Transaction Trail Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate M&A

GLOBAL PRACTICE GUIDE Definitive global law guides offering comparative analysis from top-ranked lawyers Corporate M&A Singapore: Trends & Developments Wee Hann Lim, Lawrence Tan, Sandy Foo and Favian Tan Rajah & Tann Singapore LLP chambers.com 2020 TRENDS AND DEVELOPMENTS SINGAPORE Trends and Developments Contributed by: Wee Hann Lim, Lawrence Tan, Sandy Foo and Favian Tan Rajah & Tann Singapore LLP see p.7 Overview of M&A Activity in Singapore and the Region Singapore’s sovereign wealth fund, Temasek Holdings, bought As South East Asia’s major financial hub, Singapore’s M&A stakes in fashion supply chain platform Zilingo. activity is typically measured by both domestic and regional activity in South East Asia (SEA). Singapore’s start-up eco-system is now flourishing with over 220 venture capital deals per year worth close to USD4.2 billion, M&A activity in SEA increased by almost one-third in value in and more than 150 global venture capital funds, incubators, and 2019 as compared to 2018, reaching its second highest annual accelerators based in Singapore, as stated in the 2019 Budget level since 2001. In Singapore, M&A activity in 2019 totalled Speech by Singapore’s Finance Minister. approximately USD35.3 billion (with a total deal count of 134), up approximately 125.6% from a year ago, according to Private equity and venture capital funding fuelling M&A activ- a Mergermarket report. ity in the SEA region is expected to continue and grow. The start of 2020 sees an unprecedented challenge in the form of Significant M&A transactions the COVID-19 outbreak. -

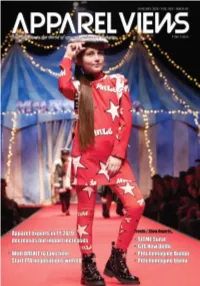

Apparel Views / January 2020 1

APPAREL VIEWS / JANUARY 2020 1 JANUARY 2020, VOL.- XIX / ISSUE No. 01 Editor & Publisher ARVIND KUMAR from the editor... Associate Editor B.P. MISHRA Asst. Editor The Indian Government has withdrawn Merchandise Exports from India SWATI SHARMA Editorial Adviser Scheme (MEIS) retrospectively from March 7, 2019 for HSN code chapters 61, RAJESH CHHABARA 62 and 63. Claims already paid to the exporters under MEIS will be suitably Sub Editor - Creative JOHN EDWARDS adjusted against Rebate of State and Central Taxes and Levies (RoSCTL) and Art Director recoveries will be made wherever due. SANJAY BHANDARI Sr. Correspondent As per the recommendations of the Expenditure Finance Committee, a special ASHWANI KUMAR one-time additional ad-hoc incentive of upto 1 percent of FoB value will be Correspondent DEEPTI provided for exports of apparel and made-ups to offset the difference between ANISH KUMAR RoSCTL and RoSL + MEIS at the rate of 4 percent, from March 7, 2019 to Creative - Head SREEKUMAR. M December 31, 2019. Sr. Layout Artist JATIN JAIN The Expenditure Finance Committee has recommended that the additional Sr. Designer RAJEEV KUMAR incentive under the scheme would be as per claims from the exporters Production Manager and the total adhoc incentive would not exceed `600 cr for the period MUKESH POKHRIYAL mentioned above. e-Magazine SUMER SINGH The Department of Commerce will take steps for the validation of claims by Business Promotion ANITA RAI (DELHI) the Directorate General of Foreign Trade (DGFT) and Department of Revenue N. SABARI SELVAM (TIRUPUR) PAVITHRA R. (TIRUPUR) (DoR) for correct disbursal of benefits. The ad-hoc incentive would be Circulation implemented in the form of scrips for which an outlay would need to be POOJA (DELHI) RAJESWARI (TIRUPUR) provided by DoR. -

PROGRAM Wednesday, September 18

SEPT 18-20, 2019 PROGRAM Wednesday, September 18 September Wednesday, Food Leaders Retreat in Asia Building a Healthier, More Sustainable Food System 8:30 AM – 1:30 PM Crescent Seasons Four The Food Leaders Retreat in Asia brings together food industry leaders, investors, ag-tech and food entrepreneurs, government leaders, and international organizations to discuss global trends in food and agriculture. Participants will explore the solutions and collaborations needed to boost efficiency, address systematic risks in the market, promote healthier diets, and reduce environmental degradation. By understanding these issues, leaders will be able to better collaborate and connect the gaps between scalable innovation, meaningful investments, profitable financing, sustainability, and personal health. Featured speakers include: Natalie Black, Her Majesty’s Trade Commissioner for Asia Pacific, covering North-East Asia, South-East Asia and Australasia, United Kingdom Heston Blumenthal OBE, Founder, The Fat Duck Bradley Busetto, Director, Global Centre for Technology, Innovation, and Sustainable Development, UNDP Christian Cadeo, Managing Partner Asia, Big Idea Ventures Peter Ford, President, Asia Pacific, Corteva Agriscience Pascal de Petrini, Chairman Asia, Danone Grahame Dixie, Executive Director, Grow Asia Hans Kabat, Group Leader, Cargill Protein Asia and Europe Simon Lowden, President, Global Foods, PepsiCo Kara Owen, British High Commissioner to Singapore Bev Postma, Consultant, GreenOcean Group Sandhya Sriram, Co-Founder and CEO, Shiok Meats John Vaske, Head of Agri-Business, Temasek Ryan Shadrick Wilson, Senior Advisor, Center for Public Health, Milken Institute David Yeung, Founder and CEO, Green Monday Asia’s Leading Women Roundtable 11:00 AM – 12:00 PM Windows West Windows Seasons Four This roundtable gathers Asia’s top women leaders for a candid discussion on the forces shaping the Asia-Pacific region. -

Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 2) | HKTDC

10 Dec 2018 Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 2) The watches and clocks markets in key ASEAN cities consist of various distribution channels, including watch specialist retailers, department stores, travel retailer/duty-free operators and private sales. Aside from brick-and- mortar retailers, e-commerce channels, including brands’ own websites, third- party marketplaces and social media, have quickly become a new force in the watch industry. For details of other distribution channels, please refer to “Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 1)”. Travel Retailers/Duty Free Operators The travel retail or duty-free (DF) channel offers a unique retail environment in several ways: 1) Travellers at airports are captive audience; 2) Travellers regard shopping to pamper themselves on holiday; 3) Last chance for travellers to shop for gifts, and 4) Shoppers’ satisfaction from purchasing duty-free. Essentially, travel retail has often considered to be less affected by the macroeconomic situation and market competition in the downtown areas. According to Dufry, the leading duty-free operator, global travel retailing is expected to grow to about US$67 billion by 2020, from an estimated US$45.7 billion in 2016. In the ASEAN region, the growth is expected to be more robust with the advent of increasing inbound and outbound tourists in major ASEAN airports. DF shops can be found in airports, downtown as well as onboard airliners and ferries. Airports shops contribute most to the DF market. For many travellers, shopping for duty- free products, from perfume and whisky to designer bags and watches, is a part of their trips overseas. -

Regional Programme Promoting Women's Economic Empowerment

Ref. Ares(2020)5908919Ares(2020)6824509 - 26/10/202017/11/2020 Funded by the European Union Regional Programme Promoting Women’s Economic Empowerment in Asia: WeEmpowerAsia Communications and Visibility Report March 2019 – March 2020 Funded by the European Union Summary The present report aims at presenting a snapshot of the key communication and visibility highlights of the European Union-UN Women Regional Programme WeEmpowerAsia from March 2019 to March 2020. As per the Communication and Visibility Strategy, during its first year of implementation, the WeEmpowerAsia programme developed a number of communication materials including its website and the first issue of its bulletin, as well as other assets such as slide decks, notebooks, stickers, banners, postcards and folders. In this period, the programme started to compile a regional database of partners to disseminate information, messages and advocacy materials totaling at 415 individuals from the private sector, governments, academia, NGOs and civil society. The programme was launched through different advocacy activities. The regional team organized a launch ceremony at the United Nations in Bangkok to introduce the programme to sister agencies and other partners. Programme-implementing countries also conducted events to officially start their work at the national level. China, for example, hosted a national launch of the programme within the framework of a larger event hosted in partnership with the EU and the Swedish Embassy. Similarly, the launch in India, which was co-led by the EU Ambassador, garnered impressive turnout by top business leaders, and culminated with the country’s largest annual Gender Equality Summit a day later. Funded by the European Union In its first year, the programme has worked extensively to establish partnerships with key stakeholders. -

ZILINGO Customer Terms and Conditions This Application

ZILINGO Customer Terms and Conditions This application software and any logos, designs, artwork, labels, symbols or any other product details not limited to those mentioned above are the sole property of Zilingo Pte. Ltd. (“ZILINGO”),a company incorporated in Singapore. The use of the ZILINGO Application is being made available through Zilingo, (Thailand) Ltd., an affiliate of Zilingo, having its registered office at No. 399 Interchange Building, 24th Floor, Room 10, Sukhumvit 21 Road, Khlong Toei Nua Sub District, Wattana District, Bangkok 10110. (1) Definitions and Interpretation: Capitalised terms or phrases as used in the Customer Terms and Conditions (“Terms and Conditions”),if not defined in this section, shall have the meaning assigned to them in the sentence immediately preceding the bold alphabets enclosed within quotes (““),such as in the para above. Additionally, in these Terms and Conditions, the following definitions apply: Definitions: “Account”refers to the user account that will be needed to create/register on Zilingo’smobile application to purchase products through the Zilingo platform. “Business Day”refers to working days in Thailand and shall relate to days on which banks in Thailand are operational and/or open for business. “Conditions”refer to the the terms of reference or use of Zilingo Products in accordance with these Terms and Conditions. “Contract”refers to the act of placing an order for a product(s) by you on Zilingo’splatform in line with its Terms and Conditions followed by Zilingo’sacceptance of the order in accordance with the process outlined in Clause 11 below. “Customer”refers to you, i.e. -

Jumpstart Media Based in Hong Kong, Jumpstart

www.jumpstartmag.com The Entrepreneur’s Magazine Issue 29 April 2020 Anatomy of an Almost− Unicorn Charting Zilingo’s Zilingo Co-Founders meteoric growth Ankiti Bose & Dhruv Kapoor from pre-seed to global titan p. 50 Why mobile gaming is about to win big Rental, resale, and the fashion industry New challengers in the search engine space Transforming urban life through farming Teletherapy to expand access to mental health treatment EDITOR’S LETTER think it’s safe to say that 2020 is not turning out the way that any of us expected. The last time I wrote to Iyou, I was brimming with enthusiasm about globaliza- tion and its potential to bring the world closer together in the next decade. How innocent those words seem today. As we impatiently watch the consequences of the COVID-19 pandemic unfold, businesses around the world are adapting and recalibrating. The optimist in me A NOTE FROM OUR CEO believes that, through each Zoom call and face mask-to- Relena Sei face mask meeting, positive changes will happen. For now, all we can do is press on and wait for better days from the am honored to be a part of the Jumpstart family. It’s only safety of our homes. been two months since I joined, but I can feel the passion For us, business-as-usual means sending another Iin our office as we prepare to launch Jumpstart Media to issue your way. This ‘Back to Basics’ issue is a bit differ- new heights. ent. We’re covering innovation from another perspective: I am proud of our magazine, which our team has worked disruption through execution. -

Sustainability Wins As Investors in Southeast Asia Shift Focus

Sustainability Wins as Investors in Southeast Asia Shift Focus More than 50% of private equity deals now back business models that contribute to environmental and social progress. By Suvir Varma and Alex Boulton Suvir Varma is a senior advisor, and Alex Boulton is a principal, with Bain & Company’s Global Private Equity practice. They are based in Singapore. Copyright © 2019 Bain & Company, Inc. All rights reserved. Sustainability Wins as Investors in Southeast Asia Shift Focus At a Glance Sustainability investments rose 60% to $3.2 billion in the first half of 2019 over the same period a year earlier. Total private equity deal value in 2018 topped $10 billion for the second year in a row, rising sharply in Vietnam and Indonesia. Four young companies in the region have surpassed $1 billion in value since January 2018, bringing the total number of unicorns to 14. Despite warnings of a looming recession, a two-year surge of investment in Southeast Asia shows no sign of slowing. Venture capital firms in the region raised more than US$500 million in the first half of 2019, and private equity investors remain on a path to double the cumulative investment since 2017 compared with the previous five years. Southeast Asia’s fast-growing start-ups are a powerful draw for investors. In the past year, the region gave rise to four additional unicorns—new companies that rapidly achieve market valuations of $1 billion or more—bringing the total in the region to 14 (see Figure 1). Coming up fast behind them, the top five start-ups ranked by cumulative funds have garnered more than $1 billion in financing. -

A Glimpse Into Southeast Asia's Golden

2020 REPORT All that glitters: A glimpse into Southeast Asia’s golden age Tech in Asia Conference 2020 Report All that glitters: A glimpse into Southeast Asia’s golden age 2 Contents 03 Contents 04 Introduction 06 Methodology 07 Powering the next decade 11 Logistics and transportation 15 Ecommerce 19 Fintech 23 Others 29 Challenges 31 Covid-19 and changes in user behavior 35 Funding 39 Human capital 42 Conclusion 44 Endnotes Tech in Asia Conference 2020 Report All that glitters: A glimpse into Southeast Asia’s golden age 3 Introduction Southeast Asia is about to enter its golden age. While the decade is off to a bumpy start Southeast Asia is also ripe for because of the Covid-19 pandemic, the disruption. Countries like Indonesia region is on the brink of a new era1, one and Vietnam are emerging markets, that holds promise of economic growth which means new businesses can and technological innovation. develop solutions to existing problems. It has seen the rise of 11 unicorns2 Consumers in the region are mobile- in the last decade, and more are first7, if not mobile-only. This opens expected to emerge3 in the coming new avenues for the growth of a digital years. At least US$7.7 billion4 was economy8. invested into Southeast Asian startups in 2019 alone, highlighting the fact With numerous tech unicorns in that investors are taking note of how its stables, Southeast Asia has the promising the region is. opportunity to outpace the rest of the world in areas like digital payments and It has a population of over 655 million smartphone-based businesses. -

IBTEX No. 11 of 2020 January 15, 2020

IBTEX No. 11 of 2020 January 15, 2020 US 70.88| EUR 78.93 | GBP 92.37| JPY 0.65 Cotton Market Spot Price - Shankar 6 ( Ex. Gin), 28.50-29 mm Rs./Bale Rs./Candy USD Cent/lb 19378 40500 72.78 Domestic Futures Price (Ex. Warehouse Rajkot), January Rs./Bale Rs./Candy USD Cent/lb 19930 41654 74.86 International Futures Price NY ICE USD Cents/lb (March 2020) 71.38 ZCE Cotton: Yuan/MT ( May 2020) 14,240 ZCE Cotton: USD Cents/lb 93.82 Cotlook A Index – Physical 82.20 Cotton Guide- The volumes were again in the 30K range at 37,641 contracts. On the other hand, the TOI – Total Open Interest is on a continuous movement towards north and the last figure seen was at 247,730 contracts which is an increase of 2,693 as compared to the previous figure. This TOI is considered to be the highest since November. While breaking things up, the March 2020 OI decreased by 541 contracts to 126,507, the May 2020 OI increased by 1,132 to 53,834 contracts and the July 2020 OI increased from 1,278 contracts to 33,274 contracts. The MCX contract on the other hand, remained volatile yesterday. The future prices settled downward, at 19,930 Rs per Bale at -40 Rs for the MCX Jan contract. The February contract DISCLAIMER: The information in this message be privileged. If you have received it by mistake please notify "the sender" by return e-mail and delete the message from "your system". -

2019 Show Report

Please contact Mr. Jason Chow (Email: [email protected]) Tel: +852 25117427, Wechat: muaythaijason for details of upcoming expos. Vietnam Hanoi Textile & Garment Industry Expo - HanoiTex 2019 Vietnam Hanoi Fabric & Garment Accessories Expo - HanoiFabric 2019 越南河内纺织及制衣工业展览会 2019 越南河内布料及制衣配件展览会 2019 展会报告 SHOW REPORT Highlights of the expos 展会亮点 - Biggest textile and garment industry events in Hanoi, Vietnam since 1990s - Attracted 195 exhibitors from 14 countries / regions, increased 59%, and over 7,000 qualified visitors - 自 90 年代于河内举行的最大规模纺织, 制衣及布料展览会 - 吸引了来自 14 个国家/地区的 195 家参展商 (展商数量比上届增加 59%) ,及超过 7,000 名优 质买家 (比上届增加 25%) Next Event 下届展会 HanoiTex / Hanoi Fabric 2020 3 - 5 Setpember, 2020, ICE, Hanoi, Vietnam Please contact Mr. Jason Chow (Email: [email protected]) Tel: +852 25117427, Wechat: muaythaijason for details of upcoming expos. Show Facts 展会概览 Date 日期 : 23 - 25 October, 2019 Venue 地点 : International Center for Exhibition (Culture Palace) 91 Tran Hung Dao, Street, Hanoi, Vietnam No. of Exhibitors: 195 companies from 14 countries and regions including China, Germany, Hong Kong, Italy, Korea, Singapore, Taiwan, Thailand, Turkey, UK, U.S.A, Vietnam 展商数量: 195 家展商来自 14 国家及地区,包括中国、德国、香港、意大利、韩国、新加坡、 台湾、泰国、土耳其、英国、美国及越南 Size of Expo 展会面积 : 4,800 sqm No. of Visitors 专业观众 : Total over 7,000 trade visitors Special Event 特别活动 : Opening Ceremony 开幕礼 VIP Tour 贵宾参观 Seminars 研讨会 Press Conference 记者招待会 Download link 资料下载 2019 List of exhibitors <http://vhanoitex.com/wp-content/uploads/2019/10/Hanoitex-231019-List.pdf > 2019 Floor plan < http://vfabric.com/wp-content/uploads/2019/10/Hanoitex-161019-Plan.pdf > Please contact Mr. Jason Chow (Email: [email protected]) Tel: +852 25117427, Wechat: muaythaijason for details of upcoming expos. -

Marvel X Zilingo 2019 T-Shirt Design Competition

MARVEL X ZILINGO 2019 T-SHIRT DESIGN COMPETITION FREQUENTLY ASKED QUESTIONS WHO CAN PARTICIPATE? How old do I have to be to enter the compeition? Entrants must be over the age of 21 on the date of entry. I don’t live in one of the listed countries. Can I still submit a design? The Contest is only open to all residents of Singapore, Malaysia, Indonesia, Thailand and the Philippines. If you have residency in another country, unfortunately you cannot participate. I work for Zilingo or Disney, can I participate? No, unfortunately not. What are the rules and regulations of this contest? To view the full terms and conditions please click here What stage of the contest is happening right now? Please see the full schedule below: PHASE EVENT DATE 1 SUBMISSION July 25th - Registration and design submission August 5th 2019 2 SHORTLISTING August 6th - Top designs shortlisted by an expert panel August 23rd 2019 3 VOTING August 23rd - Fans vote for their favourite design August 29th 2019 4 WINNERS August 31st 2019 Top 8 designs announced 5 SHOP October 2019 Buy the winning T-shirts only on Zilingo PHASE 1: SUBMITTING A DESIGN What color t-shirt will the winning design be printed on? A white t-shirt What format should I submit my design? Please upload it as a JPEG or PDF file. Max size: 10MB How do I submit my design? Step 1: Please register using this link: http://bit.ly/2Y7BZsR Step 2: You will then receive a confirmation email with a separate link to submit your design Please note: registration and design submission must be completed between July 25th (12.01am SGT) and August 5th (11.59pm SGT) 2019 I registered on the site but I didn’t get a confirmation email.