxes

As at 07 December 2020 FREEVIEW DTT Multiplexes (UK inc NI) incorporating planned Local TV and Temporary HD muxes 3PSB: Available from all transmitters (*primary and relay) 3 COM: From *80 primary transmitters only Temp HD - 25 Transmiters BBC A (PSB1) BBC A (PSB1) continued BBC B (PSB3) HD SDN (COM4) ARQIVA A (COM5) ARQIVA B (COM6) ARQIVA C (COM7) HD ARQIVA D (COM8) HD LCN LCN LCN LCN LCN LCN LCN 1 BBC ONE 65 TBN UK 12 QUEST 11 Sky Arts 22 Ideal World 64 Free Sports BBC RADIO: 1 BBC ONE NI Cambridge, Lincolnshire, 74 Shopping Quarter 13 E4 (Wales only) 17 Really 23 Dave ja vu 70 Quest Red+1 722 Merseyside, Oxford, 1 BBC ONE Scot Solent, Somerset, Surrey, 101 BBC 1 Scot HD 16 QVC 19 Dave 26 Yesterday 83 NOW XMAS Tyne Tees, WM 1 BBC ONE Wales 101 BBC 1 Wales HD 20 Drama 30 4Music 33 Sony Movies 86 More4+1 2 BBC TWO 101 BBC ONE HD 21 5 USA 35 Pick 36 QVC Beauty 88 TogetherTV+1 (00:00-21:00) 2 BBC TWO NI BBC RADIO: 101 BBC ONE NI HD 27 ITVBe 39 Quest Red 37 QVC Style 93 PBS America+1 726 BBC Solent Dorset 2 BBC TWO Wales BBC Stoke 102 BBC 2 Wales HD 28 ITV2 +1 42 Food Network 38 DMAX 96 Forces TV 7 BBC ALBA (Scot only) 102 BBC TWO HD 31 5 STAR 44 Gems TV 40 CBS Justice 106 BBC FOUR HD 9 BBC FOUR 102 BBC TWO NI HD 32 Paramount Network 46 Film4+1 43 HGTV 107 BBC NEWS HD Sony Movies Action 9 BBC SCOTLAND (Scot only) BBC RADIO: 103 ITV HD 41 47 Challenge 67 CBS Drama 111 QVC HD (exc Wales) 734 Essex, Northampton, CLOSED 24 BBC FOUR (Scot only) Sheffield, 103 ITV Wales HD 45 Channel 5+1 48 4Seven 71 Jewellery Maker 112 QVC Beauty HD 201 CBBC -

What Is Bbc Three?

We tested the public value of the proposed changes using a combination of quantitative and qualitative methodologies Quantitative methodology Qualitative methodology We ran a 15 minute online survey with 3,281 respondents to We conducted 20 x 2 hour ‘Extended Group’ sessions via Zoom with understand current associations with BBC Three, the appeal of BBC a mix of different audiences to explore and compare reactions, Three launching as a linear channel, and how this might impact from a personal and societal value perspective, to the concept of existing services in the market. BBC Three becoming a linear channel again. In the survey, we explored the following: In the sessions, we explored the following: - Demographics and brand favourability - Linear TV consumption and BBC attitudes - Current TV and video consumption - (S)VOD consumption behaviours, with a focus on BBC Three - BBC Three awareness, usage and perceptions (current) - A BBC Three content evaluation (via BBC Three on iPlayer exploration) - Likelihood of watching new TV channel and perceptions - Responses to the proposal of BBC Three becoming a TV channel - Impact on services currently used (including time taken away from each) - Expected personal and societal impact of the proposed changes - Societal impact of BBC Three launching as a TV channel - Evaluation of proposed changes against BBC Public Purposes 4 The qualitative stage involved 20 x 2-hour extended digital group discussions across the UK with a carefully designed sample 20 x 2 hour Extended Zoom Groups The qualitative -

BBC Learning – Commissioning Meeting

BBC Learning – Commissioning Meeting May 2012 Welcome and Introduction Saul Nassé – Controller, BBC Learning BBC North • BBC Learning is now located at MediaCityUK, Salford • The move to Salford aims to ensure we better serve and reflect Northern audiences • Other departments based here include: o Sport o Children’s o 5 live o Future Media o BBC Breakfast Welcome and Introduction • Our fourth session to share plans and future thinking • This is the second of two sessions held today: o AM – aimed at education publishers and distributors o PM – commissioning meeting for BBC suppliers • Minutes and recordings of both events will be put online Welcome and Introduction At the last meeting in October 2011 we covered: o Update on Learning activity and content o Information on BBC Learning online activity and plans o Emerging thoughts on the Knowledge and Learning Product o Information on BBC Learning television and Learning Zone plans o Update on finance and public affairs activity Agenda model Timing Agenda Item Speaker 2.30pm Introduction and Welcome Saul Nassé – Controller, BBC Learning Learning and Strategy Update The Knowledge and Learning Product Saul Nassé – Controller, BBC Learning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Online Commissioning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Television Abigail Appleton – Head of Commissioning, BBC Learning BBC Two: The Learning Zone Katy Jones – Executive Producer, BBC Learning Finance and Industry Engagement Alex Lloyd – Head of Operations and Public Affairs, -

Diamond Technical Account and Methodology

Diamond Technical Account and Methodology What is Diamond? Diamond is designed to answer two questions: - Does the workforce on UK productions, both on and off-screen, reflect the diversity of the UK population? - Are audiences seeing themselves reflected on-screen. With the support of production companies, Diamond collects diversity data directly from cast and crew working on TV programmes (actual data), as well as information about how those on-screen might be perceived by viewing audiences (perceived data). Diamond data collection Scope Diamond is collecting data from: UK original productions commissioned by BBC, ITV, Channel 4, C5/ViacomCBS and Sky. All genres (although we do not currently report on film, sport and news) A large number of on and off-screen TV production roles (see Appendix 2) Programmes broadcast across the following channels BBC One, BBC Two, BBC Scotland, CBBC, CBEEBIES, CITV, GMTV1, GMTV2, ITV Encore, ITV1, ITV2, ITV3, ITV4, ITVBe, 4seven, Channel4, E4, Film Four, More 4, 5 Star, Channel5, Challenge TV, Paramount Network, Pick TV, Real Lives, Sky Arts, Sky Atlantic, Sky One, Sky Two, Sky Witness1 Data about 6 diversity characteristics: gender, gender identity, age, ethnicity, disability and sexual orientation. Diamond is not collecting data about: Programmes which have not been commissioned by the five Diamond broadcasters People working across broadcasting more generally, outside of production (our data are not overall workforce statistics). People who are not making a significant contribution to a programme (for example part of a crowd scene) More information about what is and isn’t collected can be found in the guidance notes issued to producers. -

Channel 5, Playground and MASTERPIECE on PBS Announce Cast for All Creatures Great and Small

EMBARGOED UNTIL 7:01PM ET TUESDAY SEPTEMBER 24TH Channel 5, Playground And MASTERPIECE On PBS Announce Cast For All Creatures Great And Small Newcomer Nicholas Ralph to play beloved vet James Herriot opposite Samuel West, Anna Madeley, Callum Woodhouse and Rachel Shenton Channel 5, BAFTA and Golden Globe-winning production company Playground (Howards End, Wolf Hall) and MASTERPIECE on PBS today announced the casting of key roles for their upcoming adaptation of best-selling author James Herriot’s cherished collection of stories, written by Ben Vanstone (The Last Kingdom) and directed by Brian Percival (Downton Abbey). Exciting newcomer Nicholas Ralph will make his television debut as the iconic vet who became renowned for his inspiring compassion, humour and love of life. Samuel West (Mr. Selfridge, On Chesil Beach) joins as Siegfried Farnon, the wonderfully eccentric veteri- nary surgeon and proprietor of Skeldale House who reluctantly hires the recently qualified Herriot into his rural practice. Mrs Hall, the resident housekeeper and matriarch of Skeldale House will be played by Anna Madeley (The Child in Time, Patrick Melrose). Siegfried’s errant and charismatic younger brother, Tristan, will be played by Callum Woodhouse (The Durrells in Corfu). Rachel Shenton (Switched at Birth, White Gold) takes the role of Helen Alderson, an independent local farmer’s daughter who helps her father manage the family farm and care for her younger sister. “This is an exceptional cast made up of a wonderful mix of exciting new and established talent,” says executive producer Colin Callender. “Re-visiting the world of All Creatures Great and Small is like going home and re-discovering old friends whom we haven’t seen in years.