Chongqing Changan Automobile Company Limited 2015 Annual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Marketing Strategies for Chery Automobile Corporation

ISSN 1712-8056[Print] Canadian Social Science ISSN 1923-6697[Online] Vol. 9, No. 4, 2013, pp. 177-183 www.cscanada.net DOI:10.3968/j.css.1923669720130904.2560 www.cscanada.org Marketing Strategies for Chery Automobile Corporation ZHANG Junjie[a],*; DAI Xiajing[b] [a] Lecturer of Business and Management, Department of Business and Management, Business School, Jiaxing University. Jiaxing, Zhejiang, 1. RESEARCH BACKGROUND China. INTRODUCTION [b] Business School, Jiaxing University. Jiaxing, Zhejiang, China. *Corresponding author. In our modern consumer society, any organization which aims to survive and develop in the market should be marketing orientated. Satisfying customers’ needs and Abstract meeting their expectations are the most crucial ways to A marketing strategy is a road map for the marketing retain, expand a business. While marketing plan plays activities of an organization for future period of time. It a key role in the actualization of marketing activities. A always helps the organization to understand clearly about marketing plan is a road map for the marketing activities the questions like these: what are we now? Where do we of an organization for future period of time. In this want to go? How do we allocate our resources to get to business report, we mainly recommend a marketing plan where we want to go? How do we convert our plans into for Chery Automobile Corp through the studies about its actions? How do our results compare our plans, and do external business environment and internal environment deviations require new plans and actions? The paper tries by some useful business analytical tools like PEST to formulate a marketing strategy for Chery Automobile analysis and SWOT analysis. -

The International Journal of Business & Management

The International Journal Of Business & Management (ISSN 2321 – 8916) www.theijbm.com THE INTERNATIONAL JOURNAL OF BUSINESS & MANAGEMENT Why a Middle Income Country is Experiencing a Booming Auto Industrial Development: Evidence from China and its Meaning for the Developing World Bindzi Zogo Emmanuel Cedrick Ph.D Candidate, School of Economics Wuhan University of Technology, P.R. China, Hubei Province, Wuhan City, China Pr. Wei Long Professor, Wuhan University of Technology, P.R. China, Hubei Province, Wuhan City, China Abtract: From almost nothing in 1970 to the World largest manufacturer and automobile market in 2013, China has essentially focused its rapid economic progress on industrial development. This paper discusses the meaning of middle income to the developing world. It then determines the factors contributing to the growth of China auto industry. It also argues on how the fast growing of a middle income country’s auto industry could impact other developing economies. It therefore concludes that although the economic model established by China to develop its auto industry traces its basis in the diamond model’s determinants, the application of these determinants has followed a different approach backed up by a pentagram model which places the government as the primary actor in the fast transformation of China auto industry. Keywords: Middle income, growing auto industry, pentagram model, government role 1. Introduction During the last decades, the world has witnessed a faster economic development of Middle income countries. China, Brazil, India, Mexico, South Africa and more others have relatively ameliorate their industrial capabilities with positive spillovers to the rest of the world. -

Analysis of the Dynamic Relationship Between the Emergence Of

Annals of Business Administrative Science 8 (2009) 21–42 Online ISSN 1347-4456 Print ISSN 1347-4464 Available at www.gbrc.jp ©2009 Global Business Research Center Analysis of the Dynamic Relationship between the Emergence of Independent Chinese Automobile Manufacturers and International Technology Transfer in China’s Auto Industry Zejian LI Manufacturing Management Research Center Faculty of Economics, the University of Tokyo E-mail: [email protected] Abstract: This paper examines the relationship between the emergence of independent Chinese automobile manufacturers (ICAMs) and International Technology Transfer. Many scholars indicate that the use of outside supplies is the sole reason for the high-speed growth of ICAMs. However, it is necessary to outline the reasons and factors that might contribute to the process at the company-level. This paper is based on the organizational view. It examines and clarifies the internal dynamics of the ICAMs from a historical perspective. The paper explores the role that international technology transfer has played in the emergence of ICAMs. In conclusion, it is clear that due to direct or indirect spillover from joint ventures, ICAMs were able to autonomously construct the necessary core competitive abilities. Keywords: marketing, international business, multinational corporations (MNCs), technology transfer, Chinese automobile industry but progressive emergence of independent Chinese 1. Introduction automobile manufacturers (ICAMs). It will also The purpose of this study is to investigate -

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

Page Line Company Name Brand Type Code Cat

Page Line Company Name Brand Type Code Cat. 1 1 Dongfeng Motor Co., Ltd. Dongfeng truck EQ1140L9CDF CV-H 1 2 Dongfeng Commercial Vehicle Xinjiang Co., Ltd. Dongfeng truck DFV1258GP6N CV-H 1 3 Hubei Kaili Special Purpose Vehicle Co., Ltd. Kailifeng Fecal suction truck KLF5070GXEB6 CV-H5 1 4 China National Heavy Duty Truck Group Jinan Commercial Vehicle Co., Ltd. Shande Card Truck chassis ZZ1256N56CHF1 CV-H 1 5 BYD Automotive Industry Co., Ltd. BYD Pure electric car BYD7004BEV2 PV-Car 1 6 Xuzhou Xugong Shiweiying Machinery Co., Ltd. XCMG Vehicle-mounted concrete pump truck XZS5144THB1 CV-H5 1 7 Hubei Xinchufeng Automobile Co., Ltd. Chufeng Pure electric truck chassis HQG1043EV12 CV-H 1 8 King Long United Automotive Industry (Suzhou) Co., Ltd. Hager Pure electric low-floor city bus KLQ6129GAEVN3 CV-H-Bus 1 9 Anhui Jianghuai Automobile Group Co., Ltd. JAC Pure electric truck HFC1040EV2 CV-H 1 10 Zhaoqing Xiaopeng New Energy Investment Co., Ltd. Xiaopeng Pure electric car NHQ7000BEVDL PV-Car 1 11 Zhaoqing Xiaopeng New Energy Investment Co., Ltd. Xiaopeng Pure electric car NHQ7000BEVDK PV-Car 1 12 Beijing Xingguang Lutong Audiovisual Broadcasting Technology Co., Ltd. Carrier Communication vehicle BZT5062XTX CV-H5 1 13 Zhengzhou Yutong Bus Co., Ltd. Yutong Command vehicle ZK5041XZHD61 CV-H5 1 14 Jiangsu Anqizheng Special Vehicle Equipment Co., Ltd. Anqi Zhengpai Water Purifier AQZ5180XJSZ6 CV-H5 1 15 Ningxia Heli Wanxing Automobile Manufacturing Co., Ltd. Ningqi Detachable garbage truck HLN5120ZXXE6 CV-H5 1 16 Wenzhou Dadaotong Electric Vehicle Co., Ltd. Xintailong Motorcycle XTL1000DT M-Moto 1 17 Jiangsu Anqizheng Special Vehicle Equipment Co., Ltd. -

Understanding Auto Fincos

Global Research 18 March 2019 Fundamental Analytics Equities Behind the numbers: Autos Global Valuation, Modelling & Accounting Geoff Robinson, CA FCA Analyst [email protected] +44-20-7567 1706 Julian Radlinger, CFA Analyst [email protected] +44-20-7568 1171 Renier Swanepoel Analyst [email protected] +44-20-7568 9025 Patrick Hummel, CFA Analyst [email protected] +41-44-239 79 23 Guy Weyns, PhD Analyst We launch the second of our series of collaborative sector analyses … [email protected] The Fundamental Analytics team has teamed up with the UBS Global Auto Sector team +65-6495 3507 (17 analysts across six regions) to deliver the second in its series of collaborative reports Paul Gong (see the first one on pharmaceuticals here). This report focuses on all things Autos. It is Analyst written to (1) provide investors new to Autos with an exhaustive overview of everything [email protected] that's relevant to understand the sector from an industry and company perspective, (2) +852-2971 7868 help new and seasoned investors alike frame their financial statement and earnings Colin Langan, CFA quality analysis, and (3) provide a guide to the most commonly used accounting Analyst practices and pitfalls specific to the sector, how to spot them, interpret and adjust for [email protected] +1-212-713 9949 them. This report is the go-to Global Auto sector hand-book for equity investors. Kohei Takahashi … including a detailed global sector run-through … Analyst Our report starts with a ~50-page sector primer written on the basis of the combined [email protected] expertise and wealth of resources of the UBS Global Auto Sector team. -

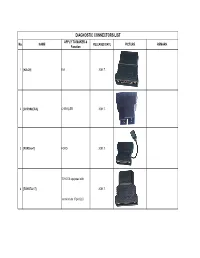

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

China Autos 2020 Outlook – Slow Lane to a Full Recovery

2 December 2019 China EQUITIES China autos Macquarie China auto coverage 2020 outlook – slow lane to a full recovery Name Ticker Price Rating TP +/- Brilliance 1114 HK 8.17 Outperform 10.10 23.6% Dongfeng 489 HK 7.64 Outperform 8.10 6.0% Key points GAC 2238 HK 8.52 Outperform 9.60 12.7% SAIC Motor 600104 CH 23.04 Outperform 31.50 36.7% Cautious outlook for 2020 PV demand, mainly considering weak demand Nexteer 1316 HK 6.66 Outperform 12.15 82.4% from lower-tier cities, increased household leverage and rising CPI. Minth 425 HK 27.30 Outperform 25.80 -5.5% Geely 175 HK 15.08 Neutral 11.20 -25.7% We expect to see further relaxation of the license plate quota in 2020. Yutong Bus 600066 CH 14.31 Neutral 12.70 -11.3% BAIC 1958 HK 4.51 Neutral 4.20 -6.9% Sector preference: higher-end > lower-end > NEVs. Near-term risks on the BYD 1211 HK 38.15 Underperform 20.70 -45.7% downside. OP: Brilliance, DFG, GAC; UP: GWM, BYD, CATL. CATL 300750 CH 87.41 Underperform 60.30 -31.0% Great Wall 2333 HK 6.04 Underperform 3.70 -38.7% Changan-B 200625 CH 3.54 Underperform 3.10 -12.4% Changan-A 000625 CH 8.31 Underperform 3.60 -56.7% Conclusions Note: updated as of 28 November closing prices; Prices are denominated in Rmb for A-share stocks, and HKD for A slow road back to recovery: We lower our 2020 China auto sales by 5% B/H-share stocks. -

Infotainment & Telema$Cs

November 2, 2015 Strategy Analy6cs, Inc 1 Kevin Li Strategy Analy6cs GENIVI 13th All-Member Mee6ng & AMM OPEN DAYS November 2, 2015 Strategy Analy9cs, Inc 2 AGENDA 1 Telema9cs Market Situa9on in China 2 Soware Topics-Smartphone GW & OS 3 Internet Company's Automo9ve Prac9ce 4 HMI & Consumer Interest 5 Aersales Market November 2, 2015 Strategy Analy9cs, Inc 3 HIGH LEVEL CHINA MARKET OVERVIEW Source: Strategy Analy6cs • 154 mIllIon cars by the end • 8% passenger cars sold In 2014 154 Mil of 2014 8% were connected In the OEM market • 17 mIllIon cars net growth • 30% passenger cars sold In the OEM 17 Mil from 2013 to 2014 30% market wIll be connected In 2018 November 2, 2015 Strategy Analy9cs, Inc 4 CHINA TELEMATICS MARKET LEADERSHIP Typical Players in OEM Market Network OEM Speed TSP Carrier In-vehicle OS Free Trial Qoros 3G MicrosoY ChIna UnIcom MicrosoY QorosQloud Lifeme BMW QNX ChIna UnIcom ConnectedDrIve 3G ChIna UnIcom GENIVI 3+7 Years Volvo ChIna UnIcom MicrosoY Sensus 3G WIrelessCar 3+7 Years Lexus ChIna Telecom QNX G-BOOK 2.5G YESWAY 4-6 Years Volkswagen VerIzon MicrosoY ChIna UnIcom Car-Net 3G Telemacs ChIna QNX 4 Years Mercedes-Benz VerIzon MicrosoY ChIna Telecom CONNET 3G Telemacs ChIna QNX 3 Years Audi ChIna UnIcom QNX AudI connect 3G WIrelessCar 3 Years SAIC 3G PATEO ChIna UnIcom AndroId InkaNet 2 Years BYD MicrosoY 3G/2.5G BYD All three 2 Years BYD Cloud AndroId Embedded telema%cs is evolving to longer free trial period. November 2, 2015 Strategy Analy9cs, Inc 5 INDUSTRY CHALLENGES: CHINA CONVERGENCE OF INFO-TELEMATICS & SAFETY -

DS Automobiles Annonce Un Modèle Surprise Les Peugeot 3008 Et 308

Vendredi 13 Avril 2018 DS Automobiles annonce un modèle surprise C’est sur Twitter qu'Yves Bonnefont, directeur général de DS Automobiles, a annoncé une surprise concernant la gamme de la marque. Une vidéo Instagram de Thierry Metroz, directeur du style de la marque, dévoile quant à elle partiellement un modèle électrifié haute performance, à l’aspect plutôt conceptuel. Rendez-vous est donné le 14 avril à 9h00 pour davantage de détails. L’électrification de la gamme est une des priorités de la marque, et plus globalement du Groupe PSA. L’indépendance de DS Automobiles par rapport à Citroën, officialisée en 2015, s’est matérialisée par la commercialisation il y a quelques mois du véhicule de loisir DS 7 Crossback, premier modèle d’une toute nouvelle gamme composée d’un nouveau produit lancé par an, et ce jusqu’en 2021. Prochain sur la liste, le DS 3 Crossback, puis une grande routière, dont le nom n’a pas encore été dévoilé. Les remplaçantes des DS 4 et DS 4 Crossback, dont l’arrêt de la production vient d’être décidé, viendront compléter la gamme à l’horizon 2020. Chacun de ces modèles bénéficiera d’une version électrifiée, dont le DS 7 Crossback, en version hybride rechargeable E-Tense, qui sera disponible mi-2019, et le DS 3 Crossback, vraisemblablement en version 100 % électrique. (JOURNALAUTO.COM 12/4/18) Les Peugeot 3008 et 308 récompensés aux prix Best Cars Le jury des lecteurs de l’Automobile Magazine a élu le Peugeot 3008 meilleur SUV compact et la 308 meilleure compacte lors de la 24ème édition des prix Best Cars. -

2019 Annual Report.Pdf

HEV TCP Buchcover2019_EINZELN_zw.indd 1 15.04.19 11:45 International Energy Agency Technology Collaboration Programme on Hybrid and Electric Vehicles (HEV TCP) Hybrid and Electric Vehicles The Electric Drive Hauls May 2019 www.ieahev.org Implementing Agreement for Co-operation on Hybrid and Electric Vehicle Technologies and Programmes (HEV TCP) is an international membership group formed to produce and disseminate balanced, objective information about advanced electric, hybrid, and fuel cell vehicles. It enables member countries to discuss their respective needs, share key information, and learn from an ever-growing pool of experience from the development and deployment of hybrid and electric vehicles. The TCP on Hybrid and Electric Vehicles (HEV TCP) is organised under the auspices of the International Energy Agency (IEA) but is functionally and legally autonomous. Views, findings and publications of the HEV TCP do not necessarily represent the views or policies of the IEA Secretariat or its individual member countries. Cover Photo: Scania’s El Camino truck developed for trials on three e-highway demonstration sites on public roads in Germany. The truck is equipped with pantograph power collectors, developed by Siemens and constructed to use e-highway infrastructure with electric power supplied from overhead lines. (Image Courtesy: Scania) The Electric Drive Hauls Cover Designer: Anita Theel ii International Energy Agency Technology Collaboration Programme on Hybrid and Electric Vehicles (HEV TCP) Annual Report Prepared by the Executive