Providing 'Value-Packed Products'

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Japanese Manufacturing Affiliates in Europe and Turkey

06-ORD 70H-002AA 7 Japanese Manufacturing Affiliates in Europe and Turkey - 2005 Survey - September 2006 Japan External Trade Organization (JETRO) Preface The survey on “Japanese manufacturing affiliates in Europe and Turkey” has been conducted 22 times since the first survey in 1983*. The latest survey, carried out from January 2006 to February 2006 targeting 16 countries in Western Europe, 8 countries in Central and Eastern Europe, and Turkey, focused on business trends and future prospects in each country, procurement of materials, production, sales, and management problems, effects of EU environmental regulations, etc. The survey revealed that as of the end of 2005 there were a total of 1,008 Japanese manufacturing affiliates operating in the surveyed region --- 818 in Western Europe, 174 in Central and Eastern Europe, and 16 in Turkey. Of this total, 291 affiliates --- 284 in Western Europe, 6 in Central and Eastern Europe, and 1 in Turkey --- also operate R & D or design centers. Also, the number of Japanese affiliates who operate only R & D or design centers in the surveyed region (no manufacturing operations) totaled 129 affiliates --- 125 in Western Europe and 4 in Central and Eastern Europe. In this survey we put emphasis on the effects of EU environmental regulations on Japanese manufacturing affiliates. We would like to express our great appreciation to the affiliates concerned for their kind cooperation, which have enabled us over the years to constantly improve the survey and report on the results. We hope that the affiliates and those who are interested in business development in Europe and/or Turkey will find this report useful. -

NISSAN Value-Up

FY04 financial results NISSAN Value-Up April 25, 2005 President and CEO Carlos Ghosn FY04 financial results / NISSAN Value-Up April 25, 2005 Agenda FY04 sales performance FY04 financial performance FY05 outlook NISSAN 180 progress NISSAN Value-Up FY04 financial results / NISSAN Value-Up April 25, 2005 FY04 Global retail sales volume 3,400 3,388 3,200 +10.8% 1990: Record sales 3,107 3,000 3,057 2,800 2,771 2,600 Thousand units 2,633 2,597 2,400 2,530 2,200 FY99 FY00 FY01 FY02 FY03 FY04 FY04 financial results / NISSAN Value-Up April 25, 2005 FY04 Global production 3,400 3,378 3,200 +10.2% Record production 3,085 3,000 3,064 2,800 2,737 2,600 Thousand units 2,614 2,400 2,402 2,469 2,200 FY99 FY00 FY01 FY02 FY03 FY04 FY04 financial results / NISSAN Value-Up April 25, 2005 FY04 sales performance Japan Fuga 1,000 “RJC Car of the Year” 983 800 837 848 +1.4% 600 400 Thousand units Industry TIV: 5.8 million (-1.2%) March Cube 200 Nissan share: 14.6% (+0.4 point) 0 Tiida Note FY03 FY04 4 models in top 10 monthly sales ranking FY04 financial results / NISSAN Value-Up April 25, 2005 FY04 sales performance United States Frontier 1,000 1,013 +18.4% 800 859 600 Pathfinder 400 Thousand units Industry TIV: 16.9 million (+0.4%) 200 Nissan share: 6.0% (+0.9 point) Titan Altima 0 FY03 FY04 FY04 financial results / NISSAN Value-Up April 25, 2005 Infiniti sales performance 140 120 132 124 +6.5% 100 80 96 78 60 76 71 Thousand units 40 0 FY99 FY00 FY01 FY02 FY03 FY04 FY04 financial results / NISSAN Value-Up April 25, 2005 FY04 sales performance Europe 1,000 800 -

Japanese Capital in Central Europe

Hitotsubashi Journal of Economics 33 (1992) 149-168. C The Hitotsubashi Academy JAPANESE CAPITAL IN CENTRAL EUROPE GABOR BAKOS* Abstract From the 1 960's onward Japan's presence in Central Europe gradually increased. First foreign trade developed, then Japanese sogo shosha (general trading companies) established themselves, Japanese banks extended credits and, after the systemic changes in Central European countries of 1989, direct investments into the region showed a dra- matic increase. The real importance of Japanese investments is far greater than their statistical share owing to their modernizing effect. For Japanese business, Central Eu- rope is a strategic door to the huge markets of both the former Soviet Union and Western Europe. After recent privatization Central European countries have been seriously hoping for active Japanese participation but, due to their long decision-making processes, Japanese firms are being squeezed out by German and U.S, frms. I. The Process In this study, we will regard capital as it appears in three forms : commodities, finances and direct investments. In the literature generally only direct investments and partly finances are regarded. Nevertheless, the inclusion of commodities should not be neglected for two reasons. First, because trade flows also involve capital goods and secondly, developments in trading patterns allow for qualification of the cooperation between the partner countries. Japan's presence in Central Europe was rather insignificant before the 1970's and con- fined solely to foreign -

Kucukarac.Pdf

M & M SENSOR İKİTELLİ ORG. SAN. BÖLG. ESKOOP SAN. SİT. C-6 BLOK NO:294 BAŞAKŞEHİR / İSTANBUL TEL: +90 212 671 41 80 FAX: +90 212 671 41 90 [email protected] / www.baltechswitches.com SWITCHES SAYFA İÇERİĞİ / INDEX 1 - 15 YAĞ BASINÇ MÜŞÜRLERİ / OIL PRESSURE SWITCHES 16 - 31 HARARET MÜŞÜRLERİ / TEMPERATURE SENDER 32 - 46 SENSÖRLER / SENSORS 47 - 59 GERİ VİTES MÜŞÜRLERİ / REVERSING LIGHT SWITCHES 60 - PNÖMATİK BASINÇ MÜŞÜRLERİ / PNEUMATIC SWITCHES 61 - HİDROLİK FREN MÜŞÜRLERİ / HYDRAULIC STOP LIGHT SWITCHES 62 - MEKANİK FREN MÜŞÜRLERİ / MECHANICAL STOP LIGHT SWITCHES 63 - HAVA BASINÇ MÜŞÜRLERİ / PNEUMATIC STOP LIGHT SWITCHES MADE IN TURKEY BİR TEKNİK GELŞ. MAK. PAZ. SAN. VE TİC. LTD. ŞTİ. İkitelli Org. San. Bölg. Eskoop San. Sit. C6 Blok No:294 İkitelli-Başakşehir / istanbul Tel: +90 212 671 41 80 Fax: +90 212 671 41 90 [email protected] / www.baltechswitches.com YAĞ BASINÇ MÜŞÜRLERİ OIL PRESSURE SWITCHES 1 OEM / ORJ. NO 40.022 Bosch 0344101072 SIMCA SKODA STANDARD Octa 1959-65 Vehículos Europeos F 1959-65 European V cles 1202 1959-65 V Bar 10x1 0,25÷0,50 OEM / ORJ. NO 40.004 Alfa Romeo 60593846 ALFA ROMEO AUDI SKODA 60595694 Alfa 33 1.8 T 1986-94 50. 80. 90. 100 1966-82 105. 120. Estelle. Ra 1977-87 6,35 mm 021 919 081,A,B Alfa 75 1985-92 BMW Fa . 136 Coupé 1987-95 111 919 081, A Alfa 90 1984-87 MERCEDES VOLKSWAGEN 113 919 081 Alfa 155 1992-93 1963-71 Escarabajo/Kafer/Beetle 1960-79 BMW 61 311 351 799 Alfa 164 2.5 Turbo D 1992-98 PORSCHE Dasher. -

Classic Japanese Performance Cars Free

FREE CLASSIC JAPANESE PERFORMANCE CARS PDF Ben Hsu | 144 pages | 15 Oct 2013 | Cartech | 9781934709887 | English | North Branch, United States JDM Sport Classics - Japanese Classics | Classic Japanese Car Importers Not that it ever truly went away. But which one is the greatest? The motorsport-derived all-wheel drive system, dubbed ATTESA Advanced Total Traction Engineering System for All-Terrainuses computers and sensors to work out what the car is doing, and gave the Skyline some particularly special abilities — famously causing some rivalry at the Nurburgring with a few disgruntled Classic Japanese Performance Cars engineers…. The latest R35 GT-R, for the first time a stand-alone model, grew in size, complexity and ultimately speed. A mid-engined sports car from Honda was always going to be special, but the NSX went above and beyond. Honda managed to convince Ayrton Senna, who was at the time driving for McLaren Honda, to assess a late-stage prototype. Honda took what he said onboard, and when the NSX went on sale init was a hugely polished and capable machine. Later cars, especially the uber-desirable Type-R model, were Classic Japanese Performance Cars to perfection. So many Imprezasbut which one to choose? All of the turbocharged Subarusincluding the Legacy and even the bonkers Forrester STi, have got something inherently special to them. Other worthy models include the special edition RB5, as well as the Prodrive fettled P1. All will make you feel like a rally driver…. Mazda took all the best parts of the classic British sports car, and built them into a reliable and equally Classic Japanese Performance Cars package. -

English BAE Systems and Nally, It Develops Arms Systems for War- the Second World Military Aerospace Ships Through the FABA Programme, Company After Boeing

THE MILITARY INDUSTRIAL COMPLEX A PARASITE ON SPANISH ECONOMY REPORT no. 12 REPORT no. 12 THE MILITARY INDUSTRIAL COMPLEX A parasite on Spanish economy Pere Ortega Camino Simarro Centre d’Estudis per la Pau J.M. Delàs · Justícia i Pau Barcelona, April 2012 Centre d’Estudis per la Pau JM Delàs Justícia i Pau · Rivadeneyra 6, 10è 08002 Barcelona T. 93 317 61 77 F. 93 412 53 84 www.centredelas.org [email protected] [email protected] Barcelona, April 2012 Graphic design: Fundació Tam-Tam D.L.: B-19745-2010 ISSN: 2013-8032 REPORT no. 12 The military industrial complex. A parasite on Spanish economy 4 THE MILITARY REPORT INDUSTRIAL COMPLEX A PARASITE ON SPANISH ECONOMY no. 12 Index EXECUTIVE SUMMARY 1. INTRODUCTION......................7 The military-industrial complex in Spain is based on an oligopoly made up of four big companies that provide all the weapons that the Ministry of Defence 2. MILITARY PRODUCTION IN SPAIN . .8 uses for its armies. EADS-Casa manufactures aeronautics for the air force; Na- vantia produces warships for the navy; Santa Bárbara/General Dynamics sells 3. A SHORT HISTORY OF THE MILITARY heavy and small arms to the army and, last but not least, Indra provides all the INDUSTRY IN SPAIN . 9 aforementioned armed forces and their weapons with most of the electronics and new technologies. 4. SOME SIGNIFICANT CHANGES IN THE SECTOR . .11 These four companies make up between 75 and 80% of the total turnover of military production which amounted to approximately E 6.6 billion in 2009. 5. DEFENCE INDUSTRIAL That represented 1.24% of the national industrial production and 1.1% of the SUBSECTORS . -

Annual Report 2008 Honda Motor Co., Ltd

Honda Motor Co., Ltd. Annual Report 2008 Honda Motor Co., Ltd. Year Ended March 31, 2008 Annual Report 2008 This annual report is printed on recycled paper using soy ink with no volatile organic content. Furthermore, a waterless printing process was used to prevent toxic emissions. Printed in Japan WorldReginfo - bc9832be-05b4-4eaa-80a4-f78d1968d3bb Corporate Profile Honda Motor Co., Ltd., operates under the basic principles of “Respect for the Individual” and “The Three Joys”—expressed as “The Joy of Buying,” “The Joy of Selling” and “The Joy of Creating.” “Respect for the Individual” reflects our desire to re- spect the unique character and ability of each individual person, trusting each other as equal partners in order to do our best in every situation. Based on this, “The Three Joys” express our belief and desire that each person working in or coming into contact with our company, directly or through our products, should share a sense of joy through that experience. In line with these basic principles, since its establishment in 1948, Honda has remained on the leading edge by creating new value and providing products of the highest quality at a reasonable price, for worldwide customer satisfaction. In addi- tion, the Company has conducted its activities with a commitment to protecting the environment and enhancing safety in a mobile society. The Company has grown to become the world’s largest motorcycle manufacturer and one of the leading automakers. With a global network of 501* subsidiaries and affiliates accounted for under the equity method, Honda develops, manufac- tures and markets a wide variety of products, ranging from small general-purpose engines and scooters to specialty sports cars, to earn the Company an outstanding reputation from customers worldwide. -

Ffiiinnnaaalll Rreeepppooorrrtt

JAPAN INTERNATIONAL COOPERATION AGENCY (JICA) MINISTRY OF ECONOMIC AFFAIRS THE REPUBLIC OF HUNGARY The Development Study on the Promotion of Small and Medium-sized Enterprises in the Republic of Hungary - Manufacturing Sector - FFFIIINNNAAALLL RRREEEPPPOOORRRTTT (SUMMARY) DECEMBER, 2000 UNICO International Corporation SRIC Corporation MPI CR (1) OO-196 ABBREVIATION AFEOSZ National Federation of Consumer Cooperative Societies APEH Bureau of Tax and Financial Control CGC Credit Guarantee Corporation EBRD European Bank for Reconstruction and Dev elopment EDB Enterprise Dev elopment Board EDI Electronic Data Interchange EIC Euro Info Center EIF European Investment Fund ERDF European Regional Development Fund EU European U nion HPC Hungarian Productivity Center HSBA Hungarian Small Business Association IFC International Finance Corporation IMD Institute for M anagement Dev elopment INNOSTART Hungary National Business & Innovation Center IPE Industrial Park Association IPOSZ Hungarian Association of Craftmen's Corporation ISDN Integrated Service & Digital Network ISP Internet Service Provider ITD-H Hungarian Investment and Trade Development Agency KISOSZ National Federation of Traders and Caterers LEA (or HVK) Local Enterprise Agency MEA M inistry of Economic Affairs MFB Hungary Development Bank MGYOSZ Confederation of Hungarian Employers and Industrialists MISZ Hungarian Innovation Association MKIK (or HCCI) Hungarian Chamber of Commerce and Industry MKVT Hungarian Small Business Association MTV MAGYAR TÁVKgZLÉSI RT. MVA Hungarian Foundation -

Australia and Japan

DRAFT Australia and Japan A New Economic Partnership in Asia A Report Prepared for Austrade by Peter Drysdale Crawford School of Economics and Government The Australian National University Tel +61 2 61255539 Fax +61 2 61250767 Email: [email protected] This report urges a paradigm shift in thinking about Australia’s economic relationship with Japan. The Japanese market is a market no longer confined to Japan itself. It is a huge international market generated by the activities of Japanese business and investors, especially via production networks in Asia. More than ever, Australian firms need to integrate more closely with these supply chains and networks in Asia. 1 Structure of the Report 1. Summary 3 2. Japan in Asia – Australia’s economic interest 5 3. Assets from the Australia-Japan relationship 9 4. Japan’s footprint in Asia 13 5. Opportunities for key sectors 22 6. Strategies for cooperation 32 Appendices 36 References 42 2 1. Summary Japan is the second largest economy in the world, measured in terms of current dollar purchasing power. It is Australia’s largest export market and, while it is a mature market with a slow rate of growth, the absolute size of the Japanese market is huge. These are common refrains in discussion of the Australia-Japan partnership over the last two decades or so. They make an important point. But they miss the main point about what has happened to Japan’s place in the world and its role in our region and what those changes mean for effective Australian engagement with the Japanese economy. -

The Automotive Industry in Hungary 217 Andras Tóth and László Neumann 1

uaderni della QFondazione G. Brodolini 45 I Quaderni della Fondazione Giacomo Brodolini presentano i risultati dell’attività di ricerca svolta dalla Fondazione nelle aree che, nel tempo, hanno costituito gli assi fon- damentali delle sue iniziative culturali, occupazione, sviluppo locale, valutazione delle politiche pubbliche, politiche sociali, pari opportunità, storia. Fondazione Giacomo Brodolini 00161 Roma - Via di Villa Massimo 21, int. 3 tel. 0644249625 fax 0644249565 [email protected] www.fondazionebrodolini.it ISBN 978-88-95380-05-6 THE LABOUR IMPACT OF GLOBALIZATION IN THE AUTOMOTIVE INDUSTRY A comparison of the Italian, German, Spanish, and Hungarian Motor Industries edited by Paolo Caputo and Elisabetta Della Corte FondazioneGiacomoBrodolini Index Contributors 9 Introduction 11 Paolo Caputo and Elisabetta Della Corte Labour on the Defensive? The Global Reorganisation of the Value Chain and Industrial Relations in the European Motor Industry 17 Josep Banyuls and Thomas Haipeter 1. Introduction 17 2. Global reorganisation in the motor industry 19 2.1 From internationalisation to globalisation 20 2.2 Internal reorganisation in OEMs 24 2.3 Reorganisation of the value chain 28 3. Confronting the pressures of globalisation: industrial relations systems in flux? 35 3.1 New collective bargaining topics 35 3.2 Collective bargaining in regime competition: between centralisation and decentralisation 39 3.3 Changing actors and strategies 42 3.4 Collective bargaining along the value chain: towards a fragmentation of industrial relations? 46 3.5 Internationalisation of industrial relations 49 4. Conclusion: convergences, divergences and the defensive of work 51 References 56 5 The Automotive Industry in Germany 61 Thomas Haipeter 1. Introduction: Developments of the automotive industry and challenges for the systems of industrial relations 61 2. -

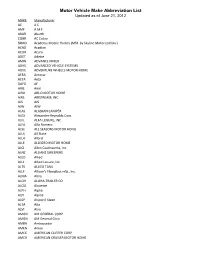

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

A Management Survey of Industry Interaction with Locational Factors

Munich Personal RePEc Archive Japanese Business in Australia: A Management Survey of Industry Interaction with Locational Factors Bayari, Celal Nagoya University Graduate School of International Development 1 January 2004 Online at https://mpra.ub.uni-muenchen.de/103896/ MPRA Paper No. 103896, posted 02 Nov 2020 16:00 UTC 1 Japanese Business in Australia: A Management Survey of Industry Interaction with Locational Factors Celal Bayari Nagoya University. Graduate School of International Development Citation: Bayari, Celal (2004) ‘Japanese Business in Australia: A Management Survey of Industry Interaction with Locational Factors’. The Otemon Journal of Australian Studies. 30: 119-149. 2004. ISSN 0385-3446. 1 2 JAPANESE BUSINESS IN AUSTRALIA: A MANAGEMENT SURVEY OF INDUSTRY INTERACTION WITH LOCATIONAL FACTORS Celal Bayari Nagoya University. Graduate School of International Development Abstract This is a discussion of research findings on the interaction of the Japanese firms with Australia’s locational factors that affect their investment decisions in Australia. The paper argues that there is a convergence as well as divergence among the sixty-five companies from three industrial sectors on ten different factors affecting satisfaction that is reported by the management and the other variables that characterise the firms.1 Japan-Australia relations: Introduction Japan has always captured the imagination of Australian business leaders and politicians (Stockwin 1972, Meaney 1988) and economic planners (Japan Secretariat 1984) in the post-war era. In the Japanese media the image of Australia is one of a tourist location and raw materials supplier that buys cars and electronics goods from Japan (The Japan Times 2001: 15). Australian exports to Japan add up to 380,000 jobs, AUS $1,300 for every Australian, and 4% of the GDP (Vaile 2001).