Analysis of the Dynamic Relationship Between the Emergence Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agreements That Have Undermined Venezuelan Democracy Xxxxxxxxxxxxxxxxxxxxxxthe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements That Have Undermined Venezuelan Democracy

THE CHINA DEALS Agreements that have undermined Venezuelan democracy xxxxxxxxxxxxxxxxxxxxxxThe Chinaxxxxxxxxxxxxxxxxxxxxxx Deals Agreements that have undermined Venezuelan democracy August 2020 1 I Transparencia Venezuela THE CHINA DEALS Agreements that have undermined Venezuelan democracy Credits Transparencia Venezuela Mercedes De Freitas Executive management Editorial management Christi Rangel Research Coordinator Drafting of the document María Fernanda Sojo Editorial Coordinator María Alejandra Domínguez Design and layout With the collaboration of: Antonella Del Vecchio Javier Molina Jarmi Indriago Sonielys Rojas 2 I Transparencia Venezuela Introduction 4 1 Political and institutional context 7 1.1 Rules of exchange in the bilateral relations between 12 Venezuela and China 2 Cash flows from China to Venezuela 16 2.1 Cash flows through loans 17 2.1.1 China-Venezuela Joint Fund and Large 17 Volume Long Term Fund 2.1.2 Miscellaneous loans from China 21 2.2 Foreign Direct Investment 23 3 Experience of joint ventures and failed projects 26 3.1 Sinovensa, S.A. 26 3.2 Yutong Venezuela bus assembly plant 30 3.3 Failed projects 32 4 Governance gaps 37 5 Lessons from experience 40 5.1 Assessment of results, profits and losses 43 of parties involved 6 Policy recommendations 47 Annex 1 52 List of Venezuelan institutions and officials in charge of negotiations with China Table of Contents Table Annex 2 60 List of unavailable public information Annex 3 61 List of companies and agencies from China in Venezuela linked to the agreements since 1999 THE CHINA DEALS Agreements that have undermined Venezuelan democracy The People’s Republic of China was regarded by the Chávez and Maduro administrations as Venezuela’s great partner with common interests, co-signatory of more than 500 agreements in the past 20 years, and provider of multimillion-dollar loans that have brought about huge debts to the South American country. -

Marketing Strategies for Chery Automobile Corporation

ISSN 1712-8056[Print] Canadian Social Science ISSN 1923-6697[Online] Vol. 9, No. 4, 2013, pp. 177-183 www.cscanada.net DOI:10.3968/j.css.1923669720130904.2560 www.cscanada.org Marketing Strategies for Chery Automobile Corporation ZHANG Junjie[a],*; DAI Xiajing[b] [a] Lecturer of Business and Management, Department of Business and Management, Business School, Jiaxing University. Jiaxing, Zhejiang, 1. RESEARCH BACKGROUND China. INTRODUCTION [b] Business School, Jiaxing University. Jiaxing, Zhejiang, China. *Corresponding author. In our modern consumer society, any organization which aims to survive and develop in the market should be marketing orientated. Satisfying customers’ needs and Abstract meeting their expectations are the most crucial ways to A marketing strategy is a road map for the marketing retain, expand a business. While marketing plan plays activities of an organization for future period of time. It a key role in the actualization of marketing activities. A always helps the organization to understand clearly about marketing plan is a road map for the marketing activities the questions like these: what are we now? Where do we of an organization for future period of time. In this want to go? How do we allocate our resources to get to business report, we mainly recommend a marketing plan where we want to go? How do we convert our plans into for Chery Automobile Corp through the studies about its actions? How do our results compare our plans, and do external business environment and internal environment deviations require new plans and actions? The paper tries by some useful business analytical tools like PEST to formulate a marketing strategy for Chery Automobile analysis and SWOT analysis. -

Volvo Cars and Geely Auto to Deepen Collaboration

Volvo Cars and Geely Auto to Deepen Collaboration VOLVO CAR AB STOCK EXCHANGE RELEASE 24 FEBRUARY 2021 AT 14:30 CET Volvo Cars and Geely Auto have agreed on a wide-ranging collaboration that will maximise the strengths of the Swedish and Chinese automotive groups, delivering synergies in powertrains, sharing of electric vehicle architecture, joint procurement, autonomous drive technologies and aftersales. • Powertrain operations to be combined in new company focused on next-generation hybrid systems and internal combustion engines • Expanded use of shared modular architectures for electric vehicles (EVs) • Enhanced collaboration in autonomous and electric drive technologies • Joint procurement to cut purchasing costs • Lynk & Co to expand globally by utilising Volvo distribution and service network • Companies to retain independent corporate structures Following a detailed review of combination options, Volvo Cars and Geely Auto have concluded they can secure new growth opportunities in their respective markets and meet evolving industry challenges through deeper cooperation, while preserving their existing separate corporate structures. The deeper collaboration will enable existing stakeholders and potential new investors in Volvo Cars and Geely Auto to value their respective standalone strategies, performance, financial exposure and returns. We will also have the opportunity to explore capital market options. The collaboration will be overseen by a new governance model, supported by Geely Holding, the lead shareholder in both companies. Volvo Cars and Geely Auto confirmed the combination of their existing powertrain operations into a new standalone company. The company, expected to become operational this year, will provide internal combustion engines, transmissions, and next-generation dual-motor hybrid systems for use by both companies as well as other automobile manufacturers. -

FOURIN's China Auto Data Directory Your Best Source of Information on the Chinese Automotive Industry and Market

FOURIN's China Auto Data Directory Your Best Source of Information on the Chinese Automotive Industry and Market ■Format: Excel ■Release Date: September 30, 2011 ■Price: 90,000JPY (excl. VAT for Japan orders) Invaluable Intelligence and Data to Support Any Automotive Business in China The only way you can stay ahead of the crowd and be the person of the moment is to have the best information available when you need it the most. FOURIN is beginning a new service offering a detailed and user-friendly database on major automakers and parts manufacturers in China. Data are provided to you in Excel format, allowing rapid searching, sorting and transfer. Based on years of close cooperation with trusted customers, the database is tailored to the needs of automotive industry professionals who are in need of detailed facts on major players in the Chinese automotive industry. Rather than wading through endless number of press releases and media reports, you choose the data that is important to you and see it in a well-organized table immediately. The database currently includes approximately 1,500 production bases and other facilities of around 200 Chinese and foreign automakers andparts suppliers. FOURIN's China Auto Data Directory (Sample) Data Source Location Location Establishment Operation Base Name Main Products (APC)/ Activities APC (units) Company (City) (Admin. Unit) Date Start CBU (4 platforms: Chery, Riich, Rely, Chery Automobile Co., Ltd. Wuhu Anhui Jan. 1997 Dec. 1999 CBU 900,000 units (2010) Karry), engines, transmissions 150,000 units (2010)→ Chery Automobile - No.1 Plant Wuhu Anhui Mar. 1997 Dec. -

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

Freedom to Move in a Personal, Sustainable and Safe Way

VOLVO CAR GROUP ANNUAL REPORT 2020 Freedom to move in a personal, sustainable and safe way TABLE OF CONTENTS OVERVIEW 4 2020 Highlights 6 CEO Comment 8 Our Strenghts 10 The Volvo Car Group 12 Our Strategic Affiliates THE WORLD AROUND US 16 Consumer Trends 18 Technology Shift OUR STRATEGIC FRAMEWORK 22 Our Purpose 24 Strategic Framework HOW WE CREATE VALUE 28 Our Stakeholders 30 Our People and Culture 32 Product Creation 38 Industrial Operations 42 Commercial Operations MANAGEMENT REPORT 47 Board of Directors Report 52 Enterprise Risk Management 55 Corporate Governance Report FINANCIAL STATEMENTS 60 Contents Financial Report 61 Consolidated Financial Statements 67 Notes to the Consolidated Financial Statements 110 Parent Company Financial Statements 112 Notes to the Parent Company Financial Statements 118 Auditor’s Report 120 Board of Directors 122 Executive Management Team Freedom to move SUSTAINABILITY INFORMATION 124 Sustainability Management and Governance 129 Performance 2020 PERSONAL SUSTAINABLE SAFE 139 Sustainability Scorecard 144 GRI Index Cars used to be the symbol for personal freedom. Owning a car meant that you had the We commit to developing We commit to the highest We commit to pioneering 146 TCFD Index means to be independently mobile – that you owned not just a vehicle, but choice as and building the most per- standard of sustainability the safest, most intelligent 147 Auditor's Limited Assurance Report on sonal solutions in mobility: in mobility to protect technology solutions in Sustainability well. Nothing of that has changed, but the world we live in has. The earth, our cities and to make life less compli- the world we share. -

5G NR Based C-V2X Safe, but May Require Significantly Enables Vehicles to Select Longer Maneuver Time Faster Yet Safe Path

ITU/SAE Workshop on "How communications will change vehicles and transport“: Communications for Automated Driving, including V2V Road to 5G and Autonomous Driving Jim Misener Senior Director, Technical Standards Qualcomm Technologies, Inc. #1 in telematics and connectivity, supplier to all major car OEMs Major automakers use Qualcomm Technologies Telematics Leading in premium next-gen infotainment design-wins for production vehicles Acura ● Audi ● BMW ● Buick ● BYD ● Cadillac starting 2019-2020 Chevrolet ● Chrysler ● Dodge ● Ford ● Geely ● Honda Infotainment Hyundai ● Infiniti ● Jaguar ● Jeep ● Kia ● Land Rover 14 Lexus ● Lincoln ● Mercedes ● Mini ● Nissan ● Opel automakers have selected Snapdragon for infotainment Porsche ● PSA ● Renault ● Rolls-Royce ● Smart Subaru ● Toyota ● Tesla ● Volvo ● VW In-car connectivity $5B design-win pipeline Source: Company data 2 Qualcomm is driving C-V2X Qualcomm® towards commercialization 9150 C-V2X Supporting C-V2X Direct Communications Chipset (V2V, V2I, V2P) based on 3GPP Rel-14 Leveraging auto industry investments Reusing established security, service and upper layers/ITS stacks that have been defined by the auto industry for over a Qualcomm decade 9150 C-V2X Public automotive ecosystem support Audi, Ford, Groupe PSA, and SAIC announced their support of our first C -V2X solution; Continental and LG announced using our C -V2X solutions; testing with R&S Healthy cellular ecosystem C -V2X has key auto and telecom players, including multiple silicon vendors, creating a healthy C -V2X ecosystem 3 Qualcomm -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

Asian Automotive Newsletter

ASIAN AUTOMOTIVE NEW SLETTER SEPTEMBER 2011, ISSUE 68 A Quarterly newsletter of developments in the auto and auto components markets This quarter it was the turn of CITIC automotive markets, as well as London Dicastal and Motherson Sumi to make and New York. If you are interested in CONTENTSC O N T E N T S major western acquisitions, of KSM discussing any of the articles in this Castings and Peguform respectively. newsletter, or how we can help you in C H I N A 1 Greenfield investments also continued at this sector, please contact us. H O N G K O N G 3 a rapid pace, with planned investments I N D I A 3 announced by Chery in Argentina, Brazil I N D O N E S I A 4 and Venezuela; Changfeng in South Africa; and Bajaj in Indonesia. J A P A N 4 K O R E A 5 Business Development Asia LLC (“BDA”) Charles Maynard Charles Maynard M A L A Y S I A 5 is an investment banking firm which Senior Managing Director, Senior Managing Director, [email protected] T A I W A N 5 specializes in Asian M&A. We have [email protected] +1 212 265 5300 offices in all of the major Asian +1 212 265 5300 China Anhui Zhongding Sealing PartsParts, a Chinese auto component manufacturer, has agreed to acquire 100% of Cooper Products Inc.Inc., a US based auto Auto Sector Stock Indices (12 months ending 29Sept 11)11)11) component manufacturer, for US$10m. -

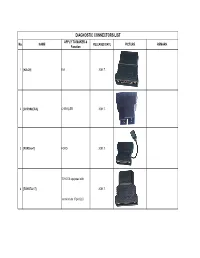

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

Alixpartners Automotive Electrification Index Second Quarter 2017 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX Alixpartners Automotive Electrification Index E-Range

AlixPartners Automotive Electrification Index Second Quarter 2017 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX AlixPartners Automotive Electrification Index e-range • By automaker, segment, region, and country E-RANGE = • Note: e-range does not include range from internal-combustion- engine (ICE) sources in plug-in hybrids—only the battery range Sum of electric is included range of all electric • The e-range attempts to rank the electrically driven range, and vehicles (EV) sold as such, does not include non-plug-in hybrids (HEVs) such as the standard Toyota Prius 2 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX AlixPartners Automotive Electrification Index ICE-vehicle equivalent market share • By automaker, segment, region, and country Using e-range data, • Full-ICE-equivalent EVs are defined as the electric range of the we can calculate an vehicle sold divided by 311 miles (500 km) ICE-vehicle • Note: to make the EV equivalent to an internal combustion engine equivalent vehicle (ICE), the 311-mile (500-km) range approximates an market share equivalent range between fill-ups for ICE vehicles. Dividing by this factor results in a more illuminating view of overall electrification, Total number of as it counts vehicles with high-electric ranges as full alternatives full-ICE-equivalent- to ICE vehicles and discounts small range city cars or compliance range EVs sold vehicles Total number of • Note: range of the ICE vehicles are not normalized to 311 miles (500 km)—each ICE unit sold is counted as a full vehicle vehicles sold (EV and ICE) 3