View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Edith Ramirez, Chairwoman Julie Brill Maureen K

122 3010 UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION COMMISSIONERS: Edith Ramirez, Chairwoman Julie Brill Maureen K. Ohlhausen Joshua D. Wright In the Matter of DOCKET NO. TBWA WORLDWIDE, INC., a corporation. COMPLAINT The Federal Trade Commission, having reason to believe that TBWA Worldwide, Inc., a corporation (“respondent”), has violated the provisions of the Federal Trade Commission Act, and it appearing to the Commission that this proceeding is in the public interest, alleges: 1. Respondent TBWA Worldwide, Inc., is a Delaware corporation with its principal office or place of business at 488 Madison Avenue, New York, New York 10022. 2. Respondent, at all times relevant to this complaint, was an advertising agency of Nissan North America, Inc., and prepared and disseminated advertisements to promote the sale of the Nissan Frontier pickup truck. 3. The acts and practices of respondent alleged in this complaint have been in or affecting commerce, as “commerce” is defined in Section 4 of the Federal Trade Commission Act. 4. Respondent has disseminated or has caused to be disseminated advertisements for the Nissan Frontier pickup truck, including “Hill Climb,” a commercial that was disseminated on television and over the internet. (Exhibit A, transcript, and Exhibit B, DVD containing ad) 5. The Hill Climb advertisement depicts a Nissan Frontier pickup truck rescuing a dune buggy that is trapped in sand on a steep hill. The Nissan Frontier speeds up the sand dune and stops immediately behind the dune buggy. The Nissan Frontier then pushes the dune buggy up and over the top of the hill. Onlookers are portrayed observing the feat in amazement. -

2017 Agency Family Tree

2017 GLOBAL AGENCY FAMILY TREE TOP 10 WPP OMNICOM Publicis Groupe INTERPUBLIC Dentsu HAVAS HAKUHODO DY MDC Partners CHEIL BlueFocus (Revenue US 17,067M) (Revenue US 15,417M) (Revenue US 10,252M) (Revenue US 7,847M) (Revenue US 7,126M) (Revenue US 2,536M) (Revenue US 2,282M) (Revenue US 1,370M) (Revenue US 874M) (Revenue US 827M) OGILVY GROUP WPP DIGITAL BBDO WORLDWIDE PUBLICIS COMMUNICATIONS MEDIABRANDS DENTSU INC. DENTSU AEGIS NETWORK HAVAS CREATIVE GROUP HAKUHODO HAKUHODO MDC PARTNERS CHEIL WORLDWIDE DIGITAL Ogilvy & Mather ACCELERATION BBDO Worldwide Publicis Worldwide Ansible Dentsu Inc. Other Agencies Havas Worldwide Hakuhodo Hakuhodo 6degrees Cheil Worldwide BlueDigital OgilvyOne Worldwide BLUE STATE DIGITAL Proximity Worldwide Publicis BPN DENTSU AEGIS NETWORK Columbus Arnold Worldwide ADSTAFF-HAKUHODO Delphys Hakuhodo International 72andSunny Barbarian Group Phluency Ogilvy CommonHealth Worldwide Cognifide Interone Publicis 133 Cadreon Dentsu Branded Agencies Copernicus Havas Health Ashton Consulting Hakuhodo Consulting Asia Pacific Sundae Beattie McGuinness Bungay Madhouse Ogilvy Government Relations F.BIZ Organic Publicis Activ Identity Dentsu Coxinall BETC Backs Group Grebstad Hicks Communications Allison + Partners McKinney Domob Ogilvy Public Relations HOGARTH WORLDWIDE Wednesday Agency Publicis Africa Group Initiative DentsuBos Inc. Crimson Room FullSIX Brains Work Associates Taiwan Hakuhodo Anomaly Cheil Pengtai Blueplus H&O POSSIBLE DDB WORLDWIDE Publicis Conseil IPG Media LAB Dentsu-Smart LLC deepblue HAVAS MEDIA GROUP -

Omnicom Group April 14, 2010 Karen Bonner

Omnicom Group April 14, 2010 Karen Bonner Kael Kristof Alexander Olson Omnicom Group Table of Contents Executive Summary............................................................................................3 Company Overview.............................................................................................5 History ...............................................................................................................5 Business Model.................................................................................................8 Competitive Analysis: Porter’s Five Forces ...................................................10 Overview .........................................................................................................10 Internal Rivalry ................................................................................................10 Entry & Exit .....................................................................................................11 Supplier Power................................................................................................12 Buyer Power....................................................................................................13 Substitutes & Complements ............................................................................13 Financial Analysis.............................................................................................15 Overview .........................................................................................................15 -

Omnicom Group Table of Table 08 People

DIVERSE TALENT COLLECTIVE STRENGTH 2019 CORPORATE RESPONSIBILITY REPORT WITH 2020 UPDATES Omnicom is a group of thousands of individuals across more than 70 countries collectively bringing their passion and creativity to over 5,000 brands. The talent of this diverse group of people allows us to create a positive and lasting impact on the world the best way we know how: through our work. Contents 04 Letter from Our CEO 05 About Omnicom Group Table of Table 08 People 27 Community 40 Environment 48 Governance 52 About This Report 53 UN Global Compact (UNGC) Communication on Progress 54 GRI Standards Content Index Governance About This Report UNGC Progress GRI Index In a world that’s rapidly changing, Omnicom grounds itself in its Furthermore, we supported Theirworld again in 2019 through its commitments to having the industry’s most innovative, collaborative #WriteTheWrong campaign, which raised awareness of the 260 million and diverse talent. Through diverse perspectives and collective strength, children who do not attend school each day. Our work on the our organization is able to uphold the highest standards of excellence and #WriteTheWrong campaign helped secure $2.3 billion in commitments creativity for our clients and the communities we share around the globe. to education over one week and underscored our own commitment to UN Sustainable Development Goal 4. While this report focuses on our 2019 activities, its release comes at a time of uncertainty and unrest in the wake of the COVID-19 pandemic We also continued our progress against our goals of reducing the and the racial inequalities brought to light by George Floyd’s tragic death. -

Agencies, the Push by Management the Requirements of an Industry in Dire Need of New, Better Consulting, Growing Independent Firms, Etc.)

Industry Update A summary of newsworthy client/agency relationship developments and relevant marketing or agency management trends from the past month. Volume 31 Executive Summary—Monthly Recap TALENT: securing the right talent and resources Holding companies are on the defensive. They’ve experienced poor stock performance as a result of disappointing revenue and negative organic Restructuring and consolidation are behind many new recent growth, which in turn results from intense competition announcements, impacting talent still too scarce to meet (the rise of in-house agencies, the push by management the requirements of an industry in dire need of new, better consulting, growing independent firms, etc.). ways to mature. Yet, it remains a highly dynamic industry with There is greater financial pressure from clients big names leading the pack. Alex Bogusky is back to CP+B, experimenting with ZBB to right-size marketing budgets Antonio Lucio leaves HP and goes on to save Facebook as and industry trends like GRDP which caused spend to its new CMO, and Sr. Martin Sorrell is still making headlines soften. A new report by Forrester, “Agency Holding rebuilding his empire brick by brick. Companies Need A Brave New Business Model,” says, • Publicis Groupe’s Publicis Communications hub “Agencies need a new business model that puts the restructured the production departments at three of its client at the center, elevates new services, and blends New York-based creative agencies in an effort to streamline creative entrepreneurialism with new executional its efforts, reduce operating costs, and drive efficiencies to prowess.” Agency holding companies must embrace better serve clients like P&G. -

Havas Group Dentsu Aegis Network

WPP OMNICOM PUBLICIS INTERPUBLIC DENTSU AEGIS HAVAS GROUP GROUP GROUPE GROUP NETWORK DOMANI Global CEO Sir Martin Sorrell ➜ J. WALTER THOMPSON ➜ WPP DIGITAL CEO & President John Wren ➜ NATIONAL ADVERTISING ➜ DIVERSIFIED AGENCY Chairman & CEO Maurice Lévy ➜ ➜ PUBLICIS MEDIA Chairman & CEO ➜ MCCANN ➜ MARKETING CEO, Dentsu Aegis Network and Chairman & CEO CEO Tamara Ingram SERVICES (continued) BBH DIRECT CEO Steve King WORLDGROUP SPECIALISTS (CMG) Established 1986 BLUE STATE DIGITAL Established 1986 AGENCIES Established 1926 Michael Roth Executive Officer, Dentsu Inc. Yannick Bolloré Number of countries 90+ Regional CEO (Americas) Chairman & CEO Headquarters London Headquarters New York Headquarters Paris Established 1961 Jerry Buhlmann Established 1835 COGNIFIDE CUSTOM PUBLISHING PUBLICIS Tim Jones Harris Diamond CASSIDY & ASSOCIATES MIRUM GOODBY, SILVERSTEIN CEO Kai Anderson, Number of countries 113 F.BIZ Number of countries 100+ AND PARTNERS CEDAR Number of countries 100+ COMMUNICATIONS Regional CEO (EMEA) Headquarters New York Established Dentsu (1901) Headquarters Puteaux SANTO McCANN Barry D. Rhoads Number of offices 3,000+ Employees 74,000+ Number of countries US only Employees 77,574 (continued) Iain Jacob Number of countries 100+ Aegis (1978) Number of countries 140+ GLOBANT Number of countries 3 Chairman & CEO CONTRACT Number of offices 1 Regional CEO (APAC) Employees 194,000 (inc. assocs) HOGARTH WORLDWIDE Revenue for 2015 $15.13bn Revenue for 2015 €9.60bn Employees 50,100 Harris Diamond CURRENT MARKETING Dentsu Aegis Network -

2019 Megabrands Table of Contents

2019 MEGABRANDS TABLE OF CONTENTS I. OOH Industry Revenue Overview II. 2019 Top 100 OOH Advertisers III. 2019 Top 100 Overall Advertisers IV. 2019 Agency List - Top 100 OOH Advertisers V. 2019 Agency List - Top 100 Overall Advertisers VI. OOH Agencies & Specialists Overview OOH INDUSTRY OVERVIEW Top 10 OOH Revenue Categories by Quarter and Full Year 2019 2019 January - March OOH Advertising Expenditures Ranked By Total Spending Category Growth Percentage Change Jan - Mar Percent of Jan - Mar Jan - Mar Jan - Mar 2019 Total 2018 '19 vs '18 '19 vs '18 Industry Categories ($m) Revenue Rank ($m) Rank ($m) (%) MISC LOCAL SERVICES & AMUSEMENTS 435,139.6 24.5% 1 403,806.8 1 31,332.8 7.8% RETAIL 174,055.8 9.8% 2 175,932.4 2 -1,876.6 -1.1% MEDIA & ADVERTISING 163,399.3 9.2% 3 144,097.0 3 19,302.3 13.4% PUBLIC TRANSPORT, HOTELS & RESORTS 124,325.6 7.0% 4 122,314.9 5 2,010.7 1.6% RESTAURANTS 115,445.2 6.5% 5 130,692.7 4 -15,247.5 -11.7% FINANCIAL 106,564.8 6.0% 6 100,532.8 6 6,032.0 6.0% INSURANCE & REAL ESTATE 103,012.6 5.8% 7 87,128.4 8 15,884.2 18.2% GOVERNMENT, POLITICS & ORGS 94,132.2 5.3% 8 92,155.1 7 1,977.1 2.1% AUTOMOTIVE DEALERS & SERVICES 74,595.4 4.2% 9 75,399.6 9 -804.2 -1.1% SCHOOLS, CAMPS & SEMINARS 69,267.1 3.9% 10 70,373.0 10 -1,105.9 -1.6% Total Top Ten Categories 1,459,937.6 82.2% 1,402,432.7 57,504.9 Total 2019 January - March OOH Expenditures $1,776,079,816 Overall Percentage Change January - March '19 vs '18 6.0% Source: Kantar Media, OAAA - May 2019 Prepared by the Out of Home Advertising Association of America 2019 April - -

FH IIR Report 01.06

INDIA INFLUENCER INTELLIGENCE REPORT An intelligence report developed by FleishmanHillard India, analyzing shifts in 2021influencer marketing and identifying upcoming trends through primary research conducted with over 500 influencers across India, in partnership with Eleve Media. TABLE OF CONTENTS 03 EXECUTIVE SUMMARY 05 INDIA INFLUENCER INTELLIGENCE TRENDS 2021: ALL YOU NEED TO KNOW Connection is the New Currency Creator Direction Trumps Creative Direction Influencers are Ambassadors Content equals Clout Micro is the new Mega 12 ASCI GUIDELINES: WHAT CHANGES 14 WAY FORWARD 17 ABOUT US About India Influencer Intelligence Study About FleishmanHillard About Omnicom Public Relations Group About Eleve Media The pandemic year has fueled trends and undercurrents that were already underway in the world of marketing and communications. One of the most prominent trends to emerge has been the growing importance of influencer engagement. What was once labeled as an additional leg to a brand's campaign to push engagement on social media (a good to-do) is today driving the communication strategy for many brands (a must-do). Many have observed that the pandemic has only accelerated the growth of influencer marketing. During peak lockdown, users stuck at home turned to cooking, gardening and DIY videos online to increase their own engagement with various social media channels. So, as the pandemic pushed more people to stay indoors 500 INDIAN INFLUENCERS and behind their screens, influencers became the sole “opinion makers” who brought brands into consumers’ consideration at a time when demand was stagnant. In other words, influencer and industry marcomm leaders marketing grew in the mix of communications and in its share of marketing spends. -

The Leading Global Resource for Benchmarking Creativity and Effectiveness a MESSAGE from CANNES LIONS

Global Creativity Report By Cannes Lions with Key Trends & Commentary by WARC The leading global resource for benchmarking creativity and effectiveness A MESSAGE FROM CANNES LIONS Creativity is Community Creativity is Potential Creativity is Curiosity Creativity is a unifying force that brings communities together. We Over 2000 brands participate in our wider initiatives throughout I recently came across the agency strapline ‘Never Finished’. For see this clearly at Cannes Lions. In 2019 a diverse collective of the year and over 100 brands brought speakers to the Festival this particular agency ‘Never Finished’ is about curiosity, limitless dedicated experts converged in Cannes to immerse themselves in stages. That’s a 15% increase from 2018 and nearly a 50% possibility and always asking ‘what can we do better?’. It’s the a rich spread of increasingly diverse creative ideas, and business increase from 2017 – so the case for creativity is alive and well. same for those who say that winning a Lion isn’t the end...it’s just solutions, from around the globe. Our jurors awarded the very Brands come to Cannes Lions because they recognise that greater the beginning. They view the Lion as a symbol of recognition, but best work and set the creative and effective benchmark for the commercial success is gained when you’re able to unlock creative also as a green light - permission to push something further and global industry, from Craft to eCommerce, Sport to Strategy. I’d potential and produce Lion-winning work. raise the bar. like to take this opportunity to thank our juries on behalf of every single person who entered. -

Madison & Vine

Advance Praise for Madison & Vine “A superb analysis of the intersection of Madison and Vine. Donaton thoroughly explores it in a concise, well-documented style. This convergence is the future financial model of the entertainment and advertising industries.” —Mark Burnett, Creator/Executive Producer of “The Apprentice” and “Survivor” “Scott Donaton does more than lay out a road map of the future. He makes you smell the sweat on the upper lip of every advertising executive trying to save his bacon in the scary, dangerous intersection of our great- est cultural forces—advertising and the entertainment media that helps this nation sell itself to itself. This book explicates the inexplicable, sure, but it also fills your imagination with the metallic taste of fear that grips the buyer, the agent, the programming executive whose next car could be a used Kia if they don’t figure out what the hell is going on. A word to those who want some action in this crazily converging techno- centric world: read this book or be left behind.” —Stanley Bing, bestselling author of What Would Machiavelli Do? and FORTUNE magazine columnist “Scott Donaton was one of the first to call attention to this space and now he’s written the definitive book about the mutual benefit that happens when filmmak- ers and marketers collaborate.” —Harvey Weinstein, President, Miramax Film Corp. “Unique and insightful, Scott provides an insider’s look into the evolving business models of entertainment and advertising. Madison & Vine has forced execs to reconsider the power of branded entertainment and serves as a guide for all involved to wake up and create strategically streamlined marketing programs that make sure dollars deliver on ROl. -

Palo Alto Networks Safely Enables Application Access for Top Global Advertising Agency

Palo Alto Networks: Customer Profile Palo Alto Networks Safely Enables Application Access for Top Global Advertising Agency “Functionality and security are like two opposites; if you give the user all the functionality they want, you’ll lose security. Palo Alto Networks enables us to give users all the functionality they need and still have the security we need.” – Jeroen Buren, IT Manager, DDB Amsterdam ORGANIZATION: DDB Amsterdam BACKGROUND INDUSTRY: With 200 offices and over 13,000 employees in more than 90 countries, DDB Worldwide Advertising Group is a top five global advertising and marketing services network. The company’s CHALLENGE: clients include major brands such as Exxon, Clorox, McDonald’s, Johnson & Johnson, Gain visibility into network to control Novartis and many others. No other agency has received more awards internationally application usage, improve security and for its creative work than DDB. Under the DDB Worldwide rubric, DDB Amsterdam, enable business operations. based in Holland, serves clients such as KLM and Philips. DDB Worldwide is part of Omnicom Group Inc., (NYSE-OMC), a global marketing and advertising communications SOLUTION: holding company ranked among the top three in the world. Replace legacy firewalls with Palo Alto Networks PA-4000 and PA-500 next- CREATIVITY DEPENDS ON ACCESS generation firewalls for granular visibility As a key component of DDB Worldwide, international marketing and advertising agency of threats and better control of Internet DDB Amsterdam interacts with clients all over the world. Its staff is heavily weighted applications. with creatives, who develop innovative, award-winning advertising campaigns for the firm’s clientele. RESULTS: DDB Amsterdam’s IT team supports over 400 internal users working out of two locations • Increased application visibility and in the city. -

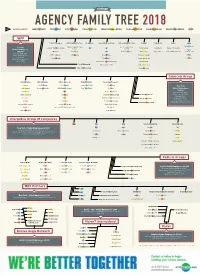

Omnicom Group WPP MDC Partners Publicis Groupe Interpublic Group of Companies Vision7 International Havas Dentsu Aegis Network

AGENCY FAMILY TREE 2018 KEY HOLDING COMPANY AGENCY NETWORK FULL SERVICE DIRECT & DIGITAL PUBLIC RELATIONS MEDIA PLANNING & BUYING PROMO & ACTIVATION BRANDING & DESIGN HEALTHCARE & MEDICAL OTHER WPP J. Walter Thompson Hill+Knowlton Strategies Grey Canada Young & Rubicam Group National Public Relations GroupM TenthAvenue Kantar Ogilvy Ogilvy Canada Hill+Knowlton Strategies Axon Communications London J. Walter Thompson Canada Tank Taxi M/Six Canada Bookmark Kantar TNS Canada Canada Toronto Global Employees: Ogilvy 205,000 JWT Inside GCI Canada Taxi 2 National Equicom Wavemaker Shopper2Buyer Kantar Millward Brown Commonhealth Revenue by Region: North America 25% JWT Intelligence SJR Canada Blast Radius Mindshare Canada John St. U.K. 21.4% Mirum Canada Wunderman Excelerator Media Geometry Western Europe 17.9% Other 35.7% Wunderman Data Management Xaxis Canada The & Partnership Wunderman Health MediaCom Canada Cohn & Wolfe Canada Catalyst Canada Omnicom Group OMG Worldwide BBDO Worldwide DDB Group Canada TBWA Worldwide DAS Group of Companies Touché BBDO Canada DDB Canada Juniper Park\TBWA Critical Mass New York OMD Canada Proximity Canada DDB Public Relations Tam-Tam\TBWA Ketchum Global Employees: 78,500 PHD Toronto Tribal Daggerwing Group Revenue by Region: Hearts & Science Track DDB FleishmanHillard Canada Red Urban Toronto North America 59.5% Europe 25.3% Alternator Twice High Road Communications Interbrand Canada Asia Pacific 10.6% Latin America 2.7% Accuen Kid Think Porter Novelli Canada GMR Marketing Canada Middle East and Africa 1.8% Highway Entertainment TracyLocke Canada MarketStar Canada Annalect Anderson DDB Health & Lifestyle IMS Canada Resolution Media CDM Montreal Interpublic Group Of Companies Huge FCB CMG McCann Worldgroup IPG Mediabrands New York / Global Employees: 49,800 FCB Golin McCann UM Revenue by Region: North America 59.7% Fuel Content Weber Shandwick MRM//McCann Initiative Asia Pacific 11.8% // Continental Europe 8.9% // U.K.