Proposals for the Adjustment of The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Maintenance Condition Monitoring

New trend in lubricants packaging P.20 Consumer choices lubricants survey P.18 WWW.LUBESAFRICA.COM VOL.4 • JULY-SEPTEMBER 2012 NOT FOR SALE MAIN FEATURE Improving plant maintenance through condition monitoring A guide to oil analysis July-September 2012 | LUBEZINE MAGAZINE 1 PLUS: THE MARKET REPORT P.4 Inside Front Cover Full Page Ad 2 LUBEZINE MAGAZINE | July-September 2012 WWW.L UBE S A FR I C A .COM VOL 4 CONTENTS JULY—SEPTEMBER 2012 NEWS • INDUSTRY UPDATE • NEW PRODUCTS • TECHNOLOGY • COMMENTARY MAIN FEATURE 14 | OIL ANALYSIS — THE FUNDAMENTALS INSIDE REGULARS 7 | COUNTRY FEATURE 2 | Editor’s Desk Uganda lubricants market 4 | The Market Report — a brief overview Eac to remove preferential tariff treatment on MAIN FEATURE 10 | lubes produced within Lubrication and condition monitoring Eac block to improve plant availability Motorol Lubricants Open Shop 14 | MAIN FEATURE In Kenya Puma Energy plans buyout of Oil analysis — The Fundamentals KenolKobil 18 | ADVERTISER’S FEATURE Additives exempted from Consumer choices lubricants survey PVoC standards — GFK 6 | Questions from our readers 20 | PACKAGING FEATURE 28 | Last Word Engine oil performance in New trends in lubricants packaging 8 MAINTENANCE numbers 22 | TECHNOLOGY FEATURE FEATURE Oil degradation Turbochargers 26 | PROFILE and lubrication 28 10 questions for lubricants 24 professionals EQUIPMENT 27 | ADVERTISER’S FEATURE FEATURE Lubrication equipment The ultimate solution in sugar mill for a profitable and lubrication professional workshop July-September 2012 | LUBEZINE MAGAZINE 1 Turn to Turbochargers and lubrication P.8 New trend in lubricants packaging P.20 Consumer choices lubricants survey P.18 WWW.LUBESAFRICA.COM VOL.4 • JULY-SEPTEMBER 2012 NOT FOR SALE EDITOR’SDESK VOL 3 • JANUARY-MARCH 2012 MAIN FEATURE Improving plant maintenance through EDITORIAL condition monitoring A guide to oil analysis One year and July-September 2012 | LUBEZINE MAGAZINE 1 PLUS: THE MARKET REPORT P.4 still counting! Publisher: Lubes Africa Ltd elcome to volume four of Lubezine magazine. -

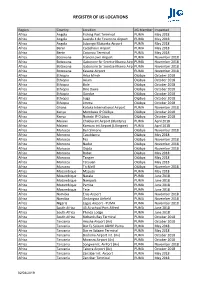

Register of IJS Locations V1.Xlsx

REGISTER OF IJS LOCATIONS Region Country Location JIG Member Inspected Africa Angola Fishing Port Terminal PUMA May 2018 Africa Angola Luanda 4 de Fevereiro Airport PUMA May 2018 Africa Angola Lubango Mukanka Airport PUMA May 2018 Africa Benin Cadjehoun Airport PUMA May 2018 Africa Benin Cotonou Terminal PUMA May 2018 Africa Botswana Francistown Airport PUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirpoPUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirpoPUMA November 2018 Africa Botswana Kasane Airport PUMA November 2018 Africa Ethiopia Arba Minch OiLibya October 2018 Africa Ethiopia Axum OiLibya October 2018 Africa Ethiopia Bole OiLibya October 2018 Africa Ethiopia Dire Dawa OiLibya October 2018 Africa Ethiopia Gondar OiLibya October 2018 Africa Ethiopia Jijiga OiLibya October 2018 Africa Ethiopia Jimma OiLibya October 2018 Africa Ghana Kotoka International Airport PUMA November 2018 Africa Kenya Mombasa IP OiLibya OiLibya October 2018 Africa Kenya Nairobi IP OiLibya OiLibya October 2018 Africa Malawi Chileka Int Airport (Blantyre) PUMA April 2018 Africa Malawi Kamuzu int.Airport (Lilongwe) PUMA April 2018 Africa Morocco Ben Slimane OiLibya November 2018 Africa Morocco Casablanca OiLibya May 2018 Africa Morocco Fez OiLibya November 2018 Africa Morocco Nador OiLibya November 2018 Africa Morocco Oujda OiLibya November 2018 Africa Morocco Rabat OiLibya May 2018 Africa Morocco Tangier OiLibya May 2018 Africa Morocco Tetouan OiLibya May 2018 Africa Morocco Tit Melil OiLibya November 2018 Africa Mozambique Maputo -

Cameroon's Finance Sector Goes Through Rapid Digitalization

MAJOR PROJECTS AGRICULTURE ENERGY BUSINESS IN MINING INDUSTRY SERVICES FINANCE November 2018 / N° 69 November 2018 CAMEROON Cameroon’s finance sector goes through rapid digitalization Cashew, a sector with great Oilibya rebranded, becomes potential, both for revenues Ola Energy and job creation FREE - CANNOT BE SOLD BUSINESSIN CAMEROON .COM Daily business news from Cameroon Compatible with iPads, smartphones or tablets APP AVAILABLE ON IOS AND ANDROID 3 Yasmine Bahri-Domon Cameroon goes through digital transformation Digitalization is spreading more and human resources will be necessary more to many sectors in Cameroon. to overcome issues arising from this It has become vital for any business modernization. The latter must align wishing to get closer to its customers with social fabric and structure. I and actually is the perfect tool for client believe that the transformation must retention. This is the exact case in other be gradual but also take into account African nations where digitalization direct employment, or this might lead is a boost palliating shortcomings in to an imbalance that will affect social quality of service provided. economy. Cameroon’s technology is going As said earlier, fact remains that digi- through a transformation as various talization helps financial institutions sectors indeed migrate toward digital- process their transaction and serve ization. This silent transformation is clients more rapidly. gradually taking shape and imposing There are “Made in Cameroon” apps itself to various targets. It is positive that currently let users conduct finan- evolution and it has today become a cial transactions or operations safely, must for financial institutions. It ap- using mobile devices such as phones or pears that customers have adapted to tablets. -

Success-Story PGS Oi

@ [email protected] www.petrogas-systems.com Key achievements • Labor & time saving solution • High safety, security and environment performance • Skid manufacture / project implementation and start-up to cost & schedule • High level of skid quality and reliability • High level of customer satisfaction. Customer satisfaction Our feedback from OiLibya indicates that the project has considerably improved the work efficiency. We dealt with a hard-working, fully The loading procedure, previously time-consuming and dedicated team who made the completion threatening to the operators’ safety, involving many of this challenging project possible. paperwork and long manual processes, became smooth, This achievement is made more notable way faster and totally safe. by the skids excellent safety performance, No shutdowns have been recorded since the implementa- a mandatory requirement that has been tion of the loading skids. Meticulous planning, design and execution stand behind completely fulfilled. such a success. OiLibya testified its high satisfaction with the delivered Bottom Loading Mr. Khalil MRABET project, and recognized that the desired effect has been Fuel Operations Manager delivered. Success Story Terminal - OiLibya - Customer : OiLibya Industry : Oil & Gas Order date : 02/2009 Project Overview Completion : 02/2010 Application - Bottom loading with vapor recovery - SCADA system - SIL3 Certied Safety System - Terminal Automation System - Pump Sequencing System Loading Skid Properties - 4 bottom loading arms - 1 vapor recovery arm - Turbine Metering Technology - AccuLoad III.NET controller Executive summary - Safety SDV - Overll & retained product control unit Formerly known as Tamoil Africa, OiLibya is a state - Grounding control unit owned company that is present in 19 African countries: Libya, Egypt, Senegal, Côte d’Ivoire, Cameroon, Safety system Gabon, Kenya, Mali, Burkina Faso, Niger, Chad, - 1 HIMA H41-q controller Eritrea, Uganda, Ile de Réunion, Morocco, Tunisia, - Redundant Power Supply Ethiopia, Sudan, and Djibouti. -

Vivo-Energy-Plc-Prospectus-4-May

ELECTRONIC TRANSMISSION DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before continuing. This electronic transmission applies to the attached document and you are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached prospectus (the “Prospectus”) relating to Vivo Energy plc (the “Company”) dated 4 May 2018 accessed from this page or otherwise received as a result of such access and you are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached Prospectus. In accessing the attached Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached Prospectus is confidential and intended for you only and you agree you will not forward, reproduce or publish this electronic transmission or the attached Prospectus to any other person. The Prospectus has been prepared solely in connection with the proposed offer to certain institutional and professional investors (the “Offer”) of ordinary shares (the “Shares”) of the Company. The Prospectus has been published in connection with the admission of the Shares to the premium listing segment of the Official List of the UK Financial Conduct Authority (the “FCA”) and to trading on London Stock Exchange plc’s main market for listed securities (together, “Admission”) and the Main Board of the JSE Limited (“JSE”) by way of secondary inward listing (“JSE Admission”). -

Repertoire 2014 Des Exportateurs Du Sénégal

Soldive, a choisi de s’implanter sur 50 ha le long du fleuve Sénégal à saint louis, il produit depuis 2006 un melon charentais d’excellente qualité gustative. Le melon Soldive Sénégal est devenu la référence sur le marché de contre-saison de Noël et de Pâques Site de production certifié Globalgap. De la graine à la commer- Production : Melon (Charentais, Galia) cialisation, en passant par la Exploitation : 100 ha récolte et le conditionnement, : Mi-novembre à début janvier, Calendrier toutes les étapes répondent et de mi-février à fin-avril aux exigences des clients et Volume : 2 000 tonnes consommateurs. Soldive Sénégal, Cité Boudiouck, Saint Louis Tel : +221 33 961 03 73 / 77 450 20 18 [email protected] / www.soldive.fr Manobi est fournisseur de services Secteurs/Services métiers inclusifs d’optimisation des chaines de valeur. mAgri™ : mFleet™ La plate-forme mAgri™ organise les La plate-forme mFleet™ est ensemble Les services fournis par MANOBI filières agricoles désorganisées en de services métiers dédiés à la gestion repose sur l’exploitation des chaines de valeur optimisée pour optimisée de la mobilité au sein de les agriculteurs, les fournisseurs l’entreprise technologies de l’information d’intrants, les agro-industriels, les (mobile, web, SIG, …) couplée à banques et les sociétés Jotbi™ d’assurance une expertise forte des secteurs de La plate-forme Jotbi™ offre un ensemble de services mobiles 2 web son marché et à un savoir-faire mWater™ optimisant la collecte de données et reconnu pour assurer le mWater™ est la plate-forme de la conduite des enquêtes. gestion optimisée des réseaux développement d’interactions d’eau urbains et villageois mShop™ asymétriques optimales et optimisant le déploiement du La plate-forme mShop™ optimise la service de l’eau pour tous. -

The Acquisition of Kenolkobil Plc by Rubis Energie Sas

THE ACQUISITION OF KENOLKOBIL PLC BY RUBIS ENERGIE SAS. 1. The Competition Authority of Kenya (CAK) approved the acquisition of KenolKobil Plc by Rubis Energie SAS. 2. Rubis Energie SAS (Rubis), the acquirer, is a subsidiary of Rubis SCA, an international firm that deals in the storage, distribution and sale of petroleum, liquefied petroleum gas, food and chemical products. 3. Rubis distributes petroleum products, liquid petroleum gas and bitumen across Europe, the Caribbean and Africa. Rubis does not directly or indirectly control any undertakings in Kenya and, therefore, does not have relevant turnover or assets within the country. 4. KenolKobil Plc (KenolKobil), the target, is incorporated in Kenya and is listed on the Nairobi Securities Exchange (NSE). Rubis presently owns 24.99% of KenolKobil’s issued shares. 5. KenolKobil Plc is a holding company for KenolKobil Kenya, Uganda, Rwanda, Ethiopia and Burundi. These subsidiaries engage in the importation, storage, marketing and retail of petroleum products. 6. The proposed transaction, as per a public offer by Rubis, will result in Rubis making a cash offer of KES 23 per share for 1,182,968,076 shares, thereby taking 100% control of KenolKobil. 7. The proposed transaction qualified as a merger within the meaning of Section 2 and 41 of the Competition Act No.12 of 2010. The combined turnover of the parties is over Ksh. 1 Billon for the preceding year (2017) and, therefore, the transaction meets the threshold for full merger analysis as provided in the Merger Threshold Guidelines. 8. For purposes of analysing the proposed transaction, the Authority determined that the relevant product markets are: i. -

WATER MARKETS in SENEGAL Market Study of Drinking Water, Coolant, and Distilled Water in Senegal

WATER MARKETS IN SENEGAL Market Study of Drinking Water, Coolant, and Distilled Water in Senegal OCTOBER 2018 The Sanitation Technology Platform Please Note: This report is a good faith effort by RTI International to accurately represent information available via secondary and primary sources at the time of the information capture. Visit the Resource Center at http://stepsforsanitation.org/ for this and other STeP resources. I. Overview II. Methodology III. Market Insights TABLE OF CONTENTS I. Drinking Water II. Coolant III. Distilled Water IV. Summarized Recommendations V. Next Steps OVERVIEW – BACKGROUND In 2017, Afri-Dev conducted a study of water markets in Senegal to support commercial deployment of the Janicki Omni-Processor (J-OP). Background on Original Study Afri-Dev conducted its research and analysis from May to August 2017, submitted an interim report in August, and The Senegalese government actively seeks to advance goals delivered a summary presentation of the report at the “Delvic that address two interconnected challenges—(1) to effectively Sanitation Initiatives (DSI) Interested Investor Meeting,” in manage its scarce water resources and provide basic water Dakar, Senegal, on August 9–10, 2017. services to the Senegalese people and (2) to improve sanitation by responsibly managing wastewater and fecal sludge. To achieve these goals, the National Office of Sanitation of Senegal About this Document (ONAS) partnered with the Bill & Melinda Gates Foundation to This document summarizes the interim report authored by Afri- launch "Restructuring the Fecal Sludge Market" to determine Dev so that it can serve as an actionable guide for a broader how to strengthen a business case for improved sanitation audience of commercial and technical partners considering the technologies. -

Register of IJS Locations V1.Xlsx

REGISTER OF PAST IJS LOCATIONS Region Country Location JIG Member Inspected Africa Angola Fishing Port Terminal PUMA May 2018 Africa Angola Luanda 4 de Fevereiro Airport PUMA May 2018 Africa Angola Lubango Mukanka Airport PUMA May 2018 Africa Benin Cadjehoun Airport PUMA May 2018 Africa Benin Cotonou Terminal PUMA May 2018 Africa Botswana Francistown Airport PUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirportPUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirportPUMA November 2018 Africa Botswana Kasane Airport PUMA November 2018 Africa Ethiopia Arba Minch OiLibya October 2018 Africa Ethiopia Axum OiLibya October 2018 Africa Ethiopia Bole OiLibya October 2018 Africa Ethiopia Dire Dawa OiLibya October 2018 Africa Ethiopia Gondar OiLibya October 2018 Africa Ethiopia Jijiga OiLibya October 2018 Africa Ethiopia Jimma OiLibya October 2018 Africa Ghana Kotoka International Airport PUMA November 2018 Africa Kenya Mombasa IP OiLibya OiLibya October 2018 Africa Kenya Nairobi IP OiLibya OiLibya October 2018 Africa Malawi Chileka Int Airport (Blantyre) PUMA April 2018 Africa Malawi Kamuzu int.Airport (Lilongwe) PUMA April 2018 Africa Morocco Al Hoceima OiLibya December 2017 Africa Morocco Ben Slimane OiLibya November 2017 Africa Morocco Ben Slimane OiLibya November 2018 Africa Morocco Casablanca Libya Oil July 2017 Africa Morocco Casablanca OiLibya May 2018 Africa Morocco Fez OiLibya November 2017 Africa Morocco Fez OiLibya November 2018 Africa Morocco Nador OiLibya December 2017 Africa Morocco Nador OiLibya November -

Environmental and Social Impact Assessment Study Report (SR) for the Expansion of OLA Energy LPG Marine Terminal in Shimanzi, Mombasa County

Environmental and Social Impact Assessment Study Report (SR) for the Expansion of OLA Energy LPG Marine Terminal in Shimanzi, Mombasa County. Prepared for Prepared by OLA Energy Kenya Limited Kurrent Technologies Ltd OiLibya Plaza, Muthaiga Road Hass Plaza, 4th Floor, Nairobi, Kenya Lower Hill Road, Upper Hill Environmental and Social Impact Assessment Study Report (SR) for the Expansion of OLA Energy LPG Marine Terminal in Shimanzi, Mombasa County. Executive Summary Executive summary Introduction OLA Energy Kenya (OEKE, the “Proponent”) intends to expand its 510 MT Liquid Petroleum Gas (LPG) depot at Shimanzi, Mombasa to a marine LPG terminal with a capacity of 14,500 MT (the “Project”). The proposed terminal will consist of 6 mounded LPG spheres with a total water capacity of 30,000m3, 4 truck loading facilities, 6 Rail Tank Carrier (RTC) facilities and a delivery line of 14 inches from Shimanzi Oil Terminal (SOT) and later to Kipevu Oil Terminal (KOT). OLA Energy is one of the leading downstream petroleum companies in Africa with operations in 17 countries comprising of over 1,200 service stations, 8 blending plants over 60 fuel terminals and presence in over 50 Airports. The proposed expansion of the LPG terminal will be undertaken by OLA Energy Kenya with the support of OLA Energy Operations Headquarters in Dubai and OLA Holdings Ltd. OLA Energy Kenya has engaged Kurrent Technologies Ltd to undertake Front End Engineering Design (FEED), prepare tender documents, acquire construction permits including Environmental Impact Assessment (EIA) license and undertake the tendering process. The project will be implemented through an Engineering, Procurement and Construction (EPC) contractor. -

Oil and Gas in a New Libyan Era: Conflict and Continuity

February 2019 Oil and Gas in a New Libyan Era: Conflict and Continuity OIES PAPER: MEP 22 Richard Barltrop, Independent Consultant The contents of this paper are the author’s sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2019 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-130-3 DOI: https://doi.org/10.26889/9781784671303 ii Oil and Gas in a New Libyan Era Contents Contents ................................................................................................................................................ iii Maps ...................................................................................................................................................... iii Tables .................................................................................................................................................... iii Figures .................................................................................................................................................. iii Executive summary ............................................................................................................................. -

Petro-Democracy: Oil, Power and Politics in Niger

Petro-Democracy: Oil, Power and Politics in Niger Dissertation zur Erlangung des Doktorgrades der Sozialwissenschaftlichen Fakultät der Georg-August-Universität Göttingen vorgelegt von Jannik Schritt geboren in Eutin Göttingen 2018 Betreuungsausschuss Erstbetreuer: Prof. Dr. Nikolaus Schareika Weitere Betreuer: Dr. Andrea Behrends Weitere Mitglieder der Prüfungskommission: Prof. Dr. Roman Loimeier Tag der mündlichen Prüfung: 22.11.2017 For Angela and Edzard Abstract In 2008, Niger signed an oil contract with China National Petroleum Corporation (CNPC) over the Agadem oil block located in the far eastern region of Diffa; and in 2011, they inaugurated the country’s first and only oil refinery near Zinder, the second biggest city, situated in the country’s south-east. While the inauguration had been planned as a major celebration to mark the coming of oil, it soon became a highly contested political event. That day, with new President Mahamadou Issoufou coming from the capital Niamey (located in the west of the country) to Zinder to mark the occasion, youths set alight tire street barricades and clashed with police. The protests turned into violent riots some days later with youth clashing with security forces in the streets, burning down a police station and looting a bank. Two people were killed and several were injured. Using in-depth ethnographic material collected over 13 months of fieldwork from 2011 to 2014 within the methodological framework of the extended case method, the book takes the event of the oil refinery’s inauguration