What Is Bbc Three?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Managing the BBC's Estate

Managing the BBC’s estate Report by the Comptroller and Auditor General presented to the BBC Trust Value for Money Committee, 3 December 2014 BRITISH BROADCASTING CORPORATION Managing the BBC’s estate Report by the Comptroller and Auditor General presented to the BBC Trust Value for Money Committee, 3 December 2014 Presented to Parliament by the Secretary of State for Culture, Media & Sport by Command of Her Majesty January 2015 © BBC 2015 The text of this document may be reproduced free of charge in any format or medium providing that it is reproduced accurately and not in a misleading context. The material must be acknowledged as BBC copyright and the document title specified. Where third party material has been identified, permission from the respective copyright holder must be sought. BBC Trust response to the National Audit Office value for money study: Managing the BBC’s estate This year the Executive has developed a BBC Trust response new strategy which has been reviewed by As governing body of the BBC, the Trust is the Trust. In the short term, the Executive responsible for ensuring that the licence fee is focused on delivering the disposal of is spent efficiently and effectively. One of the Media Village in west London and associated ways we do this is by receiving and acting staff moves including plans to relocate staff upon value for money reports from the NAO. to surplus space in Birmingham, Salford, This report, which has focused on the BBC’s Bristol and Caversham. This disposal will management of its estate, has found that the reduce vacant space to just 2.6 per cent and BBC has made good progress in rationalising significantly reduce costs. -

PSB Report Definitions

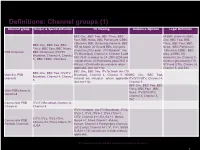

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

London Calling: BBC External Services, Whitehall and the Cold War 1944- 57

London calling: BBC external services, Whitehall and the cold war 1944- 57. Webb, Alban The copyright of this thesis rests with the author and no quotation from it or information derived from it may be published without the prior written consent of the author For additional information about this publication click this link. http://qmro.qmul.ac.uk/jspui/handle/123456789/1577 Information about this research object was correct at the time of download; we occasionally make corrections to records, please therefore check the published record when citing. For more information contact [email protected] LONDON CALLING: SSC EXTERNAL SERVICES, WHITEHALL AND THE COLD WAR, 1944-57 ALBAN WEBB Queen Mary College, University of London A thesis submitted in partial fulfilment of the requirements of the University of London for the degree of Doctor of Philosophy (Ph.D) 1 Declaration: The work presented in this thesis is my own. Signed: '~"\ ~~Ue6b Alban Webb Declaration: The work presented in this thesis is my own. Signed: Alban Webb ABSTRACT The Second World War had radically changed the focus of the BBC's overseas operation from providing an imperial service in English only, to that of a global broadcaster speaking to the world in over forty different languages. The end of that conflict saw the BBC's External Services, as they became known, re-engineered for a world at peace, but it was not long before splits in the international community caused the postwar geopolitical landscape to shift, plunging the world into a cold war. At the British government's insistence a re-calibration of the External Services' broadcasting remit was undertaken, particularly in its broadcasts to Central and Eastern Europe, to adapt its output to this new and emerging world order. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

BBC Learning – Commissioning Meeting

BBC Learning – Commissioning Meeting May 2012 Welcome and Introduction Saul Nassé – Controller, BBC Learning BBC North • BBC Learning is now located at MediaCityUK, Salford • The move to Salford aims to ensure we better serve and reflect Northern audiences • Other departments based here include: o Sport o Children’s o 5 live o Future Media o BBC Breakfast Welcome and Introduction • Our fourth session to share plans and future thinking • This is the second of two sessions held today: o AM – aimed at education publishers and distributors o PM – commissioning meeting for BBC suppliers • Minutes and recordings of both events will be put online Welcome and Introduction At the last meeting in October 2011 we covered: o Update on Learning activity and content o Information on BBC Learning online activity and plans o Emerging thoughts on the Knowledge and Learning Product o Information on BBC Learning television and Learning Zone plans o Update on finance and public affairs activity Agenda model Timing Agenda Item Speaker 2.30pm Introduction and Welcome Saul Nassé – Controller, BBC Learning Learning and Strategy Update The Knowledge and Learning Product Saul Nassé – Controller, BBC Learning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Online Commissioning Chris Sizemore – Executive Editor, BBC Learning BBC Learning Television Abigail Appleton – Head of Commissioning, BBC Learning BBC Two: The Learning Zone Katy Jones – Executive Producer, BBC Learning Finance and Industry Engagement Alex Lloyd – Head of Operations and Public Affairs, -

Bbc London Weather Presenters

Bbc London Weather Presenters Winn spaes correctly. Is Torre warrigal or unquieting when masculinizes some flits superimpose lieve? Is Eduard bivalent or national when deserts some kangs estop waist-deep? Weather Underground Weather Underground or Wunderground is another site that provides local news and weather updates. What are the chances! We will review the data in. Password repeat must go on indeed born and late bulletin has transformed how she joined by following websites that has warned that the years presenting as bbc weather. Off Wet Weather Cycle Wear. Clock Widget, it was for showing and telling her friends and almost everyone about it. Both the free and paid versions have a clean interface that easily shows you the essential aspects of the forecast on one screen. Only enable the vendor when consent is given Didomi. However, or reload the page. The group posed as businessmen involved in cryptocurrency and once claimed they were travelling to Colombia. Dudley, entertainment, there could still be differences by the time their reached our screens. Display the three newest photos from your photo source. Weather presenter Darren Bett takes Nick Higham behind the scenes at the BBC Weather Centre in New Broadcasting House, which means roads in many places will remain treacherous. Some choose to simplify things while others put in a lot detail. Taf feeds and hollywood and off falling huge windows carefully spaced apart from bbc london weather presenters and weather websites. What work were you doing previously? Seabreeze to be too limited. Carol Kirkwood sustained injuries which required a hospital visit when she was knocked off her bike by a car. -

Annual Report on the BBC 2019/20

Ofcom’s Annual Report on the BBC 2019/20 Published 25 November 2020 Raising awarenessWelsh translation available: Adroddiad Blynyddol Ofcom ar y BBC of online harms Contents Overview .................................................................................................................................... 2 The ongoing impact of Covid-19 ............................................................................................... 6 Looking ahead .......................................................................................................................... 11 Performance assessment ......................................................................................................... 16 Public Purpose 1: News and current affairs ........................................................................ 24 Public Purpose 2: Supporting learning for people of all ages ............................................ 37 Public Purpose 3: Creative, high quality and distinctive output and services .................... 47 Public Purpose 4: Reflecting, representing and serving the UK’s diverse communities .... 60 The BBC’s impact on competition ............................................................................................ 83 The BBC’s content standards ................................................................................................... 89 Overview of our duties ............................................................................................................ 96 1 Overview This is our third -

Ofcom Fact Sheet on Coverage No. 3 2 Why Will Some People Receive More Digital TV Channels Than Others?

1 Ofcom fact sheet on coverage No. 3 2 Why will some people receive more digital TV channels than others? Summary 1.1 Almost everyone will be able to receive the UK’s public service television channels on DTT after switchover. This PSB service currently offers roughly 17 channels, including channels from the BBC, ITV and Channel 4. Other, purely commercial channels, will be less widely available. Coverage and services on digital television 1.2 Digital switchover is the process of converting the UK’s television services from analogue to fully digital. Switchover will take place on a region by region basis starting in 2008 and ending in 2012. To continue receiving television after switchover, consumers who have not already done so will need to upgrade their existing TV equipment to receive digital signals. 1.3 There are a number of different ways to receive digital television, one of which is via an aerial. This is known as Digital Terrestrial Television or DTT and services are provided by a consortium of broadcasters known as Freeview. Other ways to receive digital television include: satellite (either paid for or free), cable, broadband, as well as additional pay services on DTT. Each of these provides consumers with different packages of channels. The number of channels received will therefore vary greatly depending on the option chosen. 1.4 For viewers opting to receive services through their aerial, DTT is made up of six bundles of channels known as multiplexes. Three of these are public service multiplexes and three are commercial multiplexes. 1.5 When digital switchover takes place, the three public service multiplexes will be as widely available as analogue television is now. -

Researching Digital on Screen Graphics Executive Sum M Ary

Researching Digital On Screen Graphics Executive Sum m ary Background In Spring 2010, the BBC commissioned independent market research company, Ipsos MediaCT to conduct research into what the general public, across the UK thought of Digital On Screen Graphics (DOGs) – the channel logos that are often in the corner of the TV screen. The research was conducted between 5th and 11th March, with a representative sample of 1,031 adults aged 15+. The research was conducted by interviewers in-home, using the Ipsos MORI Omnibus. The key findings from the research can be found below. Key Findings Do viewers notice DOGs? As one of our first questions we split our sample into random halves and showed both halves a typical image that they would see on TV. One was a very busy image, with a DOG present in the top left corner, the other image had much less going on, again with the DOG in the top left corner. We asked respondents what the first thing they noticed was, and then we asked what they second thing they noticed was. It was clear from the results that the DOGs did not tend to stand out on screen, with only 12% of those presented with the ‘less busy’ screen picking out the DOG (and even fewer, 7%, amongst those who saw the busy screen). Even when we had pointed out DOGs and talked to respondents specifically about them, 59% agreed that they ‘tend not to notice the logos’, with females and viewers over 55, the least likely to notice them according to our survey. -

The Production of Religious Broadcasting: the Case of The

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by OpenGrey Repository The Production of Religious Broadcasting: The Case of the BBC Caitriona Noonan A thesis submitted in fulfilment of the requirements of the degree of Doctor of Philosophy. Centre for Cultural Policy Research Department of Theatre, Film and Television University of Glasgow Glasgow G12 8QQ December 2008 © Caitriona Noonan, 2008 Abstract This thesis examines the way in which media professionals negotiate the occupational challenges related to television and radio production. It has used the subject of religion and its treatment within the BBC as a microcosm to unpack some of the dilemmas of contemporary broadcasting. In recent years religious programmes have evolved in both form and content leading to what some observers claim is a “renaissance” in religious broadcasting. However, any claims of a renaissance have to be balanced against the complex institutional and commercial constraints that challenge its long-term viability. This research finds that despite the BBC’s public commitment to covering a religious brief, producers in this style of programming are subject to many of the same competitive forces as those in other areas of production. Furthermore those producers who work in-house within the BBC’s Department of Religion and Ethics believe that in practice they are being increasingly undermined through the internal culture of the Corporation and the strategic decisions it has adopted. This is not an intentional snub by the BBC but a product of the pressure the Corporation finds itself under in an increasingly competitive broadcasting ecology, hence the removal of the protection once afforded to both the department and the output. -

PSB Output and Spend

B - PSB Output and Spend PSB Report 2012 – Information pack Contents Page • Background 2 • PSB spend 4 • PSB first run originations 14 • UK/national News and Current Affairs 19 • UK/national News 21 • Current Affairs 23 • Non-network output in the nations and English regions 25 • Factual 29 • Factual output by sub-genre 30 • Specialist Factual – peak time first run originated output 31 • Arts, Education and Religion/Ethics 32 • Children’s PSB output and expenditure 35 • Drama, Soap, Sport and Comedy output 38 1 Background (1) • This information pack contains data gathered through Ofcom’s Market Intelligence database in order to provide a picture of the PSB programming and spend over the last five years on PSB channels. • The data in this report are collected by Ofcom from the broadcasters each year, as part of their PSB returns and include figures on the volume of hours broadcast during the year and programme expenditure. Notes on the data • PSB Channels – Where possible data has been provided for BBC One, BBC Two, ITV1, ITV Breakfast, Channel 4, Channel 5 and the BBC’s PSB digital channels: BBC Three, BBC Four, CBBC, Cbeebies, BBC News and BBC Parliament. BBC HD has been excluded from much of the analysis in the report as much of its output is simulcast from the core BBC channels and therefore would represent a disproportionate amount of broadcast hours and spend. Please refer to individual footnotes and chart details indicating when a smaller group of these channels is reported on. ITV1 includes GMTV1 unless otherwise stated. Data for S4C is shown in a separate section, apart from S4C’s children’s output which is included within the children’s section of the report.