Corporate M&A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case Study Tialoc Composite Vessels at Elevated Temperatures and Pressures

Case Study Tialoc Composite Vessels at Elevated Temperatures and Pressures Page 1 of 8 www.tialocgroup.com Case Study Tialoc Composite Vessels at Elevated Temperatures and Pressures Focusing on Five Recent Examples Background: Our manufacturing division, named – tialoc Composite – has its major locations in The tialoc Group was founded in 2000 in Shanghai (China) and Penang (Malaysia), Germany and 2001 in Singapore, with the as well as minor locations in Germany, focus on supplying high quality engineered Thailand, Vietnam and Kuantan (Malaysia). environmental solutions, at competitive prices, for the European, Chinese and SE The Composite division specializes in the Asian markets. materials selection, engineering calculation, design and ultimately manufacture of world From conception, the team achieved rapid class produced plastic, FRP and dual success and grew from a simple idea; to the laminate products, most commonly pipes, multi-million dollar company it is today, storage tanks and reaction vessels at spanning five continents with over 450 staff elevated pressures. in four unique divisions. tialoc now boasts strengths in process and design All our products are manufactured to strict engineering, as well as EPC supply and in- International engineering codes, with 25 house manufacturing. year design life, so you can be assured the quality is first class and your products will Originally tialoc specialized in the chemical still be in use after many years of operation. industry, but now also has a strong presence in pharmaceutical, semiconductor, In recent times we have earned the enviable automotive, general industry, oil & gas, reputation as being the premier supplier of petrochemical and mineral processing vessels in aggressive, high temperature and sectors. -

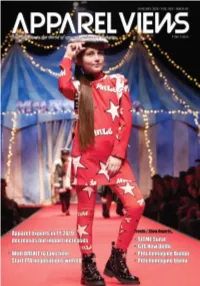

Apparel Views / January 2020 1

APPAREL VIEWS / JANUARY 2020 1 JANUARY 2020, VOL.- XIX / ISSUE No. 01 Editor & Publisher ARVIND KUMAR from the editor... Associate Editor B.P. MISHRA Asst. Editor The Indian Government has withdrawn Merchandise Exports from India SWATI SHARMA Editorial Adviser Scheme (MEIS) retrospectively from March 7, 2019 for HSN code chapters 61, RAJESH CHHABARA 62 and 63. Claims already paid to the exporters under MEIS will be suitably Sub Editor - Creative JOHN EDWARDS adjusted against Rebate of State and Central Taxes and Levies (RoSCTL) and Art Director recoveries will be made wherever due. SANJAY BHANDARI Sr. Correspondent As per the recommendations of the Expenditure Finance Committee, a special ASHWANI KUMAR one-time additional ad-hoc incentive of upto 1 percent of FoB value will be Correspondent DEEPTI provided for exports of apparel and made-ups to offset the difference between ANISH KUMAR RoSCTL and RoSL + MEIS at the rate of 4 percent, from March 7, 2019 to Creative - Head SREEKUMAR. M December 31, 2019. Sr. Layout Artist JATIN JAIN The Expenditure Finance Committee has recommended that the additional Sr. Designer RAJEEV KUMAR incentive under the scheme would be as per claims from the exporters Production Manager and the total adhoc incentive would not exceed `600 cr for the period MUKESH POKHRIYAL mentioned above. e-Magazine SUMER SINGH The Department of Commerce will take steps for the validation of claims by Business Promotion ANITA RAI (DELHI) the Directorate General of Foreign Trade (DGFT) and Department of Revenue N. SABARI SELVAM (TIRUPUR) PAVITHRA R. (TIRUPUR) (DoR) for correct disbursal of benefits. The ad-hoc incentive would be Circulation implemented in the form of scrips for which an outlay would need to be POOJA (DELHI) RAJESWARI (TIRUPUR) provided by DoR. -

Globalization and Asian Pentecostalism in Thetwenty-First Century

Pneuma 42 (2020) 500–520 brill.com/pneu Globalization and Asian Pentecostalism in the Twenty-First Century Connie Au Chinese Christian Literature Council, Hong Kong, Hong Kong Abstract This article aims to explore the development of Pentecostalism in Asia under the tide of globalization since the beginning of the twenty-first century. It will do so in three sections. First, it investigates megachurches and the prosperity gospel in Asian coun- tries and regions that enjoy a greater extent of liberty and where neo-capitalism has emerged. Second, the article discusses the situation of Pentecostalism in countries ruled by totalitarian regimes. Pentecostalism cannot grow freely there, but it is rela- tively safe for Pentecostals to provide humanitarian relief and social services. Third, the article illustrates how migration as a major phenomenon of globalization has influ- enced pentecostal mission. It focuses on African Pentecostals who engage in trades in China and the Filipino/a Charismatics who are migrant workers. In the conclusion, the article discusses how the coronavirus pandemic has been reshaping globalization and Pentecostalism and offers a possible way to see the future. Keywords globalization – neo-capitalism – megachurches – prosperity gospel – migration – mission – coronavirus © koninklijke brill nv, leiden, 2020 | doi:10.1163/15700747-bjaDownloaded10022 from Brill.com09/27/2021 09:27:56AM via free access globalization and asian pentecostalism 501 1 Globalization, Asia, and Pentecostalism1 Globalization has shaped the values, -

PROGRAM Wednesday, September 18

SEPT 18-20, 2019 PROGRAM Wednesday, September 18 September Wednesday, Food Leaders Retreat in Asia Building a Healthier, More Sustainable Food System 8:30 AM – 1:30 PM Crescent Seasons Four The Food Leaders Retreat in Asia brings together food industry leaders, investors, ag-tech and food entrepreneurs, government leaders, and international organizations to discuss global trends in food and agriculture. Participants will explore the solutions and collaborations needed to boost efficiency, address systematic risks in the market, promote healthier diets, and reduce environmental degradation. By understanding these issues, leaders will be able to better collaborate and connect the gaps between scalable innovation, meaningful investments, profitable financing, sustainability, and personal health. Featured speakers include: Natalie Black, Her Majesty’s Trade Commissioner for Asia Pacific, covering North-East Asia, South-East Asia and Australasia, United Kingdom Heston Blumenthal OBE, Founder, The Fat Duck Bradley Busetto, Director, Global Centre for Technology, Innovation, and Sustainable Development, UNDP Christian Cadeo, Managing Partner Asia, Big Idea Ventures Peter Ford, President, Asia Pacific, Corteva Agriscience Pascal de Petrini, Chairman Asia, Danone Grahame Dixie, Executive Director, Grow Asia Hans Kabat, Group Leader, Cargill Protein Asia and Europe Simon Lowden, President, Global Foods, PepsiCo Kara Owen, British High Commissioner to Singapore Bev Postma, Consultant, GreenOcean Group Sandhya Sriram, Co-Founder and CEO, Shiok Meats John Vaske, Head of Agri-Business, Temasek Ryan Shadrick Wilson, Senior Advisor, Center for Public Health, Milken Institute David Yeung, Founder and CEO, Green Monday Asia’s Leading Women Roundtable 11:00 AM – 12:00 PM Windows West Windows Seasons Four This roundtable gathers Asia’s top women leaders for a candid discussion on the forces shaping the Asia-Pacific region. -

Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 2) | HKTDC

10 Dec 2018 Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 2) The watches and clocks markets in key ASEAN cities consist of various distribution channels, including watch specialist retailers, department stores, travel retailer/duty-free operators and private sales. Aside from brick-and- mortar retailers, e-commerce channels, including brands’ own websites, third- party marketplaces and social media, have quickly become a new force in the watch industry. For details of other distribution channels, please refer to “Accessing the ASEAN Consumer Market: Watches and Clocks (Distribution Channels 1)”. Travel Retailers/Duty Free Operators The travel retail or duty-free (DF) channel offers a unique retail environment in several ways: 1) Travellers at airports are captive audience; 2) Travellers regard shopping to pamper themselves on holiday; 3) Last chance for travellers to shop for gifts, and 4) Shoppers’ satisfaction from purchasing duty-free. Essentially, travel retail has often considered to be less affected by the macroeconomic situation and market competition in the downtown areas. According to Dufry, the leading duty-free operator, global travel retailing is expected to grow to about US$67 billion by 2020, from an estimated US$45.7 billion in 2016. In the ASEAN region, the growth is expected to be more robust with the advent of increasing inbound and outbound tourists in major ASEAN airports. DF shops can be found in airports, downtown as well as onboard airliners and ferries. Airports shops contribute most to the DF market. For many travellers, shopping for duty- free products, from perfume and whisky to designer bags and watches, is a part of their trips overseas. -

The ACWC and the Adoption of the Human Rights- Based Approach to the Social Development of Women and Children in Southeast Asia

PHRG Peace Human Rights Governance Volume 4, Issue 2, July 2020 The ACWC and the Adoption of the Human Rights- based Approach to the Social Development of Women and Children in Southeast Asia Attilio Pisanò Research Articles* DOI: 10.14658/pupj-phrg-2020-2-2 How to cite: Pisanò, A. (2020) ‘The ACWC and the Adoption of the Human Rights-based Approach to the Social Development of Women and Children in Southeast Asia’, Peace Human Rights Governance, 4(2), 189-214. Article first published online July 2020 *All research articles published in PHRG undergo a rigorous double-blind review process by at least two independent, anonymous expert reviewers UPADOVA P PHRG 4(2), July 2020 The ACWC and the Adoption of the Human Rights- based Approach to the Social Development of Women and Children in Southeast Asia Attilio Pisanò* Abstract The paper aims at analysing the new perspective offered by the human rights- based approach to vulnerable people’s issues in the ASEAN, specifically concerning women and children. Defined the normative framework of the relationship between vulnerability and human rights, the paper primarily offers an in-depth study of the regional policies adopted in the ASEAN region since the institution of the ASEAN Sub-Committee on Women (1976) until the Vienna World Conference (1993). Furthermore, the pivotal role played by human rights in the process of ASEAN integration after the Vienna World Conference is explained, specifically describing the steps towards the creation of an ASEAN human rights mechanism and the full adoption of the human rights-based approach with the institution of the ASEAN Commission on the Promotion and Protection of the Rights of Women and Children. -

Regional Programme Promoting Women's Economic Empowerment

Ref. Ares(2020)5908919Ares(2020)6824509 - 26/10/202017/11/2020 Funded by the European Union Regional Programme Promoting Women’s Economic Empowerment in Asia: WeEmpowerAsia Communications and Visibility Report March 2019 – March 2020 Funded by the European Union Summary The present report aims at presenting a snapshot of the key communication and visibility highlights of the European Union-UN Women Regional Programme WeEmpowerAsia from March 2019 to March 2020. As per the Communication and Visibility Strategy, during its first year of implementation, the WeEmpowerAsia programme developed a number of communication materials including its website and the first issue of its bulletin, as well as other assets such as slide decks, notebooks, stickers, banners, postcards and folders. In this period, the programme started to compile a regional database of partners to disseminate information, messages and advocacy materials totaling at 415 individuals from the private sector, governments, academia, NGOs and civil society. The programme was launched through different advocacy activities. The regional team organized a launch ceremony at the United Nations in Bangkok to introduce the programme to sister agencies and other partners. Programme-implementing countries also conducted events to officially start their work at the national level. China, for example, hosted a national launch of the programme within the framework of a larger event hosted in partnership with the EU and the Swedish Embassy. Similarly, the launch in India, which was co-led by the EU Ambassador, garnered impressive turnout by top business leaders, and culminated with the country’s largest annual Gender Equality Summit a day later. Funded by the European Union In its first year, the programme has worked extensively to establish partnerships with key stakeholders. -

ZILINGO Customer Terms and Conditions This Application

ZILINGO Customer Terms and Conditions This application software and any logos, designs, artwork, labels, symbols or any other product details not limited to those mentioned above are the sole property of Zilingo Pte. Ltd. (“ZILINGO”),a company incorporated in Singapore. The use of the ZILINGO Application is being made available through Zilingo, (Thailand) Ltd., an affiliate of Zilingo, having its registered office at No. 399 Interchange Building, 24th Floor, Room 10, Sukhumvit 21 Road, Khlong Toei Nua Sub District, Wattana District, Bangkok 10110. (1) Definitions and Interpretation: Capitalised terms or phrases as used in the Customer Terms and Conditions (“Terms and Conditions”),if not defined in this section, shall have the meaning assigned to them in the sentence immediately preceding the bold alphabets enclosed within quotes (““),such as in the para above. Additionally, in these Terms and Conditions, the following definitions apply: Definitions: “Account”refers to the user account that will be needed to create/register on Zilingo’smobile application to purchase products through the Zilingo platform. “Business Day”refers to working days in Thailand and shall relate to days on which banks in Thailand are operational and/or open for business. “Conditions”refer to the the terms of reference or use of Zilingo Products in accordance with these Terms and Conditions. “Contract”refers to the act of placing an order for a product(s) by you on Zilingo’splatform in line with its Terms and Conditions followed by Zilingo’sacceptance of the order in accordance with the process outlined in Clause 11 below. “Customer”refers to you, i.e. -

Singapore's Foreign Policy: Beyond Realism

SINGAPORE’S FOREIGN POLICY: BEYOND REALISM Submitted by Ming Hwa Ting This thesis is submitted to the University of Adelaide as a requirement for the degree of Doctor of Philosophy Centre for Asian Studies North Terrace Campus, the University of Adelaide March 2010 consummatum est ii Abstract .......................................................................................................................... vi Thesis Declaration ........................................................................................................ vii Acknowledgements ...................................................................................................... viii List of Abbreviations ...................................................................................................... x 1. INTRODUCTION: WHY STUDY SINGAPORE‟S FOREIGN POLICY? ........ 11 1.1 Singapore in Southeast Asia: The Vulnerability Myth ................................. 12 1.2 Why Realism is in Vogue: Size as a Deteminant in Singapore‟s Threat Perception ..................................................................................................... 15 1.3 Limitations of Realism .................................................................................. 17 1.4 Literature Review .......................................................................................... 21 1.4.1 Singapore‟s Foreign Policy: Paucity of Empirical Research .................... 21 1.3.2 Paucity of Alternative Theoretical Research ........................................... -

Jumpstart Media Based in Hong Kong, Jumpstart

www.jumpstartmag.com The Entrepreneur’s Magazine Issue 29 April 2020 Anatomy of an Almost− Unicorn Charting Zilingo’s Zilingo Co-Founders meteoric growth Ankiti Bose & Dhruv Kapoor from pre-seed to global titan p. 50 Why mobile gaming is about to win big Rental, resale, and the fashion industry New challengers in the search engine space Transforming urban life through farming Teletherapy to expand access to mental health treatment EDITOR’S LETTER think it’s safe to say that 2020 is not turning out the way that any of us expected. The last time I wrote to Iyou, I was brimming with enthusiasm about globaliza- tion and its potential to bring the world closer together in the next decade. How innocent those words seem today. As we impatiently watch the consequences of the COVID-19 pandemic unfold, businesses around the world are adapting and recalibrating. The optimist in me A NOTE FROM OUR CEO believes that, through each Zoom call and face mask-to- Relena Sei face mask meeting, positive changes will happen. For now, all we can do is press on and wait for better days from the am honored to be a part of the Jumpstart family. It’s only safety of our homes. been two months since I joined, but I can feel the passion For us, business-as-usual means sending another Iin our office as we prepare to launch Jumpstart Media to issue your way. This ‘Back to Basics’ issue is a bit differ- new heights. ent. We’re covering innovation from another perspective: I am proud of our magazine, which our team has worked disruption through execution. -

Social Capital and Inequality in Singapore

SOCIAL CAPITAL AND INEQUALITY IN SINGAPORE by Vincent Kynn Hong Chua A thesis submitted in conformity with the requirements for the degree of Doctor of Philosophy Department of Sociology University of Toronto © Copyright by Vincent Chua 2010 Social Capital and Inequality in Singapore Vincent Chua Degree of Doctor of Philosophy Department of Sociology University of Toronto 2010 Abstract Written as three publishable papers, this dissertation examines the sources of several forms of social capital in Singapore, and the effects of social capital on occupational success. Using representative survey data from Singapore, these papers make several important theoretical contributions: The first paper examines how and why categorical forms of stratification such as gender and ethnicity tend to produce distinctive forms of network inequalities: for example, whereas Chinese (relative to Malays and Indians) tend to have greater access to well- educated, wealthy, Chinese and weak tie social capital (but not non-kin), men (relative to women) tend to have greater access to men, non-kin and weak ties (but not well- educated, wealthy and Chinese). The key to understanding such distinctive patterns of network inequalities (by gender and ethnicity) is to understand the distinctive ways in ii which gender and ethnic groups are distributed in routine organizations such as schools, paid work and voluntary associations. The second paper examines the significance of personal contacts in job searches, in the context of Singapore’s meritocratic system. I show that in certain sectors such as the state bureaucracy, social networking brings no distinct advantages as appointments are made exclusively on the basis of the credentials of the candidates. -

Sustainability Wins As Investors in Southeast Asia Shift Focus

Sustainability Wins as Investors in Southeast Asia Shift Focus More than 50% of private equity deals now back business models that contribute to environmental and social progress. By Suvir Varma and Alex Boulton Suvir Varma is a senior advisor, and Alex Boulton is a principal, with Bain & Company’s Global Private Equity practice. They are based in Singapore. Copyright © 2019 Bain & Company, Inc. All rights reserved. Sustainability Wins as Investors in Southeast Asia Shift Focus At a Glance Sustainability investments rose 60% to $3.2 billion in the first half of 2019 over the same period a year earlier. Total private equity deal value in 2018 topped $10 billion for the second year in a row, rising sharply in Vietnam and Indonesia. Four young companies in the region have surpassed $1 billion in value since January 2018, bringing the total number of unicorns to 14. Despite warnings of a looming recession, a two-year surge of investment in Southeast Asia shows no sign of slowing. Venture capital firms in the region raised more than US$500 million in the first half of 2019, and private equity investors remain on a path to double the cumulative investment since 2017 compared with the previous five years. Southeast Asia’s fast-growing start-ups are a powerful draw for investors. In the past year, the region gave rise to four additional unicorns—new companies that rapidly achieve market valuations of $1 billion or more—bringing the total in the region to 14 (see Figure 1). Coming up fast behind them, the top five start-ups ranked by cumulative funds have garnered more than $1 billion in financing.