Understanding Auto Fincos

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021

4/19/2021 No.1325 All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021 Tokyo, April 19, 2021 – MITSUBISHI MOTORS CORPORATION (MMC) announced that GAC Mitsubishi Motors Co., Ltd. (GMMC)1, MMC’s vehicle production and sales joint venture in China, today teased the all-new electric SUV AIRTREK at Auto Shanghai 20212. 1. A joint venture between Guangzhou Automobile Group Co., Ltd. (GAC), Mitsubishi Corporation and MMC. 2. Officially called The 19th Shanghai International Automobile Industry Exhibition. April 19 and 20 are Press Days, and April 21 to 23 are Trade Days. The show is open to the public from April 24 to 28. The exhibition is held at the National Exhibition and Convention Center (Shanghai). The all-new AIRTREK is based on the concept of an “e-cruising SUV” founded on three keywords: “Electric (electric vehicle),” “Expanding (expanding life’s pleasures with a car)” and “Expressive (expressing the uniqueness of MITSUBISHI MOTORS).” It generates an image of advanced sophistication fit for an EV while incorporating MMC’s consistent design identity, represented by its Dynamic Shield front design concept, and is styled to express the powerful performance expected of a Mitsubishi vehicle. “We have developed the AIRTREK as an SUV that enables customers to enjoy limitless adventures,” said John Signoriello, executive officer, responsible for global marketing and sales, MMC. “Designed exclusively for the Chinese market, the all-new AIRTREK will be launched by the end of this year as the fourth model of MITSUBISHI MOTORS’ lineup in China. With the addition of this electric vehicle, we aim to contribute to creating a sustainable mobility society.” # # # -1- . -

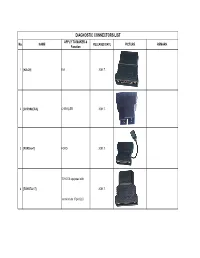

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

Annual Report

ai158746681363_GAC AR2019 Cover_man 29.8mm.pdf 1 21/4/2020 下午7:00 Important Notice 1. The Board, supervisory committee and the directors, supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. 2. All directors of the Company have attended meeting of the Board. 3. PricewaterhouseCoopers issued an unqualified auditors’ report for the Company. 4. Zeng Qinghong, the person in charge of the Company, Feng Xingya, the general manager, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Accounting Chief), represent that they warrant the truthfulness and completeness of the financial statements contained in this annual report. 5. The proposal for profit distribution or conversion of capital reserve into shares for the reporting period as considered by the Board The Board proposed payment of final cash dividend of RMB1.5 per 10 shares (tax inclusive). Together with the cash dividend of RMB0.5 per 10 shares (including tax) paid during the interim period, the ratio of total cash dividend payment for the year to net profit attributable to the shareholders’ equity of listed company for the year would be approximately 30.95%. 6. Risks relating to forward-looking statements The forward-looking statements contained in this annual report regarding the Company’s future plans and development strategies do not constitute any substantive commitment to investors and investors are reminded of investment risks. -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2020 together with the comparative figures of the corresponding period ended 31 December 2019. The result has been reviewed by the Audit Committee and the Board of the Company. - 1 - CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2020 2019 RMB’000 RMB’000 Revenue 3 63,156,985 59,704,322 Cost of sales (60,860,992) (57,181,363) Gross profit 2,295,993 2,522,959 Selling and distribution costs (3,641,480) (4,553,402) Administrative expenses (3,850,327) (3,589,516) Net impairment losses on financial assets (55,110) (53,831) Interest income 304,233 290,694 Other gains – net 4 1,379,690 2,620,340 Operating loss (3,567,001) (2,762,756) Interest income 127,551 171,565 Finance costs 5 (439,567) (516,481) Share of profit of joint ventures and associates 6 9,570,978 9,399,343 Profit before income tax 5,691,961 6,291,671 Income tax credit 7 355,990 -

Motorcycles, All Ter- Rain Vehicles (Atvs), Outboard Motors, and Other Products

ANNUAL REPORT 2010 99999-E2062-210 Printed in Japan Profile Suzuki Motor Corporation designs and manufactures passenger cars, commercial vehicles, motorcycles, all ter- rain vehicles (ATVs), outboard motors, and other products. The company continuously and vigorously promotes technical cooperation through numerous joint ventures overseas, and its main production facilities are currently located in 23 countries and regions overseas. The established network enables Suzuki to operate as a global organization serving 196 countries and regions. Suzuki Motor Corporation was first established as Suzuki Loom Manufacturing Co. in March 1920. Suzuki then entered the motorcycle business with the introduction of “Power Free” motorized bicycle in 1952, and entered the automobile business in 1955 with the introduction of “Suzulight” mini car. Suzuki is committed to use its amassed technological expertise and all other available resources to help raise the quality of human life in society by promoting corporate growth through manufacture and supply of socially demanded products. Head Office & Takatsuka Plant Headquarters, Engineering center and Motorcycle engines assembling plant Contents Profile ___________________________________________________________________ 1 A Message From The Management ________________________________________ 2 Financial Highlights ______________________________________________________ 4 Year In Review ___________________________________________________________ 5 Automobiles ___________________________________________________________ -

2005-Global Partnerships Final Poster.Qxd 8/17/2005 3:54 PM Page 1

2005-global partnerships final poster.qxd 8/17/2005 3:54 PM Page 1 SPONSORED BY GGuuiiddee ttoo gglloobbaall aauuttoommoottiivvee ppaarrttnneerrsshhiippss FULL OWNERSHIP EQUITY STAKES VEHICLE ASSEMBLY ALLIANCES TECHNICAL/PARTS ALLIANCES BMW AG Owned by: Joint venture: Contract assembly: •DaimlerChrysler - gasoline engines - Brazil •Mini •Quandt family - 46.6% •BMW Brilliance •Magna Steyr, Austria •Land Rover - diesel engines - UK •Rolls-Royce Motor Cars Ltd. •Other shareholders - 53.4% Automotive Co., China •PSA/Peugeot-Citroen - gasoline engines - France & UK •Tritec Motors, Brazil •Toyota -diesel engines DAIMLERCHRYSLER AG Owns: Owned by: Joint venture: Contract assembly: •BMW - gasoline engines - Brazil •Chrysler group •McLaren Group - 40% •Deutsche Bank - 6.9% •Beijing Benz-DaimlerChrysler •Karmann, Germany •GM - hybrid drive system •Mercedes-Benz •Mitsubishi - 12.8% •Kuwait Investments - 7.2% Automotive, China •Magna Steyr, Austria •Hyundai/Mitsubishi - 4-cylinder engines (Mercedes-Benz owns 100% of Maybach and Smart) •Mitsubishi Fuso - 65% •Other shareholders - 85.9% •Fujian Motor Industry Group, China DONGFENG MOTOR CORP. Owns: Owned by: Joint venture: •Dongfeng Yueda Kia Dongfeng Motor Corp. •Dongfeng Liuzhou Motor Co. Ltd. •Dongfeng Automobile Co. - •Chinese central government - •Dongfeng Honda Automobile Co., China 70% 100% Automobile (Wuhan), China •Zhengzhou Nissan •Dongfeng Motor Co., China Automobile Co., China •Dongfeng Peugeot Citroen Automobile Co., China FIAT S.P.A. Owns: Owned by: Joint venture: Contract assembly: •General Motors - powertrains - Poland •Fiat Auto S.p.A. •Ferrari - 50% •Agnelli family - 22% •Nanjing Fiat - China •Pininfarina, Italy •Suzuki - diesel engines - India (Fiat Auto owns 100% of Alfa Romeo, Fiat and Lancia) •Other shareholders - 78% •SEVEL - Italy, France •Suzuki, Hungary •Maserati S.p.A. •Tofas - Turkey •Nissan, South Africa •Iveo Fiat - Brazil •Mekong Corp., Vietnam FIRST AUTOMOBILE WORKS GROUP Owns: Owned by: Joint venture: •FAW-Volkswagen First Automobile (FAW) •FAW Car Co. -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

Call for Papers the Competition for the Practical Application of ICV Has Already Started in the Global Automotive Industry

Call for papers www.cicv.org.cn The competition for the practical application of ICV has already started in the global automotive industry. A sound environment for ICV are taking into shape, as China is embracing a clear trend of multi-industrial coordination and innovation and taking planned steps to make top-level policies and standards. As a national strategy, the development of ICV helps to create opportunities for cross-industrial innovation. In order to promote the development of ICV in China and build a world-class platform for technology exchange, China SAE, Tsinghua University Suzhou Automotive Research Institute and China Intelligent and Connected Vehicles (Beijing) Research Institute Co. Ltd jointly initiated an annual congress “International Congress of Intelligent and Connected Vehicles Technology (CICV)”. It is a world-class technology exchange platform for automotive, IT/Internet, communications and transportation industry. At the same time, as an important sign for policies, leading technologies showcases, and industry integration accelerator, CICV serves as a platform for communication and exchange between enterprises, universities and industrial research institutes and provide references for them. The 6th International Congress of Intelligent and Connected Vehicles Technology (CICV 2019) is to be held in June, 2019. Focusing on ADAS and key technologies of automated driving as well as ICV policies and regulations, CICV 2019 will invite about 80 experts and technical leaders to share new technology results and ideas on hot topics including Environment Perception and, Development and Testing, V2X, AI, Cyber Security, HD Map, Intelligent and Connected Transportation, Co-pilot and HMI. The concurrent activities including technical exhibition, promotional tours for innovative technologies and entrepreneurship programs. -

Bargaining Processes and Evolution of International Automotive Firms in China's New Energy Vehicle Sector

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Schwabe, Julian Article — Published Version From “obligated embeddedness” to “obligated Chineseness”? Bargaining processes and evolution of international automotive firms in China's New Energy Vehicle sector Growth and Change Provided in Cooperation with: John Wiley & Sons Suggested Citation: Schwabe, Julian (2020) : From “obligated embeddedness” to “obligated Chineseness”? Bargaining processes and evolution of international automotive firms in China's New Energy Vehicle sector, Growth and Change, ISSN 1468-2257, Wiley, Hoboken, NJ, Vol. 51, Iss. 3, pp. 1102-1123, http://dx.doi.org/10.1111/grow.12393 This Version is available at: http://hdl.handle.net/10419/230143 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

Takata Allocation Schedule V3 (01.30.2018).Xlsx

2:16-cr-20810-GCS-EAS Doc # 60-2 Filed 02/01/18 Pg 1 of 3 Pg ID 514 EXHIBIT B 2:16-cr-20810-GCS-EAS Doc # 60-2 Filed 02/01/18 Pg 2 of 3 Pg ID 515 Takata Corp OEM Allocation % Initial Consenting OEM Inflator shipping volume Initial Consenting OEM Roll‐up Units in thousands Joining OEM Non‐Consenting OEM Shipments ALL OEM Initial Consenting OEM Total PSAN Total PSAN ALL OEM # Short Name Formal Name Head office OEM Category Relationship Inflators % of total Inflators ALLOCATION % 1 Honda Honda Japan Initial Consenting OEM Honda 53,397 14.8215192% 53,419 14.8277907% 2CHAC Honda Automobile (China) Co., Ltd. China Initial Consenting OEM Roll‐up Honda Chinese JV 23 0.0062715% ‐ ‐ 3GHAC GAC Honda Automobile Co., Ltd. China Joining OEM Honda Chinese JV 3,682 1.0220562% 3,682 1.0220562% 4WDHAC Dongfeng Honda Automobile Co., Ltd. China Joining OEM Honda Chinese JV 4,323 1.2000105% 4,323 1.2000105% 5 Toyota Toyota Japan Initial Consenting OEM Toyota 44,018 12.2181997% 48,881 13.5681391% 6 NUMMI New United Motor Manufacturing, Inc. US Initial Consenting OEM Roll‐up Toyota 1,922 0.5335676% ‐ ‐ 7Daihatsu Daihatsu Motor Co., Ltd. Japan Initial Consenting OEM Roll‐up Toyota owned (100% owned) 2,908 0.8072901% ‐ ‐ 8HINO Hino Motors, Ltd. Japan Initial Consenting OEM Roll‐up Toyota affiliate 33 0.0090817% ‐ ‐ 9GTMC GAC Toyota Motor Co., Ltd. China Joining OEM Toyota Chinese JV 602 0.1671380% 602 0.1671380% 10 TFTM Tianjin FAW Toyota Motor Co., Ltd. China Joining OEM Toyota Chinese JV 3,069 0.8517936% 3,069 0.8517936% 11 SFTMCF Changchun Fengyue Company of Sichuan FAW Toyota Motor Co., Ltd. -

China Autos Driving the EV Revolution

Building on principles One-Asia Research | August 21, 2020 China Autos Driving the EV revolution Hyunwoo Jin [email protected] This publication was prepared by Mirae Asset Daewoo Co., Ltd. and/or its non-U.S. affiliates (“Mirae Asset Daewoo”). Information and opinions contained herein have been compiled in good faith from sources deemed to be reliable. However, the information has not been independently verified. Mirae Asset Daewoo makes no guarantee, representation, or warranty, express or implied, as to the fairness, accuracy, or completeness of the information and opinions contained in this document. Mirae Asset Daewoo accepts no responsibility or liability whatsoever for any loss arising from the use of this document or its contents or otherwise arising in connection therewith. Information and opin- ions contained herein are subject to change without notice. This document is for informational purposes only. It is not and should not be construed as an offer or solicitation of an offer to purchase or sell any securities or other financial instruments. This document may not be reproduced, further distributed, or published in whole or in part for any purpose. Please see important disclosures & disclaimers in Appendix 1 at the end of this report. August 21, 2020 China Autos CONTENTS Executive summary 3 I. Investment points 5 1. Geely: Strong in-house brands and rising competitiveness in EVs 5 2. BYD and NIO: EV focus 14 3. GAC: Strategic market positioning (mass EVs + premium imported cars) 26 Other industry issues 30 Global company analysis 31 Geely Automobile (175 HK/Buy) 32 BYD (1211 HK/Buy) 51 NIO (NIO US/Buy) 64 Guangzhou Automobile Group (2238 HK/Trading Buy) 76 Mirae Asset Daewoo Research 2 August 21, 2020 China Autos Executive summary The next decade will bring radical changes to the global automotive market. -

Chongqing Changan Automobile Company Limited 2019 Semi-Annual Report

Chongqing Changan Automobile Company Limited 2019 Semi-annual Report Chongqing Changan Automobile Company Limited 2019 Semi-annual Report August 2019 Chongqing Changan Automobile Company Limited 2019 Semi-annual Report Chapter 1 Important Notice, Contents, and Definitions The Board of Directors, the Board of Supervisors, Directors, Supervisors and Senior Executives of the company hereby guarantee that no false or misleading statement or major omission was made to the materials in this report and that they will assume all the responsibilities, individually and jointly, for the trueness, accuracy and completeness of the contents of this report. All the directors attended the board meeting for reviewing the semi-annual report. For the first half of 2019, the Company has no plans of cash dividend, no bonus shares and no share converted from capital reserve. The Chairman of the Board Zhang Baolin, the Chief Financial Officer Zhang Deyong and the responsible person of the accounting institution (Accountant in charge) Chen Jianfeng hereby declare that the Financial Statements enclosed in this annual report are true, accurate and complete. The prospective description regarding future business plan and development strategy in this report does not constitute virtual commitment. The investors shall pay attention to the risk. The report shall be presented in both Chinese and English, and should there be any conflicting understanding of the text, the Chinese version shall prevail. 1 Chongqing Changan Automobile Company Limited 2019 Semi-annual Report CONTENTS Chapter 1 Important Notice, Contents, and Definitions ............................................. 1 Chapter 2 Company Profile & Main Financial Indexes ............................................. 4 Chapter 3 Analysis of Main Business ........................................................................ 8 Chapter 4 Business Discussion and Analysis ..........................................................